China: Retail Foods

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dalian Refrigeration Co., Ltd. 2011 Annual Report

Dalian Refrigeration Co., Ltd. 2011 Annual Report Dalian Refrigeration Co., Ltd. 2011 Annual Report CONTENTS §1 Important Notes⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯ 2 §2 Company Profile⋯⋯⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯ 2 §3 Summary of Accounting Data and Business Data⋯⋯ ⋯ ⋯⋯⋯ ⋯⋯ ⋯⋯⋯ ⋯⋯ ⋯ 4 §4 Changes in Share Capital and Particulars about Shareholders⋯⋯⋯ ⋯⋯⋯ ⋯⋯ 6 §5 Directors, Supervisors, Senior Staff Members and Employees of the Company⋯⋯ 9 §6 The Administrative System of the Company⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 13 §7 The Internal Control of the Company⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯ 15 §8 Brief Introduction to the Shareholders General Meeting⋯ ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 16 §9 Report of the Board of Directors⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯ 17 §10 Report of the Supervisory Board⋯⋯⋯⋯ ⋯⋯⋯⋯ ⋯ ⋯⋯⋯⋯ ⋯ ⋯⋯⋯⋯ ⋯ ⋯ 29 §11 Significant Events⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯⋯⋯⋯⋯ ⋯ 31 §12 Financial Report⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 37 §13 Contents of Reference Documents⋯ ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 95 1 Dalian Refrigeration Co., Ltd. 2011 Annual Report §1 Important Notes 1.1 The directors and the Board of Directors, the supervisors and the Supervisory Board, and Senior staff members of Dalian Refrigeration Co., Ltd. (hereinafter referred to as the Company) hereby confirm that there are not any important omissions, fictitious statements or serious misleading carried in this report, and shall take all responsibilities, individual and/or joint, for the reality, accuracy and completeness of the whole contents. 1.2 The financial report has been audited by ZON ZUN Certified Public Accounts Office Ltd. who has presented unqualified opinion audit report. 1.3 Chairman of the Board of Directors of the Company Mr. Zhang He, Financial Majordomo and the head of Accounting Department Ms. Xu Junrao hereby confirm that the financial report of the annual report is true and complete. 1.4 This report is written respectively in Chinese and in English. -

Is a High Refund Strategy Always Effective?

Is a High Refund Strategy Always Effective? Shueh-Chin Ting, Professor, Department of Education, National University of Tainan, Taiwan ABSTRACT Retailers often use a refund strategy to guarantee that their products are the lowest price. However, does a high refund strategy announced by retailers definitively help consumers to believe that their products have the lowest price? Hierarchical moderator regression analysis was used to examine the moderating effect of a retailer’s reputation on the relationship between refund size and the believability of the lowest price. The results indicate that refund size has no direct effect on the believability of the lowest price and the effect is moderated by a retailer’s reputation. For reputable retailers, refund size has a positive influence on the believability of the lowest price. For less reputable retailers, refund size has a negative influence on the believability of the lowest price. Prior studies neglected the importance of a retailer’s reputation in implementing refund strategies. This study has resolved this research gap. Keywords: believability of the lowest price, guarantee strategy, refund size, retailer’s reputation. INTRODUCTION Retailers often use low-price guarantees (LPGs) as a signal to attract consumers and increase sales. Consumers interpret LPGs as signals that a particular retailer is committed to low prices (Borges, and Babin, 2012). Price-matching guarantees (PMGs) are commonly used by retailers as promises to match the lowest price for an item that a customer can find elsewhere (Yuan and Krishna, 2011). Signaling theory has been used to understand the overall effect of a PMG on consumer perceptions (Borges, 2009). -

151016 CB China Power of Retailing 2015 CN.Docx

China Power of Retailing 2015 China Power of Retailing 2015 1 Foreword 2015 has witnessed the recovery of a global economy and the gradual stabilization of a real economy in China. While the Eurozone economy continues to improve, the differentiation among its economies remains noticeable. “Abeconomics” throws Japan into deep recession. The United States of America, as the only exception, enters the trajectory of a strong recovery and the US dollar has appreciated sharply against other major world currencies. Its well-anticipated rise in interest rate in the fourth quarter forebodes an accelerated devaluation of currencies in most emerging economies. As a result, the pressure on devaluating RMB is mounting. With a slowed growth rate, the Chinese economy has arrived at the stage of new normal. The YoY growth for the first half of the year lingers around 7%, hindered by the deceleration of the three engines that used to propel GDP growth – a sluggish export, a slow growth in investment and a domestic consumption that continues to fall behind expectation. Although the growth rate of the total retail of consumer goods has dropped, it has far outpaced the domestic industrial growth. With the consumer confidence seeing constant improvement that will further free up consumption potential, consumption is expected to continue pulling the economy in the future. A continued fall in oil prices has offset the inflationary pressure, curbing the inflation at a lower level to make room for executing a lax monetary policy. To further boost investment and consumption, and reduce enterprise financing costs, the government has gradually redirected its macro economy from “stabilize growth and adjust structure” to “ensure growth,” making the lowering of interest rate and reserve ratio possible in the second half of the year. -

Merger Control 2018 Seventh Edition

Merger Control 2018 Seventh Edition Contributing Editors: Nigel Parr & Ross Mackenzie GLOBAL LEGAL INSIGHTS – MERGER CONTROL 2018, SEVENTH EDITION Editors Nigel Parr & Ross Mackenzie, Ashurst LLP Production Editor Andrew Schofi eld Senior Editors Suzie Levy Caroline Collingwood Group Consulting Editor Alan Falach Publisher Rory Smith We are extremely grateful for all contributions to this edition. Special thanks are reserved for Nigel Parr & Ross Mackenzie for all their assistance. Published by Global Legal Group Ltd. 59 Tanner Street, London SE1 3PL, United Kingdom Tel: +44 207 367 0720 / URL: www.glgroup.co.uk Copyright © 2018 Global Legal Group Ltd. All rights reserved No photocopying ISBN 978-1-912509-17-1 ISSN 2048-1292 This publication is for general information purposes only. It does not purport to provide comprehensive full legal or other advice. Global Legal Group Ltd. and the contributors accept no responsibility for losses that may arise from reliance upon information contained in this publication. This publication is intended to give an indication of legal issues upon which you may need advice. Full legal advice should be taken from a qualifi ed professional when dealing with specifi c situations. The information contained herein is accurate as of the date of publication. Printed and bound by CPI Group (UK) Ltd, Croydon, CR0 4YY June 2018 CONTENTS Preface Nigel Parr & Ross Mackenzie, Ashurst LLP General chapter Anti-competitive buyer power under UK and EC merger control – too much of a good thing? Burak Darbaz, Ben Forbes & Mat Hughes, AlixPartners UK LLP 1 Country chapters Albania Anisa Rrumbullaku, CR PARTNERS 19 Australia Sharon Henrick & Wayne Leach, King & Wood Mallesons 24 Austria Astrid Ablasser-Neuhuber & Gerhard Fussenegger, bpv Hügel Rechtsanwälte GmbH 39 Canada Micah Wood & Kevin H. -

Aeon Report Report 20172017 Creating a Future Where Communities Flourish Trees Grow And

Aeon Report Report 20172017 Creating a future where communities flourish trees grow and AEON Report 2017 1 Aeon Basic Principles Pursuing peace, respecting humanity, and contributing to local communities, always with the customer’s point of view as its core. Peace The Customer People Community The word (Aeon) has its origins in a Latin root meaning “eternity.” The customers’ beliefs and desires comprise the central core of our philosophy. At Aeon, our eternal mission as a corporate group is to benefit our customers, and our operations are thus customer-focused to the highest degree. “Peace” Aeon is a corporate group whose operations are dedicated to the pursuit of peace through prosperity. “People” Aeon is a corporate group that respects human dignity and values personal relationships. “Community” Aeon is a corporate group rooted in local community life and dedicated to making a continuing contribution to the community. On the basis of the Aeon Basic Principles, Aeon practices its “Customer-First” philosophy with its everlasting innovative spirit. Editorial Policy Aeon Co., Ltd. believes its business activities contribute to a from the aspects of the environment and society. In addition, sustainable society. To further deepen its stakeholders’ with regard to its seven priority issues, including the four understanding of its business activities, from the current society-related priority issues newly specified in a materiality fiscal year Aeon has decided to publish an Integrated Report assessment conducted during fiscal 2016, this section reports that incorporates the Aeon Environmental and Social Report. in detail on management approaches, progress toward key The first half of the Report introduces the orientation of performance indicators and individual activities. -

Annual Report 2011

Annual Report Annual 2011 Annual Report 2011 Year ended February 28, 2011 Corporate Planning Office East Tower, Gate City Ohsaki 11-2, Osaki 1-chome, Shinagawa-ku Tokyo 141-8643 Japan http://www.lawson.co.jp/company/e/ Published in October 2011 ©1975–2011 LAWSON, INC. All Rights Reserved Printed in Japan I can pick up my medications at any time I get started in the morning with – that too helps keep me healthy. fresh-baked bread and coffee. [ Businessman, 55 ] [ Office worker, 26 ] Happiness and Harmony in Our Community 1 Annual Report 2011 I’m always concerned for my family, My money is from mom. And I’m so I’m confident in buying vegetables saving up points with it too. from Lawson. [ Primary school student, 7 ] [ Housewife, 35 ] Happiness and Harmony in Our Community Annual Report 2011 2 Corporate Philosophy Corporate Philosophy Lawson assures that all corporate activities conform to its Corporate Philosophy, and that the Company’s management and employees work together as a team to realize its goals. To this end, we ensure that all of our actions are grounded in our shared values, no matter what changes may take place in the operating environment. Our Code of Conduct requires employees to be responsible for reflecting our values and standards through their actions. 3 Annual Report 2011 Contents 03 Corporate Philosophy 25 Achieving Sustainable Growth 05 Financial Highlights 27 Corporate Governance 07 CEO Message to Shareholders 33 Contributing to Our Customers and Communities 15 Convenience Store Operating Group 37 Environmental Initiatives -

Global Powers of Retailing 2019 Contents

Global Powers of Retailing 2019 Contents Top 250 quick statistics 4 Global economic outlook 5 Top 10 highlights 8 Global Powers of Retailing Top 250 11 Geographic analysis 19 Product sector analysis 23 New entrants 27 Fastest 50 30 Study methodology and data sources 35 Endnotes 39 Contacts 41 Welcome to the 22nd edition of Global Powers of Retailing. The report identifies the 250 largest retailers around the world based on publicly available data for FY2017 (fiscal years ended through June 2018), and analyzes their performance across geographies and product sectors. It also provides a global economic outlook, looks at the 50 fastest-growing retailers, and highlights new entrants to the Top 250. Top 250 quick statistics, FY2017 Minimum retail US$4.53 US$18.1 revenue required to be trillion billion among Top 250 Aggregate Average size US$3.7 retail revenue of Top 250 of Top 250 (retail revenue) billion 5-year retail Composite 5.7% revenue growth net profit margin 5.0% Composite (CAGR from Composite year-over-year retail FY2012-201 2.3% return on assets revenue growth 3.3% Top 250 retailers with foreign 23.6% 10 operations Share of Top 250 Average number aggregate retail revenue of countries where 65.6% from foreign companies have operations retail operations Source: Deloitte Touche Tohmatsu Limited. Global Powers of Retailing 2019. Analysis of financial performance and operations for fiscal years ended through June 2018 using company annual reports, Supermarket News, Forbes America’s largest private companies and other sources. 4 Global economic outlook 5 Global Powers of Retailing 2019 | Global economic outlook The global economy is currently at a turning point. -

1 Abundant Glory Limited British Virgin Islands Executive

Appendix B Present Directorships of Edith SHIH as at effective date of appointment Role Name of Company Place of Incorporation (Executive / Non-Executive) 1 Abundant Glory Limited British Virgin Islands Executive 2 Actionfirm Limited British Virgin Islands Executive 3 AICT Advisory Limited British Virgin Islands Executive Alexandria International Container Terminals 4 Egypt Executive Company S.A.E. 5 Alpha Metrics Limited British Virgin Islands Executive 6 Americas Intermodal Services SA/NV Belgium Executive 7 Americas Shipyard SA/NV Belgium Executive 8 Amsterdam Container Terminals B.V. Netherlands Executive 9 Amsterdam Marine Terminals B.V. Netherlands Executive 10 Amsterdam Port Holdings B.V. Netherlands Executive 11 Anovio Holdings Limited Cyprus Executive 12 APM Terminals Dachan Company Limited Hong Kong Executive 13 Aqaba Terminal Services Limited British Virgin Islands Executive 14 Asia Pacific Honour Holdings Limited British Virgin Islands Executive 15 Bajacorp, S.A. de C.V. Mexico Executive 16 Barcelona Europe South Terminal, S.A. Spain Executive 17 Best Fortune S.a r.l. Luxembourg Executive 18 Best Month Profits Limited British Virgin Islands Executive 19 Best Oasis Holdings Limited British Virgin Islands Executive 20 Best People Resources Limited British Virgin Islands Executive 21 Beyond Excel Investments Limited British Virgin Islands Executive 22 Brightease Profits Limited British Virgin Islands Executive 23 Brisbane Container Terminals Pty Limited Australia Executive Appendix B 24 Buenos Aires Container Terminal Services S.A. Argentina Alternate Director 25 Cape Fortune B.V. Netherlands Executive 26 Central America Shipyard SA/NV Belgium Executive 27 China Terminal Services Holding Company Limited Bermuda Executive 28 Clivedon Limited British Virgin Islands Executive 29 CLK Limited British Virgin Islands Executive 30 Coastal Work Logistics Limited British Virgin Islands Executive 31 Container Security Inc. -

PRIZES PAID for MAY TOTAL: $6.8 MILLION Facebook.Com/Wvlottery

$12,000 – Betty Carbone $2,500 – Angela Knisell $2,500 – Michael Young NORTH 7-Eleven #35948H, Clarksburg Donnie’s, Morgantown Mimi’s Dunbar Village, Dunbar LUCKY ME $700 – Linda Hypes Sunny Spot #10, Lookout 10 GRAND $1,200 – Chad Ohler $15,000 – Francis Lemasters $10,000 – Loretta Lucas Sheetz #254, Morgantown Rollins Market, Clarksburg DID I WIN? $1,000 – Brandon Campbell Fairmont N & Out, Fairmont 7-Eleven #35933H, Charleston PLATINUM TRIPLER $1,200 – Tara O’Neal $1,000 – Loren Walker $1,500 – Betty Blaylock 7-Eleven #35953H, Pennsboro Sheetz #425, Martinsburg 7-Eleven #35969H, Hernshaw 5K $1,000 – Jessica Smith $1,000 – Jerry French Speedway #9791, Huntington $1,200 – Dean Ward $50,000 – Robert Deeds Sheetz #143, Inwood Tyler Exxon, Alma SMART CASH C & M Service Center, Frankford $2,000 – Linda Rogers $1,000 – Billy Staats $1,000 – Mijee Greenburg $1,200 – Janice White Belington Shop N Save, Belington Par Mar #9, Ravenswood Speedway #3311, Parkersburg Go Mart #52, Grafton POWER 7S $1,000 – Carol Woods $777 – Seaira Barnett $5,000 – Virginia Hutson TRAVEL KENO KO Convenience Center, Bluefield Go Mart #28, Alloy $1,200 – James Barlow 7-Eleven #35951H, Salem GOLD RUSH High Life Lounge, Elkins $1,400 – Deborah Orsburn $7,000 – Robert Brooks $1,000 – Edward Morris Fast Stop Food Mart #1, Buckhannon EXTREME GREEN Speedway #9750, Huntington $4,500 – William Evans $1,200 – James Carver NBS Smokehouse #30, Mannington Buckhannon Lodge #598, Little General #2420, Glen Jean $1,400 – Simon Riggleman $777 – Sterling Moon Buckhannon $1,000 – Carl -

GFSI : Overview and GFSI : Overview and Comparaison of Comparaison Of

GFSI : Overview and comparaison of schemes CMC May 5, 2011 GFSI Background In 2000….. ¾ FdFood saftfetycrises ¾ Profileration of individual retailer schemes ¾ Burden to suppliers and producers due to frequent audits ¾ Lack of efficiency and high costs in the food supply chain Global Food Safety Initiative ¾ GFSI lhdlaunched at the CIES AlAnnual Congress in 2000, following a directive from the food business CEOs. ¾ Food Safety was then, and is still, top of mind with consumers. Consumer trust needs to be strengthened and maintained, while making the suppl y chain safer. ¾ Managed by The Consumer Goods Forum GFSI managed by The Consumer Goods Forum ¾ An independent global parity‐based Consumer Goods network ¾ Over 650 Members ¾ Representing 70 countries ¾ Over 3 continents Paris, HQ Washington D.C. Tokyo €2.1 trillion THE CONSUMER GOODS FORUM BOARD OF DIRECTORS MANUFACTURER RETAILER COLLEGE COLLEGE 25 25 CEOsCOs CEOsCOs Retailer College Manufacturer College « Safe Food for Consumers Everywhere » GFSI Mission Driving continuous improvement in food safety to strengthen consumer confidence worldwide GFSI Objectives Reduce food safety risks Manage cost GFSI Develop competencies Knowledge exchange and capacity building and networking How does GFSI work? ¾ Benchmarks existing food safety schemes, including pre‐farm gate schemes against the GFSI Guidance Document. ¾ Determines whether a scheme is equivalent to the Guidance Document requirements. ¾ Helps and encourages food safety stakeholders to share knowledge and strategy for food safety and to develop best food safety practice in a common global framework. What GFSI Does NOT Do ¾ Make policy for retailers or manufacturers ¾ Make policy for standard owners ¾ Undertake any accreditation or certification activities ¾ Have involvement with an area outside the scope of food safety i.e. -

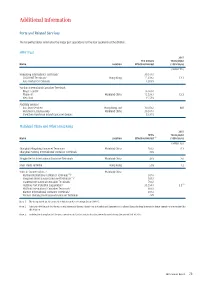

Additional Information

additional Information ports and related services The following tables summarise the major port operations for the four segments of the division. HpH trust 2015 The Group’s Throughput Name Location Effective Interest (100% basis) (million TEU) Hongkong International Terminals/ 30.07% / COSCO-HIT Terminals/ Hong Kong 15.03% / 12.1 Asia Container Terminals 12.03% Yantian International Container Terminals - Phase I and II/ 16.96% / Phase III/ Mainland China 15.53% / 12.2 West Port 15.53% Ancillary Services - Asia Port Services/ Hong Kong and 30.07% / N/A Hutchison Logistics (HK)/ Mainland China 30.07% / Shenzhen Hutchison Inland Container Depots 23.35% Mainland China and other Hong Kong 2015 HPH’s Throughput Name Location Effective Interest (1) (100% basis) (million TEU) Shanghai Mingdong Container Terminals/ Mainland China 50% / 8.3 Shanghai Pudong International Container Terminals 30% Ningbo Beilun International Container Terminals Mainland China 49% 2.0 River Trade Terminal Hong Kong 50% 1.2 Ports in Southern China - Mainland China (2) Nanhai International Container Terminals / 50% / (2) Jiangmen International Container Terminals / 50% / Shantou International Container Terminals/ 70% / (3) Huizhou Port Industrial Corporation/ 33.59% / 2.5 Huizhou International Container Terminals/ 80% / Xiamen International Container Terminals/ 49% / Xiamen Haicang International Container Terminals 49% Note 1: The Group holds an 80% interest in Hutchison Ports Holdings Group (“HPH”). Note 2: Although HPH Trust holds the economic interest in the two River Ports in Nanhai and Jiangmen in Southern China, the legal interests in these operations are retained by this division. Note 3: Includes the throughput of the port operations in Gaolan and Jiuzhou that were disposed during the second half of 2015. -

China - Peoples Republic Of

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Voluntary - Public Date: 1/26/2011 GAIN Report Number: CH0816 China - Peoples Republic of Post: Shanghai ATO China Retail Annual Report Report Categories: Retail Food Sector Approved By: Keith Schneller Prepared By: Leanne Wang, May Liu, Tong Wang and ATO-Chengdu Report Highlights: With increased disposal income, urbanization and food safety concerns, Chinese are consuming more U.S. food products; this is partly due to the excellent quality and safety reputation of American food products. While the Chinese economy has slowed this past year, it is still growing faster than any other major economy. This fact and Chinese customers‟ growing taste for imported products, makes the Chinese market very attractive to many U.S. food producers. Executive Summary In response to rising inflation and food safety concerns, more Chinese people are cutting back on eating out and are now cooking more and more at home. Consumers of imported food are generally expatriates and high and upper –middle income locals. They are least affected by inflation and pay great attention to food safety. Consumption of western style products continues to grow as they generally are regarded as good quality, nutritious and safe. Some products, such as fresh fruit, frozen vegetables and nuts, have much deeper penetration, and some supermarkets and convenience stores are becoming more interested in imported products. Rapid economic growth has caused the total U.S. dollar sales value of food and beverages to rise by 26.2% to USD132 billion in 2008.