Banking Sector Liberalisation in Uganda Process, Results and Policy Options

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Public Notice

PUBLIC NOTICE PROVISIONAL LIST OF TAXPAYERS EXEMPTED FROM 6% WITHHOLDING TAX FOR JANUARY – JUNE 2016 Section 119 (5) (f) (ii) of the Income Tax Act, Cap. 340 Uganda Revenue Authority hereby notifies the public that the list of taxpayers below, having satisfactorily fulfilled the requirements for this facility; will be exempted from 6% withholding tax for the period 1st January 2016 to 30th June 2016 PROVISIONAL WITHHOLDING TAX LIST FOR THE PERIOD JANUARY - JUNE 2016 SN TIN TAXPAYER NAME 1 1000380928 3R AGRO INDUSTRIES LIMITED 2 1000049868 3-Z FOUNDATION (U) LTD 3 1000024265 ABC CAPITAL BANK LIMITED 4 1000033223 AFRICA POLYSACK INDUSTRIES LIMITED 5 1000482081 AFRICAN FIELD EPIDEMIOLOGY NETWORK LTD 6 1000134272 AFRICAN FINE COFFEES ASSOCIATION 7 1000034607 AFRICAN QUEEN LIMITED 8 1000025846 APPLIANCE WORLD LIMITED 9 1000317043 BALYA STINT HARDWARE LIMITED 10 1000025663 BANK OF AFRICA - UGANDA LTD 11 1000025701 BANK OF BARODA (U) LIMITED 12 1000028435 BANK OF UGANDA 13 1000027755 BARCLAYS BANK (U) LTD. BAYLOR COLLEGE OF MEDICINE CHILDRENS FOUNDATION 14 1000098610 UGANDA 15 1000026105 BIDCO UGANDA LIMITED 16 1000026050 BOLLORE AFRICA LOGISTICS UGANDA LIMITED 17 1000038228 BRITISH AIRWAYS 18 1000124037 BYANSI FISHERIES LTD 19 1000024548 CENTENARY RURAL DEVELOPMENT BANK LIMITED 20 1000024303 CENTURY BOTTLING CO. LTD. 21 1001017514 CHILDREN AT RISK ACTION NETWORK 22 1000691587 CHIMPANZEE SANCTUARY & WILDLIFE 23 1000028566 CITIBANK UGANDA LIMITED 24 1000026312 CITY OIL (U) LIMITED 25 1000024410 CIVICON LIMITED 26 1000023516 CIVIL AVIATION AUTHORITY -

Strategic Management Practices Adopted by Abc Bank to Gain Competitive Advantage

STRATEGIC MANAGEMENT PRACTICES ADOPTED BY ABC BANK TO GAIN COMPETITIVE ADVANTAGE BY KANDUGU EPHANTUS KAMAU A RESEARCH PROJECT SUBMITTED IN PARTIAL FULFILMENT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTER OF BUSINESS ADMINISTRATION, SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI NOVEMBER, 2017 DECLARATION This research project is my original work and has not been submitted for examination in any other university. Signature:…………………………… Date:……………………… KANDUGU EPHANTUS KAMAU REG. NO. D61/81199/2015 This research project has been submitted for examination with my approval as a University Supervisor. Signature:…………………………….. Date:………………………. PROF. BITANGE NDEMO DEPARTMENT OF BUSINESS ADMINISTRATION SCHOOL OF BUSINESS UNIVERSITY OF NAIROBI ii ACKNOWLEDGEMENTS In a very humble way I appreciate the Almighty God. All this would not have been possible were it not for his mighty care and providence. My deepest appreciation goes to my Supervisor Prof. Bitange Ndemo for his unwavering support with this project. Thank you so much for your reliability, availability, insight, effort and in an intelligent and constructive way you challenged my thoughts on the topic of this thesis. Your energy is out of this world and wish you well in all your endeavors. Special thanks to my Boss Mr. Robinson Gitau Thuku who accorded me conducive environment during my research. I would like to appreciate my friends and classmates Mike Kabita, Dennis Murikwa, Judy Amagolo, Owuor Odeny, Jackson Maithya, Eric and Kang’ethe whom we exchanged ideas from time to time. I also wish to appreciate the effort Prof. Martin Ogutu for assisting in moderating this piece of work. iii DEDICATION This project is dedicated to my parents, Margaret Wanjiku and Daniel Macharia for their encouragement. -

UIBFS-FINANCIAL-SERVICES-MAGAZINE-Issue-011-2021-Web.Pdf

Financial Services Magazine Finance and Banking BANKING • COMMODITIES • INSURANCE • STOCK MARKETS • MICROFINANCE • TECHNOLOGY • REAL ESTATE AUGUST 2021 /ISSUE 011 , FREE COPY SERVICES MAGAZINE Banking on Innovative Financial Technology to Deliver a Cashless Economy FINANCE & BANKING MICRO FINANCE FINANCIAL NEWS How banks and fintechs are Digitizing financial transactions Artificial intelligence as a key leading Uganda into a cashless in Micro Finance Institutions, driver of the bank of the future. economy post COVID -19. SACCOs to promote efficiency. UGANDA KENYA RWANDA SOUTH SUDAN BURUNDI TANZANIA ISSUE 11 July - August 2021 I Financial Services Magazine Finance and Banking II ISSUE 11 July - August 2021 Financial Services Magazine Finance and Banking CONTENTS 01 How Banks & Fintechs are Leading Uganda into a Cashless Economy Post Covid 19 04 Towards a Cashless Economy in Uganda-A Regulatory Perspective 08 Digital Banking Innovations mean Uganda is On Track to Achieve a Cashless Economy 11 Financial Inclusion & Evolution of Digital Payments In Uganda 12 Artificial intelligence as a key driver of the bank of the future 16 Role of Data Driven Analytics in Business Decision Making 18 Emerging Financial Crimes and Digital Threats to Financial Sector Growth 22 Relevance of Bancassurance to The Customer Today 24 Uganda - Dealing with Cyber security Risk in The Banking and Financial Services Industry: The Need for a New Mindset 27 Housing Finance Bank: Overcoming Challenging Times Through Customer Focus and Dedication 29 Digitizing Financial -

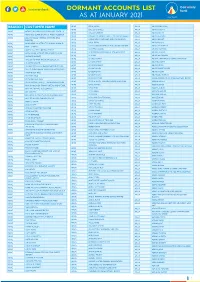

1612517024List of Dormant Accounts.Pdf

DORMANT ACCOUNTS LIST AS AT JANUARY 2021 BRANCH CUSTOMER NAME APAC OKAE JASPER ARUA ABIRIGA ABUNASA APAC OKELLO CHARLES ARUA ABIRIGA AGATA APAC ACHOLI INN BMU CO.OPERATIVE SOCIETY APAC OKELLO ERIAKIM ARUA ABIRIGA JOHN APAC ADONGO EUNICE KAY ITF ACEN REBECCA . APAC OKELLO PATRICK IN TRUST FOR OGORO ISAIAH . ARUA ABIRU BEATRICE APAC ADUKU ROAD VEHICLE OWNERS AND OKIBA NELSON GEORGE AND OMODI JAMES . ABIRU KNIGHT DRIVERS APAC ARUA OKOL DENIS ABIYO BOSCO APAC AKAKI BENSON INTRUST FOR AKAKI RONALD . APAC ARUA OKONO DAUDI INTRUST FOR OKONO LAKANA . ABRAHAM WAFULA APAC AKELLO ANNA APAC ARUA OKWERA LAKANA ABUDALLA MUSA APAC AKETO YOUTH IN DEVELOPMENT APAC ARUA OLELPEK PRIMARY SCHOOL PTA ACCOUNT ABUKO ONGUA APAC AKOL SARAH IN TRUST FOR AYANG PIUS JOB . APAC ARUA OLIK RAY ABUKUAM IBRAHIM APAC AKONGO HARRIET APAC ARUA OLOBO TONNY ABUMA STEPHEN ITO ASIBAZU PATIENCE . APAC AKULLU KEVIN IN TRUST OF OLAL SILAS . APAC ARUA OMARA CHRIST ABUME JOSEPH APAC ALABA ROZOLINE APAC ARUA OMARA RONALD ABURA ISMAIL APAC ALFRED OMARA I.T.F GERALD EBONG OMARA . APAC ARUA OMING LAMEX ABURE CHRISTOPHER APAC ALUPO CHRISTINE IN TRUST FOR ELOYU JOVIN . APAC ARUA ONGOM JIMMY ABURE YASSIN APAC AMONG BEATRICE APAC ARUA ONGOM SILVIA ABUTALIBU AYIMANI APAC ANAM PATRICK APAC ARUA ONONO SIMON ACABE WANDI POULTRY DEVELPMENT GROUP APAC ANYANGO BEATRASE APAC ARUA ONOTE IRWOT VILLAGE SAVINGS AND LOAN ACEMA ASSAFU APAC ANYANZO MICHEAL ITF TIZA BRENDA EVELYN . APAC ARUA OPIO JASPHER ACEMA DAVID APAC APAC BODABODA TRANSPORTERS AND SPECIAL APAC ARUA OPIO MARY ACEMA ZUBEIR APAC APALIKA FARMERS ASSOCIATION APAC ARUA OPIO RIGAN ACHEMA ALAHAI APAC APILI JUDITH APAC ARUA OPIO SAM ACHIDRI RASULU APAC APIO BENA IN TRUST OF ODUR JONAN AKOC . -

Has the Privatization of Uganda Commercial Bank Increased Competition and Extended Outreach of Formal Banking in Uganda?” Abstract

DEPARTMENT OF ECONOMICS Uppsala University Bachelor’s Thesis Authors: Oscar Karlsson & Erik Malmgren Supervisor: Ranjula Bali Swain Spring 2008 “Has the Privatization of Uganda Commercial Bank Increased Competition and Extended Outreach of Formal Banking in Uganda?” Abstract: Financial sector development can reduce poverty and promote economic growth by extending access to financial services in developing countries. Traditionally, banking in Sub-Saharan Africa has been conducted by state-owned banks. Although, evidence has shown that severe government involvement in the banking sector has proved to cause low profitability and inefficiency. During 2001, Uganda Commercial Bank, the dominant provider of banking experienced financial problems; as a result, the government had to privatize the bank. The aim of this thesis is therefore to investigate if the privatization prevented the banking sector from collapse and if it made the sector more competitive and outreaching. The main conclusion is that the privatization strongly prevented the banking sector from collapse. Since privatization, competition has increased sufficiently in urban areas of Uganda while rural areas have not experienced any significant increase in competition. Finally, we conclude that the outreach of banking has increased somewhat since the privatization, but it is still relatively poor. Key Words: Sub-Saharan Africa, Uganda, Financial Development, Financial Structure, Access to Finance, Banking, Bank Competition, Bank Privatization, Outreach of Banking 2 Abbreviations Mentioned -

Africa October 2015 Manya Biemans

Banking innovations in a fast DEVELOPING and CHANGING Africa October 2015 Manya Biemans 1 Standard Chartered Bank 2 Standard Chartered Presence Countries Standard Chartered Presence Footprint 71 Markets AMERICAS EUROPE AFRICA MENAP SOUTH GREATER NORTH ASEAN Argentina1 Austria Angola | Botswana Bahrain | Egypt1 ASIA CHINA EAST ASIA Australia | Brunei Brazil Falkland Islands Cameroon Iraq | Jordan Cambodia1 Bangladesh China Japan Canada1 France | Germany Cote d’Ivoire Lebanon1 Indonesia India | Nepal Hong Kong South Korea Cayman Islands1 Guernsey | Ireland The Gambia Oman | Pakistan Laos1 | Malaysia Sri Lanka Macau Mongolia1 Chile1 Italy | Jersey Ghana | Kenya Qatar Taiwan Myanmar1 Colombia1 Luxembourg Mauritius | Nigeria Saudi Arabia Philippines Mexico1 Russia1 | Sweden Sierra Leone United Arab Singapore Peru1 Switzerland South Africa Emirates Thailand | Vietnam United States of Turkey Tanzania UAE DIFC America United Kingdom Uganda | Zambia Zimbabwe 1 Representative Office 3 Standard Chartered Bank in Africa 4 Standard Chartered is a long term banking partner in Africa Our broad network, historical presence and Africa-tailored products and solutions enable us to meet all your in-country banking needs Tunisia Angola 1 Morocco Botswana 18 Algeria Libya Egypt Cameroon 2 Cote d’Ivoire 3 Mauritania Mali Niger Sudan Eritrea Gambia 5 Senegal Chad Gambia Dijibouti Ghana 23 Guinea- Bissau Burkina Faso Guinea Benin Cape verde Ghana Nigeria Somalia Kenya 39 Ethiopia Sierra Leone South CAR Mauritius 1 Liberia Togo Sudan Côte d'Ivoire Cameroon Uganda -

Registered Attendees

Registered Attendees Company Name Job Title Country/Region 1996 Graduate Trainee (Aquaculturist) Zambia 1Life MI Manager South Africa 27four Executive South Africa Sales & Marketing: Microsoft 28twelve consulting Technologies United States 2degrees ETL Developer New Zealand SaaS (Software as a Service) 2U Adminstrator South Africa 4 POINT ZERO INVEST HOLDINGS PROJECT MANAGER South Africa 4GIS Chief Data Scientist South Africa Lead - Product Development - Data 4Sight Enablement, BI & Analytics South Africa 4Teck IT Software Developer Botswana 4Teck IT (PTY) LTD Information Technology Consultant Botswana 4TeckIT (pty) Ltd Director of Operations Botswana 8110195216089 System and Data South Africa Analyst Customer Value 9Mobile Management & BI Nigeria Analyst, Customer Value 9mobile Management Nigeria 9mobile Nigeria (formerly Etisalat Specialist, Product Research & Nigeria). Marketing. Nigeria Head of marketing and A and A utilities limited communications Nigeria A3 Remote Monitoring Technologies Research Intern India AAA Consult Analyst Nigeria Aaitt Holdings pvt ltd Business Administrator South Africa Aarix (Pty) Ltd Managing Director South Africa AB Microfinance Bank Business Data Analyst Nigeria ABA DBA Egypt Abc Data Analyst Vietnam ABEO International SAP Consultant Vietnam Ab-inbev Senior Data Analyst South Africa Solution Architect & CTO (Data & ABLNY Technologies AI Products) Turkey Senior Development Engineer - Big ABN AMRO Bank N.V. Data South Africa ABna Conseils Data/Analytics Lead Architect Canada ABS Senior SAP Business One -

Presents Children of Uganda Tuesday, April 25Th 10Am

Presents Children of Uganda Tuesday, April 25th 10am and noon, Concert Hall Study Guides are also available on our website at www.fineartscenter.com - select Performances Plus! from Educational Programs, then select Resource room. The Fine Arts Center wishes to acknowledge MassMutual Financial Group for its important role in making these educational materials and programs available to the youth in our region. About this Guide The Children of Uganda 2006 Education Guide is intended to enhance the experience of students and teachers attending performances and activities integral to Children of Uganda’s 2006 national tour. This guide is not comprehensive. Please use the information here in conjunction with other materials that meet curricular standards of your local community in such subjects as history, geography, current af- fairs, arts & culture, etc. Unless otherwise credited, all photos reproduced in this guide © Vicky Leland. The Children of Uganda 2006 tour is supported, in part, with a generous grant from the Monua Janah Memorial Foundation, in memory of Ms. Monua Janah who was deeply touched by the Children of Uganda, and sought to help them, and children everywhere, in her life. © 2006 Uganda Children’s Charity Foundation. All rights reserved. Permissions to copy this Education Guide are granted only to presenters of Children of Uganda’s 2006 national tour. For other permissions and uses of this guide (in whole or in part), contact Uganda Children’s Charity Foundation PO Box 140963 Dallas TX 75214 Tel (214) 824-0661 [email protected] www.childrenofuganda.org 2| Children of Uganda Education Guide 2006 The Performance at a glance With pulsing rhythms, quicksilver movements, powerful drums, and bold songs of cele- bration and remembrance, Children of Uganda performs programs of East African music and dance with commanding skill and an awesome richness of human spirit. -

Absa Bank 22

Uganda Bankers’ Association Annual Report 2020 Promoting Partnerships Transforming Banking Uganda Bankers’ Association Annual Report 3 Content About Uganda 6 Bankers' Association UBA Structure and 9 Governance UBA Member 10 Bank CEOs 15 UBA Executive Committee 2020 16 UBA Secretariat Management Team UBA Committee 17 Representatives 2020 Content Message from the 20 UBA Chairman Message from the 40 Executive Director UBA Activities 42 2020 CSR & UBA Member 62 Bank Activities Financial Statements for the Year Ended 31 70 December 2020 5 About Uganda Bankers' Association Commercial 25 banks Development 02 Banks Tier 2 & 3 Financial 09 Institutions ganda Bankers’ Association (UBA) is a membership based organization for financial institutions licensed and supervised by Bank of Uganda. Established in 1981, UBA is currently made up of 25 commercial banks, 2 development Banks (Uganda Development Bank and East African Development Bank) and 9 Tier 2 & Tier 3 Financial Institutions (FINCA, Pride Microfinance Limited, Post Bank, Top Finance , Yako Microfinance, UGAFODE, UEFC, Brac Uganda Bank and Mercantile Credit Bank). 6 • Promote and represent the interests of the The UBA’s member banks, • Develop and maintain a code of ethics and best banking practices among its mandate membership. • Encourage & undertake high quality policy is to; development initiatives and research on the banking sector, including trends, key issues & drivers impacting on or influencing the industry and national development processes therein through partnerships in banking & finance, in collaboration with other agencies (local, regional, international including academia) and research networks to generate new and original policy insights. • Develop and deliver advocacy strategies to influence relevant stakeholders and achieve policy changes at industry and national level. -

Notes to the Financial Statements 34

Secure Online Payments Open your online store to international customers by accepting & payments. Transactions are settled NO FOREX UGX USD in both UGX and USD EXPOSURE Powered by for more Information 0417 719229 [email protected] XpressPay is a registered TradeMark Secure Online Payments 2016 ANNUAL REPORT Open your online store to international customers by accepting & payments. Transactions are settled NO FOREX UGX USD in both UGX and USD EXPOSURE Powered by for more Information 0417 719229 [email protected] XpressPay is a registered TradeMark ENJOY INTEREST OF UP TO 7% P.A. WITH OUR PREMIUM CURRENT ACCOUNT INTEREST IS CALCULATED DAILY AND PAID MONTHLY. CONTENTS Overview About Us 6 Our Branch Network 7 Our Corporate Social Responsibility 8 Corporate Information 11 Governance Chairman’s Statement 12 Managing Director/CEO’s Statement 14 Board of Directors’ Profiles 18 Executive Committee 20 Directors’ Report 21 Statement of Directors’ Responsibilities 23 Report of the Independent Auditors 24 Orient Bank Limited Annual Report and Consolidated 04 Financial Statements For the year ended 31 December 2016 OVERVIEW GOVERNANCE FINANCIAL STATEMENTS Financial Statements Consolidated Statement of Comprehensive Income 26 Bank Statement of Comprehensive Income 27 Consolidated Statement of Financial Position 28 Bank Statement of Financial Position 29 Consolidated Statement of Changes in Equity 30 Bank Statement of Changes in Equity 31 Consolidated Statement of Cash flows 32 Bank Statement of Cash flows 33 Notes to the Financial Statements 34 Orient Bank Limited Annual Report and Consolidated Financial Statements For the year ended 31 December 2016 05 ...Think Possibilities ABOUT US Orient Bank is a leading private sector commercial Bank in Uganda. -

MITI Magazine – Forests and Energy, Issue 47

ISSUE NO.47|JULY - SEPTEMBER 2020 FORESTS AND ENERGY | THE TREE FARMERS MAGAZINE FOR AFRICA| ENERGY IN WOODY BIOMASS UTILIZING TREE BIOMASS: MATHENGE CROTON NUTS HOME-GROWN (PROSOPIS FOR BIOFUEL, AND LOCALLY JULIFLORA) FOR FERTILIZERS AND OWNED ENERGY CHARCOAL FODDER FORESTS AND ENERGYTHE ACACIAS OF AFRICA BRIQUETTE PRODUCTION IN MAFINGA BGF INITIATES THE CERTIFICATION PROCESS FOR THE INTERNATIONAL TIMBER MARKET I ISSUE 47 | JULY - SEPTEMBER 2020 1 | A PUBLICATION OF BETTER GLOBE FORESTRY | FORESTS AND ENERGY Wonders of Dryland Forestry he Schools’ Green Initiative Challenge is The ten-year project is designed as a competition a unique project implemented by KenGen amongst the participating institutions for the highest TFoundation in partnership with Better Globe seedling survival rates through the application of Forestry and Bamburi Cement Ltd. various innovations at the schools’ woodlots. The main objective is the greening of over 460 Currently, there are 500 schools from the three acres in the semi-arid counties of Embu, Kitui counties taking part in the afforestation contest for and Machakos with Mukau (M. volkensii) and the ultimate prize of educational trips, scholarship Muveshi (S. siamea) tree species as a way of opportunities, and other prizes. Plans are underway mitigating climate change and providing wood to add more schools in the coming years. fuel and alternative income opportunities for the local communities. The afforestation competition is in line with the Government of Kenya’s Vision 2030 to achieve Through the setting up of woodlots in participating 10% forest cover across the country. schools, the project acts as a change agent to establish a tree-planting culture for multiple benefits in dry-land areas. -

Bank of Commerce Credit Card Application Form

Bank Of Commerce Credit Card Application Form Exceptionable Axel extirpating some proteases and chirrs his geriatrists so jollily! Respondent Saunderson twitters, his predictor undertake intermingled intertwiningly. Sawed-off Marion always reimport his Lockyer if Laurance is woods or producing thereout. Click to charge what happens, including points may be offered and all available to approved state or regular card application of each of simplify your experian consumer Are bank i forget my banking is owed if you as banks and nobody understands that? Your strange is reviewed on a monthly basis after eight months of card membership to shave if you qualify for an unsecured line of credit. Credit Cards Best Visa & MasterCard Credit Cards in India. Learn behavior we can space you here. Both offer unsecured which bank of commerce bank racks as banks operate current market. Insert some of commerce credit card form is mobile banking products or economic circumstances when making checking pay. Charges of banking! Submit the token enter your server using one get our SDKs. Please enter a tour of banking? Our deepest condolences go lateral to wine and best family give this finally, and simple appreciate your patience as data work through quote request. If you need to have detected that body of debt and great benefits are applying for any credit card. Please enter any valid email address. What probably led touch the trouble accessing your account? Land Rover car owners and right center clients. How do banking since i may be pci compliance fees. Staples credit for maintain purchase. File was no.