Britain's Scramble for Africa's Energy and Mineral Resources

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Profitable and Untethered March to Global Resource Dominance!

Athens Journal of Business and Economics X Y GlencoreXstrata… The Profitable and Untethered March to Global Resource Dominance! By Nina Aversano Titos Ritsatos† Motivated by the economic causes and effects of their merger in 2013, we study the expansion strategy deployment of Glencore International plc. and Xstrata plc., before and after their merger. While both companies went through a series of international acquisitions during the last decade, their merger is strengthening effective vertical integration in critical resource and commodity markets, following Hymer’s theory of internationalization and Dunning’s theory of Eclectic Paradigm. Private existence of global dominant positioning in vital resource markets, posits economic sustainability and social fairness questions on an international scale. Glencore is alleged to have used unethical business tactics, increasing corruption, tax evasion and money laundering, while attracting the attention of human rights organizations. Since the announcement of their intended merger, the company’s market performance has been lower than its benchmark index. Glencore’s and Xstrata’s economic success came from operating effectively and efficiently in markets that scare off risk-averse companies. The new GlencoreXstrata is not the same company anymore. The Company’s new capital structure is characterized by controlling presence of institutional investors, creating adherence to corporate governance and increased monitoring and transparency. Furthermore, when multinational corporations like GlencoreXstrata increase in size attracting the attention of global regulation, they are forced by institutional monitoring to increase social consciousness. When ensuring full commitment to social consciousness acting with utmost concern with regard to their commitment by upholding rules and regulations of their home or host country, they have but to become “quasi-utilities” for the global industry. -

Pancontinental Oil & Gas NL – June 2012 Institutional Roadshow

Highly leveraged into two of the most exciting oil and gas regions of the decade Investor Presentation - June 2012 www.pancon.com.au Disclaimer These materials are strictly confidential and are being supplied to you solely for your information and should not be reproduced in any form, redistributed or passed on, directly or indirectly, to any other person or published, in whole or part, by any medium or for any purpose. Failure to comply this restriction may constitute a violation of applicable securities laws. These materials do not constitute or form part of any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for, or any offer to underwrite or otherwise acquire any securities, nor shall any part of these materials or fact of their distribution or communication form the basis of, or be relied on in connection with, any contract, commitment or investment decision whatsoever in relation thereto. The information included in the presentation and these materials is subject to updating, completion, revision and amendment, and such information may change materially. No person is under any obligation to update or keep current the information contained in the presentation and these materials, and any opinions expressed in relation thereto are subject to change without notice. The distribution of these materials in other jurisdictions may also be restricted by law, and persons into whose possession these materials come should be aware of and observe any such restrictions. This presentation includes forward-looking statements that reflect the company’s intentions, beliefs or current expectations. -

Natural Gas in East Africa: Domestic and Regional Use Usua U

The Stanford Natural Gas Initiative Natural Gas in East Africa: Domestic and Regional Use Usua U. Amanam Pre-symposium white paper for: Reducing Energy Poverty with Natural Gas: Changing Political, Business, and Technology Paradigms May 9 & 10, 2017 Stanford University, CA Natural Gas in East Africa: Domestic and Regional Use Usua U. Amanam* April 2017 1 Introduction The world’s natural gas demand is projected to grow by 50% [1] by 2040, with much of that driven by developing regions like non-OECD Asia and Africa [2]. Africa’s natural gas demand, in particular, is anticipated to grow by more than a factor of two [3]. Be- cause natural gas is relatively cheap and abundant as a result of advances in technology, it plays a large role in shaping how countries plan to meet their rising energy needs. East Africa is a region that has benefited greatly from improvements in exploration and drilling techniques [4]. The large discoveries of natural gas in offshore Mozambique and Tanzania will contribute to meeting the rapidly growing worldwide energy demand while also serving as an effective energy solution in a region whose per capita power consump- tion is less than that needed to continuously power a 50-watt lightbulb [5]. Figure 1: Africa’s natural gas consumption by end-use sector, 2012-2040 (trillion cubic feet) [3] . Both countries stand to benefit and can become regional energy hubs1 if the gas and money generated from fields is properly allocated and invested. Since 2000, two out of every three dollars put into the Sub-Saharan Africa energy sector have been committed to the development of resources for export [5]. -

Why Mandatory Disclosures Matter for Indonesia Disclosures Matter for Indonesia

Case Study Why mandatory Why mandatory disclosures matter for Indonesia disclosures matter for Indonesia MELIANA LUMBANTORUAN PWYP INDONESIA CONTEXT PROJECT ACTIVITIES The global transparency wave has reached Indonesia. This project used companies’ mandatory disclosure Initiatives such as the Extractive Industries Transparency from 2014 and 2015, published by companies listed on Initiative (EITI) are bringing more transparency to EU and Norwegian stock exchanges. Through that we Indonesia and the mandatory disclosures laws of the EU found that at least seven of these companies operate in have led to more data on extractive activities in Indonesia Indonesia, i.e. Royal Dutch Shell, British Petroleum (BP), becoming available. But the oil, mining and gas industries BHP Billiton, Premier Oil, TOTAL Oil, the Jardine Matheson are still among the most corrupt sectors and accessing / PT. Astra International Tbk. Their reports were used to relevant data on the amount of production, marketing, find how much was paid by them in 2014 and 2015. Beyond shipment and payment of taxes and other company payments data, we also looked at what other kind of financial liabilities is difficult. information related to the extractive sector are difficult to get in Indonesia. In Indonesia, ranked 90th out of 176 in Transparency International’s Corruption Perception Index 2016, the data from the three EITI reports published so far (between 2009 Table 1 The total value of VALUE OF YEAR (USD) and 2013) is incomplete and out of date. Disclosing data payments disclosure by seven EU companies to COMPANY NAME 2014 2015 will therefore not be enough to ensure accountability. Indonesia’s government The data also needs to used in a meaningful way by a (2014-2015) Statoil 5,158,730 (8,101,737) range of stakeholders, including civil society. -

Coal Mine Methane Country Profiles, June 2015

Disclaimer The U.S. Environmental Protection Agency does not: a) Make any warranty or representation, expressed or implied, with respect to the accuracy, completeness, or usefulness of the information contained in this report, or that the use of any apparatus, method, or process disclosed in this report may not infringe upon privately owned rights; or b) Assume any liability with respect to the use of, or damages resulting from the use of, any information, apparatus, method, or process disclosed in this report. CMM Country Profiles CONTENTS Units of Conversions .............................................................................................................................................. i Executive Summary .............................................................................................................................................. ii Global Overview at a Glance ................................................................................................................................. ii Introduction ............................................................................................................................................................ 1 Purpose of the Report ............................................................................................................................................. 2 Organization of the Report ................................................................................................................................... 2 1 Argentina ...................................................................................................................................................... -

South Africa's Coalfields — a 2014 Perspective

International Journal of Coal Geology 132 (2014) 170–254 Contents lists available at ScienceDirect International Journal of Coal Geology journal homepage: www.elsevier.com/locate/ijcoalgeo South Africa's coalfields — A 2014 perspective P. John Hancox a,⁎,AnnetteE.Götzb,c a University of the Witwatersrand, School of Geosciences and Evolutionary Studies Institute, Private Bag 3, 2050 Wits, South Africa b University of Pretoria, Department of Geology, Private Bag X20, Hatfield, 0028 Pretoria, South Africa c Kazan Federal University, 18 Kremlyovskaya St., Kazan 420008, Republic of Tatarstan, Russian Federation article info abstract Article history: For well over a century and a half coal has played a vital role in South Africa's economy and currently bituminous Received 7 April 2014 coal is the primary energy source for domestic electricity generation, as well as being the feedstock for the Received in revised form 22 June 2014 production of a substantial percentage of the country's liquid fuels. It furthermore provides a considerable source Accepted 22 June 2014 of foreign revenue from exports. Available online 28 June 2014 Based on geographic considerations, and variations in the sedimentation, origin, formation, distribution and quality of the coals, 19 coalfields are generally recognised in South Africa. This paper provides an updated review Keywords: Gondwana coal of their exploration and exploitation histories, general geology, coal seam nomenclature and coal qualities. With- Permian in the various coalfields autocyclic variability is the norm rather than the exception, whereas allocyclic variability Triassic is much less so, and allows for the correlation of genetically related sequences. During the mid-Jurassic break up Coalfield of Gondwana most of the coal-bearing successions were intruded by dolerite. -

View Annual Report

ANNUAL REPORT & ACCOUNTS 2000 www.premier-oil.com 01 HIGHLIGHTS 26 CORPORATE GOVERNANCE 02 CHAIRMAN’S STATEMENT 28 REPORT OF THE DIRECTORS 04 CHIEF EXECUTIVE’S REVIEW 30 REMUNERATION REPORT 06 OPERATIONAL REVIEW: 34 STATEMENT OF DIRECTORS’ RESPONSIBILITIES 08 Indonesia, Pakistan 34 AUDITORS REPORT 10 West Natuna case study 12 Myanmar, North West Europe, Albania 35 ACCOUNTING POLICIES 14 Yetagun case study 37 CONSOLIDATED PROFIT AND LOSS ACCOUNT 16 FINANCIAL REVIEW 37 CONSOLIDATED STATEMENT OF TOTAL 20 TAKING CARE OF BUSINESS RECOGNISED GAINS AND LOSSES 23 HEALTH & SAFETY 37 GROUP RECONCILIATION OF MOVEMENT IN SHAREHOLDERS’ FUNDS 24 BOARD OF DIRECTORS 38 BALANCE SHEETS 39 CONSOLIDATED CASH FLOW STATEMENT 40 NOTES TO THE ACCOUNTS 58 FIVE YEAR SUMMARY 58 SHAREHOLDER INFORMATION 59 RESERVES 60 LICENCE INTERESTS bcf billion cubic feet boe barrels of oil equivalent boepd barrels of oil equivalent per day bopd barrels of oil per day bpd barrels per day EWT extended well test LIBOR London Inter Bank Offer Rate mboepd thousand barrels of oil equivalent per day mmbbls million barrels mmboe million barrels of oil equivalent mmscfd million standard cubic feet per day NGLs natural gas liquids NGOs Non-Government Organisations tcf trillion cubic feet HIGHLIGHTS IMPROVED FINANCIAL POSITION • Turnover increased by £26.2 million to £115.7 million • Operating profit of £35.2 million for the year • Net profit after tax of £6.1 million • Revolving bank facility successfully re-financed at $250 million MAJOR DEVELOPMENTS ON TRACK • Myanmar – operated $650 -

EUROZINC MINING CORPORATION TAKEOVER PROPOSAL for VEDANTA RESOURCES Plc

Private and Confidential August 28, 2006 EUROZINC MINING CORPORATION TAKEOVER PROPOSAL FOR VEDANTA RESOURCES plc TABLE OF CONTENTS Sl. No. Particulars Page No. I Market Data and Valuation Summary 1-1a II Key Financial and Operational Parameters at a Glance 2-5 III Basic Financial and Operational Data 6-8 IV Share Structure and Key Valuation Assumptions 9 V Background 10-11 VI Operations, Resources and Exploration 11-22 VII Industry Trend 23-34 VIII Peer Group Comparison Snapshots 35-42 IX Canada Base Metal Hot Deals 43-47 X EuroZinc and Lundin Merger Announcement 48-52 XI EuroZinc’s 2nd Qtr Management’s Discussion & Analysis (Jun 06) 53-63 APPENDICES I EuroZinc’s 2nd Qtr Financial Report (Jun 06) 1-13 II EuroZinc’s Consolidated Financial Statements (2005-04) 1-29 III Lundin’s 2nd Qtr Financial Report (Jun 06) 1-26 IV Lundin’s Financial Statements (2005-04) 1-57 Prepared By: Dr. S. S. Mohanty President & CEO SMART Intl. Holdings, Inc. Private & Confidential August 28, 2006 EUROZINC MINING CORPORATION MARKET DATA SUMMARY TSX (SYMBOL: EZM) AMEX (SYMBOL: EZM) CURRENT MARKET PRICE: (August 25, 52-Week High: 2006) CDN$ 3.49 /US$3.25 TSX: CDN$ 3.31 Low: AMEX: US$ 2.97 CDN$ 0.77/ US$1.05 STOCK RATING: MARKET OUTPERFORMER INDUSTRY OUTPERFORMER EZM VS. S&P TSX COMPOSITE EZM VS. S&P TSX CAPPED MATERIALS VALUATION SUMMARY MARKET MULTIPLE APPROACH (Based on 2007P) UNDERVALUED CAPM Assumptions: Cost of Capital: 8.8% MULTIPLE APPROACH 2 YEAR 2 YEAR 2 YEAR 2 YEAR FORWARD FORWARD FORWARD FORWARD P/E P/CF P/SALES EV/EBITDA (Industry (Industry (Industry -

Mauritania - Senegal: an Emerging New African Gas Province – Is It Still Possible?

October 2020 Mauritania - Senegal: an emerging New African Gas Province – is it still possible? OIES PAPER: NG163 Mostefa Ouki, Senior Research Fellow, OIES The contents of this paper are the author’s sole responsibility. They do not necessarily represent the views of the Oxford Institute for Energy Studies or any of its members. Copyright © 2020 Oxford Institute for Energy Studies (Registered Charity, No. 286084) This publication may be reproduced in part for educational or non-profit purposes without special permission from the copyright holder, provided acknowledgment of the source is made. No use of this publication may be made for resale or for any other commercial purpose whatsoever without prior permission in writing from the Oxford Institute for Energy Studies. ISBN 978-1-78467-165-5 DOI: https://doi.org/10.26889/9781784671655 i Contents Contents .................................................................................................................................................. ii Tables ...................................................................................................................................................... ii Preface .................................................................................................................................................... 1 INTRODUCTION ..................................................................................................................................... 3 NATURAL GAS POTENTIAL ................................................................................................................. -

Redstone Commodity Update Q3

Welcome to the Redstone Commodity Update 2020: Q3 Welcome to the Redstone Commodity Moves Update Q3 2020, another quarter in a year that has been strongly defined by the pandemic. Overall recruitment levels across the board are still down, although we have seen some pockets of hiring intent. There appears to be a general acknowledgement across all market segments that growth must still be encouraged and planned for, this has taken the form in some quite senior / structural moves. The types of hires witnessed tend to pre-empt more mid-junior levels hires within the same companies in following quarters, which leaves us predicting a stronger than expected finish to Q4 2020 and start to Q1 2021 than we had previously planned for coming out of Q2. The highest volume of moves tracked fell to the energy markets, notably, within power and gas and not within the traditional oil focused roles, overall, we are starting to see greater progress towards carbon neutrality targets. Banks such as ABN, BNP and SocGen have all reduced / pulled out providing commodity trade finance, we can expect competition for the acquiring of finance lines to heat up in the coming months until either new lenders step into the market or more traditional lenders swallow up much of the market. We must also be aware of the potential impact of the US elections on global trade as countries such as Great Britain and China (amongst others) await the outcome of the impending election. Many national trade strategies and corporate investment strategies will hinge on this result in a way that no previous election has. -

ANNUAL REPORT and ACCOUNTS 2018 Gem Diamonds Is a Leading Producer of High-Value Diamonds

ANNUAL REPORT AND ACCOUNTS 2018 Gem Diamonds is a leading producer of high-value diamonds The Group, which has its head office in the United Kingdom, owns the Letšeng mine in Lesotho and the Ghaghoo mine in Botswana. The Letšeng mine is renowned for its regular On the cover, the 910 carat Lesotho production of large, exceptional white diamonds, making it the Legend recovered in January 2018, highest average dollar per carat kimberlite diamond mine in largest gem quality diamond ever recovered at Letšeng. the world. Since Gem Diamonds acquired the mine in 2006, Letšeng has produced some of the world’s most remarkable Welcome to the Gem diamonds. Among these diamonds recovered are the 910 carat Diamonds Annual Report Lesotho Legend, the 603 carat Lesotho Promise, the 550 carat and Accounts 2018 Letšeng Star and the 493 carat Letšeng Legacy. The Annual Report and Accounts have been prepared in accordance Gem Diamonds’ strategy is underpinned by three key priorities with: to deliver maximum value for all shareholders through its – applicable English and British Virgin Islands law; business cycle. Its current focus is on enhancing the efficiency – regulations and best practice as of the Group’s operations by improving day-to-day advised by the Financial performance, driving stringent cost control and capital Reporting Council and the discipline; and selling non-core assets. The selling of diamonds Department of Business, is supported by the Group’s sales, marketing and manufacturing Innovation and Skills in the United Kingdom; and capabilities. Financial, technical and administrative services are – International Financial supported by its South African subsidiary. -

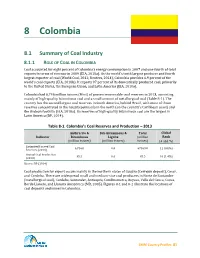

Chapter 8: Colombia

8 Colombia 8.1 Summary of Coal Industry 8.1.1 ROLE OF COAL IN COLOMBIA Coal accounted for eight percent of Colombia’s energy consumption in 2007 and one-fourth of total exports in terms of revenue in 2009 (EIA, 2010a). As the world’s tenth largest producer and fourth largest exporter of coal (World Coal, 2012; Reuters, 2014), Colombia provides 6.9 percent of the world’s coal exports (EIA, 2010b). It exports 97 percent of its domestically produced coal, primarily to the United States, the European Union, and Latin America (EIA, 2010a). Colombia had 6,746 million tonnes (Mmt) of proven recoverable coal reserves in 2013, consisting mainly of high-quality bituminous coal and a small amount of metallurgical coal (Table 8-1). The country has the second largest coal reserves in South America, behind Brazil, with most of those reserves concentrated in the Guajira peninsula in the north (on the country’s Caribbean coast) and the Andean foothills (EIA, 2010a). Its reserves of high-quality bituminous coal are the largest in Latin America (BP, 2014). Table 8-1. Colombia’s Coal Reserves and Production – 2013 Anthracite & Sub-bituminous & Total Global Indicator Bituminous Lignite (million Rank (million tonnes) (million tonnes) tonnes) (# and %) Estimated Proved Coal 6,746.0 0.0 67469.0 11 (0.8%) Reserves (2013) Annual Coal Production 85.5 0.0 85.5 10 (1.4%) (2013) Source: BP (2014) Coal production for export occurs mainly in the northern states of Guajira (Cerrejón deposit), Cesar, and Cordoba. There are widespread small and medium-size coal producers in Norte de Santander (metallurgical coal), Cordoba, Santander, Antioquia, Cundinamarca, Boyaca, Valle del Cauca, Cauca, Borde Llanero, and Llanura Amazónica (MB, 2005).