The Influence of Product Diversity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Registration Document

REGISTRATION DOCUMENT 2018 CONTENTS 1 GROUP OVERVIEW 3 4 SUSTAINABLE DEVELOPMENT 157 1.1 Business environment, economic 4.1 Klépierre’s CSR strategy 158 model and strategy 4 4.2 Act for the Planet 162 1.2 Key figures 8 4.3 Act for Territories 179 1.3 Share ownership and stock information 12 4.4 Act for People 184 1.4 Background 12 4.5 Sustainability governance 200 1.5 Property portfolio as of December 31, 2018 14 4.6 Supplemental data, methodology 1.6 Simplified organization chart and concordance tables 203 as of December 31, 2018 25 1.7 Risk management 26 5 CORPORATE GOVERNANCE 219 BUSINESS FOR THE YEAR 35 5.1 Management and oversight of the Company 221 2 5.2 Compensation and benefits of executive 2.1 Business overview 36 corporate officers 244 2.2 Business activity by region 41 2.3 Net current cash flow 45 2.4 Investments, developments, and disposals 46 2.5 Parent company earnings and distribution 49 6 SHARE CAPITAL, SHARE 2.6 Portfolio valuation 49 OWNERSHIP, GENERAL 2.7 Financial policy 54 MEETING OF SHAREHOLDERS 267 2.8 EPRA performance indicators 57 2.9 Outlook 61 6.1 Share capital and share ownership 268 6.2 General Meeting of Shareholders 282 FINANCIAL STATEMENTS 63 3 ADDITIONAL INFORMATION 309 3.1 Consolidated financial statements 7 for the year ended December 31, 2018 64 7.1 General information 310 3.2 Statutory auditors’ report on the 7.2 Documents on display 312 consolidated financial statements 122 7.3 Statement by the person responsible for 3.3 Company financial statements for the year the registration document, which serves -

Mergers & Acquisitions Mexico Annual Issue

Seale & Associates Creative Solutions. Trusted Advice. MERGERS & ACQUISITIONS MEXICO 2019 ANNUAL ISSUE SUMMARY OF MERGERS & ACQUISITIONS IN MEXICO In 2019, the volume and value of announced transactions accumulated to 169 and USD$15.8 billion, respectively, representing a decrease in volume of 25.0% and an increase in reported value 33.7% Year-Over-Year. It is necessary to clarify that two megadeals in the infrastructure sector represent US$7.1 billion of the total value reported 18 18 18 16 17 16 16 13 13 12 11 9 10 Deal Volume in Mexico # of Transactions per Month Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 18' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 2015 $15.8 226 2016 $8.6 210 2017 $11.4 240 2018 $8.6 $15.8 Deal Volume and 212 Value in Mexico Annual Transactions 2019 $8.7 $7.1* 169 (US$ billion) $7.1 *Megadeals Seale & Associates Mexico M&A 2019 Sources: Capital IQ, Mergermarket Creative Solutions. Trusted Advice. SUMMARY OF MERGERS & ACQUISITIONS BY MEXICAN COMPANIES ABROAD In 2019, the volume and value of announced transactions accumulated to 40 deals worth US$3.8 billion, representing a decrease in volume of 14.8% and a decrease in reported value of 26.9% Year-Over-Year 7 6 6 4 4 3 3 3 3 2 2 Deal Volume 1 Abroad # of Transactions 0 per Month Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 18' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 2015 $13.4 47 2016 $9.6 49 2017 $8.9 39 2018 $5.2 47 Deal Volume and Value Abroad Annual Transactions (US$ billion) 2019 $3.8 40 Seale & Associates Mexico M&A 2019 Sources: Capital IQ, Mergermarket Creative Solutions. -

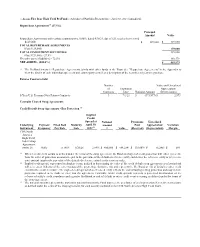

Valuation Multiples by Industry

Valuation Multiples by Industry https://www.eval.tech SIC Sector: (5200-5999) Retail Trade Report Date: 31 March 2021 Country: United States of America (U.S.A.) Industry Valuation Multiples The table below provides a summary of median industry enterprise value (EV) valuation multiples, as at the Report Date. The data is grouped by industry SIC code: EV Multiple Max # Rev EBITDA EBIT TotAss TanAss Retail-Lumber & Other Building Materials Dealers (5211) 6 1.52 13.48 16.37 3.01 3.38 Retail-Variety Stores (5331) 9 0.91 13.55 18.73 1.83 2.15 Retail-Grocery Stores (5411) 10 0.37 7.19 10.75 0.90 0.95 Retail-Auto Dealers & Gasoline Stations (5500) 21 0.94 12.34 17.63 1.64 1.74 Retail-Auto & Home Supply Stores (5531) 6 1.48 12.72 14.68 2.13 2.67 Retail-Apparel & Accessory Stores (5600) 7 1.17 14.18 39.80 1.34 1.45 Retail-Family Clothing Stores (5651) 10 1.23 15.85 53.84 1.31 1.56 Retail-Shoe Stores (5661) 5 - - - 1.24 1.20 Retail-Home Furniture, Furnishings & Equipment Stores 6 1.17 - - 1.22 2.20 (5700) Retail-Eating & Drinking Places (5810) 6 4.61 54.28 - 1.68 2.55 Retail-Eating Places (5812) 39 2.28 23.89 28.25 1.67 2.20 Retail-Miscellaneous Retail (5900) 7 2.16 - 18.46 1.49 2.69 Retail-Drug Stores And Proprietary Stores (5912) 7 0.59 16.69 39.50 0.78 1.38 Retail-Miscellaneous Shopping Goods Stores (5940) 8 0.79 7.46 10.79 0.95 1.16 Retail-Catalog & Mail-Order Houses (5961) 23 1.17 14.70 22.10 2.88 3.27 Retail-Retail Stores, Nec (5990) 12 0.91 10.77 13.84 1.32 1.28 © 2021 eVal 1 20210427 EV/Revenue Valuation Multiple We provide additional data relating to industry EV/Revenue valuation multiples: # Average Median Std. -

MINISO Announces Unaudited Results for the 2021 First Fiscal Quarter Ended September 30, 2020

MINISO InvestorRoom MINISO Announces Unaudited Results for the 2021 First Fiscal Quarter Ended September 30, 2020 GUANGZHOU, China, Dec. 18, 2020 /PRNewswire/ -- MINISO Group Holding Limited (NYSE: MNSO) ("MINISO" or the "Company"), a fast-growing global value retailer offering a variety of design-led lifestyle products, today announced its unaudited financial results for the first fiscal quarter ended September 30, 2020. Financial Highlights for the 2021 First Fiscal Quarter Ended September 30, 2020 Revenue for the fiscal quarter ended September 30, 2020, was RMB2,072.1 million (US$305.2 million), representing a decrease of 30.7% from the fiscal quarter endedS eptember 30, 2019, and an increase of 33.4% from the previous fiscal quarter ended June 30, 2020. Gross profit for the fiscal quarter ended September 30, 2020, was RMB522.4 million (US$76.9 million), representing a decrease of 44.3% from the fiscal quarter endedS eptember 30, 2019, and an increase of 37.7% from the previous fiscal quarter ended June 30, 2020. Loss from continuing operations for the fiscal quarter ended September 30, 2020, was RMB1,676.3 million (US$246.9 million) as compared to RMB20.3 million for the fiscal quarter ended September 30, 2019, and RMB74.8 million for the previous fiscal quarter ended June 30, 2020. Adjusted net profit[1] for the fiscal quarter ended September 30, 2020, was RMB102.1 million (US$15.0 million), representing a decrease of 74.6% from the fiscal quarter endedS eptember 30, 2019, and an increase of 140.8% from the previous fiscal quarter endedJ une 30, 2020. -

VIEWPOINT Weekly Rating Pages for Veritas Coverage Universe

July 28, 2017 VIEWPOINT Weekly Rating Pages for Veritas Coverage Universe WEEK ENDING JULY 27, 2017 SUMMARY PAGES 3-11 V-LIST 12 WATCHLIST 13 RATING PAGES 14-105 Viewpoint July 28, 2017 C OMPANY R ATING P AGES Click on company name below for a link to the rating page Shading indicates an updated rating page Agnico-Eagle Mines Ltd. 14 CGI Group Inc. 45 Macy’s, Inc. 76 Aimia Inc. 15 Choice Properties REIT 46 Magna International Inc. 77 Allied Properties REIT 16 Cogeco Cable Inc. 47 Manulife Financial Corp. 78 Air Canada 17 Constellation Software Inc. 48 Maple Leaf Foods Inc. 79 Amaya Inc. 18 Crescent Point Energy Corp. 49 Martinrea International Inc. 80 ARC Resources Ltd. 19 Crombie REIT 50 Metro Inc. 81 Artis REIT 20 CT Real Estate Investment Trust 51 National Bank of Canada 82 ATCO Ltd. 21 Dollarama Inc. 52 Newmont Mining Corp. 83 Badger Daylighting Ltd. 22 ECN Capital Corp. 53 Northland Power Inc. 84 Bank of Montreal 23 Element Fleet Management 54 Peyto Exploration & Development Corp. 85 Bank of Nova Scotia 24 Eldorado Gold Corp. 55 PrairieSky Royalty Ltd. 86 Barrick Gold Corp. 25 Emera Inc. 56 Quebecor Inc. 87 Baytex Energy Corp. 26 Empire Company Ltd. 57 Restaurant Brands International 88 BCE Inc. 27 Rogers Communications Inc. 89 Enbridge Inc. 58 BlackBerry Ltd. 28 Royal Bank of Canada 90 Encana Corp. 59 Boardwalk REIT 29 Enerplus Corp. 60 Shaw Communications Inc. 91 Bombardier Inc. 30 Fortis Inc. 61 Sun Life Financial Inc. 92 Bonavista Energy Corp. 31 George Weston Ltd. -

Retaillier-Magazine.Pdf

AMITY BUSINESS SCHOOL ABS works with a mission to create an ambience of academic excellence in which new ideas, research projects flourish and the leaders and innovators of tomorrow emerge. In any top university of the world, research is the foundation which leads to a strong academic orientation. ABS has one of the most distinctive team of faculty and Researchers who are constantly augmenting their research and publications and hence leading the institute to pinnacles of academic achievement. ABS provides holistic education and strives to create managers of vision, mission, and the action and above all of the commitment. It attracts committed students from all across the globe. The focus of ABS is on developing a global perspective amongst their student to create a new cadre of management professionals who are multi-skilled and have a capability to function as cross functional teams and with a deep understanding of ethical and value based business processes. Amitians of ABS are instilled with compassion, loyalty and commitment that makes them an invaluable asset of any organisation. Our Missionary Leaders Inspires us to higher ends My mission is nation building through education and beyond Dr. Ashok K. Chauhan Founder President, Ritnand Balved Education Foundation (The Foundation of Amity Institutions and the sponsoring Body o Amity Universities), AKC Group of Companies Our Role Models Who Motivate us to attain the unattainable “From the Editor-In-Chief’s Desk The Indian retailing sector has flourished to cope up with metamorphosis from the age of offline to online platform that is being rapidly adopted by the consumers. -

Page 1 of 375 6/16/2021 File:///C:/Users/Rtroche

Page 1 of 375 :: Access Flex Bear High Yield ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited) Repurchase Agreements(a) (27.5%) Principal Amount Value Repurchase Agreements with various counterparties, 0.00%, dated 4/30/21, due 5/3/21, total to be received $129,000. $ 129,000 $ 129,000 TOTAL REPURCHASE AGREEMENTS (Cost $129,000) 129,000 TOTAL INVESTMENT SECURITIES 129,000 (Cost $129,000) - 27.5% Net other assets (liabilities) - 72.5% 340,579 NET ASSETS - (100.0%) $ 469,579 (a) The ProFund invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix to view the details of each individual agreement and counterparty as well as a description of the securities subject to repurchase. Futures Contracts Sold Number Value and Unrealized of Expiration Appreciation/ Contracts Date Notional Amount (Depreciation) 5-Year U.S. Treasury Note Futures Contracts 3 7/1/21 $ (371,977) $ 2,973 Centrally Cleared Swap Agreements Credit Default Swap Agreements - Buy Protection (1) Implied Credit Spread at Notional Premiums Unrealized Underlying Payment Fixed Deal Maturity April 30, Amount Paid Appreciation/ Variation Instrument Frequency Pay Rate Date 2021(2) (3) Value (Received) (Depreciation) Margin CDX North America High Yield Index Swap Agreement; Series 36 Daily 5 .00% 6/20/26 2.89% $ 450,000 $ (44,254) $ (38,009) $ (6,245) $ 689 (1) When a credit event occurs as defined under the terms of the swap agreement, the Fund as a buyer of credit protection will either (i) receive from the seller of protection an amount equal to the par value of the defaulted reference entity and deliver the reference entity or (ii) receive a net amount equal to the par value of the defaulted reference entity less its recovery value. -

Advances in Theory and Practice in Store Brand Operations Advances in Theory and Practice in Store Brand Operations Jiazhen Huo

Jiazhen Huo Advances in Theory and Practice in Store Brand Operations Advances in Theory and Practice in Store Brand Operations Jiazhen Huo Advances in Theory and Practice in Store Brand Operations Jiazhen Huo School of Economics and Management Tongji University Shanghai, China ISBN 978-981-15-9876-0 ISBN 978-981-15-9877-7 (eBook) https://doi.org/10.1007/978-981-15-9877-7 Jointly published with Tongji University Press The print edition is not for sale in China (Mainland). Customers from China (Mainland) please order the print book from: Tongji University Press. © Tongji University Press 2021 This work is subject to copyright. All rights are solely and exclusively licensed by the Publisher, whether the whole or part of the material is concerned, specifically the rights of translation, reprinting, reuse of illustrations, recitation, broadcasting, reproduction on microfilms or in any other physical way, and transmission or information storage and retrieval, electronic adaptation, computer software, or by similar or dissimilar methodology now known or hereafter developed. The use of general descriptive names, registered names, trademarks, service marks, etc. in this publication does not imply, even in the absence of a specific statement, that such names are exempt from the relevant protective laws and regulations and therefore free for general use. The publishers, the authors, and the editors are safe to assume that the advice and information in this book are believed to be true and accurate at the date of publication. Neither the publishers nor the authors or the editors give a warranty, express or implied, with respect to the material contained herein or for any errors or omissions that may have been made. -

CO. LIMITED, MINISO LIFESTYLE CANADA INC., MIHK MANAGEMENT INC., MINISO TRADING CANADA INC., MINISO CORPORATION and GUANGDONG SAIMAN INVESTMENT CO

No. S197744 Vancouver Registry IN THE SUPREME COURT OF BRITISH COLUMBIA IN THE MATTER OF THE COMPANIES' CREDITORS ARRANGEMENT ACT, R.S.C. 1985, c. C-36, AS AMENDED BETWEEN: MINISO INTERNATIONAL HONG KONG LIMITED, MINISO INTERNATIONAL (GUANGZHOU) CO. LIMITED, MINISO LIFESTYLE CANADA INC., MIHK MANAGEMENT INC., MINISO TRADING CANADA INC., MINISO CORPORATION and GUANGDONG SAIMAN INVESTMENT CO. LIMITED PETITIONERS AND: MIGU INVESTMENTS INC., MINISO CANADA INVESTMENTS INC., MINISO (CANADA) STORE INC., MINISO (CANADA) STORE ONE INC., MINISO (CANADA) STORE TWO INC., MINISO (CANADA) STORE THREE INC., MINISO (CANADA) STORE FOUR INC., MINISO (CANADA) STORE FIVE INC., MINISO (CANADA) STORE SIX INC., MINISO (CANADA) STORE SEVEN INC., MINISO (CANADA) STORE EIGHT INC., MINISO (CANADA) STORE NINE INC., MINISO (CANADA) STORE TEN INC., MINISO (CANADA) STORE ELEVEN INC., MINISO (CANADA) STORE TWELVE INC., MINISO (CANADA) STORE THIRTEEN INC., MINISO (CANADA) STORE FOURTEEN INC., MINISO (CANADA) STORE FIFTEEN INC., MINISO (CANADA) STORE SIXTEEN INC., MINISO (CANADA) STORE SEVENTEEN INC., MINISO (CANADA) STORE EIGHTEEN INC., MINISO (CANADA) STORE NINETEEN INC., MINISO (CANADA) STORE TWENTY INC., MINISO (CANADA) STORE TWENTY-ONE INC., MINISO (CANADA) STORE TWENTY-TWO INC. and 1120701 B.C. LTD. RESPONDENTS THIRD REPORT OF THE MONITOR ALVAREZ & MARSAL CANADA INC. SEPTEMBER 11, 2019 TABLE OF CONTENTS 1.0 INTRODUCTION ....................................................................................................................... 3 2.0 PURPOSE OF REPORT -

Factors Affecting Consumer Attitude to Shop at Miniso Ongky Alex Sander1*, Tannia1, Anthony Japutra1

Advances in Economics, Business and Management Research, volume 174 Proceedings of the Ninth International Conference on Entrepreneurship and Business Management (ICEBM 2020) Factors Affecting Consumer Attitude to Shop at Miniso Ongky Alex Sander1*, Tannia1, Anthony Japutra1 1Bunda Mulia University, Jakarta, Indonesia *Corresponding author. E-mail:[email protected] ABSTRACT The very rapid development of Miniso outlets in Indonesia and the increasing number of consumers, as marked by the increasing sales value, are the competitive values that need to be investigated further regarding what factors that can cause this phenomenon to occur. Besides, since the appearance of Miniso in Indonesia, several similar retailers have started to appear, but their existence has not been able to beat the Miniso. This research is a causal research and the data collection was done by distributing the questionnaires to 180 respondents using the judgmental sampling technique. Data analysis used the SMARTPLS 3.0 statistical tool. The results show that perceived quality has a significant effect on consumer attitude. Meanwhile, the variables of perceived risk and price consciousness do not have a significant effect on consumer attitude. And finally, consumer attitude variable has a significant effect on the willingness to buy. Keywords: perceived quality, perceived risk, price consciousness, consumer attitude, willingness to buy 1. INTRODUCTION highest transaction recorded at US $ 19,000 per day has occurred at Miniso outlets at Lippo Mall Puri [4]. Since the Indonesia is a potential market for various business sectors appearance of Miniso in Indonesia, there have been several due to the high level of consumption of Indonesian society. similar competitors such as DIY, Usupso, Brun-Brun, and The retail business sector is one of the sectors with potential many more. -

Tennessee Retail Academy Partners

TENNESSEE RETAIL ACADEMY PARTNERS 10% of overall Retail Sales are conducted Online US Census Bureau Q4 2018 retail is not dying it’s changing The high level of confidence reflects a sturdy economic Consumer Confidence expansion in the U.S. that’s about to turn nine years old. Job openings are at a record high and unemployment is at a record low.” 18 Year High The Conference Board Consumer Confidence Index® The Real Story Retail Decline Plans for 2018 Retail Stores Decline Rite Aid Stripes C-Stores Toys R Us Mattress Firm Best Buy Radio Shack The Bon Ton Sears/Kmart Signet Jewelers Ascena Retail Charming Charlie Gymboree Payless Shoesource The Children’s Place Orchard Supply Perfumania Source: IHL Group, CompanyReports • Many of these Retailers Have been Shrinking for a Decade • Outdated Business Models or Market Issues? Source: Lee Holman & Greg Buzek, IHL Group, Beyond the “Retail Apocalypse” to a bright Future, August 2018 Retail Growth Plans for 2018 Retail Store Count Growth Walgreens 7-Eleven Dollar General Couche-Tard Dollar Tree O’ Reilly Great Clips Autozone Fantastic Sam’s Five Below Ulta Beauty Sherwin Williams MINISO Marathon Oil Harbor Freight Tractor Supply Source: IHL Group, CompanyReports • Fastest Growing Retailers: Dollar, C-Stores, Beauty, and Specialty Hardgoods • What’s Growing Mirrors the Incomes of Consumers: • More Discounters • Less Mid-Range Luxury Source: Lee Holman & Greg Buzek, IHL Group, Beyond the “Retail Apocalypse” to a bright Future, August 2018 Every 5 Hours in America a New Dollar Store Opens Twitter: -

FTSE Publications

2 FTSE Russell Publications FTSE All World ex Controversies ex 19 August 2021 CW Index Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 1&1 AG <0.005 GERMANY Aeon Mall <0.005 JAPAN Alleghany 0.01 USA 360 Security (A) (SC SH) <0.005 CHINA Aeroflot Russian Airlines <0.005 RUSSIA Allegion PLC 0.02 USA 3i Group 0.02 UNITED Aeroports de Paris 0.01 FRANCE Allegro 0.01 POLAND KINGDOM AES Corp. 0.03 USA Alliance Bank Malaysia <0.005 MALAYSIA 3M Company 0.18 USA AES Gener S.A. <0.005 CHILE Alliance Global <0.005 PHILIPPINES 3M India <0.005 INDIA Aflac 0.06 USA Alliant Energy 0.02 USA 3SBio (P Chip) <0.005 CHINA African Rainbow Minerals Ltd <0.005 SOUTH AFRICA Allianz SE 0.16 GERMANY 51job ADS (N Shares) <0.005 CHINA Afterpay Touch Group 0.03 AUSTRALIA Allstate Corp 0.06 USA A P Moller - Maersk A 0.02 DENMARK AGC 0.01 JAPAN Ally Financial 0.03 USA A P Moller - Maersk B 0.03 DENMARK Ageas 0.02 BELGIUM Almarai Co Ltd 0.01 SAUDI ARABIA a2 Milk 0.01 NEW ZEALAND Agile Group Holdings (P Chip) <0.005 CHINA Alnylam Pharmaceuticals 0.03 USA A2A <0.005 ITALY Agilent Technologies 0.07 USA Alony Hetz Properties & Inv <0.005 ISRAEL AAC Technologies Holdings 0.01 HONG KONG Agility Public Warehousing Co KSC 0.01 KUWAIT Alpargatas SA PN <0.005 BRAZIL Aalberts NV 0.01 NETHERLANDS AGL Energy 0.01 AUSTRALIA Alpek S.A.B.