New Zealand Wool Inside: a Discussion Case Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

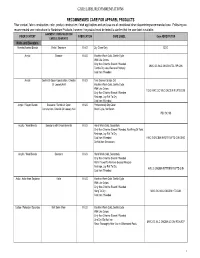

Care Label Recommendations

CARE LABEL RECOMMENDATIONS RECOMMENDED CARE FOR APPAREL PRODUCTS Fiber content, fabric construction, color, product construction, finish applications and end use are all considered when determining recommended care. Following are recommended care instructions for Nordstrom Products, however; the product must be tested to confirm that the care label is suitable. GARMENT/ CONSTRUCTION/ FIBER CONTENT FABRICATION CARE LABEL Care ABREVIATION EMBELLISHMENTS Knits and Sweaters Acetate/Acetate Blends Knits / Sweaters K & S Dry Clean Only DCO Acrylic Sweater K & S Machine Wash Cold, Gentle Cycle With Like Colors Only Non-Chlorine Bleach If Needed MWC GC WLC ONCBIN TDL RP CIIN Tumble Dry Low, Remove Promptly Cool Iron If Needed Acrylic Gentle Or Open Construction, Chenille K & S Turn Garment Inside Out Or Loosely Knit Machine Wash Cold, Gentle Cycle With Like Colors TGIO MWC GC WLC ONCBIN R LFTD CIIN Only Non-Chlorine Bleach If Needed Reshape, Lay Flat To Dry Cool Iron If Needed Acrylic / Rayon Blends Sweaters / Gentle Or Open K & S Professionally Dry Clean Construction, Chenille Or Loosely Knit Short Cycle, No Steam PDC SC NS Acrylic / Wool Blends Sweaters with Embelishments K & S Hand Wash Cold, Separately Only Non-Chlorine Bleach If Needed, No Wring Or Twist Reshape, Lay Flat To Dry Cool Iron If Needed HWC S ONCBIN NWOT R LFTD CIIN DNID Do Not Iron Decoration Acrylic / Wool Blends Sweaters K & S Hand Wash Cold, Separately Only Non-Chlorine Bleach If Needed Roll In Towel To Remove Excess Moisture Reshape, Lay Flat To Dry HWC S ONCBIN RITTREM -

Natural Materials for the Textile Industry Alain Stout

English by Alain Stout For the Textile Industry Natural Materials for the Textile Industry Alain Stout Compiled and created by: Alain Stout in 2015 Official E-Book: 10-3-3016 Website: www.TakodaBrand.com Social Media: @TakodaBrand Location: Rotterdam, Holland Sources: www.wikipedia.com www.sensiseeds.nl Translated by: Microsoft Translator via http://www.bing.com/translator Natural Materials for the Textile Industry Alain Stout Table of Contents For Word .............................................................................................................................. 5 Textile in General ................................................................................................................. 7 Manufacture ....................................................................................................................... 8 History ................................................................................................................................ 9 Raw materials .................................................................................................................... 9 Techniques ......................................................................................................................... 9 Applications ...................................................................................................................... 10 Textile trade in Netherlands and Belgium .................................................................... 11 Textile industry ................................................................................................................... -

Choosing the Proper Short Cut Fiber for Your Nonwoven Web

Choosing The Proper Short Cut Fiber for Your Nonwoven Web ABSTRACT You have decided that your web needs a synthetic fiber. There are three important factors that have to be considered: generic type, diameter, and length. In order to make the right choice, it is important to know the chemical and physical characteristics of the numerous man-made fibers, and to understand what is meant by terms such as denier and denier per filament (dpf). PROPERTIES Denier Denier is a property that varies depending on the fiber type. It is defined as the weight in grams of 9,000 meters of fiber. The current standard of denier is 0.05 grams per 450 meters. Yarn is usually made up of numerous filaments. The denier of the yarn divided by its number of filaments is the denier per filament (dpf). Thus, denier per filament is a method of expressing the diameter of a fiber. Obviously, the smaller the denier per filament, the more filaments there are in the yarn. If a fairly closed, tight web is desired, then lower dpf fibers (1.5 or 3.0) are preferred. On the other hand, if high porosity is desired in the web, a larger dpf fiber - perhaps 6.0 or 12.0 - should be chosen. Here are the formulas for converting denier into microns, mils, or decitex: Diameter in microns = 11.89 x (denier / density in grams per milliliter)½ Diameter in mils = diameter in microns x .03937 Decitex = denier x 1.1 The following chart may be helpful. Our stock fibers are listed along with their density and the diameter in denier, micron, mils, and decitex for each: Diameter Generic Type -

Yarn Numbering Systems

TECHNICAL BULLETIN 6399 Weston Parkway, Cary, North Carolina, 27513 • Telephone (919) 678-2220 TRI 1014 YARN NUMBERING SYSTEMS © 2003 Cotton Incorporated. All rights reserved; America’s Cotton Producers and Importers. TABLE OF CONTENTS Page INTRODUCTION 1 DIRECT SYSTEMS 1 INDIRECT SYSTEMS 2 CONVERSION 4 PLIED YARNS 4 YARN DIAMETER 5 YARN NUMBERING SYSTEMS - TABLE 1 6 CONVERSION FACTORS - TABLE 2 7 YARN NUMBERING SYSTEMS INTRODUCTION Textiles are often sold on a weight basis and consequently it is natural to express the size of "thickness" of a yarn in terms of weight (or mass). There are two basic ways in which this may be done. These are: (a) by saying how much a given length of yarn weighs, or (b) by saying what length of yarn one would have in a given weight. Generally these are known as the direct and indirect systems of yarn numbering, respectively. In other words: Weight(or mass) Direct yarn number = Length Length Indirect yarn number = Weight(or mass) It will be noted that one is the inverse of the other. In the first case, the number gets larger as the yarn or strand gets coarser. In the second case, the number gets smaller as the yarn or strand gets coarser. Each system has its advantages and disadvantages and each has found areas in which, by custom, it is used. It so happens that because long, thin strands are usually involved, the length figures are usually large and the weight figures are small. Consequently, the yarn numbers would get impossibly large or impossibly small unless special units are used. -

Investigation of the Mechanical Properties of a Carbon Fibre-Reinforced Nylon Filament for 3D Printing

machines Article Investigation of the Mechanical Properties of a Carbon Fibre-Reinforced Nylon Filament for 3D Printing Flaviana Calignano 1,* , Massimo Lorusso 2 , Ignanio Roppolo 3 and Paolo Minetola 1 1 Department of Management and Production Engineering, Politecnico di Torino, Corso Duca degli Abruzzi 24, 10129 Turin, Italy; [email protected] 2 Istituto Italiano di Tecnologia, Center for Sustainable Future Technologies IIT@Polito, Corso Trento 21, 10129 Turin, Italy; [email protected] 3 Department of Applied Science and Technology, Politecnico di Torino, Corso Duca degli Abruzzi 24, 10129 Turin, Italy; [email protected] * Correspondence: fl[email protected]; Tel.: +39-011-090-7218 Received: 19 July 2020; Accepted: 2 September 2020; Published: 4 September 2020 Abstract: Additive manufacturing (i.e., 3D printing) has rapidly developed in recent years. In the recent past, many researchers have highlighted the development of in-house filaments for fused filament fabrication (FFF), which can extend the corresponding field of application. Due to the limited mechanical properties and deficient functionality of printed polymer parts, there is a need to develop printable polymer composites that exhibit high performance. This study analyses the actual mechanical characteristics of parts fabricated with a low-cost printer from a carbon fibre-reinforced nylon filament. The results show that the obtained values differ considerably from the values presented in the datasheets of various filament suppliers. Moreover, the hardness and tensile strength are influenced by the building direction, the infill percentage, and the thermal stresses, whereas the resilience is affected only by the building direction. Furthermore, the relationship between the mechanical properties and the filling factor is not linear. -

Analysis of the Polyester Clothing Value Chain to Identify Key Intervention Points for Sustainability Cristina Palacios‑Mateo* , Yvonne Van Der Meer and Gunnar Seide

Palacios‑Mateo et al. Environ Sci Eur (2021) 33:2 https://doi.org/10.1186/s12302‑020‑00447‑x REVIEW Open Access Analysis of the polyester clothing value chain to identify key intervention points for sustainability Cristina Palacios‑Mateo* , Yvonne van der Meer and Gunnar Seide Abstract Clothing is one of the primary human needs, and the demand is met by the global production of thousands of tons of textile fbers, fabrics and garments every day. Polyester clothing manufactured from oil‑based polyethylene tereph‑ thalate (PET) is the market leader. Conventional PET creates pollution along its entire value chain—during the produc‑ tion, use and end‑of‑life phases—and also contributes to the unsustainable depletion of resources. The consumption of PET garments thus compromises the quality of land, water and air, destroys ecosystems, and endangers human health. In this article, we discuss the diferent stages of the value chain for polyester clothing from the perspective of sustainability, describing current environmental challenges such as pollution from textile factory wastewater, and microfbers released from clothing during the laundry cycle. We also consider potential solutions such as enhanced reuse and recycling. Finally, we propose a series of recommendations that should be applied to polyester clothing at all stages along the value chain, ofering the potential for meaningful and efective change to improve the environ‑ mental sustainability of polyester textiles on a global scale. Keywords: PET, Textiles, Value chain, Environmental sustainability, Microfbers, Pollution, Recycling, Life cycle Introduction with 2019 estimates in Germany suggesting an average Te global volume of fber production for textile manu- lifetime of only 4.4 years [5]. -

Textile Printing

TECHNICAL BULLETIN 6399 Weston Parkway, Cary, North Carolina, 27513 • Telephone (919) 678-2220 ISP 1004 TEXTILE PRINTING This report is sponsored by the Importer Support Program and written to address the technical needs of product sourcers. © 2003 Cotton Incorporated. All rights reserved; America’s Cotton Producers and Importers. INTRODUCTION The desire of adding color and design to textile materials is almost as old as mankind. Early civilizations used color and design to distinguish themselves and to set themselves apart from others. Textile printing is the most important and versatile of the techniques used to add design, color, and specialty to textile fabrics. It can be thought of as the coloring technique that combines art, engineering, and dyeing technology to produce textile product images that had previously only existed in the imagination of the textile designer. Textile printing can realistically be considered localized dyeing. In ancient times, man sought these designs and images mainly for clothing or apparel, but in today’s marketplace, textile printing is important for upholstery, domestics (sheets, towels, draperies), floor coverings, and numerous other uses. The exact origin of textile printing is difficult to determine. However, a number of early civilizations developed various techniques for imparting color and design to textile garments. Batik is a modern art form for developing unique dyed patterns on textile fabrics very similar to textile printing. Batik is characterized by unique patterns and color combinations as well as the appearance of fracture lines due to the cracking of the wax during the dyeing process. Batik is derived from the Japanese term, “Ambatik,” which means “dabbing,” “writing,” or “drawing.” In Egypt, records from 23-79 AD describe a hot wax technique similar to batik. -

Performance Evaluation of 3-D Basalt Fiber Reinforced Concrete & Basalt

Highway IDEA Program Performance Evaluation of 3-D Basalt Fiber Reinforced Concrete & Basalt Rod Reinforced Concrete Final Report for Highway IDEA Project 45 Prepared by: V Ramakrishnan and Neeraj S. Tolmare, South Dakota School of Mines & Technology, Rapid City, SD Vladimir B. Brik, Research & Technology, Inc., Madison, WI November 1998 IDEA PROGRAM F'INAL REPORT Contract No. NCHRP-45 IDEA Program Transportation Resea¡ch Board National Research Council November 1998 PERFORMANCE EVALUATION OF 3.I) BASALT ITIBER REINFORCED CONCRETE & BASALT R:D RETNFORCED CONCRETE V. Rarnalaishnan Neeraj S. Tolmare South Dakota School of Mines & Technolory, Rapid City, SD Principal Investigator: Madimir B. Brik Research & Technology, lnc., Madison, WI INNOVATIONS DESERVING EXPLORATORY ANALYSIS (IDEA) PROGRAMS MANAGED BY THE TRANSPORTATION RESEARCH BOARD (TRB) This NCHRP-IDEA investigation was completed as part of the National Cooperative Highway Research Program (NCHRP). The NCHRP-IDEA program is one of the four IDEA programs managed by the Transportation Research Board (TRB) to foster innovations in highway and intermodal surface transportation systems. The other three IDEA program areas are Transit-IDEA, which focuses on products and results for transit practice, in support of the Transit Cooperative Research Program (TCRP), Safety-IDEA, which focuses on motor carrier safety practice, in support of the Federal Motor Carrier Safety Administration and Federal Railroad Administration, and High Speed Rail-IDEA (HSR), which focuses on products and results for high speed rail practice, in support of the Federal Railroad Administration. The four IDEA program areas are integrated to promote the development and testing of nontraditional and innovative concepts, methods, and technologies for surface transportation systems. -

H'mong Ancient Methods of Indigo Dyeing and Beeswax Batik in Cat

International Journal of Science and Research (IJSR) ISSN: 2319-7064 ResearchGate Impact Factor (2018): 0.28 | SJIF (2019): 7.583 H’mong Ancient Methods of Indigo Dyeing and Beeswax Batik in Cat CAT Village, Hoang Lien Commune, SAPA Town, Lao Cai Province, Vietnam Le Thi Hanh Lien1*, Nguyen Thi Hai Yen2, Dao Thi Luu3, Phi Thi Thu Hoang4, Nguyen Thuy Linh5 1, 2, 3, 4 Institute of Geography, Vietnam Academy of Science and Technology, 18 Hoang Quoc Viet Road, Nghia Do, CauGiay District, Ha Noi, Vietnam 5Management Development Institute of Singapore *Corresponding author: lehanhlien2017[at]gmail.com Abstract: Indigo dyeing and beeswax batik are the two traditional crafts that have long been associated with the H’Mong people in Sa Pa in general, Cat Cat village in particular and still preserved until the presentday. Through many stages of making indigo dye combined with sophisticated techniques and the ingenuity, meticulousness of the artisans in each motif and pattern, unique beeswax batik and indigo dyeing products have been created bringing the cultural identity of the H’mong people. These handicraft products have become a highlight to attract tourists to learn and discover local cultural values and they are meaningful souvenirs for visitors after each trip. In recent years, the development of the community-based tourism model in Cat Cat village has brought many benefits to the local community. Meanwhile, it has also contributed to creating opportunities for the development and restoration of H’mong traditional crafts. Keywords: indigo dyeing, beeswax batik, H’Mong, Cat Cat, Sa Pa 1. Introduction cultural and religious life of the H'Mong. -

Vita NZ and Pacific Brand Holdings

PUBLIC VERSION COMMERCE ACT 1986: BUSINESS ACQUISITION SECTION 66: NOTICE SEEKING CLEARANCE Date: 7 March 2008 The Registrar Business Acquisitions and Authorisations Commerce Commission PO Box 2351 WELLINGTON Pursuant to s66(1) of the Commerce Act 1986 notice is hereby given seeking clearance of a proposed acquisition. EXECUTIVE SUMMARY 1. EXECUTIVE SUMMARY 1.1 Vita New Zealand Limited ("Vita") seeks clearance to acquire the Assets of Pacific Brands Holdings (NZ) Limited's ("Pacific Brands") Dunlop Foams & Flooring and Sleepmaker divisions, which are respectively active in the manufacture and importation of PU foam, importation of rebonded PU foam flooring underlay, and the manufacture of mattresses. 1.2 Vita has entered into a conditional agreement for the acquisition of the Assets. 1.3 The proposed acquisition affects the national market for the manufacture and wholesale supply of PU foam ("PU Foam Market") and the national market for the manufacture and / or importation for wholesale supply of flooring underlay ("Underlay Market"). Vita considers that a substantial lessening of competition will not occur in either of these markets. 1.4 In respect of the PU Foam Market, Vita considers that the proposed acquisition will not result in a substantial lessening of competition for the following reasons: (a) The combined entity will continue to be constrained by Enviro-foam's substantial excess capacity, rendering it well placed to easily and readily expand. (b) The ability for acquirers of PU foam, such as Sleepyhead [CONFIDENTIAL], to establish their own PU foam manufacturing facilities (given the low barriers) means that the threat of a switch to self-supply by any one of the combined entity's larger acquirers will act as a real constraint. -

Nylon Wool Fiber Columns

U.S. Corporate Headquarters Polysciences Europe GmbH Polysciences Asia-Pacific, Inc. 400 Valley Rd. Badener Str. 13 2F-1, 207 DunHua N. Rd. Warrington, PA 18976 69493 Hirschberg an der Taipei, Taiwan 10595 1(800) 523-2575 / (215) 343-6484 Bergstrasse, Germany (886) 2 8712 0600 1(800)343-3291 fax +(49) 6201 845 20 0 (886) 2 8712 2677 fax [email protected] +(49) 6201 845 20 20 fax [email protected] [email protected] TECHNICAL DATA SHEET 425A Page 1 of 2 Nylon Wool Fiber Columns BACKGROUND NYLON WOOL FIBER VS. SHEEP RBC ROSETTING METHODS Researchers have been using nylon wool fiber procedures to separate T-cell and Wong and Mittal (1981)9 did extensive research comparing the methods of Nylon B-cell lymphocytes for more than 20 years. In the early 1970’s M. H. Julius et al Wool Fiber separation and the commonly- used and well-studied sheep RBC (1973),1 Eisen et al (1972),2 and Greaves & Brain (1974)3 described specific (SRBC) rosetting.10,11 Wong and Mittal were interested in isolating B-cells for conditions for the use of Nylon Wool Fiber in columns or plastic straws. These serologic typing of HLA-DR antigen. protocols resulted in yields of 50-90% T-cell recovery and 10-100 fold B-cell depletion. Wong and Mittal concluded that “Due to its simplicity and reliability, nylon wool adherence may be preferred over the SRBC rosette method for the routine pheno- These early researchers found it necessary to scrub or wash their Nylon Wool Fiber typing of B-cells.” Their findings are illustrated in Table 1. -

Double Corduroy Rag

E-newes - coming to you monthly! Get connected: Visit schachtspindle.com for helpful Each issue includes a project, hints, project ideas, product manuals and informa- tion. Follow our blog, like us on Facebook, pin us on helpful tips & Schacht news. Pinterest, visit Schacht groups on Ravelry, follow us TM on Twitter. News from the Ewes DECEMBER 2014 Blanket Weaving in the Southwest. We What is a countermarche loom liked Loie Stenzel’s suggestion for us- and why do we love it for rugs? Project ing patterned as well as solid fabrics, Double Corduroy Rag Rug Before I tell you why we love our countermarche so I spent some time by Chase Ford Cranbrook loom for rug weaving, I want to give you familiarizing myself After weaving off the mohair blanket a very brief overview of three systems for creating with the color pal- sheds. on the Cranbrook Loom (see pictures ettes that appeared On jack looms, on our Facebook), Jane and I decided in the blankets in when the treadle is that a double corduroy rug would be Wheat’s book. I depressed, some shafts fun to try. Corduroy is a pile weave that found several colors raise and the others is created by weaving floats along with and prints of a light- remain stationary. Jack a ground weave. The floats are cut after weight 100% cotton looms are the most weaving to form the pile. Corduroy can fabric to sample Rug sample popular style of looms be either single or double. Generally, with. in the U.S. and is the system we use for our Wolf and Standard Floor Looms.