World Bank Document

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Crown Agents Bank's Currency Capabilities

Crown Agents Bank’s Currency Capabilities August 2020 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Majors Australia Australian Dollar AUD ✓ ✓ - - M Canada Canadian Dollar CAD ✓ ✓ - - M Denmark Danish Krone DKK ✓ ✓ - - M Europe European Euro EUR ✓ ✓ - - M Japan Japanese Yen JPY ✓ ✓ - - M New Zealand New Zealand Dollar NZD ✓ ✓ - - M Norway Norwegian Krone NOK ✓ ✓ - - M Singapore Singapore Dollar SGD ✓ ✓ - - E Sweden Swedish Krona SEK ✓ ✓ - - M Switzerland Swiss Franc CHF ✓ ✓ - - M United Kingdom British Pound GBP ✓ ✓ - - M United States United States Dollar USD ✓ ✓ - - M Africa Angola Angolan Kwanza AOA ✓* - - - F Benin West African Franc XOF ✓ ✓ ✓ - F Botswana Botswana Pula BWP ✓ ✓ ✓ - F Burkina Faso West African Franc XOF ✓ ✓ ✓ - F Cameroon Central African Franc XAF ✓ ✓ ✓ - F C.A.R. Central African Franc XAF ✓ ✓ ✓ - F Chad Central African Franc XAF ✓ ✓ ✓ - F Cote D’Ivoire West African Franc XOF ✓ ✓ ✓ ✓ F DR Congo Congolese Franc CDF ✓ - - ✓ F Congo (Republic) Central African Franc XAF ✓ ✓ ✓ - F Egypt Egyptian Pound EGP ✓ ✓ - - F Equatorial Guinea Central African Franc XAF ✓ ✓ ✓ - F Eswatini Swazi Lilangeni SZL ✓ ✓ - - F Ethiopia Ethiopian Birr ETB ✓ ✓ N/A - F 1 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Africa Gabon Central African Franc XAF ✓ ✓ ✓ - F Gambia Gambian Dalasi GMD ✓ - - - F Ghana Ghanaian Cedi GHS ✓ ✓ - ✓ F Guinea Guinean Franc GNF ✓ - ✓ - F Guinea-Bissau West African Franc XOF ✓ ✓ - - F Kenya Kenyan Shilling KES ✓ ✓ ✓ ✓ F Lesotho Lesotho Loti LSL ✓ ✓ - - E Liberia Liberian -

Crown Agents Bank's Currency Capabilities

Crown Agents Bank’s Currency Capabilities September 2020 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Majors Australia Australian Dollar AUD ✓ ✓ - - M Canada Canadian Dollar CAD ✓ ✓ - - M Denmark Danish Krone DKK ✓ ✓ - - M Europe European Euro EUR ✓ ✓ - - M Japan Japanese Yen JPY ✓ ✓ - - M New Zealand New Zealand Dollar NZD ✓ ✓ - - M Norway Norwegian Krone NOK ✓ ✓ - - M Singapore Singapore Dollar SGD ✓ ✓ - - E Sweden Swedish Krona SEK ✓ ✓ - - M Switzerland Swiss Franc CHF ✓ ✓ - - M United Kingdom British Pound GBP ✓ ✓ - - M United States United States Dollar USD ✓ ✓ - - M Africa Angola Angolan Kwanza AOA ✓* - - - F Benin West African Franc XOF ✓ ✓ ✓ - F Botswana Botswana Pula BWP ✓ ✓ ✓ - F Burkina Faso West African Franc XOF ✓ ✓ ✓ - F Cameroon Central African Franc XAF ✓ ✓ ✓ - F C.A.R. Central African Franc XAF ✓ ✓ ✓ - F Chad Central African Franc XAF ✓ ✓ ✓ - F Cote D’Ivoire West African Franc XOF ✓ ✓ ✓ ✓ F DR Congo Congolese Franc CDF ✓ - - ✓ F Congo (Republic) Central African Franc XAF ✓ ✓ ✓ - F Egypt Egyptian Pound EGP ✓ ✓ - - F Equatorial Guinea Central African Franc XAF ✓ ✓ ✓ - F Eswatini Swazi Lilangeni SZL ✓ ✓ - - F Ethiopia Ethiopian Birr ETB ✓ ✓ N/A - F 1 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Africa Gabon Central African Franc XAF ✓ ✓ ✓ - F Gambia Gambian Dalasi GMD ✓ - - - F Ghana Ghanaian Cedi GHS ✓ ✓ - ✓ F Guinea Guinean Franc GNF ✓ - ✓ - F Guinea-Bissau West African Franc XOF ✓ ✓ - - F Kenya Kenyan Shilling KES ✓ ✓ ✓ ✓ F Lesotho Lesotho Loti LSL ✓ ✓ - - E Liberia Liberian -

The Gambia April 2019

Poverty & Equity Brief Sub-Saharan Africa The Gambia April 2019 In the Gambia, 10.1 percent of the population lived below the international poverty line in 2015 (poverty measured at 2011 PPP US$1.9 a day). In the Greater Banjul Area, which includes the local government areas of Banjul and Kanifing, the country's hub of key economic activities, the poverty rate was lower than in other urban areas. Poverty rates were highest in rural areas, where the poor typically work in the low-productivity agricultural sector, while in urban areas they work in the low-productivity informal service sectors. Even though poverty rates are high in the interior of the country compared to the coastal urban areas, the highest concentration of the poor population is found in direct proximity to the Greater Banjul Area, in the local government area of Brikama. Rapid urbanization in the past triggered by high rural-to-urban migration, led to a massing of poor people, many in their youth, in and around congested urban areas where inequality is high, traditional support systems are typically weak, and women face barriers in labor market participation. High levels of poverty are closely intertwined with low levels of productivity and limited resilience, as well as with economic and social exclusion. The poor are more likely to live in larger family units that are more likely to be polygamous and have more dependent children, have high adult and youth illiteracy rates, and are significantly more exposed to weather shocks than others. Chronic malnutrition (stunting) affects 25 percent of children under the age of five, and non-monetary indicators of poverty linked to infrastructure, health and nutrition illustrate that the country is lagging vis-à-vis peers in Sub-Saharan Africa. -

Banking Sector Liberalisation in Uganda Process, Results and Policy Options

Banking Sector Liberalisation in Uganda Process, Results and Policy Options Research report Editors: Madhyam & SOMO December 2010 Banking Sector Liberalisation in Uganda Process, Results and Policy Options Research report By: Lawrence Bategeka & Luka Jovita Okumu (Economic Policy Research Centre, Uganda) Editors: Kavaljit Singh (Madhyam), Myriam Vander Stichele (SOMO) December 2010 SOMO is an independent research organisation. In 1973, SOMO was founded to provide civil society organizations with knowledge on the structure and organisation of multinationals by conducting independent research. SOMO has built up considerable expertise in among others the following areas: corporate accountability, financial and trade regulation and the position of developing countries regarding the financial industry and trade agreements. Furthermore, SOMO has built up knowledge of many different business fields by conducting sector studies. 2 Banking Sector Liberalisation in Uganda Process, Results and Policy Options Colophon Banking Sector Liberalisation in Uganda: Process, Results and Policy Options Research report December 2010 Authors: Lawrence Bategeka and Luka Jovita Okumu (EPRC) Editors: Kavaljit Singh (Madhyam) and Myriam Vander Stichele (SOMO) Layout design: Annelies Vlasblom ISBN: 978-90-71284-76-2 Financed by: This publication has been produced with the financial assistance of the Dutch Ministry of Foreign Affairs. The contents of this publication are the sole responsibility of SOMO and the authors, and can under no circumstances be regarded as reflecting the position of the Dutch Ministry of Foreign Affairs. Published by: Stichting Onderzoek Multinationale Ondernemingen Centre for Research on Multinational Corporations Sarphatistraat 30 1018 GL Amsterdam The Netherlands Tel: + 31 (20) 6391291 Fax: + 31 (20) 6391321 E-mail: [email protected] Website: www.somo.nl Madhyam 142 Maitri Apartments, Plot No. -

Country Codes and Currency Codes in Research Datasets Technical Report 2020-01

Country codes and currency codes in research datasets Technical Report 2020-01 Technical Report: version 1 Deutsche Bundesbank, Research Data and Service Centre Harald Stahl Deutsche Bundesbank Research Data and Service Centre 2 Abstract We describe the country and currency codes provided in research datasets. Keywords: country, currency, iso-3166, iso-4217 Technical Report: version 1 DOI: 10.12757/BBk.CountryCodes.01.01 Citation: Stahl, H. (2020). Country codes and currency codes in research datasets: Technical Report 2020-01 – Deutsche Bundesbank, Research Data and Service Centre. 3 Contents Special cases ......................................... 4 1 Appendix: Alpha code .................................. 6 1.1 Countries sorted by code . 6 1.2 Countries sorted by description . 11 1.3 Currencies sorted by code . 17 1.4 Currencies sorted by descriptio . 23 2 Appendix: previous numeric code ............................ 30 2.1 Countries numeric by code . 30 2.2 Countries by description . 35 Deutsche Bundesbank Research Data and Service Centre 4 Special cases From 2020 on research datasets shall provide ISO-3166 two-letter code. However, there are addi- tional codes beginning with ‘X’ that are requested by the European Commission for some statistics and the breakdown of countries may vary between datasets. For bank related data it is import- ant to have separate data for Guernsey, Jersey and Isle of Man, whereas researchers of the real economy have an interest in small territories like Ceuta and Melilla that are not always covered by ISO-3166. Countries that are treated differently in different statistics are described below. These are – United Kingdom of Great Britain and Northern Ireland – France – Spain – Former Yugoslavia – Serbia United Kingdom of Great Britain and Northern Ireland. -

EQ Pay Currencies

EQ Pay Currencies Country Currency Code Currency Name Country Currency Code Currency Name Albania ALL Albanian Lek Kazakhstan KZT Kazakh Tenge Algeria DZD Algerian Dinar Kyrgyzstan KGS Kyrgyz Som Angola AOA Angolan Kwanza Laos LAK Laotian Kip Armenia AMD Armenian Dram Lebanon LBP Lebanese Pound Aruba AWG Aruban Florin Lesotho LSL Lesotho Loti Azerbaijan AZN Azerbaijani Manat Liberia LRD Liberian Dollar Bahamas BSD Bahamian Dollar Libya LYD Libyan Dinar Bangladesh BDT Bangladeshi Taka Macau MOP Macanese Patacca Belarus BYN Belarusian Ruble Madagascar MGA Malagasy Ariary Belize BZD Belizean Dollar Malawi MWK Malawian Kwacha Benin XOF CFA Franc BCEAO Malaysia MYR Malaysian Ringgit Bermuda BMD Bermudian Dollar Maldives MVR Maldives Rufiyaa Bolivia BOB Bolivian Boliviano Mali XOF CFA Franc BCEAO Bosnia BAM Bosnian Marka Mauritania MRU Mauritanian Ouguiya Botswana BWP Botswana pula Moldova MDL Moldovan Leu Brazil BRL Brazilian Real Mongolia MNT Mongolian Tugrik Brunei BND Bruneian Dollar Mozambique MZN Mozambique Metical Bulgaria BGN Bulgarian Lev Myanmar MMK Myanmar Kyat Burkina Faso XOF CFA Franc BCEAO Namibia NAD Namibian Dollar Netherlands Antillean Burundi BIF Burundi Franc Netherlands Antilles ANG Dollar Cambodia KHR Cambodian Riel New Caledonia XPF CFP Franc Nicaraguan Gold Cameroon XAF CFA Franc BEAC Nicaragua NIO Cordoba Cape Verde Island CVE Cape Verdean Escudo Niger XOF CFA Franc BCEAO Cayman Islands KYD Caymanian Dollar Nigeria NGN Nigerian Naira Central African XAF CFA Franc BEAC North Macedonia MKD Macedonian Denar Republic Chad -

Liberia's 9 Commercial Banks

Public Disclosure Authorized IFC Mobile Money Scoping Country Report: Liberia Public Disclosure Authorized June, 2012 Public Disclosure Authorized Public Disclosure Authorized About The MasterCard Foundation Program IFC and the MasterCard Foundation (MCF) entered into a partnership focused on accelerating the growth and outreach of microfinance and mobile financial services in Sub-Saharan Africa. The partnership aims to leverage IFC’s expanding microfinance client network in the region and its emerging expertise in mobile financial services to catalyze innovative and low-cost approaches for expanding financial services to low- income populations. The Partnership has three Primary Components Mobile Financial Service IFC and The MasterCard Foundation see tremendous opportunity with Microfinance mobile banking, particularly for those living in rural areas. Mobile phones Through this partnership, IFC will result in lower transactions costs and implement a scaling program for reduce the cost of information. This Knowledge & Learning microfinance in Africa. The primary partnership will (i) identify nascent This partnership will include a major purpose of the Program is to markets to accelerate the uptake of knowledge sharing component to accelerate delivery of financial branchless banking services, (ii) work ensure broader dissemination of services in sub-Saharan Africa (SSA) with private sector players to build results, impacts and lessons learned through the significant scaling up of expertise and infrastructure to from both the microfinance and between eight and ten of IFC‘s sustainably offer financial services to mobile financial services. These strongest microfinance partners in the unbanked using mobile knowledge products will include Africa. Interventions will include technology and agent networks and product and channel diversification (iii) build robust business models that into underserved areas. -

Countries Codes and Currencies 2020.Xlsx

World Bank Country Code Country Name WHO Region Currency Name Currency Code Income Group (2018) AFG Afghanistan EMR Low Afghanistan Afghani AFN ALB Albania EUR Upper‐middle Albanian Lek ALL DZA Algeria AFR Upper‐middle Algerian Dinar DZD AND Andorra EUR High Euro EUR AGO Angola AFR Lower‐middle Angolan Kwanza AON ATG Antigua and Barbuda AMR High Eastern Caribbean Dollar XCD ARG Argentina AMR Upper‐middle Argentine Peso ARS ARM Armenia EUR Upper‐middle Dram AMD AUS Australia WPR High Australian Dollar AUD AUT Austria EUR High Euro EUR AZE Azerbaijan EUR Upper‐middle Manat AZN BHS Bahamas AMR High Bahamian Dollar BSD BHR Bahrain EMR High Baharaini Dinar BHD BGD Bangladesh SEAR Lower‐middle Taka BDT BRB Barbados AMR High Barbados Dollar BBD BLR Belarus EUR Upper‐middle Belarusian Ruble BYN BEL Belgium EUR High Euro EUR BLZ Belize AMR Upper‐middle Belize Dollar BZD BEN Benin AFR Low CFA Franc XOF BTN Bhutan SEAR Lower‐middle Ngultrum BTN BOL Bolivia Plurinational States of AMR Lower‐middle Boliviano BOB BIH Bosnia and Herzegovina EUR Upper‐middle Convertible Mark BAM BWA Botswana AFR Upper‐middle Botswana Pula BWP BRA Brazil AMR Upper‐middle Brazilian Real BRL BRN Brunei Darussalam WPR High Brunei Dollar BND BGR Bulgaria EUR Upper‐middle Bulgarian Lev BGL BFA Burkina Faso AFR Low CFA Franc XOF BDI Burundi AFR Low Burundi Franc BIF CPV Cabo Verde Republic of AFR Lower‐middle Cape Verde Escudo CVE KHM Cambodia WPR Lower‐middle Riel KHR CMR Cameroon AFR Lower‐middle CFA Franc XAF CAN Canada AMR High Canadian Dollar CAD CAF Central African Republic -

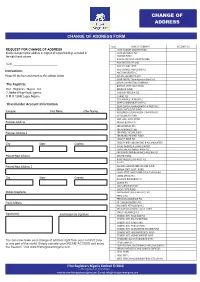

Backup of Change of Address

CHANGE OF ADDRESS CHANGE OF ADDRESS FORM TICK NAME OF COMPANY ACCOUNT NO. REQUEST FOR CHANGE OF ADDRESS ACAP CANARY GROWTH FUND Kindly change my/our address in respect of my/ourholdings as ticked in AFRICAN PAINTS PLC the right hand column ANCHOR FUND ARM AGGRESSIVE GROWTH FUND Date: _____________________________ ARM DISCOVERY FUND ARM ETHICAL FUND ASO-SAVINGS AND LOANS PLC Instructions ABC TRANSPORT PLC Please fill the form and return to the address below AUSTIN LAZ AND CO. PLC BANK PHB PLC (Now Keystone Bank Ltd) The Registrar, BCN PLC-MARKETING COMPANY BAYELSA STATE GOVT BOND First Registrars Nigeria Ltd. BEDROCK FUND 2, Abebe Village Road, Iganmu CADBURY NIGERIA PLC P. M. B. 12692 Lagos. Nigeria. CHAMS PLC COSTAIN WEST AFRICA PLC Shareholder Account Information DAAR COMMUNICATIONS PLC DEAP CAPITAL MANAGEMENT & TRUST PLC DELTA STATE GOVT BOND Surname First Name Other Names REDEEMED GLOBAL MEDIA COMPANY LTD DV BALANCED FUND EDO STATE GOVT. BOND Previous Address FAMAD NIGERIA PLC FBN HOLDINGS PLC FBN HERITAGE FUND Previous Address 2 FBN FIXED INCOME FUND FBN MONEY MARKET FUND FIDELITY BANK PLC City State Country FIDELITY NIGFUND (INCOME & ACCUMULATED) FOKAS SAVINGS & LOANS LIMITED FORTIS MICROFINANCE BANK PLC FRIESLANDCAMPINA WAMCO NIGERIA PLC Present\New Address GTBANK BOND HONEYWELL FLOUR MILLS PLC JULI PLC Present\New Address 2 KAKAWA GUARANTEED INCOME FUND KWARA STATE GOVT. BOND LAGOS STATE GOVT. BOND (1st & 2nd tranche) LEARN AFRICA PLC City State Country NIGERIAN BREWERIES PLC OANDO PLC OASIS INSURANCE PLC ONDO STATE BOND Mobile -

Sierra Leone - Mobile Money Transfer Market Study

Sierra Leone - Mobile Money Transfer Market Study FINAL REPORT, March 2013 March 2013 Report prepared by PHB Development, with the support of Disclaimer The contents of this report are the responsibility of PHB Development and do not necessarily reflect the views of Cordaid. The information contained in this report and any errors or mistakes that occurred are the sole responsibility of PHB Development. 2 Contents Introduction………………………………………………………………………………3 Executive Summary and Recommendations………………………………............... 9 I. Module 1 Regulation and Partnerships (Supply side)……………………………….23 II. Module 2 Markets and products (Demand side )……………………………………..56 III. Module 3 Distribution Networks………………………………………………………..74 IV. Module 4 MFI Internal Capacity………………………………………………………..95 V. Module 5 Scenario's for Mobile Money Transfers and the MFIs in Sierra Leone...99 3 Introduction Cordaid has invited PHB Development to execute a market study on Mobile Money Transfers (MMT) in Sierra Leone and on the opportunities this market offers for Microfinance Institutions (MFIs). This study follows on the MITAF1 programme that Cordaid co-financed in the period 2004-2011. The results of the market study were shared in an interactive workshop in Sierra Leone on 26 February 2013. 27 persons attended, representing MFIs, MMT providers, the Bank of Sierra Leone and the donor. This final report represents an overview of the information collected, on which the workshop has been based. Moreover, information obtained during the workshop is reflected in this document. In addition, the MFIs have received individual assessment reports on their readiness for MMT. This report starts with an executive summary followed by recommendations for the MFIs and Cordaid. Chapters 1-5 provide detailed information on the regulation and the supply side of market players and MMT partnerships (module 1), on the demand for financial products (module 2) and the agent networks in Sierra Leone (module 3). -

Status of Ict Access, Usage and Exploitation in the Gambia

GOVERNMENT OF THE GAMBIA/UNECA SCAN-ICT COUNTRY REPORT STATUS OF ICT ACCESS, USAGE AND EXPLOITATION IN THE GAMBIA FINAL REPORT September, 2007 TABLE OF CONTENTS ACRONYMS AND ABBREVIATIONS -------------------------------------------------------------- 5 FORWARD ------------------------------------------------------------------------------------------ 7 EXECUTIVE SUMMARY----------------------------------------------------------------------------- 8 INTRODUCTION -------------------------------------------------------------------------------------- 16 CHAPITER 1 GENERAL INFORMATION ON THE COUNTRY -------------------------- 17 1.1 Geographical Situation-------------------------------------------------------------- 17 1.2 Demographic Context--------------------------------------------------------------- 18 1.3 Political and Administrative Organization--------------------------------------- 19 1.4 Socio-Economic Characteristics--------------------------------------------------- 20 CHAPITER 2 PRESENTATION OF THE SURVEY------------------------------------------- 23 2.1 Context and Justification ----------------------------------------------------------- 23 2.2 Objectives----------------------------------------------------------------------------- 24 2.3 Methodology ------------------------------------------------------------------------- 25 2.4 Difficulties and Constraints encountered----------------------------------------- 29 2.5 Profile of sample entities ---------------------------------------------------------- 30 CHAPITER 3 ICT INFRASTRUCTURES -

The Curious Incident of the Franc in the Gambia: Exchange Rate Instability and Imperial Monetary Systems in the 1920S

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by LSE Research Online Leigh Gardner The curious incident of the franc in the Gambia: exchange rate instability and imperial monetary systems in the 1920s Article (Accepted version) (Refereed) Original citation: Gardner, Leigh (2015) The curious incident of the franc in the Gambia: exchange rate instability and imperial monetary systems in the 1920s. Financial History Review, 22 (03). pp. 291-314. ISSN 0968-5650 DOI: 10.1017/S0968565015000232 © 2016 European Association for Banking and Financial History This version available at: http://eprints.lse.ac.uk/65070/ Available in LSE Research Online: January 2016 LSE has developed LSE Research Online so that users may access research output of the School. Copyright © and Moral Rights for the papers on this site are retained by the individual authors and/or other copyright owners. Users may download and/or print one copy of any article(s) in LSE Research Online to facilitate their private study or for non-commercial research. You may not engage in further distribution of the material or use it for any profit-making activities or any commercial gain. You may freely distribute the URL (http://eprints.lse.ac.uk) of the LSE Research Online website. This document is the author’s final accepted version of the journal article. There may be differences between this version and the published version. You are advised to consult the publisher’s version if you wish to cite from it. 1 The Curious Incident of the Franc in the Gambia: Exchange Rate Instability and Imperial Monetary Systems in the 1920s1 Leigh Gardner London School of Economics and Stellenbosch University [email protected] Key words: Colonialism, exchange rates, West Africa JEL classification: N27, N17, N47 Abstract: In 1922, British colonial Gambia demonetized the French five-franc coin, which had been legal tender at a fixed rate in the colony since 1843.