Petroleum Fund Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Profitable and Untethered March to Global Resource Dominance!

Athens Journal of Business and Economics X Y GlencoreXstrata… The Profitable and Untethered March to Global Resource Dominance! By Nina Aversano Titos Ritsatos† Motivated by the economic causes and effects of their merger in 2013, we study the expansion strategy deployment of Glencore International plc. and Xstrata plc., before and after their merger. While both companies went through a series of international acquisitions during the last decade, their merger is strengthening effective vertical integration in critical resource and commodity markets, following Hymer’s theory of internationalization and Dunning’s theory of Eclectic Paradigm. Private existence of global dominant positioning in vital resource markets, posits economic sustainability and social fairness questions on an international scale. Glencore is alleged to have used unethical business tactics, increasing corruption, tax evasion and money laundering, while attracting the attention of human rights organizations. Since the announcement of their intended merger, the company’s market performance has been lower than its benchmark index. Glencore’s and Xstrata’s economic success came from operating effectively and efficiently in markets that scare off risk-averse companies. The new GlencoreXstrata is not the same company anymore. The Company’s new capital structure is characterized by controlling presence of institutional investors, creating adherence to corporate governance and increased monitoring and transparency. Furthermore, when multinational corporations like GlencoreXstrata increase in size attracting the attention of global regulation, they are forced by institutional monitoring to increase social consciousness. When ensuring full commitment to social consciousness acting with utmost concern with regard to their commitment by upholding rules and regulations of their home or host country, they have but to become “quasi-utilities” for the global industry. -

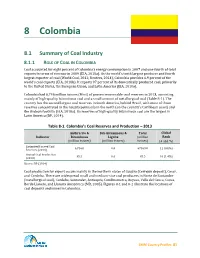

Chapter 8: Colombia

8 Colombia 8.1 Summary of Coal Industry 8.1.1 ROLE OF COAL IN COLOMBIA Coal accounted for eight percent of Colombia’s energy consumption in 2007 and one-fourth of total exports in terms of revenue in 2009 (EIA, 2010a). As the world’s tenth largest producer and fourth largest exporter of coal (World Coal, 2012; Reuters, 2014), Colombia provides 6.9 percent of the world’s coal exports (EIA, 2010b). It exports 97 percent of its domestically produced coal, primarily to the United States, the European Union, and Latin America (EIA, 2010a). Colombia had 6,746 million tonnes (Mmt) of proven recoverable coal reserves in 2013, consisting mainly of high-quality bituminous coal and a small amount of metallurgical coal (Table 8-1). The country has the second largest coal reserves in South America, behind Brazil, with most of those reserves concentrated in the Guajira peninsula in the north (on the country’s Caribbean coast) and the Andean foothills (EIA, 2010a). Its reserves of high-quality bituminous coal are the largest in Latin America (BP, 2014). Table 8-1. Colombia’s Coal Reserves and Production – 2013 Anthracite & Sub-bituminous & Total Global Indicator Bituminous Lignite (million Rank (million tonnes) (million tonnes) tonnes) (# and %) Estimated Proved Coal 6,746.0 0.0 67469.0 11 (0.8%) Reserves (2013) Annual Coal Production 85.5 0.0 85.5 10 (1.4%) (2013) Source: BP (2014) Coal production for export occurs mainly in the northern states of Guajira (Cerrejón deposit), Cesar, and Cordoba. There are widespread small and medium-size coal producers in Norte de Santander (metallurgical coal), Cordoba, Santander, Antioquia, Cundinamarca, Boyaca, Valle del Cauca, Cauca, Borde Llanero, and Llanura Amazónica (MB, 2005). -

The Weir Minerals Mill Circuit Solution Optimise Operations and Minimise Downtime

THE WEIR MINERALS MILL CIRCUIT SOLUTION OPTIMISE OPERATIONS AND MINIMISE DOWNTIME motralec 4 rue Lavoisier . ZA Lavoisier . 95223 HERBLAY CEDEX Tel. : 01.39.97.65.10 / Fax. : 01.39.97.68.48 Demande de prix / e-mail : [email protected] www.motralec.com Decreasing throughput. Interrupted fl ow. Unrealised potential. When your job is to micromanage movement, your equipment must function seamlessly. You depend on each piece of your circuit to work as one. You demand reliable starts and continuous “ We view our products in the same way The Weir Minerals Mill Circuit Solution is a combination of as our customers, seeing them not in processing—anything less than swift and steady is unacceptable. fi ve performance-leading brands, each with an exceptional isolation, but as part of a chain. In doing success record. KHD® high pressure grinding rolls, Warman® pumps, this, we recognise that a chain—the Vulco® wear resistant linings, Cavex® hydrocyclones and Isogate® valves create the solution you can count on to deliver more durability, customer’s process—is only as strong as improved throughput and less downtime. You can also count on its weakest link. This philosophy ensures technically led and quality assured complete management service that we address the areas that cost the throughout the life of your operation. Why the Weir Minerals Mill Circuit Solution? customer time and money. Our specialist We know that vital factors, including water levels, play a approach to these critical applications Because you’re only as strong as your weakest link. critical role in throughput and output. Weir Minerals offers means that all our development time and Floway® vertical turbine pumps, which work seamlessly in the circuit effort ensures that we deliver maximum For more than 75 years Weir Minerals has perfected the delivery and support of mill for many types of applications. -

A Leading Integrated Marketer and Producer of Commodities

Glencore Preliminary Results 2011 5 March 2012 Ivan Glasenberg Chief Executive Officer I 1 2011 highlights . Solid underlying profit highlighting the diversity and growth in Glencore’s businesses – Adjusted EBIT(1) up 2% to $5.4bn (Industrial up 18%, Marketing up >10% excluding Agricultural Products) – Glencore net income(1) up 7% to $4.1bn . Strong operating cash flow of $3.5bn(2) up 6% . Robust balance sheet with close to $7bn committed liquidity(3) provides security and opportunities – FFO to Net debt at 27% – S&P and Moody’s investment grade credit ratings improved in July(4) . Final dividend of $0.10 per share (total dividend of $0.15 per share) . Growth projects overall on track to time and budget Notes: (1) Pre other significant items. (2) Funds from operations. (3) Cash and undrawn committed facilities. (4) Moody’s Baa2 (stable), S&P BBB (stable). Following announcement of Xstrata merger, both agencies have flagged possible upgrade potential. I 2 2011 operating performance – Marketing activities Metals & Marketing activities delivered consistent results over 2011, generating Adjusted EBIT of $1.2bn, 11% lower than 2010 Minerals Marketed volumes were 5,652k MT Cu equivalent, 4% lower than 2010 Decline in performance partly due to lower profits from the ferroalloys and zinc/copper departments (which performed strongly in 2010 when physical purchasing and restocking in Asia was particularly intensive), offset by higher profits in the alumina/aluminium department where arbitrage opportunities were more favourable Energy Energy -

Escondida Site Tour

Escondida site tour Edgar Basto President Escondida 1 October 2012 Disclaimer Forward looking statements This presentation includes forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 regarding future events, conditions, circumstances and the future ffinancialinancial performance of BHP Billiton, including for capital expenditures, productionvn volumes, project capacity, and schedules for expected production. Often, but not always, forward-looking statements can be identified by the use of the words such as “plans”, “expects”, “expected”, “scheduled”, “estimates”, “intends”, “anticipates”, “believes” or variations of such words and phrases or state that certain actions, events, conditions, circumstances or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. These forward-looking statements are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results to differ materially from those expressed in the statements contained in this presentation. For more detail on those risks, you should refer to the sections of our annual report on Form 20-F for the year ended 30 June 2012 entitled “Risk factors ”, “Forward looking stateme nts” and “Operating and financial review and prospects” filed with the U.S. Securities and Exchange Commission (“SEC”). Any estimates and projections in this presentation are illustrative only. Our actual results may be materially affected by changes in economic or other circumstances which cannot be foreseen. Nothing in this presentation is, or should be relied on as, a promise or representation either as to future results or events or as to the reasonableness of any assumption or view expressly or impliedly contained herein. -

Xstrata Finance (Dubai)

BASE PROSPECTUS Xstrata Finance (Dubai) Limited (guaranteed on a senior, unsecured and joint and several basis by Xstrata plc, Xstrata (Schweiz) AG, Xstrata Finance (Canada) Limited and Xstrata Canada Financial Corp.) Xstrata Finance (Canada) Limited (guaranteed on a senior, unsecured and joint and several basis by Xstrata plc, Xstrata (Schweiz) AG, Xstrata Finance (Dubai) Limited and Xstrata Canada Financial Corp.) Xstrata Canada Financial Corp. (guaranteed on a senior, unsecured and joint and several basis by Xstrata plc, Xstrata (Schweiz) AG, Xstrata Finance (Dubai) Limited and Xstrata Finance (Canada) Limited) U.S.$8,000,000,000 Euro Medium Term Note Programme Under this U.S.$8,000,000,000 Euro Medium Term Note Programme as described in this Base Prospectus (the ³Programme´), Xstrata Finance (Dubai) Limited (³Xstrata Dubai´), Xstrata Finance (Canada) Limited (³Xstrata Canada´) and Xstrata Canada Financial Corp. (³Xstrata CFC´) (each an ³Issuer´ and together the ³Issuers´) may from time to time issue notes (³Notes´) denominated in any currency agreed between the relevant Issuer and the relevant Dealers (as defined below). Notes issued by Xstrata Dubai will, subject to the limitations described in Part I ²³Risk Factors ² Risks related to the Notes and the Guarantees ² Risks related to Notes generally ² Limitations in respect of Xstrata Schweiz Guarantee´ and Part VI ²³Terms and Conditions of the Notes ² Guarantee´, be fully and unconditionally guaranteed on a senior, unsecured and joint and several basis by Xstrata plc (³Xstrata´), Xstrata (Schweiz) AG (³Xstrata Schweiz´), Xstrata Canada and Xstrata CFC. Notes issued by Xstrata Canada will be fully and unconditionally guaranteed on a senior, unsecured and joint and several basis by Xstrata, Xstrata Schweiz, Xstrata Dubai and Xstrata CFC. -

The Weir Group PLC Excellent Annual Report 2006 Engineering Solutions

T The Weir Group PLC h The Weir Group PLC Excellent e Clydesdale Bank Exchange W Annual Report 2006 Engineering 20 Waterloo Street e Solutions i r Glasgow G2 6DB, Scotland G r o u Telephone: +44 (0)141 637 7111 p P Facsimile: +44 (0)141 221 9789 L C Email: [email protected] A n n Website: www.weir.co.uk u a l R e p o r t 2 0 0 6 Financial Highlights 2006 Group results - continuing operations Financial Calendar Revenue Operating profit (2) Pre-tax profit (2) Order input (1) Ex-dividend date for final dividend £940.9m £87.7m £87.1m £1,099.5m 2 May 2007 Up 19% Up 32% Up 40% Up 23% Record date for final dividend* 4 May 2007 (2) Earnings per share Dividend Net debt Annual General Meeting 32.4p 14.5p £7.1m 9 May 2007 Up 38% Up 10% Down 91% Final dividend paid 40 16 1 June 2007 30 12 (1) Excludes Joint Ventures & Associates; calculated at constant 2006 exchange rates 8 20 *shareholders on the register at this date will receive the dividend (2) Adjusted to exclude exceptional items 10 4 2005 2006 2005 2006 Registered office & company number 23.5p 32.4p 13.2p 14.5p Clydesdale Bank Exchange 20 Waterloo Street Glasgow G2 6DB, Scotland Registered in Scotland Contents: Company Number 2934 The Reports Group Financial Statements 1 2006 Highlights 42 Directors Statement of Responsibilities 2 Chairman’s Statement 43 Independent Auditors Report 4 Chief Executive’s Review 44 Consolidated Income Statement 7 Operational Review 45 Consolidated Balance Sheet 17 Financial Review 46 Consolidated Cash Flow Statement 20 Board of Directors 47 Consolidated -

Investment Base Market Value ADIDAS AG 3,012,920.22 AGGREKO

Investment Base Market Value ADIDAS AG 3,012,920.22 AGGREKO ORD GBP0.13708387 388,022.18 AIA GROUP LTD 2,796,579.12 AMGEN INC 3,339,030.73 AMLIN ORD GBP0.28125 1,074,564.21 APACHE CORP 2,940,009.21 ARM HOLDINGS ORD GBP0.0005 3,917,411.78 ASHTEAD GROUP PLC 2,130,421.50 ASSOCIATED BRITISH FOODS PLC 1,484,100.00 ASTELLAS PHARMA INC Y50 2,466,904.22 ASTRAZENECA ORD USD0.25 2,776,538.30 ATKINS (WS) ORD 0.5P 2,846,883.20 AUGEAN ORD GBP0.10 545,471.62 AVIVA PLC GBP0.25 2,549,511.56 BABCOCK INTL GROUP ORD GBP0.60 4,789,655.60 BALL CORP 3,327,899.89 BANK RAKYAT INDONESIA PERSERO 1,999,951.64 BARCLAYS ORD GBP0.25 8,955,537.08 BARCLAYS PLC NIL PD 678,960.36 BAYER AG ORD NPV 2,106,468.13 BEIJING ENTERPRISE HLDGS H SHS 2,939,136.19 BG GROUP PLC ORD GBP0.10 14,159,787.60 BHP BILLITON PLC USD0.50 2,853,776.58 BOEING CO/THE 3,320,474.92 BORGWARNER INC 3,653,158.69 BOWLEVEN PLC 235,822.53 BP PLC ORD USD.25 4,033,332.43 BRISTOL-MYERS SQUIBB CO 3,479,041.09 BRITISH AMERICAN TOBACCO ORD 7,961,924.88 BRITISH LAND ORD GBP0.25 644,410.91 BRITVIC ORD GBP0.2(WI) 1,894,189.44 BT GROUP ORD GBP0.05 4,255,329.83 BUNZL ORD GBP0.3214857 4,106,287.99 C&C GROUP ORD EUR0.01 777,864.66 CABLE & WIRELESS COMMUNICATION 254,269.27 CALPINE CORP 3,668,147.39 CANADIAN PACIFIC RAILWAY LTD 2,862,420.30 CAPITAL & COUNTIES PROPERTIES 3,921,394.34 CAPITAL ONE FINANCIAL CORP 3,430,983.46 CARPHONE WAREHOUSE GROUP PLC 1,869,542.44 CENTRICA ORD GBP0.061728395 4,266,854.59 CHECK POINT SOFTWARE TECHNOLOG 3,412,091.59 CHINA CONSTRUCTION BANK CORP 1,471,739.50 CITIGROUP INC 3,227,433.31 COCA-COLA -

Introduction to Xstrata

Transformation through Organic Growth and Operational Excellence Steve de Kruijff, COO Xstrata Copper North Queensland Analyst Visit Ernest Henry Mining – April 2011 1 Xstrata Copper is a fundamental pillar of Xstrata’s diversified model § Headquartered in Brisbane, employing over 17,000 people in eight countries § Top five global mined and refined copper producer – Mined copper production of 913,500 tonnes in 2010 § Revenue of US$14bn and operating profit of US$3.8bn in 2010 § Industry-leading approved project pipeline to further transform business and increase production by more than 50% over next four years Xstrata Copper profit* by country Contribution to Xstrata profit* Argentina Coal 16% 29% Zinc Australia 13% 22% Peru 22% Nickel 9% Alloys 4% Canada 7% Chile Copper 33% 45% *Based on earnings before interest, depreciation, tax and amortisation 2 Continued transformation and growth has created a leading global copper producer... Industry Ranking - 2005 Industry Ranking - 2010 Mined Production Codelco Codelco BHP Billiton Freeport Phelps Dodge Mount Isa Ernest Henry BHP Billiton Freeport Alumbrera Xstrata Copper #4 Rio Tinto + Anglo American Top five share: 36% Xstrata Copper #9 Top five share: 36% Tintaya, Antamina, Kidd, Collahuasi, Lomas Bayas 0 500 1000 1500 2000 0 500 1000 1500 2000 Smelter Production Codelco Codelco Nippon Jiangxi Copper KGHM Mount Isa Xstrata Copper #3 Grupo Mexico + Aurubis Mitsubishi Altonorte Xstrata Copper #19 Top five share: 25% Horne Nippon Mining Top five share: 27% 0 200 400 600 800 1000 1200 1400 0 200 400 600 800 1000 1200 Refined Production Codelco Codelco Phelps Dodge Aurubis Townsville Grupo Mexico + Freeport Nippon Tintaya SxEw Jiangxi Copper KGHM Top five share: 26% Lomas Bayas SxEw Xstrata Copper #5 Top five share: 29% Collahuasi SxEw CCR 0 500 1000 1500 2000 0 500 1000 1500 2000 Source: Brook Hunt, The Long-Term Outlook for Copper, 2nd Quarter Data Volume 2009, 4th Quarter Data Volume 2005. -

Scrutinized Companies That Boycott Israel Macbride Principles and Northern Ireland Cuba/Syria Proxy Voting Safeguards Venezuela Prohibited Investments

nd Global Governance Mandates 2 Quarter – June 13, 201 8 Protecting Florida’s Investments Act (PFIA) Florida Statutes Scrutinized Companies that Boycott Israel MacBride Principles and Northern Ireland Cuba/Syria Proxy Voting Safeguards Venezuela Prohibited Investments Quarterly Report—Global Governance Mandates Table of Contents Section 1: Protecting Florida's Investments Act (PFIA): Primary Requirements of the PFIA ............................................................................................................................................................................ 3 Definition of a Scrutinized Company ......................................................................................................................................................................... 5 SBA Scrutinized Companies Identification Methodology .......................................................................................................................................... 5 Key Changes Since the Previous PFIA Quarterly Report ............................................................................................................................................ 7 Table 1: Scrutinized Companies with Activities in Sudan ......................................................................................................................................... 10 Table 2: Continued Examination Companies with Activities in Sudan .................................................................................................................... -

Vedanta Resources Plc Annual Report and Accounts FY2015 V E D Anta R

Annual reportAnnual FY2015 and accounts plc Resources Vedanta Vedanta Resources plc Annual report and accounts FY2015 Vedanta Resources plc Annual report and accounts FY2015 Vedanta Resources plc is a UK Our assets Oil & Gas • Cairn India is one of India’s listed global diversified natural largest private sector oil & gas companies • Interest in seven blocks in resources company. India, and one each in Sri Lanka and South Africa • Contributes to ~27% of India’s domestic crude oil production Our vision Zinc-Lead-Silver To be a world-class, diversified resources • Zinc operations in India, Namibia, South Africa company, providing superior returns to our and Ireland shareholders with high-quality assets, low-cost • World’s second largest and India’s largest zinc miner operations and sustainable development. • Operators of the world’s largest zinc mine at Rampura Agucha, India • One of the largest silver producers globally with an annual capacity of 16moz Iron Ore • Operations in India and Liberia • Goa iron ore exported, with Karnataka iron ore sold domestically • Large iron ore deposit in Liberia Our brand Copper • Smelting and mining The refreshed logo signifies Vedanta’s approach to a triple bottom operations across India, line that focuses on people, planet and prosperity in its areas of Australia and Zambia • Largest custom copper operations. A leaf, an unmistakable ‘symbol of life’ which has now smelter and copper rods been included in the Vedanta globe and the new colour green, producer in India symbolise Vedanta’s ethical credentials. The colour blue reflects • Integrated copper mining and smelting operations Vedanta’s distinct virtues of integrity and professionalism. -

FTSE 100 Historic Additions and Deletions

FTSE 100 Historic Additions and Deletions ftserussell.com An LSEG Business September 2021 FTSE 100 – Historic Additions and Deletions Date Added Deleted Notes 19-Jan-84 Charterhouse J Rothschild Eagle Star Corporate Event - Acquisition of Eagle Star by BAT Industries 02-Apr-84 Lonrho Magnet & Southerns 02-Jul-84 Reuters Edinburgh Investment Trust 02-Jul-84 Woolworths Barratt Development 19-Jul-84 Enterprise Oil Bowater Corporation Corporate Event - Sub division of company into Bowater Inds and Bowater Inc 01-Oct-84 Willis Faber Wimpey (George) & Co 01-Oct-84 Granada Group Scottish & Newcastle Breweries 01-Oct-84 Dowty Group MFI Furniture Corporate Event - Acquisition of MFI Furniture by Associated Dairies Group 04-Dec-84 British Telecom Johnson Matthey Fast Entry 02-Jan-85 Dee Corporation Dowty Group 02-Jan-85 Argyll Group Berisford (S & W) 02-Jan-85 MFI Furniture RMC Group 02-Jan-85 Dixons Group Dalgety 01-Feb-85 Jaguar Hambro Life Corporate Event - Acquisition of Hambro Life by BAT Industries 01-Apr-85 Guinness (Arthur) & Son Enterprise Oil 01-Apr-85 Smith Industries House of Fraser Corporate Event - Acquisition of House of Fraser by Alfayed Investment Trust 01-Apr-85 Ranks Hovis McDougall MFI Furniture Corporate Event - Acquisition of MFI Furniture by Associated Dairies Group 01-Jul-85 Abbey Life Ranks Hovis McDougall 01-Jul-85 Debenhams Imperial Continental Gas Ass. 06-Aug-85 Bank of Scotland Debenhams 01-Oct-85 Habitat Mothercare Lonrho 02-Jan-86 Scottish & Newcastle Rothschild (J) Holdings 08-Jan-86 Storehouse Habitat Mothercare