China Retail Guide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nanjing Travel Guide - Page 1

Nanjing Travel Guide - http://www.ixigo.com/travel-guide/nanjing page 1 Max: 32.5°C Min: 24.7°C Rain: 200.7mm Nanjing When To Aug Pleasant weather. Carry Light woollen, Famed as 'The dwelling place of umbrella. Max: 31.6°C Min: 24.0°C Rain: 162.7mm tigers and dragons', Nanjing, a VISIT breathtakingly beautiful city, is Sep http://www.ixigo.com/weather-in-nanjing-lp-1137867 dotted with hills and winding Pleasant weather. Carry Light woollen, umbrella. waters. The city was the capital of Jan Max: 27.9°C Min: 19.3°C Rain: 62.6mm ancient China, famous for its Famous For : Places To VisitHistory & CulturCity Very cold weather. Carry Heavy woollen, history and culture, and is currently umbrella. Oct Max: 7.1°C Min: -1.3°C Rain: 63.4mm Cold weather. Carry Heavy woollen, a real treat for history buffs. The umbrella. Capital of Jiangsu province, Nanjing is a city presents a pleasant picture of a Max: 22.7°C Min: 12.6°C Rain: 52.4mm famous historical and cultural city housing Feb great mix of ancient and modern many museums, tombs and historical sites. Very cold weather. Carry Heavy woollen, umbrella. Nov cultures. For food-lovers, this place has a unique way Max: 9.8°C Min: 0.7°C Rain: 55.7mm Cold weather. Carry Heavy woollen, of cooking duck which has earned it one of umbrella. it’s many nicknames- Duck Capital. The rich Mar Max: 16.4°C Min: 5.9°C Rain: 57.4mm heritage combines with the natural scenic Very cold weather. -

Is a High Refund Strategy Always Effective?

Is a High Refund Strategy Always Effective? Shueh-Chin Ting, Professor, Department of Education, National University of Tainan, Taiwan ABSTRACT Retailers often use a refund strategy to guarantee that their products are the lowest price. However, does a high refund strategy announced by retailers definitively help consumers to believe that their products have the lowest price? Hierarchical moderator regression analysis was used to examine the moderating effect of a retailer’s reputation on the relationship between refund size and the believability of the lowest price. The results indicate that refund size has no direct effect on the believability of the lowest price and the effect is moderated by a retailer’s reputation. For reputable retailers, refund size has a positive influence on the believability of the lowest price. For less reputable retailers, refund size has a negative influence on the believability of the lowest price. Prior studies neglected the importance of a retailer’s reputation in implementing refund strategies. This study has resolved this research gap. Keywords: believability of the lowest price, guarantee strategy, refund size, retailer’s reputation. INTRODUCTION Retailers often use low-price guarantees (LPGs) as a signal to attract consumers and increase sales. Consumers interpret LPGs as signals that a particular retailer is committed to low prices (Borges, and Babin, 2012). Price-matching guarantees (PMGs) are commonly used by retailers as promises to match the lowest price for an item that a customer can find elsewhere (Yuan and Krishna, 2011). Signaling theory has been used to understand the overall effect of a PMG on consumer perceptions (Borges, 2009). -

1 Abundant Glory Limited British Virgin Islands Executive

Appendix B Present Directorships of Edith SHIH as at effective date of appointment Role Name of Company Place of Incorporation (Executive / Non-Executive) 1 Abundant Glory Limited British Virgin Islands Executive 2 Actionfirm Limited British Virgin Islands Executive 3 AICT Advisory Limited British Virgin Islands Executive Alexandria International Container Terminals 4 Egypt Executive Company S.A.E. 5 Alpha Metrics Limited British Virgin Islands Executive 6 Americas Intermodal Services SA/NV Belgium Executive 7 Americas Shipyard SA/NV Belgium Executive 8 Amsterdam Container Terminals B.V. Netherlands Executive 9 Amsterdam Marine Terminals B.V. Netherlands Executive 10 Amsterdam Port Holdings B.V. Netherlands Executive 11 Anovio Holdings Limited Cyprus Executive 12 APM Terminals Dachan Company Limited Hong Kong Executive 13 Aqaba Terminal Services Limited British Virgin Islands Executive 14 Asia Pacific Honour Holdings Limited British Virgin Islands Executive 15 Bajacorp, S.A. de C.V. Mexico Executive 16 Barcelona Europe South Terminal, S.A. Spain Executive 17 Best Fortune S.a r.l. Luxembourg Executive 18 Best Month Profits Limited British Virgin Islands Executive 19 Best Oasis Holdings Limited British Virgin Islands Executive 20 Best People Resources Limited British Virgin Islands Executive 21 Beyond Excel Investments Limited British Virgin Islands Executive 22 Brightease Profits Limited British Virgin Islands Executive 23 Brisbane Container Terminals Pty Limited Australia Executive Appendix B 24 Buenos Aires Container Terminal Services S.A. Argentina Alternate Director 25 Cape Fortune B.V. Netherlands Executive 26 Central America Shipyard SA/NV Belgium Executive 27 China Terminal Services Holding Company Limited Bermuda Executive 28 Clivedon Limited British Virgin Islands Executive 29 CLK Limited British Virgin Islands Executive 30 Coastal Work Logistics Limited British Virgin Islands Executive 31 Container Security Inc. -

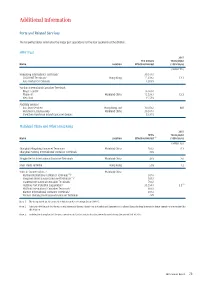

Additional Information

additional Information ports and related services The following tables summarise the major port operations for the four segments of the division. HpH trust 2015 The Group’s Throughput Name Location Effective Interest (100% basis) (million TEU) Hongkong International Terminals/ 30.07% / COSCO-HIT Terminals/ Hong Kong 15.03% / 12.1 Asia Container Terminals 12.03% Yantian International Container Terminals - Phase I and II/ 16.96% / Phase III/ Mainland China 15.53% / 12.2 West Port 15.53% Ancillary Services - Asia Port Services/ Hong Kong and 30.07% / N/A Hutchison Logistics (HK)/ Mainland China 30.07% / Shenzhen Hutchison Inland Container Depots 23.35% Mainland China and other Hong Kong 2015 HPH’s Throughput Name Location Effective Interest (1) (100% basis) (million TEU) Shanghai Mingdong Container Terminals/ Mainland China 50% / 8.3 Shanghai Pudong International Container Terminals 30% Ningbo Beilun International Container Terminals Mainland China 49% 2.0 River Trade Terminal Hong Kong 50% 1.2 Ports in Southern China - Mainland China (2) Nanhai International Container Terminals / 50% / (2) Jiangmen International Container Terminals / 50% / Shantou International Container Terminals/ 70% / (3) Huizhou Port Industrial Corporation/ 33.59% / 2.5 Huizhou International Container Terminals/ 80% / Xiamen International Container Terminals/ 49% / Xiamen Haicang International Container Terminals 49% Note 1: The Group holds an 80% interest in Hutchison Ports Holdings Group (“HPH”). Note 2: Although HPH Trust holds the economic interest in the two River Ports in Nanhai and Jiangmen in Southern China, the legal interests in these operations are retained by this division. Note 3: Includes the throughput of the port operations in Gaolan and Jiuzhou that were disposed during the second half of 2015. -

Chartered Secretaries American Express Credit Cards

Chartered Secretaries American Express Credit Cards Chartered Secretaries American Express® Platinum Credit Card and Chartered Secretaries American Express®Gold Credit Card are two co-branded cards that have been created in collaboration with The Hong Kong Institute of Chartered Secretaries (HKICS) and have been specifically designed to recognise and benefit our members. As a Member/Graduate/Student of HKICS, you are cordially invited to become a Chartered Secretaries American Express Platinum or Gold Card Cardmember. This card provides a highly convenient way to pay for HKICS membership fees, CPD events and seminars, examination fees and other fees. Application forms Exclusive privileges Merchants List Application forms Chartered Secretaries American Express Platinum Credit Card application form Chartered Secretaries American Express Gold Credit Card application form Application with required documents should be sent to: American Express International Inc Attn: New Accounts GPO Box 11250 Hong Kong Note: 1. Terms and conditions apply to the above offers and privileges. Please visit www.americanexpress.com.hk to learn more. 2. The Chartered Secretaries American Express co-branded Card is a privilege from HKICS. All Credit Card applicationapprovals will be at the sole discretion of American Express International Inc 3. For any enquiries, please call 2277 1370 Back to top Exclusive privileges: Chartered Secretaries American Express® Platinum Credit Card Half annualfee waiver saving you HK$800 a year Generous welcome offers including HK$500 Lane Crawford or Esso Synergy Fuel Cash Voucher, plus 10X Membership Rewards points in the first 3 months, up to 300,000 points Up to HK$500 travel package discount coupon when you purchasing travel packages from Farrington American Express Travel Services Ltd. -

Hong Kong Health and Beauty Retail Stores

Hong Kong Health and Beauty Retail Guide December 2014 Introduction With a wealthy population of 7 million and GDP of US$235 billion, Hong Kong is a large, high-value and expanding market for Australian consumer products, including beauty and health products. In 2013, A$132 million of Australian cosmetics and skin care were exported to Hong Kong. Australian cosmetic and skin care products have an international reputation as safe, environmentally friendly and consistently high quality. Australia is also recognised as a reliable source of quality cosmetics, skin care and health products, particularly in the natural and organic skincare categories. Hong Kong’s total sales in beauty and personal care products remained strong in 2013, reaching over HK$14.5 billion (over A$2 billion). Last year more than 50 million visitors, including some 40 million mainland Chinese, came to shop in Hong Kong, with cosmetics and skin care items a key focus. Hong Kong is a significant market in its own right and an excellent testing ground for international products entering the region. Austrade has launched a special video insights series to provide Australian beauty companies with first-hand perspectives from experts in the market. These videos provide advice on the latest market trends and tactics to be used in Hong Kong and China. Check it out from Austrade website. Table of Contents Page Number Overview of Hong Kong Distribution Channels - Beauty and Health Products 3 Hong Kong Health and Beauty Retail Stores Specialty Stores 4 Department Stores 5 Beauty Counters at Department Stores 6 Pharmacy Chains 8 Multi-brand Shops 8 Australian Concept Stores 9 Supermarkets 10 Austrade Contacts 12 November 2014 Austrade Health and Beauty Products Retail Stores in Hong Kong> 2 Overview of Hong Kong Distribution Channels - Beauty and Health Products Hong Kong has a sophisticated retail sector for the sale and distribution of health and beauty products. -

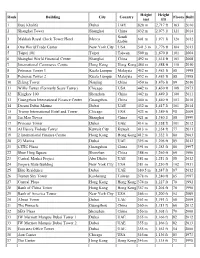

List of World's Tallest Buildings in the World

Height Height Rank Building City Country Floors Built (m) (ft) 1 Burj Khalifa Dubai UAE 828 m 2,717 ft 163 2010 2 Shanghai Tower Shanghai China 632 m 2,073 ft 121 2014 Saudi 3 Makkah Royal Clock Tower Hotel Mecca 601 m 1,971 ft 120 2012 Arabia 4 One World Trade Center New York City USA 541.3 m 1,776 ft 104 2013 5 Taipei 101 Taipei Taiwan 509 m 1,670 ft 101 2004 6 Shanghai World Financial Center Shanghai China 492 m 1,614 ft 101 2008 7 International Commerce Centre Hong Kong Hong Kong 484 m 1,588 ft 118 2010 8 Petronas Tower 1 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 8 Petronas Tower 2 Kuala Lumpur Malaysia 452 m 1,483 ft 88 1998 10 Zifeng Tower Nanjing China 450 m 1,476 ft 89 2010 11 Willis Tower (Formerly Sears Tower) Chicago USA 442 m 1,450 ft 108 1973 12 Kingkey 100 Shenzhen China 442 m 1,449 ft 100 2011 13 Guangzhou International Finance Center Guangzhou China 440 m 1,440 ft 103 2010 14 Dream Dubai Marina Dubai UAE 432 m 1,417 ft 101 2014 15 Trump International Hotel and Tower Chicago USA 423 m 1,389 ft 98 2009 16 Jin Mao Tower Shanghai China 421 m 1,380 ft 88 1999 17 Princess Tower Dubai UAE 414 m 1,358 ft 101 2012 18 Al Hamra Firdous Tower Kuwait City Kuwait 413 m 1,354 ft 77 2011 19 2 International Finance Centre Hong Kong Hong Kong 412 m 1,352 ft 88 2003 20 23 Marina Dubai UAE 395 m 1,296 ft 89 2012 21 CITIC Plaza Guangzhou China 391 m 1,283 ft 80 1997 22 Shun Hing Square Shenzhen China 384 m 1,260 ft 69 1996 23 Central Market Project Abu Dhabi UAE 381 m 1,251 ft 88 2012 24 Empire State Building New York City USA 381 m 1,250 -

The First a S Watson Global Retail Day Reveals to Suppliers the a S Watson Group’S Bigger Picture by Mark Redvers

• Retail Going Global The first A S Watson Global Retail Day reveals to suppliers the A S Watson Group’s bigger picture By Mark Redvers 28 Sphere VirTuallY everY daY, an A S Watson-owned the retail business. store opens somewhere in the world. Emerging “The aim is to markets, in particular fast growing China, have open 250 to 300 seen spectacular growth in recent years, as newly quality stores affluent customers splash out on beauty and a year in the healthcare products. Mainland, which More – much more – growth is anticipated, is about one third as the A S Watson Group (ASW) embarks on a of the total new major expansion plan, which will see the company stores we plan to reach the milestone of 10,000 stores next year. open annually in Delegates at the first A S Watson Group Global our 34 markets,” Suppliers Conference and Awards were given this said Malina Ngai, determinedly upbeat assessment, and appraised of Director Group Op- ambitious future plans that will reinforce ASW’s erations, Investments undisputed position as the world’s leading inter- and Communications national health and beauty retailer. Annual ASW and Head of International turnover currently stands at USD15 billion with Buying. plans to expand vigorously, notwithstanding the “We understand the market contemporary recessionary climate. very well after 20 years of operat- The 110 delegates to the conference, who hold ing experience. Our Watsons health and senior positions with the largest health and beauty beauty chain has 680 stores in over 101 cities, and manufacturers, were told how ASW, through its our PARKnSHOP food retail chain has 39 stores, Opposite: own name Watsons stores in Asia and its various mainly in Southern China. -

The Competitive Strategy of an Ethnic Chinese Corporate Group Under the Hong Kong Economic Development, with Special Emphasis on the Cheung Kong Group

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Ritsumeikan Research Repository © Institute of lnternational Relations and Area Studies, Ritsumeikan University The Competitive Strategy of an Ethnic Chinese Corporate Group under the Hong Kong Economic Development — With Special Emphasis on the Cheung Kong Group — Mori, Masaki* Abstract This paper discusses about the competitive strategy of an ethnic Chinese corporate group under the Hong Kong economic development, with special emphasis on the Cheung Kong group. First, Hong Kong economy, its industrial development and the economic relationship between Hong Kong and the mainland China is historically examined. Second, the growth strategy of a Hong Kong corporate group, the Cheung Kong group, is discussed how to diversify its business in adapting to Hong Kong economic environment. Third, the characteristics of its corporate governance and accounting management are discussed as a family-owned corporate group. Keywords: Competitive Strategy, Ethnic Chinese Corporate Group, the Hong Kong Economic Development, the Cheung Kong Group Ritsumeikan International Affairs Vol.12, pp.21–38 (2014). * Associate Professor, College of Business Administration, Ritsumeikan University, Japan. E-mail: [email protected] 22 Ritsumeikan International Affairs 【Vol. 12 1. Introduction This paper examines the Competitive Strategy of an ethnic Chinese corporate group under the Hong Kong economic development, through a case study of the Cheung Kong Group. The focus herein is on corporate governance and accounting management within family enterprises. You Zhongxun (1998) proposes that “The reason for the economic prosperity of ethnic Chinese…is largely attributable to Asia’s economic development. -

The Impact of NMR and MRI

WELLCOME WITNESSES TO TWENTIETH CENTURY MEDICINE _____________________________________________________________________________ MAKING THE HUMAN BODY TRANSPARENT: THE IMPACT OF NUCLEAR MAGNETIC RESONANCE AND MAGNETIC RESONANCE IMAGING _________________________________________________ RESEARCH IN GENERAL PRACTICE __________________________________ DRUGS IN PSYCHIATRIC PRACTICE ______________________ THE MRC COMMON COLD UNIT ____________________________________ WITNESS SEMINAR TRANSCRIPTS EDITED BY: E M TANSEY D A CHRISTIE L A REYNOLDS Volume Two – September 1998 ©The Trustee of the Wellcome Trust, London, 1998 First published by the Wellcome Trust, 1998 Occasional Publication no. 6, 1998 The Wellcome Trust is a registered charity, no. 210183. ISBN 978 186983 539 1 All volumes are freely available online at www.history.qmul.ac.uk/research/modbiomed/wellcome_witnesses/ Please cite as : Tansey E M, Christie D A, Reynolds L A. (eds) (1998) Wellcome Witnesses to Twentieth Century Medicine, vol. 2. London: Wellcome Trust. Key Front cover photographs, L to R from the top: Professor Sir Godfrey Hounsfield, speaking (NMR) Professor Robert Steiner, Professor Sir Martin Wood, Professor Sir Rex Richards (NMR) Dr Alan Broadhurst, Dr David Healy (Psy) Dr James Lovelock, Mrs Betty Porterfield (CCU) Professor Alec Jenner (Psy) Professor David Hannay (GPs) Dr Donna Chaproniere (CCU) Professor Merton Sandler (Psy) Professor George Radda (NMR) Mr Keith (Tom) Thompson (CCU) Back cover photographs, L to R, from the top: Professor Hannah Steinberg, Professor -

Watsons Experience Launches in Russia Focus Story

103 Watsons Experience Launches in Russia Focus Story Watsons Experience Launches in Russia Watsons is delighted to have opened its first Russian store in St.Petersberg. The launch of Asia’s No.1 health and beauty brand will deliver an unprecedented range of world-class products to the increasingly sophisticated Russian market. This is a country where people take great care over their appearance, and by introducing the products and advanced skincare regimens of Asia, Watsons taps into what it sees as huge market potential. WatsON 103 • Quarter 2 • 2018 01 Focus Story Russia will be the 12th market to host Watsons stores. In every market where it operates, Watsons sets the highest global standards in the health, wellness and beauty market. Putting customers first is what Watsons is all about. It offers customers real value, good service and expert advice – and St.Petersberg this is what Watsons will present to Russian customers. The launch of the first store in Russia is a significant step in the expansion of the Watsons brand. Watsons “cares deeply about its customers around the globe, addressing their health and beauty needs both instore and online. We are dedicated to making our customers Look Good and Feel Great and putting a smile on their faces. Andrei Melnikov ” General Manager Watsons Russia WatsON 103 • Quarter 2 • 2018 02 Focus Story Emerging Market, Golden Opportunity Russian customers are seeking out both new experiences Beauty trends from Asia and especially from Korea and new products in health and beauty. Russian is a – hugely popular across Asia but underdeveloped in Russia magnet for sophisticated travellers from across Europe, Digital and eCommerce solutions, which are well and it has significant potential for future growth. -

NANJING Retail Q4 2019

M A R K E T B E AT NANJING Retail Q4 2019 YoY 12-Mo. Golden Eagle Bloc A Re-Opened, More Quality Malls Expected in 2020 Chg Forecast Golden Eagle Shopping Mall Bloc A in Xinjiekou re-opened at the end of the year, re-introducing 45,000 sq m of prime retail supply and pushing overall stock up to 2.6 million sq m. Many prime projects in Jianye District and other urban areas are expected to be finished next year. Chongqing - 8.7% based Longfor may open four malls in Nanjing within a year, and multiple submarkets are preparing quality new projects to meet diversified Disposable Income household consumption needs in emerging areas. 1.2% Festivals Brought Opportunities to Shopping Malls Population Growth (2018) 2019 saw the 70th anniversary of the founding of the PRC. Nanjing hosted a number of celebratory activities in tourist locations during the nat ional holidays. To meet customer demand, more restaurants and bars were permitted to extend their operating hours to late nights, m arking the further 7.0% development of the ‘night economy.’ In Q4 shopping malls also hosted events and adopted strategies to attract customers durin g the festival Consumption Expenditure season. In the colder weather shopping mall atriums became ideal spaces for exhibitions and performances, which boosted foot traffic, particularly Growth where celebrities were featured. Learning from online shopping platforms, shopping malls also accelerated the improvement of their user Source: Nanjing Statistics Bureau. experience by incorporating intelligent devices or new retail formats. Customer service robots are increasingly seen in department stores and the The forecast is based on Oxford Economics functionality of retail mobile apps and mini -programs is being enhanced.