Annual Report 2010 Annual Report 2010

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

News Release

International Mathematical Modeling Challenge Committee (Zhonghua) 中 華 國 際 數 學 建 模 挑 戰 賽 委 員 會 _______________________________________________________________________________________ NEWS RELEASE THE REGIOAL ROUND OF IMMC 2017 FOR THE REGION OF MAINLAND CHINA, TAIWAN, HONG KONG, AND MACAU SENT ITS 120 TEAMS SELECTED TO PROCEED TO THE INTERNATIONAL ROUND We are pleased to announce the results of the Paper Review of the 3nd Annual International Mathematical Modeling Challenge (IMMC 2017) Regional Round for Mainland China, Taiwan, Hong Kong and Macau (the Region). There are 120 teams selected from the Region winning qualification to advance to the International Round which will be conducted during March 31- April 5 2017. Based on the judgement of the Paper Review by the Expert Panel, representative top teams will be invited to attend the Presentation Competition with their solution papers to be held April 27-28 at the Hong Kong University of Science and Technology. All teams who submit papers will be designated with recognition certificate in early May after the results of Presentation Competition come out. Each team who accomplished their solution paper is a true winner. The Committee congratulate them and their teacher advisor with pride and respect! Teams Qualified to Advance to IMMC 2017 International Round (in ascending order of control number, excluding the code “IMMC17”) 26321 Kaohsiung Municipal Kaohsiung Senior High School 63363 Yuen Long Public Secondary School 63562 Shenzhen Middle School 63728 Bao Gang No.1 high school 105584 -

Greater China Scholars Program

UNIVERSITY OF NOTRE DAME Greater China Scholars Program 大中华奖学金项目 2 // UNIVERSITY OF NOTRE DAME Thanks to the generous support provided by the Notre Dame family of alumni, parents, and friends, the Greater China Scholars Program has been able to grow and flourish since its inception in 2011. The University of Notre Dame is grateful to the Li Ka Shing Foundation for its critical role in establishing the Greater China Scholars Program. We are also grateful to Our Lady of Perpetual Succor Global Endowment for Excellence, Frank Reilly Endowment for Excellence, the HS Chau Foundation , the Huang Family Endowment for Excellence, Westfield Outdoor Endowment for Excellence, and the Dr. GU Yijian Greater China Scholars Program Endowment for Excellence for generously supporting the Greater China Scholars Program. The Greater China Scholars Program is thankful to the Office of the Provost and the Brennan Endowment for Excellence for their support of the scholars. This funding, provided by generous benefactors, alumni, and parents, will guarantee that this Program continues to support the University of Notre Dame’s important relationship with Greater China in perpetuity. 自2011年建立以来,大中华奖学金项目很幸运得到圣母大家庭中的校友、家长和朋 友们的慷慨支持,蓬勃发展。 非常感谢李嘉诚基金会的鼎力相助,圣母大学得以建立大中华奖学金项目。我们 也对永援圣母全球卓越基金、弗兰克•雷利卓越基金、周凱旋基金會、黄氏家族卓越基 金、西菲尔德户外卓越基金和顾以健博士卓越基金对大中华奖学金项目的慷慨支持表 示衷心感谢。 大中华奖学金项目感谢常务校长办公室和布伦南卓越基金对大中华学者们的支持。 由慷慨的资助人、校友和家长捐赠的这些资金,将会保障大中华奖学金项目永久支 持圣母大学和大中华地区的重要关系。 Global Scholars Circle 全球学者集团 The Li Ka Shing Foundation Francis & Grace Leung Lu Sun 李嘉诚基金会 梁伯韜夫婦 孙璐 International -

TSG 23: Visualization in the Teaching and Learning of Mathematics. Class

TSG 23 Agenda TSG 23: Visualization in the Teaching and Learning of Mathematics. Class: A Session 1 (July 13, 14:30 – 16:30) 14:30 – 14:50 Welcome and introduction - Setting the scene: Visualization and problem-solving 1. 14:50─15:06 FERDINANDO ARZARELLO, Cristina Sabena, Carlotta Soldano (University of Turin, Torino, Italy). IMAGING AND VISUALIZING IN GEOMETRY: EXPLORATIONS BY MATHEMATICS UNIVERSITY STUDENTS 2. 15:06─15:22 BEATA DONGWI, Marc Schäfer (Rhodes University, Windhoek, South Africa). VISUALIZATION AS AN EMBODIED PROBLEM-SOLVING PROCESS 3. 15:22 – 15: 38 LEAH MICHELLE FRAZEE, Michael Battista (Central Connecticut State University, US). Characterizing visualization and spatial analytic reasoning for solving isometry problems 4. 15:38 –15:54 DENNIS LEE JARVIS BARING YBANEZ, Catherine Vistro Yu (Ateneo de Manila University, Quezon City, Philippines). THE ROLE OF VISUALIZATION TOWARDS STUDENT'S MATHEMATICAL ABSTRACTION AND REPRESENTATION IN SOLVING PROBABILITIES 15: 54 – 15:58 Introduction to the theme: Classroom interaction 5. 15:58 – 16: 14 CLEMENCE CHIKIWA, Marc Schäfer (RHODES UNIVERSITY, Grahamstown, South Africa). THE USE OF GESTURES AND LANGUAGE AS CO-EXISTING VISUALISATION TEACHING TOOLS IN MULTILINGUAL CLASSES 6. 16:14 – 16: 30 MAREI FETZER (Goethe-University, Frankfurt, Germany). On objects and visualizations – An interactionistic perspective Session 2 (July 13, 19:30 – 21:00) 19:30 -19:33 Link with previous session and introducing the new session: Visualization and teaching 7. 19:33 – 19:49 HUI-YU HSU (National Tsing Hua University, Hsinchu City, Taiwan). HOW TEACHERS SCAFFOLD STUDENTS IN VISUALIZING DIAGRAM FOR UNDERSTANDING GEOMETRIC PROBLEM SOLVING 8. 19:49 – 20:05 VIMOLAN MUDALY (University of KwaZulu-Natal, Durban, ZA, South Africa). -

Parenting a Gifted Child

香港資優教育學苑 The Hong Kong Academy for Gifted Education Snapshot 附 件 Appendix HKAGE Student Members Grab 7 Awards in CMO 2013 Eight student members of the Hong Kong Academy for Gifted Education (the HKAGE), who participated in the training programme jointly organised by the HKAGE and the International Mathematical Olympiad Hong Kong Committee, achieved strong results in the China Mathematical Olympiad 2013 (CMO), winning four silvers and three bronzes for Hong Kong. The contest ran from 10th to 14th of January in Shenyang of Liaoning Province. 320 people from 31 teams representing Mainland provinces, cities or regions, Hong Kong, Macau and Russia competed for awards in the Northeast Yucai School. Wong Sze Nga, the only female member of the Hong Kong team, was happy to win a bronze award. She said,“I think I have done my best and I have no regrets.” However, she said she did not have an opportunity to travel around Shenyang due to extremely cold weather. Hui Pak Nam, another team member who also participated in the same contest last year, had richer experience this year. He said, “CMO is tough. I won a bronze last year, and had since set a goal to make progress this year. I won a silver and I am very happy with that. In fact, I have spent more time than last year to prepare for the contest. I benefit a lot from the training programme provided by the HKAGE. The instructor once asked us to do a problem-solving assignment. I spent a lot of time on it. -

Deutsche Unterrichtsangebote Für Deutschsprachige Schüler in China ( Stand: 27.11.2017 )

Deutsche Unterrichtsangebote für deutschsprachige Schüler in China ( Stand: 27.11.2017 ) Ansprechpartnerin für Internationale Schulen mit einem deutschen Unterrichtsangebot in China: Fachberaterin/Koordinatorin der Zentralstelle für das Auslandsschulwesen, Frau Gundula Meyer-Oehring ([email protected]) Schule Schulabschluss Unterrichtsangebot Kontakt Deutsche Sekundarstufen-I-Abschlüsse; deutschsprachiger Kindergarten, Schulleiterin: Botschaftsschule Peking Reifeprüfung nach Klasse 12; deutschsprachige Vorschule, Oberstudiendirektorin von der KMK anerkannte deutsche von der KMK genehmigte Lehrpläne Frau Almut Hennings Internetauftritt: Auslandsschule von Klasse 1 bis 12 [email protected] www.dspeking.net.cn Deutsche Schule Sekundarstufen-I-Abschlüsse; deutschsprachiger Kindergarten, Schulleiterin: Shanghai Reifeprüfung nach Klasse 12; deutschsprachige Vorschule, Studiendirektorin Frau Regine Michel (Hongqiao) bilinguale deutsch-englische von der KMK genehmigte Lehrpläne [email protected] Deutsche Internationale von Klasse 1 bis 12 Internetauftritt: Abiturprüfung (DIAP) nach Klasse www.ds-shanghai.de 12; von der KMK anerkannte deutsche Auslandsschule Deutsche Schule Sekundarstufen-I-Abschlüsse; deutschsprachiger Kindergarten, Schulleiter: Shanghai Reifeprüfung nach Klasse 12; deutschsprachige Vorschule, Herr Sven Heineken (Pudong) von der KMK anerkannte deutsche von der KMK genehmigte Lehrpläne [email protected] Auslandsschule von Klasse 1 bis 12 Internetauftritt: www.pudong.ds- shanghai.de -

American Campus Target List Schools

CHINA UNIVERSITÉ PUBLICATION DISTRIBUTION LIST School Name-Shanghai School Name-Beijing Adcote School Shanghai Beanstalk International Bilingual School Britannica International School, Shanghai Beijing Aidi School Canadian International School Kunshan Beijing Biss International School Concordia International School Shanghai Beijing City International School Dulwich College Shanghai Pudong Beijing Huijia Private School Dulwich College Shanghai Puxi Beijing International Bilingual Academy Dulwich College Suzhou Beijing National Day School International Department Fudan International School Beijing New Talent Academy Harrow International School Shanghai Beijing Royal School Hong Qiao International School Beijing Shuren RIBet Private School Lucton School Shanghai Beijing World Youth Academy Lycée Francais De Shanghai Canadian International School Of Beijing Nord Anglia Chinese International School Dulwich College Beijing Nord Anglia International School Shanghai, Pudong Harrow Beijing Shanghai American School Hope International School Shanghai Community International School Innova Academy Shanghai Hd Bilingual School International School Of Beijing Shanghai High School International Division Joy El International Academy Shanghai Huaer Collegiate School Kunshan Kaiwen Academy Shanghai Jincai International School Keystone Academy Shanghai Livingston American School Limai Chinese American (International) School Shanghai Pinhe School Lycée Francais International Charles De Gaulle De Pékin Shanghai QIBao Dwight High School Saint Paul American -

2018 Physicsbowl Results

2018 PhysicsBowl Results Dear Physics Teachers, Thank you for having your students participate in this year’s AAPT PHYSICSBOWL contest. This year there were more than 7200 students participating from 320 schools from Australia, Canada, Costa Rica, the Republic of Korea, the Netherlands, New Zealand, the Philippines, Singapore, Switzerland, Turkey, the United Kingdom, and the United States, as well as 318 schools participating from China! With the addition of the large number of Chinese schools, the contest is almost in two parts with Regions 00 – 14 competing for prizes from AAPT while ASDAN China is coordinating the contest in China. As a result, for simplicity of trying to read the long lists, there are three files: the list of winners in Regions 00 – 14, the list of winners in Regions 15 – 19, and a list of the top students/teams from all regions in both divisions! Instructors from regions 00 – 14 can obtain the scores of their students from a link that will be provided to you in an email from the national office. Please realize that we were able to retrieve some scores that were disqualified for improperly recording the required information, but this was done after-the-fact. If the information was not encoded correctly, the student was immediately disqualified from winning prizes even though we may be able to link that student to your code now. Some students provided no codes, the wrong regions, no name, just a last name, etc. There are a lot of records and we cannot go back and fill in missing information. -

German Section. Elementary School - Information

Orientation for Expats in Shenyang. Overview. Kindergarten New World Garden Kindergarten Creative Kids Kindergarten Yucai New Kindergarten Mei Di Yucai School Int. School Orientation for Expats in Shenyang. Northeast Yucai School - International Division. The International Division of Northeast Yucai School offers basic education (from primary education to senior high school education) to students from foreign countries. Benefiting from NEYC’s teaching and administrative resources, the International Division is committed to cultivate the students for international talents with creative spirit, supply the foreign students, native students willing to study abroad and offsprings of personnels working in multi-national corporations located in China with international advanced education. Many world-wide well known corporations have chosen to study there. Some of these corporations have established a long-term cooperation relationship with this school. Such as, the French Section built on the cooperation with Michelin Company, the German Section established on the cooperation with BMW Brilliance Automotive. Orientation for Expats in Shenyang. Northeast Yucai School - International Division. Structure. Yucai School International Chinese Department Department German Section French Section English Section Chinese Section Orientation for Expats in Shenyang. Northeast Yucai School - German Section. General Information. • Education takes mainly place in German language according to the German school system. • Currently there are two teachers: Mrs. Brunner and Mr. Moser. • The children join additionally courses e.g. sports, rolling, pottery, chorus together with children of different nations. • Adjustments to fit into the Chinese school concept oPupils are in school from 8.00 AM to 4.00 PM (from Monday to Friday), there is an exception in the elementary school (1 day from 8.00 AM to 12.00) oSchool year is divided into 2 semesters oCombination of German and Chinese holiday schedule oCollective subjects and activities in-between all sections Orientation for Expats in Shenyang. -

Silage Choppers and Snake Spirits the Lives and Struggles of Two Americans in Modern China Third Edition

Silage Choppers and Snake Spirits The Lives and Struggles of Two Americans in Modern China Third Edition Dao-Yuan Chou Foreign Languages Press Foreign Languages Press Collection “New Roads” #2 A collection directed by Christophe Kistler Contact – [email protected] https://foreignlanguages.press Paris, 2019 Third Edition ISBN: 978-2-491182-02-1 This book is under license Attribution-ShareAlike 4.0 International (CC BY-SA 4.0) https://creativecommons.org/licenses/by-sa/4.0/ For the people in the world who have tied their struggle inextricably to the struggle of others… and… For Sid and Joan, who insisted that I ‘get off my butt and do something for the world,’ and gave me many tools with which I could try. Acknowledgements Thanks to my mother, without whom I never would have made it to that small Agricultural Machinery Experiment Station in China, and who has been a personal and political compass throughout my life. She sets a loving if nearly unattainable exam- ple and makes me a better person for trying to follow. Many thanks to the people who were unwavering in their support for this long project: to Sid and Joan who trusted me to tell their story, family and friends, who if they ever doubted that I would finish it never showed it, the Philadelphia Chinatown youth who taught me about practice, IBON staff and board, and all the people who participated in making this book so much better. Second Edition: Warm thanks to Ann Tomkins for her invaluable assistance in copyediting and clarification. She will be remembered always for her tenacious com- mitment to struggle for the people of the world. -

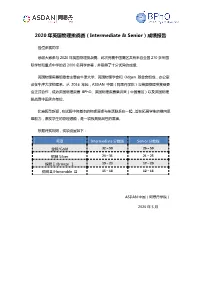

2020 年英国物理挑战赛(Intermediate & Senior)成绩报告

2020 年英国物理挑战赛(Intermediate & Senior)成绩报告 各位参赛同学: 感谢大家参与 2020 年英国物理挑战赛。此次竞赛中国赛区共有来自全国 270 多所国 际学校和重点中学的近 2000 名同学参赛,并取得了十分优异的成绩。 英国物理奥赛组委会主要由牛津大学、英国物理学会和 Odgen 基金会组成,办公室 设在牛津大学物理系。从 2016 年起,ASDAN 中国(阿思丹学院)与英国物理奥赛组委 会正式合作,成为英国物理奥赛 BPhO、英国物理奥赛集训营(中国赛区)以及英国物理 挑战赛中国承办单位。 比赛题型新颖,在试题中将基本的物理原理与生活联系在一起,旨在拓展学生的横向思 维能力,激发学生的物理潜能,是一项极具挑战性的赛事。 根据评奖规则,奖项设置如下: 奖项 Intermediate 分数线 Senior 分数线 金牌/Gold 32 – 50 26 – 50 银牌 Silver 24 – 31 21 – 25 铜牌Ⅰ/Bronze Ⅰ 19 – 23 17 – 20 铜牌Ⅱ/Honorable Ⅱ 15 – 18 12 – 16 ASDAN 中国(阿思丹学院) 2020 年 5 月 附件:2020 年英国物理挑战赛(Intermediate & Senior)获奖名单 Intermediate Name School Award YANWEN GU Nanjing Foreign Language School Gold YUZHOU YANG Nanjing Foreign Language School Gold LOK YAT Shanghai High School International Division Gold HARRISON CHAN XUERUI HE No.2 High School of East China Normal University Gold ZIHAN WANG Shenzhen College of International Education Gold ZHAOCHENG LU Shanghai High School International Division Gold CHENXU LYU YK PAO SCHOOL Gold JIARUI CAI United World College Of Changshu China Gold CHENGYUN ZHU Hefei No.6 High School Gold NANJING NORMAL UNIVERSITY SUZHOU SICHENG MA Gold EXPERIMENTAL SCHOOL RONG GUAN Guanghua Cambridge International School Gold ZIYANG WANG Shenzhen College of International Education Gold QINGCHUAN CHEN Shenzhen College of International Education Gold ZHAOCONG YUAN Shenzhen College of International Education Gold QIANSHUO YE Shenzhen College of International Education Gold The Experimental High School Attached to Beijing Normal XIANGYAN JIN Gold University ANQI YUAN Beijing National Day -

Teams Invited to 2016 Columbia Social Sciences Research Training Workshop

Teams Invited to 2016 Columbia Social Sciences Research Training Workshop Shanghai Workshop (February 16-18, 2016) Nanshan Dog Team from Guangdong Experimental High School (Guangzhou) The Effect of Family Planning on Fertility in China By Liu Yichen, Liu Ruochen, Zhao Jingtong, Cheng Kerou Advisor: Chen Jinghui The Six Musteteers Team with students from Shanghai Foreign Language School, High School Affiliated to Fudan University, Shanghai High School (Shanghai) The Future of the Chinese Population Policy By Jiwei Yao, Xiaozhuo Shi, Zhengyi Li, Chenyue Cai, Xiaowen Xia, Haotian Tong Advisor: Sherry Xie Riptide Team with students from the Affiliated High School of Fujian Normal University, Shanghai Foreign Language School Affiliated to SISU, High School Affiliated to Fudan University, High School Affiliated to Fudan University (Pudong Campus), Shanghai High School International Division (Fuzhou, Shanghai) China’s One Child Policy and Its Psychological Impacts on the Influenced Generations By Yuke Wu, Chengyi Qian, Xiaoyu Dong, Yiyun Wu, Yang Liu, MingJia Chen Advisor: Jian Du Sunlight Team from High School Affiliated to Nanjing Normal University (Nanjing) China’s Universal Second Child Policy: The Right Remedy? By Xu Jinduo, Xu Haoran, Wang Yihao, Zhang Xinyi ,Zhu Qianwen, Wei Ermian Advisor : Li Wei HSANNU 1 Team from High School Attached to Northeast Normal University (Changchun) Evaluation of the Consequences “One Child Policy” in Contexts By Zhijie Sun, Jingyi Wang, Wenhan Yu, Wanting Wang, Ling Tong, Mingke Ma Shanghai Starriver Bilingual -

High School OFFICIAL Results for CHINA 2016-2017 School Year

2016-2017 CONTEST SCORE REPORT SUMMARY FOR HIGH SCHOOL (GRADES 10 - 12) Summary of Results High School (Grades 10 - 12) – Math League China Regional Standing This Contest took place on Nov 20, 2016. Top 73 Students in High School (Grades 10 - 12) Contest (Perfect Score = 300) Rank Student School Town Score 1 Youchen Zhang The Experimental High School Attached To Beijing Normal University Beijing 300 1 Mingyu Zheng Guangzhou 300 1 Weiqi Zhou Northeast Yucai School Shenyang 300 4 Yuan Qiu The Experimental High School Attached To Beijing Normal University Beijing 280 4 Jingyuan Wang The Experimental High School Attached To Beijing Normal University Beijing 280 4 Longling Tian The Experimental High School Attached To Beijing Normal University Beijing 280 4 Yunting Zhao Qingdao 280 8 Su Wang The Experimental High School Attached To Beijing Normal University Beijing 270 8 Zhongyang Li Shenyang 270 8 Lanxi Jiang The High School Affiliated to Renmin University of China Beijing 270 8 Zifeng Liu Beijing No.5 High School Beijing 270 12 Yuming Zhu Shanghai 260 12 Litong Deng Guangzhou 260 12 Jingguo Liang Northeast Yucai School Shenyang 260 12 Shiqi Liu Northeast Yucai School Shenyang 260 12 Zhengyi Liu Suzhou 260 17 Yusi Niu Beijing 250 17 Zetao Wang Beijing 250 17 Hongyi Gu The Experimental High School Attached To Beijing Normal University Beijing 250 17 Yifei Xu The Experimental High School Attached To Beijing Normal University Beijing 250 17 Qianhao Shao The Experimental High School Attached To Beijing Normal University Beijing 250 17 Kelin Wu Shenzhen Middle School Shenzhen 250 17 Xinyu Li Shenzhen Middle School Shenzhen 250 17 Houran Bian Nanjing 250 17 Haochen Han Shenyang 250 17 Mingqi Yang Northeast Yucai School Shenyang 250 17 Wentao Luo Northeast Yucai School Shenyang 250 17 Mingxuan Ji Northeast Yucai School Shenyang 250 17 Chongkun Deng Beijing Jingshan School Beijing 250 Summary of Results High School (Grades 10 - 12) – Math League China Regional Standing This Contest took place on Nov 20, 2016.