What's Tv Worth?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

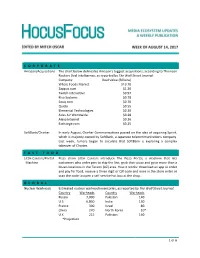

1 of 6 C O R P O R a T E Amazon/Acquisitions the Chart

CORPORATE Amazon/Acquisitions The chart below delineates Amazon’s biggest acquisitions, according to Thomson Reuters Deal Intelligence, as reported by The Wall Street Journal: Company Deal Value (Billions) Whole Foods MarKet $13.70 Zappos.com $1.20 Twitch Interactive $0.97 Kiva Systems $0.78 Souq.com $0.70 Quidsi $0.55 Elemental Technologies $0.30 Atlas Air Worldwide $0.28 Alexa Internet $0.26 Exchange.com $0.25 SoftBanK/Charter In early August, Charter Communications passed on the idea of acquiring Sprint, which is majority owned by SoftBanK, a Japanese telecommunications company. Last week, rumors began to circulate that SoftBank is exploring a complex taKeover of Charter. FAST FOOD Little Caesars/Portal Pizza chain Little Caesars introduce The Pizza Portal, a machine that lets Machine customers who order pies to skip the line, grab their pizza and go in more than a dozen locations in the Tucson (AZ) area. How it worKs: download an app to order and pay for food, receive a three digit or QR code and once in the store enter or scan the code to open a self-service hot box at the shop. GLOBAL Nuclear Warheads Estimated nuclear warhead inventories, as reported by The Wall Street Journal: Country Warheads Country Warheads Russia 7,000 Pakistan 140 U.S. 6,800 India 130 France 300 Israel 80 China 270 North Korea 10* U.K. 215 Pakistan 140 *Projection 1 of 6 MOVIES TicKet Sales According to Nielsen, North American box office ticKet sales are down 2.9% even with ticKet prices higher than the prior year – maKing up for some of the diminished theater attendance. -

Results 2017

RESULTS 2017 Results 2017 Films, television programs, production, distribution, exhibition, exports, video, new media May 2018 Results 2017 1. ELECTRONICS AND HOUSEHOLD SPENDING ON FILM, VIDEO, TV AND VIDEO GAMES .......................................................................................................................................... 4 2. CINEMA ................................................................................................................................... 12 2.1. Attendance at movie theaters ............................................................................................ 13 2.2. Distribution ........................................................................................................................ 36 2.3. Movie theater audiences .................................................................................................... 51 2.4. Exhibition ........................................................................................................................... 64 2.5. Feature film production ...................................................................................................... 74 3. TELEVISION ............................................................................................................................ 91 3.1. The television audience ..................................................................................................... 92 3.2. Films on television ............................................................................................................ -

TRANSCRIPT CMCSA - Comcast Corp at UBS Global Media and Communications Conference

Client Id: 77 THOMSON REUTERS STREETEVENTS EDITED TRANSCRIPT CMCSA - Comcast Corp at UBS Global Media and Communications Conference EVENT DATE/TIME: DECEMBER 04, 2017 / 1:45PM GMT THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2017 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. Client Id: 77 DECEMBER 04, 2017 / 1:45PM, CMCSA - Comcast Corp at UBS Global Media and Communications Conference CORPORATE PARTICIPANTS Michael J. Cavanagh Comcast Corporation - CFO and Senior EVP CONFERENCE CALL PARTICIPANTS John Christopher Hodulik UBS Investment Bank, Research Division - MD, Sector Head of the United States Communications Group, and Telco and Pay TV Analyst PRESENTATION John Christopher Hodulik - UBS Investment Bank, Research Division - MD, Sector Head of the United States Communications Group, and Telco and Pay TV Analyst Okay. If everyone can please take their seats. Again, I'm John Hodulik, the media, telecom and cable infrastructure analyst here at UBS. And welcome to the 45th Annual Media and Telecom Conference. I'm pleased to announce our keynote speaker this morning is Mike Cavanagh, CFO of Comcast. Mike, thanks for being here. Michael J. Cavanagh - Comcast Corporation - CFO and Senior EVP Thanks for having us. Great to be here once again. Three years in a row. John Christopher Hodulik - UBS Investment Bank, Research Division - MD, Sector Head of the United States Communications Group, and Telco and Pay TV Analyst That's right. -

Canadian Media Directors' Council

Display until February 28, 2011 PUBLICATIONS MAIL aGREEMENT 40070230 pOstaGe paiD in tOrOntO MarketinG MaGazine, One MOunt pleasant RoaD, tOrOntO, CanaDa M4y 2y5 September 2010 27, $19.95 Pre P ared by: MEDIA Canadian Media Directors’ Council Directors’ Media Canadian DIGEST 10 Published by: 11 4 Y CELEBRATING E A 0 RS www.marketingmag.ca Letter from the President CMDC MEMBER AGENCIES Agency 59 Canadian Media Directors’ Council AndersonDDB Cossette Welcome readers, Doner DraftFCB The Canadian Media Directors’ Council is celebrating the 40th anniversary of the Genesis Vizeum Media Digest with the publication of this 2010/11 issue you are accessing. Forty years is Geomedia quite an achievement of consistently providing the comprehensive source of key trends GJP and details on the full media landscape in the Canadian marketplace. Fascinating to Initiative consider how the media industry has evolved over those forty years and how the content M2 Universal of the Digest has evolved along with the industry. MPG As our industry has transformed and instant digital access has become such an import- MediaCom ant component of any reference source, we are pleased to make the Digest and its valu- Mediaedge.cia able and unique reference information freely available to the industry online at www. Media Experts cmdc.ca and www.marketingmag.ca, in addition to the hard copies distributed through Mindshare Marketing Magazine and our member agencies. OMD The CMDC member agencies play a crucial role in updating and reinventing the PHD Digest content on a yearly basis, and we thank each agency for their contribution. The Pegi Gross and Associates 2010/11 edition was chaired by Fred Forster, president & CEO of PHD Canada and RoundTable Advertising produced by Margaret Rye, the CMDC Digest administrator. -

SPANISH FORK PAGES 1-20.Indd

November 14 - 20, 2008 SPANISH FORK CABLE GUIDE 9 Friday Prime Time, November 14 4 P.M. 4:30 5 P.M. 5:30 6 P.M. 6:30 7 P.M. 7:30 8 P.M. 8:30 9 P.M. 9:30 10 P.M. 10:30 11 P.M. 11:30 BASIC CABLE Oprah Winfrey b News (N) b CBS Evening News (N) b Entertainment Ghost Whisperer “Threshold” The Price Is Right Salutes the NUMB3RS “Charlie Don’t Surf” News (N) b (10:35) Late Show With David Late Late Show KUTV 2 News-Couric Tonight (N) b Troops (N) b (N) b Letterman (N) KJZZ 3 High School Football The Insider Frasier Friends Friends Fortune Jeopardy! Dr. Phil b News (N) Sports News Scrubs Scrubs Entertain The Insider The Ellen DeGeneres Show Ac- News (N) World News- News (N) Access Holly- Supernanny “Howat Family” (N) Super-Manny (N) b 20/20 b News (N) (10:35) Night- Access Holly- (11:36) Extra KTVX 4 tor Nathan Lane. (N) Gibson wood (N) b line (N) wood (N) (N) b News (N) b News (N) b News (N) b NBC Nightly News (N) b News (N) b Deal or No Deal A teacher returns Crusoe “Hour 6 -- Long Pig” (N) Lipstick Jungle (N) b News (N) b (10:35) The Tonight Show With Late Night KSL 5 News (N) to finish her game. b Jay Leno (N) b TBS 6 Raymond Friends Seinfeld Seinfeld ‘The Wizard of Oz’ (G, ’39) Judy Garland. (8:10) ‘Shrek’ (’01) Voices of Mike Myers. -

BCE Inc. 2015 Annual Report

Leading the way in communications BCE INC. 2015 ANNUAL REPORT for 135 years BELL LEADERSHIP AND INNOVATION PAST, PRESENT AND FUTURE OUR GOAL For Bell to be recognized by customers as Canada’s leading communications company OUR STRATEGIC IMPERATIVES Invest in broadband networks and services 11 Accelerate wireless 12 Leverage wireline momentum 14 Expand media leadership 16 Improve customer service 18 Achieve a competitive cost structure 20 Bell is leading Canada’s broadband communications revolution, investing more than any other communications company in the fibre networks that carry advanced services, in the products and content that make the most of the power of those networks, and in the customer service that makes all of it accessible. Through the rigorous execution of our 6 Strategic Imperatives, we gained further ground in the marketplace and delivered financial results that enable us to continue to invest in growth services that now account for 81% of revenue. Financial and operational highlights 4 Letters to shareholders 6 Strategic imperatives 11 Community investment 22 Bell archives 24 Management’s discussion and analysis (MD&A) 28 Reports on internal control 112 Consolidated financial statements 116 Notes to consolidated financial statements 120 2 We have re-energized one of Canada’s most respected brands, transforming Bell into a competitive force in every communications segment. Achieving all our financial targets for 2015, we strengthened our financial position and continued to create value for shareholders. DELIVERING INCREASED -

Q1 2015 Press Release

For Immediate Release This news release contains forward-looking statements. For a description of the related risk factors and assumptions please see the section entitled “Caution Concerning Forward-Looking Statements” later in this release. BCE reports first quarter 2015 results • Net earnings attributable to common shareholders of $532 million; Adjusted net earnings up 12.6% to $705 million; Adjusted net earnings per share of $0.84, up 3.7% • 3.6% higher Adjusted EBITDA driven by 2.8% increase in total revenues as all Bell operating segments generated positive revenue growth • Strong wireless financial results with 9.7% revenue growth and 10.7% higher Adjusted EBITDA; postpaid net additions up 3.7% to 35,373 • Wireline Adjusted EBITDA up 1.0%, positive for the third consecutive quarter • IPTV adds 60,863 net new customers; total subscribers now surpass 1 million • High-speed Internet net activations up 49.2% to 39,650; broadband market share leader with 3.3 million subscribers, up 4.3% • Improved customer service drives lower churn across residential and wireless services and reduced wireline operating costs MONTRÉAL, April 30, 2015 – BCE Inc. (TSX, NYSE: BCE), Canada’s largest communications company, today reported financial and operating results for the first quarter (Q1) of 2015. FINANCIAL HIGHLIGHTS ($ millions except per share amounts) (unaudited) Q1 2015 Q1 2014 % change BCE Operating revenues 5,240 5,099 2.8% Adjusted EBITDA(1) 2,094 2,022 3.6% Net earnings attributable to common shareholders 532 615 (13.5%) EPS 0.63 0.79 (20.3%) Adjusted EPS(2) 0.84 0.81 3.7% Cash flows from operating activities 1,045 982 6.4% Free Cash Flow(3) 231 262 (11.8%) Free Cash Flow per share(3) 0.27 0.34 (20.6%) “The Bell team’s steadfast execution of our strategy to invest in Canada’s leading networks, content and service delivered strong operating and financial results across the business in Q1 2015. -

Virgil, Aeneid 11 (Pallas & Camilla) 1–224, 498–521, 532–96, 648–89, 725–835 G

Virgil, Aeneid 11 (Pallas & Camilla) 1–224, 498–521, 532–96, 648–89, 725–835 G Latin text, study aids with vocabulary, and commentary ILDENHARD INGO GILDENHARD AND JOHN HENDERSON A dead boy (Pallas) and the death of a girl (Camilla) loom over the opening and the closing part of the eleventh book of the Aeneid. Following the savage slaughter in Aeneid 10, the AND book opens in a mournful mood as the warring parti es revisit yesterday’s killing fi elds to att end to their dead. One casualty in parti cular commands att enti on: Aeneas’ protégé H Pallas, killed and despoiled by Turnus in the previous book. His death plunges his father ENDERSON Evander and his surrogate father Aeneas into heart-rending despair – and helps set up the foundati onal act of sacrifi cial brutality that caps the poem, when Aeneas seeks to avenge Pallas by slaying Turnus in wrathful fury. Turnus’ departure from the living is prefi gured by that of his ally Camilla, a maiden schooled in the marti al arts, who sets the mold for warrior princesses such as Xena and Wonder Woman. In the fi nal third of Aeneid 11, she wreaks havoc not just on the batt lefi eld but on gender stereotypes and the conventi ons of the epic genre, before she too succumbs to a premature death. In the porti ons of the book selected for discussion here, Virgil off ers some of his most emoti ve (and disturbing) meditati ons on the tragic nature of human existence – but also knows how to lighten the mood with a bit of drag. -

Article Title

International In-house Counsel Journal Vol. 11, No. 41, Autumn 2017, 1 The Future is Cordless: How the Cordless Future will Impact Traditional Television SABRINA JO LEWIS Director of Business Affairs, Paramount Television, USA Introduction A cord-cutter is a person who cancels a paid television subscription or landline phone connection for an alternative Internet-based or wireless service. Cord-cutting is the result of competitive new media platforms such as Netflix, Amazon, Hulu, iTunes and YouTube. As new media platforms continue to expand and dominate the industry, more consumers are prepared to cut cords to save money. Online television platforms offer consumers customized content with no annual contract for a fraction of the price. As a result, since 2012, nearly 8 million United States households have cut cords, according to Wall Street research firm MoffettNathanson.1 One out of seven Americans has cut the cord.2 Nielsen started counting internet-based cable-like service subscribers at the start of 2017 and their data shows that such services have at least 1.3 million customers and are still growing.3 The three most popular subscription video-on-demand (“SVOD”) providers are Netflix, Amazon Prime and HULU Plus. According to Entertainment Merchants Association’s annual industry report, 72% of households with broadband subscribe to an SVOD service.4 During a recent interview on CNBC, Corey Barrett, a senior media analyst at M Science, explained that Hulu, not Netflix, appears to be driving the recent increase in cord-cutting, meaning cord-cutting was most pronounced among Hulu subscribers.5 Some consumers may decide not to cut cords because of sports programming or the inability to watch live programing on new media platforms. -

The Streaming Wars+: an Analysis of Anticompetitive Business Practices in Streaming Business

UCLA UCLA Entertainment Law Review Title The Streaming Wars+: An Analysis of Anticompetitive Business Practices in Streaming Business Permalink https://escholarship.org/uc/item/8m05g3fd Journal UCLA Entertainment Law Review, 28(1) ISSN 1073-2896 Author Pakula, Olivia Publication Date 2021 DOI 10.5070/LR828153859 Peer reviewed eScholarship.org Powered by the California Digital Library University of California THE STREAMING WARS+: An Analysis of Anticompetitive Business Practices in Streaming Business Olivia Pakula* Abstract The recent rise of streaming platforms currently benefits consumers with quality content offerings at free or at relatively low cost. However, as these companies’ market power expands through vertical integration, current anti- trust laws may be insufficient to protect consumers from potential longterm harms, such as increased prices, lower quality and variety of content, or erosion of data privacy. It is paramount to determining whether streaming services engage in anticompetitive business practices to protect both competition and consumers. Though streaming companies do not violate existing antitrust laws because consumers are not presently harmed, this Comment thus explores whether streaming companies are engaging in aggressive business practices with the potential to harm consumers. The oligopolistic streaming industry is combined with enormous barriers to entry, practices of predatory pricing, imperfect price discrimination, bundling, disfavoring of competitors on their platforms, huge talent buyouts, and nontransparent use of consumer data, which may be reason for concern. This Comment will examine the history of the entertainment industry and antitrust laws to discern where the current business practices of the streaming companies fit into the antitrust analysis. This Comment then considers potential solutions to antitrust concerns such as increasing enforcement, reforming the consumer welfare standard, public util- ity regulation, prophylactic bans on vertical integration, divestiture, and fines. -

INSTITUTION Congress of the US, Washington, DC. House Committee

DOCUMENT RESUME ED 303 136 IR 013 589 TITLE Commercialization of Children's Television. Hearings on H.R. 3288, H.R. 3966, and H.R. 4125: Bills To Require the FCC To Reinstate Restrictions on Advertising during Children's Television, To Enforce the Obligation of Broadcasters To Meet the Educational Needs of the Child Audience, and for Other Purposes, before the Subcommittee on Telecommunications and Finance of the Committee on Energy and Commerce, House of Representatives, One Hundredth Congress (September 15, 1987 and March 17, 1988). INSTITUTION Congress of the U.S., Washington, DC. House Committee on Energy and Commerce. PUB DATE 88 NOTE 354p.; Serial No. 100-93. Portions contain small print. AVAILABLE FROM Superintendent of Documents, Congressional Sales Office, U.S. Government Printing Office, Washington, DC 20402. PUB TYPE Legal/Legislative/Regulatory Materials (090) -- Viewpoints (120) -- Reports - Evaluative/Feasibility (142) EDRS PRICE MFO1 /PC15 Plus Postage. DESCRIPTORS *Advertising; *Childrens Television; *Commercial Television; *Federal Legislation; Hearings; Policy Formation; *Programing (Broadcast); *Television Commercials; Television Research; Toys IDENTIFIERS Congress 100th; Federal Communications Commission ABSTRACT This report provides transcripts of two hearings held 6 months apart before a subcommittee of the House of Representatives on three bills which would require the Federal Communications Commission to reinstate restrictions on advertising on children's television programs. The texts of the bills under consideration, H.R. 3288, H.R. 3966, and H.R. 4125 are also provided. Testimony and statements were presented by:(1) Representative Terry L. Bruce of Illinois; (2) Peggy Charren, Action for Children's Television; (3) Robert Chase, National Education Association; (4) John Claster, Claster Television; (5) William Dietz, Tufts New England Medical Center; (6) Wallace Jorgenson, National Association of Broadcasters; (7) Dale L. -

La Maitrise Du Streaming, Un Nouvel Enjeu De Taille Pour Les Groupes Médias

La maitrise du streaming, un nouvel enjeu de taille pour les groupes médias Walt Disney Company a annoncé l’acquisition de 33% du capital de BAM Tech, société indépendante spécialisée dans les technologies de streaming vidéo, née au sein de MLB Advanced Media, une division de la Major League Baseball. Il s’agit de la dernière opération en date de rapprochement entre un acteur des contenus et un prestataire technologique devenu incontournable au moment où les services OTT de streaming en direct se multiplient. • BAM Tech passe du Baseball à l’univers Disney Walt Disney Company a annoncé l’acquisition de 33% du capital de BAM Tech, société indépendante spécialisée dans les technologies de streaming vidéo, née au sein de MLB Advanced Media, une division de la Major League Baseball créée en 2000 pour le lancement de MLB.TV qui diffuse en ligne les compétitions de la League. MLBAM reste la copropriété des 30 principales équipes de Baseball professionnel. L’opération valorise BAM Tech à hauteur de à 3,5 milliards de dollars. Et Disney disposerait également d’une option de 4 ans pour acquérir 33% supplémentaires. MLBAM a pris une autonomie croissante pour s’émanciper de l’univers du Baseball (applications MLB.TV) et plus globalement du sport U.S jusqu’à accorder son indépendance à BAM Tech, son entité opérationnelle en août 2015. Celle-ci est désormais devenue un prestataire de service majeur pour les grands networks et autres propriétaires de contenus. Ainsi, BAM Tech a réussi à se diversifier en gérant le streaming de HBO Now et PlayStation Vue après avoir fait ses preuves au sein de MLBAM dans le sport en direct via des plates- formes en marque blanche (WatchESPN, WWE Network, Yankee’s Yes Network, PGA Tour Live, les sites et applications de la NHL ou encore 120 sports et Ice Network, spécialiste des sports de glisse).