100 Global Inspirational Women in Mining Project

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

North America Other Continents

Arctic Ocean Europe North Asia America Atlantic Ocean Pacific Ocean Africa Pacific Ocean South Indian America Ocean Oceania Southern Ocean Antarctica LAND & WATER • The surface of the Earth is covered by approximately 71% water and 29% land. • It contains 7 continents and 5 oceans. Land Water EARTH’S HEMISPHERES • The planet Earth can be divided into four different sections or hemispheres. The Equator is an imaginary horizontal line (latitude) that divides the earth into the Northern and Southern hemispheres, while the Prime Meridian is the imaginary vertical line (longitude) that divides the earth into the Eastern and Western hemispheres. • North America, Earth’s 3rd largest continent, includes 23 countries. It contains Bermuda, Canada, Mexico, the United States of America, all Caribbean and Central America countries, as well as Greenland, which is the world’s largest island. North West East LOCATION South • The continent of North America is located in both the Northern and Western hemispheres. It is surrounded by the Arctic Ocean in the north, by the Atlantic Ocean in the east, and by the Pacific Ocean in the west. • It measures 24,256,000 sq. km and takes up a little more than 16% of the land on Earth. North America 16% Other Continents 84% • North America has an approximate population of almost 529 million people, which is about 8% of the World’s total population. 92% 8% North America Other Continents • The Atlantic Ocean is the second largest of Earth’s Oceans. It covers about 15% of the Earth’s total surface area and approximately 21% of its water surface area. -

Innovation Ecosystem

Central Alberta Alberta Real Estate Regional Innovation Wood Buffalo Alberta Biodiversity Regional (CATAPULT) Alberta Industrial Foundation Network for Southern Regional Innovation Monitoring Miistakis Institute Municipality of Heartland Association Tri-region (Spruce Alberta Network Canadian Association Canadian Institute Wood Buffalo Edmonton Grove, Stony Plain, Grande Prairie Edmonton Regional of Petroleum Producers Renewable Fuels County of (TEC Edmonton, Startup Innovation Network Resource BC Bioenergy Alberta Land Parkland County) (Spark!) East Central Alberta Grande Prairie Association Wetaskiwin Municipal District Edmonton, NABI, NAIT) East MEGlobal Industries Suppliers Association Land Trust Stewardship Regional Innovation Regional Innovation Petroleum Services Association Alberta Centre Pembina Institute of Greenview Central Central Alberta Alliance Calgary Network Network Petroleum Association of Bioenergy Regional Innovation Concordia Technology Alliance Canadian Lumber St. Paul Town of Sundre University Athabasca NOVA Chemicals Canada BioAlberta Producers Waterton Biosphere Athabasca County Southern Alberta Network Canada Standards Association Alberta Land Medicine Hat University Reserve Association City of Red Deer (TecConnect) Southeast Alberta Transalta Institute (APEX) Canadian (WBRA) City of Edmonton Calgary Regional Regional Innovation MacEwan Enerplus BioTalent University University of Sundre Clean Power Innovation Network University Canada ENVIRONMENTAL Sturgeon County Red Deer County of Alberta Lethbridge Petroleum -

From Operation Serval to Barkhane

same year, Hollande sent French troops to From Operation Serval the Central African Republic (CAR) to curb ethno-religious warfare. During a visit to to Barkhane three African nations in the summer of 2014, the French president announced Understanding France’s Operation Barkhane, a reorganization of Increased Involvement in troops in the region into a counter-terrorism Africa in the Context of force of 3,000 soldiers. In light of this, what is one to make Françafrique and Post- of Hollande’s promise to break with colonialism tradition concerning France’s African policy? To what extent has he actively Carmen Cuesta Roca pursued the fulfillment of this promise, and does continued French involvement in Africa constitute success or failure in this rançois Hollande did not enter office regard? France has a complex relationship amid expectations that he would with Africa, and these ties cannot be easily become a foreign policy president. F cut. This paper does not seek to provide a His 2012 presidential campaign carefully critique of President Hollande’s policy focused on domestic issues. Much like toward France’s former African colonies. Nicolas Sarkozy and many of his Rather, it uses the current president’s predecessors, Hollande had declared, “I will decisions and behavior to explain why break away from Françafrique by proposing a France will not be able to distance itself relationship based on equality, trust, and 1 from its former colonies anytime soon. solidarity.” After his election on May 6, It is first necessary to outline a brief 2012, Hollande took steps to fulfill this history of France’s involvement in Africa, promise. -

We Want to Help the World Reach Net Zero and Improve People's Lives

BP Sustainability Report 2019 Our purpose is reimagining energy for people and our planet. We want to help the world reach net zero and improve people’s lives. We will aim to dramatically reduce carbon in our operations and production and grow new low carbon businesses, products and services. We will advocate for fundamental and rapid progress towards Paris and strive to be a leader in transparency. We know we don’t have all the answers and will listen to and work with others. We want to be an energy company with purpose; one that is trusted by society, valued by shareholders and motivating for everyone who works at BP. We believe we have the experience and expertise, the relationships and the reach, the skill and the will, to do this. Introduction Message from Bernard Looney 2 Our ambition 4 2019 at a glance Energy in context 8 Sustainability at BP UN Sustainable Development Goals 11 Sustainability at BP 11 Key sustainability issues 14 Our focus areas Climate change and the energy transition 16 Our role in the energy transition 18 Our ‘reduce, improve, create’ framework 20 Accrediting our lower carbon activities 22 Reducing emissions in our operations 23 Improving our products 26 Creating low carbon businesses 30 Safety 36 Process safety 38 Personal safety 39 Safety performance 41 Our value to society 42 Creating social value 44 Social investment 45 Local workers and suppliers 46 Human rights 47 Community engagement 48 Our impact on communities 49 Labour rights 50 Doing business responsibly Environment 54 People 60 Business ethics 68 Navigating our reports Governance Our quick read Human rights governance 74 provides a summary of the Executive oversight of sustainability 74 Sustainability Report, including key Managing risks 75 highlights and performance in 2019. -

Towards-Sustauinable-Mining-Report

2018 2018 Progress Report Table of Contents Introduction About Towards Sustainable Mining® (TSM®) 3 TSM Guiding Principles 4 Message from the Chair of the TSM Governance Team and MAC’s President and CEO 5 2017 Statement from the Community of Interest Advisory Panel 7 How TSM Works 11 Industry Performance Understanding the Results 15 Communities and People 16 Aboriginal and Community Outreach 16 Crisis Management and Communications Planning 17 Safety and Health 19 Preventing Child and Forced Labour 21 Environmental Stewardship 25 Tailings Management 25 Biodiversity Conservation Management 27 Energy Efficiency 32 Energy Use and GHG Emissions Management 32 International Application of TSM 35 TSM Awards TSM Excellence Awards 47 TSM Leadership Awards 50 TSM Performance by Company 51 © 2018 The Mining Association of Canada. Trademarks, including but not limited to Towards Sustainable Mining®, TSM®, and the diamond shaped figure arcs and quadrilaterals designs, are either registered trademarks or trademarks of The Mining Association of Canada in Canada and/or other countries. TSM Progress Report 2 2018 Introduction About Towards Sustainable Mining Towards Sustainable Mining ® (TSM®) is an award-winning performance system that helps mining companies evaluate and manage their environmental and social responsibilities. It is a set of tools and indicators to drive performance and ensure that key mining risks are managed responsibly at participating mining and metallurgical facilities. Mining companies that participate in the TSM initiative demonstrate their strong commitment to responsible mining. By adhering to the TSM Guiding Principles, mining companies exhibit leadership by: Committing to the Engaging Driving world-leading safety and health of with communities. -

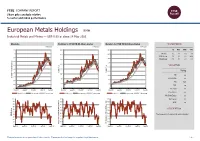

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance European Metals Holdings EMH Industrial Metals and Mining — GBP 0.69 at close 14 May 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-May-2021 14-May-2021 14-May-2021 1.1 450 900 1D WTD MTD YTD 1 Absolute 0.0 -6.8 -4.2 7.8 400 800 Rel.Sector 1.2 -2.9 -7.5 -20.3 0.9 700 Rel.Market -1.1 -5.5 -4.8 -1.3 350 0.8 600 300 0.7 VALUATION 500 0.6 250 400 Trailing Relative Price Relative 0.5 Price Relative 200 300 PE -ve 0.4 Absolute Price (local currency) (local Price Absolute 150 EV/EBITDA -ve 200 0.3 PB 12.3 100 0.2 100 PCF -ve 0.1 50 0 Div Yield 0.0 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 Price/Sales +ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.0 100 90 90 Div Payout 0.0 90 80 80 ROE -ve 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 40 40 The Company is focusing in tin mining industry. -

News Release

NEWS RELEASE Release Time IMMEDIATE Date 17 April 2013 Number 05/13 BHP BILLITON PRODUCTION REPORT FOR THE NINE MONTHS ENDED 31 MARCH 2013 . Full year production guidance is retained for our major businesses following another quarter of robust operating performance. Western Australia Iron Ore achieved record production for the nine month period ended March 2013. Production guidance of 183 million tonnes (100% basis) for the 2013 financial year remains unchanged, despite cyclone related downtime during the period. An annualised production rate approaching 200 million tonnes (100% basis) is anticipated for the June 2013 quarter. Onshore US produced more than five million barrels of liquids during the March 2013 quarter and the Eagle Ford is now our single largest liquids producing field. Petroleum production guidance for the 2013 financial year remains unchanged at approximately 240 million barrels of oil equivalent. Copper in concentrate production at Escondida increased by 61% during the nine month period ended March 2013. Total Escondida copper production remains on track to increase by at least 20% in the 2013 financial year. Queensland Coal production was affected by adverse weather conditions during the March 2013 quarter. However, recently installed flood mitigation infrastructure enabled a rapid recovery in performance and the business was operating at full supply chain capacity at the end of the period. Petroleum MAR MAR MAR YTD13 MAR Q13 MAR Q13 2013 2013 vs vs vs YTD QTR MAR YTD12 MAR Q12 DEC Q12 Crude oil, condensate and natural gas liquids (‘000 boe) 66,610 20,871 1% -4% -10% Natural gas (bcf) 659.78 207.27 10% -1% -6% Total petroleum products (million boe) 176.57 55.42 6% -2% -7% Total petroleum production – An average production rate of 644 thousand barrels of oil equivalent per day was achieved during the nine month period ended March 2013. -

Integrated Annual Report 2020

ANGLO AMERICAN PLATINUM LIMITED INTEGRATED ANNUAL REPORT 2020 REPORT ANNUAL INTEGRATED Integrated annual report 2020 Anglo American Platinum Limited Purpose: re-imagining mining to improve people’s lives We are grounded in our purpose to re-imagine mining to improve people’s lives. We are transforming the very nature of mining for a safer, cleaner, smarter future. We are using more precise technologies, less energy and less water; we are reducing our physical footprint for every ounce of PGM and base metal we produce. We are combining smart innovation with the utmost consideration for our people, their families, local communities, our customers, and the world at large – to better connect precious resources in the ground to all of us who need and value them. Our focus is on our four strategic priorities to deliver the next phase of value creation for stakeholders. – Stimulate new markets and leverage new capabilities – Embed anti-fragility across our business – Maximise value from our core – Be a leader in ESG Refers to other pages in this report Supporting documentation on the website Full annual financial statements (AFS) Full Ore Reserves and Mineral Resources report Environmental, social and governance (ESG) report Notice of annual general meeting www.angloamericanplatinum.com/investors/annual-reporting/2020 Contents 1 Our report 4 Strategy, PGM markets and 99 Our economic contribution in Zimbabwe business model in 2020 1 Approach to reporting 101 Mining and concentrator operations review 2 Reporting principles 38 Strategic priorities -

Group Information

Group information AngloGold Limited was founded in June 1998 through the consolidation of the gold mining interests of Anglo American. The company, AngloGold Ashanti as it is now, was formed on 26 April 2004 following the business combination between AngloGold and Ashanti Goldfields Company Limited. AngloGold Ashanti is currently the third largest gold producing mining company in the world. CURRENT PROFILE AngloGold Ashanti Limited, headquartered in Johannesburg, South Africa, is a global gold company with a portfolio of long-life, relatively low-cost assets and differing orebody types in key gold producing regions. The company's 21 operations are located in 10 countries (Argentina, Australia, Brazil, Ghana, Guinea, Mali, Namibia, South Africa, Tanzania and the United States of America), and are supported by extensive exploration activities. The combined Proved and Probable Ore Reserves of the group amounted to 74.9 million ounces as at 31 December 2008. The primary listing of the company's ordinary shares is on the JSE Limited (JSE) in South Africa. Its ordinary shares are also listed on stock exchanges in London, Paris and Ghana, as well as being quoted in Brussels in the form of International Depositary Receipts (IDRs), in New York in the form of American Depositary Shares (ADSs), in Australia, in the form of Clearing House Electronic Subregister System Depositary Interests (CDIs) and in Ghana, in the form of Ghanaian Depositary Shares (GhDSs). AngloGold Ashanti Limited (Registration number 1944/017354/06) was incorporated in the Republic of South Africa in 1944 under the name of Vaal Reefs Exploration and Mining Company Limited and operates under the South African Companies Act 61 of 1973, as amended. -

Franklin Gold and Precious Metals Fund August 31, 2021

FTIF - Franklin Gold and Precious Metals Fund August 31, 2021 FTIF - Franklin Gold and Precious August 31, 2021 Metals Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date BK9M4K4 ADVENTUS MINING CORP 1,950,000 $1,360,069 0.32% N/A N/A 008474108 AGNICO EAGLE MINES LTD 23,000 $1,322,960 0.32% N/A N/A 011532108 ALAMOS GOLD INC 1,138,800 $8,996,520 2.15% N/A N/A 011532108 ALAMOS GOLD INC 486,071 $3,837,098 0.92% N/A N/A 6761000 ANGLO AMERICAN PLATINUM LTD 44,900 $5,092,029 1.22% N/A N/A 035128206 ANGLOGOLD ASHANTI LTD 327,620 $5,595,749 1.34% N/A N/A 6565655 -

Latin America's Leading Mining & Investment Expo and Conference

650 80 200+ 150+ 30 200+ ATTENDEES SPEAKERS MINING INVESTORS COUNTRIES MEETINGS COMPANIES REPRESENTED ARRANGED www.mininglatam.com Sponsors, Partners & Supporting Organisations PLATINUM & COCKTAIL SPONSOR GOLD SPONSOR SILVER SPONSORS BRONZE SPONSORS MASGLAS MINING PARTNERS AIRLINE PARTNER SUPPORTING ORGANISATIONS MEDIA PARTNERS COUNTRY PARTNER www.mineriaenergia.com Register your place today www.mininglatam.com Latin America’s leading Mining & Investment Expo and Conference Connecting the entire mining community Meet the senior decision-makers from the biggest players in the Latin American mining industry 650 80+ 4 150+ 200+ 30 ATTENDEES WORLD CLASS SPEAKERS STAGES INVESTORS MINING COMPANIES COUNTRIES REPRESENTED Atrracting a senior audience, The best speakers in the industry 2 days packed with over 20 hours Meet local and international Meet the leading mining Opportunity to exchange 72% of which are government taking attendees on a journey of content, inspirational sessions investors with real interest in companies and find out the experiences with the global officials,miners and investors through Commodity prices, led by our expert speakers: Main investment opportunities in the latest mining projects in Latin community from different parts of looking for new business Financing Trends, Country Conference room, Junior Miner Latam Mining industry America Latin America opportunities Insights, CSR and more Roadshow, CSR Roundtable, Major Roundtable AUDIENCE BREAKDOWN COUNTRY BREAKDOWN SENIORITY BREAKDOWN 20% Canada 10% Government 5% Europe -

Annual Report and Financial Statements 2016 Introduction

ANNUAL REPORT AND FINANCIAL STATEMENTS 2016 INTRODUCTION Antofagasta is a Chilean copper mining group with signifi cant by-product production and interests in transport. The Group creates value for its stakeholders through the discovery, development and operation of copper mining assets. The Group is committed to generating value in a safe and sustainable way throughout the commodity cycle. See page 2 for more information CONTENTS STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS 01-05 66-119 120-187 OVERVIEW 2016 highlights 1 Leadership Independent auditors’ report 122 At a glance 2 Chairman’s Governance Q&A 68 Consolidated income statement 127 Letter from the Chairman 4 Senior Independent Director’s Q&A 70 Consolidated statement Governance overview 71 of comprehensive income 128 Board of Directors 72 Consolidated statement of Executive Committee 76 changes in equity 128 06-27 Effectiveness Consolidated balance sheet 129 STRATEGY Board activities 78 Consolidated cash flow statement 130 Professional development 80 Notes to the financial statements 131 Effectiveness reviews 82 Parent company financial statements 181 Statement from the CEO 8 Accountability Question and answer 9 Nomination and Governance Committee 85 Investment case 10 Audit and Risk Committee 88 Our new operating model 11 Sustainability and Stakeholder Our position in the market 14 188-204 Management Committee 92 Our strategy 16 OTHER INFORMATION Projects Committee 94 Key performance indicators 18 Remuneration Risk management 20 Five year summary 188 Committee Chairman’s Principal