The Secret Sauce of Convergence LAN New Software Helps the Internet Find Its Voice

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Section 13F Securities

List of Section 13F Securities 1st Quarter FY 2004 Copyright (c) 2004 American Bankers Association. CUSIP Numbers and descriptions are used with permission by Standard & Poors CUSIP Service Bureau, a division of The McGraw-Hill Companies, Inc. All rights reserved. No redistribution without permission from Standard & Poors CUSIP Service Bureau. Standard & Poors CUSIP Service Bureau does not guarantee the accuracy or completeness of the CUSIP Numbers and standard descriptions included herein and neither the American Bankers Association nor Standard & Poor's CUSIP Service Bureau shall be responsible for any errors, omissions or damages arising out of the use of such information. U.S. Securities and Exchange Commission OFFICIAL LIST OF SECTION 13(f) SECURITIES USER INFORMATION SHEET General This list of “Section 13(f) securities” as defined by Rule 13f-1(c) [17 CFR 240.13f-1(c)] is made available to the public pursuant to Section13 (f) (3) of the Securities Exchange Act of 1934 [15 USC 78m(f) (3)]. It is made available for use in the preparation of reports filed with the Securities and Exhange Commission pursuant to Rule 13f-1 [17 CFR 240.13f-1] under Section 13(f) of the Securities Exchange Act of 1934. An updated list is published on a quarterly basis. This list is current as of March 15, 2004, and may be relied on by institutional investment managers filing Form 13F reports for the calendar quarter ending March 31, 2004. Institutional investment managers should report holdings--number of shares and fair market value--as of the last day of the calendar quarter as required by Section 13(f)(1) and Rule 13f-1 thereunder. -

Manufacturers Codes for H.32X Terminals July 9, 2020 US Manufacturer (Country Code 0Xb5) Contact First Byte Second Byte Compress

Manufacturers Codes For H.32X Terminals July 9, 2020 US Manufacturer Contact First Second (Country Code 0xB5) Byte Byte Compression Labs Dan Klenke ?? 0x00 0x00 408-435-3000 PictureTel Dave Lindbergh 0x00 0x01 (Polycom) 978-292-5366 Compression Labs Dan Klenke ?? 0x00 0x02 (possibly not used) 408-435-3000 VTEL Dave Hein??? 0x00 0x03 512-314-2742 ERIS 0x00 0x05 AT&T Worldworx Tom Chu 0x00 0x07 908-957-5646 VideoServer Rubin Gruber ?? 0x00 0x09 63 Third Avenue George Kajos ?? Burlington, MA. 01803 781-229-2000 781-505-2101 Fax 3Com Corporation Choon Lee 0x00 0x0B 5400 Bayfront Plaza, 408-326-5000 Santa Clara, CA 95052 408-326-5002 Fax Clarent Corporation Jean-François Mulé 0x00 0x0C 700 Chesapeake Drive 650-481-2835 Redwood City, CA 94114 650-867-1271 Fax Genesys Telecommunications John Boyle 0x00 0x0D Labs Inc, 415-551-2801 1155 Market Street 415-437-1260 Fax San Francisco, CA 94103 C-Phone Corporation. Mark White 0x00 0x0E 6714 Netherlands Drive 910-395-6100 Wilmington, NC 28405 910-395-6108 Fax Science Dynamics Corporation Martin Knodle 0x00 0x0F 1919 Springdale Road 856-424-0068 Cherry Hill, NY 08003 856-751-7361 Fax AT&T Starpoint Martin Carroll 0x00 0x10 908-582-5979 Netscape Conference Douglas Mosher 0x00 0x11 501 East Middlefield Road 415-937-4367 Mountain View, CA 94043 415-528-4122 Fax US Manufacturer Contact First Second (Country Code 0xB5) Byte Byte Cisco Systems Irene Kuffel 0x00 0x12 Mail Stop SJ-F2 408-527-7627 170West Tasman Drive 408-526-4952 Fax San Jose, CA 95134-1706 Cirilium, Inc. -

The Wainhouse Research Bulletin

The Wainhouse Research Bulletin ONLINE NEWS AND VIEWS ON VISUAL COLLABORATION AND RICH MEDIA Please feel free to forward this newsletter to your colleagues. To be added to our automated email distribution list, simply visit http://www.wainhouse.com/bulletin. SUBSCRIBE NOW! IT’S FREE! Andrew W. Davis, [email protected]. Welcome to 2001 and Volume 2 pay a purchase price of $7 million in cash and 1 million Genesis shares, which are trading for about Happy New Year Everyone. This is issue #1 of $42.50/share as this newsletter is being written – so volume 2 of the Wainhouse Research Bulletin! The the purchase price is about $50 million. team here is looking forward to reporting to you all While PlaceWare, Evoke, and WebEx are more well the multimedia conferencing and collaboration news known in the web conferencing arena, Astound has and views in the coming year. Since we began our been quietly building a solid product/service in the newsletter on July 24, 2000, we’ve published 23 market, and has closed several service provider issues and we’re very pleased with the feedback accounts, including Vialog and Genesys. Several we’ve been getting and with the rising tide of months ago, when Genesys selected Astound it also subscribers. Please encourage your colleagues to invested about $5 million in the Canadian company. sign up for their own subscriptions. Despite the message in the header above, we are averaging about Here’s What I Think two phone calls per week asking us how much the subscription costs (it’s free!) and three emails a This acquisition positions Genesys well to provide a week asking us how to sign up (go to comprehensive range of audio, video, and web wainhouse.com). -

RADVISION LTD. (Exact Name of Registrant As Specified in Its Charter and Translation of Registrant’S Name Into English)

SECURITIES AND EXCHANGE COMMISSION Washington D.C. 20549 FORM 20-F o REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ⌧ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________ to __________ o SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report __________ Commission file number 0-29871 RADVISION LTD. (Exact Name of Registrant as specified in its charter and translation of Registrant’s name into English) Israel (Jurisdiction of incorporation or organization) 24 Raoul Wallenberg Street, Tel Aviv 69719, Israel (Address of principal executive offices) Rael Kolevsohn, +972-3-7679394 (phone), +972-3-7679382 (fax) 24 Raoul Wallenberg Street, Tel Aviv 69719, Israel (Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Ordinary Shares, NIS 0.1 Par Value NASDAQ Global Select Market Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: Ordinary Shares, par value NIS 0.1 per share……………18,435,699 (as of December 31, 2011) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

U.S. Technology, Media & Telecom Industry

Technology, Media & Telecom Industry Update May 2012 Member FINRA/SIPC www.harriswilliams.com Table of Contents Technology, Media & Telecom What We've Been Reading…………………………………………………………………………………………1 Bellwethers……………………………………………………………………………………………2 TMT Public Market Trading Statistics………………………………………………………………………..…………………..3 Recent TMT M&A Activity…………………………………………………………………………………………….4 Recent U.S. TMT Initial Public Offerings………………………………………………………………………….………………...………..5 Public and M&A Market Overview by Sector Data and Information Services………………………………………………………………..…………..6 Financial Technology…………………………………………………………………………8 Internet & Digital Media……………………………………………………..…………………..10 IT and Tech-Enabled Services………………………………………………………………..13 Software – Application…………………………………………………….…………………..15 Software – Infrastructure……………………………………………………..…………………..18 Software – SaaS……………………………………………………………………………………………………..20 Tech Hardware……………………………………………………………………..…………………..22 Telecom………………………………………………………………………………………………..25 Selected HW&Co. TMT Transactions…………………………………………………………………………………………..28 TMT Group Overview and Disclosures…………………………………………………………………………………………..29 Note: All market data in the following materials is as of April 30, 2012. What We’ve Been Reading How The Bush Tax Cuts Could Lead To A Crazy Year For M&A Business Insider 4/30/2012 An increased amount of M&A activity is expected in the remainder of 2012 as potential changes in the capital gains tax policies are motivating firms to exit investments before the end of the year when the Bush Tax Cuts expire. -

Schedule of Investments Jan 12

THE PENSION BOARDS - UNITED CHURCH OF CHRIST, INC. SCHEDULE OF INVESTMENTS January 31, 2012 Unaudited for information purposes only. SUMMARY OF INVESTMENTS COST VALUE STABLE VALUE INVESTMENTS Short-Term Investments $ 88,112,256 $ 88,112,256 Fixed Maturity Synthetic Guaranteed Investment Contracts 3,503,106 3,503,106 Constant Duration Synthetic Guaranteed Investment Contracts 120,285,465 120,285,465 TOTAL STABLE VALUE INVESTMENTS $ 211,900,827 $ 211,900,827 SHORT-TERM INVESTMENTS Short-term Investments $ 223,660,531 $ 223,660,531 TOTAL SHORT-TERM INVESTMENTS$ 223,660,531 $ 223,660,531 FIXED-INCOME INVESTMENTS Bonds $ 918,816,120 $ 1,022,402,808 Emerging markets local currency debt fund 30,175,097 31,850,967 Mortgage-backed Securities 26,901,839 22,546,874 TOTAL FIXED-INCOME INVESTMENTS $ 975,893,056 $ 1,076,800,649 EQUITY INVESTMENTS Common stocks and equivalents $ 961,095,924 $ 1,062,836,088 Equity mutual funds 260,493,963 267,843,606 TOTAL EQUITY INVESTMENTS $ 1,221,589,887 $ 1,330,679,694 OTHER INVESTMENTS Participation in the United Church Funds, Inc. $ 35,868,173 $ 39,375,254 Hedge funds 31,855,949 34,363,159 Private equity 6,091,353 5,921,636 TOTAL OTHER INVESTMENTS $ 73,815,474 $ 79,660,049 TOTAL INVESTMENTS $ 2,706,859,775 $ 2,922,701,750 PRINCIPAL INTEREST DESCRIPTION SERIES MATURITY COST VALUE AMOUNT RATE % STABLE VALUE INVESTMENTS SHORT-TERM INVESTMENTS MFB NI Treasury Money Market Fund $ 88,112,256 $ 88,112,256 TOTAL SHORT-TERM INVESTMENT $ 88,112,256 $ 88,112,256 FIXED MATURITY SYNTHETIC GUARANTEED INVESTMENT CONTRACTS: Asset-Backed -

Novmagazine:Layout 1.Qxd

O’Dwyer’s Profiles of High-tech & Industrial PR firms agency that can help you tell in business-to-business and busi- cessfully crafted our clients’ cam- your story to stakeholders in a ness-to-consumer public relations paigns within a variety of industries manner that increases your for a full range of companies in var- including: software, hardware, mindshare, your market share ious industries. Our research-driven electronics, toys, entertainment, and your bottom line. For the programs help to create awareness, defense, R&D and green technolo- past 18 years, we have helped credibility and reputation by com- gy for business, government and startups create and lead cate- municating with the audiences that consumer markets. gories, guided clients through matter most: media, analysts, com- Antarra’s approach embraces IPOs, transformed executives munities, customers and employ- both traditional and new media into thought leaders, and ees. Airfoil is adept at using public strategies to creatively and effec- helped clients build billions of relations to help create awareness tively deliver our clients’ message dollars of brand equity. Our and understanding of complex to generate “real business out- agency portfolio includes busi- products and processes. Airfoil is comes.” ness technology, consumer time and budget-sensitive and takes technology, network infra- a “higher thinking” approach to structure, telecommunications, strategic communications. ANTENNA GROUP solar energy, consumer prod- Recently, Airfoil was named ucts and entertainment compa- Technology Agency of The Year by 135 Main St., Ste. 800 nies. Contact Susan Butenhoff, The Holmes Report. San Francisco, CA 94105 Sandra Fathi, President our founder, CEO and presi- Airfoil now represents some 415/896-1800 of Affect Strategies. -

International Registered and Reporting Companies

FOREIGN COMPANIES REGISTERED AND REPORTING WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION December 31, 2006 Geographic Listing by Country of Incorporation COMPANY COUNTRY MARKET Antigua Sinovac Biotech Ltd. Antigua AMEX Argentina Alto Palermo S.A. Argentina GLOBAL MKT Banco Macro S.A. Argentina NYSE BBVA Banco Frances S.A. Argentina NYSE Cresud Sacif Argentina GLOBAL MKT Grupo Financiero Galicia S.A. Argentina GLOBAL MKT IRSA Inversiones y Representacions, S.A. Argentina NYSE Mastellone Hermanos S.A. Argentina OTC - Debt MetroGas S.A. Argentina NYSE Nortel Inversora S.A. Argentina NYSE Petrobras Energia Participaciones S.A. Argentina NYSE Telecom Argentina S.A. Argentina NYSE Telefonica de Argentina S.A. Argentina NYSE Telefonica Holding of Argentina, Inc. Argentina OTC - Debt Transportadora de Gas del Sur S.A. Argentina NYSE YPF S.A. Argentina NYSE Australia Alumina Ltd. Australia NYSE Amcor Ltd. Australia GLOBAL MKT Ansell Ltd. Australia OTC Atlas South Sea Pearl Ltd. Australia CAP MKT Australia & New Zealand Banking Group Ltd. Australia NYSE BHP Billiton Ltd. Australia NYSE Chemgenex Pharmaceuticals Ltd. Australia GLOBAL MKT CityView Corp Ltd. Australia OTC Coles Group Ltd. Australia OTC Commonwealth Bank of Australia Australia OTC Genetic Technologies Ltd. Australia GLOBAL MKT Metal Storm Ltd. Australia CAP MKT National Australia Bank Ltd. Australia NYSE Novogen Ltd. Australia GLOBAL MKT Orbital Corp Ltd. Australia OTC Petsec Energy Ltd. Australia OTC Pharmaxis Ltd. Australia GLOBAL MKT Prana Biotechnology Ltd. Australia CAP MKT Progen Industries Ltd. Australia CAP MKT pSivida Ltd. Australia GLOBAL MKT Rinker Group Ltd. Australia NYSE Rio Tinto Ltd. Australia OTC Page 1 COMPANY COUNTRY MARKET Telstra Corp Ltd. -

Unified Communications

Unified Communications: Convergence of Platforms and Strategies of Two Software Vendors By Muhammad Zia Hydari Submitted to the System Design and Management Program in Partial Fulfillment of the Requirements for the Degree of Master of Science in Engineering and Management at the Massachusetts Institute of Technology May 2008 © 2008 Muhammad Zia Hydari All rights reserved The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part. Signature of Author______________________________________________________________ Muhammad Zia Hydari System Design and Management Program May 2008 Certified by____________________________________________________________________ Professor Erik Brynjolfsson Schussel Professor of Management Director, MIT Center for Digital Business Thesis Advisor Accepted by___________________________________________________________________ Mr. Patrick Hale Director System Design and Management Program 1 This page intentionally left blank 2 Unified Communications: Convergence of Platforms and Strategies of Two Software Vendors by Muhammad Zia Hydari ABSTRACT Unified communication (UC) is the convergence of various modes of communication - voice telephony, email, instant messaging (IM), video conferencing and so on - used by enterprise workers. Academic literature exists that discusses digital convergence in various domains. Although UC has received considerable attention in the business press, we are not aware of any academic study within the domain of UC that explains the convergence of platforms and its links to the technology strategy of UC firms. This thesis presents an academic analysis of some platforms underlying UC and the emerging strategies of two software firms within the UC market. The theory of network effects originally developed by Rohlfs is central to the analysis in this thesis. -

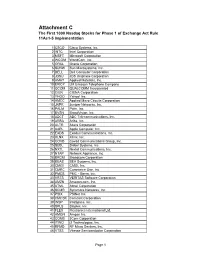

Attachment C the First 1000 Nasdaq Stocks for Phase 1 of Exchange Act Rule 11Ac1-5 Implementation

Attachment C The First 1000 Nasdaq Stocks for Phase 1 of Exchange Act Rule 11Ac1-5 Implementation 1 CSCO Cisco Systems, Inc. 2 INTC Intel Corporation 3 MSFT Microsoft Corporation 4 WCOM WorldCom, Inc. 5 ORCL Oracle Corporation 6 SUNW Sun Microsystems, Inc. 7 DELL Dell Computer Corporation 8 JDSU JDS Uniphase Corporation 9 AMAT Applied Materials, Inc. 10 ERICY LM Ericsson Telephone Company 11 QCOM QUALCOMM Incorporated 12 CIEN CIENA Corporation 13 YHOO Yahoo! Inc. 14 AMCC Applied Micro Circuits Corporation 15 JNPR Juniper Networks, Inc. 16 PALM Palm, Inc. 17 BVSN BroadVision, Inc. 18 ADCT ADC Telecommunications, Inc. 19 ARBA Ariba, Inc. 20 ALTR Altera Corporation 21 AAPL Apple Computer, Inc. 22 EXDS Exodus Communications, Inc. 23 XLNX Xilinx, Inc. 24 COVD Covad Communications Group, Inc. 25 SEBL Siebel Systems, Inc. 26 NXTL Nextel Communications, Inc. 27 NTAP Network Appliance, Inc. 28 BRCM Broadcom Corporation 29 BEAS BEA Systems, Inc. 30 CMGI CMGI, Inc. 31 CMRC Commerce One, Inc. 32 PMCS PMC - Sierra, Inc. 33 VRTS VERITAS Software Corporation 34 AMZN Amazon.com, Inc. 35 ATML Atmel Corporation 36 SCMR Sycamore Networks, Inc. 37 PSIX PSINet Inc. 38 CMCSK Comcast Corporation 39 INSP InfoSpace, Inc. 40 SPLS Staples, Inc. 41 FLEX Flextronics International Ltd. 42 AMGN Amgen Inc. 43 COMS 3Com Corporation 44 ITWO i2 Technologies, Inc. 45 RFMD RF Micro Devices, Inc. 46 VTSS Vitesse Semiconductor Corporation Page 1 47 INKT Inktomi Corporation 48 EXTR Extreme Networks, Inc. 49 SDLI SDL, Inc. 50 MFNX Metromedia Fiber Network, Inc. 51 VRSN VeriSign, Inc. 52 IMNX Immunex Corporation 53 COST Costco Wholesale Corporation 54 KLAC KLA-Tencor Corporation 55 TRLY Terra Networks, S.A. -

To: All Option Members, Member Organizations & Rots From: Market

MEMO # : 1800-07 To: All Option Members, Member Organizations & ROTs From: Market Watch Date: July 20, 2007 Subject: PHLX Defense SectorSM (DFXSM) Quarterly Rebalancing The Philadelphia Stock Exchange, Inc. (PHLX) has determined to make the following changes to the PHLX Defense SectorSM (DFXSM), before the open of business on Monday, July 23, 2007. Company Name Stock Symbol Shares Alliant Techsystems, Inc. ATK 96 Boeing Company BA 96 Rockwell Collins, Inc. COL 136 DRS Technologies, Inc. DRS 181 EDO Corp. EDO 276 Embraer Emp. Brasileira de Aero ERJ 208 Esterline Technologies Corp. ESL 198 General Dynamics Corp. GD 124 General Electric Co GE 249 Gencorp, Inc. GY 763 ITT Corporation ITT 141 L3 Communications, Inc. LLL 100 Lockheed Martin Corp. LMT 102 Northrop Grumman Corp. NOC 129 Raytheon Company RTN 184 Teledyne Technologies, Inc. TDY 221 United Technologies Corp. UTX 132 The revised DFXSM divisor is: 455.5556 Questions concerning this release should be directed to Market Watch at 1-800-THE-PHLX, choice #2 or (215) 496-1508. MEMO # : 1801-07 To: All Option Members, Member Organizations & ROTs From: Market Watch Date: July 20, 2007 Subject: theStreet.com Internet Sector (DOTSM) Quarterly Rebalancing The Philadelphia Stock Exchange, Inc. (PHLX) has determined to make the following changes to theStreet.com Internet Sector (DOTSM), before the open of business on Monday, July 23, 2007. Company Name Stock Symbol Shares Adobe Systems ADBE 241 Amazon.com, Inc. AMZN 136 Avocnet Corp. AVCT 332 Check Point Software Tech CHKP 429 CheckFree Corporation CKFR 248 Cisco Systems, Inc. CSCO 336 eBay, Inc. EBAY 292 FedEX Corp. -

Vendor Landscape Publication Calendar (April 2011 to March 2012)

Vendor Landscape Publication Calendar (April 2011 to March 2012) Info-Tech Research Group Vendor Landscape Publication Calendar (April 2011 to March 2012) 1 Our Vendor Landscape Calendar April 2011 to March 2012 Info-Tech Research Group advises IT buyers on vendor selection through our Vendor Landscape series of Solution Sets. Our rigorous methodology includes user surveys, vendor briefings, and our own proprietary research process. The following pages of this document indicate the market spaces we will cover and the current (as of this publication) list of vendors we will consider. To learn more, please visit our Vendor Evaluation Methodology. Please note: The schedules indicated herein are subject to change without prior notice. What is the difference between a VL and a VL+? VL: An Info-Tech Vendor Landscape focuses tightly on the vendor evaluation and the Vendor Landscape diagram. The VL gets you right to the point. VL+: An Info-Tech Vendor Landscape Plus starts with the VL but then goes further to provide coverage of strategy and implementation. The VL+ is also accompanied by additional templates and tools. How does Info-Tech decide which format to use? Info-Tech analysts consider market trends and Info-Tech’s existing coverage when deciding whether a market space is covered in a VL+ or VL format. Both formats share the same process and impartial rigor to produce the Vendor Landscape diagram and ranking. The only difference is the additional content. Info-Tech Research Group Vendor Landscape Publication Calendar (April 2011 to March 2012) 2 Participate in our Research Vendors, please contact: IT Leaders and Buyers, contact: Rachel Flewelling Bator, Scott Koopman, PR and Vendor Relations Manager Panel Coordinator Office: 519-432-3550 ext.