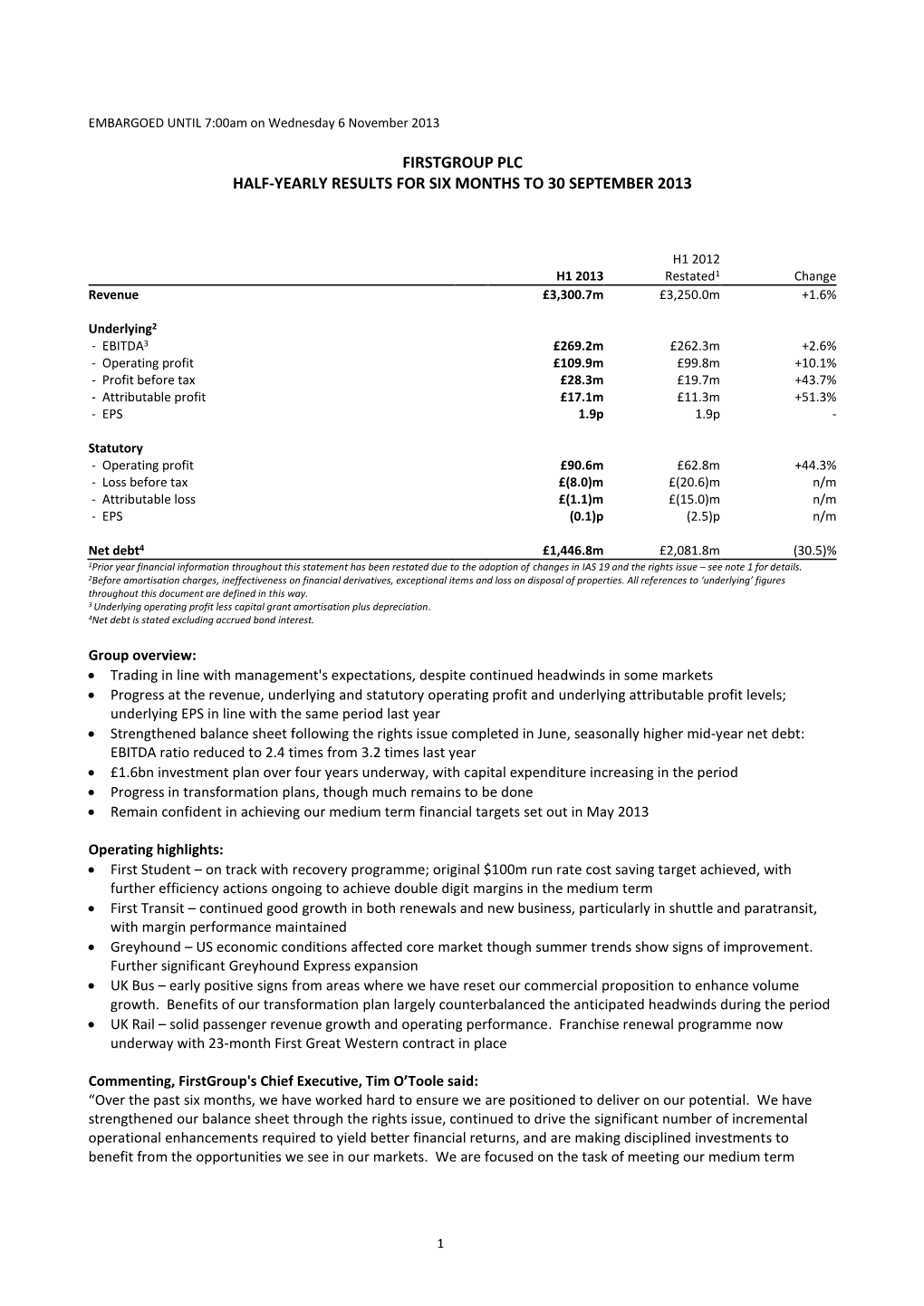

Firstgroup Plc Half-Yearly Results for Six Months to 30 September 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Firstgroup Plc Annual Report and Accounts 2015 Contents

FirstGroup plc Annual Report and Accounts 2015 Contents Strategic report Summary of the year and financial highlights 02 Chairman’s statement 04 Group overview 06 Chief Executive’s strategic review 08 The world we live in 10 Business model 12 Strategic objectives 14 Key performance indicators 16 Business review 20 Corporate responsibility 40 Principal risks and uncertainties 44 Operating and financial review 50 Governance Board of Directors 56 Corporate governance report 58 Directors’ remuneration report 76 Other statutory information 101 Financial statements Consolidated income statement 106 Consolidated statement of comprehensive income 107 Consolidated balance sheet 108 Consolidated statement of changes in equity 109 Consolidated cash flow statement 110 Notes to the consolidated financial statements 111 Independent auditor’s report 160 Group financial summary 164 Company balance sheet 165 Notes to the Company financial statements 166 Shareholder information 174 Financial calendar 175 Glossary 176 FirstGroup plc is the leading transport operator in the UK and North America. With approximately £6 billion in revenues and around 110,000 employees, we transported around 2.4 billion passengers last year. In this Annual Report for the year to 31 March 2015 we review our performance and plans in line with our strategic objectives, focusing on the progress we have made with our multi-year transformation programme, which will deliver sustainable improvements in shareholder value. FirstGroup Annual Report and Accounts 2015 01 Summary of the year and -

RC02 Electrification Paper

Electrification paper Introduction to the Rail Cluster Project The Rail Cluster Builder project was awarded to Scottish Engineering in August 2020 and is an 18-month programme funded by Scottish Enterprise and supported by Transport Scotland. The purpose of the project is to facilitate connections for SMEs in the engineering and manufacturing sectors in Scotland seeking to diversify into the rail market. The project is jointly funded by Scottish Enterprise and the 2014 – 2020 European Structural and Investment Fund through SPRITE (Scottish Programme for Research, Innovation and Technology Ecosystem). This is a small programme which aims to improve the innovation performance of Scotland’s Small and Medium Sized Enterprises (SMEs) and stimulate greater coordination between stakeholders and partner organisations to help businesses capitalise on new economic and public sector innovation opportunities. The roots of the rail cluster project lie in the Rail Services Decarbonisation Plan in which the Scottish Government aims to decarbonise passenger rail services in Scotland by 2035, ahead of the UK’s target of 2040. By moving away from diesel and using green sources such as electricity, battery or hydrogen, opportunities will arise for innovation in train manufacturing as well as wider supply chains, supporting the creation of skilled, sustainable employment in Scotland. The Rail Cluster Builder will be key in helping to develop Scotland as a leader in the innovation and manufacture of net zero rail products and services. The UK government set out in June 2019 its legal commitment to achieve ‘net zero’ greenhouse gas emissions by 2050. In respect of the railway, in 2018 the DfT challenged the rail industry to remove all diesel-only trains from the network by 2040. -

View Annual Report

FirstGroupplc Principal and registered office London office FirstGroup plc FirstGroup plc 395 King Street 50 Eastbourne Terrace Aberdeen AB24 5RP Paddington Keeping people Tel. +44 (0)1224 650100 London W2 6LG Fax. +44 (0)1224 650140 Tel. +44 (0)20 7291 0505 Ann Registered in Scotland Fax. +44 (0)20 7436 3337 ualReport and Accounts 2012 number SC157176 www.firstgroup.com moving and Printed in the UK by Royle Print, a Carbon Neutral printing company, on material made from 100% post consumer waste; the printer and paper communities manufacturing mill are both accredited with ISO 14001 environmental management systems standard and both are Forestry Stewardship Council certified. When you have finished with this report, please dispose of it in your recycled waste stream. prospering www.firstgroup.com Annual Report and Accounts 2012 Overview About us Shareholder profile At 23 May 2012 Number of shareholders % Shares held % Performance By category FirstGroup plc is the leading transport Individuals 37,892 95.0 46,748,910 9.7 operator in the UK and North America. Banks and Nominees 1,695 4.3 427,940,406 88.8 Insurance and assurance 1 – 300 – With revenues of over £6.5 billion per Other companies 114 0.3 1,889,454 0.4 Other institutions 150 0.4 5,488,100 1.1 annum and approximately 124,000 39,852 100.0 482,067,170 100.0 employees we transport more than By size of holding 1-1,000 30,642 76.9 8,011,808 1.7 Governance 2.5 billion passengers every year. 1,001-5,000 7,138 17.9 15,759,366 3.3 5,001-10,000 1,072 2.7 7,428,005 1.5 In our increasingly congested world 10,001-100,000 699 1.7 19,184,334 4.0 we help to keep people moving and Over 100,000 301 0.8 431,683,657 89.5 39,852 100.0 482,067,170 100.0 communities prospering. -

Scottish Strategic Rail Study Final Report

Scottish Strategic Rail Study Final Report Scottish Strategic Rail Study Rail Strategic Scottish Transport Research Series Research Transport I SBN 0-7559- 3528- 4 ISSN 0950 2254 ISBN 0 7559 3528 4 Transport Research Price £5.00 Planning Group 9 780755 935284 ASTRON 207854 02-03 Further copies of this report are available priced £5.00. Cheques should be made payable to The Stationery Office Ltd and addressed to: The Stationery Office Bookshop 71 Lothian Road Edinburgh EH3 9AZ Tel: 0870 606 5566 Fax: 0870 606 5588 The views expressed in this report are those of the researchers and do not necessarily represent those of the Department or Scottish Ministers. © Crown Copyright 2003 Limited extracts from the text may be produced provided the source is acknowledged. For more extensive reproduction, please write to the Chief Research Officer at the Office of Chief Researcher, 3rd Floor West Rear, St Andrew’s House, Edinburgh EH1 3DG SCOTTISH STRATEGIC RAIL STUDY Final Report March 2003 Prepared for: Prepared by: Scottish Executive & Steer Davies Gleave Scottish Strategic Rail Study Project Steering Group Reception House 21 Lansdowne Crescent Edinburgh EH12 5EH [t] +44 (0)131-535 1101 [i] www.steerdaviesgleave.com Further copies of this report are available priced £5.00. Cheques should be made payable to The Stationery Office Ltd and addressed to: The Stationery Office Bookshop 71 Lothian Road Edinburgh EH3 9AZ Tel: 0870 606 5566 Fax: 0870 606 5588 The views expressed in this report are those of the researchers and do not necessarily represent those of the Department or Scottish Ministers. -

Portland's Big Step

THE INTERNATIONAL LIGHT RAIL MAGAZINE HEADLINES l Grand Paris Express project approved l Chicago invites new L-Train bids l New cross-industry lobbying group formed CROSSING THE RIVER: PORtland’s big step 120 years of the Manx Electric Railway Budapest renewals Czech car building The challenges of From Tatra to modernising one PRAGOIMEX: of Europe’s Proven tram largest tramways technology MAY 2013 No. 905 WWW . LRTA . ORG l WWW . TRAMNEWS . NET £3.80 TAUT_1305_Cover.indd 1 04/04/2013 16:59 Grooved rail to carry you far into the future Together we make the difference At Tata Steel, we believe that the secret to developing rail products and services that address the demands of today and tomorrow, lies in our lasting relationships with customers. Our latest innovation is a high performance grooved rail that has three times wear resistance* and is fully weld-repairable, responding to our customers’ needs for reduced life cycle costs. Tata Steel Tata Steel Rail Rail 2 Avenue du Président Kennedy PO Box 1, Brigg Road 78100 Saint Germain en Laye Scunthorpe, DN16 1BP France UK T: +33 (0) 139 046 300 T: +44 (0) 1724 402112 F: +33 (0) 139 046 344 F: +44 (0) 1724 403442 www.tatasteelrail.com [email protected] *Compared to R260 Untitled-2 1 03/04/2013 11:26 TS_Rail Sector Ad_Revised.indd 1 25/09/2012 08:57 Contents The official journal of the Light Rail Transit Association 164 News 164 MAY 2013 Vol. 76 No. 905 European electrified transport lobbying group launched; Not- www.tramnews.net tingham enters intensive works phase; US public transport’s EDITORIAL 57-year high; 200km Grand Paris Express metro network Editor: Simon Johnston approved; Chicago invites bid for next-generation L-train cars; Tel: +44 (0)1832 281131 E-mail: [email protected] Eaglethorpe Barns, Warmington, Peterborough PE8 6TJ, UK. -

Brussels, 30.1.2013 SWD(2013) 10 Final

EUROPEAN COMMISSION Brussels, 30.1.2013 SWD(2013) 10 final Part 4 COMMISSION STAFF WORKING DOCUMENT IMPACT ASSESSMENT Accompanying the documents Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EC) No 1370/2007 concerning the opening of the market for domestic passenger transport services by rail Proposal for a Directive of the European Parliament and of the Council amending Directive 2012/34/EU of the European Parliament and of the Council of 21 November 2012 establishing a single European railway area, as regards the opening of the market for domestic passenger transport services by rail and the governance of the railway infrastructure {COM(2013) 28 final} {COM(2013) 29 final} {SWD(2013) 11 final} {SWD(2013) 12 final} {SWD(2013) 13 final} EN EN COMMISSION STAFF WORKING DOCUMENT IMPACT ASSESSMENT Accompanying the documents Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EC) No 1370/2007 concerning the opening of the market for domestic passenger transport services by rail Proposal for a Directive of the European Parliament and of the Council amending Directive 2012/34/EU of the European Parliament and of the Council of 21 November 2012 establishing a single European railway area, as regards the opening of the market for domestic passenger transport services by rail and the governance of the railway infrastructure Disclaimer: This impact assessment commits only the Commission's services involved in its preparation and does not prejudge the final form of any decision to be taken by the Commission EN 2 EN ANNEX 4 ANALYSIS OF NATIONAL RAIL MARKETS Introduction This annex gives an overview of the structure of the current national rail markets in terms of competition for the market (mostly public service obligations) and competition in the market (mostly commercial services under open access). -

Printmgr File

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take, you are recommended to seek your own personal financial advice immediately from your stockbroker, bank manager, solicitor, accountant, fund manager or other independent financial adviser authorised under FSMA if you are in the United Kingdom or, if you are not, from another appropriately authorised independent financial adviser. This document comprises a circular and a prospectus relating to FirstGroup and the Rights Issue, prepared in accordance with the Prospectus Rules of the UK Listing Authority made under section 73A of FSMA. This document has been approved by the FCA in accordance with section 85 of FSMA. A copy of this document has been filed with the FCA in accordance with paragraph 3.2.1 of the Prospectus Rules. This document will be made available to the public in accordance with paragraph 3.2.1 of the Prospectus Rules by the same being made available at www.firstgroup.com. This document can also be obtained on request from the Receiving Agent. Subject to the restrictions set out below, if you sell or transfer or have sold or transferred all of your Existing Ordinary Shares (other than ex- rights) held in certificated form before 8.00 a.m. on 11 June 2013 (the “Ex-Rights Date”), please send this document, together with any Provisional Allotment Letter, if and when received, as soon as possible to the purchaser or transferee, or to the stockbroker, bank or other agent through whom the sale or transfer was effected, for onward delivery to the purchaser or transferee. -

RAIL STAFF TRAVEL in EUROPE (FIP): Tips on Making the Most of Your Benefits DISCOUNTED TRAVEL FIP Discounted Travel Bookings

v11: 010513 RAIL STAFF TRAVEL IN EUROPE (FIP): tips on making the most of your benefits DISCOUNTED TRAVEL FIP discounted travel bookings are handled for RSTL by Deutsche Bahn UK (aka DB-UK). You can contact DB-UK by telephone on 08444 997171 if you are planning a simple journey using your FIP travel facilities. For example, to make a Eurostar reservation from London St. Pancras to Paris at the special FIP reduced rate fare, call that number, quote your FIP card number (bottom right hand corner of the card) and they‟ll do the rest. For multiple station journeys, eg travelling from London St. Pancras to Italy via France and Switzerland, you need to complete an IPTIS booking form (Form 1213), which can be found online at http://www.atoc.org/about-atoc/rail-staff-travel/forms). You can send your IPTIS booking form to DB-UK by e-mail, fax or post: full details on the form itself. Useful tips when making a booking through DB-UK To make your booking as quick and easy for you as possible, please always remember to have the following information to hand before contacting DB-UK: 1. Know the date(s) that you wish to travel. 2. Know which stations/countries you wish to travel to or through. 3. Have your valid FIP card to hand to make your booking (your coupons are not required when booking through DB UK). 4. Have a valid credit or debit card so you can quote the number by phone or add it to your IPTIS booking form. -

Future Prospects of Short Distance Rail Based Passenger Transport in Northern Europe

LAPPEENRANTA UNIVERSITY OF TECHNOLOGY Faculty of Technology Management Department of Industrial Management FUTURE PROSPECTS OF SHORT DISTANCE RAIL BASED PASSENGER TRANSPORT IN NORTHERN EUROPE Instructor and Supervisor Prof. Olli-Pekka Hilmola Supervisor Doctoral student, M.Sc. (Econ.) Milla Laisi Kouvola, March 11, 2011 Tiina Susanna Poikolainen Eräpolku 6 b 16 45130 KOUVOLA ii ABSTARCT Author: Tiina Susanna Poikolainen Title: Future prospects of short distance rail based passenger transport in Northern Europe Department: Industrial Management Year: 2011 Place: Kouvola Master’s Thesis. Lappeenranta University of Technology. 107 pages, 19 figures, 21 tables and 11 appendices. Supervisors: Professor Olli-Pekka Hilmola Doctoral student, M.Sc. (Econ.) Milla Laisi Keywords: Commuter transport, passenger railway market deregulation, passenger railway transport, public transport, railway undertaking The worlds’ population is increasing and cities have become more crowded with people and vehicles. Communities in the fringe of metropolitans’ increase the traffic done with private cars, but also increase the need for public transportation. People have typically needs traveling to work located in city centers during the morning time, and return to suburbs in the afternoon or evening. Rail based passenger transport is environmentally friendly transport mode with high capacity to transport large volume of people. Railways have been regulated markets with national incumbent having monopoly position. Opening the market for competition is believed to have a positive effect by increasing the efficiency of the industry. National passenger railway market is opened for competition only in few countries, where as international traffic in EU countries was deregulated in 2010. The objective of this study is to examine the passenger railway market of three North European countries, Sweden, Denmark and Estonia. -

Returning to Strength Firstgroup

Returning to strength FirstGroup plc Annual Report and Accounts 2013 FirstGroup plc Annual Report and Accounts 2013 FirstGroup plc is the leading transport operator in the UK and North America. With revenues of more than £6.9 billion per annum and approximately 120,000 employees, we transport more than 2.5 billion passengers every year. Contents Overview Financial statements 01 Business summary 76 Consolidated income statement 01 Financial highlights 2012/13 77 Consolidated statement of comprehensive income 02 Chairman’s statement 78 Consolidated balance sheet 04 Chief Executive’s strategic review 79 Consolidated statement of changes in equity 06 Our business model 80 Consolidated cash flow statement 08 Our businesses 81 Notes to the consolidated financial statements 10 Our markets 128 Independent auditor’s report Performance 129 Group financial summary 130 Company balance sheet 16 Operating and financial review 131 Notes to the Company financial statements 40 Key performance indicators 138 Independent auditor’s report 42 Corporate responsibility 139 Glossary 46 Risks and uncertainties 140 Shareholder information Governance 141 Financial calendar 52 Board of Directors 54 Corporate governance 63 Directors’ remuneration report 72 Directors’ report 75 Directors’ responsibilities statement Find out more about FirstGroup on our website www.firstgroup.com Business summary Solid performance for the year with overall First Student recovery plan is on track, building on trading in line with management’s expectations progress made from a more efficient operating model and transformation plans on track and uniform practices Fully underwritten c.£615m rights issue to remove First Transit saw strong growth underpinned by Overview balance sheet constraints and enable continued good contract wins. -

Sharpness Branch Line Outline Case Submission

TECHNICAL NOTE Job Name: Sharpness Vale Job No: 332210067 Note No: 332210067/TN-LP01 Date: 23rd June 2021 Subject: Status and context of the Restoring your Railway – Sharpness Branch Line - Outline Case Submission – 30th September 2020 1. Introduction As part of the development of Stroud DC’s submission for support through the DfT’s “Restoring your Railway” fund (“RyR”), a range of supporting evidence was prepared. Sharpness Development LLP, as promoters of the Sharpness new settlement (included in the draft Local Plan as strategic housing allocation PS36), contributed a document titled “Restoring your Railway – Sharpness Branch Line - Outline Case Submission – 30th September 2020”. The Outline Business Case document provided supporting information for the purposes of the RyR bid process to provide confidence to DfT that the scheme was both viable and deliverable. The original document is attached to this note, but with redactions in respect of personal information related to individuals involved in compiling the note and the addition of a footnote to explain the updated status of one of the members of the Sharpness Development LLP. 2. Context The document was provided as a supplementary submission, outside of the formal RyR process, in response to queries raised by DfT after the first round submission was completed by Stroud DC. DfT considered that the level of detail available in respect of the Sharpness branch line proposals might allow them to be considered under a different funding regime or to transfer to a capital schemes process. Hence, they asked for greater detail of the proposals, to the extent that this was available, in order for them to determine which process would be most appropriate for the Sharpness scheme to be placed within. -

Firstgroup Plc Annual Report and Accounts 2014 Firstgroup Plc Is the Leading Transport Operator in the UK and North America

FirstGroup plc Annual Report and Accounts 2014 FirstGroup plc Annual Report and Accounts 2014 FirstGroup plc is the leading transport operator in the UK and North America. With revenues of more than £6.7 billion per annum and approximately 117,000 employees, we transport around 2.5 billion passengers every year. Contents Strategic report Business summary and financial highlights 2013/14 01 This strategic report, set out on pages Chairman’s statement 02 1 to 49, includes an analysis of our Group overview 04 Chief Executive’s strategic review 06 performance and financial position, Business model 08 a review of the business during the Strategic objectives 10 year, and outlines the principal risks Business review 12 and uncertainties we face. Corporate responsibility 32 Key performance indicators 34 Risks and uncertainties 36 Financial review 42 Governance Board of Directors 50 We introduce our Board, explain our Directors’ and corporate governance report 52 approach to corporate governance and Directors’ remuneration report 70 Directors’ remuneration policy 71 give details of the Group’s remuneration Directors’ annual report on remuneration 81 principles and policies to support Directors’ responsibilities statement 93 shareholder value creation. Financial statements Consolidated income statement 94 This section contains the financial Consolidated statement of comprehensive income 95 statements, the auditor’s report, the Consolidated balance sheet 96 Consolidated statement of changes in equity 97 accounting policies and the notes to the Consolidated cash flow statement 98 accounts together with a glossary of Notes to the consolidated financial statements 99 terms, information for our shareholders Independent auditor’s report 149 and our financial calendar.