Unprecedented Financial Performance Annual Report, 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Social and Economic Space Compression in Border Areas: the Case of the Northwestern Federal District Romanova, E.; Vinogradova, O.; Frizina, I

www.ssoar.info Social and economic space compression in border areas: the case of the Northwestern Federal District Romanova, E.; Vinogradova, O.; Frizina, I. Veröffentlichungsversion / Published Version Zeitschriftenartikel / journal article Empfohlene Zitierung / Suggested Citation: Romanova, E., Vinogradova, O., & Frizina, I. (2015). Social and economic space compression in border areas: the case of the Northwestern Federal District. Baltic Region, 3, 28-46. https://doi.org/10.5922/2079-8555-2015-3-3 Nutzungsbedingungen: Terms of use: Dieser Text wird unter einer Free Digital Peer Publishing Licence This document is made available under a Free Digital Peer zur Verfügung gestellt. Nähere Auskünfte zu den DiPP-Lizenzen Publishing Licence. For more Information see: finden Sie hier: http://www.dipp.nrw.de/lizenzen/dppl/service/dppl/ http://www.dipp.nrw.de/lizenzen/dppl/service/dppl/ Diese Version ist zitierbar unter / This version is citable under: https://nbn-resolving.org/urn:nbn:de:0168-ssoar-51391-6 Economic and geographical development of the Russian Northwest ECONOMIC AND GEOGRAPHICAL DEVELOPMENT OF THE RUSSIAN NORTHWEST The so-called “compression” of social SOCIAL AND ECONOMIC and economic space has been the subject of SPACE COMPRESSION quite a few studies in the past decades. There are two principle types of compres- IN BORDER AREAS: sion: communicative, that is, associated THE CASE with the development of transport and in- OF THE NORTHWESTERN formation systems, and physical, mani- FEDERAL DISTRICT fested in the rapid decrease of the number of new territories to explore. While physi- cal and communicative compression are in- terrelated, they have different spatial ex- * pressions depending on geographical con- E. -

Specialised Asset Management

specialised research and investment group Russian Power: The Greatest Sector Reform on Earth www.sprin-g.com November 2010 specialised research and investment group Specialised Research and Investment Group (SPRING) Manage Investments in Russian Utilities: - HH Generation - #1 among EM funds (12 Months Return)* #2 among EM funds (Monthly return)** David Herne - Portfolio Manager Previous positions: Member, Board of Directors - Unified Energy Systems, Federal Grid Company, RusHydro, TGK-1, TGK-2, TGK-4, OGK-3, OGK-5, System Operator, Aeroflot, etc. (2000-2008) Chairman, Committee for Strategy and Reform - Unified Energy Systems (2001-2008) Boston Consulting Group, Credit Suisse First Boston, Brunswick. * Top 10 (by 12 Months Return) Emerging Markets (E. Europe/CIS) funds in the world by BarclayHedge as of 30 September 2010 ** Top 10 (by Monthly Return) Emerging Markets (E. Europe/CIS) funds in the world by BarclayHedge as of 31 August 2010 2 specialised research and investment group Russian power sector reform: Privatization Pre-Reform Post-Reform Government Government 52% 1 RusHydro 1 FSK RAO ES RAO UES 58% 79% hydro generation HV distribution 53% Far East Holding control control Independent energos 53% 1 MRSK Holding 14 TGKs 0% (Bashkir, Novosibirsk, ~72 energos 0% generation (CHP) generation Irkutsk, Tat) 35 federal plants transmission thermal 11 MRSK distribution 51% hydro LV distribution 0% ~72 SupplyCos supply 6 OGKs other 0% generation 45% InterRAO 0% ~100 RepairCos Source: UES, Companies Data, SPRING research 3 specialised research -

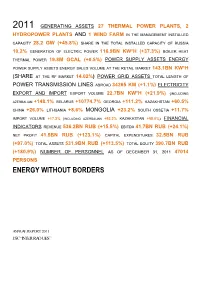

Energy Without Borders

2011 GENERATING ASSETS 27 THERMAL POWER PLANTS, 2 HYDROPOWER PLANTS AND 1 WIND FARM IN THE MANAGEMENT INSTALLED CAPACITY 28.2 GW (+45.8%) SHARE IN THE TOTAL INSTALLED CAPACITY OF RUSSIA 10.2% GENERATION OF ELECTRIC POWER 116.9BN KW*H (+37.3%) BOILER HEAT THERMAL POWER 19.8M GCAL (+0.5%) POWER SUPPLY ASSETS ENERGY POWER SUPPLY ASSETS ENERGY SALES VOLUME AT THE RETAIL MARKET 143.1BN KW*H (SHARE AT THE RF MARKET 14.02%) POWER GRID ASSETS TOTAL LENGTH OF POWER TRANSMISSION LINES ABROAD 34265 KM (+1.1%) ELECTRICITY EXPORT AND IMPORT EXPORT VOLUME 22.7BN KW*H (+21.9%) (INCLUDING AZERBAIJAN +148.1% BELARUS +10774.7% GEORGIA +111.2% KAZAKHSTAN +60.5% CHINA +26.0% LITHUANIA +8.6% MONGOLIA +23.2% SOUTH OSSETIA +11.7% IMPORT VOLUME +17.2% (INCLUDING AZERBAIJAN +93.2% KAZAKHSTAN +58.0%) FINANCIAL INDICATORS REVENUE 536.2BN RUB (+15.5%) EBITDA 41.7BN RUB (+24.1%) NET PROFIT 41.5BN RUB (+123.1%) CAPITAL EXPENDITURES 32.5BN RUB (+97.0%) TOTAL ASSETS 531.9BN RUB (+113.5%) TOTAL EQUITY 390.7BN RUB (+180.9%) NUMBER OF PERSONNEL AS OF DECEMBER 31, 2011 47014 PERSONS ENERGY WITHOUT BORDERS ANNUAL REPORT 2011 JSC “INTER RAO UES” Contents ENERGY WITHOUT BORDERS.........................................................................................................................................................1 ADDRESS BY THE CHAIRMAN OF THE BOARD OF DIRECTORS AND THE CHAIRMAN OF THE MANAGEMENT BOARD OF JSC “INTER RAO UES”..............................................................................................................8 1. General Information about the Company and its Place in the Industry...........................................................10 1.1. Brief History of the Company......................................................................................................................... 10 1.2. Business Model of the Group..........................................................................................................................12 1.4. -

Supply Chain Business Model GRI 106–2, GRI 102–7, GRI 102–9

Annual Report of PJSC Inter RAO for 2020 Strategic report Sustainable Development Report Corporate Governance Report Appendix 024/025 Supply chain business model GRI 106–2, GRI 102–7, GRI 102–9 Supplier Inter RAO Group Consumers st ELECTRIC POWER Installed capacity of 1st pricing zone of WECM nd 1 pricing zone of WECM Europe and European non-pricing zones GAS SUPPLY Installed capacity of 2 GRID COMPANIES OF RUSSIA 25 GENERATION IN RF and European non-pricing zone 19,933 MW, 5,072 Gcal/h pricing zone of WECM ROSNEFT GROUP 1,855 MW, 554 Gcal/h Gas-fired generation of electricity and heat Coal-fired generation of electricity and heat GAZPROM GROUP bln m3 63,557 mln kWh, 3,569,000 Gcal 3,010 mln kWh, 411,000 Gcal 21,788 Gas-fired Coal-fired power Coal-fired JSC BPGC MW power plants plants power plants 18,541 MW, 1,392 MW, 1,855 MW, COAL SUPPLY 1 5,626 4,580 Gcal/h 492 Gcal/h 554 Gcal/h 10.5 Gcal/h 2nd pricing zone of WECM Siberia JSC RAZREZ KHARANORSKY MUNICIPAL HEATING NETWORKS LLC LOGOTRANSENERGO mln t LLC RUSEXPORTUGOL st nd Gas-fired generation of electricity and heat Coal-fired generation of electricity and heat LLC ARMZ SERVICE JSC RZD THERMAL POWER Installed capacity of 1 pricing zone of WECM Installed capacity of 2 GENERATION IN RF 4,260 MW, 12,216 Gcal/h pricing zone of WECM 2,959 mln kWh, 9,830,000 Gcal 11,874 mln kWh, 5,634,000 Gcal 2,051 MW, 7,192 Gcal/h FUEL OIL SUPPLY 75,000 PJSC ROSNEFT OC t LLC REGIONTOPRESURS 1st pricing zone of WECM Europe PJSC GAZPROM NEFT ELECTRICITY AND HEAT CONSUMERS IN RUSSIA Gas-fired generation of -

Uniper and Fortum

FORTUM – For a cleaner world Investor / Analyst material April 2018 Disclaimer This presentation does not constitute an invitation to underwrite, subscribe for, or otherwise acquire or dispose of any Fortum shares. Past performance is no guide to future performance, and persons needing advice should consult an independent financial adviser. Any references to the future represent the management’s current best understanding. However the final outcome may differ from them. 2 Content Fortum today 4 – 18 European and Nordic power markets 19 – 26 Fortum’s nuclear fleet 27 – 30 Russia 31 – 33 Thermal capacity in Russia 33 Historical achieved prices 34 Interim Report Q1 2018 35 – 55 Uniper investment 56 – 59 IR contacts 60 3 Appr. 130,000 shareholders • Power and heat company in the Nordic Finnish households countries, Russia, Poland and the Baltics 10.3% Financial and • Listed at the Helsinki Stock Exchange insurance institutions 1.4% since 1998 Other Finnish • Among the most traded shares on investors the Nasdaq Helsinki stock exchange 7.5% Finnish • Market cap ~16 billion euros State 50.8% Foreign investors 30.0% 28 February 2018 4 Capital returns: 2017 EUR 1.10 per share ~ EUR 1 billion Fortum’s dividend policy is based on 5 year dividend per share (EUR) history the following preconditions: • The dividend policy ensures that shareholders receive a fair remuneration for their entrusted capital, supported 1,4 1.3 by the company’s long-term strategy that aims at increasing earnings per share and thereby the dividend. 1,2 1.1 0.2 1.1 1.1 1.1 • When proposing the dividend, the Board of Directors 1,0 1.1 looks at a range of factors, including the macro 0,8 environment, balance sheet strength as well as future investment plans. -

QUARTERLY REPORT Public Joint-Stock Company

QUARTERLY REPORT Public Joint-Stock Company Federal Hydrogeneration Company RusHydro Code of the Issuer: 55038-E for Q4 2015 Address of the Issuer: 43 Dubrovinskogo St., bldg. 1, Krasnoyarsk, Krasnoyarsk Krai, 660017. The information contained herein is subject to disclosure pursuant to the securities legislation of the Russian Federation Chairman of the Management Board ― General Director ___________________ N.G. Shulginov Date: 15.04.2016 signature _________________ D.V. Finkel Chief Accountant signature Date: 15.04.2016 Contact person: Roman Yurievich Sorokin, Head of Methodology of Corporate Governance and Property Management Department Tel.: +7 800 333 8000 Fax: +7(495) 225-3737 E-mail: [email protected] The address of the Internet site (sites) where the information contained herein is to be disclosed: www.rushydro.ru, http://www.e-disclosure.ru/portal/company.aspx?id=8580 1 Table of Contents Table of Contents .................................................................................................................................................... 2 I. Information on Bank Accounts, Auditor (Audit Organization), Appraiser, and Financial Advisor of the Issuer, as well as on Persons who Have Signed the Quarterly Report ................................................................................ 6 1.1. Information on the Issuer's Bank Accounts .................................................................................................. 6 1.2. Information on the Issuer's Auditor (Audit Organization) .......................................................................... -

Download PDF Competitive Cost-Advantage And

INVESTMENT CASE COMPETITIVE COST-ADVANTAGE AND KNOWHOW MANAGEMENT SUEK is a leader in the resilient energy, logistics and premium coal markets. REINFORCING OUR LEADERSHIP POSITION No. 6 No. 3 No. 2 No. 4 No. 4 electricity heat producer bulk port gondola railcar coal exporter producer in Russia operator operator globally in Russia in Russia in Russia (TWh) (MGcal) (Mt) Gondola railcars (Mt) managed (ths units) Rosenergoatom Gazprom Energoholding Kuzbassrazrezugol Federal Freight Company Glencore 216 108.3 54 112 78.4 Rushydro T plus SUEK First Freight Company BHP Billiton 131 91.8 50 72 60.4 Gazprom Energoholding SUEK NMTP Modum Trans Bumi Resources 127 43.7 23 68 55.2 Inter RAO Inter RAO UCL Port SUEK SUEK 106 37.3 18 48 53.8 En+ Group RusHydro Mechel Globaltrans Anglo American 82 29.4 14 47 49.8 SUEK En+ Group NefteTransService Adaro 64 26.9 37 40.8 T Plus Kvadra Novotrans Yancoal 55 21.2 25 37.9 UniPro Tatenergo Ugol-Trans Sinar Mas 42 10.5 23 36.8 Source: Companies' public data. MAINTAINING A LOW-COST POSITION THROUGH INTEGRATION Our coal producing assets are positioned at the lower end of the global cost curve due ( $/t, FOB) to economies of scale, highly efficient production and RUB denominated cost base. 100 Quartile 1 Quartile 2 Quartile 3 Quartile 4 FOB NEWC = 75 60.5 $/t (2020 average) 50 API2 = 50.3 $/t (2020 average) 25 SUEK 0 Other eporters 0 100 200 300 400 500 600 700 800 900 (Mt) Sources: Wood Mackenzie, SUEK estimates. -

Tel Sprav2013.Pdf

ГОСУДАРСТВЕННОЕ УПРАВЛЕНИЕ ОБРАЗОВАНИЯ ПСКОВСКОЙ ОБЛАСТИ ИНФОРМАЦИЯ ТЕЛЕФОНЫ АДРЕСА 2014 ББК 92 (4Пс) У92 Составитель Э.Ф. Винтанюк, консультант отдела управления делами, кадров Государственного управления образования Псковской области Информацию для справочника представили специалисты рай(гор)управлений образования области, учреждений обра- зования областного и федерального подчинения. Названия учреждений даны в соответствии с информацией на 20.12.2014 г. Учреждения образования: информация, телефоны, адреса: У92 справочник / сост. Э.Ф. Винтанюк. – 10-е изд., доп. и перераб. – Псков: ПОИПКРО, 2014. – 168 с. Справочник содержит информационный материал по сфере образования области (адреса, телефоны). ББК 92 (4Пс) © Издательство Псковского областного института повышения квалификации работников образования, 2014 ÑÎÄÅÐÆÀÍÈÅ Аппарат Государственного управления образования Псковской области .................................................... 7 Городские и районные управления, отделы образования Псковской области .......................................................................... 11 Псковская областная организация профсоюза работников народного образования и науки РФ .............................................. 24 Вузы ФГОУ ВПО «Великолукская государственная академия физической культуры и спорта» ................................................... 25 ФГОУ ВПО «Великолукская государственная сельскохозяйственная академия» ................................................ 25 ФГОУ ВПО «Псковский государственный университет» ............. -

2017 Annual Report of PJSC Inter RAO / Report on Sustainable Development and Environmental Responsibility

INFORMATION TRANSLATION Draft 2017 Annual Report of PJSC Inter RAO / Report on Sustainable Development and Environmental Responsibility Chairman of the Management Board Boris Kovalchuk Chief Accountant Alla Vainilavichute Contents 1. Strategic Report ...................................................................................................................................................................................... 8 1.1. At a Glance .................................................................................................................................................................................. 8 1.2. About the Report ........................................................................................................................................................................ 11 Differences from the Development Process of the 2016 Report ............................................................................................................ 11 Scope of Information ............................................................................................................................................................................. 11 Responsibility for the Report Preparation .............................................................................................................................................. 11 Statement on Liability Limitations ......................................................................................................................................................... -

Zarasai, Litnuania [email protected] DATE LOCATION ACTIVITY CHAIN of COMMAND 163

162 290. INFANTtRIE-DIVISION - UNIT HISTORY LOCATION ACTIVITY CHAIN OF COMMAND 1940/02/01 Tr.Ueb.Pl. monster, Wenrkreis X, Activation (8. Welle), Subordinate to: Stellv.Gen.Kdo. X, 1940/02/01-1940/05/16 Soltau, Fallingbostel, iibstorf, formation, training C.O.: Gen.Lt. Max uennerlein, 1940/02/06-1940/06/09 Schneveraingen, Bergen, WenrKr. XI (source: situation maps of Lage West ana general officer personnel files) 1940/05/10 Operational readiness 1940/05/14 Schnee citei Transfer Subordinate to: AK 38, 1940/05/17-1940/05/20 1940/05/19 Reuland, Weisstoampach, Saint- Movement AK 42, 1940/05/21-1940/05/23 Hubert, Libin, Gedinne, Belgium 1940/05/24 Kevin, Any, Origny-en-Thieracne, Movement, AK 38, 1940/05/24 Vervins, Sains- Ricnauinont, offensive engagements AK 42, 1940/05/25-1940/06/02 Saint-^uentin, Venaeuil, Laon, AK 18, 1940/06/03-1940/07/08 Oise-Aisne Canal, Soissons, wezy, Chateau-Tiiierry, Nangis, Montargis, CoO.: Gen.Lt. Theodor Frhr. von Wrede, 1940/06/08-1942/07/01 Bieneau, Gien, France 1940/00/21 Bieneau, Gien Offensive engagements 1940/07/01 Cnateauoriant, La Baule, Blois, Coastal defense, 1940/10/10 Neung, Vivy, floyetut, Anders, security, Saint-i>iazaire, Nantes occupation duty, training (no records for I940/0o/21-l941/01/31, source: situation maps of Lage West) 1941/02/01 La iiaule, Cnateaubriant, Nantes Coastal defense, security Subordinate to: AK 25, 1941/02/01-1941/02/28 1941/02/25 Gruuziadz, Poland Transfer, training AK 1, 1941/03/01-1941/03/15 AK 2, 1941/03/16-1941/03/31 1941/04/08 Elbing, Wormditt (Orneta), Movement, AK -

75E6231a30789a77100300d26

ИНВЕСТИЦИОННЫЙ МЕМОРАНДУМ ПСКОВСКОЙ ОБЛАСТИ INVESTMENT MEMORANDUM PSKOV REGION 3 СОДЕРЖАНИЕ CONTENT 1. КРАТКАЯ ИНФОРМАЦИЯ О ПСКОВСКОЙ ОБЛАСТИ .........4 1. SHORT DESCRIPTION OF PSKOV REGION ........................ 5 2. КОНКУРЕНТНЫЕ ПРЕИМУЩЕСТВА 2. COMPITITIVE PREFERENCES ПСКОВСКОЙ ОБЛАСТИ ......................................................8 OF PSKOV REGION ............................................................. 9 2.1. Выгодное экономико-географическое положение, 2.1. Advantage economic geographical location, высокий уровень транспортной доступности ..................... 8 Effi ciency transport accessibility .......................................... 9 2.2. Высококвалифицированные трудовые ресурсы ........ 12 2.2. Highly-skilled labor resources. .....................................13 2.3 Наличие площадок для размещения промышленных 2.3 Existence of sites for industrial production производств и логистических центров ........................... 14 and logistics centers .........................................................15 2.4. Потенциал использования природных 2.4. Potential of nature resources ресурсов и полезных ископаемых ................................... 16 and minerals use ...............................................................17 2.4.1. Лесные ресурсы .................................................... 16 2.4.1. Forest resources ......................................................17 2.4.2. Водные ресурсы ................................................... 18 2.4.2. Water resources ......................................................19 -

1 Press Conference Gazprom's Power Generation Strategy May 16, 2018

Press Conference Gazprom’s Power Generation Strategy May 16, 2018 MODERATOR: Good afternoon. We continue the series of Press Conferences in the lead-up to the annual General Shareholders Meeting of Gazprom. Today, we will review Gazprom’s Power Generation Strategy. This Press Conference is attended by Denis Fyodorov, Head of Directorate at Gazprom and Director General of Gazprom Energoholding. I give the floor to Mr. Fyodorov, and then we will move on to your questions. DENIS FYODOROV: Good afternoon, dear colleagues. I will try to be brief in my presentation and then answer all of your questions. I would like to begin by emphasizing that 2017 was an anniversary year for us. It was exactly 10 years ago that Gazprom obtained its first power assets. The Gazprom Board of Directors approved the power generation development strategy. By now, it has been fully implemented and completed, and we are ready to put forward a new 10-year strategy for approval very soon. The projects implemented by Gazprom made it possible to create the country’s largest power holding company: controlling stakes were acquired in Mosenergo and TGC-1, in OGK-2 and OGK-6, which are now consolidated in a single company, as well as in MOEK. Today, we account for 16 per cent of all electricity produced in Russia and hold the lead in the national heat supply market. Our most remarkable success of recent years is MOEK’s transformation into a company with positive operating results. We already know that some banking organizations are showing interest in its bond issues, which means that the company has finally managed to show a consistently positive trend after several years of financial instability.