Comcast Corp at Morgan Stanley Technology, Media & Telecom

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 of 6 C O R P O R a T E Amazon/Acquisitions the Chart

CORPORATE Amazon/Acquisitions The chart below delineates Amazon’s biggest acquisitions, according to Thomson Reuters Deal Intelligence, as reported by The Wall Street Journal: Company Deal Value (Billions) Whole Foods MarKet $13.70 Zappos.com $1.20 Twitch Interactive $0.97 Kiva Systems $0.78 Souq.com $0.70 Quidsi $0.55 Elemental Technologies $0.30 Atlas Air Worldwide $0.28 Alexa Internet $0.26 Exchange.com $0.25 SoftBanK/Charter In early August, Charter Communications passed on the idea of acquiring Sprint, which is majority owned by SoftBanK, a Japanese telecommunications company. Last week, rumors began to circulate that SoftBank is exploring a complex taKeover of Charter. FAST FOOD Little Caesars/Portal Pizza chain Little Caesars introduce The Pizza Portal, a machine that lets Machine customers who order pies to skip the line, grab their pizza and go in more than a dozen locations in the Tucson (AZ) area. How it worKs: download an app to order and pay for food, receive a three digit or QR code and once in the store enter or scan the code to open a self-service hot box at the shop. GLOBAL Nuclear Warheads Estimated nuclear warhead inventories, as reported by The Wall Street Journal: Country Warheads Country Warheads Russia 7,000 Pakistan 140 U.S. 6,800 India 130 France 300 Israel 80 China 270 North Korea 10* U.K. 215 Pakistan 140 *Projection 1 of 6 MOVIES TicKet Sales According to Nielsen, North American box office ticKet sales are down 2.9% even with ticKet prices higher than the prior year – maKing up for some of the diminished theater attendance. -

TRANSCRIPT CMCSA - Comcast Corp at UBS Global Media and Communications Conference

Client Id: 77 THOMSON REUTERS STREETEVENTS EDITED TRANSCRIPT CMCSA - Comcast Corp at UBS Global Media and Communications Conference EVENT DATE/TIME: DECEMBER 04, 2017 / 1:45PM GMT THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2017 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. Client Id: 77 DECEMBER 04, 2017 / 1:45PM, CMCSA - Comcast Corp at UBS Global Media and Communications Conference CORPORATE PARTICIPANTS Michael J. Cavanagh Comcast Corporation - CFO and Senior EVP CONFERENCE CALL PARTICIPANTS John Christopher Hodulik UBS Investment Bank, Research Division - MD, Sector Head of the United States Communications Group, and Telco and Pay TV Analyst PRESENTATION John Christopher Hodulik - UBS Investment Bank, Research Division - MD, Sector Head of the United States Communications Group, and Telco and Pay TV Analyst Okay. If everyone can please take their seats. Again, I'm John Hodulik, the media, telecom and cable infrastructure analyst here at UBS. And welcome to the 45th Annual Media and Telecom Conference. I'm pleased to announce our keynote speaker this morning is Mike Cavanagh, CFO of Comcast. Mike, thanks for being here. Michael J. Cavanagh - Comcast Corporation - CFO and Senior EVP Thanks for having us. Great to be here once again. Three years in a row. John Christopher Hodulik - UBS Investment Bank, Research Division - MD, Sector Head of the United States Communications Group, and Telco and Pay TV Analyst That's right. -

Downloading of Movies, Television Shows and Other Video Programming, Some of Which Charge a Nominal Or No Fee for Access

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO Commission file number 001-32871 COMCAST CORPORATION (Exact name of registrant as specified in its charter) PENNSYLVANIA 27-0000798 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) One Comcast Center, Philadelphia, PA 19103-2838 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (215) 286-1700 SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: Title of Each Class Name of Each Exchange on which Registered Class A Common Stock, $0.01 par value NASDAQ Global Select Market Class A Special Common Stock, $0.01 par value NASDAQ Global Select Market 2.0% Exchangeable Subordinated Debentures due 2029 New York Stock Exchange 5.50% Notes due 2029 New York Stock Exchange 6.625% Notes due 2056 New York Stock Exchange 7.00% Notes due 2055 New York Stock Exchange 8.375% Guaranteed Notes due 2013 New York Stock Exchange 9.455% Guaranteed Notes due 2022 New York Stock Exchange SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. -

Nbcuniversal Partnership & Fy2020 Results August 2020

NBCUNIVERSAL PARTNERSHIP & FY2020 RESULTS AUGUST 2020 IMPORTANT NOTICE AND DISCLAIMER This document and any oral presentation accompanying it has been prepared in good faith, Materials are not, and shall not be relied upon as, a promise or representation as to future matters. The however, no express or implied representation or warranty is given as to the accuracy or Company accepts no responsibility or liability in relation to the accuracy or completeness of any forecasts, completeness of the information in this document, in any accompanying presentation or in forward looking statements or statements as to future affairs, or whether they are achievable. The any other written or oral communication transmitted or made available to any investor or Company does not assume any obligation to revise or update this document, any accompanying potential investor (collectively, the “Other Materials”). Nothing in this document, in any presentation, any Other Materials or any of the estimates, assumptions or expectations underlying such accompanying presentation or in any Other Materials is, or shall be relied upon as, a forecasts, forward looking statements and statements as to future affairs. No representations or warranties promise or representation. All statutory representations and warranties are excluded, and are made as to the accuracy or reasonableness of such estimates, assumptions or expectations or the any liability in negligence is excluded, in both cases to the fullest extent permitted by law. forecasts, forward looking statements or statements as to future affairs based thereon. Certain data No responsibility is assumed for any reliance on this document or the accompanying included herein has been obtained from alternative external sources and as such may be inconsistent given presentation or any Other Materials. -

Article Title

International In-house Counsel Journal Vol. 11, No. 41, Autumn 2017, 1 The Future is Cordless: How the Cordless Future will Impact Traditional Television SABRINA JO LEWIS Director of Business Affairs, Paramount Television, USA Introduction A cord-cutter is a person who cancels a paid television subscription or landline phone connection for an alternative Internet-based or wireless service. Cord-cutting is the result of competitive new media platforms such as Netflix, Amazon, Hulu, iTunes and YouTube. As new media platforms continue to expand and dominate the industry, more consumers are prepared to cut cords to save money. Online television platforms offer consumers customized content with no annual contract for a fraction of the price. As a result, since 2012, nearly 8 million United States households have cut cords, according to Wall Street research firm MoffettNathanson.1 One out of seven Americans has cut the cord.2 Nielsen started counting internet-based cable-like service subscribers at the start of 2017 and their data shows that such services have at least 1.3 million customers and are still growing.3 The three most popular subscription video-on-demand (“SVOD”) providers are Netflix, Amazon Prime and HULU Plus. According to Entertainment Merchants Association’s annual industry report, 72% of households with broadband subscribe to an SVOD service.4 During a recent interview on CNBC, Corey Barrett, a senior media analyst at M Science, explained that Hulu, not Netflix, appears to be driving the recent increase in cord-cutting, meaning cord-cutting was most pronounced among Hulu subscribers.5 Some consumers may decide not to cut cords because of sports programming or the inability to watch live programing on new media platforms. -

Comcast Corp

COMCAST CORP FORM 10-K (Annual Report) Filed 02/23/10 for the Period Ending 12/31/09 CIK 0001166691 Symbol CMCSA SIC Code 4841 - Cable and Other Pay Television Services Industry Broadcasting & Cable TV Sector Services Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2010, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. Table of Contents FORM 10-K UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO Commission file number 001-32871 COMCAST CORPORATION (Exact name of registrant as specified in its charter) PENNSYLVANIA 27 -0000798 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) One Comcast Center, Philadelphia, PA 19103 -2838 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (215) 286-1700 SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: Title of Each Class Name of Each Exchange on which Registered Class A Common Stock, $0.01 par value NASDAQ Global Select Market Class A Special Common Stock, $0.01 par value NASDAQ Global Select Market 2.0% Exchangeable Subordinated Debentures due 2029 New York Stock Exchange 6.625% Notes due 2056 New York Stock Exchange 7.00% Notes due 2055 New York Stock Exchange 7.00% Notes due 2055, Series B New York Stock Exchange 8.375% Guaranteed Notes due 2013 New York Stock Exchange 9.455% Guaranteed Notes due 2022 New York Stock Exchange SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

The Streaming Wars+: an Analysis of Anticompetitive Business Practices in Streaming Business

UCLA UCLA Entertainment Law Review Title The Streaming Wars+: An Analysis of Anticompetitive Business Practices in Streaming Business Permalink https://escholarship.org/uc/item/8m05g3fd Journal UCLA Entertainment Law Review, 28(1) ISSN 1073-2896 Author Pakula, Olivia Publication Date 2021 DOI 10.5070/LR828153859 Peer reviewed eScholarship.org Powered by the California Digital Library University of California THE STREAMING WARS+: An Analysis of Anticompetitive Business Practices in Streaming Business Olivia Pakula* Abstract The recent rise of streaming platforms currently benefits consumers with quality content offerings at free or at relatively low cost. However, as these companies’ market power expands through vertical integration, current anti- trust laws may be insufficient to protect consumers from potential longterm harms, such as increased prices, lower quality and variety of content, or erosion of data privacy. It is paramount to determining whether streaming services engage in anticompetitive business practices to protect both competition and consumers. Though streaming companies do not violate existing antitrust laws because consumers are not presently harmed, this Comment thus explores whether streaming companies are engaging in aggressive business practices with the potential to harm consumers. The oligopolistic streaming industry is combined with enormous barriers to entry, practices of predatory pricing, imperfect price discrimination, bundling, disfavoring of competitors on their platforms, huge talent buyouts, and nontransparent use of consumer data, which may be reason for concern. This Comment will examine the history of the entertainment industry and antitrust laws to discern where the current business practices of the streaming companies fit into the antitrust analysis. This Comment then considers potential solutions to antitrust concerns such as increasing enforcement, reforming the consumer welfare standard, public util- ity regulation, prophylactic bans on vertical integration, divestiture, and fines. -

La Maitrise Du Streaming, Un Nouvel Enjeu De Taille Pour Les Groupes Médias

La maitrise du streaming, un nouvel enjeu de taille pour les groupes médias Walt Disney Company a annoncé l’acquisition de 33% du capital de BAM Tech, société indépendante spécialisée dans les technologies de streaming vidéo, née au sein de MLB Advanced Media, une division de la Major League Baseball. Il s’agit de la dernière opération en date de rapprochement entre un acteur des contenus et un prestataire technologique devenu incontournable au moment où les services OTT de streaming en direct se multiplient. • BAM Tech passe du Baseball à l’univers Disney Walt Disney Company a annoncé l’acquisition de 33% du capital de BAM Tech, société indépendante spécialisée dans les technologies de streaming vidéo, née au sein de MLB Advanced Media, une division de la Major League Baseball créée en 2000 pour le lancement de MLB.TV qui diffuse en ligne les compétitions de la League. MLBAM reste la copropriété des 30 principales équipes de Baseball professionnel. L’opération valorise BAM Tech à hauteur de à 3,5 milliards de dollars. Et Disney disposerait également d’une option de 4 ans pour acquérir 33% supplémentaires. MLBAM a pris une autonomie croissante pour s’émanciper de l’univers du Baseball (applications MLB.TV) et plus globalement du sport U.S jusqu’à accorder son indépendance à BAM Tech, son entité opérationnelle en août 2015. Celle-ci est désormais devenue un prestataire de service majeur pour les grands networks et autres propriétaires de contenus. Ainsi, BAM Tech a réussi à se diversifier en gérant le streaming de HBO Now et PlayStation Vue après avoir fait ses preuves au sein de MLBAM dans le sport en direct via des plates- formes en marque blanche (WatchESPN, WWE Network, Yankee’s Yes Network, PGA Tour Live, les sites et applications de la NHL ou encore 120 sports et Ice Network, spécialiste des sports de glisse). -

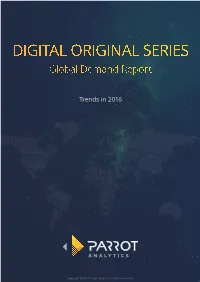

DIGITAL ORIGINAL SERIES Global Demand Report

DIGITAL ORIGINAL SERIES Global Demand Report Trends in 2016 Copyright © 2017 Parrot Analytics. All rights reserved. Digital Original Series — Global Demand Report | Trends in 2016 Executive Summary } This year saw the release of several new, popular digital } The release of popular titles such as The Grand Tour originals. Three first-season titles — Stranger Things, and The Man in the High Castle caused demand Marvel’s Luke Cage, and Gilmore Girls: A Year in the for Amazon Video to grow by over six times in some Life — had the highest peak demand in 2016 in seven markets, such as the UK, Sweden, and Japan, in Q4 of out of the ten markets. All three ranked within the 2016, illustrating the importance of hit titles for SVOD top ten titles by peak demand in nine out of the ten platforms. markets. } Drama series had the most total demand over the } As a percentage of all demand for digital original series year in these markets, indicating both the number and this year, Netflix had the highest share in Brazil and popularity of titles in this genre. third-highest share in Mexico, suggesting that the other platforms have yet to appeal to Latin American } However, some markets had preferences for other markets. genres. Science fiction was especially popular in Brazil, while France, Mexico, and Sweden had strong } Non-Netflix platforms had the highest share in Japan, demand for comedy-dramas. where Hulu and Amazon Video (as well as Netflix) have been available since 2015. Digital Original Series with Highest Peak Demand in 2016 Orange Is Marvels Stranger Things Gilmore Girls Club De Cuervos The New Black Luke Cage United Kingdom France United States Germany Mexico Brazil Sweden Russia Australia Japan 2 Copyright © 2017 Parrot Analytics. -

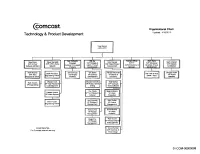

@Omcast Organizational Chart Technology & Product Development Updated: 4/1612010

@omcast Organizational Chart Technology & Product Development Updated: 4/1612010 Tony Werner EVP & eTa I I I I I I I I I .::.am .;x;nwartz _A~" t-ran~~uy~ ~fnlas Sree Kotay Steve Reynolds JOy Gary Koerper sv~a:;:~ed Sam Chernak Pres~t SVP Strategy & SVP IP SVP & Chief SVP CPE 8. Home SVP Video Product SVP Nelwork Comcas1 Converged Comm. Product Communications & 8lJsiness & Tech Softwatl! Architect Network Development Architecture Products DeveloDment Services Develoomerrt I I I Rich Woundy See Corneast Eric Budin Richard Hounsell Douglas Jones Ma~ Francisco See Tech & Prod SVP Tech Converged VP Business VP Search & VP Access ngmeenng Fello Devel- Hess Research & Devel. Products Development Discovery NotwoOO Michael Cook Michael Connelly Todd Walker Marti Vic.kers vp Tech Research VP Product 08'191 SVP Comcast VP Engineering & Development & Mng1 VidEKI Softward Dan Wang Melanie Means Edward Grauch P Tech Research VP Video VP Video Devices & Dell'el Production Jan Palmatier John Radloff KeVin Taylor VP Slra.tegy & VP Prodlc1 Fello~ nglneenng Oevelopmenl Managemem Anthony Fox Bruce Brodley VP Product VP Video Management Plo.tforms RogerFoK Ryan Cumer VP Producl P Product Ovlpm Management & Management Gerard Kunkel SVP User Exp, & Prod. De5ign 01-COM-00000008 @omcast Organizational Chari National Engineering & Technology Operations Updated: 411612010 John Schanz EVP National Eng Ineenng & I I Technology Operatioos I I Myma bOlO Greg Boles Ric\( Gasloli LyZiJ. Dilhhn Chief Information anc VP SVP Product VP HR & Org Intraslructure Flnarx;e Engineering Effecllveness Securil Officer I I I I I I ~a'Y raver Charlotte Field Raymond Celona Marl( Muehl PaLll Struhsaker KeVIn Mc;Elearnev SVP & COO SVP Dps, Tesling & SVP Planning & SVP Produd SVP Software Acting SVP Networ1o:. -

COMCAST CORPORATION (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q (Mark One) ☒ Quarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the quarterly period ended March 31, 2010 OR ☐ Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the Transition Period from to Commission File Number 001-32871 COMCAST CORPORATION (Exact name of registrant as specified in its charter) PENNSYLVANIA 27-0000798 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) One Comcast Center, Philadelphia, PA 19103-2838 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (215) 286-1700 Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such period that the registrant was required to submit and post such files). Yes ☒ No ☐ Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. -

TRANSCRIPT CMCSA - Comcast Corp at Bank of America Merrill Lynch Media, Communications and Entertainment Conference

THOMSON REUTERS STREETEVENTS EDITED TRANSCRIPT CMCSA - Comcast Corp at Bank of America Merrill Lynch Media, Communications and Entertainment Conference EVENT DATE/TIME: SEPTEMBER 14, 2016 / 3:00PM GMT THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2016 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. SEPTEMBER 14, 2016 / 3:00PM, CMCSA - Comcast Corp at Bank of America Merrill Lynch Media, Communications and Entertainment Conference CORPORATE PARTICIPANTS Steve Burke Comcast Corporation - Senior EVP and CEO, NBCUniversal CONFERENCE CALL PARTICIPANTS Jessica Reif Cohen Bank of America Merrill Lynch - Analyst PRESENTATION Jessica Reif Cohen - Bank of America Merrill Lynch - Analyst Good morning, hi. Thank you so much for coming. It's hard to believe you have been at Comcast for 18 years. Steve Burke - Comcast Corporation - Senior EVP and CEO, NBCUniversal That's true. Jessica Reif Cohen - Bank of America Merrill Lynch - Analyst It's really amazing. So let's focus on NBCU. It's flourished under your stewardship and Comcast's ownership. When you originally bought the asset, NBCU was obviously a turnaround story and to say the least the turnaround at NBCU has been outstanding. How does your strategy shift now that you are managing an asset that has been turned around and is now one of the leading media companies in the world? Steve Burke - Comcast Corporation - Senior EVP and CEO, NBCUniversal So let me start by talking a little bit about the Company that we bought and the Company as it is today.