2013 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MBL 2009 Annual Report PDF 918 KB

MACQUARIE BANK 2009 ANNUAL REPORT MACQUARIE BANK LIMITED ACN 008 583 542 Macquarie Bank Limited is a 2009 Annual General Meeting Cover image: Constellation Energy subsidiary of Macquarie Group Macquarie Bank’s 2009 Annual Constellation Energy is one of the largest marketers of Limited and is regulated by the General Meeting will be held on natural gas in North America, providing physical natural Australian Prudential Regulation Wednesday, 29 July 2009 in the gas to distribution companies, power generators, retail Authority (APRA) as an Authorised Macquarie Auditorium, Level 3, aggregators and large end-users in the United States Deposit-taking Institution (ADI). No.1 Martin Place, Sydney NSW and Canada. Macquarie Group Limited is after the Macquarie Group Limited The acquisition and integration of the Constellation regulated by APRA as a non- Annual General Meeting but not downstream gas trading portfolio makes Macquarie operating holding company earlier than 2:00 pm. Group’s North American gas trading business, of an ADI. Details of the business of the Macquarie Cook Energy, a leading participant in this meeting will be contained in key wholesale gas market. the separate Notice of Annual Cover photograph Dan Tobin Smith/Gallery Stock General Meeting to be sent to securityholders. Macquarie Bank Limited and its subsidiaries Macquarie Bank Limited 2009 Annual Report Contents Directors’ Report 2 Directors’ Report Schedules 50 Financial Report 54 Directors’ declaration 154 Independent audit report 155 Investor information 157 Glossary 160 Macquarie Bank Limited 2009 Annual Report 1 Macquarie Bank Limited and its subsidiaries Directors’ Report for the financial year ended 31 March 2009 In accordance with a resolution of the Voting Directors Mr A.E. -

MACQUARIE Bank 2009 Annual Report

MACQUARIE BA NK 2009 ANNU A L REPO R T MACQUARIE BANK 2009 ANNUAL REPORT www.macquarie.com.au MACQUARIE BANK LIMITED ACN 008 583 542 Macquarie Bank Limited is a 2009 Annual General Meeting Cover image: Constellation Energy The Holey Dollar Macquarie Bank Head Office subsidiary of Macquarie Group Macquarie Bank’s 2009 Annual Constellation Energy is one of the largest In 1813 Governor Lachlan Macquarie overcame an No.1 Martin Place Limited and is regulated by the General Meeting will be held on marketers of natural gas in North America, acute currency shortage by purchasing Spanish silver Sydney NSW 2000 Australian Prudential Regulation Wednesday, 29 July 2009 in the providing physical natural gas to distribution dollars (then worth five shillings), punching the centres Australia Authority (APRA) as an Authorised Macquarie Auditorium, Level 3, companies, power generators, retail out and creating two new coins – the ‘Holey Dollar’ Tel: +61 2 8232 3333 Deposit-taking Institution (ADI). No.1 Martin Place, Sydney NSW aggregators and large end-users in the (valued at five shillings) and the ‘Dump’ (valued at one Macquarie Group Limited is after the Macquarie Group Limited United States and Canada. shilling and three pence). Registered Office Macquarie Bank Limited regulated by APRA as a non- Annual General Meeting but not The acquisition and integration of the This single move not only doubled the number of coins Level 3, 25 National Circuit operating holding company earlier than 2:00 pm. Constellation downstream gas trading in circulation but increased their worth by 25 per cent Forrest ACT 2603 of an ADI. -

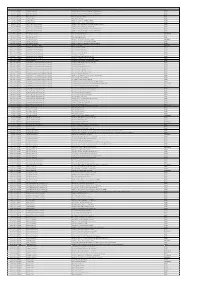

Meeting Date ASX Code Company Name Summary Caresuper Vote 6

Meeting Date ASX Code Company Name Summary CareSuper Vote 6/07/2011 CDU Cudeco Limited Ratify the prior issue of shares to Oceanwide FOR 6/07/2011 CDU Cudeco Limited Ratify the prior issue of shares to Oceanwide FOR 6/07/2011 CDU Cudeco Limited Approve the issue of shares to Oceanwide FOR 7/07/2011 CSR CSR Limited Elect Kathleen Conlon FOR 7/07/2011 CSR CSR Limited Elect Rob Sindel FOR 7/07/2011 CSR CSR Limited Approve grant of ZEPOs to CEO FOR 7/07/2011 CSR CSR Limited Approve the remuneration report FOR 8/07/2011 GCL Gloucester Coal Limited Approve the acquisition of the Donaldson Group FOR 8/07/2011 GCL Gloucester Coal Limited Approve the marketing agreement FOR 8/07/2011 GCL Gloucester Coal Limited Approve the acquisition of the Monash Group FOR 8/07/2011 GCL Gloucester Coal Limited Approve the amendment to the constitution FOR 8/07/2011 GCL Gloucester Coal Limited Approve provision of financial assistance FOR 13/07/2011 SPN SP Ausnet Group Re-elect Jeremy Davis AGAINST 13/07/2011 SPN SP Ausnet Group Re-elect Ian Renard FOR 13/07/2011 SPN SP Ausnet Group Elect Tina McMeckan FOR 13/07/2011 SPN SP Ausnet Group Approve the remuneration report AGAINST 13/07/2011 SPN SP Ausnet Group Approve issue to underwriter of DRP FOR 13/07/2011 SPN SP Ausnet Group Approve issue for Singapore law purposes FOR 27/07/2011 CQO Charter Hall Office REIT Remove the RE AGAINST 28/07/2011 MQG Macquarie Group Limited Re-elect Peter Kirby FOR 28/07/2011 MQG Macquarie Group Limited Re-elect John Niland FOR 28/07/2011 MQG Macquarie Group Limited Re-elect Helen -

Extracts from the Macquarie Group Limited 2014 Annual Report PDF 3

Macquarie Group 2014 Annual Report Financial 2014 2014 Annual Financial Report macquarie.com.au Macquarie Group MACQUARIE GROUP LIMITED ACN 122 169 279 Corporate Governance Statement company has followed the governance recommendations of Macquarie’s approach to Corporate the ASX Corporate Governance Council (ASX Governance Recommendations) during the reporting period. Macquarie's Macquarie’s approach to governance, which has remained corporate governance remains consistent with the ASX largely consistent over time, is to: Recommendations. A summary of the ASX – promote the long term profitability of Macquarie while Recommendations and reference to the applicable prudently managing risk Macquarie governance practice is available on Macquarie’s – drive superior and sustainable shareholder value over website at macquarie.com.au the long term through the alignment of the interests of Macquarie as a non-operating holding company of a shareholders and staff licensed Australian bank, Macquarie Bank Limited – meet stakeholder expectations of sound corporate (Macquarie Bank), is regulated by the Australian Prudential governance as part of Macquarie’s broader Regulation Authority (APRA). APRA’s prudential standards responsibility to clients, shareholders, investors and include governance requirements. Macquarie also has the communities in which it operates. subsidiaries that are supervised by regulators in the overseas Macquarie recognises that a key factor in delivering long jurisdictions in which they operate. The notes to Macquarie’s term shareholder returns is providing superior services to financial statements include a list of material subsidiaries of clients. Macquarie recruits high quality staff and expects the company. staff to uphold the company’s Goals and Values. Macquarie's corporate governance framework continues to Macquarie Group Limited (Macquarie) is a global financial evolve to respond to regulatory changes in the global services provider and its shares are listed on the Australian markets in which it operates. -

Extracts from the Macquarie Group Limited 2013 Annual Report PDF 3

2013 Annual Financial Report Macquarie Group MACQUARIE GROUP LIMITED ACN 122 169 279 Macquarie Group Limited and its subsidiaries 2013 Annual Financial Report macquarie.com.au Corporate Governance Statement Macquarie’s approach to Corporate company has followed the governance recommendations Governance set by the ASX Corporate Governance Council (ASX Recommendations) during the reporting period. Macquarie's Macquarie’s approach to governance, which has remained corporate governance framework, which was unchanged largely consistent over time, is to: during the year, remains consistent with the governance arrangements set out in the ASX Recommendations. A – promote the long term profitability of Macquarie while prudently managing risk summary of the ASX Recommendations and reference to the applicable Macquarie governance practice is available on – drive superior and sustainable shareholder value over the long term through the alignment of the interests of Macquarie’s website at macquarie.com.au. shareholders and staff Macquarie is regulated by the Australian prudential regulator, – meet stakeholder expectations of sound corporate APRA, as a non-operating holding company of a licensed governance as part of Macquarie’s broader Australian bank, Macquarie Bank Limited (Macquarie Bank). responsibility to clients, shareholders, investors and APRA’s prudential standards include governance the communities in which it operates. requirements. Macquarie also has subsidiaries that are Macquarie recognises that a key factor in delivering long supervised by regulators in the overseas jurisdictions in term shareholder returns is providing superior services to which they operate. The notes to Macquarie’s financial clients. Macquarie recruits high quality staff and expects statements include a list of material subsidiaries of the staff to uphold the company’s Goals and Values. -

Extracts from the Macquarie Bank Limited 2013 Annual Report PDF 1

2013 Annual Report Macquarie Bank MACQUARIE BANK LIMITED ACN 008 583 542 Macquarie Bank Limited and its subsidiaries 2013 Annual Report macquarie.com.au Macquarie Bank Limited 2013 Annual Report Directors’ Report 2 – Remuneration Report 7 – Schedule 1 34 – Schedule 2 39 Financial Report 40 – Income Statements 41 – Statements of comprehensive income 42 – Statements of financial position 43 – Statements of changes in equity 44 – Statements of cash flows 46 – Notes to the financial statements 48 – Directors’ declaration 152 – Independent audit report 153 Investor information 154 Glossary 157 1 Macquarie Bank Limited and its subsidiaries 2013 Annual Report macquarie.com.au Directors’ Report for the financial year ended 31 March 2013 In accordance with a resolution of the Voting Directors (the Directors) of Macquarie Bank Limited (MBL, Macquarie Bank, Company), the Directors submit herewith the income statements and the cash flow statements for the year ended 31 March 2013 and the balance sheets as at 31 March 2013 of the Company and its subsidiaries (the Consolidated Entity) at the end of, and during, the financial year ended on that date and report as follows: Directors At the date of this report, the Directors of Macquarie Bank are: Independent Directors H.K. McCann AM, Chairman M.J. Coleman(1) D.J. Grady AM M.J. Hawker AM P.M. Kirby C.B. Livingstone AO J.R. Niland AC H.M. Nugent AO P.H. Warne Executive Directors G.C. Ward, Managing Director and Chief Executive Officer N.W. Moore Other than Mr Coleman, the Voting Directors listed above each held office as a Director of Macquarie Bank throughout the financial year ended 31 March 2013. -

Macquarie Bank 2007 Annual Review

MACQUARIE BANK MACQUARIE 2007 2007 ANNUAL REVIEW MACQUARIE BANK 2007 ANNUAL REVIEW www.macquarie.com.au MACQUARIE BANK LIMITED ACN 008 583 542 The Macquarie Bank Group’s 2007 If you would like a copy of the annual report consists of two 2007 Financial Report please call documents – the 2007 Annual Review us on +61 2 8232 5006 or visit (incorporating the Concise Report) www.macquarie.com.au/ and the 2007 Financial Report. This shareholdercentre. Annual Review provides an overview of the Group’s operations and a summary of the financial statements. The Financial Report contains the Bank’s risk management report and statutory financial statements. Cover: Thames Water 2007 Annual General Meeting The Holey Dollar Thames Water is the largest water Macquarie Bank’s 2007 Annual In 1813 Governor Lachlan Macquarie and wastewater services company in General Meeting will be held at overcame an acute currency the United Kingdom, serving eight 10.30am on Thursday, 19 July 2007 shortage by purchasing Spanish million water and 13 million wastewater at the Westin Sydney, in the Grand silver dollars (then worth five shillings), customers across London and the Ballroom, Lower Level, No.1 Martin punching the centres out and Thames Valley. The history of Thames Place, Sydney. creating two new coins – the ‘Holey Water dates back to the early 1600s Details of the business of the meeting Dollar’ (valued at five shillings) and when the privately funded New River, will be contained in the separate the ‘Dump’ (valued at one shilling a 40-mile channel, was built to create Notice of Annual General Meeting to and three pence). -

Macquarie Bank 2004 Annual Review

MACQUARIE BANK LIMITED ACN 008 583 542 MACQUARIE BANK 2004 ANNUAL REVIEW Review 02 Highlights 08 Chairman’s and Managing Director’s Report 12 Management and organisation 18 Investment Banking Group 20 Treasury and Commodities Group 21 Equity Markets Group 22 Banking and Property Group 23 Financial Services Group Our communities An important part of the Macquarie Bank Foundation’s and is recognising approach cant supporting the signifi community contributions made by our staff. 24 Funds Management Group 25 Other Groups and Divisions 32 Corporate Governance Statement 2004 Concise Report 47 Directors’ report 58 Directors’ report schedule 60 Consolidated statement of financial performance 61 Consolidated statement of financial position 62 Consolidated statement of cash flows Our people our business. People are Our potential for continued is dependent upon growth our ability to attract and quality people. retain 63 Discussion and analysis 64 Notes to and forming part of the concise financial statements 71 Directors’ declaration 72 Independent audit report 73 Financial summary since listing 74 Contact directory Specialist markets With under properties management in Seoul exceeding $450 million, Macquarie is now one of the largest foreign managers of investment grade in Korea. property 2004 Annual General Meeting Macquarie Bank’s 2004 Annual General Meeting will be held at 10.30am on Client commitment of the core Our clients are our business and central to success. Macquarie’s Thursday 29 July 2004 at The Westin Sydney, in the Grand Ballroom, Lower Level, No.1 Martin Place, Sydney. Details of the business of the meeting are contained in the separate Notice of Annual General Meeting sent to securityholders. -

2012 Annual Report

MACQUARIE GROUP 2012 ANNUAL FINANCIAL REPORT MACQUARIE GROUP LIMITED ACN 122 169 279 Macquarie Group Limited’s 2012 Annual General Meeting The Holey Dollar 2012 Annual Report consists of Macquarie Group’s 2012 Annual In 1813 Governor Lachlan Macquarie overcame two documents – the 2012 General Meeting will be held at an acute currency shortage by purchasing Spanish Annual Review and the 2012 10:30am on Wednesday 25 July silver dollars (then worth five shillings), punching Annual Financial Report. 2012 at the Four Seasons Hotel the centres out and creating two new coins – the This 2012 Macquarie Group (Grand Ballroom), 199 George ‘Holey Dollar’ (valued at five shillings) and the ‘Dump’ Annual Financial Report complies Street, Sydney NSW. (valued at one shilling and three pence). with reporting requirements and Details of the business of the This single move not only doubled the number of contains the statutory financial meeting will be contained in the coins in circulation but increased their worth by report. It includes Macquarie’s Notice of Annual General Meeting, 25 per cent and prevented the coins leaving the Corporate Governance Statement, to be sent to shareholders colony. Governor Macquarie’s creation of the Holey the Directors’ Report including the separately. Dollar was an inspired solution to a difficult problem Remuneration Report and the full and for this reason it was chosen as the symbol for financial statements. Macquarie Group. The 2012 Annual Review contains a report from the Chairman and Managing Director on Macquarie’s business and operational highlights. It is not a concise report prepared under section 314 (2) of the Corporations Act. -

Extracts from the Macquarie Bank Limited 2011

MACQUARIE BANK 2011 ANNUAL REPORT MACQUARIE BANK LIMITED ACN 008 583 542 Macquarie Bank Limited and its subsidiaries 2011 Annual Report macquarie.com.au Directors’ Report for the financial year ended 31 March 2011 In accordance with a resolution of the Voting Directors (the The Directors listed above each held office as a Director Directors) of Macquarie Bank Limited (MBL, Macquarie of Macquarie Bank throughout the financial year ended Bank, Company), the Directors submit herewith the 31 March 2011. Those Directors listed as Independent income statements and the statements of cash flows for Directors have been independent throughout the period the year ended 31 March 2011 and the statements of of their appointment. financial position as at 31 March 2011 of the Company Mr D.S. Clarke was the Non-Executive Chairman of and its subsidiaries (the Consolidated Entity) at the end of, Macquarie Bank from the beginning of the financial and during, the financial year ended on that date and year until his resignation which was effective on report as follows: 17 March 2011. Directors Details of the qualifications, experience and special At the date of this report, the Directors of Macquarie Bank responsibilities of the Directors and qualifications and are: experience of the Company Secretaries at the date of this Independent Voting Directors report are set out in Schedule 1 at the end of this report. H.K. McCann, AM, Chairman1 M.J. Hawker, AM P.M. Kirby C.B. Livingstone, AO J.R. Niland, AC H.M. Nugent, AO P.H. Warne 1 Appointed as Chairman on 17 March 2011 Executive Voting Directors W.R.