When Reality Kicks

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Marc Faber Limited May 26, 2003

THE GLOOM, BOOM & DOOM REPORT ISSN 1017-1371 A PUBLICATION OF MARC FABER LIMITED MAY 26, 2003 Do Great Investment Opportunities Knock on Your Door Only Once??? It is much more easy to have sympathy with suffering than it is to have sympathy with thought. Accordingly, with admirable, though misdirected intentions, they very seriously and very sentimentally set themselves to the task of remedying the evils that they see. But their remedies do not cure the disease: they merely prolong it. Indeed, their remedies are part of the disease. Oscar Wilde, The Soul of Man under Socialism (1890) INTRODUCTION from the list of most livable cities. people’s homes. The danger in According to a survey conducted by Thailand isn’t violence, but poor As some of my readers may know, Mercer Human Resources driving. Most drivers in the north almost three years ago I moved my Consulting, Zurich has the world’s don’t observe road rules, and few family to Chiangmai, where we have highest quality of life, ahead of even have a driver’s licence. Each remodelled an old Thai house by the Vancouver and Vienna. In the US, year during Sonkran (the week-long river that runs through the city. Now, San Francisco was the top-rated city Thai New Year’s festival during my office building is also 99% (placed number 18), while New York which people throw water at each completed (in Thailand, nothing is was rated number 44 and Los Angeles other, and which is actually a lot of ever 100% finished) and this is the 53. -

Where Keynes Went Wrong

Praise for Where Keynes Went Wrong “[An] impassioned . and . much needed book. In plain prose, . Hunter Lewis . begins by patiently walking us through precisely what Keynes said . then reveals why Keynes’s work is ‘remarkably unsupported by evidence or logic.’ Lewis does much more besides, showing how Keynesianism has lived in the minds and hearts of politicians, with disastrous results.” —Gene Epstein, Barron’s “Lewis has exposed with unmatched clarity the lineaments of Keynes’s system and enabled us to see exactly its disabling defects. Keynes defied common sense, unable to sustain the brilliant para- doxes that his fertile intellect constantly devised. Lewis’s book is an ideal guide to Keynes’s dangerous and destructive economics. .” —David Gordon, LewRockwell.com “Just what the world needs, and just in time. Keynes is demolished and his quack system refuted. But this wonderful book does more. It restores clear thinking and common sense to their rightful places in the economic policy debate. Three cheers for Hunter Lewis!” —James Grant, Editor of Grant’s Interest Rate Observer “Hunter Lewis has written a splendid book called Where Keynes We nt Wrong. The dissection of the English economist who died in 1946 is especially timely, given that the past two administra- tions and the current one are identical in believing wholeheart- edly in . key Keynesian dogma.” —Patrick McIlheran, Milwaukee Journal Sentinel “[This] compelling, powerful, and extremely readable book . is fantastic. ‘Must’ reading.” —Kevin Price, CBS and CNN Radio and BizPlusBlog “Lewis has done a service, even if in the negative, of concisely and critically summarizing Keynes’s economic theories, and his book will make readers think.” —Library Journal “[This] highly readable . -

Mr. Chetan Parikh and Mr. J.Mulraj of Capital Ideas Online Interviewed Dr Marc Faber

Mr. Chetan Parikh and Mr. J.Mulraj of Capital Ideas Online interviewed Dr Marc Faber . Dr Marc Faber was born in Zurich and studied Economics at the University of Zurich, obtaining a Ph.D. at the age of 24. Between 1970 and 1978 he worked at White Weld & Co Ltd. For the next twelve years he was the Managing Director of Drexel Burnham Lambert, based in Hong Kong. In 1990 he set up his own firm Marc Faber Ltd., acting as an investment advisor, fund manager and broker/dealer. He is a well known ‘contrarian investor’ and brings out a monthly newsletter called the ‘Gloom, Boom and Doom Report’. His website is at www.gloomboomdoom.com. He is the author of a boom ‘The Great Money Illusion – the Confusion of the Confusions’. He was recently in Mumbai and gave a speech at a function organized by Enam Financial Consultants Ltd. J Mulraj and Chetan Parikh, of www.capitalideasonline.com interviewed Dr Faber in Mumbai. Q: Thank you Dr. Faber for giving us this interview for capitalideasonline. Even prior to Sept. 11th you had a very bearish outlook on the global economy. The Sept. 11th terrorist attacks have certainly impacted globalization in terms of outsourcing, production, just in time inventory management, supply scale economy. How badly is globalization affected in your opinion and how would global economy growth suffer? A: Actually before Sept. 11th I was particularly negative about the U.S. economy and the economies of the Western industrialized nations. I thought that the Asian economies had bottomed out. And I still think that relatively speaking the Asian economies will do better probably in the years to come and that the financial markets in Asia will do better than say in America. -

Austrian Economics Golden Opportunities Fund

Austrian Economics Golden Opportunities Fund Prepared for Inflation And Deflation Ronald-Peter Stöferle & Mark J. Valek Executive Summary I Quo Vadis… The Fund and its Objectives ► Real (inflation-adjusted) growth in uncertain times ► Active protection against Inflation/Deflation ► Absolute Return, Global Macro approach ► Target return 8% p.a. ► Modest Drawdown-Risk (Ø Volatility between 10 and 12%) ► Diversification to traditional bond and equity portfolios …Inflation or Deflation? Our Investment Approach ► Identifying the respective inflation momentum utilizing the „Incrementum-Inflation-Signal“. ► Strategies are implemented based on our know-how in the Inflation/Deflation portfolio via precious metals, equities and commodities. ► Budget for tactical opportunities for other themes using Austrian School perspective. Sources: Societe Generale, Incrementum AG 2 Executive Summary II Austrian Economics for Investors Our Investment Philosophy ► Insights of the Austrian School of Economics are the intellectual foundation of our macro-analyses. ► In contrast to traditional tenets the Austrian School recognizes the “fiat money” and fractional reserve banking system as the major cause of the ongoing crisis. Conservative Risk Profile Characteristics of the Fund ► No benchmark, Absolute Return approach ► Active asset allocation for Inflation or Deflation by means of diversified basket of securities ► Significantly lower volatility (between 10-12%) compared to mining stocks (about 50%) and silver (about 35%) ► UCITS IV Funds Sources: Societe Generale, -

Dr Marc Faber Editor of the Doom Boom Gloom Report Investor Advisor and Fund Manager

Mar15 Dr Marc Faber Editor of The Doom Boom Gloom Report Investor Advisor and Fund Manager Global / Asia Economist & Investment Expert Famous for his contrarian approach to investing, Marc Faber does not run with the bulls or bait the bears, but steers his own course through the maelstrom of international finance markets. Professional experience Dr Faber publishes a widely read monthly investment newsletter The Gloom Boom & Doom report which highlights unusual investment opportunities. He is the author of several books including “Tomorrow’s Gold; Asia’s Age of Discovery,” first published in 2002 and which highlights future investment opportunities around the world. It was on Amazon’s best seller list for several weeks and has been translated into Japanese, Korean, Thai and German. Dr. Faber is also a regular contributor to several leading financial publications around the world. Sample assignments Dr Faber is a regular speaker at various investment seminars, well known for his “contrarian” investment approach. He is also associated with a variety of funds. What he says is always impeccably well argued, yet it is the delivery which makes him so sought after as a speaker: a master of rhetoric and of vivid everyday examples, and the very dry sense of humour. Marc Faber - Personal bio-data In June 1990, he set up his own business, Marc Faber Limited which acts as an investment advisor, fund manager and broker/dealer. He has lived in Hong Kong since 1973. From 1978 to February 1990, he was the Managing Director of Drexel Burnham Lambert (HK) Ltd. Dr Faber worked for White Weld & Company from 1970 to 1978 in New York, Zurich and Hong Kong. -

ANNUAL REPORT 2011 the Improvement of the Public Image of the Chemical Industry

About EPCA The European Petrochemical Association (EPCA) is a Brussels- based chemical industry-led international non profit association. As legitimate network and platform to meet, communicate, exchange of information as well as transfer of learning for more than 640 international member companies, EPCA operates for and through its members. These are chemical producers, their service providers, their customers and their suppliers. With 45 years’ experience, EPCA is a service provider for its member companies. EPCA organizes meetings, seminars, workshops and think tanks for its members and stakeholders. Purpose of these activities is to open debate to the long term sustainable development of the petrochemical industry all over the world and to contribute to ANNUAL REPORT 2011 the improvement of the public image of the chemical industry. including members index EPCA meeting venues are located in Europe. EPCA also supplies meeting facilities in the format the chemical business community needs and appreciates. Given its large and global membership base, EPCA has never been, nor intended to be, a lobbying organization. As such EPCA does not have any international or national federations or associations in its membership. www.epca.eu EPCA a.i.s.b.l. The European Petrochemical Assocation i.v.z.w. Avenue de Tervueren 270 Tervurenlaan B 1150 Brussels – Belgium Phone + 32 2 741 86 60 Fax + 32 2 741 86 80 © EPCA, 2012 Content Annual Report 2011 Photos inside : © Antwerp Gas Terminal, EPCA Strategy 3 © Bruhn Spedition, © Borealis, © Caldic, © C4U -

In Gold We Trust Report 2016

Incrementum AG In Gold we Trust 2016 June 28th, 2016 In Gold we Trust 2016 Gold is back! With the strongest quarterly performance in 30 years, the precious metal in Q1 2016 emerged from the bear market that had been in force since 2013. A decisive factor in this comeback is growing uncertainty over the recovery of the post-Lehman economy. After years of administering high doses of monetary painkillers, will the Fed succeed in discontinuing the practice? Or is the entire therapy about to be fundamentally challenged? Generating growth and inflation remains the imperative of monetary Authors: policy. The systematic credit expansion required for this just doesn't want to get going. Even the ECB, which initially acted with restraint after the financial Ronald-Peter Stoeferle, CMT crisis, is nowadays stuck in a perennial loop of monetary improvisation and [email protected] stimulus. General uncertainty has now increased even further after the Twitter @RonStoeferle surprise outcome of the Brexit referendum. Mark J. Valek, CAIA [email protected] After years of pursuing low interest rate policies, central banks have Twitter @MarkValek maneuvered themselves into a lose-lose situation: Both continuing and ending the low interest rate regime harbors considerable risks. In an attempt to finally achieve the desired boost to growth, a monetary Rubicon has been crossed in several currency areas with the imposition of negative interest rates. Gold is increasingly attractive in this environment. It used to be said that gold doesn't pay interest, now it can be said that it doesn't cost interest. As a last resort, even the radical measure of helicopter money is considered these days. -

Lehren Aus Der Krise – Lernen Für Die Zukunft

4195187815007 GO AHEAD! leading responsibly www.go-ahead.at DAS MAGAZIN FÜR VISIONÄRE DENKER UND ANDERE NUMMER 0/2009 Lehren aus der Krise – Lernen für die Zukunft Foto: (c) Andreas H. Bitesnich Kongress zur Österreichischen Schule der Nationalökonomie Lehren aus der Krise – Lernen für die ZukunftSeite 36 Nummer 0/2009 John und Doris Naisbitt Demokratie und Marktwirtschaft in neuem Das Magazin für visionäre Denker und andere Gewand Seite 18 Eugen Schulak – Herbert Unterköfler Gregor Hochreiter Geschichte der Österreichischen Über die Vorteilhaftigkeit GO AHEAD! Schule der Nationalökonomie. Seite 8 des Tauschens Seite 22 Immer ein Gewinn Der GEWINN erscheint jetzt minütlich: www.gewinn.com! Die GEWINN-Homepage – Immer ein Gewinn! Ein Klick auf www.gewinn.com und Sie werden begeistert sein: Vom übersichtlichen Design, vom Online-Archiv für Abonnenten, von der umfassenden Immobiliendatenbank mit Tausenden Top-Objekten, von der umfangreichen Fondsdatenbank mit einfacher Fondssuche, von den aktuellen Börsenkursen mit Charts und Profilen. Außerden finden alle Autointeressierten spezielle Services und zusätzlich gibt es jede Menge gewinnbringender Tipps und Tricks zur Geldanlage, IT-Kommunikation, Management, Recht & Steuer – und vieles mehr! www.gewinn.com Reducing IT-Complexity. Tailormade IT-Lösungen. Vom Cross-Platform Spezialisten. Kosteneffizient und zuverlässig. uptime ITechnologies GmbH www.uptime.at Leading IT. Since 1994. [email protected] GA ➛ Nummer 0/2009 ➛ Editorial Lehren aus der Krise -Lernen für die Zukunft DAS IST DAS THEMA DES GO AHEAD! BUSINESS SUMMIT 09 UND GLEICHZEITIG DIE ZENTRALE HERAUSFORDERUNG FÜR GESELLSCHAFT, WIRTSCHAFT UND POLITIK. DIE BESCHÄFTIGUNG MIT DEN EIGENTLICHEN URSACHEN UND KONSEQUENZEN DER FINANZMARKT- UND WIRTSCHAFTS- KRISE SIND AUS DEM BLICKWINKEL DER ÖFFENTLICHE DEBATTE GERÜCKT, NACHDEM MAN „DIE SCHULDIGEN “ („DIE GIERIGEN MANAGER“, „DIE WIRTSCHAFT“) AUSGEMACHT UND ABGEURTEILT HAT. -

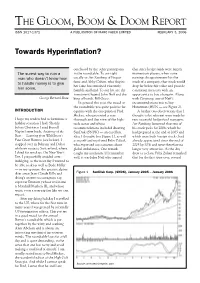

The Gloom, Boom & Doom Report

THE GLOOM, BOOM & DOOM REPORT ISSN 1017-1371 A PUBLICATION OF MARC FABER LIMITED FEBRUARY 3, 2006 Towards Hyperinflation? outclassed by the other participants that since hedge funds were largely The surest way to ruin a in the roundtable. To our right momentum players, when some man who doesn’t know how usually sit Art Samberg of Pequot earnings disappointment hit the to handle money is to give fame and Abby Cohen, who despite stock of a company, that stock would her fame has remained extremely drop far below fair value and provide him some. humble and kind. To our left are the contrarian investors with an investment legend John Neff and the opportunity to buy a bargain. Along George Bernard Shaw king of bonds, Bill Gross. with Citigroup, one of Neff’s In general this year, the mood at recommendations was to buy the roundtable was quite positive for Hunstman (HUN — see Figure 2). INTRODUCTION equities with the exception of Fred A further two observations that I Hickey, who presented a very thought to be relevant were made by I hope my readers had as fortuitous a thorough and dim view of the high- two successful hedge fund managers. holiday season as I had. Shortly tech sector and whose Art Samberg lamented that two of before Christmas I read Russell recommendations included shorting his stock picks for 2006, which he Napier’s new book, Anatomy of the SanDisk (SNDK) — an excellent had prepared at the end of 2005 and Bear — Learning from Wall Street’s idea, I thought (see Figure 1), as well which were both foreign stocks, had Four Great Bottoms (see below). -

@Ttalibrary @Ttalibrary BULL! Ba History of the Boom and Bust, 1982–2004

@ttalibrary @ttalibrary BULL! Ba history of the boom and bust, 1982–2004 maggie mahar @ttalibrary To Raymond, who believes that everything is possible @ttalibrary — Contents — Acknowledgments vii Prologue Henry Blodget xiii Introduction Chapter 1—The Market’s Cycles 3 Chapter 2—The People’s Market 17 Beginnings (1961–89) Chapter 3—The Stage Is Set 35 (1961–81) Chapter 4—The Curtain Rises 48 (1982–87) Chapter 5—Black Monday (1987–89) 61 @ttalibrary iv Contents The Cast Assembles (1990–95) Chapter 6—The Gurus 81 Chapter 7—The Individual Investor 102 Chapter 8—Behind the Scenes, 123 in Washington The Media, Momentum, and Mutual Funds (1995–96) Chapter 9—The Media: CNBC Lays 153 Down the Rhythm Chapter 10—The Information Bomb 175 Chapter 11—AOL: A Case Study 193 Chapter 12—Mutual Funds: 203 Momentum versus Value Chapter 13—The Mutual Fund 217 Manager: Career Risk versus Investment Risk The New Economy (1996–98) Chapter 14—Abby Cohen Goes to 239 Washington; Alan Greenspan Gives a Speech Chapter 15—The Miracle of 254 Productivity The Final Run-Up (1998–2000) Chapter 16—“Fully Deluded 269 Earnings” @ttalibrary Contents v Chapter 17—Following the Herd: 288 Dow 10,000 Chapter 18—The Last Bear Is Gored 304 Chapter 19—Insiders Sell; 317 the Water Rises A Final Accounting Chapter 20—Winners, Losers, and Scapegoats 333 (2000–03) Chapter 21—Looking Ahead: What 353 Financial Cycles Mean for the 21st-Century Investor Epilogue (2004–05) 387 Notes 397 Appendix 473 Index 481 about the author credits cover copyright about the publisher @ttalibrary @ttalibrary — Acknowledgments — More than a hundred people contributed to this book, sharing their expe- riences, their insights, and their knowledge. -

Rta Maxsus Ta`Lim Vazirligi

UDK: 330.8 O`ZBEKISTON RESPUBLIKASI OLIY VA O`RTA MAXSUS TA`LIM VAZIRLIGI NAMANGAN DAVLAT UNIVERSITETI K.Q.Tajibayev, J.A.Abdullayev, M.T.Baltabayev NAMANGAN - 2020 Ushbu qo’llanma bakalavriat bosqichining iqtisodiy ta`lim yo`nalishi talabalari uchun “Iqtisodiyot nazarizasi”, “Iqtisodiy ta’limotlar tarixi”, “Zamonaviy raqobat nazariyalari”, “Makroiqtisodiyot”, “Mikroiqtisodiyot” fanlaridan olgan bilimlarini yanada mustaxkamlashda alohida ahamiyat kasb etadi. Talabalar ushbu qo’llanma bilan tanishish davomida iqtisodiy fanlarni rivojlantirishga hissa qo’shgan jahonning olimlari, iqtisodiy maktablar tomonidan ilgari surilgan iqtisodiy qarashlar, goyalar, yondashuvlar haqida keng ma’lumot olishlari mumkin. Shu bilan birga ushbu qo’llanma keng kitobxonlar ommasiga mo’ljallangan. Mualliflar: K.Tajibayev, J.Abdullayev, M.Baltabayev Taqrizchilar: i.f.n.dotsent K. Sirojidiinov i.f.n.dotsent M. G’aniyev Namangan davlat universiteti ilmiy kengashining 2020 yil ____________dagi majlisi qaroriga asosan nashrga tavsiya etilgan (Bayonnoma №___) KIRISH Jahon iqtisodiyotining yuqori sur’atlar bilan rivojlanib borishi, iqtisodiy integratsiyalashuv jarayonlarining jadallashuvi, rivojlanayotgan mamlakatlardagi iqtisodiy o’sish sur’atlarining barqaror saqlanib qolinayotganligi, rivojlangan va rivojlanayotgan mamlakatlar o’rtasidagi savdo urushlari kabi jarayonlar iqtisodiy tafakkur taraqqiyotiga kuchli ta’siri o’tkazmoqda. Jahon iqtisodiyotida sodir bo’layotgan voqea va hodisalarni iqtisodiy jihatdan sharhlash, ularning yechimlarni izlash jarayoni bevosita yetakchi iqtisodchi olimlarning boy merosini o’rganish bilan bog’liqdir. SHu ma’noda ayni paytgacha yaratilgan ilmiy g’oyalar va ilmiy asarlar katta ahamiyat kasb etadi. Ta’kidlab o’tish zarurki, iqtisodchi olimlar tomonidan ishlab chiqilgan iqtisodiy goyalar hali ham o’zining nazariy va amaliy ahamityaini yo’qotgan emas. Jahonga mashhur iqtisodchi olimlar o'z tadqiqotlari, nazariyalari va asarlari orqali nafaqat iqtisodiyot faniga katta hissa qo'shdilar balki iqtisodiy taraqqiyotning yangi yo’nalishlarini begilalab berdilar. -

71 Who, As We Have Noted, Had Worked out the Primary Reason for Crashes a Century Earlier: Boom

Free Prices Now! Free Prices Now! Fixing the Economy by Abolishing the Fed Hunter Lewis AC2 Books 94 Landfill Road Edinburg, VA 22824 888.542.9467 [email protected] Free Prices Now!: Fixing the Economy by Abolishing the Fed © 2013 by AC2 Books. All rights reserved. Printed in the United States of America. No part of this book may be used or reproduced in any manner whatsoever with- out written permission except in the case of brief quotations used in criti- cal articles and reviews. Publisher’s Cataloging-in-Publication (Provided by Quality Books, Inc.) Lewis, Hunter. Free prices now! : fixing the economy by abolishing the Fed / Hunter Lewis. p. cm. Includes bibliographical references and index. LCCN 2013935436 ISBN 978-0-9887267-0-3 1. Price regulation--United States. 2. United States--Economic policy. 3. United States--Economic conditions. I. Title. HB236.U5L49 2013 338.5’26’0973 QBI13-600052 Contents Part 1 1: Introduction . 1 Part 2: The Free Price System 2: Why We Need Free Prices . 7 3: The Role of Profits in Driving Down Prices . 13 4: Who Are the Bosses in a Free Price System? . 17 5: “Spontaneous Order” from Free Prices . 23 6: What About Inequality? . .. 27 7: The Essential Role of Loss and Bankruptcy . 33 8: Why Greed Is Not “Good” in a Free Price System . 37 Part 3: How Central Banking Threatens the Free Price System 9: The Puzzle of Central Banking . 47 10: The US Federal Reserve and Prices . 51 11: Prices, Bubbles, and Busts . 61 • v vi • Free Prices Now! 12: Price Fixing Follies 1 .