Investec Wealth & Investment Voting Summary 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COVID-19 Proxy Governance Update

COVID-19 Proxy Governance Update 2020 AGM mid-season review FROM EQUINITI 01 Looking back and planning ahead It is incredible to note that it has been over 12 weeks since the official announcement on 23 March of the UK Government’s Stay at Home Measures, and nearly seven months since the severity of the pandemic became apparent in China. Over the said period, PLC boards, company secretaries and investor relations officers have kept their corporate calendars going thanks to rapid adoption of modified regulatory guidelines and inventive modes of engagement with investors. With annual general meetings being an obvious highlight in the corporate calendar, we take stock of the progress made so far over the 2020 AGM season, as well as using what we learned to plan ahead. Now that we are over the first ‘hump’ with the busy period of May AGMs out of the way, we are readying for the second ‘peak’ of June and July AGMs, and then an ‘easing’ until the second ‘mini’ season in the early autumn. As such, in this update, we look at: • 2020 AGM season statistics…so far • Proxy adviser engagement and ISS recommendations review • High-level assumptions for Q3 and Q4 • Relevant updates from the regulators, industry bodies and proxy advisers • Communications in the COVID-19 world – special commentary by leading financial PR firm,Camarco • How has COVID-19 impacted activism – special commentary by international law firm,White & Case 02 2020 AGM Season Statistics…so far Scope of data To assess progress and forecast what is to come, we look at the key statistics for the UK AGM season 2020 thus far. -

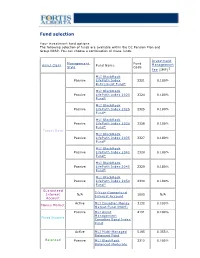

Fund Selection

Fund selection Y our investment fund options The following selection of funds are available within the DC Pension Plan and Group RRSP. You can choose a combination of these funds. Investment Management Fund Asset Class Fund Name Management Style Code Fee (IMF)1 MLI BlackRock Passive LifeP ath Index 2321 0.180% Retirement Fund* MLI BlackRock Passive LifeP ath Index 2020 2324 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2025 2325 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2030 2326 0.180% Fund* Target Date MLI BlackRock Passive LifeP ath Index 2035 2327 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2040 2328 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2045 2329 0.180% Fund* MLI BlackRock Passive LifeP ath Index 2050 2330 0.180% Fund* Guaranteed 5-Y ear Guaranteed Interest N/A 1005 N/A Interest Account Account Active MLI Canadian Money 3132 0.100% Money Market Market Fund (MAM) Passive MLI Asset 4191 0.100% Management Fixed Income Canadian Bond Index Fund Active MLI Multi-Managed 5195 0.355% Balanced Fund Balanced Passive MLI BlackRock 2312 0.105% Balanced Moderate Index Fund Active MLI Canadian Equity 7011 0.210% Fund Canadian Passive MLI Asset 7132 0.100% Equity Management Canadian Equity Index Fund Active MLI U.S. Diversified 8196 0.375% Grow th Equity (Wellington) Fund U.S. Equity Passive MLI BlackRock U.S. 8322 0.090% Equity Index Fund* Active MLI MFS MB 8162 0.280% International Equity International Fund Equity Passive MLI BlackRock 8321 0.160% International Equity Index Fund* 1 IMFs shown do not include applicable taxes. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Report & Accounts 2018

Report & Accounts 2018 Report & Accounts Derwent London plc Report & Accounts 2018 CONTENTS STRATEGIC REPORT GOVERNANCE 2018 summary ......................................................................................... 04 Introduction from the Chairman ........................................................... 84 Chairman’s statement ............................................................................ 07 Governance at a glance .......................................................................... 86 Chief Executive’s statement .................................................................. 08 Board of Directors ................................................................................... 88 CEO succession ........................................................................................11 Senior management ............................................................................... 90 London: Open for business .....................................................................12 Corporate governance statement ........................................................ 92 Central London office market ................................................................14 Nominations Committee report ......................................................... 100 A well-placed portfolio ............................................................................16 Audit Committee report ....................................................................... 104 Our stakeholders ......................................................................................18 -

XINT F UK Real Estate P GBP Index

As of December 30, 2020 XINT F UK Real Estate P GBP Index DE000A13PXZ5 GBP The XINT F UK Real Estate P GBP Index is a free-float adjusted index, designed to track the performance of real estate companies and REITS listed on the London Stock Exchange. INDEX PERFORMANCE - PRICE RETURN 120 115 110 105 100 95 90 85 80 75 70 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Returns (p.a) Standard Deviation (p.a) Maximum Drawdown 3M 69.43% 3M 23.80% From 14.02.2020 6M 21.90% 6M 21.90% To 19.03.2020 1Y -17.08% 1Y -17.08% Return -38.63% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com Top 10 Constituents FFMV (GBPm) Weight % Industry Sector Segro PLC 11,298 19.84 Real Estate Land Securities Group PLC 4,910 8.62 Real Estate British Land Company PLC 4,630 8.13 Real Estate Unite Group PLC 3,341 5.87 Real Estate Derwent London PLC 3,136 5.51 Real Estate Tritax Big Box REIT Plc 2,866 5.03 Real Estate LondonMetric Property PLC 2,059 3.61 Real Estate Assura PLC 2,021 3.55 Real Estate Primary Health Properties PLC 1,989 3.49 Real Estate Grainger PLC 1,900 3.34 Real Estate Total 38,151 66.99 This information has been prepared by Index Intelligence GmbH (“IIG”). All information is provided "as is" and IIG makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to any data included herein. -

Annual Report 2011

RIT Capital Partners plcACCOUNTS & REPORT ANNUAL ANNUAL REPORT & ACCOUNTS 31 MARCH 2011 31 MARCH 2011 RIT CAPITAL PARTNERS PLC ANNUAL REPORT AND ACCOUNTS 2011 1 Financial Highlights and Performance 3 Chairman’s Statement 4 Investment Director’s Review 7 Board of Directors 19 Directors’ Report 21 Corporate Governance Report 26 Directors’ Remuneration Report 33 Report of the Independent Auditors 39 Consolidated Income Statement 41 Consolidated Statement of Comprehensive Income 41 Consolidated Balance Sheet 43 Balance Sheet of the Parent Company 44 Consolidated Statement of Changes in Equity 45 Parent Company Statement of Changes in Equity 46 Consolidated Cash Flow Statement 47 Parent Company Cash Flow Statement 48 Group Accounting Policies 49 Notes to the Financial Statements 55 Historical Information 90 Financial Calendar 90 Annual General Meeting 91 Explanatory Notes 95 Advisers 100 Company Registration Number 2129188 RIT CAPITAL PARTNERS PLC ANNUAL REPORT AND ACCOUNTS 2011 2 CORPORATE to deliver long-term capital growth, while OBJECTIVE preserving shareholders’ capital; to invest without the constraints of a formal benchmark, but to deliver for shareholders increases in capital value in excess of the relevant indices over time. INVESTMENT to invest in a widely diversified, international portfolio across a range of POLICY asset classes, both quoted and unquoted; to allocate part of the portfolio to exceptional managers in order to ensure access to the best external talent available. Further information relating to the Company’s investment -

COVERAGE LIST GEO Group, Inc

UNITED STATES: REIT/REOC cont’d. UNITED STATES: REIT/REOC cont’d. UNITED STATES: NON-TRADED REITS cont’d. COVERAGE LIST GEO Group, Inc. GEO Sabra Health Care REIT, Inc. SBRA KBS Strategic Opportunity REIT, Inc. Getty Realty Corp. GTY Saul Centers, Inc. BFS Landmark Apartment Trust, Inc. Gladstone Commercial Corporation GOOD Select Income REIT SIR Lightstone Value Plus Real Estate Investment Trust II, Inc. Gladstone Land Corporation LAND Senior Housing Properties Trust SNH Lightstone Value Plus Real Estate Investment Trust III, Inc. WINTER 2015/2016 • DEVELOPED & EMERGING MARKETS Global Healthcare REIT, Inc. GBCS Seritage Growth Properties SRG Lightstone Value Plus Real Estate Investment Trust, Inc. Global Net Lease, Inc. GNL Silver Bay Realty Trust Corp. SBY Moody National REIT I, Inc. Government Properties Income Trust GOV Simon Property Group, Inc. SPG Moody National REIT II, Inc. EUROPE | AFRICA | ASIA-PACIFIC | MIDDLE EAST | SOUTH AMERICA | NORTH AMERICA Gramercy Property Trust Inc. GPT SL Green Realty Corp. SLG MVP REIT, Inc. Gyrodyne, LLC GYRO SoTHERLY Hotels Inc. SOHO NetREIT, Inc. HCP, Inc. HCP Sovran Self Storage, Inc. SSS NorthStar Healthcare Income, Inc. UNITED KINGDOM cont’d. Healthcare Realty Trust Incorporated HR Spirit Realty Capital, Inc. SRC O’Donnell Strategic Industrial REIT, Inc. EUROPE Healthcare Trust of America, Inc. HTA St. Joe Company JOE Phillips Edison Grocery Center REIT I, Inc. GREECE: Athens Stock Exchange (ATH) AFI Development Plc AFRB Hersha Hospitality Trust HT STAG Industrial, Inc. STAG Phillips Edison Grocery Center REIT II, Inc. AUSTRIA: Vienna Stock Exchange (WBO) Babis Vovos International Construction S.A. VOVOS Alpha Pyrenees Trust Limited ALPH Highwoods Properties, Inc. -

Blackrock in France

BlackRock in France Stéphane Sébastien Henri Carole Crozat Lapiquonne Herzog Chabadel BlackRock Country Manager, Chief Operating Chief Investment Officer, Sustainable France, Belgium, Officer, France, France, Belgium & Investing, Head of Luxembourg Belgium, Luxembourg Luxembourg Thematic Research Jean-François Martin Parkes Sylvain Bettina Cirelli Public Policy, Favre-Gilly Mazzocchi Chairman, France, France, Head of Institutional Head of iShares & Belgium, Switzerland & Business, France Wealth, France, Luxembourg Luxembourg Monaco, Belgium, Luxembourg Independent fiduciary asset Connecting client capital to companies and projects We have put nearly EUR185bn2 from investors in France manager and globally to work in the French economy, supporting BlackRock is a leading provider of investment, advisory growth, jobs and innovation. and risk management solutions. Our purpose is to help Renewable energy: Our infrastructure investment more and more people invest in their financial well-being. platform has enabled clients to contribute to financing six As an asset manager, we connect the capital of diverse wind and solar energy projects in France, as well as green individuals and institutions to investments in companies, network heating operator and transport projects. projects and governments. This helps fuel growth, jobs Real estate: With a team of dedicated experts on the and innovation, to the benefit of society as a whole. ground, our real estate team creates value for clients and We have been present in France since 2006 and are local citizens through our investments across Paris, committed to the local market. Our local clients include including 3 Quartiers and Grande Arche. A number of insurers, pensions, official institutions, corporates, projects have earned certificates for their positive traditional and digital banks, and foundations, for whom environmental footprint. -

Blackrock International Limited Annual Best Execution Disclosure

BlackRock International Limited Annual Best Execution Disclosure 2019 June 2020 Contents Introduction Quantitative Analysis Top five entity reports for the transmission of orders Top five entity report for the execution of orders Securities Finance Transactions o Top five entity reports for the execution of orders Qualitative Analysis Equities Shares & Depository Receipts Equity derivatives: Futures & Options admitted to trading on a trading venue Interest rate derivatives: Futures & Options admitted to trading on a trading venue Currency derivatives: Futures & Options admitted to trading on a trading venue Commodities derivatives: Futures & Options admitted to trading on a trading venue Credit derivatives: Futures & Options admitted to trading on a trading venue Securitized derivatives: Warrants and certificate derivatives Equity derivatives: Swaps & other equity derivatives Contracts For Difference Debt instruments: Bonds Debt instruments: Money Market Instruments Interest rate derivatives: Swaps, forwards & other interest rates derivatives Credit derivatives: Other credit derivatives Currency derivatives: Swaps, forwards & other currency derivatives Commodities derivatives: Swaps and other commodities derivatives Structured Finance Instruments Exchange Traded Products Other Instruments Securities Finance Transactions BLACKROCK Annual Best Execution Disclosure 2019 | 2 Introduction The publication of this report is required under the Markets in Financial Instruments Directive 2014/65/EU (“MIFID II”) and it is designed to provide information on the top five execution venues* utilised by BlackRock to execute its clients’ orders, as well as the top five entities to which BlackRock transmitted its clients’ orders for execution. It also includes information on how BlackRock monitors the quality of its clients’ trades’ execution, on BlackRock’s conflicts of interest and other matters, as they relate to the execution by BlackRock of its clients’ trades. -

Good and Bad News for Investors

STOCKS | FUNDS | INVESTMENT TRUSTS | PENSIONS AND SAVINGS VOL 19 / ISSUE 46 / 23 NOVEMBER 2017 / £4.49 SHARES WE MAKE INVESTING EASIER CAN YOUR HOME FUND YOUR RETIREMENT? Good and bad news for investors WHY DO 5 QUESTIONS COMPANIES DIGITAL DISRUPTION RAISED BY BUY BACK HOW TO INVEST IN GAME ZPG’S MOVE ON SHARES? CHANGING COMPANIES GOCOMPARE Fundsmith LLP (“Fundsmith”) is authorised and regulated by The Fundsmith Emerging Equities Trust the Financial Conduct Authority and only acts for the funds (FEET) research team searches the world to to whom it provides regulated investment management and find companies that make their money from a transaction arrangement services. Fundsmith does not act for or advise potential investors in connection with acquiring large number of everyday, repeat, predictable shares in Fundsmith Emerging Equities Trust plc and will not transactions and will benefit from the rise of the be responsible to potential investors for providing them with protections afforded to clients of Fundsmith. consumer in developing economies. Prospective investors are strongly advised to take their own For example, Indofood sold 9 billion packets of legal, investment and tax advice from independent and suitably qualified advisers. The value of investments may Indomie noodles last year, Magnit welcomed 11 million go up as well as down. Past performance is not a guide to shoppers a day, MercadoLibre sold over 50 million future performance. items on its website last quarter and Dabur’s Hajmola FEET Performance, % Total Return tablets were taken 26 million times a day in India. Year ending 31st August 2017 2016 2015 Since inception You may never have heard of them, despite their FEET Share Price +3.6 +21.5 -16.2 +15.5 scale, but all can be found in the FEET portfolio. -

2017 Annual Report

Annual Report 2017 Capital and income growth from active global equity investment Witan Investment Trust plc Our objective /RQJWHUPJURZWKLQLQFRPHDQGFDSLWDOWKURXJK 4USBUFHJD3FQPSU 01 3HUIRUPDQFHVQDSVKRW DFWLYHPXOWLPDQDJHULQYHVWPHQWLQJOREDOHTXLWLHV 02 )LQDQFLDOKLJKOLJKWV 04 &KDLUPDQpVUHSRUW 06 &KLHI([HFXWLYHpVUHSRUW 08 6WUDWHJLF5HSRUW :LWDQLVDQLQYHVWPHQWWUXVWZKLFKLVOLVWHGRQWKH 21 ,QYHVWPHQW0DQDJHUV 24 )LIW\/DUJHVW,QYHVWPHQWV /RQGRQ6WRFN([FKDQJHDQGZDVIRXQGHGLQ 25 &ODVVLßFDWLRQRI,QYHVWPHQWV %JSFDUPSTn3FQPSU :LWDQRIIHUVDFWLYHO\PDQDJHGH[SRVXUHWRJOREDO 26 Board of Directors 28 'LUHFWRUVp5HSRUW PDUNHWV SULQFLSDOO\HTXLWLHV XVLQJDPXOWLPDQDJHU $PSQPSBUF(PWFSOBODF DSSURDFK7KHSRUWIROLRLVGLYHUVLßHGE\JHRJUDSKLFDO 32 &RUSRUDWH*RYHUQDQFH6WDWHPHQW 41 5HSRUWRIWKH$XGLW&RPPLWWHH UHJLRQLQGXVWULDOVHFWRUDQGDWWKHLQGLYLGXDOVWRFN 43 'LUHFWRUVp5HPXQHUDWLRQ5HSRUW OHYHO 56 6WDWHPHQWRI'LUHFWRUVp5HVSRQVLELOLWLHV 'JOBODJBMTUBUFNFOUT 57 ,QGHSHQGHQW$XGLWRUpV5HSRUW :LWDQW\SLFDOO\XVHVEHWZHHQDQGLQYHVWPHQW 64&RQVROLGDWHG6WDWHPHQWRI &RPSUHKHQVLYH,QFRPH PDQDJHUV7KHEOHQGRIGLIIHUHQWDFWLYHDSSURDFKHV 65&RQVROLGDWHGDQG,QGLYLGXDO&RPSDQ\Statement RI&KDQJHVLQ(TXLW\ DQGVW\OHVDLPVWRGHOLYHUDGGHGYDOXHIRU 66&RQVROLGDWHGDQG,QGLYLGXDO&RPSDQ\%DODQFH VKDUHKROGHUVZKLOHVPRRWKLQJRXWWKHYRODWLOLW\ Sheets 67&RQVROLGDWHGDQG,QGLYLGXDO&RPSDQ\ QRUPDOO\DVVRFLDWHGZLWKDVLQJOHPDQDJHU &DVK)ORZ6WDWHPHQWV 68 1RWHVWRWKH)LQDQFLDO6WDWHPHQWV 0UIFS*OGPSNBUJPO 94 Other Information 96$OWHUQDWLYH,QYHVWPHQW)XQG0DQDJHUVp 'LUHFWLYH 97 +LVWRULFDOUHFRUG 98 +RZWRLQYHVW 99 6KDUHKROGHULQIRUPDWLRQ and AOWHUQDWLYH 5PßOEPVUNPSF -

Witan Investment Trust

Witan Investment Trust Adding to its record of outperformance Investment trusts 21 May 2018 Witan Investment Trust (WTAN) has employed an active multi-manager strategy since 2004, offering investors diverse exposure to global equities. Price 1,094.0p In 2017, the trust delivered another year of outperformance versus its Market cap £1,950m composite benchmark, which it has surpassed over the last one, three, five AUM £2,188m and 10 years. WTAN’s investment director, James Hart, believes that equities can continue to offer attractive returns for the patient investor, NAV* 1,110.5p Discount to NAV 1.5% although he notes that stock market volatility is now higher than the NAV** 1,102.9p benign levels experienced in 2017. In this environment, he believes that Discount to NAV 0.8% active stock picking, rather than blanket equity exposure, should produce *Excluding income. **Including income. As at 17 May 2018. better returns for investors. WTAN has a progressive dividend policy; its Yield 2.0% annual distribution has increased for the last 43 consecutive years. Ordinary shares in issue 178.2m Code WTAN 12 months Share price NAV Composite MSCI World FTSE All- FTSE AW North Primary exchange LSE ending (%) (%) benchmark* (%) (%) Share (%) America (%) AIC sector Global 30/04/14 18.9 9.8 7.1 8.1 10.5 10.6 Benchmark Composite benchmark 30/04/15 19.6 17.0 14.3 18.7 7.5 23.0 30/04/16 (7.1) (1.4) (3.6) 1.1 (5.7) 4.8 Share price/discount performance 30/04/17 35.3 30.7 27.2 30.6 20.1 33.1 1,150 2 30/04/18 10.6 8.9 8.8 6.9 8.2 6.3 1,100 0 Discount(%) Source: Thomson Datastream.