Delta Air Lines, Inc.; Rule 14A-8 No-Action Letter

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Aircraft Noise and Operations Report 2014 Bi-Annual Summary January – June

Aircraft Noise and Operations Report 2014 Bi-Annual Summary January – June Cincinnati/Northern Kentucky International Airport AIRCRAFT NOISE AND OPERATIONS REPORT 2014 BI-ANNUAL SUMMARY JANUARY - JUNE Table of Contents and Summary of Reports Aircraft Noise Report Page 1 This report details the locations of all complaints for the reporting period. Comparisons include state, county and areas within each county. Quarterly & Annual Comparison of Complaints Page 2 This report shows the trends of total complaints comparing the previous five years by quarter to the current year. Complaints by Category Page 3 Complaints received for the reporting period are further detailed by fourteen types of complaints, concerns or questions. A complainant may have more than one complaint, concern or question per occurrence. Complaint Locations and Frequent Complainants Page 4 This report shows the locations of the complainants on a map and the number of complaints made by the most frequent/repeat complainants for the reporting period. Total Runway Usage - All Aircraft Page 5 This report graphically shows the total number and percentage of departures and arrivals on each runway for the reporting period. Nighttime Usage by Large Jets Page 6 This report graphically shows the total number and percentage of large jet departures and arrivals on each runway during the nighttime hours of 10:00 p.m. to 7:00 a.m. for the reporting period. Nighttime Usage by Small Jets and Props Page 7 This report graphically shows the total number and percentage of small jet and prop departures and arrivals on each runway during the nighttime hours of 10:00 p.m. -

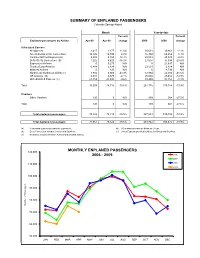

APR 2009 Stats Rpts

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Apr-09 Apr-08 change 2009 2008 change Scheduled Carriers Allegiant Air 2,417 2,177 11.0% 10,631 10,861 -2.1% American/American Connection 14,126 14,749 -4.2% 55,394 60,259 -8.1% Continental/Cont Express (a) 5,808 5,165 12.4% 22,544 23,049 -2.2% Delta /Delta Connection (b) 7,222 8,620 -16.2% 27,007 37,838 -28.6% ExpressJet Airlines 0 5,275 N/A 0 21,647 N/A Frontier/Lynx Aviation 6,888 2,874 N/A 23,531 2,874 N/A Midwest Airlines 0 120 N/A 0 4,793 N/A Northwest/ Northwest Airlink (c) 3,882 6,920 -43.9% 12,864 22,030 -41.6% US Airways (d) 6,301 6,570 -4.1% 25,665 29,462 -12.9% United/United Express (e) 23,359 25,845 -9.6% 89,499 97,355 -8.1% Total 70,003 78,315 -10.6% 267,135 310,168 -13.9% Charters Other Charters 120 0 N/A 409 564 -27.5% Total 120 0 N/A 409 564 -27.5% Total enplaned passengers 70,123 78,315 -10.5% 267,544 310,732 -13.9% Total deplaned passengers 71,061 79,522 -10.6% 263,922 306,475 -13.9% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

Delta Pilots' Scheduling Reference Handbook

Delta Pilots’ Scheduling Reference Handbook Prepared by the Delta MEC Scheduling Committee Revision 8 | October 2020 UPDATES Updated October 2020: • New contact information for the MEC Scheduling Committee • Reorganized entire document into sequential subject matter chapters • Added Table of Contents to each chapter • Added examples of common scenarios to When Have You Been Contacted? • Clarified references to eight-hour uninterrupted sleep opportunity • Deleted references to Special Incentive Lines (SIL) • Clarified references to ACARS notification of reroutes • Added references to ARCOS • Added references to ACARS notification of FDP extension • Updated information on fatigue calls and the Fitness Review Board • Incorporated information from recent Flight Time Duty Time Updates and Scheduling Alerts • Moved iCrew User Guide from Appendix to separate file in AeroDocs Contents Introduction 1 Can They Do That to Me? 2 When Have You Been Contacted? 4 You Have to Tell Someone 7 Timeline of Scheduling Events 9 Monthly Bidding Process 11 Regular Line Adjustment Process 18 Pilot Change Schedule (PCS), Slip Requests and Pay 19 Reserve 45 Reroute and Recovery Obligations 65 Flight and Duty Time Limits and Rest Requirements 73 Fatigue and the Fitness Review Board 103 Vacation 105 Training 115 Sick Leave 118 Staffing, Vacancies, and Surpluses 124 Odds and Ends 139 Airport Longitude Table 153 Appendix I: FAR 117 & IROPS Information 160 Appendix II: FAR 117 Quick Reference Guide (QRG) 169 Appendix III: FAR Part 117 – An In-Depth Discussion 177 Introduction The Scheduling Reference Handbook has been developed by the MEC Scheduling Committee to provide the line pilot with a quick and easy reference to various scheduling, FAR, and Pilot Working Agreement (PWA) rules and processes. -

2015 Fourth Quarter Management Discussion and Analysis

POINTS INTERNATIONAL LTD. MANAGEMENT'S DISCUSSION AND ANALYSIS INTRODUCTION The following management’s discussion and analysis (‘‘MD&A’’) of the performance and financial condition of Points International Ltd. and its subsidiaries (which are also referred to herein as “Points” or the “Corporation”) should be read in conjunction with the Corporation’s audited consolidated financial statements (including the notes thereto) for the years ended December 31, 2015 and 2014. Further information, including the Annual Information Form (“AIF”) and Form 40-F for the year ended December 31, 2015, may be accessed at www.sedar.com or www.sec.gov. All financial data herein has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and all dollar amounts herein are in thousands of United States dollars unless otherwise specified. This MD&A is dated as of March 2, 2016 and was reviewed by the Audit Committee and approved by the Corporation’s Board of Directors. FORWARD-LOOKING STATEMENTS This MD&A contains or incorporates forward-looking statements within the meaning of United States securities legislation and forward-looking information within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). These forward-looking statements relate to, among other things, revenue, earnings, changes in costs and expenses, capital expenditures and other objectives, strategic plans and business development goals, and may also include other statements that are predictive in nature, or that depend upon or refer to future events or conditions, and can generally be identified by words such as “may”, “will”, “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” or similar expressions. -

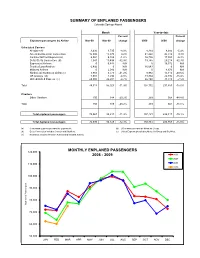

MAR 2009 Stats Rpts

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Mar-09 Mar-08 change 2009 2008 change Scheduled Carriers Allegiant Air 3,436 3,735 -8.0% 8,214 8,684 -5.4% American/American Connection 15,900 15,873 0.2% 41,268 45,510 -9.3% Continental/Cont Express (a) 6,084 6,159 -1.2% 16,736 17,884 -6.4% Delta /Delta Connection (b) 7,041 10,498 -32.9% 19,785 29,218 -32.3% ExpressJet Airlines 0 6,444 N/A 0 16,372 N/A Frontier/Lynx Aviation 6,492 0 N/A 16,643 0 N/A Midwest Airlines 0 2,046 N/A 0 4,673 N/A Northwest/ Northwest Airlink (c) 3,983 6,773 -41.2% 8,982 15,110 -40.6% US Airways (d) 7,001 7,294 -4.0% 19,364 22,892 -15.4% United/United Express (e) 24,980 26,201 -4.7% 66,140 71,510 -7.5% Total 74,917 85,023 -11.9% 197,132 231,853 -15.0% Charters Other Charters 150 188 -20.2% 289 564 -48.8% Total 150 188 -20.2% 289 564 -48.8% Total enplaned passengers 75,067 85,211 -11.9% 197,421 232,417 -15.1% Total deplaned passengers 72,030 82,129 -12.3% 192,861 226,953 -15.0% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

Columbus Regional Airport Authority

COLUMBUS REGIONAL AIRPORT AUTHORITY - PORT COLUMBUS INTERNATIONAL AIRPORT TRAFFIC REPORT June 2014 7/22/2014 Airline Enplaned Passengers Deplaned Passengers Enplaned Air Mail Deplaned Air Mail Enplaned Air Freight Deplaned Air Freight Landings Landed Weight Air Canada Express - Regional 2,377 2,278 - - - - 81 2,745,900 Air Canada Express Totals 2,377 2,278 - - - - 81 2,745,900 AirTran 5,506 4,759 - - - - 59 6,136,000 AirTran Totals 5,506 4,759 - - - - 59 6,136,000 American 21,754 22,200 - - - 306 174 22,210,000 Envoy Air** 22,559 22,530 - - 2 ,027 2 ,873 527 27,043,010 American Totals 44,313 44,730 - - 2,027 3,179 701 49,253,010 Delta 38,216 36,970 29,594 34,196 25,984 36,845 278 38,899,500 Delta Connection - ExpressJet 2,888 2,292 - - - - 55 3,709,300 Delta Connection - Chautauqua 15,614 14,959 - - 640 - 374 15,913,326 Delta Connection - Endeavor 4 ,777 4,943 - - - - 96 5,776,500 Delta Connection - GoJet 874 748 - - 33 - 21 1,407,000 Delta Connection - Shuttle America 6,440 7,877 - - 367 - 143 10,536,277 Delta Connection - SkyWest 198 142 - - - - 4 188,000 Delta Totals 69,007 67,931 29,594 34,196 27,024 36,845 971 76,429,903 Southwest 97,554 96,784 218,777 315,938 830 103,146,000 Southwest Totals 97,554 96,784 - - 218,777 315,938 830 103,146,000 United 3 ,411 3,370 13,718 6 ,423 1 ,294 8 ,738 30 3,990,274 United Express - ExpressJet 13,185 13,319 - - - - 303 13,256,765 United Express - Mesa 27 32 - - - - 1 67,000 United Express - Republic 4,790 5,133 - - - - 88 5,456,000 United Express - Shuttle America 9,825 9,076 - - - - 151 10,919,112 -

Loyalty Programs: the Vital Safety Feature for Airlines to Survive COVID-19

The current issue and full text archive of this journal is available on Emerald Insight at: https://www.emerald.com/insight/2516-8142.htm Airline loyalty Loyalty programs: the vital programs safety feature for airlines to survive COVID-19 Manuel E. Pascual Chaplin School of Hospitality and Tourism, Florida International University, Miami, Florida, USA, and Received 9 March 2021 Revised 13 April 2021 Lisa Nicole Cain Accepted 14 April 2021 Hospitality and Tourism Management, Florida International University Biscayne Bay Campus, North Miami, Florida, USA Abstract Purpose – The airline industry has been severely impacted by COVID-19 due to widespread travel restrictions. Its current response is crucial to ensure continued operations after the global pandemic is resolved. One resource the airlines are leveraging is loyalty programs. This study aims to examine the viability of leveraging loyalty programs in times of crisis. Design/methodology/approach – This study employs a case study methodology to examine how one company, American Airlines, has used its loyalty program to survive a pandemic and alleviate the financial costs associated with limited and restricted travel. Findings – American Airlines’ AAdvantage loyalty program structure may be used as a benchmark to understand how airlines can anchor their loyalty base to reinvigorate travel interest and use these programs as safeguards in critical instances that may arise in the future. Research limitations/implications – The case was bound by the fact that the pandemic was still a threat during the time of analysis. The findings of this case study go beyond the airline industry and may inform other hospitality and tourism organizations on the benefits of loyalty programs in times of financial distress. -

Fly Quiet Program Chicago O’Hare International Airport

2nd Quarter 2016 Report Fly Quiet Program Chicago O’Hare International Airport Visit the O’Hare Noise Webpage on the Internet at www.flychicago.com/ORDNoise nd 2 Quarter 2016 Report Background On June 17, 1997, the City of Chicago announced that airlines operating at O’Hare International Airport had agreed to use designated noise abatement flight procedures in accordance with the Fly Quiet Program. The Fly Quiet Program was implemented in an effort to further reduce the impacts of aircraft noise on the surrounding neighborhoods. The Fly Quiet Program is a voluntary program that encourages pilots and air traffic controllers to use designated nighttime preferential runways and flight tracks developed by the Chicago Department of Aviation in cooperation with the O'Hare Noise Compatibility Commission, the airlines, and the air traffic controllers. These preferred routes direct aircraft over less-populated areas, such as forest preserves, highways, as well as commercial and industrial areas. As part of the Fly Quiet Program, the Chicago Department of Aviation prepares a Quarterly Fly Quiet Report. This report is shared with Chicago Department of Aviation officials, the O'Hare Noise Compatibility Commission, the airlines, and the general public. The Fly Quiet Report contains detailed information regarding nighttime runway use, flight operations, flight tracks, and noise complaints and 24-hour tracking of ground run-ups. The data presented in this report is compiled from the Airport Noise Management System (ANMS) and airport operation logs. Operations O’Hare has seven runways that are all utilized at different times depending on a number of conditions including weather, airfield pavement and construction activities and air traffic demand. -

October 2015

Sacramento International Airport Airline Passenger Statistics October 2015 CURRENT MONTH FISCAL YEAR TO DATE CALENDAR YEAR TO DATE THIS YEAR LAST YEAR % + / ( - ) 2015/16 2014/15 % + / ( - ) 2015 2014 % + / ( - ) Enplaned Domestic Alaska Airlines 24,314 21,483 13.2% 106,593 98,546 8.2% 251,752 212,805 18.3% American Airlines 52,119 39,179 33.0% 204,837 171,926 19.1% 468,408 293,818 59.4% Compass/Delta Connection 4,011 264 1419.3% 28,336 4,672 506.5% 60,380 6,008 905.0% Delta Airlines 27,687 22,989 20.4% 115,413 108,854 6.0% 250,314 238,737 4.8% Hawaiian Airlines 7,612 7,248 5.0% 28,912 28,161 2.7% 70,769 69,253 2.2% Horizon Air 9,042 8,841 2.3% 38,720 37,124 4.3% 92,142 93,294 (1.2%) Jet Blue 11,573 11,687 (1.0%) 50,834 47,714 6.5% 116,071 110,678 4.9% Seaport 152 - 758 - 1,821 - Skywest/Delta Connection 16,963 11,234 51.0% 54,574 47,136 15.8% 117,840 123,133 (4.3%) Skywest/United Express 15,280 14,803 3.2% 54,418 55,562 (2.1%) 122,979 132,634 (7.3%) Southwest 223,974 207,538 7.9% 870,384 829,518 4.9% 2,088,327 1,967,043 6.2% United Airlines 30,551 31,710 (3.7%) 132,173 129,688 1.9% 295,264 304,007 (2.9%) US Airways - - - - - 126,710 (100.0%) CHARTER - 193 (100.0%) - 193 (100.0%) - 1,308 (100.0%) 423,278 377,169 12.2% 1,685,952 1,559,094 8.1% 3,936,067 3,679,428 7.0% International AeroMexico 3,800 3,588 5.9% 17,860 14,129 26.4% 41,801 34,032 22.8% Volaris 2,639 1,723 53.2% 11,736 10,312 13.8% 29,743 24,615 20.8% CHARTER - - - - - 869 (100.0%) 6,439 5,311 21.2% 29,596 24,441 21.1% 71,544 59,516 20.2% Total Enplaned 429,717 382,480 12.4% -

Ideaworks Announces Client Relationships in the Travel and Cons

Contact: Jay Sorensen For inquiries: 414-961-1939 Jay @ IdeaworksCompany.com Southwest, JetBlue Lead Average Reward Price Rankings Among Five Major US Frequent Flyer Programs Switchfly Reward Seat Availability Survey finds that pay-with-points change still yields similar reward price rankings. August 22, 2016, Shorewood, Wisconsin ─ Low-cost carriers Southwest and JetBlue continue to offer US flyers the lowest average reward seat pricing, despite an industry shift to dollar-based rather than mileage-based loyalty points accrual. The rankings for the two airlines mirror the results from 2015—and from the year before, when miles flown was the universal accrual method. These findings derive from the IdeaWorksCompany annual Switchfly Reward Seat Availability Survey. In May the firm released reward seat availability rankings for 25 of the world’s largest airlines. Today's analysis features average reward prices associated with US frequent flyer programs that use ticket prices, rather than miles flown, as an accrual method. Among these programs, the pay-with-points method used by Southwest and JetBlue yielded lower prices for short and medium haul reward travel. Until recently, American, Delta, and United based accrual on the distance flown—like most major airlines around the world. Now this is changing to a revenue-based method similar to JetBlue and Southwest. Among low economy fare passengers, who don’t have elite tier status, JetBlue's TrueBlue and Southwest's Rapid Rewards programs offer higher accrual at 6 points per dollar compared to the rate of 5 miles per dollar offered by the others. This is combined with lower average reward prices, Southwest being the lowest at 10,182 points per roundtrip reward. -

Columbus Regional Airport Authority

COLUMBUS REGIONAL AIRPORT AUTHORITY - PORT COLUMBUS INTERNATIONAL AIRPORT TRAFFIC REPORT October 2014 11/25/2014 Airline Enplaned Passengers Deplaned Passengers Enplaned Air Mail Deplaned Air Mail Enplaned Air Freight Deplaned Air Freight Landings Landed Weight Air Canada Express 1,784 2,085 - - - - 86 2,915,400 Air Canada Express Totals 1,784 2,085 - - - - 86 2,915,400 AirTran - - - - - - - - AirTran Totals - - - - - - - - American 19,482 19,533 - - 613 37,006 168 21,216,500 Envoy Air** 22,618 22,842 - - 2 ,274 916 578 29,918,100 American Totals 42,100 42,375 - - 2,887 37,922 746 51,134,600 Delta 40,094 40,220 79,582 55,614 41,659 26,618 318 44,840,300 Delta Connection - ExpressJet 92 172 - - - - 3 201,000 Delta Connection - Chautauqua 13,557 13,377 - - 234 - 365 15,530,385 Delta Connection - Compass - - - - - - - - Delta Connection - Endeavor 4 ,073 3,542 - - - - 92 4,492,600 Delta Connection - GoJet 1,083 1,159 - - 173 26 1,742,000 Delta Connection - Shuttle America 9,341 10,062 170 - 312 - 198 14,531,904 Delta Connection - SkyWest - - - - - - - - Delta Totals 68,240 68,532 79,752 55,614 42,378 26,618 1,002 81,338,189 Frontier - - - - - - - - Frontier Airlines Totals - - - - - - - - Southwest 86,752 84,785 - - 287,282 354,440 757 94,318,000 Southwest Totals 86,752 84,785 - - 287,282 354,440 757 94,318,000 United 3,731 4,024 - - 33 4,177,800 United Express - Chautauqua - - - - - - - - United Express - CommutAir - - - - - - - - United Express - ExpressJet 11,202 10,481 - - - - 248 10,877,831 United Express - Mesa 4,451 4,345 - - - - -

POINTS INTERNATIONAL LTD. (Translation of Registrant's Name Into English)

OMB APPROVAL OMB Number: 3235-0116 Expires: March 31, 2011 Estimated average burden hours per response 8.7 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 6-K REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934 For the month of September, 2010 Commission File Number 000-51509 POINTS INTERNATIONAL LTD. (Translation of registrant's name into English) 171 John Street, 5th Floor, Toronto, Ontario, M5T 1X3, Canada (Address of principal executive offices) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F [X] Form 40-F [ ] Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ] Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders. Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ] Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.