Memorandum To

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The BG News January 26, 1996

Bowling Green State University ScholarWorks@BGSU BG News (Student Newspaper) University Publications 1-26-1996 The BG News January 26, 1996 Bowling Green State University Follow this and additional works at: https://scholarworks.bgsu.edu/bg-news Recommended Citation Bowling Green State University, "The BG News January 26, 1996" (1996). BG News (Student Newspaper). 5953. https://scholarworks.bgsu.edu/bg-news/5953 This work is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 4.0 License. This Article is brought to you for free and open access by the University Publications at ScholarWorks@BGSU. It has been accepted for inclusion in BG News (Student Newspaper) by an authorized administrator of ScholarWorks@BGSU. Inside the News This Week in Rtttitv City • Bowling Green gets crime lab Where else will you find Nation • Flat tax in hot debate in Congress The Bursar, Vinyl, Barry White and The Best Music Sports • It's gut-check time for hockey team 8 of 1995? WR Friday, January 26, 1996 Bowling Green, Ohio Volume 82, Issue 68 The News' Government is open...for now Final B p i e f s Alan Fram of federal agencies functioning Despite an apparent truce over For the next seven weeks, the The Associated Press tHrough March IS, though at extending the debt limit and stopgap spending measure would lower levels than 1995. The Sen- pressure from Wall Street to do finance many agencies whose exam NHL Scores WASHINGTON - Bruised by ate was expected to approve the so, the two sides fenced over how 1996 budgets are incomplete, in- Hartford 8 two government shutdowns. -

Star Cafe Cherry Hill Park

STAR CAFE CHERRY HILL PARK BREAKFAST SPECIALS FROM THE GRILL PIZZA Star Cafe Breakfast Plate $4.79 Served with potato chips and cole slaw OR cookie Your choice of up to three toppings: pepperoni, sausage, ham, bacon, (2) eggs, cooked to order, choice of bacon, sausage onion, mushrooms, black olives, tomato patty, or ham, and a side of toast (white, wheat, or rye) Hamburger (1/2 lb) $8.69 1/4 lb $4.69 By the Slice $2.99 Pancake Breakfast $4.89 (4) pancakes with bacon or sausage patty Cheeseburger (1/2 lb) $8.99 Whole Pizza (16”) $17.59 1/4 lb $4.99 Ham & Cheese Omelet $4.39 Cheese Steak Sub $8.29 DELI Served with a side of toast Served with potato chips and cole slaw OR cookie. Choice of American, Add peppers and onions $4.95 Grilled Cheese $4.19 Swiss, cheddar, or provolone cheese. White, wheat, rye, sub roll, gluten Sausage Gravy & Biscuits $6.79 Hot Dog (1/4 lb) $4.29 free, or wrap. Add cheese... .60 1/2 Order $3.89 Chili Dog $4.99 Ham or Turkey $5.99 French Toast $4.89 Chili Dog with cheese $5.49 Corned Beef $7.49 with powdered sugar Grilled Chicken Breast Sandwich $7.39 Tuna Salad $6.59 Breakfast Sandwich $3.79 Reuben $8.39 BLT $6.69 (1) egg, choice of bacon, sausage patty, or ham with American, Swiss, Corned beef or turkey on rye, with Swiss & thousand island cheddar, or provolone & served on an English Muffin Turkey Club with bacon $9.69 Served on a bagel $4.79 Quesadilla (beef or chicken) $8.39 Pulled Pork BBQ Sandwich $7.89 Cheese, peppers, and onions. -

"Trendy" Wireless Phones Most Likely to Be Researched Online; Low-Cost Models Most Often Ordered

"Trendy" Wireless Phones Most Likely To Be Researched Online; Low-Cost Models Most Often Ordered Motorola RAZR V3C Tops the List of Most Researched Wireless Phones; Sony Ericsson Z520A Most Frequently Ordered Online, with More than Two-Thirds at No Cost to the Consumer "Trendy" Wireless Phones Most Likely To Be Researched Online; Low-Cost Models Most Often Ordered RESTON, VA. June 12, 2006 - comScore Networks, a leader in the measurement and analysis of consumer behavior and attitudes, today released an analysis of the online research and purchase behavior of consumers in the wireless phone market. comScore revealed that consumers were most likely to research newly released and "trendy" models, with the Motorola RAZR V3C topping the list during the first quarter of 2006. Other models securing spots on the most researched list include the Palm Treo 650, the Palm Treo 700W, and the Motorola Pebl. Top 10 Wireless Phones Researched Online First Quarter 2006 Source: comScore Networks Manufacturer Model Motorola Razr V3C Palm Treo 650 Motorola E815 Palm Treo 700W Motorola Razr V3 Samsung A900 Motorola Pebl Sony Ericsson Z520A Nokia 6101/6102 LG C2000 The Motorola Q is the latest phone to be released, with Verizon Wireless positioned as sole provider of this model for a limited time. As a measure of interest in the model, comScore found that the Motorola Q product page on the Verizon Wireless Web site received slightly more than 100,000 unique visitors in the second half of May, 2006. Price is a Driving Factor When Purchasing a Phone comScore also analyzed trends in ordering cell phones online, among new and existing customers, at major carrier and wireless sites in the first quarter of 2006. -

Comment Letter

July 23, 2008 Subject: Follow-up on July 22 Meeting Dr. Sirri et al.: I thank you for meeting with Ken Salomon, John Welborn and me yesterday afternoon to discuss Reg SHO, naked short selling and the SEC's recent emergency order. As a follow-up, I want to emphasize the following points: 1. OSTK continues to believe that it is critical that the SEC extend the pre-borrow requirement of the emergency order to the entire market, not just the 19 select companies. OSTK requests that the SEC promptly undertake swift rulemaking so that this protection applies fairly across the market. 2. OSTK continues to support the prompt and full elimination of the option market maker exception, an exception that swallows up the good intentions of Reg SHO. During yesterday's meeting, we discussed the relationship between the markets for equities and their corresponding derivatives (including listed options). You stated that options market makers enjoy an exception from the Reg SHO requirement that they locate and/or deliver shares when hedging against options positions. I am not sure that I would read Reg SHO to say that. However, under your theory, if an options market maker sells a put with a 6- month expiration, then that same market maker has the legal right to naked short and fail to deliver an equivalent amount of the underlying equity (leaving the option market maker "delta neutral”) for six months. This exception is unnecessary and open to abuse/manipulation, particularly with the married puts that often occur in Reg SHO threshold securities. -

North American Company Profiles 8X8

North American Company Profiles 8x8 8X8 8x8, Inc. 2445 Mission College Boulevard Santa Clara, California 95054 Telephone: (408) 727-1885 Fax: (408) 980-0432 Web Site: www.8x8.com Email: [email protected] Fabless IC Supplier Regional Headquarters/Representative Locations Europe: 8x8, Inc. • Bucks, England U.K. Telephone: (44) (1628) 402800 • Fax: (44) (1628) 402829 Financial History ($M), Fiscal Year Ends March 31 1992 1993 1994 1995 1996 1997 1998 Sales 36 31 34 20 29 19 50 Net Income 5 (1) (0.3) (6) (3) (14) 4 R&D Expenditures 7 7 7 8 8 11 12 Capital Expenditures — — — — 1 1 1 Employees 114 100 105 110 81 100 100 Ownership: Publicly held. NASDAQ: EGHT. Company Overview and Strategy 8x8, Inc. is a worldwide leader in the development, manufacture and deployment of an advanced Visual Information Architecture (VIA) encompassing A/V compression/decompression silicon, software, subsystems, and consumer appliances for video telephony, videoconferencing, and video multimedia applications. 8x8, Inc. was founded in 1987. The “8x8” refers to the company’s core technology, which is based upon Discrete Cosine Transform (DCT) image compression and decompression. In DCT, 8-pixel by 8-pixel blocks of image data form the fundamental processing unit. 2-1 8x8 North American Company Profiles Management Paul Voois Chairman and Chief Executive Officer Keith Barraclough President and Chief Operating Officer Bryan Martin Vice President, Engineering and Chief Technical Officer Sandra Abbott Vice President, Finance and Chief Financial Officer Chris McNiffe Vice President, Marketing and Sales Chris Peters Vice President, Sales Michael Noonen Vice President, Business Development Samuel Wang Vice President, Process Technology David Harper Vice President, European Operations Brett Byers Vice President, General Counsel and Investor Relations Products and Processes 8x8 has developed a Video Information Architecture (VIA) incorporating programmable integrated circuits (ICs) and compression/decompression algorithms (codecs) for audio/video communications. -

Manara Academy Manara Academy, Inc

Application Coversheet Manara Academy Manara Academy, Inc. Name of Proposed Charter School Name of Sponsoring Entity Note: If the sponsoring entity is a 501(c)(3) nonprofit organization, the name must appear exactly as il appears in the Articles of Incorporation or any amendments thereto. The sponsoring entity is a (Check only one.): ^ 501(c)(3) nonprofit organization I I Governmental Entity I] College or University Chairperson of Governing Body of Sponsoring Entity: Ehap Sabri CEO of Sponsoring Entity: Ehap Sabri CEO/Superintendent of Proposed Charter School:, To be determined Representative Who Attended an Applicant Conference: Jaszeer Mohammed Date of Conference: Dec 3r 2067 ~~ Applicant Mailing Address: 4070 N Beltline Rd. Suite 110-140, Irving TX 75038 Physical Address of Proposed Administrative Offices (if different from above): To be determined Number of Campuses Being Requested : One Physical Address of Each Proposed Campus: To be determined Contact Name: Michelle Alkhatib Contact E-mail Address: [email protected] Contact Phone #: (972)896-321 Contact Fax#: (214)260-4984 Circle Grade Levels to be served and state maximum enrollment for each year: By Year 3, at least one grade in which the state accountability tests are administered must be offered. Yearl: Pre-K.3 Pre-K4 (5)6 7 8 9 10 11 12 Maximum Enrollment:_ 326 Year 2: Pre-K3 Pre-K.4 78 9 10 11 12 Maximum Enrollment:. 400 Year 3: Pre-K3 Pre-K4 8 9 10 11 12 Maximum Enrollment:_ 450 Year 4: Pre-K3 Pre-K4 '3X4*5^6 )f7*$) 9 10 11 12 Maximum Enrollment: 500 Year 5: Pre-K3 Pre-K4 'a^rsy/feKTjfS) 9 10 11 12 Maximum Enrollment: 500 I certify that 1 have the authority to submit this application and that all information contained herein is complete and accurate, realizing that any misrepresentation could result in disqualification from the application process or revocation after award. -

Multidistrict Litigation Terminated Through September 30, 2016 Multidistrict Litigation Terminated Through September 30, 2016

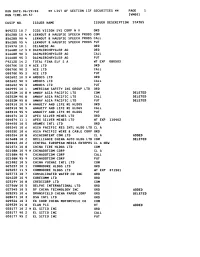

UNITED STATES JUDICIAL PANEL ON MULTIDISTRICT LITIGATION Multidistrict Litigation Terminated Through September 30, 2016 Multidistrict Litigation Terminated Through September 30, 2016 Actions Terminated District MDL MDL Caption Transferee Judge Total Tr'd Total Filed Closed Remanded Year of Court Code No. in Tr'e Court Termination GRAND TOTALS (1,435 Litigations) 99,958 65,073 151,980 13,051 52 in 2016 DISTRICT OF COLUMBIA CIRCUIT 090 DISTRICT OF COLUMBIA (37 Litigations) 50 Ampicillin AT Richey, C.R. 16 45 61 0 1984 54Alsco-Harvard Fraud Oberdorfer, L.F.81901983 105 National Student Marketing Parker, B.D. 7 4 11 0 1983 135 Mutual Fund Sales AT Corcoran, H.F. 43 4 47 0 1975 205Griseofulvin AT Robinson, Jr., A.E.21301978 213Radiation Incident - 4/5/74 CD Hart, Jr., G.L. 16701978 221 Saigon, S. Vietnam AD Oberdorfer, L.F. 32 14 42 4 1986 258Government Employees Insurance Co. SEC Hart, Jr., G.L. 22401978 283Taipei Airport - 7/31/75 AD Bryant, W.M. 41501981 328 Amoxicillin PAT & AT Richey, C.R. 51241984 330 Swine Flu Immunization PL Gesell, G.A. 1,585 20 306 1,299 1988 344General Aircraft Corp./Tort Claims Act AT Green, J.L. 11201979 372 Federal Election Campaign Act Richey, J.L. 17 2 19 0 1979 389Barrow, AK - 10/13/78 AD Robinson, Jr., A.E.31401980 458 Riyadh Airport, Saudi Arabia - 8/19/80 AD Flannery, T.A. 38 8 46 0 1982 499 Washington, DC - 1/13/82 AD Green, J.H. 33 50 83 0 1988 565 Korean Airlines - 9/1/83 AD Robinson, Jr., A.E. -

LIST of SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 Ivmool

RUN DATE:06/29/00 ** LIST OF SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 IVMOOl CUSIP NO. ISSUER NAME ISSUER DESCRIPTION STATUS B49233 10 7 ICOS VISION SYS CORP N V ORD B5628B 10 4 * LERNOUT & HAUSPIE SPEECH PRODS COM B5628B 90 4 LERNOUT & HAUSPIE SPEECH PRODS CALL B5628B 95 4 LERNOUT 8 HAUSPIE SPEECH PRODS PUT D1497A 10 1 CELANESE AG ORD D1668R 12 3 * DAIMLERCHRYSLER AG ORD D1668R 90 3 DAIMLERCHRYSLER AG CALL D1668R 95 3 DAIMLERCHRYSLER AG PUT F9212D 14 2 TOTAL FINA ELF S A WT EXP 080503 G0070K 10 3 * ACE LTD ORD G0070K 90 3 ACE LTD CALL G0070K 95 3 ACE LTD PUT GO2602 10 3 * AMDOCS LTD ORD GO2602 90 3 AMDOCS LTD CALL GO2602 95 3 AMDOCS LTD PUT GO2995 10 1 AMERICAN SAFETY INS GROUP LTD ORD G0352M 10 8 * AMWAY ASIA PACIFIC LTD COM DELETED G0352M 90 8 AMWAY ASIA PACIFIC LTD CALL DELETED G0352M 95 8 AMWAY ASIA PACIFIC LTD PUT DELETED GO3910 10 9 * ANNUITY AND LIFE RE HLDGS ORD GO3910 90 9 ANNUITY AND LIFE RE HLDGS CALL GO3910 95 9 ANNUITY AND LIFE RE HLDGS PUT GO4074 10 3 APEX SILVER MINES LTD ORD GO4074 11 1 APEX SILVER MINES LTD WT EXP 110402 GO4450 10 5 ARAMEX INTL LTD ORD GO5345 10 6 ASIA PACIFIC RES INTL HLDG LTD CL A G0535E 10 6 ASIA PACIFIC WIRE & CABLE CORP ORD GO5354 10 8 ASIACONTENT COM LTD CL A ADDED G1368B 10 2 BRILLIANCE CHINA AUTO HLDG LTD COM DELETED 620045 20 2 CENTRAL EUROPEAN MEDIA ENTRPRS CL A NEW G2107X 10 8 CHINA TIRE HLDGS LTD COM G2108N 10 9 * CHINADOTCOM CORP CL A G2108N 90 9 CHINADOTCOM CORP CALL G2lO8N 95 9 CHINADOTCOM CORP PUT 621082 10 5 CHINA YUCHAI INTL LTD COM 623257 10 1 COMMODORE HLDGS LTD ORD 623257 11 -

European Biotechnology | Summer Edition | Vol

I S S N 2 3 6 4 - 2 351 | A 6 0 711 | Interview Hospira’s Paul Greenland talks European about the launch Life Sciences and of the first mAb Industry Magazine biosimilar and the new challenges in Biotechnology Summer Edition 2015 | Volume 14 | 20 € development. Financing European biotech companies have added crowdinvesting to the fi nancing toolbox Nagoya Protocol Poor implementation of benefi t sharing could block Tracking biotech innovation in Europe Antibiotics New EU fi nancing instrument to close funding gap in high- stealthy risk antibiotic development EuroBioFairsCompass The unique guide to the top life killers sciences events in the second half of 2015 FREE EXCERPT Liquid Biopsy 4 CONTENTS European Biotechnology | Summer Edition | Vol. 14 | 2015 FREE EXCERPT COVER STORY INSIGHT EUROPE REGIONAL NEWS 6 European Commission opens 42 Northern Europe: fl oodgates for GM imports Sweden, Denmark, Finland, and Norway 10 First genome-edited crops to be stamped non-GMO by Member 44 Western Europe: States; Heard in Brussels France, Belgium, The Netherlands and the UK 12 European Commission and Euro- pean Investment Bank set to 46 Central Europe: launch new fi nancing instrument Austria, Germany and Switzerland for high-risk antibiotics develop- ment; Horizon2020 call focuses 48 Southern Europe: on personalised medicine; UK lags Italy, Spain, Portugal, Cyprus & Malta behind EU in fi ght against cancer; MEPs demand no dilution of EU life 50 Eastern Europe: sciences rules through TTIP Poland and the Czech Republic ECONOMY PICK & MIX 22 Interview: Paul -

1 UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 13F FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: September 30, 2000 Check here if Amendment [ ]; Amendment Number: This Amendment (Check only one.): [ ] is a restatement. [ ] adds new holdings entries Institutional Investment Manager Filing this Report: Name: AMERICAN INTERNATIONAL GROUP, INC. Address: 70 Pine Street New York, New York 10270 Form 13F File Number: 28-219 The Institutional Investment Manager filing this report and the person by whom it is signed represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Edward E. Matthews Title: Vice Chairman -- Investments and Financial Services Phone: (212) 770-7000 Signature, Place, and Date of Signing: /s/ Edward E. Matthews New York, New York November 14, 2000 - ------------------------------- ------------------------ ----------------- (Signature) (City, State) (Date) Report Type (Check only one.): [X] 13F HOLDINGS REPORT. (Check if all holdings of this reporting manager are reported in this report.) [ ] 13F NOTICE. (Check if no holdings reported are in this report, and all holdings are reported in this report and a portion are reported by other reporting manager(s).) [ ] 13F COMBINATION REPORT. (Check -

Como Prometió Fidel, En Junio Del 2001, Cuando Dijo: ¡Volverán!, Arribaron Hoy a Nuestra Patria, Gerardo, Ramón Y Antonio.” Raúl

EDITOR: NOEL GONZÁLEZ GOTERA Nueva Serie. Número 166 Diseño: Lic. Roberto Chávez y Liuder Machado. Semana 131214 - 191214 Foto: Lic. Belkis Romeu e Instituto Finlay La Habana, Cuba. “Como prometió Fidel, en junio del 2001, cuando dijo: ¡Volverán!, arribaron hoy a nuestra Patria, Gerardo, Ramón y Antonio.” Raúl “Desde mi elección como Presidente de los Consejos de Estado y de Ministros, he reiterado en múltiples ocasiones, nuestra disposición a sostener con el gobierno de los Estados Unidos un diálogo respetuoso, basado en la igualdad soberana, para tratar los más diversos temas de forma recíproca, sin menoscabo a la independencia nacional y la autodeterminación de nuestro pueblo… Resultado de un diálogo al más alto nivel, que incluyó una conversación telefónica que sostuve ayer con el Presidente Barack Obama, se ha podido avanzar en la solución de algunos temas de interés para ambas naciones... Esta decisión del Presidente Obama, merece el respeto y reconocimiento de nuestro pueblo. … Proponemos al Gobierno de los Estados Unidos adoptar medidas mutuas para mejorar el clima bilateral y avanzar hacia la normalización de los vínculos entre nuestros países, basados en los principios del Derecho Internacional y la Carta de las Naciones Unidas… Cuba reitera su disposición a sostener cooperación en los organismos multilaterales, como la Organización de Naciones Unidas… Los progresos alcanzados en los intercambios sostenidos demuestran que es posible encontrar solución a muchos problemas… Como hemos repetido, debemos aprender el arte de convivir, de forma civilizada, con nuestras diferencias…“ Raúl Castro Ruz, La Habana, 17 de diciembre de 2014. Fragmentos de su alocución. 1 "Indeed, we've seen the benefits of cooperation between our countries before. -

Merrill Lynch Security Risk Evaluation 1-07

Security Risk Evaluation ALPHA January 2007 Price As of December 2006 Month End COPYRIGHT 1998 MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED (MLPF&S). APPROVED FOR PUBLICATION IN THE UNITED KINGDOM BY MERRILL LYNCH, PIERCE, FENNER & SMITH LIMITED, AN AFFILIATED COMPANY AND REGULATED BY THE SECURITIES AND FUTURES AUTHORITY LIMITED. THE INFORMATION HEREIN WAS OBTAINED FROM VARIOUS SOURCES; WE DO NOT GUARANTEE ITS ACCURACY. ADDITIONAL INFORMATION AVAILABLE. GLOBAL SECURITIES RESEARCH & ECONOMICS RESEARCH TECHNOLOGY ALPHA (1) 800 255-9107 CONTINENTAL UNITED STATES January 2007 (1) 212 449-1072 WORLD WIDE PRICE AS OF December 2006 MONTH END Merrill Lynch, Pierce, Fenner & Smith, Inc. Market Sensitivity Statistics 2006/ 12 Resid Number Ticker Close Std --Std Error-- Adjusted Of Symbol Security Name Price Beta Alpha R-Sqr Dev-n Beta Alpha Beta Observ DOWI DOW JONES & CO 30 INDUSTRIALS 12463.150 0.96 0.03 0.91 1.09 0.04 0.14 0.98 60 DJ 20 DOW JONES & CO 20 TRANS ACTUAL 4560.200 0.94 0.65 0.42 3.86 0.14 0.50 0.96 60 DJ 15 DOW JONES & CO 15 UTIL ACTUAL 456.770 0.57 0.60 0.19 4.12 0.15 0.54 0.72 60 DJ 65 DOW JONES & CO 65 STOCK COMPOSITE 4120.960 0.89 0.28 0.86 1.29 0.05 0.17 0.93 60 SPALNS S&P 500 500 STOCKS 1418.300 1.00 0.00 1.00 0.00 0.00 0.00 1.00 60 Based on S&P 500 Index Using Straight Regression Merrill Lynch, Pierce, Fenner & Smith, Inc.