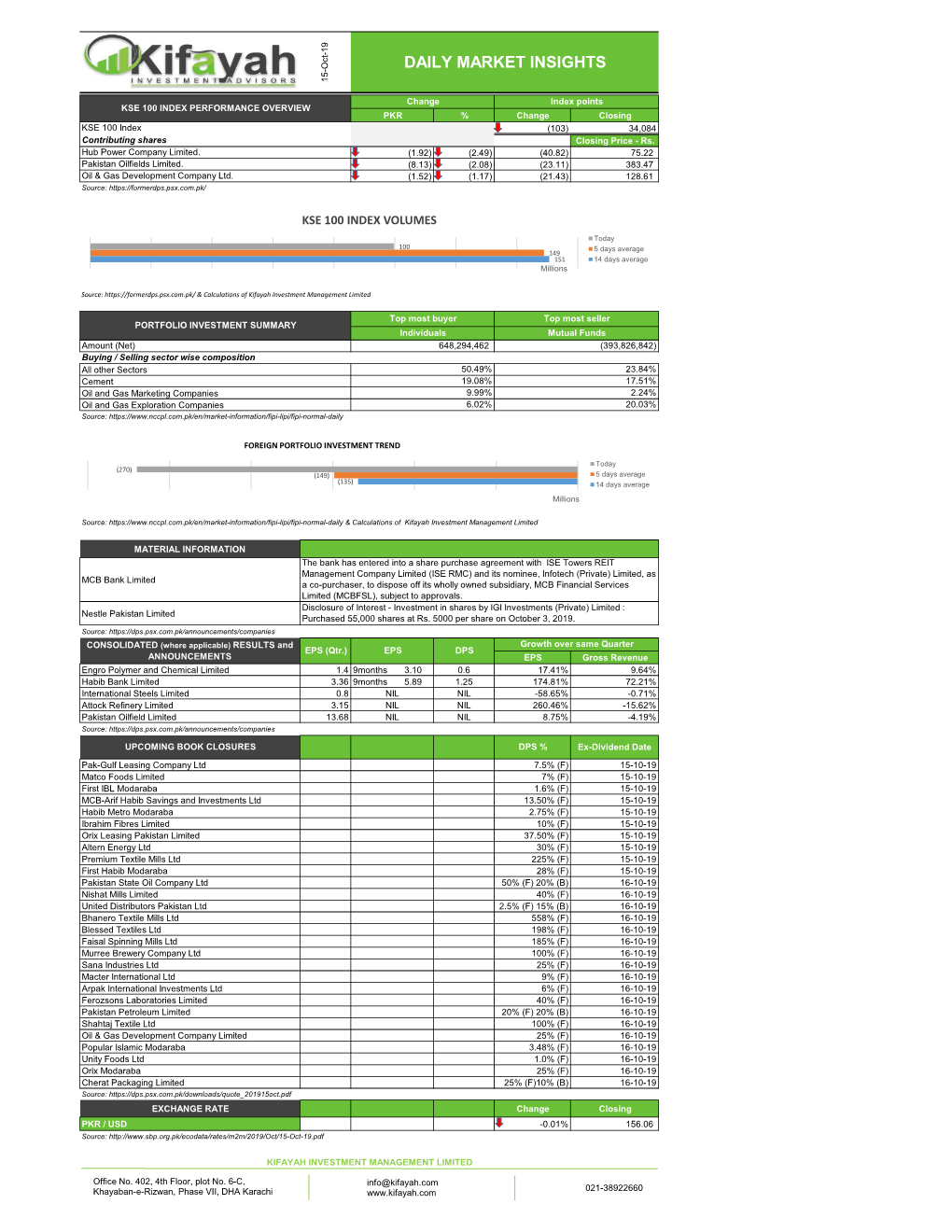

DAILY MARKET INSIGHTS Change (1.52) (8.13) (1.92)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Posted Issuer

Central Depository Company of Pakistan Limited Element Report Page# : 1 of 267 User : XKYFSI2 Report Selection : Posted Date : 04/11/2020 Element Type : Issuer Time : 06:02:58 Element ID : ALL Location : ALL Status : Active From Date : 01/01/1996 To Date : 04/11/2020 Element Id Element Code Element Name Phone / Fax Contact Name CDC Loc Role Code Maximum User Status Main A/c Address eMail Address Designation Client A/c CM Option No. Date -------- -------- ------------------------ ---------------------- --------------- --------- -------- ----------- -------- 00002 EFU GENERAL 2313471-90 ALTAF QAMRUDDIN KHI Active INSURANCE LIMITED GOKAL 3RD FLOOR, 2314288 CFO AND 08/06/1998 QAMAR HOUSE, CORPORATE M. A. JINNAH ROAD, SECRETARY KARACHI. 00003 HABIB INSURANCE 111-030303 SHABBIR A. KHI Active COMPANY LIMITED GULAMALI 1ST FLOOR, STATE 32421600 CHIEF 01/09/1997 LIFE BLDG. NO. 6, EXECUTIVE HABIB SQUARE, M. A. JINNAH ROAD, [email protected] KARACHI. et 00004 HAYDARI 2411247 ALI ASGHAR KHI Active CONSTRUCTION RAJANI COMPANY LIMITED MEZZANINE FLOOR, 2637965 CHIEF 10/03/2004 UBL BUILDING, EXECUTIVE OPP. POLICE HEAD OFFICER OFFICE, I.I CHUNDRIGAR ROAD, KARACHI. 00005 K-ELECTRIC LIMITED 38709132 EXT:9403 AMJAD MUSTAFA KHI Active Central Depository Company of Pakistan Limited Element Report Page# : 2 of 267 User : XKYFSI2 Report Selection : Posted Date : 04/11/2020 Element Type : Issuer Time : 06:02:58 Element ID : ALL Location : ALL Status : Active From Date : 01/01/1996 To Date : 04/11/2020 Element Id Element Code Element Name Phone / Fax Contact Name CDC Loc Role Code Maximum User Status Main A/c Address eMail Address Designation Client A/c CM Option No. Date -------- -------- ------------------------ ---------------------- --------------- --------- -------- ----------- -------- 1ST FLOOR, 32647159 MANAGER, 01/09/1997 BLOCK-A, CORPORATE AFFAIRS POWER HOUSE, [email protected] ELANDER ROAD, KARACHI 00006 MURREE BREWERY 5567041-7 CH. -

CFA Institute Research Challenge Hosted by CFA Society of Pakistan Institute of Business Administration – Karachi

CFA Institute Research Challenge hosted by CFA Society of Pakistan Institute of Business Administration – Karachi CFA Institute Research Challenge 2015-16 Institute of Business Administration (IBA) – Student Research This report is published for educational purposes only by [Oil & Gas Sector, Oil Marketing Company] Students competing in The CFA Institute Research Challenge. Pakistan Stock Exchange (PSX) Pakistan State Oil Date: 11/01/16 Current Price: 321.27 PKR/share Recommendation: BUY (33% upside) Ticker: PSO (PSX) Ticker: PSO PA (Bloomberg) PKR/USD: 105 Target Price: 428 PKR/share (4.08 USD) Market Profile Closing price (PKR) 321.27 PSO: Proxy for Pakistan’s economic revival 52-week price 283.75 - range (PKR) 415.40 We issue a BUY recommendation on Pakistan State Oil (PSO) with a one-year target price of PKR 428 using the Discounted Average daily Free Cash Flow to Firm (FCFF) and Relative Valuation Method. This offers a 33% upside from its closing price of PKR 321 volume (12M) 919,134 on January 11, 2016. PSO is one of the biggest and most liquid blue-chips on KSE with average daily volume being 0.34% As a % of shares of shares outstanding. Our investment thesis is based on PSO’s earnings growth, backed by volumes growth, outstanding 0.34% improving operating cash flows, and being a cheap blue-chip asset. PSO’s earnings growth is primarily driven by its volumetric sales growth during FY16-21 (CAGR: 12%) due to a changing energy mix, lower financing costs which will Dividend yield reduce over the years due to lower borrowings and positive operating cash flows. -

Habibmetro Modaraba Management (AN(AN ISLAMICISLAMIC FINANCIALFINANCIAL INSTITUTION)INSTITUTION)

A N N U A L R E P O R T 2017 1 HabibMetro Modaraba Management (AN(AN ISLAMICISLAMIC FINANCIALFINANCIAL INSTITUTION)INSTITUTION) 2 A N N U A L R E P O R T 2017 JOURNEY OF CONTINUOUS SUCCESS A long term partnership Over the years, First Habib Modaraba (FHM) has become the sound, strong and leading Modaraba within the Modaraba sector. Our stable financial performance and market positions of our businesses have placed us well to deliver sustainable growth and continuous return to our investors since inception. During successful business operation of more than 3 decades, FHM had undergone with various up and down and successfully countered with several economic & business challenges. Ever- changing requirement of business, product innovation and development were effectively managed and delivered at entire satisfaction of all stakeholders with steady growth on sound footing. Consistency in perfect sharing of profits among the certificate holders along with increase in certificate holders' equity has made FHM a sound and well performing Modaraba within the sector. Our long term success is built on a firm foundation of commitment. FHM's financial strength, risk management protocols, governance framework and performance aspirations are directly attributable to a discipline that regularly brings prosperity to our partners and gives strength to our business model which is based on true partnership. Conquering with the challenges of our operating landscape, we have successfully journeyed steadily and progressively, delivering consistent results. With the blessing of Allah (SWT), we are today the leading Modaraba within the Modaraba sector of Pakistan, demonstrating our strength, financial soundness and commitment in every aspect of our business. -

List of Unclaimed Shares and Dividend

ATTOCK REFINERY LIMITED LIST OF SHAREHOLDERS REGARDING UNCLAIMED DIVIDENDS / UNCLAIMED SHARES FOLIO NO / CDC SHARE NET DIVIDEND S/NO. NAME OF SHAREHOLDER / CERTIFICATE HOLDER ADDRESS ACCOUNT NO. CERTIFICATES AMOUNT 1 208020582 MUHAMMAD HAROON DASKBZ COLLEGE, KHAYABAN-E-RAHAT, PHASE-VI, D.H.A., KARACHI 450 2 208020632 MUHAMMAD SALEEM SHOP NO.22, RUBY CENTRE,BOULTON MARKETKARACHI 8 3 307000046 IGI FINEX SECURITIES LIMITED SUIT # 701-713, 7TH FLOOR, THE FORUM, G-20, BLOCK 9, KHAYABAN-E-JAMI, CLIFTON, KARACHI 15 4 307013023 REHMAT ALI HASNIE HOUSE # 96/2, STREET # 19, KHAYABAN-E-RAHAT, DHA-6, KARACHI. 15 5 307020846 FARRUKH ALI HOUSE # 246-A, STREET # 39, F-11/3, ISLAMABAD 67 6 307022966 SALAHUDDIN QURESHI HOUSE # 785, STREET # 11, SECTOR G-11/1, ISLAMABAD. 174 7 307025555 ALI IMRAN IQBAL MOTIWALA HOUSE NO. H-1, F-48-49, BLOCK - 4, CLIFTON, KARACHI. 2,550 8 307026496 MUHAMMAD QASIM C/O HABIB AUTOS, ADAM KHAN, PANHWAR ROAD, JACOBABAD. 2,085 9 307028922 NAEEM AHMED SIDDIQUI HOUSE # 429, STREET # 4, SECTOR # G-9/3, ISLAMABAD. 7 10 307032411 KHALID MEHMOOD HOUSE # 10 , STREET # 13 , SHAHEEN TOWN, POST OFFICE FIZAI, C/O MADINA GERNEL STORE, CHAKLALA, RAWALPINDI. 6,950 11 307034797 FAZAL AHMED HOUSE # A-121,BLOCK # 15,RAILWAY COLONY , F.B AREA, KARACHI 225 12 307037535 NASEEM AKHTAR AWAN HOUSE # 183/3 MUNIR ROAD , LAHORE CANTT LAHORE . 1,390 13 307039564 TEHSEEN UR REHMAN HOUSE # S-5, JAMI STAFE LANE # 2, DHA, KARACHI. 3,475 14 307041594 ATTIQ-UR-REHMAN C/O HAFIZ SHIFATULLAH,BADAR GENERALSTORE,SHAMA COLONY,BEGUM KOT,LAHORE 7 15 307042774 MUHAMMAD NASIR HUSSAIN SIDDIQUI HOUSE-A-659,BLOCK-H, NORTH NAZIMABAD, KARACHI. -

STOXX Emerging Markets 1500 Last Updated: 03.08.2020

STOXX Emerging Markets 1500 Last Updated: 03.08.2020 Rank Rank (PREVIO ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) US) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Large 298.2 1 1 KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Large 211.4 2 2 INE002A01018 6099626 RELI.BO IN0027 Reliance Industries Ltd IN INR Large 76.4 3 4 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Large 60.5 4 3 ZAE000015889 6622691 NPNJn.J ZA004D Naspers Ltd ZA ZAR Large 59.1 5 5 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Large 51.5 6 7 INE040A01034 BK1N461 HDBK.BO IN00CH HDFC Bank Ltd IN INR Large 50.4 7 6 INE009A01021 6205122 INFY.BO IN006B Infosys Ltd IN INR Large 43.4 8 12 RU0009024277 B59SNS8 LKOH.MM EV020 LUKOIL RU RUB Large 38.0 9 8 BRVALEACNOR0 2196286 VALE3.SA BR0024 Vale SA BR BRL Large 37.3 10 13 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Large 35.4 11 9 KR7035420009 6560393 035420.KS KR00NY NAVER CORP KR KRW Large 35.2 12 15 INE001A01036 6171900 HDFC.BO IN00EJ Housing Development Finance Co IN INR Large 34.9 13 11 KR7000660001 6450267 000660.KS KR00EP SK HYNIX INC KR KRW Large 34.2 14 10 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Large 32.4 15 14 TW0002454006 6372480 2454.TW TW006V MediaTek Inc TW TWD Large 30.3 16 18 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Large 27.2 17 16 INE467B01029 B01NPJ1 TCS.BO IN005A Tata Consultancy Services Ltd IN INR Large 27.1 18 20 RU0009029540 -

Rastgar Review (July-September, 2012).Cdr

VOL - 3 July-September 2012 Rastgar & Co., Pakistan’s Leading Distributor of Air Compressors, Air Dryers, Filters and Construction Machinery. INSIDE FerozeTextile : Leader in Textiles Uses Oil Free Air From Page 2 CompAir in Fazal Steel (Pvt.) Ltd Quantima Compressors Installed at Feroze Textile a m o n g a l l t h e l o c a l locations, Feroze Textile is competitors. FTI maintains performing the entire process high set of standards in every of spinning, weaving, dyeing Page 3 Jam-e-Shirin area of concern, ranging from and stitching. Being partnered Q u a nt i m a C o m p re s s o rs To Be Produced with CompAir the highest quality of products with 1888 Mills (USA), they are installed at Feroze Textile run to m ax i m u m e m p l o ye e recognized as a Progressive round the clock and round the satisfaction. and Global Manufacturers of year at this Progressive and quality textiles for home, Global manufacturers of hospitality and healthcare quality textiles. sectors. Feroze Textile is yet another Experts from CompAir visited leading manufacturer and Feroze Textile installation site exporters of specialized Yarn & and lauded the technical Textile Terry Products in expertise of Rastgar CompAir Pakistan which chose to rely on service team for its Turnkey Rastgar because of its excellent installation of compressors and Page 4 service and support facilities. Training on Air a u t h e n t i c a t e d a l l t h e Starting in early 70s, FTI has Compressor Use and Service installation process. -

Companies Listed On

Companies Listed on KSE SYMBOL COMPANY AABS AL-Abbas Sugur AACIL Al-Abbas CementXR AASM AL-Abid Silk AASML Al-Asif Sugar AATM Ali Asghar ABL Allied Bank Limited ABLTFC Allied Bank (TFC) ABOT Abbott (Lab) ABSON Abson Ind. ACBL Askari Bank ACBL-MAR ACBL-MAR ACCM Accord Tex. ACPL Attock Cement ADAMS Adam SugarXD ADMM Artistic Denim ADOS Ados Pakistan ADPP Adil Polyprop. ADTM Adil Text. AGIC Ask.Gen.Insurance AGIL Agriautos Ind. AGTL AL-Ghazi AHL Arif Habib Limited AHSL Arif Habib Sec. AHSM Ahmed Spining AHTM Ahmed Hassan AIBL Asset Inv.Bank AICL Adamjee Ins. AJTM Al-Jadeed Tex AKDCL AKD Capital Ltd AKDITF AKD Index AKGL AL-Khair Gadoon ALFT Alif Tex. ALICO American Life ALNRS AL-Noor SugerXD ALQT AL-Qadir Tex ALTN Altern Energy ALWIN Allwin Engin. AMAT Amazai Tex. AMFL Amin Fabrics AMMF AL-Meezan Mutual AMSL AL-Mal Sec. AMZV AMZ Ventures ANL Azgard Nine ANLCPS Azg Con.P.8.95 Perc.XD ANLNCPS AzgN.ConP.8.95 Perc.XD ANLPS Azgard (Pref)XD ANLTFC Azgard Nine(TFC) ANNT Annoor Tex. ANSS Ansari Sugar APL Attock Petroleum APOT Apollo Tex. APXM Apex Fabrics AQTM Al-Qaim Tex. ARM Allied Rental Mod. ARPAK Arpak Int. ARUJ Aruj Garments ASFL Asian Stocks ASHT Ashfaq Textile ASIC Asia Ins. ASKL Askari Leasing ASML Amin Sp. ASMLRAL Amin Sp.(RAL) ASTM Asim Textile ATBA Atlas Battery ATBL Atlas Bank Ltd. ATFF Atlas Fund of Funds ATIL Atlas Insurance ATLH Atlas Honda ATRL Attock Refinery AUBC Automotive Battery AWAT Awan Textile AWTX Allawasaya AYTM Ayesha Textile AYZT Ayaz Textile AZAMT Azam Tex AZLM AL-Zamin Mod. -

State-Owned Enterprises

STATE-OWNED ENTERPRISES- DO THE ENDS JUSTIFY THE MEANS? PreparedFor RONCO Consulting Corporation Analysis of Corporate Sector Constraints In Agriculture (ACSCA) Project PreparedBy Constance R. Church, C.P.A. Financial Analyst RONCO Consulting Corporation November 15, 1990 Islamabad, Pakistan The analysis on which this report is based is supported by the United States Agency for International Development under contract number 391-0470-C-00-9265-00 FOREWORD In the course of doing financial analysis on various agro-industries for the Analysis of Corporate Sector Constraints in Agriculture project undertaken by RONCO Consulting Corporation, in cooperation with Agri-Bi-Con International (Private) Ltd., under contract with the U.S. Agency for International Development (USAID), time and again I came across statements about the profits which Pakistani state-owned enterprises were making. Articles in the national press, often based on government press releases, would mention profits of XX million rupees for a given enterprise. Letters to shareholders from the Chairman of the Board in annual reports often gave rosy pictures of how the company was doing. Seldom mentioned was how much the government, the primary if not sole shareholder in these enterprises, had invested, either directly as equity or indirectly in loans and subsidies to the company or to its state-owned suppliers. Without the benchmark of total investment, the absolute numbers were meaningless. Thus was born the idea to analyze how state-owned enterprises are faring relative to capital invested and to compare their results with those of private companies in the same industries. The goal was to find out if running the myriad of state-owned enterprises which Pakistan has is an efficient means to providing goods and services or if the many state owned enterprises are a luxury which Pakistan can ill afford. -

Dai Ly Quotati

D A I LY Q U O TAT I O N S No. 161/2021 Wednesday, Sep 1, 2021 LISTED COMPANIES - 531 MARKET REPORT UPTO 04:15 LISTED CAPITAL 1,458,220.972 M TRADING VOLUME TRADING VALUE MARKET CAPITALIZATION COS. TOTAL Pre. 378,832,096 Pre. 14,023,728,426 Pre: Rs.8,290,427,669,434 P LUS. 307 Cur. 536,640,545 Cur. 14,368,773,492 Cur: Rs. 8,307,132,366,059 MINUS. 207 N.Change: 16,704,696,625 E QUA L. 20 TOTA L. 534 TRADING VOLUME (B&B) TRADING VALUE (B&B) REMARKS Pre. 0 Pre. 0 For further details, please see debt instrument segments hereunder Cur. 0 Cur. 0 PSX INDICES Index Code Previous Current High Low Change %age Change K S E-100 47,419.74 47,413.46 47,629.20 47,352.54 -6.28 -0.01 K S E-A LL-Shares 32,394.47 32,460.77 32,590.08 32,394.47 66.30 0.20 K S E-30 19,027.87 19,029.27 19,129.16 19,011.66 1.40 0.01 K MI-30 77,641.73 77,663.99 78,115.66 77,574.99 22.26 0.03 B K Ti 12,936.20 12,886.42 13,009.69 12,866.71 -49.78 -0.38 OGTi 12,244.10 12,239.90 12,345.54 12,223.88 -4.20 -0.03 P S X-K MI-All-Shares 23,461.71 23,525.33 23,613.54 23,461.71 63.62 0.27 UP P9 13,056.93 13,065.87 13,129.56 13,048.09 8.94 0.07 NITP GI 9,744.65 9,746.77 9,793.90 9,738.20 2.12 0.02 NB P P GI 11,757.52 11,770.22 11,830.08 11,757.52 12.70 0.11 MZNP I 10,854.55 10,861.58 10,918.47 10,850.82 7.03 0.06 APPLIED FOR LISTING PROSPECTUS/OFFER FOR SALE APPROVED BY THE EXCHANGE COMPANY Sr. -

Profile of Candidates Contesting the Election of Directors

PROFILES OF CANDIDATES CONTESTING DIRECTORS’ ELECTION 2020 1. Mr. Isphanyar M. Bhandara Mr. Isphanyar M. Bhandara started his family business, Murree Brewery Co. Ltd. Rawalpindi, one of the oldest public limited companies of the sub-continent in 1997. Joined Board of Directors of the company in 1998. Before this he has significant exposure to fields operation including production, project development, development planning, conceptual engineering and operation supports in the brewery and its other divisions. In June, 2005 became Executive Director till 2008. In June, 2008 was appointed as Chief Executive Officer of the Murree Brewery Group of Companies on the demise of his father. The Company has also other divisions manufacturing food products, fruit juices, mineral water, non- alcoholic products and glass containers. The traditional activities of the Company are brewing and distilling of fine liquors and beers. With the passage of time the company has increased the product lines and capacity as well. Holds a Master Degree in Business & Administration. Ex-Member of the National Assembly of Pakistan on seat reserved for Minorities (2013-2018). Currently President of Rawalpindi Parsi Anjuman. Representing and helping following Minority communities of Pakistan Parsi, Sikhs, Baha’is, Buddhists, Kalash and doing other social and welfare activities. Attended various LUMS workshops on business. Completed Directors’ Training Program from Pakistan Institute of Corporate Governance. Office address: Murree Brewery Company Limited, 3-National Park Road, Rawalpindi. ********** 2. Ch. Mueen Afzal Ch. Mueen Afzal after getting his MA Degree from Oxford University joined the Civil Service of Pakistan in 1964, finally retiring from Government Service in 2002. -

About This Report

SUSTAINABILITY REPORT| 2019 12 About this Report Prioritization Validation Identification Review Process for Defining Report Content and Aspect Boundaries Scope This report covers all operations of Attock (SA-8000), UNGC indices, ISO Management Refinery Limited at Morgah, Rawalpindi consid- Standards (ISO 14001, ISO 9001, ISO 50001 and ering its Social, Environmental and Economic OHSAS 18001) for reporting Social, Environmen- aspects. ARL is keen and committed to share tal and Economic performance. This report also information about its sustainability endeavors, contains our commitment to the Ten Guiding targets, goals, initiatives and performance with Principles of UNGC. To accomplish the Agenda all stakeholders. This report is a consolidated 2030, we have mapped our Reporting tool with and concise document on ARL’s economic , the 17 Sustainable Development Goals. social and environmental performance. The Differences from the Sustainability report also demonstrates ARL commitment to Report 2018 good governance, transparency and highlights This year's report compilation is based on GRI the methodology for recognition and evaluation Standards, published by the Global Reporting of stakeholder's needs/expectations and its Initiatives (GRI), and is supplemented with ten transformation into actionable items. We guiding principles of UNGC. The GRI Standard consider Sustainability Report as a tool for com- has been mapped with 17 SDGs as well to municating ARL’s performance to all stakehold- achieve the targets of National Initiative for ers. SDGs. The material aspects identified in 2018 Reporting Period report, re-evaluated by considering comments ARL is publishing Sustainability Report annually from internal and external parties. The defined since 2005. The Report presents social & envi- prioritized material aspects are categorized ronmental performance data for the calendar again by changing their category from high to year 2019, economic and financial data for the moderate and vice versa. -

Identification and Estimation of the Role of Internal Micro Level Factors Towards Efficient Working Capital Management

Identification and Estimation of the Role of Internal Micro Level Factors Towards Efficient Working Capital Management A case study based on the experience of manufacturing firms in Pakistan. By Shahid Ali A research thesis submitted to the Department of Management & Social Sciences, Mohammad Ali Jinnah University, Islamabad In partial fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY IN MANAGEMENT SCIENCES (FINANCE) DEPARTMENT OF MANAGEMENT & SOCIAL SCIENCES MOHAMMAD ALI JINNAH UNIVERSITY ISLAMABAD JANUARY 2012 Identification and Estimation of the Role of Internal Micro Level Factors Towards Efficient Working Capital Management A case study based on the experience of manufacturing firms in Pakistan. By Shahid Ali A research thesis submitted to the Department of Management & Social Sciences, Mohammad Ali Jinnah University, Islamabad In partial fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY IN MANAGEMENT SCIENCES (FINANCE) DEPARTMENT OF MANAGEMENT & SOCIAL SCIENCES MOHAMMAD ALI JINNAH UNIVERSITY ISLAMABAD JANUARY 2012 Copyright© 2012 by Mr. Shahid Ali All rights are reserved. No part of the material protected by this copy right notice may be reproduced or utilized in any form or any means, electronic or mechanical, including photocopying, recording or by any information storage and retrieval system, without the permission from the author. Table of Contents Table of Contents ......................................................................................................................................