Betting on Ott's Future

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

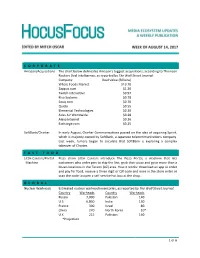

1 of 6 C O R P O R a T E Amazon/Acquisitions the Chart

CORPORATE Amazon/Acquisitions The chart below delineates Amazon’s biggest acquisitions, according to Thomson Reuters Deal Intelligence, as reported by The Wall Street Journal: Company Deal Value (Billions) Whole Foods MarKet $13.70 Zappos.com $1.20 Twitch Interactive $0.97 Kiva Systems $0.78 Souq.com $0.70 Quidsi $0.55 Elemental Technologies $0.30 Atlas Air Worldwide $0.28 Alexa Internet $0.26 Exchange.com $0.25 SoftBanK/Charter In early August, Charter Communications passed on the idea of acquiring Sprint, which is majority owned by SoftBanK, a Japanese telecommunications company. Last week, rumors began to circulate that SoftBank is exploring a complex taKeover of Charter. FAST FOOD Little Caesars/Portal Pizza chain Little Caesars introduce The Pizza Portal, a machine that lets Machine customers who order pies to skip the line, grab their pizza and go in more than a dozen locations in the Tucson (AZ) area. How it worKs: download an app to order and pay for food, receive a three digit or QR code and once in the store enter or scan the code to open a self-service hot box at the shop. GLOBAL Nuclear Warheads Estimated nuclear warhead inventories, as reported by The Wall Street Journal: Country Warheads Country Warheads Russia 7,000 Pakistan 140 U.S. 6,800 India 130 France 300 Israel 80 China 270 North Korea 10* U.K. 215 Pakistan 140 *Projection 1 of 6 MOVIES TicKet Sales According to Nielsen, North American box office ticKet sales are down 2.9% even with ticKet prices higher than the prior year – maKing up for some of the diminished theater attendance. -

Sample Pages

Connected Consumer Survey 2019: TV and video in Malaysia and the Philippines Connected Consumer Survey 2019: TV and video in Malaysia and the Philippines Martin Scott Connected Consumer Survey 2019: TV and video in Malaysia and the Philippines 2 About this report This report focuses on aspects of Analysys Mason’s Connected GEOGRAPHICAL COVERAGE Consumer Survey that relate to the behaviour, preferences and plans of consumers in their use of pay-TV and OTT video services Emerging Asia–Pacific: in Malaysia and the Philippines. The viewership of video content is ▪ Malaysia changing rapidly and the interaction between pay TV and OTT ▪ Philippines services is complex. The survey was conducted in association with Dynata between July and August 2019. The survey groups were chosen to be representative of the internet-using population in these countries. We set quotas on age, gender and geographical spread to that effect. There were a minimum of 1000 respondents per country. KEY QUESTIONS ANSWERED IN THIS REPORT WHO SHOULD READ THIS REPORT ▪ How should pay-TV providers evolve their services in order to remain ▪ Product managers and strategy teams working for pay-TV providers or relevant in a world of changing viewing habits? operators with pay-TV operations, or companies that use video services ▪ How are consumers’ viewing habits changing in light of increased OTT as a value-added service (VAS) to support their core services. video use? ▪ Marketing executives and product managers for pay-TV providers and ▪ How exposed are pay-TV providers in Malaysia and the Philippines to the operators that are making decisions about TV and video service design disruption caused by the COVID-19 pandemic? and its impact on customer retention. -

Corus Secures High-Profile Partnerships in Continued Multiplatform Digital Expansion

CORUS SECURES HIGH-PROFILE PARTNERSHIPS IN CONTINUED MULTIPLATFORM DIGITAL EXPANSION Corus Brings Complex Networks and its Leading Youth Culture Brands to Canada in 360° Partnership so.da partners with Twitter to launch custom content initiative Twitter Originals, fueled with so.da Kin Expands with New Male Vertical so.da originals Launches with Four Social Series for Brand Integrations For additional photography and press kit material visit: www.corusent.com To share this socially: http://bit.ly/2HPaFdW For Immediate Release TORONTO, June 3, 2019 – Corus announced today its latest big moves in the digital space: becoming the home to premium digital brands and audiences in Canada through pivotal partnerships with Complex and Twitter; adding new branded content opportunities for advertisers with the launch of so.da originals; as well as the expansion of Kin with a new male creator vertical. Corus Brings Complex to Canada Continuing to deliver premium content to its highly engaged audiences across multiple platforms, Corus brings Complex Networks, a global media company, to Canadians through a new 360° partnership. As the #1 youth culture brand in the U.S. for the Male 18-24 demo with more viewers than Netflix in this demo*, Complex offers a portfolio of premium video-first brands positioned to serve diverse audiences, bringing unparalleled reach with Millennials and Gen Z. Corus will serve as the exclusive ad sales partner for Complex Networks in Canada and will license content from the Networks’ diverse library to be distributed on various platforms, including linear and on demand. Beginning this fall, Complex Networks’ Hot Ones, from the food brand First We Feast, will get a one-hour block on Global Television, following Canada’s #1 late night show for millennials and A25-54, Saturday Night Live**. -

TRANSCRIPT CMCSA - Comcast Corp at UBS Global Media and Communications Conference

Client Id: 77 THOMSON REUTERS STREETEVENTS EDITED TRANSCRIPT CMCSA - Comcast Corp at UBS Global Media and Communications Conference EVENT DATE/TIME: DECEMBER 04, 2017 / 1:45PM GMT THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2017 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. Client Id: 77 DECEMBER 04, 2017 / 1:45PM, CMCSA - Comcast Corp at UBS Global Media and Communications Conference CORPORATE PARTICIPANTS Michael J. Cavanagh Comcast Corporation - CFO and Senior EVP CONFERENCE CALL PARTICIPANTS John Christopher Hodulik UBS Investment Bank, Research Division - MD, Sector Head of the United States Communications Group, and Telco and Pay TV Analyst PRESENTATION John Christopher Hodulik - UBS Investment Bank, Research Division - MD, Sector Head of the United States Communications Group, and Telco and Pay TV Analyst Okay. If everyone can please take their seats. Again, I'm John Hodulik, the media, telecom and cable infrastructure analyst here at UBS. And welcome to the 45th Annual Media and Telecom Conference. I'm pleased to announce our keynote speaker this morning is Mike Cavanagh, CFO of Comcast. Mike, thanks for being here. Michael J. Cavanagh - Comcast Corporation - CFO and Senior EVP Thanks for having us. Great to be here once again. Three years in a row. John Christopher Hodulik - UBS Investment Bank, Research Division - MD, Sector Head of the United States Communications Group, and Telco and Pay TV Analyst That's right. -

The Growth of VOD Investment in Local Entertainment Industries Contents

Asia-on- demand: the Growth of VOD Investment in Local Entertainment Industries contents Important Notice on Contents – Estimations and Reporting 04 GLOSSARY This report has been prepared by AlphaBeta for Netflix. 08 EXECUTIVE SUMMARY All information in this report is derived or estimated by AlphaBeta analysis using both 13 FACT 1: proprietary and publicly available information. Netflix has not supplied any additional data, nor VOD INVESTMENT IN LOCAL ASIAN CONTENT COULD GROW 3.7X BY 2022 does it endorse any estimates made in the report. Where information has been obtained from third party sources and proprietary sources, this is clearly referenced in the footnotes. 17 FACT 2: STRONG CONSUMER DEMAND INCENTIVIZES INVESTMENT IN HIGH-QUALITY Published in October 2018 LOCAL ENTERTAINMENT ONLINE 23 FACT 3: THROUGH VOD, ORIGINAL CONTENT PRODUCED IN ASIA IS GETTING INCREASED ACCESS TO GLOBAL AUDIENCES 27 FACT 4: THE ECONOMIC IMPACT OF LOCAL CONTENT INVESTMENT IS 3X LARGER THAN WHAT VOD PLAYERS SPEND 32 FACT 5: VOD PLAYERS OFFER BENEFITS TO THE LOCAL INDUSTRY - WELL BEYOND LOCAL CONTENT INVESTMENT 38 FACT 6: THE CONTENT PRODUCTION VALUE CHAIN IS BECOMING MORE GLOBAL AND DIVERSE, ALLOWING ASIAN COUNTRIES TO SPECIALIZE 43 FACT 7: THE KEY DRIVERS TO CAPTURING THE VOD CONTENT OPPORTUNITY ARE INVESTMENT INCENTIVES, SUPPORTIVE REGULATION, AND AlphaBeta is a strategy and economic advisory business serving clients across Australia and HIGH-QUALITY INFRASTRUCTURE Asia from offices in Singapore, Sydney, Canberra and Melbourne. 54 FINAL THOUGHTS: IMPLICATIONS FOR POLICYMAKERS SINGAPORE Level 4, 1 Upper Circular Road 57 APPENDIX: METHODOLOGY Singapore, 058400 Tel: +65 6443 6480 Email: [email protected] Web: www.alphabeta.com glossary The following terms have been used at various stages in this report. -

Article Title

International In-house Counsel Journal Vol. 11, No. 41, Autumn 2017, 1 The Future is Cordless: How the Cordless Future will Impact Traditional Television SABRINA JO LEWIS Director of Business Affairs, Paramount Television, USA Introduction A cord-cutter is a person who cancels a paid television subscription or landline phone connection for an alternative Internet-based or wireless service. Cord-cutting is the result of competitive new media platforms such as Netflix, Amazon, Hulu, iTunes and YouTube. As new media platforms continue to expand and dominate the industry, more consumers are prepared to cut cords to save money. Online television platforms offer consumers customized content with no annual contract for a fraction of the price. As a result, since 2012, nearly 8 million United States households have cut cords, according to Wall Street research firm MoffettNathanson.1 One out of seven Americans has cut the cord.2 Nielsen started counting internet-based cable-like service subscribers at the start of 2017 and their data shows that such services have at least 1.3 million customers and are still growing.3 The three most popular subscription video-on-demand (“SVOD”) providers are Netflix, Amazon Prime and HULU Plus. According to Entertainment Merchants Association’s annual industry report, 72% of households with broadband subscribe to an SVOD service.4 During a recent interview on CNBC, Corey Barrett, a senior media analyst at M Science, explained that Hulu, not Netflix, appears to be driving the recent increase in cord-cutting, meaning cord-cutting was most pronounced among Hulu subscribers.5 Some consumers may decide not to cut cords because of sports programming or the inability to watch live programing on new media platforms. -

The-Evolution-Of-The-OTT-TV-Market-January-2017.Pdf

BSAC Business Briefing The Evolution of the OTT TV Market January 2017 This paper was commissioned by BSAC and presented at a BSAC Council Meeting on 13 October 2016 accompanied by a complementary presentation and discussion by Ben Keen. It was subsequently revised and published in January 2017. Cutting the pay TV cord? Over the Top (OTT) television has become a shorthand term for a range of different online video services that may circumvent existing pay TV and broadcast business models, using the Internet as a means of distributing ‘Over The Top’ of those legacy services. The context of OTT growth is a slowing global pay TV market. Whilst still the dominant business model, pay TV operators all over the world are now experiencing slowing growth rates in their core subscriber metrics. To date, North America is the only region where there are signs that the traditional pay TV sector is actually contracting in size, prompting fears that consumers are genuinely starting to ‘cut the pay TV cord’. However, the industry has justifiable concerns that ‘cord cutting’ will eventually spread to all markets around the world as OTT alternatives become more attractive. BSAC Business Briefing: The Evolution of the OTT TV Market January 2017 1 The largest European pay TV operator by subscriber count is Liberty Global, which has been building scale through a series of acquisitions. Close behind Liberty is Sky Europe, which operates in Italy and Germany as well as the UK. All of the other top ranked pay TV players in Europe are primarily known as ‘telcos’ – but most use a variety of different distribution technologies to deliver their video services to paying customers (cable, satellite, IPTV and terrestrial). -

Contentasia Enewsletter 17 May 2021 Issue

C NTENT 17-30 May 2021 www.contentasia.tv l www.contentasiasummit.com C NTENT The Plot Thickens 25-27 August 2021 Discovery + WarnerMedia in Asia Job fears sweep a battered industry While debate rages around the Warner- Media/Discovery alliance announced last night, in Asia a fresh round of panic is battering an industry still reeling from this month’s fallout of the latest phase of Disney’s Fox Networks Group acquisition and an HBO Asia team only just unpack- ing boxes at their new WarnerMedia regional HQ in Singapore. The full story is on page 8 q Disney+ Hotstar heads for Thailand 30 June launch for hybrid service Disney is rolling out its lower-cost hybrid streaming service, Disney+ Hotstar, in Thailand on 30 June. This is the third Disney+ Hotstar platform in Southeast Asia after Indonesia, which launched in September last year, and Malaysia, which goes live on 1 June. The full story is on page 3 By 2029, HD Cable Households are Expected to Increase by 78% to 306 Million Across the Asia-Pacific Region Are you prepared to capture this growth? As a global leader of broadcast services and communications and a clear leader in this region, Intelsat continues to deliver the reliability and scalability programmers need to deliver high-quality video to viewers. Check out our latest eBook to understand the shifting media trends across the region and to make sure you are positioned to capture future subscribers and revenue in this highly competitive market. 230M+ Pay TV subscribers _________ 800 Channels _________ 5 Premier Video Neighborhoods _________ 3 Satellites Learn more by downloading intelsat.com linkedin.com/company/Intelsat Intelsat’s Media Market Watch 2021 twitter.com/Intelsat A Complete Guide to Pay TV Opportunities in the Asia-Pacific Region facebook.com/Intelsat youtube.com/user/IntelsatMedia 17-30 May 2021 page 2. -

The Streaming Wars+: an Analysis of Anticompetitive Business Practices in Streaming Business

UCLA UCLA Entertainment Law Review Title The Streaming Wars+: An Analysis of Anticompetitive Business Practices in Streaming Business Permalink https://escholarship.org/uc/item/8m05g3fd Journal UCLA Entertainment Law Review, 28(1) ISSN 1073-2896 Author Pakula, Olivia Publication Date 2021 DOI 10.5070/LR828153859 Peer reviewed eScholarship.org Powered by the California Digital Library University of California THE STREAMING WARS+: An Analysis of Anticompetitive Business Practices in Streaming Business Olivia Pakula* Abstract The recent rise of streaming platforms currently benefits consumers with quality content offerings at free or at relatively low cost. However, as these companies’ market power expands through vertical integration, current anti- trust laws may be insufficient to protect consumers from potential longterm harms, such as increased prices, lower quality and variety of content, or erosion of data privacy. It is paramount to determining whether streaming services engage in anticompetitive business practices to protect both competition and consumers. Though streaming companies do not violate existing antitrust laws because consumers are not presently harmed, this Comment thus explores whether streaming companies are engaging in aggressive business practices with the potential to harm consumers. The oligopolistic streaming industry is combined with enormous barriers to entry, practices of predatory pricing, imperfect price discrimination, bundling, disfavoring of competitors on their platforms, huge talent buyouts, and nontransparent use of consumer data, which may be reason for concern. This Comment will examine the history of the entertainment industry and antitrust laws to discern where the current business practices of the streaming companies fit into the antitrust analysis. This Comment then considers potential solutions to antitrust concerns such as increasing enforcement, reforming the consumer welfare standard, public util- ity regulation, prophylactic bans on vertical integration, divestiture, and fines. -

La Maitrise Du Streaming, Un Nouvel Enjeu De Taille Pour Les Groupes Médias

La maitrise du streaming, un nouvel enjeu de taille pour les groupes médias Walt Disney Company a annoncé l’acquisition de 33% du capital de BAM Tech, société indépendante spécialisée dans les technologies de streaming vidéo, née au sein de MLB Advanced Media, une division de la Major League Baseball. Il s’agit de la dernière opération en date de rapprochement entre un acteur des contenus et un prestataire technologique devenu incontournable au moment où les services OTT de streaming en direct se multiplient. • BAM Tech passe du Baseball à l’univers Disney Walt Disney Company a annoncé l’acquisition de 33% du capital de BAM Tech, société indépendante spécialisée dans les technologies de streaming vidéo, née au sein de MLB Advanced Media, une division de la Major League Baseball créée en 2000 pour le lancement de MLB.TV qui diffuse en ligne les compétitions de la League. MLBAM reste la copropriété des 30 principales équipes de Baseball professionnel. L’opération valorise BAM Tech à hauteur de à 3,5 milliards de dollars. Et Disney disposerait également d’une option de 4 ans pour acquérir 33% supplémentaires. MLBAM a pris une autonomie croissante pour s’émanciper de l’univers du Baseball (applications MLB.TV) et plus globalement du sport U.S jusqu’à accorder son indépendance à BAM Tech, son entité opérationnelle en août 2015. Celle-ci est désormais devenue un prestataire de service majeur pour les grands networks et autres propriétaires de contenus. Ainsi, BAM Tech a réussi à se diversifier en gérant le streaming de HBO Now et PlayStation Vue après avoir fait ses preuves au sein de MLBAM dans le sport en direct via des plates- formes en marque blanche (WatchESPN, WWE Network, Yankee’s Yes Network, PGA Tour Live, les sites et applications de la NHL ou encore 120 sports et Ice Network, spécialiste des sports de glisse). -

DIGITAL ORIGINAL SERIES Global Demand Report

DIGITAL ORIGINAL SERIES Global Demand Report Trends in 2016 Copyright © 2017 Parrot Analytics. All rights reserved. Digital Original Series — Global Demand Report | Trends in 2016 Executive Summary } This year saw the release of several new, popular digital } The release of popular titles such as The Grand Tour originals. Three first-season titles — Stranger Things, and The Man in the High Castle caused demand Marvel’s Luke Cage, and Gilmore Girls: A Year in the for Amazon Video to grow by over six times in some Life — had the highest peak demand in 2016 in seven markets, such as the UK, Sweden, and Japan, in Q4 of out of the ten markets. All three ranked within the 2016, illustrating the importance of hit titles for SVOD top ten titles by peak demand in nine out of the ten platforms. markets. } Drama series had the most total demand over the } As a percentage of all demand for digital original series year in these markets, indicating both the number and this year, Netflix had the highest share in Brazil and popularity of titles in this genre. third-highest share in Mexico, suggesting that the other platforms have yet to appeal to Latin American } However, some markets had preferences for other markets. genres. Science fiction was especially popular in Brazil, while France, Mexico, and Sweden had strong } Non-Netflix platforms had the highest share in Japan, demand for comedy-dramas. where Hulu and Amazon Video (as well as Netflix) have been available since 2015. Digital Original Series with Highest Peak Demand in 2016 Orange Is Marvels Stranger Things Gilmore Girls Club De Cuervos The New Black Luke Cage United Kingdom France United States Germany Mexico Brazil Sweden Russia Australia Japan 2 Copyright © 2017 Parrot Analytics. -

Yearbook 2019/2020 Key Trends

YEARBOOK 2019/2020 KEY TRENDS TELEVISION, CINEMA, VIDEO AND ON-DEMAND AUDIOVISUAL SERVICES - THE PAN-EUROPEAN PICTURE → Director of publication Susanne Nikoltchev, Executive Director → Editorial supervision Gilles Fontaine, Head of Department for Market Information → Authors Francisco Javier Cabrera Blázquez, Maja Cappello, Laura Ene, Gilles Fontaine, Christian Grece, Marta Jiménez Pumares, Martin Kanzler, Ismail Rabie, Agnes Schneeberger, Patrizia Simone, Julio Talavera, Sophie Valais → Coordination Valérie Haessig → Special thanks to the following for their contribution to the Yearbook Ampere Analysis, Bureau van Dijk (BvD), European Broadcasting Union - Media Intelligence Service (EBU-M.I.S.), EURODATA-TV, LyngSat, WARC, and the members of the EFARN and the EPRA networks. → Proofreading Anthony Mills → Layout Big Family → Press and public relations Alison Hindhaugh, [email protected] → Publisher European Audiovisual Observatory 76 Allée de la Robertsau, 67000 Strasbourg, France www.obs.coe.int If you wish to reproduce tables or graphs contained in this publication please contact the European Audiovisual Observatory for prior approval. Please note that the European Audiovisual Observatory can only authorise reproduction of tables or graphs sourced as “European Audiovisual Observatory”. All other entries may only be reproduced with the consent of the original source. Opinions expressed in this publication are personal and do not necessarily represent the view of the Observatory, its members or of the Council of Europe. © European Audiovisual Observatory (Council of Europe), Strasbourg 2020 YEARBOOK 2019/2020 KEY TRENDS TELEVISION, CINEMA, VIDEO AND ON-DEMAND AUDIOVISUAL SERVICES - THE PAN-EUROPEAN PICTURE 4 YEARBOOK 2019/2020 – KEY TRENDS TABLE OF CONTENT INTRODUCTION 0 Six keywords for 2019 and, possibly, 2020 .