Gazprom Power Generation: Growing in Scope, but Still Nimble

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Specialised Asset Management

specialised research and investment group Russian Power: The Greatest Sector Reform on Earth www.sprin-g.com November 2010 specialised research and investment group Specialised Research and Investment Group (SPRING) Manage Investments in Russian Utilities: - HH Generation - #1 among EM funds (12 Months Return)* #2 among EM funds (Monthly return)** David Herne - Portfolio Manager Previous positions: Member, Board of Directors - Unified Energy Systems, Federal Grid Company, RusHydro, TGK-1, TGK-2, TGK-4, OGK-3, OGK-5, System Operator, Aeroflot, etc. (2000-2008) Chairman, Committee for Strategy and Reform - Unified Energy Systems (2001-2008) Boston Consulting Group, Credit Suisse First Boston, Brunswick. * Top 10 (by 12 Months Return) Emerging Markets (E. Europe/CIS) funds in the world by BarclayHedge as of 30 September 2010 ** Top 10 (by Monthly Return) Emerging Markets (E. Europe/CIS) funds in the world by BarclayHedge as of 31 August 2010 2 specialised research and investment group Russian power sector reform: Privatization Pre-Reform Post-Reform Government Government 52% 1 RusHydro 1 FSK RAO ES RAO UES 58% 79% hydro generation HV distribution 53% Far East Holding control control Independent energos 53% 1 MRSK Holding 14 TGKs 0% (Bashkir, Novosibirsk, ~72 energos 0% generation (CHP) generation Irkutsk, Tat) 35 federal plants transmission thermal 11 MRSK distribution 51% hydro LV distribution 0% ~72 SupplyCos supply 6 OGKs other 0% generation 45% InterRAO 0% ~100 RepairCos Source: UES, Companies Data, SPRING research 3 specialised research -

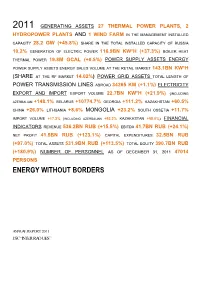

Energy Without Borders

2011 GENERATING ASSETS 27 THERMAL POWER PLANTS, 2 HYDROPOWER PLANTS AND 1 WIND FARM IN THE MANAGEMENT INSTALLED CAPACITY 28.2 GW (+45.8%) SHARE IN THE TOTAL INSTALLED CAPACITY OF RUSSIA 10.2% GENERATION OF ELECTRIC POWER 116.9BN KW*H (+37.3%) BOILER HEAT THERMAL POWER 19.8M GCAL (+0.5%) POWER SUPPLY ASSETS ENERGY POWER SUPPLY ASSETS ENERGY SALES VOLUME AT THE RETAIL MARKET 143.1BN KW*H (SHARE AT THE RF MARKET 14.02%) POWER GRID ASSETS TOTAL LENGTH OF POWER TRANSMISSION LINES ABROAD 34265 KM (+1.1%) ELECTRICITY EXPORT AND IMPORT EXPORT VOLUME 22.7BN KW*H (+21.9%) (INCLUDING AZERBAIJAN +148.1% BELARUS +10774.7% GEORGIA +111.2% KAZAKHSTAN +60.5% CHINA +26.0% LITHUANIA +8.6% MONGOLIA +23.2% SOUTH OSSETIA +11.7% IMPORT VOLUME +17.2% (INCLUDING AZERBAIJAN +93.2% KAZAKHSTAN +58.0%) FINANCIAL INDICATORS REVENUE 536.2BN RUB (+15.5%) EBITDA 41.7BN RUB (+24.1%) NET PROFIT 41.5BN RUB (+123.1%) CAPITAL EXPENDITURES 32.5BN RUB (+97.0%) TOTAL ASSETS 531.9BN RUB (+113.5%) TOTAL EQUITY 390.7BN RUB (+180.9%) NUMBER OF PERSONNEL AS OF DECEMBER 31, 2011 47014 PERSONS ENERGY WITHOUT BORDERS ANNUAL REPORT 2011 JSC “INTER RAO UES” Contents ENERGY WITHOUT BORDERS.........................................................................................................................................................1 ADDRESS BY THE CHAIRMAN OF THE BOARD OF DIRECTORS AND THE CHAIRMAN OF THE MANAGEMENT BOARD OF JSC “INTER RAO UES”..............................................................................................................8 1. General Information about the Company and its Place in the Industry...........................................................10 1.1. Brief History of the Company......................................................................................................................... 10 1.2. Business Model of the Group..........................................................................................................................12 1.4. -

Jsc Ogk-2 Annual Report 2017

JSC OGK-2 ANNUAL REPORT 2017 JSC OGK-2 ANNUAL REPORT 2017 This 2017 annual report (hereinafter referred to as the “Annual Report”) has been prepared using the information available to Joint-Stock Company “Second Wholesale Power Market Generating Company” (hereinafter, OGK-2, or the Company) at the time of its preparation. Some statements included in this Annual Report of the Company are forecasts for future events. Words such as “plans”, “will be”, “expected”, “will take place”, “estimates”, “will total”, “will occur”, and the like are forecasting by nature. Investors should not fully rely on the estimates and forecasts as they imply a risk of contradiction to reality. For this reason, the Company warns that the actual results or course of any events may significantly differ from forecast statements included in this annual report. Except as otherwise established by the applicable laws, the Company does not undertake to revise or confirm any expectations and estimates or publish updates and changes of forecast statements of the annual report as a result of any subsequent events or if new information becomes available. The information about the Company’s management staff is provided under the Federal Law No. 152-FZ “On Personal Data” dated July 27, 2006. 2 JSC OGK-2 ANNUAL REPORT 2017 Table of Contents 1. INFORMATION ABOUT THE COMPANY ............................................................................. 5 ADDRESS BY CHAIRMAN OF THE BOARD OF DIRECTORS OF JSC OGK-2, DIRECTOR GENERAL OF GAZPROM ENERGOHOLDING LLC D.V. FEDOROV ..... 10 ADDRESS BY DIRECTOR GENERAL OF JSC OGK-2 S.A. ANANYEV ........................ 11 1.1. Business Model ....................................................................................................................................... 12 1.2. -

INTER RAO Share Placement Price – 0.0535 RUB

Additional share issue Fundamentals Basic results of Private placement : INTER RAO share placement price – 0.0535 RUB Number of shares issued – 13,800,000,000,000 common shares Total number of shares placed with the participants of private placement – 6,822,972,629,771 shares. A total of 49.4% of newly issued shares were placed Number of shares placed with Inter RAO Capital – 2,917,890,939,501 (including shares for deal with Norilsk Nickel, stock option program and future deals) Final volume of Inter RAO’s authorized capital after private placement - 9,716,000,000,000 ordinary shares (increase by a factor of 3.36) Value of the share capital of the Company - 272.997 billion RUB* Total value of assets acquired by Inter RAO within the private placement: • Shares of utility companies - 283.2 bn RUB** • Cash – 81.8 bn RUB Share of government and state-owned companies in the authorized capital of Inter RAO amounts to 60%; Registration of additional share placement report by Federal Service for Financial Markets is planned for June 2011 Newly issued shares should start trading in June 2011 and merge into main symbol in October 2011 (MICEX) * Par value of 1 share - 0.02809767 RUB ** Value of assets based on independent appraisers. It does not include assets that might be received by INTER RAO’ s subsidiaries (closed subscription participants) after May, 17 2 Ownership structure Equity structure before Equity structure to May 17, 2011 Target equity structure after deals placement Minority finalization shareholders Federal Property Federal Property -

INTER RAO UES Generating Assets: Target Shareholding Structure

INTER RAO UES Generating Assets: Target Shareholding Structure March,16 2012 1. Strategy recap and update INTER RAO at a Glance A Leading Russian Power Company Diversified Group Structure . Diversified power holding involved in electricity/heat generation and supply, export/import of electricity and engineering . Operates and manages 27 thermal, 2 hydro power plants and 1 wind power farm Domestic Engineering . Total installed electricity capacity of 29GW and electricity output of Generation Trading Supply International 117 TWh⁽¹⁾ in 2011 . INTER RAO – . RAO Nordic Oy . 9 supply companies . Generation: . Quartz Group . 2 Hydro PP - 0.2 GW Electrogeneration (Finland) . Customer base: . 4 Thermal PP - 5.2 GW . JV with Worley Leading Russian export-import operator accounting for 97% of Russian (100%) . Kazenergoresurs . 1 wind power farm - Parsons electricity export in 2011 . 314 thousand 0.03 GW . OGK-1 (75%) (Kazakhstan) legal entities and . Distribution . JV with Rosatom . OGK-3 (82%) . TGR Enerji (Turkey) . c. 34 ths. km of power . Operations in over 14 countries, including Russia, Belarus, Lithuania, 9.8 million . JV with GE lines (Georgia, residential . TGK-11 (68%) . INTER RAO Lietuva Armenia) Georgia, Armenia, Kazakhstan, Tajikistan, Moldova, and Finland . EMAlliance (the Baltics) customers Engineering (2) . Listed on RTS and MICEX (List A1), MCAP of $10.2bn. Shares are (2) included into MSCI Large Caps Index (0,54%) . GDRs admitted to LSE trading Ownership Structure Broad Geographical Coverage INTER RAO UES Finland Generation Assets -

Proxy Materials for the Annual General Meeting of Shareholders

Proxy materials for the Annual General Meeting of Shareholders Table of contents NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS ................................................................... 5 VOTING INFORMATION................................................................................................................................................. 7 1. Approval of the Annual Report of the Company .................................................................................... 9 2. Approval of the Company's annual financial statements, including profit and loss statements (profit and loss accounts) ................................................................................................................... 10 3. Distribution of profits (including payment (declaration) of dividends) and losses of the Company based on the results of the year 2012 ............................................................................................... 14 4. Payment of remuneration to the members of the Board of Directors - non-governmental officers for serving as members of the Board of Directors, in the amount established by the Company's internal documents ............................................................................................................................... 15 5. Payment of additional remuneration to the members of the Revision Commission of the Company .......................................................................................................................................................................... -

Federal Grid Company of Unified Energy System

FEDERAL GRID COMPANY OF UNIFIED ENERGY SYSTEM ANNUAL REPORT WorldReginfo - b29cb2af-cbc8-402d-b3a6-fffe86634d00 ANNUAL REPORT 2008 WorldReginfo - b29cb2af-cbc8-402d-b3a6-fffe86634d00 Address to Shareholders Operating Corporate Operating Development of the Human Resources Environmental policy. Attachments of Chairmen of Board Results (13) Governance (23) Activity (51) Corporate Information management and Corporate Social (127) of Directors and Management System Social policy. Responsibility (117) Management Board (5) (CIMS) and Telecom- Social Partnership (103) munication Network (91) History of Establishing Scientific and Technical Contact information Most Important and Core Types Economics and work and Innovative for Shareholders Events in 2008 (9) of Activity (17) Securities (43) Finance (71) Investments (81) Procurement (99) Technologies (111) and Investors (123) WorldReginfo - b29cb2af-cbc8-402d-b3a6-fffe86634d00 CHAPTER 1. ADDRESS TO SHAREHOLDERS OF CHAIRMEN OF BOARD OF DIRECTORS AND MANAGEMENT BOARD 4 5 WorldReginfo - b29cb2af-cbc8-402d-b3a6-fffe86634d00 FGC UES Annual Report 2008 Chapter 1 Address to Shareholders of Chairmen of Board of Directors and Management Board Address to shareholders of Chairmen of Board of Directors and Management Board During 2008 the Company continued realization of its large-scale investment program. JSC FGC UES invested RUR 136.221 billion into modernization of assets within the Unified national energy grid (UNEG) enabling to put into service 1,047 km of electric energy transmis- sion facilities; 10,314 MVA of transformer capacity; 1,285 MVA of reactor capacity, back up commissioning of future periods. Key UNEG facilities were commissioned during 2008. In particular, modernization of substations 500 kV Beskudnikovo and 500 kV Otchakovo was completed and substation 500 kV Zapadnaya was built within the Moscow energy system that increased reliability, transmission capacity of the backbone grid and provided for con- necting new customers in Moscow and Moscow region. -

Open Power for a Brighter Future

9 1 0 nanziaria annuale 2 fi elazione R OPEN POWER FOR A BRIGHTER FUTURE WE EMPOWER SUSTAINABLE PROGRESS enelrussia.ru ANNUAL REPORT 2019 ANNUAL REPORT 2019 To improve the operational efficiency of the power plants PJSC Enel Russia is introducing modern digital technologies. One of the projects of this kind is predictive analytics which detects negative dynamics in the operation of equipment at the early stages and, therefore, reduces CCGT operational risks. All power plants are equipped with e-Planner tool which enables additional control of the preparation process to maintenance campaign and provides a visual representation of key milestones. EtaPRO System was successfully introduced as part of the Heat Rate Management digital project. Every unit of gas power plant main equipment now can be monitored using an individual model which allows to keep a record of reasons of heat rate deviations in the real-time mode, to analyze reasons of losses and to develop a more detailed maintenance program as well as to control the quality of the works performed after the maintenance is completed. Health, Safety, Environment and Quality remains one of the main priorities of the company. We successfully implemented the SHE 365 project (Safety, Health, Environment 365 days) aimed to ensure everyday industrial safety and to incentivize employees to develop initiatives in operation, maintenance and interaction with contractors. A number of health and environment improvement plans have been implemented as part of the project. As far as the environment is concerned, the company focused mainly on decarbonization, reporting Address to shareholders 102-14 digitalization, water consumption optimization. -

Annual Report 2019

Annual Report 2019 The ROSSETI Group is the backbone power grid company of the country www.rosseti.ru/eng/ Report Approval Information The Annual Report received prior approval from the Annual General The reliability of information contained in this Report was confirmed Meeting of Shareholders of ROSSETI on June 1, 2020 (Minutes of the by the Internal Audit Commission of the Company (Minutes of the Meeting № n/n of June 1, 2020). Meeting No. 5 of April 16, 2020). The Annual Report received prior approval from the Board of Directors of ROSSETI on April 30, 2020 (Minutes of the Meeting No. 410 of April 30, 2020). Brief Information on the Report This Annual Report includes a review of the operating results and Until 2024"1 and under the Development Strategy 2030 approved by highlights of Public Joint Stock Company ROSSETI and its subsidiaries the Board of Directors of ROSSETI in late 2019, the Annual Report dis- (collectively, the ROSSETI Group) for 2019. closes the Company’s goals and priorities, operational performance Subject to the President’s Decree "On the National Goals and Strategic in the reporting year in comparison with prior periods, corporate Objectives of Development of the Russian Federation for the Period governance and risk management, and sustainable management ap- proaches consistent with implementing digital transformation. This Annual Report was prepared in accordance with: → Federal Law No. 208-FZ of December 26, 1995, "On Joint-Stock Managing Joint-Stock Companies Whose Shares Are Federally Companies"; Owned and Federal State Unitary Enterprises"; → Regulations for the Disclosure of Information by Issuers of Is- → Corporate Governance Code recommended by the Bank of Rus- sue-Grade Securities (approved by the Bank of Russia on Decem- sia’s letter No. -

Russian Electricity Reform

INTERNATIONAL ENERGY AGENCY RUSSIAN ELECTRICITY REFORM Emerging challenges and opportunities INTERNATIONAL ENERGY AGENCY RUSSIAN ELECTRICITY REFORM Emerging challenges and opportunities page2-20x27b 14/03/05 9:40 Page 1 INTERNATIONAL ENERGY AGENCY The International Energy Agency (IEA) is an autonomous body which was established in November 1974 within the framework of the Organisation for Economic Co-operation and Development (OECD) to implement an international energy programme. It carries out a comprehensive programme of energy co-operation among twenty-six of the OECD’s thirty member countries. The basic aims of the IEA are: • to maintain and improve systems for coping with oil supply disruptions; • to promote rational energy policies in a global context through co-operative relations with non-member countries, industry and international organisations; • to operate a permanent information system on the international oil market; • to improve the world’s energy supply and demand structure by developing alternative energy sources and increasing the efficiency of energy use; • to assist in the integration of environmental and energy policies. The IEA member countries are: Australia, Austria, Belgium, Canada, the Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Japan, the Republic of Korea, Luxembourg, the Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, Turkey, the United Kingdom, the United States. The European Commission takes part in the work of the IEA. ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT The OECD is a unique forum where the governments of thirty democracies work together to address the economic, social and environmental challenges of globalisation. The OECD is also at the forefront of efforts to understand and to help governments respond to new developments and concerns, such as corporate governance, the information economy and the challenges of an ageing population. -

A Path to Smart Cost Cutting, Capacity Growth, and Profit Gains Reviving the Russian Power Industry

Reviving the Russian power industry A path to smart cost cutting, capacity growth, and profit gains Contacts Helsinki Houston Moscow Hannu Suonio Jason Palmenberg Alexey Khokhlov Partner, PwC Finland Principal, PwC US Partner, PwC Russia +358-20-787-7000 +1-713-356-8083 +7-495-604-4100 hannu.suonio jason.palmenberg alexey.khokhlov @fi.pwc.com @strategyand.pwc.com @strategyand.ru.pwc.com Ekaterina Kozinchenko Partner, PwC Russia +7-495-604-4100 ekaterina.kozinchenko @strategyand.ru.pwc.com Maria Kulagina Director, PwC Russia +7-495-604-4100 maria.e.kulagina @strategyand.ru.pwc.com 2 Strategy& About the authors Ekaterina Kozinchenko is a leading practitioner in the energy and utilities practice of Strategy&, PwC’s strategy consulting business. Based in Moscow, she is a partner with PwC Russia. She has more than 20 years of consulting experience, and specializes in developing and implementing corporate strategy, optimizing business processes, and managing strategic transformations. Alexey Khokhlov is an advisor to executives in the energy and utilities practice of Strategy&. He is a partner with PwC Russia, based in Moscow. He has more than 10 years of consulting experience and has led numerous transformation programs for major utility companies. He specializes in strategy, organization and operational excellence, transformation, and change management. Maria Kulagina is a specialist in the energy and utilities practice of Strategy&. Based in Moscow, she is a director with PwC Russia. She has more than 12 years of consulting experience and specializes in corporate strategy, operational efficiency, and post-merger integration. Hannu Suonio is an advisor to executives in the energy and utilities and chemicals practices of Strategy&. -

Corporate Social Responsibility and Sustainability Report 2017

CORPORATE SOCIAL RESPONSIBILITY AND SUSTAINABILITY REPORT 2017 CORPORATE SOCIAL RESPONSIBILITY AND SUSTAINABILITY REPORT Table of Contents Message from the Director General 6 OUR REPORT ROSSETI IN 2017: RESULTS AND Development of the AchIEVEMENTS Reporting System 10 Identified Material Topics 10 Operating Data Collection and Financial Methodology 12 Performance 42 Dividend Payment 43 Principal Provisions 4 of the Dividend Policy 1 of ROSSETI 43 Profit Distribution 44 Procurement 44 COMPANY PROFILE International Projects, Nationwide and Regional Events 48 Company History 16 International Projects 48 Business Model 18 Regions of Operations 20 Main Activities 23 Customer Relations 23 High-Quality and Accessible Power Infrastructure 25 2 Innovation 26 Governance 27 HUMAN RESOURCE Charters and Membership DEVELOPMENT in Associations 31 Basic Principles of and Approaches to Human Resource Management 52 Personnel Characteristics 52 Youth Policy 53 Occupational Guidance and Cooperation 5 with Schools 56 Cooperation with Educational Institutions 56 Development of Young Employees’ Competencies 57 OUR SUSTAINABILITY Remuneration StRATEGY and Social Support 57 Cooperation with the All-Russian Sustainability Priorities 34 Electrounion 58 Stakeholder Engagement 35 Personnel Training Risk Management 37 and Human Resource Corporate Ethics Development 59 and Anti-Corruption 39 Occupational Safety 59 Corporate Culture 61 Corporate Social Responsibility and Sustainability Report 2017 Social Responsibility and Sustainability Corporate Awards I T and Achievements