Printmgr File

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Registration Document

REGISTRATION DOCUMENT 2018 CONTENTS 1 GROUP OVERVIEW 3 4 SUSTAINABLE DEVELOPMENT 157 1.1 Business environment, economic 4.1 Klépierre’s CSR strategy 158 model and strategy 4 4.2 Act for the Planet 162 1.2 Key figures 8 4.3 Act for Territories 179 1.3 Share ownership and stock information 12 4.4 Act for People 184 1.4 Background 12 4.5 Sustainability governance 200 1.5 Property portfolio as of December 31, 2018 14 4.6 Supplemental data, methodology 1.6 Simplified organization chart and concordance tables 203 as of December 31, 2018 25 1.7 Risk management 26 5 CORPORATE GOVERNANCE 219 BUSINESS FOR THE YEAR 35 5.1 Management and oversight of the Company 221 2 5.2 Compensation and benefits of executive 2.1 Business overview 36 corporate officers 244 2.2 Business activity by region 41 2.3 Net current cash flow 45 2.4 Investments, developments, and disposals 46 2.5 Parent company earnings and distribution 49 6 SHARE CAPITAL, SHARE 2.6 Portfolio valuation 49 OWNERSHIP, GENERAL 2.7 Financial policy 54 MEETING OF SHAREHOLDERS 267 2.8 EPRA performance indicators 57 2.9 Outlook 61 6.1 Share capital and share ownership 268 6.2 General Meeting of Shareholders 282 FINANCIAL STATEMENTS 63 3 ADDITIONAL INFORMATION 309 3.1 Consolidated financial statements 7 for the year ended December 31, 2018 64 7.1 General information 310 3.2 Statutory auditors’ report on the 7.2 Documents on display 312 consolidated financial statements 122 7.3 Statement by the person responsible for 3.3 Company financial statements for the year the registration document, which serves -

Mergers & Acquisitions Mexico Annual Issue

Seale & Associates Creative Solutions. Trusted Advice. MERGERS & ACQUISITIONS MEXICO 2019 ANNUAL ISSUE SUMMARY OF MERGERS & ACQUISITIONS IN MEXICO In 2019, the volume and value of announced transactions accumulated to 169 and USD$15.8 billion, respectively, representing a decrease in volume of 25.0% and an increase in reported value 33.7% Year-Over-Year. It is necessary to clarify that two megadeals in the infrastructure sector represent US$7.1 billion of the total value reported 18 18 18 16 17 16 16 13 13 12 11 9 10 Deal Volume in Mexico # of Transactions per Month Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 18' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 2015 $15.8 226 2016 $8.6 210 2017 $11.4 240 2018 $8.6 $15.8 Deal Volume and 212 Value in Mexico Annual Transactions 2019 $8.7 $7.1* 169 (US$ billion) $7.1 *Megadeals Seale & Associates Mexico M&A 2019 Sources: Capital IQ, Mergermarket Creative Solutions. Trusted Advice. SUMMARY OF MERGERS & ACQUISITIONS BY MEXICAN COMPANIES ABROAD In 2019, the volume and value of announced transactions accumulated to 40 deals worth US$3.8 billion, representing a decrease in volume of 14.8% and a decrease in reported value of 26.9% Year-Over-Year 7 6 6 4 4 3 3 3 3 2 2 Deal Volume 1 Abroad # of Transactions 0 per Month Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 18' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 19' 2015 $13.4 47 2016 $9.6 49 2017 $8.9 39 2018 $5.2 47 Deal Volume and Value Abroad Annual Transactions (US$ billion) 2019 $3.8 40 Seale & Associates Mexico M&A 2019 Sources: Capital IQ, Mergermarket Creative Solutions. -

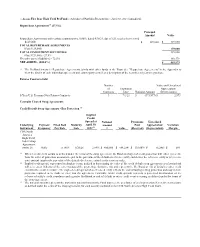

Valuation Multiples by Industry

Valuation Multiples by Industry https://www.eval.tech SIC Sector: (5200-5999) Retail Trade Report Date: 31 March 2021 Country: United States of America (U.S.A.) Industry Valuation Multiples The table below provides a summary of median industry enterprise value (EV) valuation multiples, as at the Report Date. The data is grouped by industry SIC code: EV Multiple Max # Rev EBITDA EBIT TotAss TanAss Retail-Lumber & Other Building Materials Dealers (5211) 6 1.52 13.48 16.37 3.01 3.38 Retail-Variety Stores (5331) 9 0.91 13.55 18.73 1.83 2.15 Retail-Grocery Stores (5411) 10 0.37 7.19 10.75 0.90 0.95 Retail-Auto Dealers & Gasoline Stations (5500) 21 0.94 12.34 17.63 1.64 1.74 Retail-Auto & Home Supply Stores (5531) 6 1.48 12.72 14.68 2.13 2.67 Retail-Apparel & Accessory Stores (5600) 7 1.17 14.18 39.80 1.34 1.45 Retail-Family Clothing Stores (5651) 10 1.23 15.85 53.84 1.31 1.56 Retail-Shoe Stores (5661) 5 - - - 1.24 1.20 Retail-Home Furniture, Furnishings & Equipment Stores 6 1.17 - - 1.22 2.20 (5700) Retail-Eating & Drinking Places (5810) 6 4.61 54.28 - 1.68 2.55 Retail-Eating Places (5812) 39 2.28 23.89 28.25 1.67 2.20 Retail-Miscellaneous Retail (5900) 7 2.16 - 18.46 1.49 2.69 Retail-Drug Stores And Proprietary Stores (5912) 7 0.59 16.69 39.50 0.78 1.38 Retail-Miscellaneous Shopping Goods Stores (5940) 8 0.79 7.46 10.79 0.95 1.16 Retail-Catalog & Mail-Order Houses (5961) 23 1.17 14.70 22.10 2.88 3.27 Retail-Retail Stores, Nec (5990) 12 0.91 10.77 13.84 1.32 1.28 © 2021 eVal 1 20210427 EV/Revenue Valuation Multiple We provide additional data relating to industry EV/Revenue valuation multiples: # Average Median Std. -

MINISO Announces Unaudited Results for the 2021 First Fiscal Quarter Ended September 30, 2020

MINISO InvestorRoom MINISO Announces Unaudited Results for the 2021 First Fiscal Quarter Ended September 30, 2020 GUANGZHOU, China, Dec. 18, 2020 /PRNewswire/ -- MINISO Group Holding Limited (NYSE: MNSO) ("MINISO" or the "Company"), a fast-growing global value retailer offering a variety of design-led lifestyle products, today announced its unaudited financial results for the first fiscal quarter ended September 30, 2020. Financial Highlights for the 2021 First Fiscal Quarter Ended September 30, 2020 Revenue for the fiscal quarter ended September 30, 2020, was RMB2,072.1 million (US$305.2 million), representing a decrease of 30.7% from the fiscal quarter endedS eptember 30, 2019, and an increase of 33.4% from the previous fiscal quarter ended June 30, 2020. Gross profit for the fiscal quarter ended September 30, 2020, was RMB522.4 million (US$76.9 million), representing a decrease of 44.3% from the fiscal quarter endedS eptember 30, 2019, and an increase of 37.7% from the previous fiscal quarter ended June 30, 2020. Loss from continuing operations for the fiscal quarter ended September 30, 2020, was RMB1,676.3 million (US$246.9 million) as compared to RMB20.3 million for the fiscal quarter ended September 30, 2019, and RMB74.8 million for the previous fiscal quarter ended June 30, 2020. Adjusted net profit[1] for the fiscal quarter ended September 30, 2020, was RMB102.1 million (US$15.0 million), representing a decrease of 74.6% from the fiscal quarter endedS eptember 30, 2019, and an increase of 140.8% from the previous fiscal quarter endedJ une 30, 2020. -

VIEWPOINT Weekly Rating Pages for Veritas Coverage Universe

July 28, 2017 VIEWPOINT Weekly Rating Pages for Veritas Coverage Universe WEEK ENDING JULY 27, 2017 SUMMARY PAGES 3-11 V-LIST 12 WATCHLIST 13 RATING PAGES 14-105 Viewpoint July 28, 2017 C OMPANY R ATING P AGES Click on company name below for a link to the rating page Shading indicates an updated rating page Agnico-Eagle Mines Ltd. 14 CGI Group Inc. 45 Macy’s, Inc. 76 Aimia Inc. 15 Choice Properties REIT 46 Magna International Inc. 77 Allied Properties REIT 16 Cogeco Cable Inc. 47 Manulife Financial Corp. 78 Air Canada 17 Constellation Software Inc. 48 Maple Leaf Foods Inc. 79 Amaya Inc. 18 Crescent Point Energy Corp. 49 Martinrea International Inc. 80 ARC Resources Ltd. 19 Crombie REIT 50 Metro Inc. 81 Artis REIT 20 CT Real Estate Investment Trust 51 National Bank of Canada 82 ATCO Ltd. 21 Dollarama Inc. 52 Newmont Mining Corp. 83 Badger Daylighting Ltd. 22 ECN Capital Corp. 53 Northland Power Inc. 84 Bank of Montreal 23 Element Fleet Management 54 Peyto Exploration & Development Corp. 85 Bank of Nova Scotia 24 Eldorado Gold Corp. 55 PrairieSky Royalty Ltd. 86 Barrick Gold Corp. 25 Emera Inc. 56 Quebecor Inc. 87 Baytex Energy Corp. 26 Empire Company Ltd. 57 Restaurant Brands International 88 BCE Inc. 27 Rogers Communications Inc. 89 Enbridge Inc. 58 BlackBerry Ltd. 28 Royal Bank of Canada 90 Encana Corp. 59 Boardwalk REIT 29 Enerplus Corp. 60 Shaw Communications Inc. 91 Bombardier Inc. 30 Fortis Inc. 61 Sun Life Financial Inc. 92 Bonavista Energy Corp. 31 George Weston Ltd. -

Anticipated Acquisition of 99P Stores Limited by Poundland Group Plc

Non-confidential ANTICIPATED ACQUISITION OF 99P STORES LIMITED BY POUNDLAND GROUP PLC RESPONSE TO PHASE II STATEMENT OF ISSUES 9 JULY 2015 LON37045457/6 163772-0005 POUNDLAND GROUP PLC Response to the CMA’s Statement of Issues This document is Poundland Group plc’s (Poundland) response to the UK Competition and Markets Authority’s (CMA) statement of issues of 25 June (Statement of Issues) regarding Poundland’s proposed acquisition of 99p Stores Ltd (99p Stores) (the Transaction). Please note that this document contains Poundland confidential information and should not be shared with third parties absent Poundland’s express prior written consent. 1. Executive Summary 1.1 Poundland welcomes the opportunity to provide the CMA with its input on the CMA’s Statement of Issues. 1.2 Poundland believes that the evidence strongly supports the view that this transaction does not pose any risk to competition. On the contrary, Poundland considers that the merger will be pro-competitive – bringing a superior proposition to 99p Stores’ customers, and further enhancing competition along the High Street. 1.3 In particular, the evidence shows that: (a) Poundland competes in a competitive marketplace everywhere it operates. Poundland competes all along the High Street: all of the products that Poundland sells are either available at a supermarket, at a limited assortment discounter (LAD), at another value general merchandiser (VGM), at a specialist retailer or at an independent discounter. Customers are value conscious – they want more for less, can easily switch retailers and do not display any ‘fascia loyalty’ in their quest for value. (b) There is no variation of the offer across the Poundland estate. -

Retaillier-Magazine.Pdf

AMITY BUSINESS SCHOOL ABS works with a mission to create an ambience of academic excellence in which new ideas, research projects flourish and the leaders and innovators of tomorrow emerge. In any top university of the world, research is the foundation which leads to a strong academic orientation. ABS has one of the most distinctive team of faculty and Researchers who are constantly augmenting their research and publications and hence leading the institute to pinnacles of academic achievement. ABS provides holistic education and strives to create managers of vision, mission, and the action and above all of the commitment. It attracts committed students from all across the globe. The focus of ABS is on developing a global perspective amongst their student to create a new cadre of management professionals who are multi-skilled and have a capability to function as cross functional teams and with a deep understanding of ethical and value based business processes. Amitians of ABS are instilled with compassion, loyalty and commitment that makes them an invaluable asset of any organisation. Our Missionary Leaders Inspires us to higher ends My mission is nation building through education and beyond Dr. Ashok K. Chauhan Founder President, Ritnand Balved Education Foundation (The Foundation of Amity Institutions and the sponsoring Body o Amity Universities), AKC Group of Companies Our Role Models Who Motivate us to attain the unattainable “From the Editor-In-Chief’s Desk The Indian retailing sector has flourished to cope up with metamorphosis from the age of offline to online platform that is being rapidly adopted by the consumers. -

The Influence of Product Diversity

ISSN 2303-1174 L.S.A.Pojoh., P.Kindangen., F.V.Arie…… THE INFLUENCE OF PRODUCT DIVERSITY AND STORE ATMOSPHERE ON CUSTOMER SATISFACTION AT MINISO MANADO PENGARUH KERAGAMAN PRODUK DAN SUASANA TOKO TERHADAP KEPUASAN PELANGGAN DI MINISO MANADO By: Lourina S.A. Pojoh1 Paulus Kindangen2 Fitty V. Arie3 123International Business Administration, Management Program, Faculty of Economics and Business University of Sam Ratulangi Manado E-mail: [email protected] [email protected] [email protected] Abstract: Diversity of business keeps developing through times, which creates more fierce competition in business. Companies do marketing strategies to survive the competition and to stay relevant with the industry. Companies have many ways to make the business become more competitive and can overcome the competition. One of the things that can be done to survive in the industry is to pursue customer satisfaction. There are many ways to pursue customer satisfaction in which there are a diversity of products and the atmosphere of the store offered. So this research aims to know the influence of product diversity and store atmosphere on customer satisfaction at Miniso Manado. This study uses a quantitative method with questionnaires used to collect the data. This research derived and examined the model through ordinal regression model in a sample of 100 respondents who have already bought a product at Miniso Manado. The finding of this research shows that the product diversity and store atmosphere have no significant influence on customer satisfaction at Miniso Manado. Retailers should pay attention to other things such as price, the quality of product, and the service. -

Page 1 of 375 6/16/2021 File:///C:/Users/Rtroche

Page 1 of 375 :: Access Flex Bear High Yield ProFund :: Schedule of Portfolio Investments :: April 30, 2021 (unaudited) Repurchase Agreements(a) (27.5%) Principal Amount Value Repurchase Agreements with various counterparties, 0.00%, dated 4/30/21, due 5/3/21, total to be received $129,000. $ 129,000 $ 129,000 TOTAL REPURCHASE AGREEMENTS (Cost $129,000) 129,000 TOTAL INVESTMENT SECURITIES 129,000 (Cost $129,000) - 27.5% Net other assets (liabilities) - 72.5% 340,579 NET ASSETS - (100.0%) $ 469,579 (a) The ProFund invests in Repurchase Agreements jointly with other funds in the Trust. See "Repurchase Agreements" in the Appendix to view the details of each individual agreement and counterparty as well as a description of the securities subject to repurchase. Futures Contracts Sold Number Value and Unrealized of Expiration Appreciation/ Contracts Date Notional Amount (Depreciation) 5-Year U.S. Treasury Note Futures Contracts 3 7/1/21 $ (371,977) $ 2,973 Centrally Cleared Swap Agreements Credit Default Swap Agreements - Buy Protection (1) Implied Credit Spread at Notional Premiums Unrealized Underlying Payment Fixed Deal Maturity April 30, Amount Paid Appreciation/ Variation Instrument Frequency Pay Rate Date 2021(2) (3) Value (Received) (Depreciation) Margin CDX North America High Yield Index Swap Agreement; Series 36 Daily 5 .00% 6/20/26 2.89% $ 450,000 $ (44,254) $ (38,009) $ (6,245) $ 689 (1) When a credit event occurs as defined under the terms of the swap agreement, the Fund as a buyer of credit protection will either (i) receive from the seller of protection an amount equal to the par value of the defaulted reference entity and deliver the reference entity or (ii) receive a net amount equal to the par value of the defaulted reference entity less its recovery value. -

Total Retail 2017 Stores Strike Back!

Total Retail 2017 Stores Strike Back! May 2017 “A deep dive into the Netherlands’ retail market” www.pwc.nl/totalretail 2 Total Retail 2017 Stores Strike Back! At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 157 countries with more than 223,000 people. At PwC in the Netherlands over 4,700 people work together. We’re committed to delivering quality in assurance, tax and advisory services. Tell us what matters to you and find out more by visiting us at www.pwc.nl. PwC Total Retail 2017 3 Online shopping in a hectic life Balancing my career with raising two children is a constant But we can predict trends by going to the source and juggling act and for me, time is at a premium. So, when my asking customers what they want and expect. To daughter recently asked me to buy her a new pencil case shed some light on the preferences and behaviours for school, I thought to myself: “When am I going to fit that of consumers, PwC surveys thousands of shoppers in?” Of course, it wasn’t just any pencil case she wanted; worldwide every year and presents the findings in our she had something specific in mind. Children notoriously Total Retail report. This year, we decided to take things have the best timing, and she happened to make this a step further, with a deep dive into the Netherlands’ request just as we were boarding an aeroplane. Once we market. Our findings from surveying 2,000 Dutch were both seated and while waiting for the plane to take shoppers are presented in this report. -

Annual Report 2019.Pdf (6.93

Annual Report 2019 Headphones with microphone DKK 70 An invitation to a richer life At Flying Tiger Copenhagen, we don’t design to make products look nice. We design to make people feel good. Whether we are designing extraordinary products for everyday life, or making everyday products look extraordinary, we want to bring you something that can bring you closer to someone else. Things that make you smile. Gifts you’ll want to give. Stuff you feel the urge to try and desperately want to share with others. Because real value lies not in the products we own, but in the experiences we share. Every month, Flying Tiger Copenhagen launches an array of new products. Things you need. Things you dream of. Things you didn’t know existed. Products made with thought for you and the resources we share. Each one designed to make the things you care about happen. A richer life doesn’t cost a fortune. At least not at Flying Tiger Copenhagen. Content 04 The world of Flying Tiger Copenhagen 43 Risk management 06 Message from the Chairman and the CEO 50 Board of Directors 09 Key figures 52 Executive Management 11 Mission and strategy 57 Consolidated financial statements 17 Operating and financial review 2019 107 Financial statements – Parent Company 25 Corporate social responsibility 135 Management statement 39 Corporate governance 136 Independent Auditors’ report We are online 14 Sustainably managed 22 forests Easy Store 38 Diversity 48 matters 4 Management Commentary Zebra A/S Annual Report 2019 Norway 42 stores (-4) Norway 42 stores (-4) Finland Sweden -

Ollie's Bargain Outlet Holdings, Inc

OLLIE’S BARGAIN OUTLET HOLDINGS, INC. 6295 Allentown Boulevard, Suite 1 Harrisburg, Pennsylvania 17112 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS To Be Held June 22, 2020 To our Stockholders, Notice is hereby given that the 2020 Annual Meeting of Stockholders of Ollie’s Bargain Outlet Holdings, Inc. will be held solely online via webcast on June 22, 2020, at 10:00 a.m. Eastern Time, to: 1. Elect Directors of the Board of Directors to hold office until the 2021 Annual Meeting of Stockholders; 2. Approve a non-binding proposal regarding the named executive officer compensation; 3. Ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending January 30, 2021. We will also consider any other matters that may properly come before the meeting or any adjournments or postponements of the meeting. Our Board of Directors has fixed the close of business on April 27, 2020 as the record date for the determination of stockholders entitled to notice of and to vote at our Annual Meeting of Stockholders and any adjournments or postponements thereof. We are again making our proxy materials available to you electronically in an effort to reduce the number of copies that we print. Ollie’s continues to respond to the rapidly changing circumstances surrounding the COVID-19 pandemic. We determined to hold our Annual Meeting on a virtual-only basis in response to public health, travel, and safety concerns related to COVID-19. As a result, the entire meeting will occur online and there will be no physical location where stockholders can attend.