U.S. Technology, Media & Telecom Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

North American Company Profiles 8X8

North American Company Profiles 8x8 8X8 8x8, Inc. 2445 Mission College Boulevard Santa Clara, California 95054 Telephone: (408) 727-1885 Fax: (408) 980-0432 Web Site: www.8x8.com Email: [email protected] Fabless IC Supplier Regional Headquarters/Representative Locations Europe: 8x8, Inc. • Bucks, England U.K. Telephone: (44) (1628) 402800 • Fax: (44) (1628) 402829 Financial History ($M), Fiscal Year Ends March 31 1992 1993 1994 1995 1996 1997 1998 Sales 36 31 34 20 29 19 50 Net Income 5 (1) (0.3) (6) (3) (14) 4 R&D Expenditures 7 7 7 8 8 11 12 Capital Expenditures — — — — 1 1 1 Employees 114 100 105 110 81 100 100 Ownership: Publicly held. NASDAQ: EGHT. Company Overview and Strategy 8x8, Inc. is a worldwide leader in the development, manufacture and deployment of an advanced Visual Information Architecture (VIA) encompassing A/V compression/decompression silicon, software, subsystems, and consumer appliances for video telephony, videoconferencing, and video multimedia applications. 8x8, Inc. was founded in 1987. The “8x8” refers to the company’s core technology, which is based upon Discrete Cosine Transform (DCT) image compression and decompression. In DCT, 8-pixel by 8-pixel blocks of image data form the fundamental processing unit. 2-1 8x8 North American Company Profiles Management Paul Voois Chairman and Chief Executive Officer Keith Barraclough President and Chief Operating Officer Bryan Martin Vice President, Engineering and Chief Technical Officer Sandra Abbott Vice President, Finance and Chief Financial Officer Chris McNiffe Vice President, Marketing and Sales Chris Peters Vice President, Sales Michael Noonen Vice President, Business Development Samuel Wang Vice President, Process Technology David Harper Vice President, European Operations Brett Byers Vice President, General Counsel and Investor Relations Products and Processes 8x8 has developed a Video Information Architecture (VIA) incorporating programmable integrated circuits (ICs) and compression/decompression algorithms (codecs) for audio/video communications. -

List of Section 13F Securities

List of Section 13F Securities 1st Quarter FY 2004 Copyright (c) 2004 American Bankers Association. CUSIP Numbers and descriptions are used with permission by Standard & Poors CUSIP Service Bureau, a division of The McGraw-Hill Companies, Inc. All rights reserved. No redistribution without permission from Standard & Poors CUSIP Service Bureau. Standard & Poors CUSIP Service Bureau does not guarantee the accuracy or completeness of the CUSIP Numbers and standard descriptions included herein and neither the American Bankers Association nor Standard & Poor's CUSIP Service Bureau shall be responsible for any errors, omissions or damages arising out of the use of such information. U.S. Securities and Exchange Commission OFFICIAL LIST OF SECTION 13(f) SECURITIES USER INFORMATION SHEET General This list of “Section 13(f) securities” as defined by Rule 13f-1(c) [17 CFR 240.13f-1(c)] is made available to the public pursuant to Section13 (f) (3) of the Securities Exchange Act of 1934 [15 USC 78m(f) (3)]. It is made available for use in the preparation of reports filed with the Securities and Exhange Commission pursuant to Rule 13f-1 [17 CFR 240.13f-1] under Section 13(f) of the Securities Exchange Act of 1934. An updated list is published on a quarterly basis. This list is current as of March 15, 2004, and may be relied on by institutional investment managers filing Form 13F reports for the calendar quarter ending March 31, 2004. Institutional investment managers should report holdings--number of shares and fair market value--as of the last day of the calendar quarter as required by Section 13(f)(1) and Rule 13f-1 thereunder. -

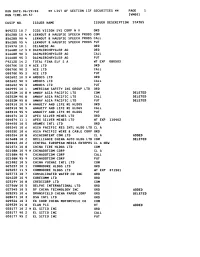

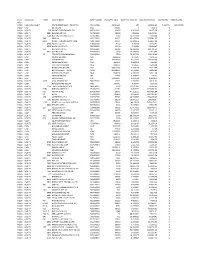

LIST of SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 Ivmool

RUN DATE:06/29/00 ** LIST OF SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 IVMOOl CUSIP NO. ISSUER NAME ISSUER DESCRIPTION STATUS B49233 10 7 ICOS VISION SYS CORP N V ORD B5628B 10 4 * LERNOUT & HAUSPIE SPEECH PRODS COM B5628B 90 4 LERNOUT & HAUSPIE SPEECH PRODS CALL B5628B 95 4 LERNOUT 8 HAUSPIE SPEECH PRODS PUT D1497A 10 1 CELANESE AG ORD D1668R 12 3 * DAIMLERCHRYSLER AG ORD D1668R 90 3 DAIMLERCHRYSLER AG CALL D1668R 95 3 DAIMLERCHRYSLER AG PUT F9212D 14 2 TOTAL FINA ELF S A WT EXP 080503 G0070K 10 3 * ACE LTD ORD G0070K 90 3 ACE LTD CALL G0070K 95 3 ACE LTD PUT GO2602 10 3 * AMDOCS LTD ORD GO2602 90 3 AMDOCS LTD CALL GO2602 95 3 AMDOCS LTD PUT GO2995 10 1 AMERICAN SAFETY INS GROUP LTD ORD G0352M 10 8 * AMWAY ASIA PACIFIC LTD COM DELETED G0352M 90 8 AMWAY ASIA PACIFIC LTD CALL DELETED G0352M 95 8 AMWAY ASIA PACIFIC LTD PUT DELETED GO3910 10 9 * ANNUITY AND LIFE RE HLDGS ORD GO3910 90 9 ANNUITY AND LIFE RE HLDGS CALL GO3910 95 9 ANNUITY AND LIFE RE HLDGS PUT GO4074 10 3 APEX SILVER MINES LTD ORD GO4074 11 1 APEX SILVER MINES LTD WT EXP 110402 GO4450 10 5 ARAMEX INTL LTD ORD GO5345 10 6 ASIA PACIFIC RES INTL HLDG LTD CL A G0535E 10 6 ASIA PACIFIC WIRE & CABLE CORP ORD GO5354 10 8 ASIACONTENT COM LTD CL A ADDED G1368B 10 2 BRILLIANCE CHINA AUTO HLDG LTD COM DELETED 620045 20 2 CENTRAL EUROPEAN MEDIA ENTRPRS CL A NEW G2107X 10 8 CHINA TIRE HLDGS LTD COM G2108N 10 9 * CHINADOTCOM CORP CL A G2108N 90 9 CHINADOTCOM CORP CALL G2lO8N 95 9 CHINADOTCOM CORP PUT 621082 10 5 CHINA YUCHAI INTL LTD COM 623257 10 1 COMMODORE HLDGS LTD ORD 623257 11 -

1 UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 13F FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: September 30, 2000 Check here if Amendment [ ]; Amendment Number: This Amendment (Check only one.): [ ] is a restatement. [ ] adds new holdings entries Institutional Investment Manager Filing this Report: Name: AMERICAN INTERNATIONAL GROUP, INC. Address: 70 Pine Street New York, New York 10270 Form 13F File Number: 28-219 The Institutional Investment Manager filing this report and the person by whom it is signed represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Edward E. Matthews Title: Vice Chairman -- Investments and Financial Services Phone: (212) 770-7000 Signature, Place, and Date of Signing: /s/ Edward E. Matthews New York, New York November 14, 2000 - ------------------------------- ------------------------ ----------------- (Signature) (City, State) (Date) Report Type (Check only one.): [X] 13F HOLDINGS REPORT. (Check if all holdings of this reporting manager are reported in this report.) [ ] 13F NOTICE. (Check if no holdings reported are in this report, and all holdings are reported in this report and a portion are reported by other reporting manager(s).) [ ] 13F COMBINATION REPORT. (Check -

Manufacturers Codes for H.32X Terminals July 9, 2020 US Manufacturer (Country Code 0Xb5) Contact First Byte Second Byte Compress

Manufacturers Codes For H.32X Terminals July 9, 2020 US Manufacturer Contact First Second (Country Code 0xB5) Byte Byte Compression Labs Dan Klenke ?? 0x00 0x00 408-435-3000 PictureTel Dave Lindbergh 0x00 0x01 (Polycom) 978-292-5366 Compression Labs Dan Klenke ?? 0x00 0x02 (possibly not used) 408-435-3000 VTEL Dave Hein??? 0x00 0x03 512-314-2742 ERIS 0x00 0x05 AT&T Worldworx Tom Chu 0x00 0x07 908-957-5646 VideoServer Rubin Gruber ?? 0x00 0x09 63 Third Avenue George Kajos ?? Burlington, MA. 01803 781-229-2000 781-505-2101 Fax 3Com Corporation Choon Lee 0x00 0x0B 5400 Bayfront Plaza, 408-326-5000 Santa Clara, CA 95052 408-326-5002 Fax Clarent Corporation Jean-François Mulé 0x00 0x0C 700 Chesapeake Drive 650-481-2835 Redwood City, CA 94114 650-867-1271 Fax Genesys Telecommunications John Boyle 0x00 0x0D Labs Inc, 415-551-2801 1155 Market Street 415-437-1260 Fax San Francisco, CA 94103 C-Phone Corporation. Mark White 0x00 0x0E 6714 Netherlands Drive 910-395-6100 Wilmington, NC 28405 910-395-6108 Fax Science Dynamics Corporation Martin Knodle 0x00 0x0F 1919 Springdale Road 856-424-0068 Cherry Hill, NY 08003 856-751-7361 Fax AT&T Starpoint Martin Carroll 0x00 0x10 908-582-5979 Netscape Conference Douglas Mosher 0x00 0x11 501 East Middlefield Road 415-937-4367 Mountain View, CA 94043 415-528-4122 Fax US Manufacturer Contact First Second (Country Code 0xB5) Byte Byte Cisco Systems Irene Kuffel 0x00 0x12 Mail Stop SJ-F2 408-527-7627 170West Tasman Drive 408-526-4952 Fax San Jose, CA 95134-1706 Cirilium, Inc. -

The Wainhouse Research Bulletin

The Wainhouse Research Bulletin ONLINE NEWS AND VIEWS ON VISUAL COLLABORATION AND RICH MEDIA Please feel free to forward this newsletter to your colleagues. To be added to our automated email distribution list, simply visit http://www.wainhouse.com/bulletin. SUBSCRIBE NOW! IT’S FREE! Andrew W. Davis, [email protected]. Welcome to 2001 and Volume 2 pay a purchase price of $7 million in cash and 1 million Genesis shares, which are trading for about Happy New Year Everyone. This is issue #1 of $42.50/share as this newsletter is being written – so volume 2 of the Wainhouse Research Bulletin! The the purchase price is about $50 million. team here is looking forward to reporting to you all While PlaceWare, Evoke, and WebEx are more well the multimedia conferencing and collaboration news known in the web conferencing arena, Astound has and views in the coming year. Since we began our been quietly building a solid product/service in the newsletter on July 24, 2000, we’ve published 23 market, and has closed several service provider issues and we’re very pleased with the feedback accounts, including Vialog and Genesys. Several we’ve been getting and with the rising tide of months ago, when Genesys selected Astound it also subscribers. Please encourage your colleagues to invested about $5 million in the Canadian company. sign up for their own subscriptions. Despite the message in the header above, we are averaging about Here’s What I Think two phone calls per week asking us how much the subscription costs (it’s free!) and three emails a This acquisition positions Genesys well to provide a week asking us how to sign up (go to comprehensive range of audio, video, and web wainhouse.com). -

RADVISION LTD. (Exact Name of Registrant As Specified in Its Charter and Translation of Registrant’S Name Into English)

SECURITIES AND EXCHANGE COMMISSION Washington D.C. 20549 FORM 20-F o REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ⌧ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________ to __________ o SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report __________ Commission file number 0-29871 RADVISION LTD. (Exact Name of Registrant as specified in its charter and translation of Registrant’s name into English) Israel (Jurisdiction of incorporation or organization) 24 Raoul Wallenberg Street, Tel Aviv 69719, Israel (Address of principal executive offices) Rael Kolevsohn, +972-3-7679394 (phone), +972-3-7679382 (fax) 24 Raoul Wallenberg Street, Tel Aviv 69719, Israel (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Ordinary Shares, NIS 0.1 Par Value NASDAQ Global Select Market Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: Ordinary Shares, par value NIS 0.1 per share……………18,435,699 (as of December 31, 2011) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Schedule of Investments Jan 12

THE PENSION BOARDS - UNITED CHURCH OF CHRIST, INC. SCHEDULE OF INVESTMENTS January 31, 2012 Unaudited for information purposes only. SUMMARY OF INVESTMENTS COST VALUE STABLE VALUE INVESTMENTS Short-Term Investments $ 88,112,256 $ 88,112,256 Fixed Maturity Synthetic Guaranteed Investment Contracts 3,503,106 3,503,106 Constant Duration Synthetic Guaranteed Investment Contracts 120,285,465 120,285,465 TOTAL STABLE VALUE INVESTMENTS $ 211,900,827 $ 211,900,827 SHORT-TERM INVESTMENTS Short-term Investments $ 223,660,531 $ 223,660,531 TOTAL SHORT-TERM INVESTMENTS$ 223,660,531 $ 223,660,531 FIXED-INCOME INVESTMENTS Bonds $ 918,816,120 $ 1,022,402,808 Emerging markets local currency debt fund 30,175,097 31,850,967 Mortgage-backed Securities 26,901,839 22,546,874 TOTAL FIXED-INCOME INVESTMENTS $ 975,893,056 $ 1,076,800,649 EQUITY INVESTMENTS Common stocks and equivalents $ 961,095,924 $ 1,062,836,088 Equity mutual funds 260,493,963 267,843,606 TOTAL EQUITY INVESTMENTS $ 1,221,589,887 $ 1,330,679,694 OTHER INVESTMENTS Participation in the United Church Funds, Inc. $ 35,868,173 $ 39,375,254 Hedge funds 31,855,949 34,363,159 Private equity 6,091,353 5,921,636 TOTAL OTHER INVESTMENTS $ 73,815,474 $ 79,660,049 TOTAL INVESTMENTS $ 2,706,859,775 $ 2,922,701,750 PRINCIPAL INTEREST DESCRIPTION SERIES MATURITY COST VALUE AMOUNT RATE % STABLE VALUE INVESTMENTS SHORT-TERM INVESTMENTS MFB NI Treasury Money Market Fund $ 88,112,256 $ 88,112,256 TOTAL SHORT-TERM INVESTMENT $ 88,112,256 $ 88,112,256 FIXED MATURITY SYNTHETIC GUARANTEED INVESTMENT CONTRACTS: Asset-Backed -

The Secret Sauce of Convergence LAN New Software Helps the Internet Find Its Voice

December 14, 1998 J.P. Morgan Securities Inc. San Francisco Equity Research William D. Rabin (1-415) 954-9283 [email protected] Data Networking WAN The Secret Sauce of Convergence LAN New Software Helps the Internet Find Its Voice “We have reached an amazing moment: fundamental advances in microprocessors, photonics, storage and wireless technologies, together with the digitization of just about everything from photography to radio and television, combined with the universal adoption of 1 Buy Web technology, are ushering in a golden age of networking.” Not So Fast! CSCO ASND Before we join hands to usher in this “golden age of networking” when all media (including telephone, data, television, radio, photography, fax, etc.) converge into a single integrated COMS network, there are some technical issues to be resolved. Specifically, an overall architecture LU for the integration of voice and data networks must be created and new software products and control protocols must be developed and perfected. Long-Term Buy Such new products are currently being engineered by Bellcore and Cisco for Sprint’s new Integrated On-Demand Network (ION) in the traditional telephone market and for Canada’s NN Videotron in the cable TV market. While other vendors are also developing advanced products to NT facilitate the convergence of voice and data, we focus mostly on the Bellcore/Cisco approach as they appear to be leading the race at this point. The objectives of this report are to explain how convergence will really happen and to help investors understand: • how data networks and voice networks will integrate technically and how advanced Technology – Data Networking Equity Research: telephony features (such as call waiting, caller ID, call forwarding, 800 numbers, etc.) will operate over data networks William D. -

Company Vendor ID (Decimal Format) (AVL) Ditest Fahrzeugdiagnose Gmbh 4621 @Pos.Com 3765 0XF8 Limited 10737 1MORE INC

Vendor ID Company (Decimal Format) (AVL) DiTEST Fahrzeugdiagnose GmbH 4621 @pos.com 3765 0XF8 Limited 10737 1MORE INC. 12048 360fly, Inc. 11161 3C TEK CORP. 9397 3D Imaging & Simulations Corp. (3DISC) 11190 3D Systems Corporation 10632 3DRUDDER 11770 3eYamaichi Electronics Co., Ltd. 8709 3M Cogent, Inc. 7717 3M Scott 8463 3T B.V. 11721 4iiii Innovations Inc. 10009 4Links Limited 10728 4MOD Technology 10244 64seconds, Inc. 12215 77 Elektronika Kft. 11175 89 North, Inc. 12070 Shenzhen 8Bitdo Tech Co., Ltd. 11720 90meter Solutions, Inc. 12086 A‐FOUR TECH CO., LTD. 2522 A‐One Co., Ltd. 10116 A‐Tec Subsystem, Inc. 2164 A‐VEKT K.K. 11459 A. Eberle GmbH & Co. KG 6910 a.tron3d GmbH 9965 A&T Corporation 11849 Aaronia AG 12146 abatec group AG 10371 ABB India Limited 11250 ABILITY ENTERPRISE CO., LTD. 5145 Abionic SA 12412 AbleNet Inc. 8262 Ableton AG 10626 ABOV Semiconductor Co., Ltd. 6697 Absolute USA 10972 AcBel Polytech Inc. 12335 Access Network Technology Limited 10568 ACCUCOMM, INC. 10219 Accumetrics Associates, Inc. 10392 Accusys, Inc. 5055 Ace Karaoke Corp. 8799 ACELLA 8758 Acer, Inc. 1282 Aces Electronics Co., Ltd. 7347 Aclima Inc. 10273 ACON, Advanced‐Connectek, Inc. 1314 Acoustic Arc Technology Holding Limited 12353 ACR Braendli & Voegeli AG 11152 Acromag Inc. 9855 Acroname Inc. 9471 Action Industries (M) SDN BHD 11715 Action Star Technology Co., Ltd. 2101 Actions Microelectronics Co., Ltd. 7649 Actions Semiconductor Co., Ltd. 4310 Active Mind Technology 10505 Qorvo, Inc 11744 Activision 5168 Acute Technology Inc. 10876 Adam Tech 5437 Adapt‐IP Company 10990 Adaptertek Technology Co., Ltd. 11329 ADATA Technology Co., Ltd. -

Fund Asset Class Ticker Security Name CUSIP Number Shares/Par

Fund Asset Class Ticker Security Name CUSIP Number Shares/Par Value Base Price Amount Base Market Value Interest Rate Maturity Date NQ11 ' NQ20 CASH EQUIVALENT STATE STREET BANK + TRUST CO '8611239B5 459562.42 100 459562.42 0.155781 12/31/2030 NQ20 CASH US DOLLAR 'USD -3168.1 1 -3168.1 0 NQ2A EQUITY 316 ORIENT OVERSEAS INTL LTD '665911905 10000 4.847328 48473.28 0 NQ2A EQUITY 9997 BELLUNA CO LTD '607035904 19000 7.883193 149780.67 0 NQ2A EQUITY 7518 NET ONE SYSTEMS CO LTD '603654906 3600 13.247274 47690.19 0 NQ2A EQUITY EAD EADS NV '401225909 63129 35.457258 2238381.23 0 NQ2A EQUITY IFS B_ INDUST + FINANCIAL SYSTEM B '508170909 10371 15.682951 162647.88 0 NQ2A EQUITY 6406 FUJITEC CO LTD '635682008 4000 6.35418 25416.72 0 NQ2A EQUITY 8056 NIHON UNISYS LTD '664268000 35100 7.30668 256464.47 0 NQ2A EQUITY BLT BHP BILLITON PLC '005665906 32542 28.326213 921791.61 0 NQ2A EQUITY 7631 MACNICA INC '620789909 1100 22.358692 24594.56 0 NQ2A EQUITY TD TORONTO DOMINION BANK '891160954 7500 78.159792 586198.44 0 NQ2A CASH POUND STERLING 'GBP 28911.69 1.56845 45346.55 0 NQ2A CASH JAPANESE YEN 'JPY 35926970 0.012533 450269.08 0 NQ2A CASH CANADIAN DOLLAR 'CAD 5601.52 0.980921 5494.65 0 NQ2A CASH AUSTRALIAN DOLLAR 'AUD 73410.53 1.02505 75249.48 0 NQ2A CASH HONG KONG DOLLAR 'HKD 308101.62 0.128918 39719.94 0 NQ2A CASH MEXICAN PESO (NEW) 'MXN 803148.56 0.074483 59820.84 0 NQ2A CASH NORWEGIAN KRONE 'NOK 240817.9 0.168224 40511.38 0 NQ2A CASH SWEDISH KRONA 'SEK 725.52 0.144877 105.11 0 NQ2A CASH SWISS FRANC 'CHF 122129.07 1.056524 129032.3 0 NQ2A EQUITY AGFB AGFA GEVAERT NV '568905905 29401 1.637075 48131.63 0 NQ2A CASH NEW ZEALAND DOLLAR 'NZD 7307.71 0.80375 5873.57 0 NQ2A EQUITY 7729 TOKYO SEIMITSU CO LTD '689430007 3500 17.646322 61762.13 0 NQ2A EQUITY HSBA HSBC HOLDINGS PLC '054052907 131069 8.800575 1153482.52 0 NQ2A EQUITY RIO RIO TINTO PLC '071887004 39671 47.351515 1878481.94 0 NQ2A EQUITY BP. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 13F Form 13F COVER PAGE Report for the Calendar Year or Quarter Ended: December 31, 2002 Check here if Amendment [ ]; Amendment Number: This Amendment (Check only one.): [ ] is a restatement. [ ] adds new holdings entries. Institutional Investment Manager Filing this Report: Name: Putnam Investment Management, LLC Address: One Post Office Square Boston, MA 02109 Form 13F File Number: 28 - 90 The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete , and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Andrew J. Hachey Title: Vice President Phone: (617) 760-8235 Signature, Place and Date of Signing: /s/ Andrew J. Hachey Boston, MA__________________ _2/15/2003 [Signature] [City, State] [Date] Report Type (Check only one.): [ X ] 13F HOLDINGS REPORT. (Check here if all holdings of this reporting manager are reported in this report.) [ ] 13F NOTICE. (Check here if no holdings reported are in this report, and all holdings are reported by other reporting manager (s).) [ ] 13F COMBINATION REPORT. (Check here if a portion of the holdings for this reporting manager are reported in this report and a portion are reported by other reporting manager (s).) FORM 13F SUMMARY PAGE Report Summary: Number of Other Included Managers: 3 Form 13F Information Table Entry Total: 4,012 Form 13F Information Table Value Total: $ 124,441,614 (thousands) List of Other Included Managers: Provide a numbered list of the name(s) and Form 13F file number(s) of all institutional investment managers with respect to which this report is filed, other than the manager filing this report.