Macquarie Bank 2007 Annual Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MBL 2009 Annual Report PDF 918 KB

MACQUARIE BANK 2009 ANNUAL REPORT MACQUARIE BANK LIMITED ACN 008 583 542 Macquarie Bank Limited is a 2009 Annual General Meeting Cover image: Constellation Energy subsidiary of Macquarie Group Macquarie Bank’s 2009 Annual Constellation Energy is one of the largest marketers of Limited and is regulated by the General Meeting will be held on natural gas in North America, providing physical natural Australian Prudential Regulation Wednesday, 29 July 2009 in the gas to distribution companies, power generators, retail Authority (APRA) as an Authorised Macquarie Auditorium, Level 3, aggregators and large end-users in the United States Deposit-taking Institution (ADI). No.1 Martin Place, Sydney NSW and Canada. Macquarie Group Limited is after the Macquarie Group Limited The acquisition and integration of the Constellation regulated by APRA as a non- Annual General Meeting but not downstream gas trading portfolio makes Macquarie operating holding company earlier than 2:00 pm. Group’s North American gas trading business, of an ADI. Details of the business of the Macquarie Cook Energy, a leading participant in this meeting will be contained in key wholesale gas market. the separate Notice of Annual Cover photograph Dan Tobin Smith/Gallery Stock General Meeting to be sent to securityholders. Macquarie Bank Limited and its subsidiaries Macquarie Bank Limited 2009 Annual Report Contents Directors’ Report 2 Directors’ Report Schedules 50 Financial Report 54 Directors’ declaration 154 Independent audit report 155 Investor information 157 Glossary 160 Macquarie Bank Limited 2009 Annual Report 1 Macquarie Bank Limited and its subsidiaries Directors’ Report for the financial year ended 31 March 2009 In accordance with a resolution of the Voting Directors Mr A.E. -

MACQUARIE Bank 2009 Annual Report

MACQUARIE BA NK 2009 ANNU A L REPO R T MACQUARIE BANK 2009 ANNUAL REPORT www.macquarie.com.au MACQUARIE BANK LIMITED ACN 008 583 542 Macquarie Bank Limited is a 2009 Annual General Meeting Cover image: Constellation Energy The Holey Dollar Macquarie Bank Head Office subsidiary of Macquarie Group Macquarie Bank’s 2009 Annual Constellation Energy is one of the largest In 1813 Governor Lachlan Macquarie overcame an No.1 Martin Place Limited and is regulated by the General Meeting will be held on marketers of natural gas in North America, acute currency shortage by purchasing Spanish silver Sydney NSW 2000 Australian Prudential Regulation Wednesday, 29 July 2009 in the providing physical natural gas to distribution dollars (then worth five shillings), punching the centres Australia Authority (APRA) as an Authorised Macquarie Auditorium, Level 3, companies, power generators, retail out and creating two new coins – the ‘Holey Dollar’ Tel: +61 2 8232 3333 Deposit-taking Institution (ADI). No.1 Martin Place, Sydney NSW aggregators and large end-users in the (valued at five shillings) and the ‘Dump’ (valued at one Macquarie Group Limited is after the Macquarie Group Limited United States and Canada. shilling and three pence). Registered Office Macquarie Bank Limited regulated by APRA as a non- Annual General Meeting but not The acquisition and integration of the This single move not only doubled the number of coins Level 3, 25 National Circuit operating holding company earlier than 2:00 pm. Constellation downstream gas trading in circulation but increased their worth by 25 per cent Forrest ACT 2603 of an ADI. -

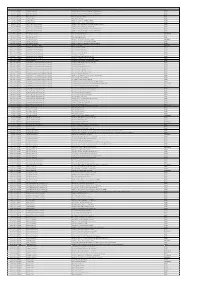

Meeting Date ASX Code Company Name Summary Caresuper Vote 6

Meeting Date ASX Code Company Name Summary CareSuper Vote 6/07/2011 CDU Cudeco Limited Ratify the prior issue of shares to Oceanwide FOR 6/07/2011 CDU Cudeco Limited Ratify the prior issue of shares to Oceanwide FOR 6/07/2011 CDU Cudeco Limited Approve the issue of shares to Oceanwide FOR 7/07/2011 CSR CSR Limited Elect Kathleen Conlon FOR 7/07/2011 CSR CSR Limited Elect Rob Sindel FOR 7/07/2011 CSR CSR Limited Approve grant of ZEPOs to CEO FOR 7/07/2011 CSR CSR Limited Approve the remuneration report FOR 8/07/2011 GCL Gloucester Coal Limited Approve the acquisition of the Donaldson Group FOR 8/07/2011 GCL Gloucester Coal Limited Approve the marketing agreement FOR 8/07/2011 GCL Gloucester Coal Limited Approve the acquisition of the Monash Group FOR 8/07/2011 GCL Gloucester Coal Limited Approve the amendment to the constitution FOR 8/07/2011 GCL Gloucester Coal Limited Approve provision of financial assistance FOR 13/07/2011 SPN SP Ausnet Group Re-elect Jeremy Davis AGAINST 13/07/2011 SPN SP Ausnet Group Re-elect Ian Renard FOR 13/07/2011 SPN SP Ausnet Group Elect Tina McMeckan FOR 13/07/2011 SPN SP Ausnet Group Approve the remuneration report AGAINST 13/07/2011 SPN SP Ausnet Group Approve issue to underwriter of DRP FOR 13/07/2011 SPN SP Ausnet Group Approve issue for Singapore law purposes FOR 27/07/2011 CQO Charter Hall Office REIT Remove the RE AGAINST 28/07/2011 MQG Macquarie Group Limited Re-elect Peter Kirby FOR 28/07/2011 MQG Macquarie Group Limited Re-elect John Niland FOR 28/07/2011 MQG Macquarie Group Limited Re-elect Helen -

Macquarie Infrastructure and Real Assets Credentials

Macquarie Infrastructure and Real Assets Credentials 30 September 2015 Disclaimer This presentation is not an offer to sell or a solicitation of an offer to subscribe or purchase or a recommendation of any securities or interests referred to in this presentation and has been created by the Macquarie Infrastructure and Real Assets (“MIRA”) division of Macquarie Group Limited to provide readers with general information in respect of the funds management business carried on by MIRA. The information in this presentation may not be incorporated into any documents or presentations prepared by or for the reader without the consent of Macquarie. This presentation incorporates third party information from sources believed to be reliable. The accuracy of such information (including all assumptions) has not been independently verified by Macquarie and Macquarie cannot guarantee its accuracy or completeness. Except as required by law, Macquarie and the MIRA funds mentioned in this presentation and their respective directors, officers, employees, agents and consultants make no representation or warranty as to the accuracy or completeness of the information contained in this presentation. Past performance of MIRA funds is not an indication of future performance and Macquarie does not guarantee the performance or return of capital from any investment in any MIRA fund. None of the entities noted in this presentation is an authorised deposit-taking institution for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of Macquarie Bank Limited (ABN 46 008 583 542) (“MBL”). MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities. -

Extracts from the Macquarie Group Limited 2014 Annual Report PDF 3

Macquarie Group 2014 Annual Report Financial 2014 2014 Annual Financial Report macquarie.com.au Macquarie Group MACQUARIE GROUP LIMITED ACN 122 169 279 Corporate Governance Statement company has followed the governance recommendations of Macquarie’s approach to Corporate the ASX Corporate Governance Council (ASX Governance Recommendations) during the reporting period. Macquarie's Macquarie’s approach to governance, which has remained corporate governance remains consistent with the ASX largely consistent over time, is to: Recommendations. A summary of the ASX – promote the long term profitability of Macquarie while Recommendations and reference to the applicable prudently managing risk Macquarie governance practice is available on Macquarie’s – drive superior and sustainable shareholder value over website at macquarie.com.au the long term through the alignment of the interests of Macquarie as a non-operating holding company of a shareholders and staff licensed Australian bank, Macquarie Bank Limited – meet stakeholder expectations of sound corporate (Macquarie Bank), is regulated by the Australian Prudential governance as part of Macquarie’s broader Regulation Authority (APRA). APRA’s prudential standards responsibility to clients, shareholders, investors and include governance requirements. Macquarie also has the communities in which it operates. subsidiaries that are supervised by regulators in the overseas Macquarie recognises that a key factor in delivering long jurisdictions in which they operate. The notes to Macquarie’s term shareholder returns is providing superior services to financial statements include a list of material subsidiaries of clients. Macquarie recruits high quality staff and expects the company. staff to uphold the company’s Goals and Values. Macquarie's corporate governance framework continues to Macquarie Group Limited (Macquarie) is a global financial evolve to respond to regulatory changes in the global services provider and its shares are listed on the Australian markets in which it operates. -

2 the Structure of the Airport Industry

Copyrighted material - Taylor & Francis www.routledge.com/cw/page The structure of the airport 2 industry TRADITIONAL AIRPORT OWNERSHIP AND MANAGEMENT The aim of this chapter is to discuss the structure of the airport industry, particularly in terms of the ownership and governance models that are used. It traces the development of the airport sector as it has moved from an industry characterised by public sector ownership and national requirements into a changed era of airport management, where the private sector and inter- national companies play a signifi cant role. Virtually all airports were traditionally owned by the public sector. European airports serving major cities such as Paris, London, Dublin, Stockholm, Copenhagen, Madrid and Geneva were all owned by national governments, as were many other airports outside Europe, such as those in Tokyo, Singapore, Bangkok, Sydney and Johannesburg. Elsewhere, local governments, either at a regional or municipal level, were the airport owners. This was the situation with most US airports. Regional airports in the United Kingdom also followed this pattern. Manchester airport, for example, was owned by a consortium of local authorities, with 55 per cent ownership resting with Manchester City Council and the remaining 45 per cent split evenly among eight councils of other nearby towns. In Germany, Dusseldorf airport was jointly owned by the governments of North Rhine, Westphalia state and the city of Dusseldorf, while the joint owners of Hanover airport were the governments of the state of Lower Saxony and the city of Hanover. With a number of airports, there may have been both local and national government interest. -

The Times , 1992, UK, English

—- 2 ^ Aima* » tt Bdtfum a m 6a Gundfr *2-75; cuutfes Pe» 225: &tna 90 cerasr Denmark Dkr 16-Ott PteMnd tax !5-0a Fiance F 12-Oa CtnaiW DM 4.0Q: GKnuar sop: Gicece Df 30ft Holland d 4JXk UMi RepnW 60ps MJy L 3JM0; huem- ITERNATIONAL! fcowr* U 55: Maddre er 275: MUM 43c Morocco DIT 25Oa Norway » EDITION 16-Ott ronupU ex 275: 5 pain Pec 225: Sweden Skr l&dft SwiizertaxJ S Fnt 3Mk Tunisia Din 1 JStk USA I3.0Q THE TIMES No 64/'/- SATURDAY AUGUST 1 1992 50p REBORN ON BACK FROM LOST ON WELL FOUND THE WIND THE BRINK THE STREETS IN FRANCE Neil Lyndon dons The chilling story Jah Bones and other A Times offer opens oilies, cleats sheets of how Chris community leaders the door to some of and generally does Bonnington’s luck have no doubt that the best hospitality well for a landlubber nearly ran out in inner city violence in the world at down all at sea the Himalayas is linked to poverty to earth prices Weekend Times Saturday Review Saturday Review Weekend Times Page I Pages Page 12 Page 7 Confusion over British drug testing Banned lifters fight to return to Olympics FROM JOHN GOODBODY IN BARCELONA IN A dramatic about-turn laboratory, Chelsea, may not Dick Palmer, the secretary it was revealed last night have adhered to the interna- of the British Olympic Associ- that the two British tional committee's procedur- ation. said last night that they weightlifters sent home al guidelines. would be gating formal guid- Although there were horn Barcelona in dis- ru- ance from the IOC. -

Who Manages Airports? Page 2 Company Activities

Who owns and manages privatized airports? compiled by Momberger Airport Information March 2012 Copyright © 2012 - Momberger Airport Information - www.mombergerairport.info Who manages airports? Page 2 Company Activities data compiled by Manfred Momberger photos by Martin Lamprecht Copyright © 2012 - Momberger Airport Information publisher: Martin Lamprecht e-mail: [email protected] Momberger Airport Information is the independent source of information for airport professionals around the world, published biweekly since 1973. It provides unbiased news free of advertising. The newsletter is published in a modular format that allows subscribers to put together their own newsletter package that matches their professional interest in the airport industry. Find out more at: www.mombergerairport.info Copyright © 2012 - Momberger Airport Information - www.mombergerairport.info Who manages airports? Page 3 Company Activities Who owns and manages privatized airports? compiled by Momberger Airport Information – includes historical data Company Activities ABB South Africa, Modderfon- Led a team for the BOT project of a new passenger terminal at Sharm el-Sheikh tein, South Africa Airport in Egypt; Led a consortium which built the Kruger Mpumalanga International Airport near Nelspruit in South Africa, which is owned and operated by ABB through its specialist airport management company, Primkop Airport Management (PAM); tried unsuc- cessfully to sell its 90% stake in PAM in spring 2004; Mbuyane community owns the remaining 10%. Through ABB -

Extracts from the Macquarie Group Limited 2013 Annual Report PDF 3

2013 Annual Financial Report Macquarie Group MACQUARIE GROUP LIMITED ACN 122 169 279 Macquarie Group Limited and its subsidiaries 2013 Annual Financial Report macquarie.com.au Corporate Governance Statement Macquarie’s approach to Corporate company has followed the governance recommendations Governance set by the ASX Corporate Governance Council (ASX Recommendations) during the reporting period. Macquarie's Macquarie’s approach to governance, which has remained corporate governance framework, which was unchanged largely consistent over time, is to: during the year, remains consistent with the governance arrangements set out in the ASX Recommendations. A – promote the long term profitability of Macquarie while prudently managing risk summary of the ASX Recommendations and reference to the applicable Macquarie governance practice is available on – drive superior and sustainable shareholder value over the long term through the alignment of the interests of Macquarie’s website at macquarie.com.au. shareholders and staff Macquarie is regulated by the Australian prudential regulator, – meet stakeholder expectations of sound corporate APRA, as a non-operating holding company of a licensed governance as part of Macquarie’s broader Australian bank, Macquarie Bank Limited (Macquarie Bank). responsibility to clients, shareholders, investors and APRA’s prudential standards include governance the communities in which it operates. requirements. Macquarie also has subsidiaries that are Macquarie recognises that a key factor in delivering long supervised by regulators in the overseas jurisdictions in term shareholder returns is providing superior services to which they operate. The notes to Macquarie’s financial clients. Macquarie recruits high quality staff and expects statements include a list of material subsidiaries of the staff to uphold the company’s Goals and Values. -

Managing Airports

Managing Airports Managing Airports presents a comprehensive and cutting-edge insight into today’s international airport industry. Approaching management topics from a strategic and commercial perspective, rather than from an operational and technical one, the book provides an innovative insight into the processes behind running a successful airport. This fifth edition has been fully revised and updated to reflect the many important developments in the management of airports. It features: • New content on: evolving airline models and implications for airports, self- connection, digital marketing, sensor and beacon technology, policy decisions and economic benefits, and climate change adaptation. • Updated and expanded content on: airport privatisation, economic regulation, technology within the terminal, non-aeronautical innovations, service quality and the passenger experience. • New and updated international case studies to show recent issues and theory in practice, including studies from emerging economies such as China, India and Brazil. Accessible and up-to-date, Managing Airports is ideal for students, lecturers and researchers of transport and tourism, and practitioners within the air transport industry. Anne Graham is Professor of Air Transport and Tourism Management at the University of Westminster in London, UK. One of her key areas of expertise and knowledge is airport management, economics and regulation, and she has over 30 years’ experience of lecturing, research and consultancy on these topics. She has published widely with recent books including The Routledge Companion to Air Transport Management, Airport Finance and Investment in the Global Economy, Aviation Economics and Airport Marketing. Between 2013 and 2015 Anne was Editor-in-Chief of the Journal of Air Transport Management and is on the Editorial Board of a number of other journals. -

Extracts from the Macquarie Bank Limited 2013 Annual Report PDF 1

2013 Annual Report Macquarie Bank MACQUARIE BANK LIMITED ACN 008 583 542 Macquarie Bank Limited and its subsidiaries 2013 Annual Report macquarie.com.au Macquarie Bank Limited 2013 Annual Report Directors’ Report 2 – Remuneration Report 7 – Schedule 1 34 – Schedule 2 39 Financial Report 40 – Income Statements 41 – Statements of comprehensive income 42 – Statements of financial position 43 – Statements of changes in equity 44 – Statements of cash flows 46 – Notes to the financial statements 48 – Directors’ declaration 152 – Independent audit report 153 Investor information 154 Glossary 157 1 Macquarie Bank Limited and its subsidiaries 2013 Annual Report macquarie.com.au Directors’ Report for the financial year ended 31 March 2013 In accordance with a resolution of the Voting Directors (the Directors) of Macquarie Bank Limited (MBL, Macquarie Bank, Company), the Directors submit herewith the income statements and the cash flow statements for the year ended 31 March 2013 and the balance sheets as at 31 March 2013 of the Company and its subsidiaries (the Consolidated Entity) at the end of, and during, the financial year ended on that date and report as follows: Directors At the date of this report, the Directors of Macquarie Bank are: Independent Directors H.K. McCann AM, Chairman M.J. Coleman(1) D.J. Grady AM M.J. Hawker AM P.M. Kirby C.B. Livingstone AO J.R. Niland AC H.M. Nugent AO P.H. Warne Executive Directors G.C. Ward, Managing Director and Chief Executive Officer N.W. Moore Other than Mr Coleman, the Voting Directors listed above each held office as a Director of Macquarie Bank throughout the financial year ended 31 March 2013. -

Macquarie Infrastructure and Real Assets Allentown, Pa Water and Sewer Concession Request for Qualifications Response August 17, 2012

MACQUARIE INFRASTRUCTURE AND REAL ASSETS ALLENTOWN, PA WATER AND SEWER CONCESSION REQUEST FOR QUALIFICATIONS RESPONSE AUGUST 17, 2012 WS:ISF_NewYork:2914780:v51 General Disclaimer This document is being distributed to you by Macquarie Infrastructure and Real Assets Inc. (“MIRA Inc.”). “Macquarie” refers to Macquarie Group Limited and its worldwide subsidiaries, affiliates and the funds and similar investment entities that they manage or advise. MIRA Inc. is an entity within the Macquarie Infrastructure and Real Assets division of Macquarie Funds Group (“MIRA”). References to “we”, “us”, “our” and similar expressions are to MIRA Inc. This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. This document is an outline of matters for discussion only and no representations or warranties are given or implied. This document does not contain all the information necessary to fully evaluate any transaction or investment or MIRA’s participation therein, and you should not rely on the contents of this document for such purpose. Any investment decision should be made based solely upon appropriate due diligence and, if applicable, upon receipt and careful review of any formal disclosure document. This document includes forward-looking statements that represent our opinions and expectations regarding the future, which may not be realized. Actual and future results and trends could differ materially from those described by such statements due to various factors, including those beyond our ability to control or predict. Given these uncertainties, you should not place undue reliance on the forward-looking statements and we do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.