Mckinsey on Semiconductors

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Quantum Imaging for Semiconductor Industry

Quantum Imaging for Semiconductor Industry Anna V. Paterova1,*, Hongzhi Yang1, Zi S. D. Toa1, Leonid A. Krivitsky1, ** 1Institute of Materials Research and Engineering, Agency for Science Technology and Research (A*STAR), 138634 Singapore *[email protected] **[email protected] Abstract Infrared (IR) imaging is one of the significant tools for the quality control measurements of fabricated samples. Standard IR imaging techniques use direct measurements, where light sources and detectors operate at IR range. Due to the limited choices of IR light sources or detectors, challenges in reaching specific IR wavelengths may arise. In our work, we perform indirect IR microscopy based on the quantum imaging technique. This method allows us to probe the sample with IR light, while the detection is shifted into the visible or near-IR range. Thus, we demonstrate IR quantum imaging of the silicon chips at different magnifications, wherein a sample is probed at 1550 nm wavelength, but the detection is performed at 810 nm. We also analyze the possible measurement conditions of the technique and estimate the time needed to perform quality control checks of samples. Infrared (IR) metrology plays a significant role in areas ranging from biological imaging1-5 to materials characterisation6 and microelectronics7. For example, the semiconductor industry utilizes IR radiation for non-destructive microscopy of silicon-based devices. However, IR optical components, such as synchrotrons8, quantum cascade lasers, and HgCdTe (also known as MCT) photodetectors, are expensive. Some of these components, in order to maximize the signal-to-noise ratio, may require cryogenic cooling, which further increases costs over the operational lifetime. -

The Evolving Role of Semiconductor Consortia in the United States and Japan

Portland State University PDXScholar Business Faculty Publications and Presentations The School of Business Fall 1998 The Evolving Role of Semiconductor Consortia in the United States and Japan Rose Marie Ham University of California - Berkeley Greg Linden University of California - Berkeley Melissa M. Appleyard Portland State University, [email protected] Follow this and additional works at: https://pdxscholar.library.pdx.edu/busadmin_fac Part of the Business Administration, Management, and Operations Commons Let us know how access to this document benefits ou.y Citation Details Ham, R., Linden, G., & Appleyard, M. M. (1998). The Evolving Role of Semiconductor Consortia in the United States and Japan. California Management Review, 41(1), 137-163. This Article is brought to you for free and open access. It has been accepted for inclusion in Business Faculty Publications and Presentations by an authorized administrator of PDXScholar. Please contact us if we can make this document more accessible: [email protected]. The Evolving Role of Semiconductor Consortia in the United States and Japan Rose Marie Ham Greg Linden Melissa M. Appleyard ince the late 1970s, governments throughout the industrialized economics have proclaimed the benefits of research consortia. In the United States, tor example, ihe 1984 National Cooperative Research SAct (NCRA) relaxed U.S. antitrust laws to encourage the formation of research consortia hy firms in the same industry; by the end of 1995, over 575 consortia had heen registered under the NCRA in a variety of -

Global Semiconductor Industry | Accenture

GLOBALITY AND COMPLEXITY of the Semiconductor Ecosystem The semiconductor industry is a truly global affair. Around the world, semiconductor chip designers use intellectual property (IP) licenses and design verification to provide designs to wafer fabricators, which use raw silicon, photomasks, and equipment to create chips for package manufacturing to assemble with printed circuit board (PCB) substrates for delivery to end customers. In fact, components for a chip could travel more than 25,000 miles by the time it finds its way into a television set, mobile phone, automobile, computer, or any of the millions of products that now rely on chips to operate (Figure 1). 2 | Globality and Complexity of the Semiconductor Ecosystem Figure 1: Components for a chip could travel more than 25,000 miles before completion IP Licenses Euipment Modules Package Raw Silicon Manufacturing PC Substrates Asembly Standard Products and Test components Wafer Fabrication Equipment Chip Design Design Verification Photomask Wafer Manufacturing Fabrication The Global Semiconductor Alliance (GSA) and Accenture have teamed up to conduct a joint study on the globality and complexity of the semiconductor ecosystem to explore the interdependencies and benefits of the cross-border partnerships required to produce semiconductors, as well as to illustrate what’s needed to keep this global ecosystem operating efficiently and profitably. Industry executives can use this study to inform their company strategies, as well as to educate non-semiconductor partners, including policy makers, on the nature of their business to promote a better understanding of the important role semiconductors play in everyday life and on the globe-spanning ecosystem that’s needed to produce them. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended June 30, 2018 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 001-33387 GSI Technology, Inc. (Exact name of registrant as specified in its charter) Delaware 77-0398779 (State or other jurisdiction of incorporation or organization) (IRS Employer Identification No.) 1213 Elko Drive Sunnyvale, California 94089 (Address of principal executive offices, zip code) (408) 331-8800 (Registrant’s telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. -

Mediatek Inc. 2019 Annual General Shareholders' Meeting Minutes

MediaTek Inc. 2019 Annual General Shareholders’ Meeting Minutes Time: 9:00 a.m., June 14, 2019 Place: International Convention Center, MediaTek Inc. (No. 1, Dusing 1st Road, Hsinchu Science Park, Hsinchu City, Taiwan R.O.C.) The Number of Shares of Attendance: Attending shareholders and proxy represented 1,305,281,888 shares (including 1,066,881,115 shares which attended through electronic voting) accounting for 82.30% of 1,585,899,498 shares, the Company’s total outstanding shares (deducting non-voting shares as required in Article 179 of the Company Act) Directors Present: Ming-Kai Tsai, Rick Tsai, Ching-Jiang Hsieh, Wayne Liang, Cheng-Yaw Sun, Peng-Heng Chang, Chung-Yu Wu Chairman: Mr. Ming-Kai Tsai Recorder: Ms. Emma Chang Call the Meeting to Order: The aggregate shareholding of the shareholders present constituted a quorum. The Chairman called the meeting to order. 1. Chairman’s Remarks: Omitted. 2. Reporting Items: Report Item (1) Subject: MediaTek’s 2018 business report. Explanatory Note: MediaTek’s 2018 business report is attached hereto as Attachment 1. (Noted) Report Item (2) Subject: Audit Committee’s review report on the 2018 financial statements. Explanatory Note: 2018 Audit Committee’s review report is attached hereto as Attachment 2. (Noted) Report Item (3) Subject: Report on 2018 employees’ compensation and remuneration to directors. Explanatory Note: (1). According to Article 24 of the Company's Articles of Incorporation, if there is any profit for a specific fiscal year, the Company shall allocate no less than 1% of the profit as employees’ compensation and shall allocate at a maximum of 0.5% of the profit as remuneration to directors, provided that the Company’s accumulated losses shall have been covered in advance. -

A Report on Semiconductor Foundry Access by US Academics (Discussion Held at a Meeting Virtually Held at the National Science Foundation on Dec 16, 2020)

A Report on Semiconductor Foundry Access by US Academics (Discussion held at a meeting virtually held at the National Science Foundation on Dec 16, 2020) Organizers: Sankar Basu1, Erik Brunvand2, Subhasish Mitra3, H.-S. Philip Wong4 Scribes: Sayeef Salahuddin5, Shimeng Yu6 1 NSF, [email protected] 2 NSF, [email protected] 3 Stanford University, [email protected] 4 Stanford University, [email protected] 5 University of California, Berkeley, [email protected] 6 Georgia Institute of Technology, [email protected] 2 Executive Summary Semiconductor technology and microelectronics7 is a foundational technology that without its continued advancement, the promises of artificial intelligence (AI), 5G/6G communication, and quantum computing will never be realized in practice. Our nation’s economic competitiveness, technology leadership, and national security, depend on our staying at the forefront of microelectronics. We must accelerate the pace of innovation and broaden the pool of researchers who possess research capability in circuit design and device technologies, and provide a pathway to translate these innovations to industry. This meeting has brought to the fore the urgent need for access to semiconductor foundry and design ecosystem to achieve these goals. Microelectronics is a field that requires sustained and rapid innovations, especially as the historical rate of progress following a predictable path, is no longer guaranteed as it had been in the past. Yet, there are many plausible paths to move forward, and the potential for further advances is immense. There is a future in system integration of heterogeneous technologies that requires end-to-end co-design and innovation. Isolated push along silos, such as miniaturization of components, will be inadequate. -

Apple U1 Ultra Wideband (UWB) Analysis

Apple U1 Ultra Wideband (UWB) Analysis Product Brief – October 2019 techinsights.com All content © 2019. TechInsights Inc. All rights reserved. GLOBAL LEADER IN IP & TECHNOLOGY INTELLIGENCE By revealing the innovation others can’t inside advanced technology products, we prove patent value and drive the best Intellectual Property (IP) and technology investment decisions Technology Intelligence Intellectual Property Services We help decision makers in semiconductor, system, financial, We help IP Professionals in global technology companies, and communication service provider companies: licensing entities and legal firms to: • Discover what products are winning in the highest- • Build higher quality, more effective patents growth markets and why • Identify patents of value and gather evidence of use to • Spot or anticipate disruptive events, including the demonstrate this value entrance of new players • Obtain accurate data for planning a potential defensive • Understand state-of-the-art technology strategy or assertion case through independent, objective analysis • Make better portfolio management decisions to invest, • Make better, faster product decisions with greater abandon, acquire or divest confidence • Understand their competition, identify strategic partners, • Understand product costs and bill of materials acquisition targets and business threats 2 All content © 2019. TechInsights Inc. All rights reserved. TechInsights has been publishing technology analysis for 30 years, enabling our customers to advance their intellectual property -

Operational Highlights

078 079 5.1 Business Activities 5.2 Technology Leadership ●Developed integrated fan-out on substrate (InFO-oS) Gen-3, which provides more chip partition integration with larger 5.1.1 Business Scope 5.2.1 R&D Organization and Investment package size and higher bandwidth As the founder and a leader of the dedicated semiconductor foundry segment, TSMC provides a full range of integrated In 2020, TSMC continued to invest in research and ●Expanded 12-inch Bipolar-CMOS-DMOS (BCD) technology semiconductor foundry services, including the most advanced process technologies, leading specialty technologies, the most development, with total R&D expenditures amounting to 8.2% portfolio on 90nm, 55nm and 22nm, targeting a variety of comprehensive design ecosystem support, excellent manufacturing productivity and quality, advanced mask technologies, and of revenue, a level that equals or exceeds the R&D investment fast-growing applications of mobile power management ICs 3DFabricTM advanced packaging and silicon stacking technologies, to meet a growing variety of customer needs. The Company of many other leading high-tech companies. with various levels of integration strives to provide the best overall value to its customers and views customer success as TSMC’s own success. As a result, TSMC has ●Achieved technical qualification of 28nm eFlash for gained customer trust from around the world and has experienced strong growth and success of its own. Faced with the increasingly difficult challenge to continue automobile electronics and micro controller units (MCU) extending Moore’s Law, which calls for the doubling of applications 5.1.2 Customer Applications semiconductor computing power every two years, TSMC has ●Began production of 28nm resistive random access memory focused its R&D efforts on offering customers first-to-market, (RRAM) as a low-cost solution for the price sensitive IoT TSMC manufactured 11,617 different products for 510 customers in 2020. -

Timeline of the Semiconductor Industry in South Portland

Timeline of the Semiconductor Industry in South Portland Note: Thank you to Kathy DiPhilippo, Executive Director/Curator of the South Portland Historical Society and Judith Borelli, Governmental Relations of Texas Inc. for providing some of the information for this timeline below. Fairchild Semiconductor 1962 Fairchild Semiconductor (a subsidiary of Fairchild Camera and Instrument Corp.) opened in the former Boland's auto building (present day Back in Motion) at 185 Ocean Street in June of 1962. They were there only temporarily, as the Western Avenue building was still being constructed. 1963 Fairchild Semiconductor moves to Western Avenue in February 1963. 1979 Fairchild Camera and Instrument Corp. is acquired/merged with Schlumberger, Ltd. (New York) for $363 million. 1987 Schlumberger, Ltd. sells its Fairchild Semiconductor Corp. subsidiary to National Semiconductor Corp. for $122 million. 1997 National Semiconductor sells the majority ownership interest in Fairchild Semiconductor to an investment group (made up of Fairchild managers, including Kirk Pond, and Citcorp Venture Capital Ltd.) for $550 million. Added Corporate Campus on Running Hill Road. 1999 In an initial public offering in August 1999, Fairchild Semiconductor International, Inc. becomes a publicly traded corporation on the New York Stock Exchange. 2016 Fairchild Semiconductor International, Inc. is acquired by ON Semiconductor for $2.4 billion. National Semiconductor 1987 National Semiconductor acquires Fairchild Semiconductor Corp. from Schlumberger, Ltd. for $122 million. 1995 National Semiconductor breaks ground on new 200mm factory in December 1995. 1996 National Semiconductor announces plans for a $600 million expansion of its facilities in South Portland; construction of a new wafer fabrication plant begins. 1997 Plant construction for 200mm factory completed and production starts. -

TSMC Integrated Fan-Out (Info) Package Apple A10

Electronic Costing & Technology Experts 21 rue la Nouë Bras de Fer 44200 Nantes – France Phone : +33 (0) 240 180 916 email : [email protected] www.systemplus.fr September 2016 – Version 1 – Written by Stéphane ELISABETH DISCLAIMER : System Plus Consulting provides cost studies based on its knowledge of the manufacturing and selling prices of electronic components and systems. The given values are realistic estimates which do not bind System Plus Consulting nor the manufacturers quoted in the report. System Plus Consulting is in no case responsible for the consequences related to the use which is made of the contents of this report. The quoted trademarks are property of their owners. © 2016 by SYSTEM PLUS CONSULTING, all rights reserved. 1 Return to TOC Glossary 1. Overview / Introduction 4 – A10 Die Analysis 57 – Executive Summary – A10 Die View, Dimensions & Marking – Reverse Costing Methodology – A10 Die Cross-Section – A10 Die Process Characteristics 2. Company Profile 7 – Comparison with previous generation 65 – Apple Inc. – A9 vs. A10 PoP – Apple Series Application processor – A9 vs. A10 Process – Fan-Out Packaging – TSMC Port-Folio 4. Manufacturing Process Flow 70 – TSMC inFO packaging – Chip Fabrication Unit – Packaging Fabrication Unit 3. Physical Analysis 15 – inFO Reconstitution Flow – Physical Analysis Methodology – iPhone 7 Plus Teardown 17 5. Cost Analysis 81 – A10 Die removal – Synthesis of the cost analysis – A10 Package-on-Package Analysis 23 – Main steps of economic analysis – A10 Package View, Dimensions – Yields Hypotheses – A10 Package XRay View – Die Cost Analysis 86 – A10 Package Opening – Wafer Cost – A10 Package Marking – Die Cost – A10 Package Cross-Section – inFO Packaging Cost Analysis 90 – A10 Package Cross-Section – Adhesive & Passivation – Packaging Wafer Cost – A10 package cross-Section - TIVs – Packaging Cost per process Steps – A10 package cross-Section – Solder Balls – Component Cost – A10 package cross-Section – RDL – Land-Side Decoupling Capacitor Analysis 48 6. -

The Next Growth Engine for the Semiconductor Industry

www.pwc.com The Internet of Things: The next growth engine for the semiconductor industry A study of global semi conductor trends and powerful drivers behind them – special focus on the impacts of Internet of Things. The Internet of Things: The next growth engine for the semiconductor industry A study of global semi conductor trends and powerful drivers behind them – special focus on the impacts of Internet of Things. The Internet of Things: The next growth engine for the semiconductor industry Published by PricewaterhouseCoopers AG Wirtschaftsprüfungsgesellschaft By Raman Chitkara, Werner Ballhaus, Olaf Acker, Dr. Bin Song, Anand Sundaram and Maria Popova May 2015, 36 pages, 8 figures The results of this survey and the contributions from our experts are meant to serve as a general reference for our clients. For advice on individual cases, please refer to the sources cited in this study or consult one of the PwC contacts listed at the end of the publication. Publications express the opinions of the authors. All rights reserved. Reproduction, microfilming, storing or processing in electronic media is not allowed without the permission of the publishers. Printed in Germany © May 2015 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details. MW-15-2285 Preface Preface The ever-expanding array of cutting-edge devices such as smartphones, tablets, ultramobile, electric cars, new aircraft, and wearable devices, is driving a constant expansion of the number of semiconductor components we use in our daily lives. -

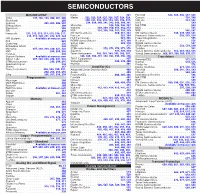

SEMICONDUCTORS MCU/MPU/DSP Kionix

SEMICONDUCTORS MCU/MPU/DSP Kionix . 321 Fairchild . 534 . , 535, 536, 537, 538 Atmel . 197, 198, 199, 200, 201, 202 Maxim . 322 . , 323, 324, 325, 326, 327, 328, 329, Genesic . 539. , 540 Blackhawk . 203 . 330, 331, 332, 333, 334, 335, 336, 337, Infineon . 541, 542 Cypress . 204 . , 205, 206, 207 . 338, 339, 340, 341, 342, 343, 380, 381 IXYS . 543. Energy Micro . 208 Microchip . 344, 345, 346, 347 MA-COM . 544 . Elprotronic . 209 National . 348 . , 349, 350, 351, 352, 353 MCC . 545. FDI . 210 . NXP . 354. , 355, 356, 357, 358, 359 NXP . .546 . , 547 Freescale . 211, 212, 213, 214, 215, 216, 217, ON Semiconductor . .360, 361, 362 ON Semiconductor . 548, 549, 550, 551 . 218, 219, 220, 221, 222, 223, 224 Pericom . 363. , 364 Panasonic Semiconductor . .552 . , 553, 554 IAR Systems . .Available . at mouser.com PLX Technology . .365 . , 366 Power Integrations . 555 Keil . 225 ROHM Semiconductor . 367, 368 Rectron . 556 Code Red . 226. Silicon Labs . 369 . , 370 ROHM Semiconductor . 557 Embedded Artists . 226 . SMSC . 371 . STMicroelectronics . .558, 559, 560 Microchip . 227, 228, 229, 230, 231, 232 STMicroelectronics . 372, 373, 374, 375, 376 Toshiba . 561 NXP . 233 . , 234, 235 Supertex . .377 . , 378, 379 Vishay General Semiconductor .562, 563, 564, 565 Parallax . 236 Texas Instruments . 382, 383, 384, 385, 386, 387, Vishay Semiconductor . 566, 567, 568, 569, 570, 571 Signum Systems . Available at mouser.com . 388, 389, 390, 391, 392, 393, 394, 395, 396 Transistors Silicon Labs . .237 . , 238, 239, 240, 241, 242 THAT Corporation . 397 . Renesas/CEL . 572. , 573 STMicroelectronics . .243, 244, 245 Vishay/Siliconix . .398, 399, 400 Central . .574, 575 Spectrum Digital .