Vedanta Resources Plc Annual Report and Accounts FY2015 V E D Anta R

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Profitable and Untethered March to Global Resource Dominance!

Athens Journal of Business and Economics X Y GlencoreXstrata… The Profitable and Untethered March to Global Resource Dominance! By Nina Aversano Titos Ritsatos† Motivated by the economic causes and effects of their merger in 2013, we study the expansion strategy deployment of Glencore International plc. and Xstrata plc., before and after their merger. While both companies went through a series of international acquisitions during the last decade, their merger is strengthening effective vertical integration in critical resource and commodity markets, following Hymer’s theory of internationalization and Dunning’s theory of Eclectic Paradigm. Private existence of global dominant positioning in vital resource markets, posits economic sustainability and social fairness questions on an international scale. Glencore is alleged to have used unethical business tactics, increasing corruption, tax evasion and money laundering, while attracting the attention of human rights organizations. Since the announcement of their intended merger, the company’s market performance has been lower than its benchmark index. Glencore’s and Xstrata’s economic success came from operating effectively and efficiently in markets that scare off risk-averse companies. The new GlencoreXstrata is not the same company anymore. The Company’s new capital structure is characterized by controlling presence of institutional investors, creating adherence to corporate governance and increased monitoring and transparency. Furthermore, when multinational corporations like GlencoreXstrata increase in size attracting the attention of global regulation, they are forced by institutional monitoring to increase social consciousness. When ensuring full commitment to social consciousness acting with utmost concern with regard to their commitment by upholding rules and regulations of their home or host country, they have but to become “quasi-utilities” for the global industry. -

EUROZINC MINING CORPORATION TAKEOVER PROPOSAL for VEDANTA RESOURCES Plc

Private and Confidential August 28, 2006 EUROZINC MINING CORPORATION TAKEOVER PROPOSAL FOR VEDANTA RESOURCES plc TABLE OF CONTENTS Sl. No. Particulars Page No. I Market Data and Valuation Summary 1-1a II Key Financial and Operational Parameters at a Glance 2-5 III Basic Financial and Operational Data 6-8 IV Share Structure and Key Valuation Assumptions 9 V Background 10-11 VI Operations, Resources and Exploration 11-22 VII Industry Trend 23-34 VIII Peer Group Comparison Snapshots 35-42 IX Canada Base Metal Hot Deals 43-47 X EuroZinc and Lundin Merger Announcement 48-52 XI EuroZinc’s 2nd Qtr Management’s Discussion & Analysis (Jun 06) 53-63 APPENDICES I EuroZinc’s 2nd Qtr Financial Report (Jun 06) 1-13 II EuroZinc’s Consolidated Financial Statements (2005-04) 1-29 III Lundin’s 2nd Qtr Financial Report (Jun 06) 1-26 IV Lundin’s Financial Statements (2005-04) 1-57 Prepared By: Dr. S. S. Mohanty President & CEO SMART Intl. Holdings, Inc. Private & Confidential August 28, 2006 EUROZINC MINING CORPORATION MARKET DATA SUMMARY TSX (SYMBOL: EZM) AMEX (SYMBOL: EZM) CURRENT MARKET PRICE: (August 25, 52-Week High: 2006) CDN$ 3.49 /US$3.25 TSX: CDN$ 3.31 Low: AMEX: US$ 2.97 CDN$ 0.77/ US$1.05 STOCK RATING: MARKET OUTPERFORMER INDUSTRY OUTPERFORMER EZM VS. S&P TSX COMPOSITE EZM VS. S&P TSX CAPPED MATERIALS VALUATION SUMMARY MARKET MULTIPLE APPROACH (Based on 2007P) UNDERVALUED CAPM Assumptions: Cost of Capital: 8.8% MULTIPLE APPROACH 2 YEAR 2 YEAR 2 YEAR 2 YEAR FORWARD FORWARD FORWARD FORWARD P/E P/CF P/SALES EV/EBITDA (Industry (Industry (Industry -

Redstone Commodity Update Q3

Welcome to the Redstone Commodity Update 2020: Q3 Welcome to the Redstone Commodity Moves Update Q3 2020, another quarter in a year that has been strongly defined by the pandemic. Overall recruitment levels across the board are still down, although we have seen some pockets of hiring intent. There appears to be a general acknowledgement across all market segments that growth must still be encouraged and planned for, this has taken the form in some quite senior / structural moves. The types of hires witnessed tend to pre-empt more mid-junior levels hires within the same companies in following quarters, which leaves us predicting a stronger than expected finish to Q4 2020 and start to Q1 2021 than we had previously planned for coming out of Q2. The highest volume of moves tracked fell to the energy markets, notably, within power and gas and not within the traditional oil focused roles, overall, we are starting to see greater progress towards carbon neutrality targets. Banks such as ABN, BNP and SocGen have all reduced / pulled out providing commodity trade finance, we can expect competition for the acquiring of finance lines to heat up in the coming months until either new lenders step into the market or more traditional lenders swallow up much of the market. We must also be aware of the potential impact of the US elections on global trade as countries such as Great Britain and China (amongst others) await the outcome of the impending election. Many national trade strategies and corporate investment strategies will hinge on this result in a way that no previous election has. -

Chapter 8: Colombia

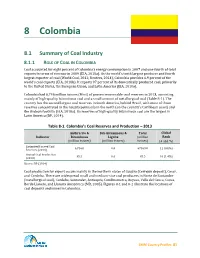

8 Colombia 8.1 Summary of Coal Industry 8.1.1 ROLE OF COAL IN COLOMBIA Coal accounted for eight percent of Colombia’s energy consumption in 2007 and one-fourth of total exports in terms of revenue in 2009 (EIA, 2010a). As the world’s tenth largest producer and fourth largest exporter of coal (World Coal, 2012; Reuters, 2014), Colombia provides 6.9 percent of the world’s coal exports (EIA, 2010b). It exports 97 percent of its domestically produced coal, primarily to the United States, the European Union, and Latin America (EIA, 2010a). Colombia had 6,746 million tonnes (Mmt) of proven recoverable coal reserves in 2013, consisting mainly of high-quality bituminous coal and a small amount of metallurgical coal (Table 8-1). The country has the second largest coal reserves in South America, behind Brazil, with most of those reserves concentrated in the Guajira peninsula in the north (on the country’s Caribbean coast) and the Andean foothills (EIA, 2010a). Its reserves of high-quality bituminous coal are the largest in Latin America (BP, 2014). Table 8-1. Colombia’s Coal Reserves and Production – 2013 Anthracite & Sub-bituminous & Total Global Indicator Bituminous Lignite (million Rank (million tonnes) (million tonnes) tonnes) (# and %) Estimated Proved Coal 6,746.0 0.0 67469.0 11 (0.8%) Reserves (2013) Annual Coal Production 85.5 0.0 85.5 10 (1.4%) (2013) Source: BP (2014) Coal production for export occurs mainly in the northern states of Guajira (Cerrejón deposit), Cesar, and Cordoba. There are widespread small and medium-size coal producers in Norte de Santander (metallurgical coal), Cordoba, Santander, Antioquia, Cundinamarca, Boyaca, Valle del Cauca, Cauca, Borde Llanero, and Llanura Amazónica (MB, 2005). -

Most Environmentally and Socially Controversial Companies of 2010 Zurich, December 15, 2010 / Karen Reiner

Most Environmentally and Socially Controversial Companies of 2010 Zurich, December 15, 2010 / Karen Reiner According to the reputational risk radar RepRisk, the top ten most environmentally and socially controversial multinational companies in 2010 were: 1. Transocean Ltd 6. Chevron Corp 2. BP PLC 7. BG Group PLC 3. Vedanta Resources PLC 8. Royal Dutch Shell 4. ExxonMobil Corp 9. Sinar Mas Group 5. Foxconn Electronics Inc 10. Magyar Aluminium (MAL) Companies on the list have been severely criticized by the world’s media, governmental organizations and NGOs for issues including human rights abuses, severe environmental violations, impacts on local communities, corruption and bribery, as well as breaches of labor, and health and safety standards. Rankings are based on the Reputational Risk Index (RRI), as measured by RepRisk throughout 2010. The RRI is directly derived from the negative pr ess captured by RepRisk and its calculation is strictly rule-based. RepRisk does not measure a firm's overall reputation. Instead, by capturing criticism, RepRisk computes a firm's exposure to controversy and therefore provides an indicator for reputational risk. RepRisk is used by asset owners and asset managers, commercial and investment bankers, supply chain managers, and corporate responsibility experts. The Reputational Risk Index (RRI) ranges from zero (lowest) to 100 (highest) and its calculation is based on the reach of news sources, the frequency and timing of news, as well as its content, i.e. severity and novelty of the issues addressed. The RRI is an indicator of a company's exposure to controversial issues and allows an initial assessment of risks that are attached to investments and business relationships. -

Printmgr File

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take, you are recommended immediately to seek your own personal financial advice from your stockbroker, bank manager, solicitor, accountant or other independent financial adviser authorised under the Financial Services and Markets Act 2000. If you have sold or otherwise transferred all of your shares in Cairn Energy PLC, you should pass this document, the accompanying form of proxy and the Annual Report and Accounts of Cairn Energy PLC for the financial year ended 31 December 2016 without delay to the stockbroker, bank or other person who arranged the sale or transfer so they can pass these documents to the person who now holds the shares. CAIRN ENERGY PLC (incorporated in Scotland with registered number SC226712) Notice of Annual General Meeting Proposed New Long Term Incentive Plan and Proposed renewal of authority to dispose of or reduce the Group’s residual interest in Cairn India This document should be read as a whole and in conjunction with the accompanying Form of Proxy. Your attention is drawn to the letter from the Chairman of Cairn which is set out in Part I of this document recommending, on behalf of the Directors, that you vote in favour of the resolutions to be proposed at the Annual General Meeting referred to below. Notice of the 2017 Annual General Meeting of Cairn to be held in the Castle Suite of The Caledonian, a Waldorf Astoria Hotel, Princes Street, Edinburgh EH1 2AB at 12.00 noon (BST) on Friday 19 May 2017, is set out at the end of this document. -

(Volcan) and Vedanta Resources Limit

Further Clarification in relation to the transaction with Volcan Volcan Investments Limited (Volcan) and Vedanta Resources Limited, the parent companies of Vedanta Limited, holding more than 50%, have played a significant role in shaping and building Vedanta Limited businesses in a visionary and entrepreneurial manner. Volcan owns a 21% stake (voting interest) in Anglo American Plc (AA Plc). AA Plc is a globally diversified mining business that comprises of De Beers (largest diamond producer), copper, platinum and other precious metals, iron ore, coal and nickel. Cairn India Holdings Limited (CIHL), an overseas subsidiary of the Company, was offered the opportunity by Volcan to invest some of its surplus cash resources in a structured investment representing the economic interest in upside potential of ~24.71 million shares (~1.8% of outstanding shares) of AA Plc. The structure provides significantly higher returns compared to other overseas cash management investments that would typically return around 2%. After careful consideration of the risk adjusted returns of this opportunity relative to other available investments, it elected to invest a portion (which is less than 5% of Group’s cash and cash equivalent of around US$5.0bn) of its available cash resources, as part of its cash management activity. The ownership of the underlying shares, and the associated voting interest, remains with Volcan. The investment now has full capital and downside protection to ensure that the interests of Vedanta Limited shareholders’ are protected. The investment was made on an arm’s length basis in December 2018, after meeting all governance requirements. The economic interest was valued by an independent valuer and approved by the boards of CIHL and Vedanta Ltd. -

VRPLC Results Presentation FY2019.Pdf

Cautionary Statement and Disclaimer The views expressed here may contain information derived from statement involves risk and uncertainties, and that, although we publicly available sources that have not been independently verified. believe that the assumption on which our forward-looking statements are based are reasonable, any of those assumptions No representation or warranty is made as to the accuracy, could prove to be inaccurate and, as a result, the forward-looking completeness, reasonableness or reliability of this information. Any statement based on those assumptions could be materially forward looking information in this presentation including, without incorrect. limitation, any tables, charts and/or graphs, has been prepared on the basis of a number of assumptions which may prove to be This presentation is not intended, and does not, constitute or form incorrect. This presentation should not be relied upon as a part of any offer, invitation or the solicitation of an offer to recommendation or forecast by Vedanta Resources plc and Vedanta purchase, otherwise acquire, subscribe for, sell or otherwise dispose Limited and any of their subsidiaries. Past performance of Vedanta of, any securities in Vedanta Resources plc and Vedanta Limited and Resources plc and Vedanta Limited and any of their subsidiaries any of their subsidiaries or undertakings or any other invitation or cannot be relied upon as a guide to future performance. inducement to engage in investment activities, nor shall this presentation (or any part of it) nor the fact of its distribution form This presentation contains 'forward-looking statements' – that is, the basis of, or be relied on in connection with, any contract or statements related to future, not past, events. -

Emerging Players in Global Mining Public Disclosure Authorized Public Disclosure Authorized

Extractive Industries and Development48882 Series #5 June 2009 Public Disclosure Authorized Emerging Players in Global Mining Public Disclosure Authorized Public Disclosure Authorized Dr. David Humphreys The World Bank 1818 H Street, N.W. Washington, D.C. 20433 USA www.worldbank.org/ogmc (OR /oil OR /gas OR /mining) Public Disclosure Authorized www.ifc.org/ogmc (OR /oil OR /gas OR /mining) World Bank Group’s Oil, Gas, and Mining Policy Division Oil, Gas, Mining, and Chemicals Department A joint service of the World Bank and the International Finance Corporation The Oil, Gas, and Mining Policy Division series publishes reviews and analyses of sector experience from around the world as well as new findings from analytical work. It places particular emphasis on how the experience and knowledge gained relates to developing country policy makers, communities affected by extractive industries, extractive industry enterprises, and civil society organizations. We hope to see this series inform a wide range of interested parties on the opportunities as well as the risks presented by the sector. The findings, interpretations, and conclusions expressed in this paper are entirely those of the authors and should not be attributed in any manner to the World Bank or its affiliated organizations, or to members of its Board of Executive Directors or the countries they represent. The World Bank does not guarantee the accuracy of the data included in this publication and accepts no responsibility whatsoever for any consequence of their use. Extractive Industries -

TMEC-Annual-Report-201617.Pdf

TMEC | Annual Report 2016/17 CONTENTS President’s Report Connecting Tasmanian Manufacturers – Ray Mostogl .....................................................5 to the World .......................................................20 CEO’s Report Portal Profile: – Wayne Bould....................................................6 Currawong Engineering Pty Ltd .................21 Energy Report Combined Experience – Ray Mostogl .....................................................7 Delivers Product Improvements ................22 Occupational Health and Safety Report METS Ignited Encourages – Peter Walker .....................................................8 Collaboration ....................................................23 Land Management Report Ensuring Mining Sector Innovation ..........24 – Cassie Arnold ...................................................9 Industry Challenged to Take a Advanced Manufacturing Report New Look at ‘Safety’ ......................................25 – Kelly Elphinstone .................................. 10 - 11 Diversity and Inclusion: Environment Report Good for Business ............................................26 – Mark Wright ....................................................11 2016-17 Financials .................................. 27 - 32 Emergency Response Report – Ben Maynard .......................................... 12 - 13 Board of Directors ................................... 33 - 36 Simulated Work Environment Opens its List of Members ........................................ 37 - 38 Doors to -

Mineral Resources Tasmania Annual Review 2007/2008

Mineral Resources Tasmania Department of Infrastructure, Energy and Resources A Division of the Department of Infrastructure, Energy and Resources Mineral Resources Tasmania Annual Review 2007/2008 Mineral Resources Tasmania PO Box 56 Rosny Park Tasmania 7018 Phone: (03) 6233 8377 l Fax: (03) 6233 8338 Email: [email protected] l Internet: www.mrt.tas.gov.au 2 Mineral Resources Tasmania Mineral Resources Tasmania (MRT) is a Division of the Department of Infrastructure, Energy and Resources (DIER). It is Tasmania’s corporate entity for geoscientific data, information and knowledge, and consists of a multi-tasking group of people with a wide range of specialist experience. The role of MRT is to ensure that Tasmania’s mineral resources and infrastructure development are managed in a sustainable way now, and for future generations, in accordance with present Government Policy, Partnership Agreements and goals of Tasmania Together. — Mission — ! To contribute to the economic development of Tasmania by providing the necessary geoscientific information and services to foster mineral resource and infrastructure development and responsible land management for the benefit of the Tasmanian community — Objectives — ! Benefit the Tasmanian community by an effective and co-ordinated government approach to mineral resources, infrastructure development and land management. ! Maximise the opportunities for community growth by providing timely and relevant geoscientific information for integration with other government systems. ! Optimise the operational -

The Weir Minerals Mill Circuit Solution Optimise Operations and Minimise Downtime

THE WEIR MINERALS MILL CIRCUIT SOLUTION OPTIMISE OPERATIONS AND MINIMISE DOWNTIME motralec 4 rue Lavoisier . ZA Lavoisier . 95223 HERBLAY CEDEX Tel. : 01.39.97.65.10 / Fax. : 01.39.97.68.48 Demande de prix / e-mail : [email protected] www.motralec.com Decreasing throughput. Interrupted fl ow. Unrealised potential. When your job is to micromanage movement, your equipment must function seamlessly. You depend on each piece of your circuit to work as one. You demand reliable starts and continuous “ We view our products in the same way The Weir Minerals Mill Circuit Solution is a combination of as our customers, seeing them not in processing—anything less than swift and steady is unacceptable. fi ve performance-leading brands, each with an exceptional isolation, but as part of a chain. In doing success record. KHD® high pressure grinding rolls, Warman® pumps, this, we recognise that a chain—the Vulco® wear resistant linings, Cavex® hydrocyclones and Isogate® valves create the solution you can count on to deliver more durability, customer’s process—is only as strong as improved throughput and less downtime. You can also count on its weakest link. This philosophy ensures technically led and quality assured complete management service that we address the areas that cost the throughout the life of your operation. Why the Weir Minerals Mill Circuit Solution? customer time and money. Our specialist We know that vital factors, including water levels, play a approach to these critical applications Because you’re only as strong as your weakest link. critical role in throughput and output. Weir Minerals offers means that all our development time and Floway® vertical turbine pumps, which work seamlessly in the circuit effort ensures that we deliver maximum For more than 75 years Weir Minerals has perfected the delivery and support of mill for many types of applications.