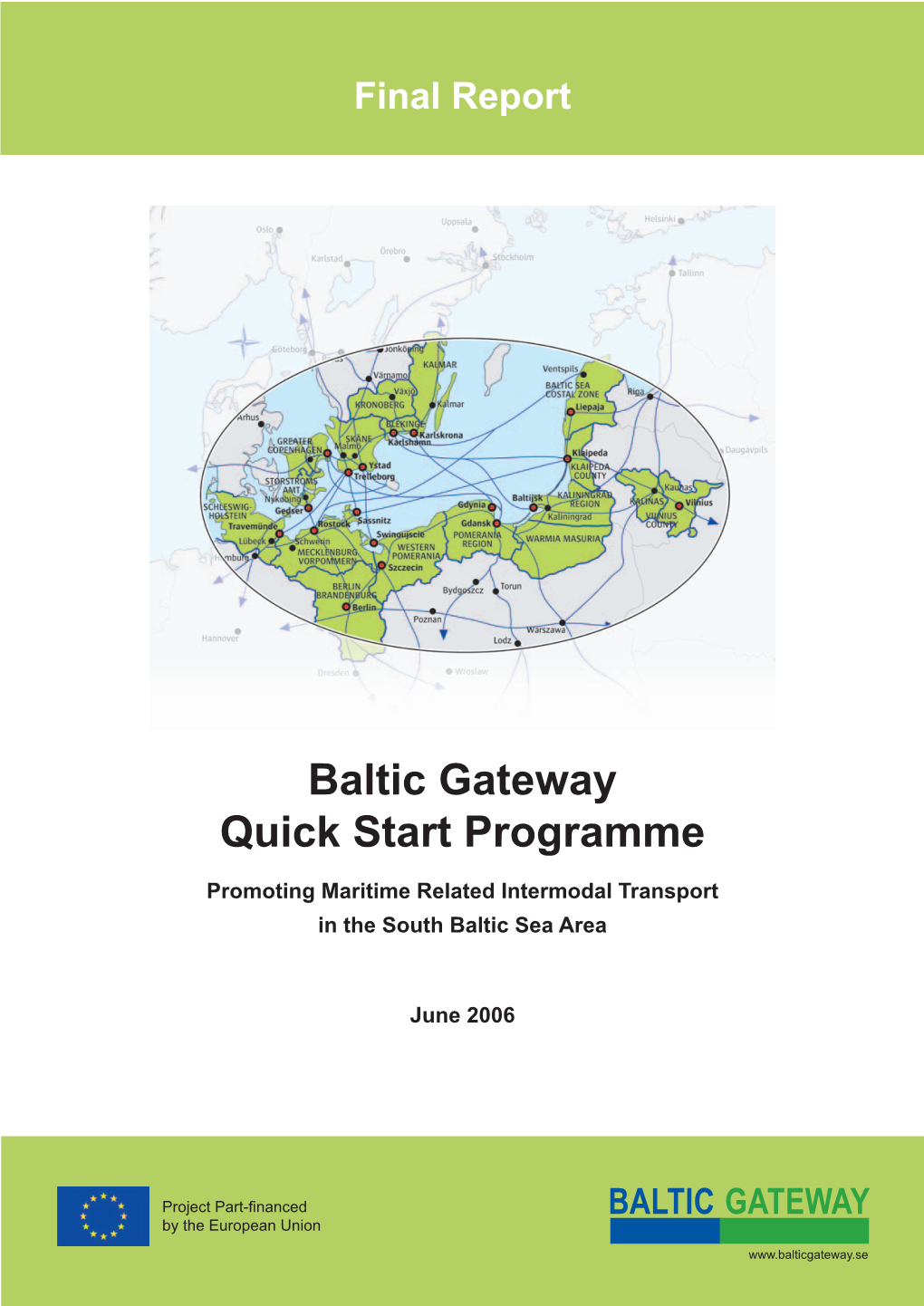

Baltic Gateway Quick Start Programme

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Elections Act the Elections Act (1997:157) (1997:157) 2 the Elections Act Chapter 1

The Elections Act the elections act (1997:157) (1997:157) 2 the elections act Chapter 1. General Provisions Section 1 This Act applies to elections to the Riksdag, to elections to county council and municipal assemblies and also to elections to the European Parliament. In connection with such elections the voters vote for a party with an option for the voter to express a preference for a particular candidate. Who is entitled to vote? Section 2 A Swedish citizen who attains the age of 18 years no later than on the election day and who is resident in Sweden or has once been registered as resident in Sweden is entitled to vote in elections to the Riksdag. These provisions are contained in Chapter 3, Section 2 of the Instrument of Government. Section 3 A person who attains the age of 18 years no later than on the election day and who is registered as resident within the county council is entitled to vote for the county council assembly. A person who attains the age of 18 years no later than on the election day and who is registered as resident within the municipality is entitled to vote for the municipal assembly. Citizens of one of the Member States of the European Union (Union citizens) together with citizens of Iceland or Norway who attain the age of 18 years no later than on the election day and who are registered as resident in Sweden are entitled to vote in elections for the county council and municipal assembly. 3 the elections act Other aliens who attain the age of 18 years no later than on the election day are entitled to vote in elections to the county council and municipal assembly if they have been registered as resident in Sweden for three consecutive years prior to the election day. -

Osby Kyrkobok 1647 - 1690

Osby kyrkobok 1647 - 1690 transkriberad av Ulf Svarte Bagge och Tord Jšran Hallberg UtgŒva 1, maj 1995 ii InnehŒll Sida V=vŠnster spalt H=hšger spalt F…RORD iii INLEDANDE ANM€RKNINGAR iv DATUMBER€KNING v KYRKOBOKEN Christian IV:s fšrordning om kyrkobokfšring 1646 1H TillŠgg till fšrordningen 1669 2V Vigda 1647 - 1690 2H - 32V Publicae absolverede 1660 - 1690 32H - 39V Dšpta 1647 - 1674 44H - 152V Begravda 1647 - 1684 152H - 228V Dšpta 1674 - 1690 228H - 240H Begravda 1685 - 1690 241H - 246H ORTNAMNSREGISTER 1 - 24 iii Fel upptŠckta efter tryckningen Fšrord 7H:4 Denna transkription av Osby sockens Šldsta kyrkobok har Festo Circumcis. Dominica Desp. varit Ulf Svarte Bagges hobby sedan 1989. Den har skall vara kontrollŠsts av Tord Jšran Hallberg i tvŒ omgŒngar, innan Festo Circumcis. Domini Desp. denna utgŒva givits ut. JŠmfšrt med Jan Lindstršms tidigare gjorda och genom 8H:32 SkŒnes Genealogiska Fšrening utgivna transkription, CoPulati Dnic. 2 P. Trin. dvs Sct. Hans Da* kŠnnetecknas vŒr transkription av att faddrarna och latinet har tagits med. skall vara CoPulati Dnic. 2 P. Trin. ++ Sct. Hans Da* BetrŠffande kvaliteten Šr det inte vŒr sak att bedšma den, men vi tror att den svenska texten Šr sŒ gott som felfri, medan en del fel fšrmodligen ŒterstŒr i den latinska texten 9V:20 (ingen av oss Šr latinkunnig). Copul. Dn. EPiPh. Domini. dvs 6 Janu* skall vara MŒlet med transkriptionen har varit att gšra en av de viktigaste kŠllorna till Osby sockens Šldsta historia Copul. Dn. EPiPh. Domini. ++ 6 Janu* tillgŠnglig fšr slŠktforskare, hembygdsforskare m fl. Utgivningen har gjorts pŒ rent ideell grund, nŒgra 14V:1 kommersiella intressen finns inte. -

Verksamheter Med Länsstyrelsen Skåne Som Tillsynsmyndighet Sida 1 Av 6

2021-09-01 Verksamheter med Länsstyrelsen Skåne som tillsynsmyndighet Sida 1 av 6 Nummer Anläggning Kommun 1260-101 Foodhills AB, Bjuv Bjuv 1260-129 Sven Jönssons Cykelaffär AB Bjuv 1272-50-001 Bromölla avloppsreningsverk Bromölla 1272-125 G. Larsson Starch Technology AB Bromölla 1272-102 Geberit Production AB Bromölla 1272-101 Stora Enso Paper AB Bromölla 1272-118 Ytbehandlingsteknik i Näsum AB Bromölla 1272-60-004 Åsens Avfallsanläggning Bromölla 1272-20-011 Östad Bromölla 1272-20-001 Östad Norr Bromölla 1278-20-017 Förslöv grustäkt Båstad 1278-101 LINDAB VENTILATION AB Båstad 1278-60-001 NSR återvinningsanläggning Bås Båstad 1278-50-004 Torekovs avloppsreningsverk Båstad 1285-50-001 Ellinge Avloppsreningsverk Eslöv 1285-144 O. Kavli AB Eslöv 1285-101 Orkla Foods Sverige AB Eslöv 1285-20-006 Rönneholms mosse Eslöv 1285-91-804 Skibaröd Eslöv 1285-158 Örtofta Kraftvärmeverk Eslöv 1285-105 Örtofta Sockerbruk Eslöv 1283-109H Filborna Kraftvärmeverk Helsingborg 1283-109A Fjärrvärmecentral, Israel (FCI) Helsingborg 1283-75-001 Helsingborgs Hamn AB Helsingborg 1283-101 KEMIRA KEMI AB Helsingborg 1283-60-001 NSR återvinningsanläggning Hel Helsingborg 1283-60-002 RÖKILLE AVFALLSUPPLAG Helsingborg 1283-102 Solenis Sweden AB Helsingborg 1283-109B Västhamnsverket, (VHV) Helsingborg 1283-50-001 Öresundsverket, AVR Helsingborg 1293-60-001 Hässleholms Kretsloppscenter Hässleholm 1293-20-910 Vinne mosse Hässleholm 1293-20-901 Åbuamossen Hässleholm 1284-50-001 Höganäs avloppsreningsverk Höganäs 1284-101B Höganäs Hetvattencentral 1 Höganäs 1284-101 Höganäs -

JASPERS Annual Report 2007

Annual Report 2007 Jaspers Joint Assistance to Support Projects in European Regions • Jaspers Joint Assistance to Support Projects in European Regions JASPERS Joint Assistance to Support Projects in European Regions JASPERS 2 Joint Assistance to Support Projects in European Regions Annual Report 2007 Joint Assistance to Support Projects in European Regions Annual Report 2007 3 JASPERS Index I. Narrative report 4 ➾ 1. Institutional issues and organisation 4 ➾ 2. Organisational development 4 ➾ 3. Operational activities 8 ➾ 4. Detailed commentary by sector 12 II. Financial information 17 ➾ 1. The budget of year 2007 17 ➾ 2. Summary of the Action: income and expenditure and payments received 17 Appendices 18 ➾ 1. Human Resources as of December 31, 2007 18 ➾ 2. Status of JASPERS assignments as of December 31, 2007 19 ➾ 3. JASPERS assignment list as at December 31, 2007 21 ➾ 4. JASPERS cumulative assignments and outcomes to December 31, 2007 25 ➾ 5. List of completed assignments 2007 per country and per sector 27 ➾ 6. Financial statement of the “Action / JASPERS” for the year to December 31, 2007 28 JASPERS 4 Joint Assistance to Support Projects in European Regions Annual Report 2007 I. Narrative report This is the Annual Report for 2007 which was an important year for JASPERS since it was the first full year of operations. There was a significant build-up in staffing throughout the year, bring- ing the number of professional staff close to the total number of technical experts envisaged by the stakeholders when JASPERS was established. 1. Institutional issues and organisation 2. Organisational development 1.1 Governance and reporting 2.1 JASPERS recruitment and staffing Meetings of the Steering Committee comprising Following an intensive screening process in the lat- representatives of the three stakeholders (European er stages of 2006, interviews for the majority of the Commission, European Investment Bank and Euro- 32 Technical Expert posts funded by the European pean Bank for Reconstruction and Development) Commission were completed by March 2007. -

Development Priorities

HIERARCHICAL STRUCTURE OF THE CITIES KOPENHAGA SZTOKHOLSZTOKHOLM Lubmin METROPOLITAN HAMBURG OSLO LUBEKA Greifswald Zinnowitz REGIONAL Wolgast M Dziwnów GDAŃSKRYGA SUBREGIONAL Loitz DEVELOPMENT PRIORITIES SUPRA-LOCAL Heringsdorf Kamień Gutzkow Międzyzdroje Jarmen Pomorski LOCAL Świnoujście the Polish Part of MAIN CONNECTIONS Anklam ROAD CROSS BORDER METROPOLITAN REGION OF Wolin RAILWAY Golczewo ZACHODNIOPOMORSKIE WATER REGION Ducherow NATIONAL ROAD SZCZECIN REGIONAL ROAD Uckermunde Nowe Warpno VIA HANSEATICA Altentreptow Eggesin CETC-ROUTE 65 Friedland Ferdindndshof INTERNATIONAL CYCLING TRAILS Nowogard Torgelow PROTECTED NATURAL AREAS Neubrandenburg Police INLAD AND SEA INFRASTRUCTURE Goleniów THE ASSOCIATION OF SEAPORTS WITH BASIC MEANING FOR NATIONAL ECONOMY THE SZCZECIN METROPOLITAN REGION Burg Stargard SEAPORTS Pasewalk Locknitz SMALL SEAPORTS Woldegk HARBOURS Szczecin MARINAS ACCESS CHANNELS AVIATION INFRASTRUCTURE Feldberg Stargard Szczeciński SZCZECIN-GOLENIÓW AIRPORT Prenzlau WARSZAWA COMMUNICATION AIRPORTS THE CITY OF ŚWINOUJŚCIE PROPOSED AIRPORTS, BASED ON EXISTING INFRASTRUCTURE Gryfino Gartz RAILWAY NETWORK - PLANNED SZCZECIN METROPOLITAN RAILWAY LOCAL LINE POSSIBLE CONNECTIONS Templin Pyrzyce TRAIN FERRY ECONOMICAL ACTIVITY ZONES Schwedt POZNAŃ MAIN INDUSTRIAL & SERVICE AREAS WROCŁA THE ASSOCIATION OF POLISH MUNICIPALITIES Angermunde EUROREGION POMERANIA MAIN SPATIAL STRUCTURES AGRICULTURAL Chojna Trzcińsko Zdrój TOURISTIC W Myślibórz SCIENCE AND EDUCATION Cedynia UNIVERSITIES SCHOOLS WITH BILINGUAL DEPARTMENTS Moryń CONFERENCE -

Financial Statements of Bank Gospodarstwa Krajowego Prepared in Accordance with IFRS for the Financial Year from 1 January to 31 December 2018

Financial statements of Bank Gospodarstwa Krajowego prepared in accordance with IFRS for the financial year from 1 January to 31 December 2018 The above Financial Statements of Bank Gospodarstwa Krajowego is a translation from the original Polish version. In case of any discrepancies between the Polish and English version, the Polish version shall prevail. Warsaw, 15 April 2019 Financial statements of Bank Gospodarstwa Krajowego prepared in accordance with IFRS for the financial year from 1 January to 31 December 2018 (in PLN thousand) Selected financial data on financial statements The selected financial data specified below constitutes additional information to the financial statements of BGK for 2018. in PLN thousand in EUR thousand For the period For the period For the period For the period from 1 Jan 2018 from 1 Jan 2017 from 1 Jan 2018 from 1 Jan 2017 to 31 Dec 2018 to 31 Dec 2017 to 31 Dec 2018 to 31 Dec 2017 Net interest income 882,835 773,077 206,903 182,128 Net fee and commission income 190,379 156,774 44,618 36,934 Operating result 519,462 606,203 121,742 142,814 Profit before tax 519,462 606,203 121,742 142,814 Net profit 445,347 517,813 104,372 121,990 Net comprehensive income 386,624 950,041 90,610 223,818 Cash flows from operating activities 25,262,104 -1,429,555 5,920,482 -336,786 Cash flows from investing activities -3,467,675 -693,011 -812,692 -163,265 Cash flows from financing activities -1,213,038 1,772,758 -284,290 417,640 Net cash flows 20,581,391 -349,808 4,823,500 -82,411 in PLN thousand in EUR thousand As at As -

|91| Kristianstad

|91| Kristianstad - Hässleholm - Åstorp - Helsingborg 14 aug 2017-9 dec 2017 Skåne Ø-tåg Skåne Skåne Skåne Skåne Skåne Skåne Skåne Skåne Skåne Ø-tåg Ø-tåg Skåne Uppdaterad 20 aug 2017 2 2 2 2 2 2 2 2 2 2 2 Påga Påga Påga Påga Påga Påga Påga Påga Påga Påga Påga Tågnummer 1841 1127 1843 1243 1803 1853 1805 1855 1259 1807 1207 1025 1025 1857 Period Dagar Ti-F Dagl L,SoH Ti-SoH M-F M-F M-F M-F L,SoH M-L M-F M-F L,SoH M-F Går även / Går ej 1 2 3 fr Karlskrona C 90 21.47 4.47 t Kristianstad C 90 23.18 6.18 fr Kristianstad C 23.24 0.03 5.38 5.45 6.03 6.24 6.24 6.38 fr Önnestad | 0.11 5.45 5.53 6.11 | | 6.45 fr Vinslöv | 0.16 5.51 5.58 6.16 | | 6.51 t Hässleholm C 23.42 0.24 5.57 6.06 6.24 6.42 6.42 6.57 fr Stockholm C 80 23.09 4 t Hässleholm C 80 5.53 4 fr Hässleholm C 0.31 5.01 5.31 6.01 6.31 7.01 fr Tyringe 0.40 5.10 5.40 6.10 6.40 7.10 fr Perstorp 0.49 5.19 5.49 6.19 6.49 7.19 fr Klippan 1.01 5.31 6.01 6.30 7.01 7.30 fr Kvidinge 1.05 5.35 6.05 | 7.05 | t Åstorp 1.10 5.40 6.10 6.37 7.10 7.37 fr Åstorp 1.12 5.12 5.42 6.12 6.40 7.12 7.40 fr Bjuv 0.17 1.17 5.17 5.47 6.17 6.45 7.17 7.45 fr Mörarp 0.21 1.21 5.21 5.51 6.21 6.49 7.21 7.49 fr Påarp 0.26 1.26 5.26 5.56 6.26 6.54 7.26 7.54 fr Ramlösa 0.30 1.30 5.30 6.00 6.30 7.00 7.30 8.00 t Helsingborg C 0.35 1.35 5.35 6.05 6.35 7.03 7.35 8.03 14 aug 2017-9 dec 2017 Skåne Skåne Skåne Ø-tåg Ø-tåg Skåne Skåne Skåne Skåne Ø-tåg Ø-tåg Skåne Skåne Skåne Uppdaterad 20 aug 2017 2 2 2 2 2 2 2 2 2 2 Påga Påga Påga Påga Påga Påga Påga Påga Påga Påga Tågnummer 11857 1809 1209 1031 1031 1859 11859 1811 1211 1037 -

Rapport A4 Mall

UPPDRAG 2021 Sjukhusstyrelse Skånes universitetssjukhus Sjukhusstyrelse Landskrona Sjukhusstyrelse Helsingborg Sjukhusstyrelse Ängelholm Sjukhusstyrelse Kristianstad Sjukhusstyrelse Hässleholm Sjukhusstyrelse Ystad Sjukhusstyrelse Trelleborg Psykiatri-, habilitering- och hjälpmedelsnämnd Primärvårdsnämnd Innehåll Inledning .............................................................................................................................. 1 Attraktiv arbetsgivare ....................................................................................................... 2 Sjukhusstyrelse Skånes universitetssjukhus ............................................................ 3 Sjukhusstyrelse Landskrona .......................................................................................... 3 Sjukhusstyrelse Helsingborg ......................................................................................... 3 Sjukhusstyrelse Ängelholm ............................................................................................ 3 Sjukhusstyrelse Kristianstad ......................................................................................... 3 Sjukhusstyrelse Hässleholm .......................................................................................... 4 Sjukhusstyrelse Ystad ...................................................................................................... 4 Sjukhusstyrelse Trelleborg ............................................................................................. 4 Psykiatri-, habilitering- -

THREE LINKS Timetables

THREE LINKS Timetables COntact Stena Line Scandinavia AB SE-405 19 Gothenburg Phone +46 (0) 31 85 80 00 www.stenalinefreight.com For further information please contact your local sales representative at Stena Line Freight. If you are new to Stena Line, please contact Christer Kjellberg: [email protected] Phone: +46 (0) 31 85 86 19 Logent Ports & Terminals AB Torgny Nyholm [email protected] Phone +46 (0)723-704 832 www.logent.se Green Cargo AB Anders Ohlsén [email protected] Phone +46 (0) 10 455 40 00 www.greencargo.com Kiruna Timetables Timetable Timetable Haparanda Gdynia Haparanda Luleå Gdynia Luleå Pick-up time in Gdynia, Pick-up time in Gdynia, Haparanda additional unloading time: 1,5 hrs additional unloading time: 1,5 hrs Luleå Piteå Haparanda Gdynia Luleå Gdynia Skellefteå Closing Arrival Closing Arrival Day time Day time Ship Day time Day time Ship Haparanda Gdynia Luleå Gdynia Umeå Mon 13:00 Fri 05:30 Stena Baltica Mon 10:30 Thu 07:30 Stena Spirit Örnsköldsvik Mon 13:00 Fri 09:15 Stena Spirit Tue 10:30 Fri 05:30 Stena Baltica Tue 13:00 Sat 07:30 Stena Vision Tue 10:30 Fri 09:15 Stena Spirit Sundsvall Tue 13:00 Sat 10:00 Stena Baltica Wed 10:30 Sat 07:30 Stena Vision Wed 13:00 Tue 07:30 Stena Spirit Wed 10:30 Sat 10:00 Stena Baltica Thu 13:00 Tue 07:30 Stena Spirit Thu 10:30 Tue 07:30 Stena Spirit Fri 13:00 Tue 07:30 Stena Spirit Fri 10:30 Tue 07:30 Stena Spirit Borlänge Gävle NORWAY Oslo Gdynia Haparanda Gdynia Luleå Stockholm Departure Arrival Departure Arrival Day time Day time Ship Day time Day -

Exhibition & Sponsorship Dossier

ACMFS 2 E 0 1 8 Y N M A UN M ICH - GER Vadsz Tromsø Bodø Luleå Steinkjer Umeå Trondheim Östersund Molde Härnösand SWEDEN NORWAY Hermansverk Lillehammer Hamar Gävle Bergen Falun Oslo Uppsala Drammen Västeràs Tønsberg Moss Karlstad Örebro Skien Stockholm Stavanger Nyköping Arendal Kristiansand Linköpingen Visby Göteborg Jönköpingen Aalborg Växjö Kalmar Halmstad Viborg Karlskrona DENMARK Vejle København (Copenhagen) Malmö Olsztyn Biafystok Szczecin Bydgoszcz Poznañ POLAND Warszawa (Warsaw) Kódz Zielona Góra Lublin Luts'k Wroclaw Kielce Rivne Opole Katowic Rzeszów L'viv Krakáw Ternopil Zilina SLOVAKIA Chernivtsi Banská Bystrica Trnava Nitra Bratislava Linz Sankt Pölten Wien Salzburg Eisenstadt AUSTRIA Bregenz Innsbruck Graz Klagenfurt SLOVENIA Ljuljana CROATIA Zagreb BOSNIA AND HERZEGOVINA Sarajevo Tirana ALBANIA exhibition&sponsorship 2 INDEX EACMFS Executive Officers - Main Contact Details 04 Welcome address 05 Congress venue 06 Former Congresses & Presidents 07 Main Topics 07 Congress Objectives 08 General Information 09 Exhibition Sponsorship 10 Sponsorship Opportunities 11 Additional Sponsorship Opportunities 12 Advertisement and Sponsor Items 15 Exhibition map 16 3 Vadsz Tromsø Bodø Luleå Steinkjer Umeå Trondheim Östersund Molde Härnösand SWEDEN NORWAY Hermansverk Lillehammer Hamar Gävle Bergen Falun Oslo Uppsala Drammen Västeràs Tønsberg Moss Karlstad Örebro Skien Stockholm Stavanger Nyköping Arendal Kristiansand Linköpingen Visby Göteborg Jönköpingen Aalborg Växjö Kalmar Halmstad Viborg Karlskrona DENMARK Vejle København (Copenhagen) -

Ex-Post Study of Support to the Transport Sector in IE OP 2007-2013

Ex-post study of support to the transport sector in IE OP 2007-2013 SYNTHESIS Publication co-financed by the Cohesion Fund under the Infrastructure and Environment Program 2014-2020 Ex-post study of support to the transport sector in IE OP 2007-2013 SYNTHESIS WARSAW 2017 Researchers: CUPT (Center for EU Transport Projects) Evaluation Experts: Joanna Obarymska-Dzierzgwa Edyta Boratyńska-Karpiej Aleksander Wołowiec Study recipient: Centrum Unijnych Projektów Transportowych Plac Europejski 2 00-844 Warszawa Warsaw, March 31, 2017. ISBN 978-83-940563-3-9 Evaluation study co-funded by the European Union under the Cohesion Fund The photos on the cover are from the archives of the Center for EU Transport Projects 1. Foreword Transport sector under the Infrastructure and Environment Operational Program (IE OP) has benefited from the largest pool of financial resources available under the Program (Priority Axes VI- VIII). The aim was to improve the investment attractiveness of Poland and its regions through the development of technical infrastructure while protecting and improving the environment, health, preserving cultural identity and developing territorial cohesion. The growing role of infrastructure investments - both in the context of building Poland’s international competitiveness and the amount of EU support directed to this industry in 2007 - 2013 - necessitates an assessment of effectiveness thereof and therefore of the long-term impact of projects, which should be based on actual experiences from previously implemented investments. As part of the study, the effectiveness and complementarity of transport projects were summarized and their usefulness was examined through the prism of transport specific objectives recorded in the program documents and 2007-2013 strategic perspectives (mainly IE OP and NSRF) The effects of the expansion of the transport network can be seen both in terms of demand (usually short-term, occurring during the investment process), as well as in terms of supply (usually long-term). -

8Bc4fd89e71854ab.Pdf

dokument TEXT: mikaEl bErgling och frEdrik nEjman Vart tredje övergångsställe håller inte säger Niklas Stavegård, trafiksäkerhetsansva- Resultatet från de fyra momenten har vägts måttet. rig på Motormännen. samman till ett betyg för varje övergångsställe. det visar en granskning som motormän- Undersökningen baseras på fyra olika del- Farligast övergångsställen sett till slutbety- nen har gjort av 162 övergångsställen i 22 moment: gen finns i Visby och Gävle. I båda städerna städer. Utformningen. Finns det mittrefug? Hur de farligaste övergångsställena finns i 01 ser skyltarna ut? Om det finns ljussigna- Visby, gävle och karlstad. ler, hur fungerar de? 02 Synlighet dagtid. Är det lätt att upp- Från Luleå i norr till Malmö i sö- täcka övergångsstället som förare? der. Från Göteborg i väst till Visby i Synlighet nattetid. Är det svårt öst. Motormännen har granskat 03 eller lätt att se övergångsstället övergångsställen enligt en interna- och fotgängare när det är mörkt? tionellt erkänd teststandard i 22 städer i Sve- 04 Tillgänglighet. Hur bra är rige. Resultatet visar att många övergångsstäl- övergångsstället för syn- len inte håller måttet. skadade och funktionshindrade? Av de 162 granskade övergångsställena blev 54 underkända. – Många syns inte tillräckligt bra när det är representanter för motormännens lokalklubbar har granskat 162 övergångs- mörkt. Det är extra allvarligt med tanke på ställen i 22 svenska städer ur 22 olika hur det ser ut i Sverige under vinterhalvåret, säkerhetsfaktorer. 24 MOTOR • 09.11 luleå 0% umeå 11% östersund 0% sundsvall 14% gävle 86% foto: petra jonsson karlstad västerås uppsala sveriges farligaste 70% 29% 50% övergångsställen örebro stockholm – stor granskning 0% eskilstuna 33% fick 86 procent – eller sex av sju undersökta skara 29% övergångsställen – underkänt.