Prospectus, You Should Obtain Independent Professional Advice

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Minutes of the 7 Meeting of the Tuen Mun District Council Date: 1

Minutes of the 7th Meeting of the Tuen Mun District Council Date: 1 November 2016 (Tuesday) Time: 9:32 a.m. Venue: Tuen Mun District Council (TMDC) Conference Room Present : Time of Arrival Time of Departure Mr LEUNG Kin-man, BBS, MH, JP (Chairman) 9:30 a.m. End of meeting Mr LEE Hung-sham, Lothar, MH (Vice-chairman) 9:30 a.m. End of meeting Mr SO Shiu-shing 9:34 a.m. End of meeting Mr TO Sheck-yuen, MH 9:30 a.m. End of meeting Mr CHU Yiu-wah 9:32 a.m. 2:03 p.m. Ms KONG Fung-yi 9:30 a.m. End of meeting Mr NG Koon-hung 9:30 a.m. 11:50 a.m. Ms WONG Lai-sheung, Catherine 9:34 a.m. 3:40 p.m. Mr AU Chi-yuen 9:30 a.m. End of meeting Ms HO Hang-mui 9:30 a.m. End of meeting Mr LAM Chung-hoi 9:41 a.m. End of meeting Mr TSUI Fan, MH 12:39 p.m. 2:38 p.m. Ms CHING Chi-hung 9:30 a.m. End of meeting Ms LUNG Shui-hing, MH 9:30 a.m. End of meeting Mr CHAN Man-wah, MH 9:30 a.m. End of meeting The Hon LAU Ip-keung, Kenneth, MH, JP 9:30 a.m. 2:03 p.m. Mr CHAN Manwell, Leo 10:37 a.m. 2:03 p.m. Mr CHEUNG Hang-fai 9:30 a.m. End of meeting The Hon HO Kwan-yiu, JP 9:41 a.m. -

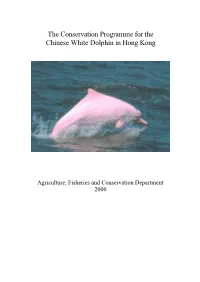

The Conservation Programme for the Chinese White Dolphin in Hong Kong

The Conservation Programme for the Chinese White Dolphin in Hong Kong Agriculture, Fisheries and Conservation Department 2000 TABLE OF CONTENTS I. INTRODUCTION............................................................................................2 II. SPECIES OVERVIEW ...................................................................................4 1. DISTRIBUTION .....................................................................................................4 2. ABUNDANCE .......................................................................................................4 3. HOME RANGE AND GROUP SIZE..........................................................................4 4. BEHAVIOUR ........................................................................................................5 5. GROWTH AND DEVELOPMENT.............................................................................5 6. FEEDING AND REPRODUCTION ............................................................................5 7. THREATS.............................................................................................................5 III. HUMAN IMPACTS.........................................................................................7 1. HABITAT LOSS AND DISTURBANCE .....................................................................7 2. POLLUTION .........................................................................................................7 3. DEPLETION OF FOOD RESOURCES .......................................................................8 -

M / SP / 14 / 172 ¨·P Eªä 13 Yeung Siu Hang Century M �⁄ Gateway a PUI to ROAD C S· L E S·O 11 H

·‘†Łƒ C«s¤ Close Quarter Battle Range ¶¶· Sun Fung Wai l¹º Yonking Garden dª ⁄l s•‹Łƒ KONG SHAM Nai Wai Qª Tuen Tsz Wai West N.T. Landfill 100 Chung Shan C«j A´ Z¸W Tsing Chuen Wai CASTLE PEAK ROAD - LAM TEI The Sherwood g 200 HIGHWAY j⁄ ROAD Tai Shui Hang I´A¿ WESTERN ⁄l Fortress Garden LONG WAN Tuen Tsz Wai flA» ø¨d NIM Ø Villa Pinada ROAD Dumping Area Å LAU Tsoi Yuen Tsuen YUEN HIGHWAY NG Lam Tei Light Rail 200 297 q a Å AD ®§k RO w Z¸ œf Miu Fat ¿´ ”ºƒ 80 Lingrade Monastery TSUI Nim Wan Garden The Sherwood g Ser Res ´» ½ õ«d Borrow Area s TSANG ÅÂa¦ C y s LAM TEI ¤h HO N d±_ G P s·y C«s¤m½v O ⁄ø“ RO MAIN A San Hing Tsuen STREET D Tuen Mun ¿´ San Tsuen Tsang Tsui SAN HING ”º æ” Fuk Hang Tsuen RO AD Botania Villa ”ºƒ 300 FUK HANG _˜ TSUEN ROAD — RD 67 Pipeline 300 Po Tong Ha Tsz Tin Tsuen 100 LAU fiØ To Yuen Wai NG 69 394 65 ‚⁄fi 100 300 200 29 ƒŒ — Lo Fu Hang ¥d ROAD SIU HONG RD NULLAH C«s¤m½v TSZ HANG 200 FU NIM WAN ROAD TIN êªa¦ RD Tsing Shan Firing Range Boundary p¤| ê| Fu Tei Ha Tsuen Siu Hang Tsuen ¥d 30 ¥q 100 TONG HANG RD LINGNAN Z¸W 100 _˜ I´õ 45 Fu Tai Estate Quarry 200 IJT - _˜ 66 ⁄Q 68 IJG TSING LUN ROAD qÄs 47 RD 31 Kwong Shan Tsuen HUNG SHUI HANG Q˜ KWAI 44 TUEN SIU HONG RESERVOIR E»d± HING FU STREET 64 BeneVille ¶º TUEN QÄC ST FU RD 27 Catchwater TSING ROAD PEAK CASTLE ¥ Tsing Shan Firing Range Boundary Siu Hong KEI Pipeline 281 Court 46 200 _ÄÐ HING KWAI ST Œœ 100 32 M²D² Parkland Villas ⁄I 61 63 Ching Leung SAN FUK RD Nunnery LAM TEI RESERVOIR C«s¤ TUEN MUN ROAD s• ›n« Castle Peak Hospital TUEN FU RD 137 33 Lingnan -

Minutes of the 3Rd Meeting of the Traffic and Transport Committee (2016-2017) of the Tuen Mun District Council

Minutes of the 3rd Meeting of the Traffic and Transport Committee (2016-2017) of the Tuen Mun District Council Date : 13 May 2016 (Monday) Time : 9:30 a.m. Venue : Tuen Mun District Council (TMDC) Conference Room Present Time of Arrival Time of Departure Mr SO Shiu-shing (Chairman) TMDC Member 9:30 a.m. End of meeting Mr YIP Man-pan (Vice-chairman) TMDC Member 9:39 a.m. End of meeting Mr LEE Hung-sham, Lothar, MH TMDC Vice-chairman 9:33 a.m. End of meeting Mr KWU Hon-keung TMDC Member 9:33 a.m. 2:30 p.m. Mr TO Sheck-yuen, MH TMDC Member 9:30 a.m. End of meeting Mr CHU Yiu-wah TMDC Member 9:42 a.m. End of meeting Ms KONG Fung-yi TMDC Member 9:30 a.m. 12:48 p.m. Mr NG Koon-hung TMDC Member 9:31 a.m. End of meeting Ms WONG Lai-sheung, Catherine TMDC Member 9:41 a.m. End of meeting Ms HO Hang-mui TMDC Member 9:34 a.m. End of meeting Mr LAM Chung-hoi TMDC Member 9:33 a.m. 2:04 p.m. Ms CHING Chi-hung TMDC Member 9:30 a.m. 1:20 p.m. Ms LUNG Shui-hing TMDC Member 9:30 a.m. End of meeting Mr CHAN Man-wah, MH TMDC Member 9:33 a.m. End of meeting Mr CHEUNG Hang-fai TMDC Member 9:33 a.m. 1:10 p.m. Mr HO Kwan-yiu TMDC Member 9:43 a.m. -

Rural Protest in Hong Kong a Historical and Sociological Analysis

RURAL PROTEST IN HONG KONG A HISTORICAL AND SOCIOLOGICAL ANALYSIS By Hung Ho Fung B. Soc. Sc. (1995) The Chinese University of Hong Kong Thesis Submitted in partial fulfillment of the requirements for the degree ofM.Phil in Sociology in the Graduate School of the Chinese University ofHong Kong 1 ||^^^^( 1 6 服 199 ^j ^^^S^^s"k^W ^^^p^ /, f Summary This paper is an attempt to explain the puzzling rural stability despite drastic rural development in the colonial period in Hong Kong, bi the first part of the thesis, previous research on the problem is reviewed critically. Then insights are drawn from the current literature on social movements and peasant resistance in order to formulate an alternative framework in explaining the phenomenon. From a comparative case analysis based on the six cases of rural social conflicts, I locate two crucial factors of the emergence or non-emergence of rural protests. The first is the absence or presence of suppression by the rural elite. The second is the absence or presence of autonomous organization in the villages. The non-occurrence of manifested rural protests was a combined effect of the absence of autonomous organizations and presence of elite suppression. Highly confrontational collective action with high participation rate would appear when the elite suspended their suppression of mobilization and relevant autonomous organizations existed. When only one of the two conditions of non-emergence of rural protest was fulfilled, intermediate forms of collective action would arise: either confrontational action with low participation rate or non-confrontational action with high participation rate. -

Minutes of 676Th Meeting of the Rural and New Town Planning Committee Held at 2:30 P.M

TOWN PLANNING BOARD Minutes of 676th Meeting of the Rural and New Town Planning Committee held at 2:30 p.m. on 23.7.2021 Present Director of Planning Chairman Mr Ivan M.K. Chung Mr Stephen L.H. Liu Vice-chairman Mr Peter K.T. Yuen Mr Philip S.L. Kan Mr K.K. Cheung Dr C.H. Hau Dr Lawrence K.C. Li Miss Winnie W.M. Ng Mr L.T. Kwok Mr K.W. Leung Dr Jeanne C.Y. Ng Dr Venus Y.H. Lun Dr Conrad T.C. Wong - 2 - Chief Traffic Engineer/New Territories West, Transport Department Ms Carrie K.Y. Leung Chief Engineer (Works), Home Affairs Department Mr Gavin C.T. Tse Principal Environmental Protection Officer (Strategic Assessment), Environmental Protection Department Mr Stanley C.F. Lau Assistant Director/Regional 3, Lands Department Mr Alan K.L. Lo Deputy Director of Planning/District Secretary Miss Fiona S.Y. Lung Absent with Apologies Mr Ricky W.Y. Yu Mr Y.S. Wong In Attendance Assistant Director of Planning/Board Ms Lily Y.M. Yam Chief Town Planner/Town Planning Board Ms Caroline T.Y. Tang Town Planner/Town Planning Board Mr Gary T.L. Lam - 3 - Opening Remarks 1. The Chairman said that the meeting would be conducted with video conferencing arrangement. Agenda Item 1 Confirmation of the Draft Minutes of the 675th RNTPC Meeting held on 9.7.2021 [Open Meeting] 2. The draft minutes of the 675th RNTPC meeting held on 9.7.2021 were confirmed without amendments. Agenda Item 2 Matter Arising [Open Meeting] 3. -

1. INTRODUCTION Background to the Study 1.1 a Doppler VHF Omni

1. INTRODUCTION Background To The Study 1.1 A Doppler VHF Omni-directional Range and Distance Measuring Equipment (DVOR/DME) Station is being operated on Lung Kwu Chau to provide bearing and distance information to the approaching/departing aircrafts to and from the Chek Lap Kok Airport. The existing jetty at Lung Kwu Chau, which is ruined and abandoned for use, is too small and of too shallow water depth to accommodate the Civil Aviation Department’s (CAD) vessels for transporting equipment and personnel for servicing and maintaining the DVOR/DME. Currently, the transportation has to rely on helicopters, which is however prohibited during night times and adverse weather conditions. In order that emergency repair work can be undertaken during such periods, CAD has proposed to construct a proper jetty for berthing of marine vessels. The construction work will be implemented under the project, namely “Construction of Lung Kwu Chau Jetty” (hereinafter referred to as “ the Project”). 1.2 Maunsell Consultants Asia Ltd have been commissioned by the Civil Engineering Department (CED) of the Hong Kong SAR Government to undertake the EIA Study of the Project. In accordance with the EIA Study Brief, an initial assessment of the environmental impacts arising from the Project was firstly undertaken to identify those environmental issues of key concern during the construction and operation phases of the Project that require further more detailed assessment. The findings of the initial assessment were presented in the Final Initial Assessment Report (IAR) submitted on 16 May 2001. A detailed assessment of all the key issues identified in the IAR has followed after the consultation exercise with the Lung Kwu Tan villagers, relevant government departments and the Marine Parks Committee, and confirmation of the preferred jetty location. -

Administration's Paper on Tuen Mun South Extension

LC Paper No. CB(4)646/19-20(01) Translation Legislative Council Panel on Transport Subcommittee on Matters Relating to Railways Tuen Mun South Extension Introduction This paper briefs Members on the proposed way forward of the Tuen Mun South (“TMS”) Extension project. Background 2. The TMS Extension is one of the seven recommended railway schemes in the Railway Development Strategy 2014 (“RDS-2014”). The proposed project will extend the West Rail Line (“WRL”) from Tuen Mun Station southwards by about 2.4 kilometres, including the provision of a new station near Tuen Mun Ferry Pier and an intermediate station at Tuen Mun Area 16 (“A16”), to improve railway access to the community south of the Tuen Mun town centre. MTRCL’s Project Proposal for TMS Extension 3. In February 2016, the Transport and Housing Bureau (“THB”) invited the MTR Corporation Limited (“MTRCL”) to submit a proposal for TMS Extension under the ownership approach 1 . MTRCL submitted a Project Proposal in December 2016, which was subsequently supplemented with updates in July 2017 and January 2018 respectively. In addition to a new TMS Station to be provided near Tuen Mun Ferry Pier as envisaged in RDS-2014, MTRCL proposed in its latest Project Proposal to provide an additional station at Tuen Mun A16 (see A Annex A) with topside development. 4. Incorporating an A16 Station in the TMS Extension will provide residential development opportunities at A16. Having considered the pros and 1 Under the ownership approach, MTRCL will be responsible for the financing, design, construction, operation and maintenance of the new railway, and ultimately own the railway. -

G.N. 6454 G.N

G.N. 6454 G.N. ELECTORAL AFFAIRS COMMISSION (REGISTRATION OF ELECTORS) (RURAL REPRESENTATIVE ELECTION) REGULATION (Cap. 541K) (Section 30) INSPECTION OF THE 2019 FINAL REGISTER Pursuant to section 30 of the Electoral Affairs Commission (Registration of Electors) (Rural Representative Election) Regulation (Cap. 541K), it is hereby notified that: (a) a copy of the Existing Villages final register or a copy of the specific division of such final register; (b) a copy of the Indigenous Villages and Composite Indigenous Villages final register or a copy of the specific division of such final register; and (c) a copy of the Market Towns final register or a copy of the specific division of such final register, are now available for public inspection during ordinary business hours (Monday to Friday: from 9 a.m. to 1 p.m. and 2 p.m. to 6 p.m.; except Saturdays and general holidays) from 18 October 2019 onwards, at the following places: Full copy of the final register Home Affairs Department/Office of the Electoral Registration Officer 30th Floor, Southorn Centre, 130 Hennessy Road, Wan Chai, Hong Kong Copy of those specific divisions of the final register for a Rural Area that belongs to the following Rural Committees: (i) Cheung Chau Rural Committee (ii) Lamma Island (North) Rural Committee (iii) Lamma Island (South) Rural Committee (iv) Mui Wo Rural Committee (v) Peng Chau Rural Committee (vi) South Lantao Rural Committee (vii) Tai O Rural Committee 1 (viii) Tung Chung Rural Committee Islands District Office/Office of Assistant Electoral Registration -

1. the Meeting Was Resumed at 9:00 A.M. on 6.8.2018. 2. the Following Members and the Secretary Were Present in the Resumed Meet

1. The meeting was resumed at 9:00 a.m. on 6.8.2018. 2. The following Members and the Secretary were present in the resumed meeting: Permanent Secretary for Development Chairperson (Planning and Lands) Ms Bernadette H.H. Linn Professor S.C. Wong Vice-Chairperson Mr Lincoln L.H. Huang Dr F.C. Chan Mr Peter K.T. Yuen Mr K.K. Cheung Mr Wilson Y.W. Fung Dr C.H. Hau Mr Alex T.H. Lai Professor T.S. Liu Ms Lilian S.K. Law Mr K.W. Leung Professor John C.Y. Ng Principal Environmental Protection Officer (Strategic Assessment) Environmental Protection Department Mr Raymond W.M. Wong Assistant Director (Regional 3), Lands Department Mr Edwin W.K. Chan Chief Traffic Engineer (New Territories West), Transport Department Mr Patrick K.H. Ho - 2 - Agenda Item 1 (continued) [Open Meeting (Presentation and Question Sessions only)] Consideration of Representations and Comments in respect of Draft Tuen Mun Outline Zoning Plan No. S/TM/34 (TPB Paper No. 10449) [The item was conducted in Cantonese.] 3. The Vice-chairperson said that the meeting was to continue the hearing of representations and comments in respect of the draft Tuen Mun Outline Zoning Plan No. S/TM/34 (the draft OZP). 4. The Secretary said that Members’ declarations of interests were made at the morning session on 2.8.2018 (paragraph 2 of the Minutes of 2.8.2018). Members’ declaration of interests had been made in the morning session of the hearing held on 2.8.2018 and was recorded in the minutes of the meeting accordingly. -

Legislative Council Panel on Constitutional Affairs Composition

LC Paper No. CB(2)2086/01-02(01) Legislative Council Panel on Constitutional Affairs Composition of the Second Term District Councils Purpose This paper sets out the Administration’s proposals relating to the composition of the second term District Councils (DCs). Background 2. According to Schedule 1 to the District Councils Ordinance (Cap.547), there shall be 18 districts, and the area for each district is delineated in a map deposited in the office of the Director of Home Affairs. Schedule 2 provides that a DC should be established in each of the 18 districts. Schedule 3 sets out the composition of the 18 DCs. Schedules 1, 2 and 3 are at Annex A. 3. Pursuant to section 18 of the Electoral Affairs Commission Ordinance (Cap. 541), for the second term DC elections to be held in late 2003, the Electoral Affairs Commission (EAC) has to make recommendations on constituency boundaries to be submitted to the Chief Executive on or before 27 November 2002. Before finalising the recommendations, the EAC will conduct a one-month public consultation in September 2002 to solicit public views on its draft proposals. 4. In making its recommendations on District Council Constituencies (DCCs), section 20 of the Electoral Affairs Commission Ordinance provides that the EAC should – - 2 - (a) have regard to the community identities and the preservation of local ties as well as physical features such as size, shape, accessibility and development of the relevant area; (b) ensure that the population in each constituency is as near the population quota as practicable (the population quota, by definition, means the total population of Hong Kong divided by the total number of elected members to be returned in a particular election); and (c) where it is not practicable to comply with the requirement at (b), ensure that the extent of each constituency is such that the population in that constituency does not exceed or fall short of the population quota by more than 25%. -

27 April 2020, at 2:30 Pm in Conference Room 3 of the Legislative Council Complex

立法會 Legislative Council LC Paper No. CB(1)764/19-20 (These minutes have been seen by the Administration) Ref : CB1/PL/EA Panel on Environmental Affairs Minutes of meeting held on Monday, 27 April 2020, at 2:30 pm in Conference Room 3 of the Legislative Council Complex Members present : Dr Hon Junius HO Kwan-yiu, JP (Chairman) Hon CHAN Hak-kan, BBS, JP Dr Hon Priscilla LEUNG Mei-fun, SBS, JP Hon Frankie YICK Chi-ming, SBS, JP Hon WU Chi-wai, MH Hon CHAN Chi-chuen Hon Kenneth LEUNG Hon KWOK Wai-keung, JP Hon Dennis KWOK Wing-hang Hon Elizabeth QUAT, BBS, JP Ir Dr Hon LO Wai-kwok, SBS, MH, JP Hon CHU Hoi-dick Hon Tanya CHAN Hon HUI Chi-fung Hon Kenneth LAU Ip-keung, BBS, MH, JP Hon Tony TSE Wai-chuen, BBS Members absent : Hon Steven HO Chun-yin, BBS (Deputy Chairman) Hon SHIU Ka-fai, JP Public Officers : For item IV attending Mr WONG Kam-sing, GBS, JP Secretary for the Environment - 2 - Dr LEUNG Siu-fai, JP Director of Agriculture, Fisheries and Conservation Ms Daisy LO Assistant Director (Nature Conservation) Environmental Protection Department Mr Patrick LAI Assistant Director (Country and Marine Parks) Agriculture, Fisheries and Conservation Department For item V Mrs Vicki KWOK, JP Deputy Director of Environmental Protection (2) Environmental Protection Department Ms Daisy LO Assistant Director (Nature Conservation) Environmental Protection Department Mr Simon CHAN Assistant Director (Conservation) Agriculture, Fisheries and Conservation Department Dr Jackie YIP Senior Conservation Officer (Biodiversity) Agriculture, Fisheries and Conservation