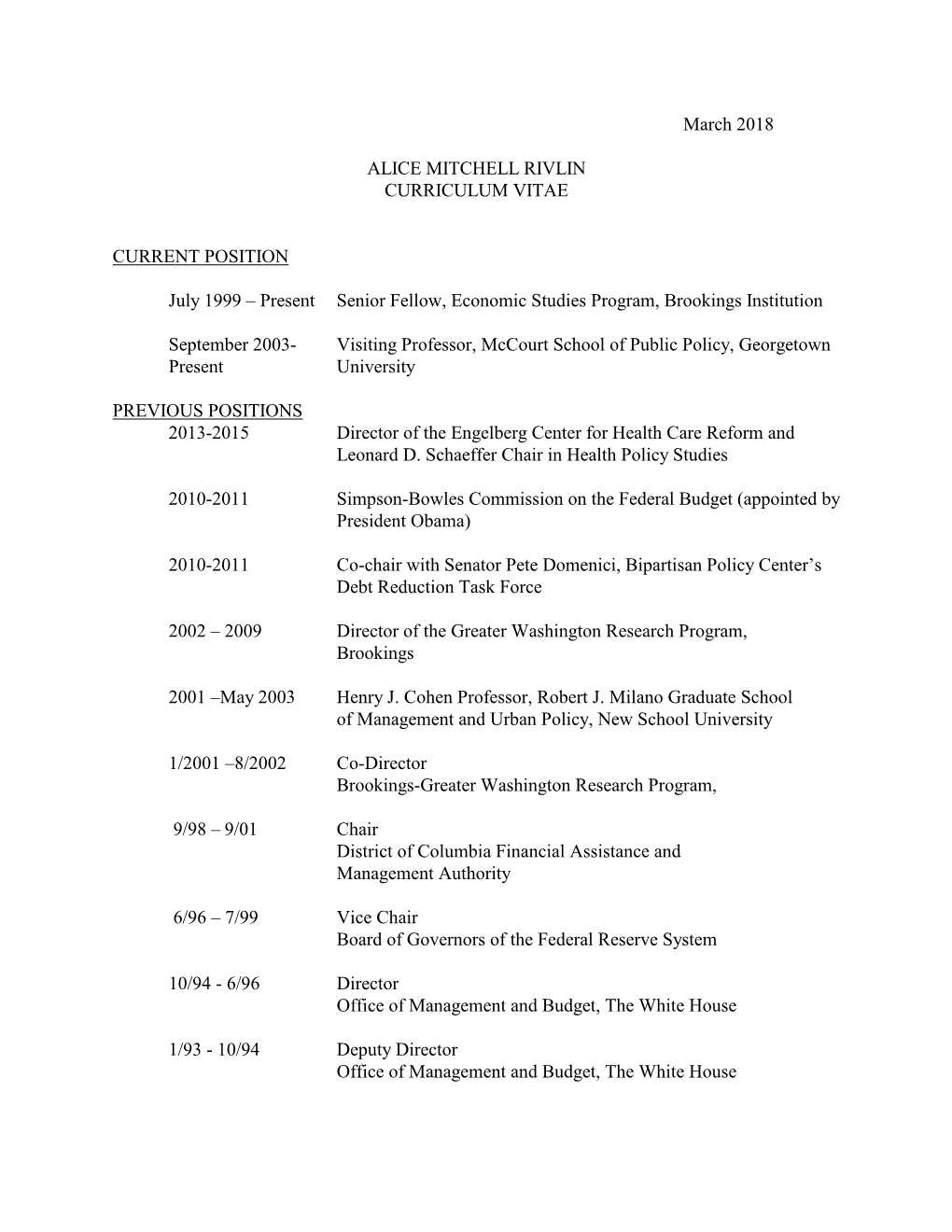

Alice Mitchell Rivlin Curriculum Vitae

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appendix File Anes 1988‐1992 Merged Senate File

Version 03 Codebook ‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐‐ CODEBOOK APPENDIX FILE ANES 1988‐1992 MERGED SENATE FILE USER NOTE: Much of his file has been converted to electronic format via OCR scanning. As a result, the user is advised that some errors in character recognition may have resulted within the text. MASTER CODES: The following master codes follow in this order: PARTY‐CANDIDATE MASTER CODE CAMPAIGN ISSUES MASTER CODES CONGRESSIONAL LEADERSHIP CODE ELECTIVE OFFICE CODE RELIGIOUS PREFERENCE MASTER CODE SENATOR NAMES CODES CAMPAIGN MANAGERS AND POLLSTERS CAMPAIGN CONTENT CODES HOUSE CANDIDATES CANDIDATE CODES >> VII. MASTER CODES ‐ Survey Variables >> VII.A. Party/Candidate ('Likes/Dislikes') ? PARTY‐CANDIDATE MASTER CODE PARTY ONLY ‐‐ PEOPLE WITHIN PARTY 0001 Johnson 0002 Kennedy, John; JFK 0003 Kennedy, Robert; RFK 0004 Kennedy, Edward; "Ted" 0005 Kennedy, NA which 0006 Truman 0007 Roosevelt; "FDR" 0008 McGovern 0009 Carter 0010 Mondale 0011 McCarthy, Eugene 0012 Humphrey 0013 Muskie 0014 Dukakis, Michael 0015 Wallace 0016 Jackson, Jesse 0017 Clinton, Bill 0031 Eisenhower; Ike 0032 Nixon 0034 Rockefeller 0035 Reagan 0036 Ford 0037 Bush 0038 Connally 0039 Kissinger 0040 McCarthy, Joseph 0041 Buchanan, Pat 0051 Other national party figures (Senators, Congressman, etc.) 0052 Local party figures (city, state, etc.) 0053 Good/Young/Experienced leaders; like whole ticket 0054 Bad/Old/Inexperienced leaders; dislike whole ticket 0055 Reference to vice‐presidential candidate ? Make 0097 Other people within party reasons Card PARTY ONLY ‐‐ PARTY CHARACTERISTICS 0101 Traditional Democratic voter: always been a Democrat; just a Democrat; never been a Republican; just couldn't vote Republican 0102 Traditional Republican voter: always been a Republican; just a Republican; never been a Democrat; just couldn't vote Democratic 0111 Positive, personal, affective terms applied to party‐‐good/nice people; patriotic; etc. -

Why Should We Worry About the National Debt: MITCH DANIELS Questions and Answers LEON PANETTA TIM PENNY April 16, 2019

CHAIRMEN Why Should We Worry About the National Debt: MITCH DANIELS Questions and Answers LEON PANETTA TIM PENNY April 16, 2019 “Why Should We Worry About the National Debt?” describes six important ways PRESIDENT MAYA MACGUINEAS that the growing national debt will affect the budget and the economy. Below, we answer specific questions frequently raised about the topic. DIRECTORS Isn’t debt sustainable when the economy grows faster than interest rates? BARRY ANDERSON Despite the fact economic growth rate is higher than government interest rates (r<g), ERSKINE BOWLES CHARLES BOWSHER debt remains on an unsustainable trajectory in the United States. Economist Olivier KENT CONRAD Blanchard and others have pointed out that governments can shrink their debt-to- DAN CRIPPEN GDP ratio while still borrowing to finance their interest payments when r<g. VIC FAZIO However, this only leads to a sustainable outcome if a government is running a WILLIS GRADISON primary balance (revenue equals non-interest spending) or a sufficiently modest JANE HARMAN WILLIAM HOAGLAND primary deficit. The United States today is running a large and growing primary JIM JONES deficit. As a result, both debt and interest payments will continue to rise faster than LOU KERR the economy despite low interest rates. There is also no guarantee that the economic JIM KOLBE growth rate will remain higher than interest rates, particularly as rising debt puts CYNTHIA LUMMIS MARJORIE MARGOLIES downward pressure on growth and upward pressure on rates. DAVE MCCURDY JAMES MCINTYRE, JR. Do low interest rates mean deficits don’t “crowd out” investment? DAVID MINGE Evidence suggests that today’s low interest rates are in spite of, not because of, high JUNE O’NEILL deficits and debt – and that deficits continue to “crowd out” investment. -

The Defense Program and the Economy Hearings

THE DEFENSE PROGRAM AND THE ECONOMY HEARINGS BEFORE THE SUBCOMMITTEE ON ECONOMIC GOALS AND INTERGOVERNMENTAL POLICY OF THE JOINT ECONOMIC COMMITTEE CONGRESS OF THE UNITED STATES NINETY-SEVENTH CONGRESS FIRST AND SECOND SESSIONS PART 1 OCTOBER 7, 13, 22, AND 29, 1981, AND DECEMBER 15, 1982 Printed for the use of the Joint Economic Committee U.S. GOVERNMENT PRINTING OFFICE 9-760 WASHINGTON:.1983 JOINT ECONOMIC COMMITTEE (Created pursuant to see. 5(a) of Public law 304, 79th Cong.) HOUSE OF REPRESENTATIVES SENATE HENRY S. REUSS, Wisconsin, Chairman ROGER W. JEPSEN, Iowa, Vice Chairman RICHARD BOLLING, Missouri WILLIAM V. ROTH, Ja., Delaware LEE H. HAMILTON, Indiana JAMES ABDNOR, South Dakota. GILLIS W. LONG, Louisiana STEVEN D. SYMMS, Idaho PARREN J. MITCHELL, Maryland PAULA HAWKINS, Florida FREDERICK W. RICHMOND, New York' MACK MATTINGLY, Georgia CLARENCE J. BROWN, Ohio LLOYD BENTSEN, Texas MARGARET M. HECKLER, Massachusetts WILLIAM PROXMIRE, Wisconsin JOHN H. ROUSSELOT, California EDWARD M. KENNEDY, Massachusetts CHALMERS P. WYLIE, Ohio PAUL S. SARBANES, Maryland JAMES K. GALBRAITH, Executive Director BRucE R. BARTLETT, Deputy Director SUBCOMMITTEE ON ECONOMIC GOALS AND INTERGOVEBNMENTAL PoLIor HOUSE OF REPRESENTATIVES SENATE LEE H. HAMILTON, Indiana, Chairman LLOYD BENTSEN, Texas, Vice Chairman RICHARD BOLLING, Missouri PAULA HAWKINS, Florida STEVEN D. SYMMS, Idaho MACK MATTINGLY, Georgia 1 Representative Richmond resigned from the U.S. House of Representatives on Aug. 25, 1982, and Representative Augustus F. Hawkins, of California, was subsequently appointed to the committee on Sept. 23, 1982. CONTENTS WITNESSES AND STATEMENTS WEDNESDAY, OCTOBEB 7, 1981 Reuss, Hon. Henry S., chairman of the Joint Economic Committee: Open- Page ing statement ------------------------------------------------- 1 Weidenbaum, Hon. -

Janet Yellen's Legacy at the Federal Reserve

Journal of Finance and Bank Management December 2019, Vol. 7, No. 2, pp. 82-87 ISSN: 2333-6064 (Print), 2333-6072 (Online) Copyright © The Author(s). All Rights Reserved. Published by American Research Institute for Policy Development DOI: 10.15640/jfbm.v7n2a6 URL: https://doi.org/10.15640/jfbm.v7n2a6 Janet Yellen’s Legacy at the Federal Reserve Alexander G. Kondeas1 Abstract This paper examines the empirical results of the monetary policies followed by the Federal Reserve during the period of 2010-2018, when Janet Yellen served first as vice chair (2010-2014) and subsequently as chair (2014-2018) of the Federal Reserve Board of Governors. As the Central Bank of the United States, the Federal Reserve System (FED) is entrusted with conducting the monetary policy in a way that fulfills the Congressional dual mandate of price stability and full employment. Janet Yellen generally adhered to a dovish view of monetary policy, one that favors looser monetary control and lower interest rates in order to stimulate economic growth. At first glance, the dual mandate was satisfied during her eight years of progressively higher leadership roles at the FED. The economic recovery from the Great Recession (2007- 2008) continued, inflation remained tamed, and the rate of unemployment fell to its lowest level since 1970. Yet a closer look at consumer spending and private fixed investment indicate a sharp decline in the years following the Great Recession and until the end of Yellen’s term at the FED. It is difficult therefore, to argue that the loose monetary policies of her years in office had much of a stimulating effect on the household sector or the business sector. -

Brief of Amici Curiae Bipartisan Economic Scholars

No. 19-840 In the Supreme Court of the United States _________ CALIFORNIA, ET AL., Petitioners, v. TEXAS, ET AL., Respondents. _________ On Writ of Certiorari to the United States Court of Appeals for the Fifth Circuit _________ BRIEF AMICI CURIAE FOR BIPARTISAN ECONOMIC SCHOLARS IN SUPPORT OF PETITIONERS _________ SHANNA H. RIFKIN MATTHEW S. HELLMAN JENNER & BLOCK LLP Counsel of Record 353 N. Clark Street JENNER & BLOCK LLP Chicago, IL 60654 1099 New York Avenue, NW Washington, DC 20001 (202) 639-6000 May 13, 2020 [email protected] i TABLE OF CONTENTS TABLE OF AUTHORITIES ......................................... iii INTEREST OF AMICI CURIAE .................................. 1 INTRODUCTION AND SUMMARY OF ARGUMENT ....................................................................... 3 ARGUMENT ....................................................................... 5 I. The Fifth Circuit’s Severability Analysis Lacks Any Economic Foundation And Would Cause Egregious Harm To Those Currently Enrolled In Medicaid And Private Individual Market Insurance As Well As Health Care Providers. ....................................................................... 5 A. Economic Data Establish That The ACA Markets Can Operate Without The Mandate. ................................................................... 5 B. There Is No Economic Reason Why Congress Would Have Wanted The Myriad Other Provisions In The ACA To Be Invalidated. ....................................................... 10 II. Because The ACA Can Operate Effectively Without -

Symposium Proceedings, 1998: Income Inequality: Issues And

The Contributors A.B. Atkinson, Warden, Nuffield College, Oxford University Mr. Atkinson is currently serving as warden of Nuffield College, Oxford University. Previously, he was professor of political econ- omy at the University of Cambridge, and chairman of the Suntory Toyota International Centre at the London School of Economics. A fellow of the British Academy, he is a past president of the Royal Economic Society, the Econometric Society, the European Eco- nomic Association, and the International Economic Association. He has served on the Royal Commission on the Distribution of Income and Wealth, the Pension Law Review Committee, and the Commis- sion on Social Justice. He is also the author or co-author of a number of books dealing with public economic issues and income distribution. Alan S. Blinder, Professor, Princeton University Mr. Blinder is the Gordon S. Rentschler Memorial Professor of Economics and co-director and founder of the Center for Economic Policy Studies at Princeton University where he has been a member of the faculty since 1971. He is also vice chairman of the G-7 Group. Between June 1994 and January 1996, he was vice chairman of the Board of Governors of the Federal Reserve System. Before joining the Board, he was a member of President Clinton’s Council of Eco- nomic Advisers where he was in charge of macroeconomic forecast- ing and also worked on budget, international trade, and health care issues. Mr. Blinder is the author or co-author of 12 books and scores ix x Contributors of articles on such topics as fiscal policy, monetary policy, and the distribution of income. -

Union Calendar No. 607

1 Union Calendar No. 607 110TH CONGRESS " ! REPORT 2d Session HOUSE OF REPRESENTATIVES 110–934 REPORT ON THE LEGISLATIVE AND OVERSIGHT ACTIVITIES OF THE COMMITTEE ON WAYS AND MEANS DURING THE 110TH CONGRESS JANUARY 2, 2009.—Committed to the Committee of the Whole House on the State of the Union and ordered to be printed U.S. GOVERNMENT PRINTING OFFICE 79–006 WASHINGTON : 2009 VerDate Nov 24 2008 22:51 Jan 06, 2009 Jkt 079006 PO 00000 Frm 00001 Fmt 4012 Sfmt 4012 E:\HR\OC\HR934.XXX HR934 sroberts on PROD1PC70 with HEARING E:\Seals\Congress.#13 COMMITTEE ON WAYS AND MEANS CHARLES B. RANGEL, New York, Chairman FORTNEY PETE STARK, California JIM MCCRERY, Louisiana SANDER M. LEVIN, Michigan WALLY HERGER, California JIM MCDERMOTT, Washington DAVE CAMP, Michigan JOHN LEWIS, Georgia JIM RAMSTAD, Minnesota RICHARD E. NEAL, Massachusetts SAM JOHNSON, Texas MICHAEL R. MCNULTY, New York PHIL ENGLISH, Pennsylvania JOHN S. TANNER, Tennessee JERRY WELLER, Illinois XAVIER BECERRA, California KENNY C. HULSHOF, Missouri LLOYD DOGGETT, Texas RON LEWIS, Kentucky EARL POMEROY, North Dakota KEVIN BRADY, Texas STEPHANIE TUBBS JONES, Ohio THOMAS M. REYNOLDS, New York MIKE THOMPSON, California PAUL RYAN, Wisconsin JOHN B. LARSON, Connecticut ERIC CANTOR, Virginia RAHM EMANUEL, Illinois JOHN LINDER, Georgia EARL BLUMENAUER, Oregon DEVIN NUNES, California RON KIND, Wisconsin PAT TIBERI, Ohio BILL PASCRELL, JR., New Jersey JON PORTER, Nevada SHELLY BERKLEY, Nevada JOSEPH CROWLEY, New York CHRIS VAN HOLLEN, Maryland KENDRICK MEEK, Florida ALLYSON Y. SCHWARTZ, Pennsylvania ARTUR DAVIS, Alabama (II) VerDate Nov 24 2008 13:20 Jan 06, 2009 Jkt 079006 PO 00000 Frm 00002 Fmt 5904 Sfmt 5904 E:\HR\OC\HR934.XXX HR934 sroberts on PROD1PC70 with HEARING LETTER OF TRANSMITTAL U.S. -

Regional Oral History Office University of California the Bancroft Library Berkeley, California

Regional Oral History Office University of California The Bancroft Library Berkeley, California Charles Schultze Slaying the Dragon of Debt: Fiscal Politics and Policy from the 1970s to the Present A project of the Walter Shorenstein Program in Politics, Policy and Values Interviews conducted by Martin Meeker in 2010 Copyright © 2011 by The Regents of the University of California ii Since 1954 the Regional Oral History Office has been interviewing leading participants in or well-placed witnesses to major events in the development of Northern California, the West, and the nation. Oral History is a method of collecting historical information through tape-recorded interviews between a narrator with firsthand knowledge of historically significant events and a well-informed interviewer, with the goal of preserving substantive additions to the historical record. The tape recording is transcribed, lightly edited for continuity and clarity, and reviewed by the interviewee. The corrected manuscript is bound with photographs and illustrative materials and placed in The Bancroft Library at the University of California, Berkeley, and in other research collections for scholarly use. Because it is primary material, oral history is not intended to present the final, verified, or complete narrative of events. It is a spoken account, offered by the interviewee in response to questioning, and as such it is reflective, partisan, deeply involved, and irreplaceable. ********************************* All uses of this manuscript are covered by a legal agreement between The Regents of the University of California and Charles Schultze, dated January 19, 2011. The manuscript is thereby made available for research purposes. All literary rights in the manuscript, including the right to publish, are reserved to The Bancroft Library of the University of California, Berkeley. -

Henry Aaron, Brookings Insitution Gilbert Metcalf, Tufts University

An Open Statement Opposing Proposals for a Gas Tax Holiday In recent weeks, there have been proposals in Congress and by some presidential candidates to suspend the gas tax for the summer. As economists who study issues of energy policy, taxation, public finance, and budgeting, we write to indicate our opposition to this policy. Put simply, suspending the federal tax on gasoline this summer is a bad idea and we oppose it. There are several reasons for this opposition. First, research shows that waiving the gas tax would generate major profits for oil companies rather than significantly lowering prices for consumers. Second, it would encourage people to keep buying costly imported oil and do nothing to encourage conservation. Third, a tax holiday would provide very little relief to families feeling squeezed. Fourth, the gas tax suspension would threaten to increase the already record deficit in the coming year and reduce the amount of money going into the highway trust fund that maintains our infrastructure. Signers of this letter are Democrats, Republicans and Independents. This is not a partisan issue. It is a matter of good public policy. Henry Aaron, Brookings Insitution Gilbert Metcalf, Tufts University Joseph Stiglitz, Columbia University (Nobel Prize in Economics, 2001) James Heckman, University of Chicago (Nobel Prize in Economics, 2000) Daniel Kahneman, Princeton University (Nobel Prize in Economics, 2002) Charles Schultze, Brookings Institution (President of the American Economic Association, 1984, Chairman Council of Economic Advisers 1977-1981, Director, Bureau of the Budget, 1965-1967) Alice Rivlin, Brookings Institution (President of the American Economic Association, 1986, Director of O.M.B. -

Tell Congress╦.It's Time to Invest in America

laliiii I l .1 C T ~;;; ;ta (/)o., O~ CD= ~o " <Eo~ ::::i •I:I 0 ::::i 'II '- I ? ~ !. c::: 1992 can be the year we begin defending health care for good jobs and to improve vital 0 ,:!: . = () () :II - !:;. .., n all its citizens. services provided by our cities I to Invest In America again. Germany "':i:,. O Ill 0 < .. And we've never needed it and Japan Now it's and states. 8 (D ii! co ::::i CD q ~ (J) C: (J) C: more. Our economy is faltering, against a ...,~ America's Tell Congress you want to sfi I ~ O.l ~ in O.l ~ in jobs are disappearing. Our threat that turn . It's time (/) O.l • z "a (/) O.l • r('\~ ~~~ rebuild America. Send the ::r ,...,. en ~ ::s. ::r ,...,. en ' " ~'-- -____.: \ - · (D - 0 - · (D schools are falling short. Health no longer to meet vital ,, ::s. attached postcards today. c6 0 Cl 0 c:r. c6 0 Cl ...... :I c: CD ...... :I care costs so much Americans exists. In fA~~ _J L: =-- ~✓~, needs at 0 =+: I» 0 =+: I» Make sure your Senators ::::J - · .. 5' Ill ::::J - · .. () 0 ,, () 0 can't afford to get sick. fact. we home with mil and Representative know that 0 (D .. 0 0 (D .. 0 OJ 0..., 0 OJ But now spend ,t, /-__, "'( Ji'-" itary dollars no you believe ifs time to Invest C: C: I\) Q.. I\) - the world more to longer needed in America. 0 - · 0 Q- Ul ::i ::::J has changed . defend abroad . _. c.a -~ c.a 0 0 The Soviet Germany Defense Union is no than Ger experts say more. -

The Buttonwood Gathering New York, October 25 - 26, 2010 the Graduate Center/City University of New York

The Buttonwood Gathering New York, October 25 - 26, 2010 The Graduate Center/City University of New York About the event At last year’s Buttonwood Gathering, National Economic Council Director Larry Summers called on banks to accept the responsibility of greater regulation as a service to their country. Have they taken his words to heart? As the news continues to tell of a weak and jobless recovery, are banks and other financial institutions living up to their responsibilities? Once again in 2010, The Buttonwood Gathering will draw together leading policymakers, banking executives and regulators to discuss restoring trust in the financial system and evaluate our place on the road to recovery. Chair person John Micklethwait, Editor-in-Chief, The Economist The Bagehot lecture Mervyn King, Governor, Bank of England Confirmed speakers Mark Almeida, President, Moody’s Analytics Clifford Asness, Managing & Founding Principal, AQR Capital Management Zanny Minton Beddoes, Economics Editor, The Economist Matthew Bishop, American Business Editor, New York Bureau Chief, The Economist Joshua Bolten, Visiting Professor, Princeton University Joyce Chang, Managing Director and Global Head of Emerging Markets Strategy and Credit Research, JPMorgan James Chanos, Founder and Managing Partner, Kynikos Associates Ed Clark, President and Chief Executive Officer, TD Bank Financial Group Philip Coggan, Capital Markets Editor and Buttonwood Columnist, The Economist Sean Dobson, Chairman and Chief Executive Officer, Amherst Securities Group Former Senator Pete -

![CHAIRMEN of SENATE STANDING COMMITTEES [Table 5-3] 1789–Present](https://docslib.b-cdn.net/cover/8733/chairmen-of-senate-standing-committees-table-5-3-1789-present-978733.webp)

CHAIRMEN of SENATE STANDING COMMITTEES [Table 5-3] 1789–Present

CHAIRMEN OF SENATE STANDING COMMITTEES [Table 5-3] 1789–present INTRODUCTION The following is a list of chairmen of all standing Senate committees, as well as the chairmen of select and joint committees that were precursors to Senate committees. (Other special and select committees of the twentieth century appear in Table 5-4.) Current standing committees are highlighted in yellow. The names of chairmen were taken from the Congressional Directory from 1816–1991. Four standing committees were founded before 1816. They were the Joint Committee on ENROLLED BILLS (established 1789), the joint Committee on the LIBRARY (established 1806), the Committee to AUDIT AND CONTROL THE CONTINGENT EXPENSES OF THE SENATE (established 1807), and the Committee on ENGROSSED BILLS (established 1810). The names of the chairmen of these committees for the years before 1816 were taken from the Annals of Congress. This list also enumerates the dates of establishment and termination of each committee. These dates were taken from Walter Stubbs, Congressional Committees, 1789–1982: A Checklist (Westport, CT: Greenwood Press, 1985). There were eleven committees for which the dates of existence listed in Congressional Committees, 1789–1982 did not match the dates the committees were listed in the Congressional Directory. The committees are: ENGROSSED BILLS, ENROLLED BILLS, EXAMINE THE SEVERAL BRANCHES OF THE CIVIL SERVICE, Joint Committee on the LIBRARY OF CONGRESS, LIBRARY, PENSIONS, PUBLIC BUILDINGS AND GROUNDS, RETRENCHMENT, REVOLUTIONARY CLAIMS, ROADS AND CANALS, and the Select Committee to Revise the RULES of the Senate. For these committees, the dates are listed according to Congressional Committees, 1789– 1982, with a note next to the dates detailing the discrepancy.