Retail Savills Research

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nanjing Travel Guide - Page 1

Nanjing Travel Guide - http://www.ixigo.com/travel-guide/nanjing page 1 Max: 32.5°C Min: 24.7°C Rain: 200.7mm Nanjing When To Aug Pleasant weather. Carry Light woollen, Famed as 'The dwelling place of umbrella. Max: 31.6°C Min: 24.0°C Rain: 162.7mm tigers and dragons', Nanjing, a VISIT breathtakingly beautiful city, is Sep http://www.ixigo.com/weather-in-nanjing-lp-1137867 dotted with hills and winding Pleasant weather. Carry Light woollen, umbrella. waters. The city was the capital of Jan Max: 27.9°C Min: 19.3°C Rain: 62.6mm ancient China, famous for its Famous For : Places To VisitHistory & CulturCity Very cold weather. Carry Heavy woollen, history and culture, and is currently umbrella. Oct Max: 7.1°C Min: -1.3°C Rain: 63.4mm Cold weather. Carry Heavy woollen, a real treat for history buffs. The umbrella. Capital of Jiangsu province, Nanjing is a city presents a pleasant picture of a Max: 22.7°C Min: 12.6°C Rain: 52.4mm famous historical and cultural city housing Feb great mix of ancient and modern many museums, tombs and historical sites. Very cold weather. Carry Heavy woollen, umbrella. Nov cultures. For food-lovers, this place has a unique way Max: 9.8°C Min: 0.7°C Rain: 55.7mm Cold weather. Carry Heavy woollen, of cooking duck which has earned it one of umbrella. it’s many nicknames- Duck Capital. The rich Mar Max: 16.4°C Min: 5.9°C Rain: 57.4mm heritage combines with the natural scenic Very cold weather. -

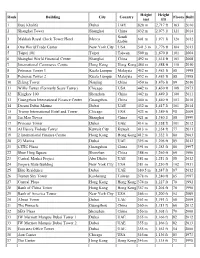

List of World's Tallest Buildings in the World

Height Height Rank Building City Country Floors Built (m) (ft) 1 Burj Khalifa Dubai UAE 828 m 2,717 ft 163 2010 2 Shanghai Tower Shanghai China 632 m 2,073 ft 121 2014 Saudi 3 Makkah Royal Clock Tower Hotel Mecca 601 m 1,971 ft 120 2012 Arabia 4 One World Trade Center New York City USA 541.3 m 1,776 ft 104 2013 5 Taipei 101 Taipei Taiwan 509 m 1,670 ft 101 2004 6 Shanghai World Financial Center Shanghai China 492 m 1,614 ft 101 2008 7 International Commerce Centre Hong Kong Hong Kong 484 m 1,588 ft 118 2010 8 Petronas Tower 1 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 8 Petronas Tower 2 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 10 Zifeng Tower Nanjing China 450 m 1,476 ft 89 2010 11 Willis Tower (Formerly Sears Tower) Chicago USA 442 m 1,450 ft 108 1973 12 Kingkey 100 Shenzhen China 442 m 1,449 ft 100 2011 13 Guangzhou International Finance Center Guangzhou China 440 m 1,440 ft 103 2010 14 Dream Dubai Marina Dubai UAE 432 m 1,417 ft 101 2014 15 Trump International Hotel and Tower Chicago USA 423 m 1,389 ft 98 2009 16 Jin Mao Tower Shanghai China 421 m 1,380 ft 88 1999 17 Princess Tower Dubai UAE 414 m 1,358 ft 101 2012 18 Al Hamra Firdous Tower Kuwait City Kuwait 413 m 1,354 ft 77 2011 19 2 International Finance Centre Hong Kong Hong Kong 412 m 1,352 ft 88 2003 20 23 Marina Dubai UAE 395 m 1,296 ft 89 2012 21 CITIC Plaza Guangzhou China 391 m 1,283 ft 80 1997 22 Shun Hing Square Shenzhen China 384 m 1,260 ft 69 1996 23 Central Market Project Abu Dhabi UAE 381 m 1,251 ft 88 2012 24 Empire State Building New York City USA 381 m 1,250 -

NANJING Retail Q4 2019

M A R K E T B E AT NANJING Retail Q4 2019 YoY 12-Mo. Golden Eagle Bloc A Re-Opened, More Quality Malls Expected in 2020 Chg Forecast Golden Eagle Shopping Mall Bloc A in Xinjiekou re-opened at the end of the year, re-introducing 45,000 sq m of prime retail supply and pushing overall stock up to 2.6 million sq m. Many prime projects in Jianye District and other urban areas are expected to be finished next year. Chongqing - 8.7% based Longfor may open four malls in Nanjing within a year, and multiple submarkets are preparing quality new projects to meet diversified Disposable Income household consumption needs in emerging areas. 1.2% Festivals Brought Opportunities to Shopping Malls Population Growth (2018) 2019 saw the 70th anniversary of the founding of the PRC. Nanjing hosted a number of celebratory activities in tourist locations during the nat ional holidays. To meet customer demand, more restaurants and bars were permitted to extend their operating hours to late nights, m arking the further 7.0% development of the ‘night economy.’ In Q4 shopping malls also hosted events and adopted strategies to attract customers durin g the festival Consumption Expenditure season. In the colder weather shopping mall atriums became ideal spaces for exhibitions and performances, which boosted foot traffic, particularly Growth where celebrities were featured. Learning from online shopping platforms, shopping malls also accelerated the improvement of their user Source: Nanjing Statistics Bureau. experience by incorporating intelligent devices or new retail formats. Customer service robots are increasingly seen in department stores and the The forecast is based on Oxford Economics functionality of retail mobile apps and mini -programs is being enhanced. -

Welcome to Education First

Welcome To Education First The School Education First Nanjing was established in 2002, and has grown to include five schools serving over 3000 students aged 3- 18. Our diverse teaching staff is comprised of thirty-five foreign teachers from eight different countries and twenty-five local Chinese teachers, and is growing all the time. Our schools are equipped with cutting edge technology and all the resources needed to make both the teaching and learning experience outstanding. At Education First Nanjing, we are looking for motivated, professional, and open-minded people who want to make a difference. We want our teachers to deliver high quality, creative and engaging lessons to our students. If you think that can be you, you've found the right place. Joining our schools, you will be joining a team with rapid growth, which means in the future there will always be Senior Teachers and Directors of Studies needed, career growth is at the heart of our company. The Management Investor: Queena Tian Production Manager: James Cullimore School 1 Centre Manager: Dora Sun School 1 Director of Studies: Christopher Olford School 2 Centre Manager: Catherine Shen School 2 Director of Studies: Colin Smith School 3 Centre Manager: Monica Hua School 3 Director of Studies: Olena Livermore School 4 Centre Manager: Ann Fu School 4 Director of Studies: Blake Livermore School 5 Centre Manager: Stina Shi School 5 Director of Studies: Emily Dunhill The Job Our school offers one contract package of over 180,000 RMB to a new teacher. 15,800 RMB-19,000RMB Monthly -

MARKET NAME Office QX 20XX

M A R K E T B E AT NANJING Retail Q2 2021 YoY 12-Mo. Qiaobei Mix One Opened in Q2 Chg Forecast Mix One in Qiaobei opened as scheduled at the end of June. It is a high-quality commercial project in Jiangbei New Area. The overall occupancy rate of the mall has reached 100%. The project covers an area of 100,000 sq m and it adopts a TOD comprehensive development strategy. As 14.3% more quality malls nearby complete soon, such as Golden Elephant City-Wangfujing and Wondercity, market competition is likely to be intensified. Disposable Income The total stock of quality retail space reached 4.21 million sq m at the end of Q2 2021. Many previously delayed malls are no w expected to be 9.5% completed this year, which will particularly boost the development of Hexi New Town and Jiangbei New Area. Population Growth (2020) Demand for Quality Retail Space Continued to Grow 23.9% Supported by economic growth, customer footfall at shopping malls increased dramatically in Q2. According to the Nanjing Stat istics Bureau, Consumption Expenditure Growth consumption expenditure growth and disposable income rose 23.9% and 14.3% y-o-y, respectively. Demand for quality retail space from many international and domestic retailers continued to grow in Q2. F&B, new retail, apparel, entertainment and cosmetics retailers were the major drivers Source: Nanjing Statistics Bureau. of demand. Examples include UNIQLO and CGS Cinema in Mix One, Yan Ji You in the Splendors, Man Man’s first store at Golden Ea gle and Maia The forecast is based on Oxford Economics Active at Deji Plaza. -

An Overview of 30 Retail Locations in China Retail Sales in 2013

China City Profiles 2014 An Overview of 30 Retail Locations in China Retail sales in 2013 Y-o-y Growth (%) Beijing 8.7% Shanghai 8.2% Guangzhou 15.2% Chongqing 11.9% Tianjin 14.0% Shenzhen 10.6% Wuhan 13.0% Chengdu 13.1% Suzhou 11.5% Hangzhou 19.9% Nanjing 13.8% Shenyang 13.7% Qingdao 13.3% Changsha 14.1% Wuxi 12.9% Harbin 13.9% Fuzhou 18.7% Ningbo 13.2% Ji'nan 13.4% Zhengzhou 12.9% Xi'an 14.0% Dalian 13.6% Foshan 12.1% Changchun 13.3% Nantong 12.8% Kunming 14.0% Changzhou 13.7% Hefei 14.5% Xiamen 10.5% Zhuhai 13.4% 0 100 200 300 400 500 600 700 800 900 1,000 (RMB billion) Source: CEIC Disposable income in 2013 Y-o-y Growth (%) Shenzhen 9.6% Shanghai 9.1% Guangzhou 10.5% Ningbo 10.1% Xiamen 10.1% Suzhou 9.5% Beijing 10.6% Nanjing 9.8% Hangzhou 4.8% Wuxi 9.4% Foshan 10.0% Changzhou 10.0% Zhuhai 10.3% Ji'nan 9.5% Qingdao 9.6% Changsha 11.1% Xi'an 10.4% Tianjin 10.2% Fuzhou 9.7% Nantong 9.8% Dalian 9.8% Chengdu 10.2% Wuhan 10.2% Shenyang 9.6% Kunming 10.3% Hefei 10.4% Zhengzhou 5.2% Changchun 12.8% Chongqing 9.8% Harbin 12.0% 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 (RMB per annum) Source: CEIC 2 China City Profiles 2014 China Retail Profiles 2014 The China market presents a compelling opportunity for retailers. -

Signature Redacted Department of Civil and Environmental Engineering May 21, 2015

TRENDS AND INNOVATIONS IN HIGH-RISE BUILDINGS OVER THE PAST DECADE ARCHIVES 1 by MASSACM I 1TT;r OF 1*KCHN0L0LGY Wenjia Gu JUL 02 2015 B.S. Civil Engineering University of Illinois at Urbana-Champaign, 2014 LIBRAR IES SUBMITTED TO THE DEPARTMENT OF CIVIL AND ENVIRONMENTAL ENGINEERING IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTER OF ENGINEERING IN CIVIL ENGINEERING AT THE MASSACHUSETTS INSTITUTE OF TECHNOLOGY JUNE 2015 C2015 Wenjia Gu. All rights reserved. The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known of hereafter created. Signature of Author: Signature redacted Department of Civil and Environmental Engineering May 21, 2015 Certified by: Signature redacted ( Jerome Connor Professor of Civil and Environmental Engineering Thesis Supervisor Accepted bv: Signature redacted ?'Hei4 Nepf Donald and Martha Harleman Professor of Civil and Environmental Engineering Chair, Departmental Committee for Graduate Students TRENDS AND INNOVATIONS IN HIGH-RISE BUILDINGS OVER THE PAST DECADE by Wenjia Gu Submitted to the Department of Civil and Environmental Engineering on May 21, 2015 in Partial Fulfillment of the Degree Requirements for Master of Engineering in Civil and Environmental Engineering ABSTRACT Over the past decade, high-rise buildings in the world are both booming in quantity and expanding in height. One of the most important reasons driven the achievement is the continuously evolvement of structural systems. In this paper, previous classifications of structural systems are summarized and different types of structural systems are introduced. Besides the structural systems, innovations in other aspects of today's design of high-rise buildings including damping systems, construction techniques, elevator systems as well as sustainability are presented and discussed. -

THE BEST CHOICE for the Five-Star Hotels and Residential Apartments

THE BEST CHOICE FOR the five-star hotels and residential apartments Asian edition 040 01 DESIGN CENTER 设 计 中 心 Bravat has two design centers around the world: A German-based one which is well-known for its design simplicity and its designers of different cultural backgrounds. The other center is located in Asia, and it consists of designers from Mainland China and Taiwan. Each design team includes professionals in the areas of external appearance, materials, structure, manufacturing, etc. They work together by integrating the Western and Eastern cultures, both rationally and emotionally. Keeping to the same design philosophy, they are dedicated to product renovation and pay attention to researching the cultural characteristics and users’ demands in different countries. In addition, they intensely create elements in order to provide users with comprehensive sanitary solutions which are gifted to local market features and take the lead in prospective lifestyle. According to its design philosophy, Bravat hopes to give the products with profound value of thinking. When consumers use Bravat’s sanitary products, hopefully they will appreciate the metaphoric beauty, both internally and externally, of the products that are given from their merits and perseverance in design. In return, we hope to extend our care to the consumers needs and create a life experience which is simpler and more comfortable for them. 贝朗在全球拥有两个设计中心:以极简设计闻名,由不同文化背景的设计师组成的 德国设计中心;及中国、台湾设计师组成的亚洲设计中心。每一个设计团队都包含 外型、材质、结构、制造等不同的专业性人员,他们一起合作,融汇东西方文化, 理性和感性,凭借相同的设计理念致力于产品创新,并关注各个地区文化特征研究 -

Enjoy up to 20% Off at Renowned Chinese Restaurants

Enjoy up to 20% off at renowned Chinese restaurants Discount CNY100 off when spend minimum CNY500/ sale slip for renowned Chinese restaurants with ICBC (Thai) UnionPay card at selected restaurants in Beijing, Shanghai, Guangzhou, Shenzhen and Chengdu From 20 May – 20 November 2019 Conditions:1. This promotion is apply with UnionPay cards issued outside Mainland China (card number starting with 62). Excluded UnionPay cards issued in Mainland China. 2.Offers are only valid with card-based payment or mobile QuickPass payment. 3.One card per event day can only enjoy the discount once. All participating restaurants share the daily quota. 4.Beijing Time (GMT+8) is adopted in transaction confirmation. Due to the system cut-off, event day commences at 23:00 p.m. and terminates at 22:59 p.m. the next natural day. Due to daily system maintenance, offers are not valid during 22:58 p.m. to 23:05 p.m. 5.The receipt will indicate original amount of bill without discount, even though the discount is applied. Please refer to transaction SMS or bank statement for actual payment amount. 6.In the event of refund, only the amount paid by cardholders will be returned, excluding the discount amount. 7.Limited quantity of offers on a first-come-first-served basis for all UnionPay cards issued from all banks in Thailand. 8.Bills are not allowed to be split for payment. UnionPay International and merchants reserve the right to withdraw or cancel a discount offer in case of any alleged violation or abuse of the offer rules. -

Briefing Retail Sector November 2018

Savills China Research Nanjing Briefing Retail sector November 2018 Image: Yanziji Garden City SUMMARY No new projects entered the market in Q3/2018, stabilising city-wide vacancy rates and rents. No new projects were launched in Mid-to high-end shopping mall Q3/2018, thus mid- to high-end retail average first-floor rent increased by “The city-wide first floor average stock remains at approximately 4.22 0.84% QoQ to RMB14.0 per sq m per rent is experiencing a slight million sq m. day, down 4.45% year-on-year (YoY). decline mainly due to lower rents The city-wide shopping mall One new mid-end retail project offered by landlords in emerging vacancy rate decreased by 0.7 of a is scheduled to enter the market in retail areas. New shopping percentage point (ppt) quarter-on- Q4/2018, contributing retail space of malls mushrooming in emerging quarter (QoQ) to 6.2 % in Q3/2018. 100,000 sq m. areas will change Nanjing’s retail property landscape and improve the city’s vitality.” James Macdonald, Savills Research savills.com.cn/research 01 Briefing |Nanjing retail sector November 2018 Economic overview GRAPH 1 City-wide retail sales maintained Retail supply and stock, 2007- Q3/2018 steady growth in Q3/2018, exceeding RMB426 billion by the Shopping mall (LHS) Department stock (LHS) Stock (RHS) end of September 2018, up 8.9% 700 4.5 YoY. Over the same period, fixed- 4.0 asset investment (FAI) grew 9.2% 600 YoY to RMB408 billion. Additionally, 3.5 disposable income per capita in 500 3.0 Nanjing grew by 8.9% YoY. -

Urban Commercial Spatial Structure Optimization in the Metropolitan Area of Beijing: a Microscopic Perspective

sustainability Article Urban Commercial Spatial Structure Optimization in the Metropolitan Area of Beijing: A Microscopic Perspective Fang Wang 1 and Fang-qu Niu 2,* 1 School of Public Administration, Inner Mongolia University, Hohhot 010070, China; [email protected] 2 Institute of Geographic Sciences and Natural Resources Research, Chinese Academy of Sciences, Beijing 100101, China * Correspondence: [email protected] Received: 13 December 2018; Accepted: 18 February 2019; Published: 20 February 2019 Abstract: Urban commercial districts (UCDs) are the concentrated areas for commercial activities in a city, which provide shopping, leisure, business, and other functions. Urban planners usually face problems in how to plan and design UCDs. The layout of UCDs should not only be appropriately concentrated to realize economic benefits, but should also be properly dispersed to accommodate the distribution of the population. Using Beijing as a case study, this study conducted research into UCDs from a microscopic perspective by utilizing open source big data. A recognition and classification method of UCDs was proposed based on the data of POI and road networks. The proposed model combines Huff’s model and the Voronoi method to analyze how various UCDs should be distributed within a city according to the spatial pattern of the population. The results showed that different kinds of UCDs had different spatial distribution features. Problems were also found, for example, UCDs on the urban outskirts served a large population; there were limitations to the spatial distribution of UCDs in the downtown area; and there was incongruity between the UCD types and the population layout. Based on these findings, suggestions regarding the optimization of the urban commercial spatial structure were also put forward. -

CTBUH 2013 Review

CTBUH Year in Review: Tall Trends of 2013 Small Increase in Completions Marks Return to Upward Trend Report by Daniel Safarik and Antony Wood, CTBUH Research by Marty Carver and Marshall Gerometta, CTBUH By all appearances, the small increase in the total number of tall-building completions from 2012 into 2013 is indicative of a return to the prevalent trend of increasing completions each year over the past decade. Perhaps 2012, with its small year-on-year drop in completions, was the last year to register the full effect of the 2008 / 2009 global financial crisis, and a small sigh of relief can be let out in the tall-building industry as we begin 2014. Figure 1. The tallest 20 buildings completed in 2013 © CTBUH Please see end of report for a more detailed 2013 skyline At the same time, it is important to note that 2013 was the second-most successful year ever, in terms of 200-meter-plus building completion, with 73 buildings of 200 meters or greater height completed. When examined in the broad course of skyscraper completions since 2000, the rate is still increasing. From 2000 to 2013, the total number of 200-meter-plus buildings in existence increased from 261 to 830 – an astounding 318 percent. From this point of view, we can more confidently estimate that the slight slowdown of 2012, which recorded 69 completions after 2011’s record 81 – was a “blip,” and that 2013 was more representative of the general upward trend. 2013 Tallest #1: JW Marriott Marquis Hotel Dubai, Dubai 2013 Tallest #4: Al Yaqoub Tower, Dubai (CC BY-NC-ND) 2013 Tallest #5: The Landmark, Abu Dhabi.