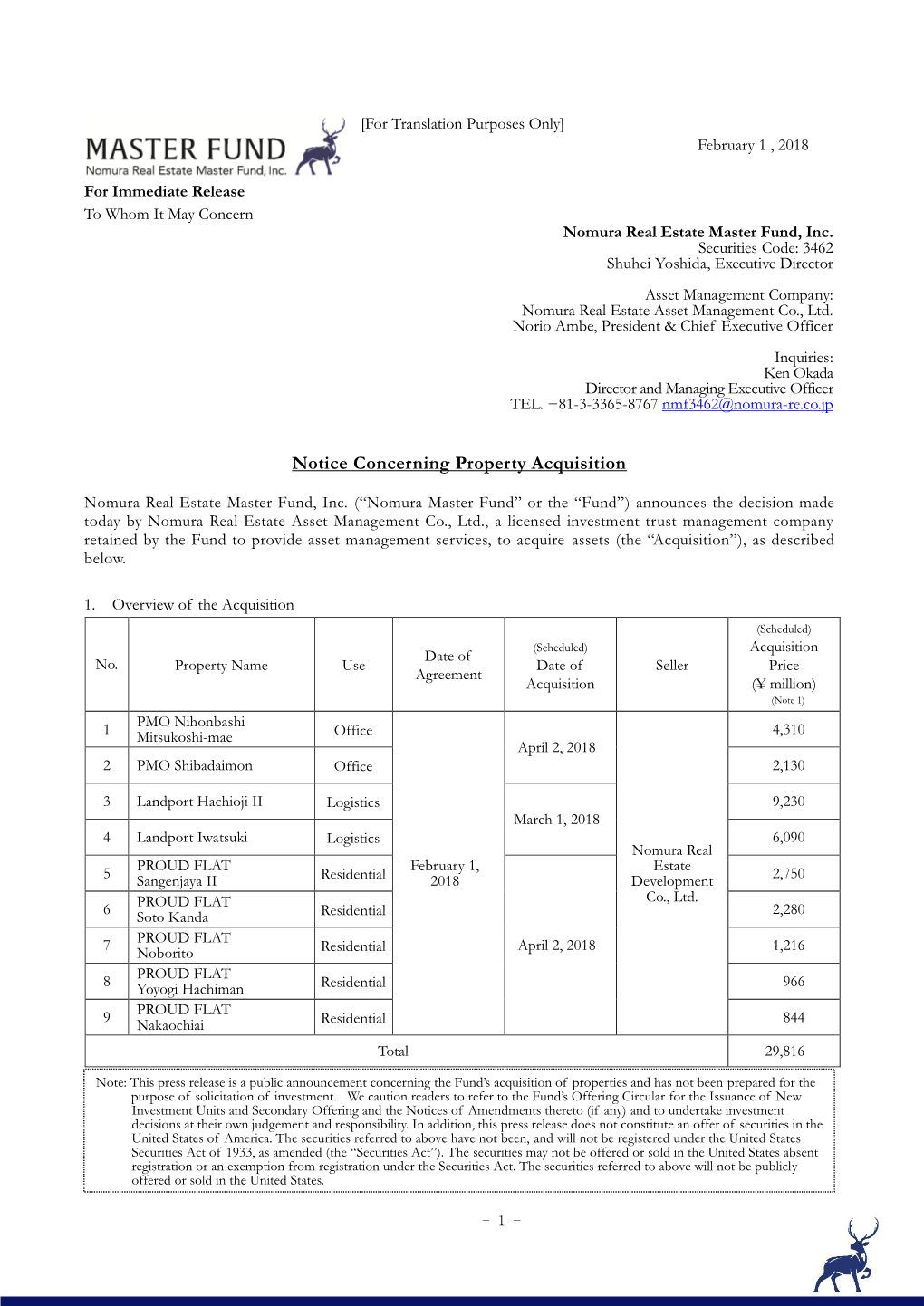

Notice Concerning Property Acquisition (PMO Nihonbashi

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CULTURAL PROGRAMS in Kanagawa 2019-2020

in Kanagawa 2019-2020 FEATURE: RUGBY WORLD CUP 2019™,JAPAN (pp.04-05) TM©Rugby World Cup Limited 2015. All rights reserved. Good day, everyone! I am Yuji Kuroiwa, Governor of Kanagawa Prefecture. Kanagawa Prefecture promotes “Magnetic Culture (MAGCUL)” which attracts people through the appeal of culture and the arts, as well as livens up the region. A rich variety of culture and art-related events are being held in Be BORN NARITA various locations around the prefecture based on this from K A N A GAWA INTERNATIONAL initiative. Last year, the “Cultural Programs in Kanagawa 成田 AIRPORT 国際空港 2018” was published out of our desire to convey the appeal of culture and arts widely throughout the country and overseas as well. As we enter the new Reiwa era this year, the prefecture TOKYO will be hosting large-scale international competitions, 東京 including the Rugby World Cup 2019™ and the Sailing’s World Cup Series Enoshima. 2019 presents wonderful opportunities for a large number of people from within Japan and from overseas to visit the prefecture. This year as well we have published the “Cultural Programs in Kanagawa” brochure which is brimming with a wealth of content about all the outstanding attractions 川崎市 TOKYO we would like to promote in Kanagawa Prefecture. 相模原市 KAWASAKI INTERNATIONAL AIRPORT 東京 We strongly encourage you to see, hear, and experience SAGAMIHARA 国際空港 a “MAGCUL” event in Kanagawa. 愛川町 AIKAWA 皆さん、こんにちは。 神奈川県知事の黒岩祐治です。 清川村 座間市 神奈川県では、文化芸術の魅力で 大和市 KIYOKAWA 厚木市 ZAMA ATSUGI YAMATO 横浜市 Be 人を引きつけ 、地 域 の に ぎ わ い を つ くり 出 す YOKOHAMA -

Corridor Studies

UvA-DARE (Digital Academic Repository) Station area developments in Tokyo and what the Randstad can learn from it Chorus, P.R.W.E. Publication date 2012 Link to publication Citation for published version (APA): Chorus, P. R. W. E. (2012). Station area developments in Tokyo and what the Randstad can learn from it. General rights It is not permitted to download or to forward/distribute the text or part of it without the consent of the author(s) and/or copyright holder(s), other than for strictly personal, individual use, unless the work is under an open content license (like Creative Commons). Disclaimer/Complaints regulations If you believe that digital publication of certain material infringes any of your rights or (privacy) interests, please let the Library know, stating your reasons. In case of a legitimate complaint, the Library will make the material inaccessible and/or remove it from the website. Please Ask the Library: https://uba.uva.nl/en/contact, or a letter to: Library of the University of Amsterdam, Secretariat, Singel 425, 1012 WP Amsterdam, The Netherlands. You will be contacted as soon as possible. UvA-DARE is a service provided by the library of the University of Amsterdam (https://dare.uva.nl) Download date:02 Oct 2021 6 Corridor studies In the previous chapter the development patterns of 99 station areas in the Tokyo Metropolitan Area were explored by analyzing their respective node and place values. The correlation analysis revealed that certain combinations of transport (the node) and land use (the place) factors had a stronger influence on structuring station area redevelopments than others. -

川崎市長による国連グローバル・コンパクト コミュニケーション・オン・エンゲージメント Communication on Engagement (COE) with the UN Global Compact Submitted by the Mayor of Kawasaki City

川崎市長による国連グローバル・コンパクト コミュニケーション・オン・エンゲージメント Communication on Engagement (COE) with the UN Global Compact Submitted by the Mayor of Kawasaki City 川崎市は、多摩川や多摩丘陵などの自然や、地域に根付 The city of Kawasaki is blessed with many beautiful natural features such as the Tama River いた文化やスポーツ、京浜臨海部の一翼を担ってきた産業 and Tama Hills. Moreover, this region is also well known for its many sports and cultural の集積、交通・物流の利便性などの特色を持つ、首都圏の events, as well as the accumulation of important industries in the Keihin Coastal Area, and the 大都市として存在感を増しています。我が国の人口が減少 convenience of its transportation and logistics. Due to these factors, the presence of Kawasaki as しているなかで、本市は 2019 年 10 月に人口 153 万人を突 a major city in the greater metropolitan area of Tokyo is continuously increasing. 破し、現在も増加が続いており、特に若い世代の方々に「選 ばれる都市」として進化を続けております。 While the national population is decreasing, the population of Kawasaki stands at 日本の産業発展をけん引してきた川崎市は、深刻な環境 approximately 1.53 million (as of October 2019) and is becoming an increasingly popular place to 問題など、これまで幾多の困難に直面し、知恵と工夫をも live – especially amongst the younger generations. って、課題解決に向け挑んできました。公害問題への取組 川崎市長 の過程では、優れた人材が培われるとともに産業の集積が As one of the cities that helped propel the development of the Japanese industry sector, 進み、現在では、最先端の環境技術などをもつ世界的な企 Kawasaki has faced a number of difficulties in the past – such as serious environmental issues. However, the city has used both its wisdom and ingenuity in order to tackle these problems and Mayor of Kawasaki City 業や研究機関が数多く立地する国際的な産業・研究環境都 Norihiko Fukuda 市へ変貌を遂げるなど、苦難を乗り越え、ピンチをチャン thus successfully resolve them. In the process of overcoming pollution issues, the city has スに転換して発展を成し遂げてきました。 cultivated superior human-potential and as a result the amassment of industries in the area has 日々複雑化する社会状況の中、日本で唯一「国連グローバル・コンパクト」に参加している progressed. -

National Institute of Occupational Safety and Health, Japan

National Institute of Occupational Safety and Health, Japan Japan Organization of Occupational Health and Safety Contents Organization …………………………………………………………………………… 1 Mission of JNIOSH …………………………………………………………………… 2 Promotion of research for planning and drafting governmental policy in occupational safety and health fields ……………………………………………… 2 Contribution to the administration of occupational safety and health by the establishment of centers ……………………………………… 3 Entrusted Research, Facility Use, Information Services, etc. ………………… 3 Activities of JNIOSH in connection with Ministry of Health, Labour & Welfare and other Institutions …………………………………………… 4 Center for Occupational Accident Investigation …………………………………… 5 Research Center for Chemical Information and Management ………………… 6 Division of Exposure Science ……………………………………………………… 7 Division of Industrial Toxicology and Biological Monitoring ……………………… 8 Research Center for Overwork-Related Disorders ……………………………… 9 Research Center for Prevention from Radiation Hazards of Workers ………… 10 Outline of Eight Research Groups ………………………………………………… 11 History of JNIOSH ………………………………………………………………… 19 Outline of Building Facilities ……………………………………………………… 20 Access ……………………………………………………………………………… 21 Organization Department of Administration Center for Research Promotion and International Affairs Center for Occupational Accident Investigation Research Center for Chemical Information and Management Director-General Division of Chemical Information Division of Exposure Science Deputy Director-General Division of Industrial -

Dormy Funabashi

Dormy List ドーミーリスト INDEX by Area TOKYO|東京都 KANAGAWA|神奈川県 SAITAMA|埼⽟県 CHIBA|千葉県 Update: 2019/07/10 Contact: [email protected] Tokyo 東京都 ■ Dormy Ayase 3 【Details】 Address:3-9-19 Kosuge, Katsushika-ku, Tokyo Access:12-minute walk from Ayase sta. (Chiyoda Line) 10-minute walk from Horikirishobuen sta. (Keisei Line) Building:3-story reinforced concrete Room:Western style 7.92-12.90 ㎡ Capacity: 105 people 【 Room Facilities : Room type A 】 ・Desk・Chair・Bed・Book shelf ・Closet・IP Phone・A/C・Curtain 【Shared Facilities】 ・Dining・Kitchen・Public bathroom・Private shower ・ ・ Laundry room Bicycle parking ・Outside clothes-drying area ・Automatically locking door 【MAP】 Dormy Ayase 3 ■ Dormy Ayase Lei 【Details】 Address:2-13-20 Kosuge, Katsushika-ku, TOKYO Access:12-minute walk from Ayase sta. (Chiyoda Line) 10-minute walk from Horikiri-Shobuen sta. (Keisei Line) Building:3-story reinforced concrete Room:Western style roomⅠ: 8.10 ㎡ roomⅡ: 12.96 ㎡ Capacity: 128 people 【 Room Facilities : Room type A 】 ・Desk・Chair・Bed・Book shelf ・IP Phone・A/C・Curtain・Closet 【Shared Facilities】 ・Dining・Private shower・Public bath・Laundry room ・Bicycle parking lots・Automatically locking door ・Mailbox・Outside clothes-drying area ・Kitchen(Gas stove) ・Massage Chair 【MAP】 Dormy Ayase Lei ■ Dormy Naka-Kasai 【Details】 Address:3-25-5 Naka-Kasai, Edogawa-ku, Tokyo Access:6-minute walk from Kasai sta. (Tozai Line) Building:3-story heavy weight steel structure Room:Western style roomⅠ: 8.10 ㎡ Capacity: 92 people 【 Room Facilities : Type A 】 ・Desk・Chair・Bed・Book shelf ・IP Phone・A/C・Curtain・Closet 【Shared Facilities】 ・Dining Room・Private Shower・Public Bath ・Bicycle Parking・Automatic Lock Gate ・Mailbox・Outside Laundry-Drying Area ・Kitchen(Gas stove) ・Laundry Room 【MAP】 Towards Kasai-bashi Convenience Store Towards Urayasu Dormy Koban Lottery Shop Nagashima Naka-Kasai Rikkyo Japanese Restaurant Marimo Restaurant Marine Park Ramen Shop Seven Eleven Pedestrian Trail Community Hall Post Office DOCOMO Hirokuni Clinic Bloom Seven Eleven Cassino My Basket Pachinko Tomin Bank Kasai Sta. -

2005 Annual Report

Tokyo and Eastern Honshu... Annual Report 2005 For the year ended March 31, 2005 Profile ̈̈ JR East is the largest passenger ̈̈ JR East alone provides nearly railway company in the world, half of the huge volume of railway transportation serving about 16 million passengers daily. in the Tokyo metropolitan area. ̈̈ ̈̈ JR East operates a five-route Shinkansen JR East’s strong and stable network between Tokyo and major cities core transportation business in eastern Honshu (mainland). contributes 70% of operating revenues. ̈̈ JR East has the ability to leverage ̈̈ passenger traffic and railway assets JR East has abundant and to develop non-transportation businesses. stable cash flow. JR EAST RAILWAY NETWORK AROUND TOKYO Omiya Ikebukuro Takadanobaba Shinjuku Tokyo EAST JAPAN RAILWAY COMPANY Shibuya Shimbashi Shinagawa Tokyo Yokohama Annual Report 2005 OPERATING AREA (As of June 30, 2005 ) Shinkansen lines Conventional lines 2 stations: More than 1,000,000 passengers / day 4 stations: More than 500,000 passengers / day 3 stations: More than 400,000 passengers / day 23 stations: More than 200,000 passengers / day Forward-Looking Statements Statements contained in this report with respect to JR East’s plans, strategies, ments to differ materially from the expectations expressed herein. These factors and beliefs that are not historical facts are forward-looking statements about include, without limitation, (i) JR East’s ability to successfully maintain or the future performance of JR East which are based on management’s assump- increase current passenger levels on railway services, (ii) JR East’s ability to tions and beliefs in light of the information currently available to it. -

Tokyo Kanagawa Chiba Saitama Tochigi Yamanashi Shizuoka Gunma

TOKYO Photo by Shinkenchiku-sha photo:Chuo City Tourism Association 1 Tokyo Station 4 Ginza 7 Shibuya 10 Shibuya Hikarie 13 Asakusa 16 Jiyugaoka 20 Mt.Takao The Tokyo Station brick station building was Ginza is the classy area of Tokyo The statue of Hachiko is famous and This high-rise complex opened in Shibuya in The Kaminarimon gate is a famous Asakusa Some of the fashionable streets of this popular area of Mount Takao, with a three-star rating restored to its original appearance in October where many of Japan's oldest brands marks the spot where the dog Hachiko 2012 and contains 34 floors and 4 basement landmark known as the temple gate to Sensoji town include the red-brick Sunset Array, Marie Claire from Michelin Travel, is located in a quasi- Street lined with Sakura trees, and the La Vita, which is known as of 2012, taking pains to preserve the original have their flagship stores. With many waited for his professor owner at floors. The complex offers many features Temple. The gate is easily identified by the 3.3 national park about 50 minutes from Tokyo. the Venice of Jiyugaoka. With all of the cafes, restaurants and fashion historical building as much possible. During sophisticated department stores, jewelry Shibuya Station. Hachiko's story was to enjoy including the ShinQs commercial m wide, 3.9 m tall, 700 kg in weight large red There are three mountain-climbing trails. stores, even walking around aimlessly can be an enjoyable experience. the Meiji Era a number of brick buildings were constructed modelled stores, stationery stores, cosmetics retold in the film Hachi: A Dog's Tale complex, a dining floor with 26 different lantern. -

2005 Annual Report

Review of Operations Non-Transportation—Station Space Utilization ̈̈ OVERVIEW Ecute Omiya—A Business Model Is Born JR East stations—used by roughly 16 million passen- Omiya station is one of Japan’s major terminal sta- gers a day—are JR East’s largest management resource. tions, used by almost half a million passengers daily. JR East operates a wide range of businesses, including In March 2005, JR East cut the tape on Ecute* retail outlets and restaurants, to enhance customer Omiya, a commercial space in Omiya station, which convenience and comfort and to raise profitability. was designed based on the concept of a “station-as- Many of JR East’s stations have high passenger one-large-shop.” Improvements to existing floor space volumes; 86 stations are used by more than 100 and the creation of artificial ground above the station’s thousand passengers a day, including 32 used by south-side platforms have added 5,000 square meters more than 200 thousand passengers a day in fiscal of floor space, of which 2,300 square meters is for 2005. Given those volumes, there is clearly significant stores. JR East expects that Ecute Omiya’s 68 shops— potential for the further development of non-trans- all Suica electronic money compatible—will generate portation services. annual revenues of ¥5.5 billion. As well as being functional and barrier-free, Ecute Omiya’s design has ̈̈ TOPICS decorated the station’s concourse walls and floors to Station Renaissance enhance the appeal of the entire station. JR East is aggressively pursuing ways to take full Ecute Omiya is the maiden project of JR East advantage of the potential of stations—its largest Station Retailing Co., Ltd., which has built an inte- management resource—based on the Station grated system for the management of merchandising Renaissance business strategy, which aims to simul- by commercial facilities, the selection of business taneously make stations more attractive and raise partners, sales area management, sales promotions, profitability. -

Yumoto Kenban (Hakone Yumoto Entertainment Union)

Kanagawa sightseeing charm creation conference West of <Japanese Culture> the Prefecture Hakone Town Come and meet the geisha girls of Hakone, Tourist Attraction No. Japan's emotional heart! 2221 Yumoto Kenban (Hakone Yumoto Entertainment Union) The stage is located on the first floor of the building, which underwent renovations as part of the TV Asahi's television show, "Before and After! That's a Dramatic Change!", and it is possible to see rehearsals going on here from the road as you walk past.The results of the daily Explanation of rehearsals the geisha girls take part in are revealed once every year (every June) during the Tourist Attraction Hakone-Odori stage performance. The seats facing the stage are long tatami-style seats so that you can enjoy watching the performance in comfort.Feel free to visit the outside of the theater. Various events are held inside the theater throughout each season (held irregularly). The Hakone-odori, which reveals the results of the geisha girls' daily rehearsals, is a must-see. Ozashiki-asobi selling point (traditional games with geisha) can also be enjoyed at your hotel or lodgings. (Contact necessary) Address 694 Yumoto, Hakone-machi, Ashigarashimo-gun, Kanagawa Opening Hours Check the opening days on the following link (Contact necessary):http://www.geisha.co.jp/gyouji.html Availability of Parking Chargeable car park located nearby URL http://www.geisha.co.jp/ Recommended Season All year Access Group/Individual Mark Individual 5-minutes' walk from Hakone Yumoto Station on the Hakone Tozan Line Target Regions Europe, North America, Oceania Model Route No. -

Investor Presentation Fiscal Period Ended February 2018

Nomura Real Estate Master Fund, Inc. Investor Presentation Fiscal Period Ended February 2018 April 18, 2018 目次 1. Public Offering 7. APPENDIX ・ Overview of the 1st Public Offering 5 ・ Changes in Various Indices 30 ・ Porfolio Summary(as of February 28, 2018) 33 2. Financial Highlights ・ Portfolio Management 34 ・ Financial Highlights for February 2018 (5th) Period 8 ・ Asset Management Status - Office - 35 ・ Summary of Main Indicators 10 ・ Asset Management Status - Retail - 36 ・ Asset Management Status - Logistics - 37 3. External Growth ・ Asset Management Status - Residentail - 38 ・ Acquisitions and Dispositions in February 2018(5th) Period 11 ・ New Acquisitions (1st PO) 39 ・ Track Record of Sponsor Support by Leasing Value Chain 14 ・ Strong Sponsor Pipelines for External Growth 45 ・ Track Record of Growth since Inception 15 ・ Mid- to Long-term Management Strategy - Growth Phase - 47 ・ Top 10 Tenants by Leased Space 48 4. Internal Growth ・ Portfolio List 49 ・ Internal Growth -Management Status- 17 ・ Profit and Loss 56 ・ Appraisal Valuation 21 ・ NOI Analysis by Sector 57 ・ ESG Initiatives 22 ・ Balance Sheet 58 ・ Changes in Unit Price 59 5. Financial Status ・ Unitholders 60 ・ Financial Status 25 ・ Internal Reserves Equivalent to Gain on Sale 61 ・ Market Review 62 6. Earning Forecast Earning Forecast for Aug.2018 (6th) and Feb.2019(7th) Fiscal 29 ・ period ・ Organization and IR Activities 30 3 1 Public Offering 4 Overview of the 1st Public Offering - 1 - Implemented the Fund’s first public offering in February 2018. Promoting our strategy in our growth phase by acquiring prime properties totaling ¥33.4 billion. Highlights Summary Offering type Domestic st ・ The 1 public offering for sustainable growth in our growth Total number of units offered 138,670 units phase(Feb. -

Fujiko F. Fujio Museum

Kanagawa sightseeing charm creation conference Yokohama & <Amusement・Mag-Cul> Kawasaki Kawasaki City Tourist Attraction No. Meet that character you loved as a child 293 Fujiko F. Fujio Museum A museum dedicated to the worldview and messages expressed in the work of manga artist Fujiko F. Fujio, creator of Doraemon. Explanation of Our museum is focused on the display of rare original artwork, with a themed cafe and menu Tourist Attraction inspired by Fujio's work. You can also buy a wide range of merchandise unique to our store. Entrance to the museum is by reservation only, with tickets being for a set time and day. This is to allow our visitors the time they need to fully enjoy all we have to offer. selling point Our museum provides an audio guide in four languages (Japanese, English, Chinese and Korean.) Address 2-8-1 Nagao Tama-ku Kawasaki-shi Kanagawa-ken Opening Hours 10:00-18:00 (Closed on Tuesdays, year-end holidays) ※This facility is reservation-only. Please specify the date and time you would like to visit. Availability of Parking - URL http://fujiko-museum.com/ Recommended Season All year Access Group/Individual Mark Group Individual 10 min direct bus ride from Noborito Station (Odakyu Odawara Line, JR Nambu Line) Target Regions Europe, North America, Oceania, Asia Specific Model Route Details Individual Keio Line [Shinjuku Station] +++ (19 min) +++ Keio Sagamihara Line [Keio-Yomiuri-Land Station]*** Gondola (10 min) *** Yomiuriland (30 min) === Route bus (10 min) ===Odakyu Odawara Line [Yomiuriland-mae Station] +++ (4 min) +++ Odakyu Odawara Line [Noborito Station] === City bus (9 min) === Fujiko F. -

Gyu-Kaku Japan Store List * Capital Region Only

* As of April 9, 2012 Gyu-Kaku Japan Store List * Capital region only. Other area will be updating soon. Store Name *Alphabetical Post Code Address TEL Nearest Station Tokyo Gyu-Kaku Akabane 1150045 1-21-3-1F Akabane, Kita-ku, Tokyo 0352495529 Akabane Station Gyu-Kaku Akihabara Ekimae 1010021 1-15-9-8F Sotokanda, Chiyoda-ku, Tokyo 0352971929 Akihabara Station Gyu-Kaku Akihabara Showa-dori-guchi 1010025 1-24 Sakumacho, Kanda, Chiyoda-ku 0335266029 Akihabara Station Gyu-Kaku Akiruno 1970804 1-15-6 Akigawa, Akiruno-shi, Tokyo 0425324531 Akigawa Station Gyu-Kaku Akishima 1960015 5-14-17-1F Showacho, Akishima-shi, Tokyo 0425491929 Akishima Station Gyu-Kaku Akishima Mori-town 1960014 562-1-3F Tanakacho, Akishima-shi, Tokyo 0425006329 Akishima Station Gyu-Kaku Akitsu 2040004 5-298-5-2F Noshio, Kiyose-shi, Tokyo 0424967129 Akitsu Station Gyu-Kaku Aoto 1240012 6-30-8-2F Tateishi, Katsushika-ku, Tokyo 0356718929 Aoto Station Gyu-Kaku Asagayakitaguchi 1660001 2-1-3-3F Asagayakita, Suginami-ku, Tokyo 0353275629 Asagaya Station Gyu-Kaku Asakusa 1110032 1-32-11-B1F Asakusa, Taito-ku, Tokyo 0358305929 Asakusa Station Gyu-Kaku Asakusa Kokusaidori 1110035 2-13-9-2F Nishiasakusa, Taito-ku, Tokyo 0358272120 Tawaramachi Station Gyu-Kaku Asakusabashi 1110053 2-29-13-2F Asakusaba-shi, Taito-ku, Tokyo 0358351129 Asakusabashi Station Gyu-Kaku Awashimadori 1540005 2-38-7-1F Mishuku, Setagaya-ku, Tokyo 0357796829 Ikenoue Station Gyu-Kaku Ayase 1200005 3-1-16-1F Ayase, Adachi-ku, Tokyo 0356737029 Ayase Station Gyu-Kaku Chofu 1820024 1-35-3-1F Fuda, Chofu-shi, Tokyo