Extracts from the Macquarie Group Limited 2013 Annual Report PDF 3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MBL 2009 Annual Report PDF 918 KB

MACQUARIE BANK 2009 ANNUAL REPORT MACQUARIE BANK LIMITED ACN 008 583 542 Macquarie Bank Limited is a 2009 Annual General Meeting Cover image: Constellation Energy subsidiary of Macquarie Group Macquarie Bank’s 2009 Annual Constellation Energy is one of the largest marketers of Limited and is regulated by the General Meeting will be held on natural gas in North America, providing physical natural Australian Prudential Regulation Wednesday, 29 July 2009 in the gas to distribution companies, power generators, retail Authority (APRA) as an Authorised Macquarie Auditorium, Level 3, aggregators and large end-users in the United States Deposit-taking Institution (ADI). No.1 Martin Place, Sydney NSW and Canada. Macquarie Group Limited is after the Macquarie Group Limited The acquisition and integration of the Constellation regulated by APRA as a non- Annual General Meeting but not downstream gas trading portfolio makes Macquarie operating holding company earlier than 2:00 pm. Group’s North American gas trading business, of an ADI. Details of the business of the Macquarie Cook Energy, a leading participant in this meeting will be contained in key wholesale gas market. the separate Notice of Annual Cover photograph Dan Tobin Smith/Gallery Stock General Meeting to be sent to securityholders. Macquarie Bank Limited and its subsidiaries Macquarie Bank Limited 2009 Annual Report Contents Directors’ Report 2 Directors’ Report Schedules 50 Financial Report 54 Directors’ declaration 154 Independent audit report 155 Investor information 157 Glossary 160 Macquarie Bank Limited 2009 Annual Report 1 Macquarie Bank Limited and its subsidiaries Directors’ Report for the financial year ended 31 March 2009 In accordance with a resolution of the Voting Directors Mr A.E. -

Voting Report 31 December 2016

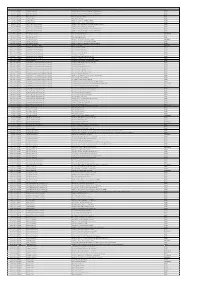

Voting report for the period 1 July 2016 to 31 December 2016 Meeting Date Ticker Company Name Summary CareSuper Vote 08/11/16 NCM Newcrest Mining Ltd. Elect Peter Hay as Director For 08/11/16 NCM Newcrest Mining Ltd. Elect Philip Aiken as Director For 08/11/16 NCM Newcrest Mining Ltd. Elect Rick Lee as Director For 08/11/16 NCM Newcrest Mining Ltd. Elect John Spark as Director For 08/11/16 NCM Newcrest Mining Ltd. Elect Vickki McFadden as Director For 08/11/16 NCM Newcrest Mining Ltd. Approve the Grant of Performance Rights to Sandeep Biswas For 08/11/16 NCM Newcrest Mining Ltd. Approve the Grant of Performance Rights to Gerard Bond For 08/11/16 NCM Newcrest Mining Ltd. Approve the Remuneration Report For 04/07/16 BAP Bapcor Limited Approve the Change of Company Name to BAPCOR Limited For 12/07/16 SEA Sundance Energy Australia Ltd. Ratify the Past Issuance of Shares to Certain Sophisticated, Professional or Institutional Investors Abstain^ 12/07/16 SEA Sundance Energy Australia Ltd. Approve the Issuance of Shares to Certain Sophisticated, Professional and Institutional Investors Abstain^ 12/07/16 SEA Sundance Energy Australia Ltd. Approve the Issuance of SPP Shares to Shareholders Abstain^ 14/07/16 AAC Australian Agricultural Company Ltd. Approve the Remuneration Report For 14/07/16 AAC Australian Agricultural Company Ltd. Elect David Crombie as Director For 14/07/16 AAC Australian Agricultural Company Ltd. Elect Tom Keene as Director For 14/07/16 AAC Australian Agricultural Company Ltd. Elect Neil Reisman as Director For 14/07/16 AAC Australian Agricultural Company Ltd. -

Vanguard Australian Shares Index Fund

ANNUAL REPORT OF PROXY VOTING RECORD DATE OF REPORTING PERIOD: JULY 1, 2018 - JUNE 30, 2019 FUND: VANGUARD AUSTRALIAN SHARES INDEX FUND --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: Abacus Property Group TICKER: ABP CUSIP: Q0015N187 MEETING DATE: 11/15/2018 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #2: APPROVE THE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3: ELECT MARK HABERLIN AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #4: APPROVE GRANT OF SECURITY ACQUISITION ISSUER YES FOR FOR RIGHTS TO STEVEN SEWELL --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: Accent Group Ltd. TICKER: AX1 CUSIP: Q0R618101 MEETING DATE: 11/23/2018 FOR/AGAINST PROPOSAL: PROPOSED BY VOTED? VOTE CAST MGMT PROPOSAL #2: APPROVE REMUNERATION REPORT ISSUER YES FOR FOR PROPOSAL #3a: ELECT MICHAEL HAPGOOD AS DIRECTOR ISSUER YES AGAINST AGAINST PROPOSAL #3b: ELECT STEPHEN GODDARD AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #3c: ELECT DONNA PLAYER AS DIRECTOR ISSUER YES FOR FOR PROPOSAL #3d: ELECT BRETT BLUNDY AS DIRECTOR ISSUER YES FOR FOR --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- ISSUER: Adelaide Brighton Ltd. TICKER: ABC CUSIP: Q0109N101 MEETING -

2019 Voting Record As at 30 June 2019

2019 Voting Record as at 30 June 2019 Solaris Core Australian Equity Fund Solaris High Alpha Australian Equity Fund Solaris Core Australian Equity Fund (Total Return) Stock Company Name Meeting Date Item Resolutions Solaris Resolution Management/ Decision Type Shareholder Proposal MQG Macquarie Group Limited 26/07/2018 2a Elect Peter H Warne as Director For Ordinary Management MQG Macquarie Group Limited 26/07/2018 2b Elect Gordon M Cairns as Director For Ordinary Management MQG Macquarie Group Limited 26/07/2018 2c Elect Glenn R Stevens as Director For Ordinary Management MQG Macquarie Group Limited 26/07/2018 3 Approve the Remuneration Report For Ordinary Management MQG Macquarie Group Limited 26/07/2018 4 Approve Participation of Nicholas Moore in the Macquarie Group Employee Retained Equity Plan For Ordinary Management MQG Macquarie Group Limited 26/07/2018 5 Approve Issuance of Macquarie Group Capital Notes For Ordinary Management JHX James Hardie Industries plc 10/08/2018 1 Accept Financial Statements and Statutory Reports For Ordinary Management JHX James Hardie Industries plc 10/08/2018 2 Approve the Remuneration Report For Ordinary Management JHX James Hardie Industries plc 10/08/2018 3a Elect Persio Lisboa as Director For Ordinary Management JHX James Hardie Industries plc 10/08/2018 3b Elect Andrea Gisle Joosen as Director For Ordinary Management JHX James Hardie Industries plc 10/08/2018 3c Elect Michael Hammes as Director For Ordinary Management JHX James Hardie Industries plc 10/08/2018 3d Elect Alison Littley as Director -

Business Leadership: the Catalyst for Accelerating Change

BUSINESS LEADERSHIP: THE CATALYST FOR ACCELERATING CHANGE Follow us on twitter @30pctAustralia OUR OBJECTIVE is to achieve 30% of ASX 200 seats held by women by end 2018. Gender balance on boards does achieve better outcomes. GREATER DIVERSITY ON BOARDS IS VITAL TO THE GOOD GOVERNANCE OF AUSTRALIAN BUSINESSES. FROM THE PERSPECTIVE OF PERFORMANCE AS WELL AS EQUITY THE CASE IS CLEAR. AUSTRALIA HAS MORE THAN ENOUGH CAPABLE WOMEN TO EXCEED THE 30% TARGET. IF YOUR BOARD IS NOT INVESTING IN THE CAPABILITY THAT DIVERSITY BRINGS, IT’S NOW A MARKED DEPARTURE FROM THE WHAT THE INVESTOR AND BROADER COMMUNITY EXPECT. Angus Armour FAICD, Managing Director & Chief Executive Officer, Australian Institute of Company Directors BY BRINGING TOGETHER INFLUENTIAL COMPANY CHAIRS, DIRECTORS, INVESTORS, HEAD HUNTERS AND CEOs, WE WANT TO DRIVE A BUSINESS-LED APPROACH TO INCREASING GENDER BALANCE THAT CHANGES THE WAY “COMPANIES APPROACH DIVERSITY ISSUES. Patricia Cross, Australian Chair 30% Club WHO WE ARE LEADERS LEADING BY EXAMPLE We are a group of chairs, directors and business leaders taking action to increase gender diversity on Australian boards. The Australian chapter launched in May 2015 with a goal of achieving 30% women on ASX 200 boards by the end of 2018. AUSTRALIAN 30% CLUB MEMBERS Andrew Forrest Fortescue Metals Douglas McTaggart Spark Group Ltd Infrastructure Trust Samuel Weiss Altium Ltd Kenneth MacKenzie BHP Billiton Ltd John Mulcahy Mirvac Ltd Stephen Johns Brambles Ltd Mark Johnson G8 Education Ltd John Shine CSL Ltd Paul Brasher Incitec Pivot -

MACQUARIE Bank 2009 Annual Report

MACQUARIE BA NK 2009 ANNU A L REPO R T MACQUARIE BANK 2009 ANNUAL REPORT www.macquarie.com.au MACQUARIE BANK LIMITED ACN 008 583 542 Macquarie Bank Limited is a 2009 Annual General Meeting Cover image: Constellation Energy The Holey Dollar Macquarie Bank Head Office subsidiary of Macquarie Group Macquarie Bank’s 2009 Annual Constellation Energy is one of the largest In 1813 Governor Lachlan Macquarie overcame an No.1 Martin Place Limited and is regulated by the General Meeting will be held on marketers of natural gas in North America, acute currency shortage by purchasing Spanish silver Sydney NSW 2000 Australian Prudential Regulation Wednesday, 29 July 2009 in the providing physical natural gas to distribution dollars (then worth five shillings), punching the centres Australia Authority (APRA) as an Authorised Macquarie Auditorium, Level 3, companies, power generators, retail out and creating two new coins – the ‘Holey Dollar’ Tel: +61 2 8232 3333 Deposit-taking Institution (ADI). No.1 Martin Place, Sydney NSW aggregators and large end-users in the (valued at five shillings) and the ‘Dump’ (valued at one Macquarie Group Limited is after the Macquarie Group Limited United States and Canada. shilling and three pence). Registered Office Macquarie Bank Limited regulated by APRA as a non- Annual General Meeting but not The acquisition and integration of the This single move not only doubled the number of coins Level 3, 25 National Circuit operating holding company earlier than 2:00 pm. Constellation downstream gas trading in circulation but increased their worth by 25 per cent Forrest ACT 2603 of an ADI. -

For Personal Use Only Use Personal for [email protected] Investor Relations: Melanie Kirk Ph: 02 9118 7166

Commonwealth Bank announces appointment of new Chairman Wednesday, 12 October 2016: The Commonwealth Bank of Australia today announced that its Chairman Mr David Turner will retire from the Board at the end of December 2016. He will be succeeded as Chairman by current non-executive director Ms Catherine Livingstone AO. Mr Turner has been a member of CBA’s Board since 2006, and has served as Chairman since the beginning of 2010. Commenting on his decision to retire from the Board, Mr Turner said “I have greatly enjoyed my time on the Board of the Commonwealth Bank and especially as Chairman for the past seven years. It has been a privilege to work with an exceptional Board and management team. “The strength of CBA meant that following the Global Financial Crisis it was able to continue supporting its customers, accelerate innovation and fulfil its vital role in the broader Australian economy. It has been exciting to be Chairman of the Bank in such a fast changing environment.” Ms Catherine Livingstone has been a non-executive director of CBA since March 2016. She was formally Chairman of Telstra Corporation and Chief Executive Officer of Cochlear. She is presently President of the Business Council of Australia and will retire from that role in November 2016. Mr Turner said “Catherine’s strong business experience complemented by her interest in technology and innovation will mean she will be an excellent and well-qualified Chairman.” Ms Livingstone said “It is an enormous honour to be appointed Chairman by the Board of the Commonwealth Bank of Australia. -

Meeting Date ASX Code Company Name Summary Caresuper Vote 6

Meeting Date ASX Code Company Name Summary CareSuper Vote 6/07/2011 CDU Cudeco Limited Ratify the prior issue of shares to Oceanwide FOR 6/07/2011 CDU Cudeco Limited Ratify the prior issue of shares to Oceanwide FOR 6/07/2011 CDU Cudeco Limited Approve the issue of shares to Oceanwide FOR 7/07/2011 CSR CSR Limited Elect Kathleen Conlon FOR 7/07/2011 CSR CSR Limited Elect Rob Sindel FOR 7/07/2011 CSR CSR Limited Approve grant of ZEPOs to CEO FOR 7/07/2011 CSR CSR Limited Approve the remuneration report FOR 8/07/2011 GCL Gloucester Coal Limited Approve the acquisition of the Donaldson Group FOR 8/07/2011 GCL Gloucester Coal Limited Approve the marketing agreement FOR 8/07/2011 GCL Gloucester Coal Limited Approve the acquisition of the Monash Group FOR 8/07/2011 GCL Gloucester Coal Limited Approve the amendment to the constitution FOR 8/07/2011 GCL Gloucester Coal Limited Approve provision of financial assistance FOR 13/07/2011 SPN SP Ausnet Group Re-elect Jeremy Davis AGAINST 13/07/2011 SPN SP Ausnet Group Re-elect Ian Renard FOR 13/07/2011 SPN SP Ausnet Group Elect Tina McMeckan FOR 13/07/2011 SPN SP Ausnet Group Approve the remuneration report AGAINST 13/07/2011 SPN SP Ausnet Group Approve issue to underwriter of DRP FOR 13/07/2011 SPN SP Ausnet Group Approve issue for Singapore law purposes FOR 27/07/2011 CQO Charter Hall Office REIT Remove the RE AGAINST 28/07/2011 MQG Macquarie Group Limited Re-elect Peter Kirby FOR 28/07/2011 MQG Macquarie Group Limited Re-elect John Niland FOR 28/07/2011 MQG Macquarie Group Limited Re-elect Helen -

Focus 194: Women Are Making Their Mark

NUMBER 194 | FEBRUARY 2016 WOMEN ARE MAKING THEIR MARK – NOW BUT THERE IS STILL A MOUNTAIN OF CHALLENGES TO OVERCOME THE ARGUMENT ABOUT ‘WHY’ IS OVER – IT’S NOW ABOUT ‘HOW’ AND ‘WHEN’ – AND AUSTRALIA IS MAKING PROGRESS AUSTRALIAN ACADEMY OF TECHNOLOGY AND ENGINEERING™ AGRIBUSINESS 2030 2016 ATSE NATIONAL TECHNOLOGY CHALLENGES DIALOGUE REGISTER NOW AT www.atse.org.au/agribusiness2030 The Academy’s inaugural National Technology Challenges Dialogue is a two-day event in Sydney, at the Sofitel Sydney Wentworth, on 15 and 16 June, 2016. Agribusiness 2030 is an exciting opportunity to exchange ideas Sponsorship Packages are available for both the two-day between the nation’s most eminent entrepreneurs, decision Agribusiness Dialogue and Innovation Dinner. makers, government officials, researchers, academics and Visit the website for more details or contact Sue Wickham, business leaders, who will explore: Executive Manager Operations and Events n the future of agribusiness in the digital age; [email protected] n how this will play-out domestically and globally; n the opportunities and challenges this offers Australia. Importantly, this event also highlight’s ATSE’s consistent commitment to leading the public discussion on Australia’s future prosperity with a focus on using the best of Australian and international technologies to address our national challenges. It also incorporates ATSE’s Annual Innovation Dinner on 15 June where the Clunies Ross Awards will be presented. These exciting awards bring together Australia’s top leaders and innovators from research, industry and government and provide a valuable networking opportunity at the nation’s premier annual awards for innovation commercialisation. -

Annual Report 2016-17 Australian Museum Trust Staff Agency Financial Statements 2016-17

Annual report 2016–17 Roro headdress. Port Moresby, Central Province, Papua New Guinea, acquired 1923, on display in the Westpac Long Gallery. Photograph by Stuart Humphreys 2016–17 Annual report Australian Museum 1 William Street Sydney, NSW, 2010 Australia The Australian Museum Annual Report 2016–17 Minister is published by the Australian Museum Trust The Hon Don Harwin, MP 1 William Street Sydney NSW 2010 Minister for the Arts © Australian Museum Trust 2017 Governance ISSN 2206-8473 The Museum is governed by a Trust established under Acknowledgements the Australian Museum Trust Act 1975. The objectives Compiled by Amanda Farrar of the Australian Museum Trust Act are to propagate Design & Production by Trudi Fletcher knowledge about the natural environment of Australia and to increase that knowledge, particularly in the natural All images © Australian Museum unless otherwise sciences of biology, anthropology and geology. The Trust indicated. has 11 members, one of whom must have knowledge of, Contact or experience in, science; one of whom must have Australian Museum knowledge of, or experience in, education; and one 1 William Street Sydney NSW 2010 of whom must have knowledge of, or experience in, Open daily 9.30am – 5pm Australian Indigenous culture. t 02 9320 6000 Trustees are appointed by the Governor on the f 02 9320 6050 recommendation of the Minister for a term of up to e [email protected] three years. Trustees may serve no more than three w australianmuseum.net.au terms. Vacancies may be filled by the Governor on the recommendation of the Minister. The President Availability of the Trust is appointed by the Governor on the This annual report has been designed for accessible recommendation of the Minister. -

Female Participation on the Boards of ASX200 Companies by Percentage of Female Directors

Female participation on the boards of ASX200 companies By percentage of female directors Company Sector Total Female % female Chair State Female directors directors directors directors QBE Insurance Group Insurance 7 3 42.9 Ms Belinda Hutchinson NSW Isabel Hudson, Irene Lee, Belinda Hutchinson Invest a Offi ce F und RRlEtteal Estate 5 2 40.0 MMDbs Deborah hP Page NSW DDbeborah hP Page, Mi ng L ong (CFO) Trade Me Group Retailing 5 2 40.0 Mr David Kirk NZ Joanna Perry, Gail Hambly Billabong International Consumer Durables & Apparel 8 3 37.5 Dr Ian Pollard Qld Colette Paull, Launa Inman, Sally Pitkin Downer EDI Commercial & professional 8 3 37.5 Mr Michael Harding NSW Annabelle Chaplain, Kerry Sanderson, services Eve Howell Mirvac Group Real Estate 8 3 37.5 Mr James MacKenzie NSW Alana Rubin, Marina Darling, Susan Lloyd- Hurwitz(CEO) Bendigo and Adelaide Bank Banks 9 3 33.3 Mr Robert Johanson Vic Jenny Dawson, Deborak Radford, Jacqueline Hey Commonwealth Bank Banks 9 3 33.3 Mr David Turner NSW Jane Hemstritch, Carolyn Kay, Launa Inman FlexiGroup Diversified Financials 6 2 33.3 Ms Margaret Jackson NSW Margaret Jackson, Anne Ward Insurance Australia Group Insurance 9 3 33.3 Mr Brian Schwartz NSW Yasmin Allen, Alison Deanes, Nora Schienkestel Myer Retailing 6 2 33.3 Mr Paul McLintock Vic Anne Brennan, Chris Froggatt Platinum Asset Management Diversified Financials 6 2 33.3 Mr Michael Cole NSW Margaret Towers, Elizabeth Norman Skilled Group Commercial & Professional 6 2 33.3 Ms Vicki McFadden Vic Vicki Mcfadden, Tracey Horton Services Spark -

Review of Indian Railway Coaching Cost Data for Fixing Track Access Charges for Private Operators

REVIEW OF INDIAN RAILWAY COACHING COST DATA FOR FIXING TRACK ACCESS CHARGES FOR PRIVATE OPERATORS A dissertation submitted to the Indian Institute of Public Administration (IIPA), New Delhi for the Degree of Master’s Diploma in Public Administration (MDPA) in partial fulfillment of the requirement for the 45th advanced Professional Programme in Public Administration (APPPA) By Neeraj Kumar Mouriya RollNo : 4525 Under the Guidance of Dr. Roma Mitra Debnath 45thAdvanced Professional Programme In Public Administration (APPPA) INDIAN INSTITUTE OF PUBLIC ADMINISTRATION NEW DELHI 2019-20 CERTIFICATE I have the pleasure to certify that the dissertation titled “Review of Indian Railway Coaching cost data for fixing Track Access Charges for Private Operators” is a bonafide research work carried out by Shri Neeraj Kumar Mouriya under my guidance and supervision. The dissertation is a result of his own research and to the best of my knowledge no part of it has earlier comprised in other monograph, dissertation or book. This is being submitted to the Panjab University, Chandigarh for the award of Master’s Diploma in Public Administration in partial fulfillment of the requirement for Advanced Professional Programme in Public Administration (APPPA) of Indian Institute of Public Administration (IIPA), New Delhi. I recommend that the dissertation of Mr. Neeraj Kumar Mouriya is worthy of the award of Master’s Diploma in Public Administration. (Dr Roma Mitra Debnath) Associate Professor Indian Institute of Public Administration I.P Estate, New Delhi - 1100012 Place: New Delhi Date: ACKNOWLEDGEMENT I wish to express my sincere gratitude to Dr. Roma Mitra Debnath, Associate Professor, Indian Institute of Public Administration, for her guidance in writing of this dissertation.