Return of Organization Exempt from Income Tax OMB No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GLOBAL CHILLING the Impact of Mass Surveillance on International Writers

The Impact of Mass Surveillance on International Writers GLOBAL CHILLING The Impact of Mass Surveillance on International Writers Results from PEN’s International Survey of Writers January 5, 2015 1 Global Chilling The Impact of Mass Surveillance on International Writers Results from PEN’s International Survey of Writers January 5, 2015 © PEN American Center 2015 All rights reserved PEN American Center is the largest branch of PEN International, the world’s leading literary and human rights organization. PEN works in more than 100 countries to protect free expression and to defend writers and journalists who are imprisoned, threatened, persecuted, or attacked in the course of their profession. PEN America’s 3700 members stand together with more than 20,000 PEN writers worldwide in international literary fellowship to carry on the achievements of such past members as James Baldwin, Robert Frost, Allen Ginsberg, Langston Hughes, Arthur Miller, Eugene O’Neill, Susan Sontag, and John Steinbeck. For more information, please visit www.pen.org. CONTENTS INTRODUCTION 4 PRESENTATION OF KEY FINDINGS 7 RECOMMENDATIONS 15 ACKNOWLEDGMENTS 17 METHODOLOGY 18 APPENDIX: PARTIAL SURVEY RESULTS 24 NOTES 35 GLOBAL CHILLING From August 28 to October 15, 2014, INTRODUCTION PEN American Center carried out an international survey of writers1, to in- vestigate how government surveillance influences their thinking, research, and writing, as well as their views of gov- ernment surveillance by the U.S. and its impact around the world. The survey instrument was developed and overseen by the nonpartisan expert survey research firm The FDR Group.2 The survey yielded 772 responses from writers living in 50 countries. -

Return of Organization Exempt from Income Tax OMB No

PUBLIC DISCLOSURE COPY - STATE REGISTRATION NO. 00-75-66 Return of Organization Exempt From Income Tax OMB No. 1545-0047 Form 990 Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation) 2012 Department of the Treasury Open to Public Internal Revenue Service | The organization may have to use a copy of this return to satisfy state reporting requirements. Inspection A For the 2012 calendar year, or tax year beginning and ending B Check if C Name of organization D Employer identification number applicable: Address change PEN AMERICAN CENTER, INC. Name change Doing Business As 13-3447888 Initial return Number and street (or P.O. box if mail is not delivered to street address) Room/suite E Telephone number Termin- ated 588 BROADWAY 303 (212)334-1660 Amended return City, town, or post office, state, and ZIP code G Gross receipts $ 4,792,345. Applica- tion NEW YORK, NY 10012-5246 H(a) Is this a group return pending F Name and address of principal officer:SUZANNE NOSSEL for affiliates? Yes X No SAME AS C ABOVE H(b) Are all affiliates included? Yes No I Tax-exempt status: X 501(c)(3) 501(c) ( )§ (insert no.) 4947(a)(1) or 527 If "No," attach a list. (see instructions) J Website: | WWW.PEN.ORG H(c) Group exemption number | K Form of organization: X Corporation Trust Association Other | L Year of formation: 1985 M State of legal domicile: NY Part I Summary 1 Briefly describe the organization's mission or most significant activities: PEN AMERICAN CENTER, INC. -

Supreme Court of the United States ______

No. 17-965 IN THE Supreme Court of the United States _____________________________ DONALD J. TRUMP, PRESIDENT OF THE UNITED STATES, ET AL., Petitioners, v. STATE OF HAWAII, ET AL., Respondents. _____________________________ ON WRIT OF CERTIORARI TO THE UNITED STATES COURT OF APPEALS FOR THE NINTH CIRCUIT _____________________________ BRIEF OF AMICI CURIAE PEN AMERICA AND OTHERS IN SUPPORT OF RESPONDENTS _____________________________ Robert D. Balin Robert Corn-Revere Abigail B. Everdell Counsel of Record DAVIS WRIGHT DAVIS WRIGHT TREMAINE LLP TREMAINE LLP 1251 Avenue of the 1919 Pennsylvania Ave., NW Americas, 21st Fl. Ste. 800 New York, NY 10020 Washington, DC 20006 (212) 489-8230 (202) 973-4200 [email protected] Counsel for Amici Curiae LEGAL PRINTERS LLC, Washington DC ! 202-747-2400 ! legalprinters.com TABLE OF CONTENTS Page TABLE OF AUTHORITIES ...................................... ii I. INTEREST OF AMICI CURIAE .................... 1 II. INTRODUCTION AND SUMMARY OF ARGUMENT .................................................... 3 III. ARGUMENT .................................................... 6 A. The Proclamation Impermissibly Burdens The First Amendment Rights of Amici and Other U.S. Citizens to Receive Information ............................. 6 B. Americans Have a First Amendment Right to Receive Information and Ideas Via In-Person Interactions ........................................................... 12 C. By Any Standard of Review, the Proclamation’s Burdens on Free Speech Must be Found Unconstitutional ...................................... -

Financial Statement 2018-2019

PEN AMERICAN CENTER, INC. CONSOLIDATED FINANCIAL STATEMENTS DECEMBER 31, 2019 AND 2018 INDEPENDENT AUDITORS’ REPORT To the Board of Trustees of PEN American Center, Inc. We have audited the accompanying consolidated financial statements of PEN American Center, Inc. (a not-for-profit corporation), which comprise the consolidated statements of financial position as of December 31, 2019 and 2018, and the related consolidated statements of activities, functional expenses and cash flows for the years then ended, and the related notes to the consolidated financial statements. Management's Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditors' Responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence -

By Alyson Miller, Bachelor of Arts

SCANDALOUS TEXTS: THE ANXIETIES OF THE LITERARY By Alyson Miller, Bachelor of Arts (Hons.) Submitted in fulfilment of the requirements for the degree of Doctor of Philosophy Deakin University September 2010 DEAKIN UNIVERSITY CANDIDATE DECLARATION I certify that the thesis entitled Scandalous Texts: The Anxieties of the Literary submitted for the degree of Doctor of Philosophy is the result of my own work and that where reference is made to the work of others, due acknowledgment is given. I also certify that any material in the thesis which has been accepted for a degree or diploma by any university or institution is identified in the text. Full Name: Alyson Miller Signed…………………………………………… Date: September 6, 2010 ACKNOWLEDGEMENTS Dr Maria Takolander and Dr David McCooey: for a beginning, a middle and the end of many green pens. Mum and Dad: for the patient belief, the coffee, the clean washing, and ‘the’, ‘and’, ‘a’, ‘at’ and ‘with’. James and Lisa: for pumpkins and boats, waffles and Mexico. TABLE OF CONTENTS INTRODUCTION Scandalous Texts: Haunted by Words 1 CHAPTER ONE Unsuited to Age Group: The Anxieties of Children’s Literature 9 Framing the Child: Childhood, Children and Literature Igniting Debate: The Scandalous Texts ‘Feel Yer Tits?’: Sexual Content in Young Adult Literature A Scandalous Absence: Controversy and Race Masterpieces of Satanic Deception: Transgressing the Sacred An Anxious Connection: Children and Literature CHAPTER TWO Dismembering Women: Gender and Identity in Top-Notch Smut 39 Femmes Fatales: Madame Bovary, The Well -

Global Chilling: the Impact of Mass Surveillance on International Writers

The Impact of Mass Surveillance on International Writers GLOBAL CHILLING The Impact of Mass Surveillance on International Writers Results from PEN’s International Survey of Writers January 5, 2014 1 Global Chilling The Impact of Mass Surveillance on International Writers Results from PEN’s International Survey of Writers January 5, 2015 © PEN American Center 2015 All rights reserved PEN American Center is the largest branch of PEN International, the world’s leading literary and human rights organization. PEN works in more than 100 countries to protect free expression and to defend writers and journalists who are imprisoned, threatened, persecuted, or attacked in the course of their profession. PEN America’s 3700 members stand together with more than 20,000 PEN writers worldwide in international literary fellowship to carry on the achievements of such past members as James Baldwin, Robert Frost, Allen Ginsberg, Langston Hughes, Arthur Miller, Eugene O’Neill, Susan Sontag, and John Steinbeck. For more information, please visit www.pen.org. CONTENTS INTRODUCTION 4 PRESENTATION OF KEY FINDINGS 7 RECOMMENDATIONS 15 ACKNOWLEDGMENTS 17 METHODOLOGY 18 APPENDIX: PARTIAL SURVEY RESULTS 24 NOTES 35 GLOBAL CHILLING From August 28 to October 15, 2014, INTRODUCTION PEN American Center carried out an international survey of writers1, to in- vestigate how government surveillance influences their thinking, research, and writing, as well as their views of gov- ernment surveillance by the U.S. and its impact around the world. The survey instrument was developed and overseen by the nonpartisan expert survey research firm The FDR Group.2 The survey yielded 772 responses from writers living in 50 countries. -

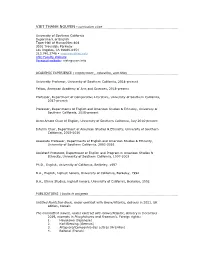

Viet Thanh Nguyen CV 2019

VIET THANH NGUYEN • curriculum vitae University of Southern California Department of English Taper Hall of Humanities 404 3501 Trousdale Parkway Los Angeles, CA 90089-0354 213.740.3746 • [email protected] USC Faculty Website Personal website: vietnguyen.info ACADEMIC EXPERIENCE | employment , education, and titles University Professor, University of Southern California, 2018-present Fellow, American Academy of Arts and Sciences, 2018-present Professor, Department of Comparative Literature, University of Southern California, 2017-present Professor, Departments of English and American Studies & Ethnicity, University of Southern California, 2016-present Aerol Arnold Chair of English, University of Southern California, July 2016-present Interim Chair, Department of American Studies & Ethnicity, University of Southern California, 2015-2016 Associate Professor, Departments of English and American Studies & Ethnicity, University of Southern California, 2003-2016 Assistant Professor, Department of English and Program in American Studies & Ethnicity, University of Southern California, 1997-2003 Ph.D., English, University of California, Berkeley, 1997 B.A., English, highest honors, University of California, Berkeley, 1992 B.A., Ethnic Studies, highest honors, University of California, Berkeley, 1992 PUBLICATIONS | books in progress Untitled Nonfiction Book, under contract with Grove/Atlantic, delivery in 2021. UK edition, Corsair. The Committed (novel), under contract with Grove/Atlantic, delivery in December 2019, excerpts in Ploughshares and Freeman’s. Foreign rights: 1. Hayakawa (Japanese) 2. Karl Blessing (German) 3. Alfaguara/Companhia das Lettras (Brazilian) 4. Belfond (French) 2/70 NGUYEN • curriculum vitae, 10/1/2019 5. Neri Pozza (Italian) 6. Elsinore (Portuguese) Featured in: 1. “The Ark,” short film adaptation of the opening to The Committed, by Matty Huynh, Smithsonian Asian Pacific American Center | A cultural laboratory for Asian Pacific American history, art, and culture, June 2018 PUBLICATIONS | single-authored books 1. -

35931 Marx Myles

AUTHORS GUILD Winter 2017 BULLETIN A Writing Career: Pitching, Persisting, Getting Ahead, Getting Paid and Staying Out of Trouble New York City Passes Landmark Freelancer Law What the Trump Presidency Could Mean for Writers collecting payment at some point in their careers—and New York City are stiffed an average of $6,000 annually—will come as no surprise to many writers. One of the Guild’s most Passes Landmark Bill significant advocacy efforts in the last two decades was the $18 million class action suit we filed alongside to Protect Freelance the American Society of Journalists and Authors, the National Writers Union, and 21 freelance writers in 2000, on behalf of thousands of freelance writers who Workers had been paid by major newspapers and magazines By Brandon Reiter for one-time use of their articles, and then saw their work swept into electronic databases without further et’s start with some good news. On October 27, compensation. (The case was settled in the plaintiffs’ New York’s City Council voted unanimously in favor in 2005 but various court challenges have de- Lfavor of the “Freelance Isn’t Free Act,” providing freelance workers with an unprecedented set of legal protections against client nonpayment. Under the bill, anyone hiring a freelance worker for a project valued The legislation is the first of its kind— at $800 or more over a four-month period will have to a milestone for freelancers’ rights agree, in writing, to a contract that clearly outlines the scope of the work, the agreed-upon rate, the method of and the first serious challenge to the payment, and the payment deadline. -

49 Books 69 Libraries 30 Countries 10 Languages 1 Winner

49 Books 30 Countries 1 Winner 69 Libraries 10 Languages 2021 LONGLIST Clap When You Land Elizabeth Acevedo............................... 1 Things That Fall From The Sky Selja Ahava..........................1 Homeland Fernando Aramburu.............................................1 The Vanishing Half Brit Bennett............................................2 The White Girl Tony Birch.....................................................2 It Would Be Night In Caracus Karina Sainz Borgo...................2 The Cat and The City Nick Bradley.........................................3 The Confessions of Frannie Langton Sara Collins.................. 3 The Innocents Michael Crummy............................................4 The Pelican: a comedy Martin Michael Driessen..................4 Catacombs Mary Anna Evans.................................................5 Girl, Woman, Other Bernardine Evaristo.................................5 The Other Name: Septology 1-11 Jon Fosse......................... 5 Gun Island Amitav Ghosh.....................................................6 When All Is Said Anne Griffin................................................6 The Eighth Life: ( for Brilka ) Nino Haratischwili...................6 Beyond Yamashita and Percival Shaari Isa............................ 7 . Tyll Daniel Kehlmann...........................................................7 The Ditch Herman Koch.......................................................8 . While The Music Played Nathaniel Lande..............................8 Until Stones Become Lighter -

PEN America: a Journal for Writers and Readers- 14 the Good Books

6 | pen america C O N T E N T S 10 The Good Books: A Forum 11 The Book of Disquiet Wayne Koestenbaum 11 Don Quixote Alice Mattison 12 Kiss of the Spider Woman Jessica Hagedorn 13 Plutarch’s Lives Anne Fadiman 13 Kingdom’s End and Other Stories Amitava Kumar 14 The Essential Haiku Aimee Bender 16 Mythologies Maurice Berger 18 If on a winter’s night a traveler Alan Michael Parker 19 The Book of Psalms Binnie Kirshenbaum 19 The Ambassador Karen Russell 20 La Bâtarde Eileen Myles 21 The Enigmatic Book of the Netherworld Joanna Scott 21 The Cave Martha Cooley 23 Cleaned the Crocodile’s Teeth Terese Svoboda 24 The Gift Lila Azam Zanganeh 25 The Secret of the Unicorn Pasha Malla & Red Rackham’s Treasure 25 Day of the Oprichnik Gary Shteyngart 28 Madame Bovary Alice Elliott Dark 29 Amerika (The Man Who Disappeared) Lynne Tillman 30 Our Lady of the Flowers Michael F. Moore 32 Chinese Tales Srikanth Reddy 34 Sketches from a Hunter’s Album Yiyun Li 34 Marcovaldo: or The seasons in the city Maureen Howard 35 The Book of Disquiet Paul LaFarge 36 The Green Sea of Heaven Paul Kane 37 A Sorrow Beyond Dreams Joshua Furst 39 The Random House Book of Bob Hicok Twentieth Century French Poetry 39 Picasso’s Mask Jed Perl contents | 7 40 Translations from the Poetry of Neil Baldwin Rainer Maria Rilke 41 Tian Wen: A Chinese Book of Origins Arthur Sze 42 What I Saw Phillip Lopate 42 Don Quixote Jaime Manrique 44 The Book of Disquiet Honor Moore 45 Guide to the Underworld Rika Lesser 46 Fortunata and Jacinta Antonio Muñoz Molina 48 The Second Sex Catharine R. -

Philadelphia,Pa

#AWP22 CONFERENCE & BOOKFAIR PHILADELPHIA,PA MARCH 23–26, 2022 Guide to Sponsoring, Exhibiting & Advertising SPONSORSHIP Join the professional association of writers and writing programs for four days of panels, readings, and networking and a bookfair of over 600 exhibitors. TOP 4 REASONS TO BECOME A SPONSOR 1. Advertising and marketing for up to nine months before the conference 2. Registration waivers for your faculty, students, and staff 3. Exhibitor space along “Bookfair Boulevard” at the heart of the action 4. Ringside access to VIP author and publisher events PREMIER SPONSOR: $25,000 BENEFACTOR: $10,000 CONTRIBUTOR: $1,000 1 available (SOLD) 15 available 50 available Eighty registration waivers, a back cover conference Twenty-five registration waivers, a half-page conference Five registration waivers, sponsor listing on program ad, two bookfair booths, optional evening program ad, bookfair booth, optional evening reception AWP’s website, sponsor listing in up to three issues of reception space, sponsor logo on AWP’s website, space, sponsor listing on AWP’s website, sponsor listing The Writer’s Chronicle, and conference planner sponsor logo in up to three issues of The Writer’s in up to three issues of The Writer’s Chronicle, and and program. Chronicle, conference planner and program, sponsor conference planner and program. logo on conference tote, e-newsletter/social media Cash value: $1,100 marketing, and two exclusive premium benefits. Cash value: $11,009 Cash value: $36,884 CONFERENCE SCHOLARSHIP PATRON: $5,000 PROGRAM: $10,000 PRESENTING SPONSOR: $20,000 45 available 4 available 2 available Twenty registration waivers, choice of digital or Fifty scholarships for BIPOC writers, disabled writers, print ad options (half-page or skyscraper), bookfair or writers in financial need. -

12 Celebrating Black Voices 27 Remembering RBG 33 Revising

FALl–WINTER 2020 12 Celebrating Black Voices 27 Remembering RBG 33 Revising Section 512 Articles THE AUTHORS GUILD President BULLETIN Douglas Preston 9 Vice President Two Lawsuits Chief Executive Officer Monique Truong Mary Rasenberger 12 The Case for Revising Section 512 Treasurer General Counsel Peter Petre 15 In Memoriam: Ruth Bader Ginsburg Cheryl L. Davis Secretary 1933–2020 Editor Rachel Vail Martha Fay Members of the Council 17 Celebrating Black Voices Copy Editor Rich Benjamin Heather Rodino Amy Bloom 20 Q&A: Judy Allen Dodson and Kelly Starling Design Mary Bly Studio Elana Schlenker Alexander Chee Lyons Pat Cummings Cover Art + Illustration Sylvia Day 28 Busier Than Ever: In the Time of COVID-19 Lindsey Bailey W. Ralph Eubanks lindseyswop.com Peter Gethers 44 Authors Guild Foundation Benefit, 2020 All non-staff contributors Lauren Groff to the Bulletin retain Tayari Jones 52 Regional Chapters Update copyright to the articles Min Jin Lee that appear in these pages. Nicholas Lemann Guild members seeking Steven Levy information on contributors’ John R. MacArthur other publications are D. T. Max Departments invited to contact the Daniel Okrent Guild office. Published by Michelle Richmond Julia Sanches 2 The Authors Guild, Inc. Short Takes James Shapiro Hampton Sides The Authors Guild, 4 From the President T.J. Stiles the oldest and largest Jonathan Taplin association of published 6 From the Home Office Danielle Trussoni authors in the United Nicholas Weinstock 32 Legal Watch States, works to protect and promote the Ex-Officio & 35 Advocacy News professional interests Honorary Members of its members. The Guild’s of the Council 38 Books by Members forerunner, The Authors Roger Angell League of America, was Roy Blount Jr.