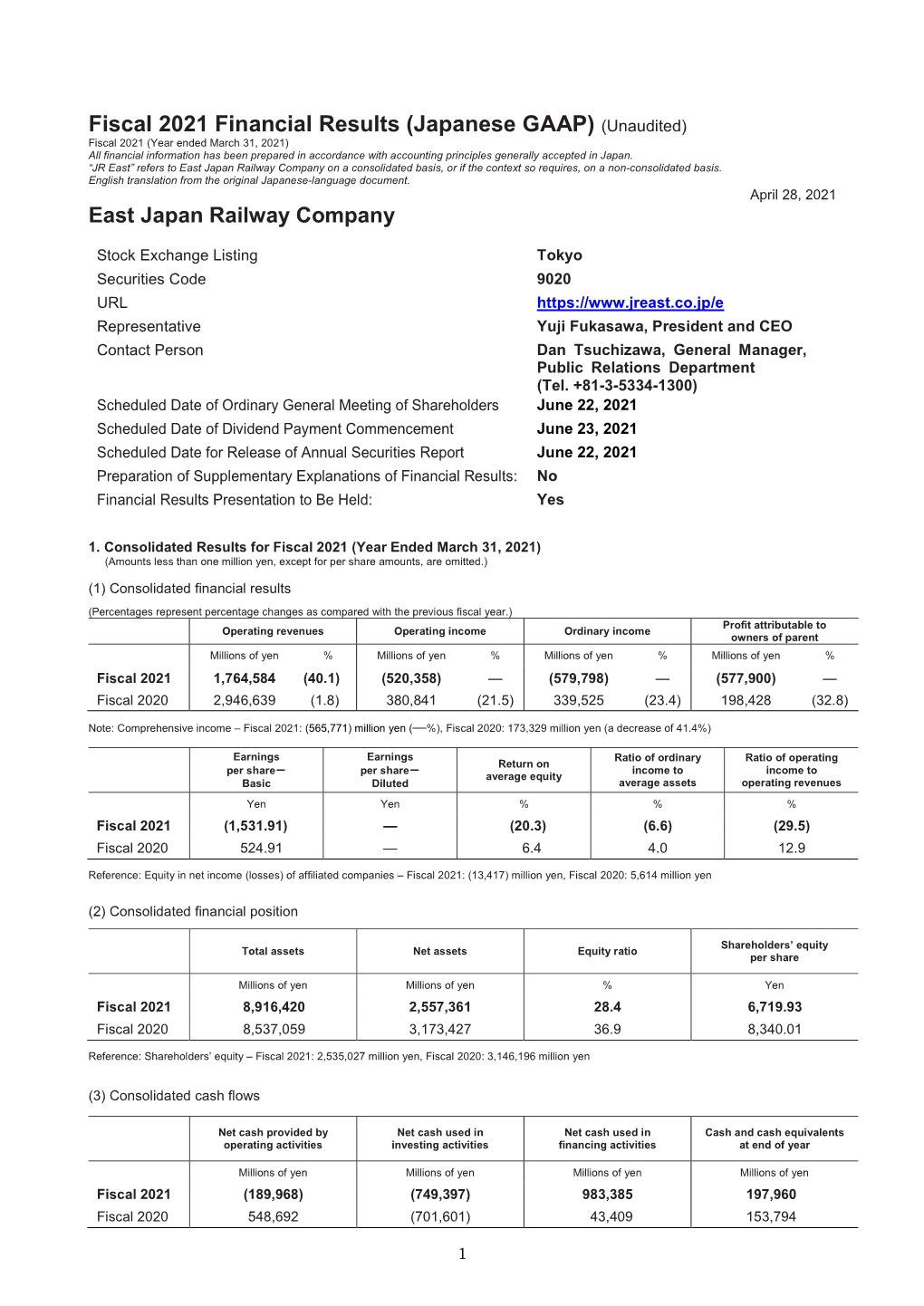

Fiscal 2021 Financial Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notice of Convocation of the 30Th Ordinary General Meeting of Shareholders

Shinagawa Season Terrace (Minato-ku, Tokyo) Notice of Convocation of the 30th Ordinary General Meeting of Shareholders Shareholders’ Meeting Information ■ Date and Time Table of contents Tuesday, June 23, 2015 P2 Notice of Convocation 10:00 a.m. P4 (Reference) Exercising Your Voting Rights P5 Reference Materials for the Ordinary General ■ Place Meeting of Shareholders 4-1, Shibaura 3-chome, Minato-ku, Tokyo 【Attachments to the Notice of Convocation】 Granpark Plaza Bldg. 3F Conference Room P12 Business Report P38 Consolidated Financial Statements P42 Financial Statements (Non-consolidated) NTT Urban Development Corporation P45 Auditors’ Report (Cord: 8933, First Section of TSE) (Reference) P51 【Topics】 May, 2015 To Our Shareholders Please let me take this opportunity to thank our shareholders for your continued generous support. We are pleased to announce that the 30th Ordinary General Meeting of Shareholders will be held on June 23. This notice gives an overview of our operations in the 30th fiscal year (from April 1, 2014 to March 31, 2015) and the resolutions of the general meeting of shareholders. In the real estate market, the rush to develop new Class A buildings continued, particularly in central Tokyo, and there have been changes in the market environment, including rises in building cost and increases in land and building prices particularly around the Tokyo metropolitan area. In response to these changes, in the fiscal year under review we revised our Medium-Term Vision 2018, which we announced in the fiscal year ended March 31, 2014, including our strategies in our main businesses, and are taking steps to achieve our plan. -

East Japan Railway Company on a Consolidated Basis, Or If the Context So Requires, on a Non-Consolidated Basis

Consolidated Financial Results for the Nine-Month Period Ended December 31, 2020 (Japanese GAAP) (Unaudited) Fiscal 2021 (Year ending March 31, 2021) “Third Quarter” means the nine months from April 1 to December 31. All financial information has been prepared in accordance with accounting principles generally accepted in Japan. “JR East” refers to East Japan Railway Company on a consolidated basis, or if the context so requires, on a non-consolidated basis. English translation from the original Japanese-language document. January 29, 2021 East Japan Railway Company Stock Exchange Listing Tokyo Securities Code 9020 URL https://www.jreast.co.jp/e Representative Yuji Fukasawa, President and CEO Contact Person Dan Tsuchizawa, General Manager, Public Relations Department (Tel. +81-3-5334-1300) Scheduled Date for Release of a Quarterly Report February 10, 2021 Scheduled Date of Dividend Payment Commencement Not applicable Preparation of Supplementary Explanations of Quarterly Financial Results: No Quarterly Financial Results Presentation to Be Held: Yes 1. Consolidated Results for the Nine-Month Period Ended December 31, 2020 (April 1, 2020-December 31, 2020) (Amounts less than one million yen, except for per share amounts, are omitted.) (1) Consolidated financial results (Percentages represent percentage changes as compared with the corresponding period in the previous fiscal year.) Profit attributable to Operating revenues Operating income Ordinary income owners of parent Millions of yen % Millions of yen % Millions of yen % Millions of -

Let's Take a Stroll Around Koishikawa and Zoshigaya !

Opening Information Place of ISHIKAWA Takuboku’s Main Hall of Gokoku-ji Temple Death [Open] All Year (except special events [Open] All Year or activities at the main hall) [Hours] All Day ※The principal image is unveiled on [Fee] Free the 18th of each months Tokyo Heritage Week [Hours] All Day Memorial to Ishikawa Takuboku [Fee] Free Monument and Gallery [Open] All Year (except the Year-End Former McCaleb Residence Let’s take a stroll around and New Year and the exceptional (Old Missionary House, Zoshigaya ) closing period) [Open] All Year (except Mondays, Koishikawa and Zoshigaya ! [Hours] 9:00~17:00 Sunday of the 3rd week and the [Fee] Free Year-End and New Year. If a holiday A rolling land of Koishikawa and Zoshigaya area is formed by falls on them, the following day) midsize and small rivers pouring into Kanda-gawa River and plateau. Koishikawa area is known for temples associated with the Tokugawa Koishikawa Botanical Garden [Hours] 9:00~16:30 [Open] All Year (except Mondays and [Fee] Free Shogunate, and temple towns were developed around such temples, territories and roadside of “Kasuga-dori Street” and “Otowa-dori the Year-End and New Year. If a Street”. Tokugawa Tsunayoshi, the fifth shogun, specially had a close holiday falls on Monday, closed on Avenue of Zelkova Trees at connection to the area. Zoshigaya Kishimojin Temple was worshipped Tuesday. If there are consecutive Kishimojin Daimon by a wide range of believers and thrived in the Edo period. [Open] All Year holidays, the day after the last holiday This route introduces the historic sites such as Gokoku-ji Temple will be closed) [Hours] All Day and Zoshigaya Kishimojin Temple that allow us to experience the [Hours] 9:00~16:30 (Enter by 16:00) [Fee] Free atmosphere of the Edo period, as well as the Former McCaleb [Fee] General ¥400 (a group more than Residence and Jiyu Gakuen Myonichikan built in the Meiji and the 20 pers ¥300), Elementary school & Jr Ginkgo of Zoshigaya Kishimojin Taisho era. -

Accommodation Near Rikkyo University, Ikebukuro Campus

Accommodation Near Rikkyo University, Ikebukuro Campus IKEBUKURO TRAIN STATION Rikkyo University is located in Ikebukuro (池袋), in the heart of Tokyo, and convenient from just about any location within Tokyo proper. The Yamanote (JY13), Saikyo (JA12), and the Shonan Shinjuku (JS21) train lines all stop here, as well as the Marunouchi (M25), Yurakucho (Y09), and Fukutoshin (F09) subway lines. Rikkyo University’s Ikebukuro campus, on the west side, is a leisurely 10-15 minute walk from the station. The closest exit is C2, which is on the far end of the station. Ikebukuro station is rather large, very crowded, and complicated. Those familiar with Chinese characters are warned to ignore the department store names located at either end of the station. The Tobu (east-side) department store is near the station’s west exit, and the Seibu (west-side) department store at the east exit. For directions to the campus please see the map provided on the ASCJ homepage under directions to Rikkyo. FROM THE AIRPORT If planning to arrive by air please be aware that Tokyo is served by two airports, Haneda and Narita. Either airport offers easy access to Ikebukuro station, with Haneda being the more convenient. Tickets for buses/trains are easily purchased at the airport stations. By Bus: Limousine bus service to Ikebukuro station or to the nearby Metropolitan Hotel From Haneda: ¥1230 From Narita: ¥3100 By Train: From Haneda (two possibilities): 1. Monorail→Hamamatsu-cho (last stop)→Yamamoto line (Platform 2)→Ikebukuro 2. Keikyu Line→Shinagawa (Not all trains go here so check)→Yamamoto line (Platform 2)→Ikebukuro From Narita: Keisei Line Narita→Nippori→Yamanote line (platform 11)→Ikebukuro ***The Keisei line runs two trains with the Skyliner being the faster and more expensive option. -

Annual Report 2015 11 Office and Commercial Properties Development Businesses

Businesses of the NTT Urban Development Group —At a Glance Office and Commercial Properties Development Businesses P. 1 2 This refers to a business that leases office buildings and a busi- ness that leases commercial properties and facilities. They have well-balanced portfolios that are centered on the Tokyo metro- politan area and include properties in major cities across Japan. Residential Development Business P. 2 0 As well as selling condominiums planned and developed in- house under the Wellith brand, this business sells residential land. Global Business P. 2 3 Launched in 2009, the global business has operations in the United Kingdom, Australia, Southeast Asia, and the United States. We will exploit expertise acquired in Japan to advance this business steadily and establish it as a new growth driver. NTT Urban Development Corporation Annual Report 2015 11 Office and Commercial Properties Development Businesses Photo by Forward Stroke In the office leasing market, vacancy rates continued to improve. At the same time, market rents showed signs of bottoming out, with rents rising in some sectors. At March 31, 2015, the average market vacancy rate*1 in the five wards of central Tokyo was 5.30%, down 1.40 percentage points from the previous fiscal year-end. Furthermore, asking rents are rising in central Tokyo. The average market asking rent*1 in the five wards of central Tokyo was ¥17,195 per 3.3 square meters, up 5.33% from the previous fiscal year-end. *1. The average market vacancy rate in the five wards of central Tokyo and the average market asking rent are based on data from Miki Shoji Co., Ltd. -

![[Print] Gakushuin University, Mejiro Campus](https://docslib.b-cdn.net/cover/1652/print-gakushuin-university-mejiro-campus-4561652.webp)

[Print] Gakushuin University, Mejiro Campus

[Print] Venue Gakushuin University, Mejiro Campus Address: 1-5-1 Mejiro Toshima-Ku, Tokyo 171-8588, Japan Its location is very convenient for participants to move around downtown Tokyo and go to other fancy places in the vicinity. Campus map is available at http://www.gakushuin.ac.jp/ad/kikaku/english/location/index4a.html Access to Mejiro 1. Transportation from Narita Airport to Mejiro Station Fore more details, http://www.narita-airport.jp/en/access/train/index.html C: Limousine Bus is available from Narita Airport to Shinjuku Station, Ikebukuro, and Four Seasons Hotel near Mejiro. It takes about 120 minutes depending on traffic congestion. Frequency is about every one hour depending on destination. Taxi is not recommended since it is costly. For more details, http://www.limousinebus.co.jp/global.html About Narita Airport, http://www.narita-airport.jp/en/index.html 2. Transportation from Haneda Airport (Tokyo International Airport) to Mejiro Station C: Limousine Bus is available from Haneda Airport to Shinjuku Station, Ikebukuro, etc. For more details including railway services, http://www.haneda-access.com/worldwide/index.shtml 3. Time to Mejiro from main stations on JR Yamanote Line Shibuya Station to Mejiro Station by outside circle: 13 minutes Shinjuku Station to Mejiro Station by outside circle: 6 minutes Ikubukuro Station to Mejiro Station by inside circle: 3 minutes Ueno Station to Mejiro Station by inside circle: 18 minutes Akihabara Station to Mejiro Station by inside circle: 21 minutes Tokyo Station to Mejiro Staion by inside circle: 25 minutes Shinagawa Station to Mejiro Statrion by JR outside circle: 25 minutes 4. -

“The Ten-Year Plan” (1993) and “Bygones”

Mysteries Lurking in the Everyday: A Translation of Two Short Stories by Miyabe Miyuki A Senior Honors Thesis Presented in Partial Fulfillment of the Requirements for graduation with research distinction in Japanese in the undergraduate colleges of the Ohio State University by Samantha Netzley The Ohio State University June 2010 Project Advisor: Professor Richard Torrance Department of East Asian Languages and Literature Copyright by Samantha Elise Netzley 2010 Abstract This thesis consists of a translation of two short stories by popular Japanese fiction writer Miyabe Miyuki, whose naturalistic style and supernatural flair hint at “the mysteries lurking in the everyday.” The two stories, “The Ten-Year Plan” (1993) and “Bygones” (1994), are provided with an introduction and with translation notes where appropriate. ii Dedication For Sean, who always believed in me and Pete, who was good for it at least 80% of the time iii Acknowledgements I would like to sincerely thank Professor Richard Torrance for serving as my advisor for this project and putting in many long hours going over the original Japanese line by line once a week for three quarters, and for never being too busy to go off on an interesting tangent for a minute or two. I would also like to thank Professors Shelley Quinn and James Fredal for serving on my thesis committee on what was regrettably very short notice, and for graciously enduring my panicked e-mails. I would again like to thank Professor Fredal, as well as Professors Terence Odlin and Wayne Redenbarger, for writing recommendations to SUISS on my behalf and allowing me the privilege of studying modern British literature abroad. -

Tabegotoya-Norabo URL

Suginami ☎ 03-3395-7251 Tabegotoya-Norabo URL 4-3-5Nishiogikita, Suginami-ku 12 9 3 6 17:00 – 0:00 Mondays 7 min. from Chuo Line Nishiogikubo Station North Exit Signature menu Local vegetables and Kakiage tempura with corn and ★ tofu salad edamame soybeans Available Year-round Available June-July Ingredients (Almost completely) Uses Ingredients Corn and edamame soybeans used seasonal vegetables from used from Mitaka City Mitaka City Nishi-Ogikubo Toshima ☎ 03-3988-1161 Royal Garden Cafe MEJIRO URL https://royal-gardencafe.com/mejiro/ 2F TRAD Mejiro, 2-39-1 Mejiro, Toshima-ku 12 9 3 6 Mondays-Saturdays: 11:00 – 23:00 Sundays: 11:00 – 22:00 New Year Holidays (New Year's Eve/New Year's Day) Immediately from JR Mejiro Station Signature menu Recommended Seasonal Tokyo Vegetables Menu (Menu varies by season) ★ Available Year-round MejiroMejiro Ingredients Seasonal vegetables from Tokyo and Edo Tokyo used 54 Yofu Souzai Teppan Daidokoro ☎ 03-6454-4252 Kita Theory Akabane URL https://www.hotpepper.jp/strJ001162446/ 1-29-7 Akabane, Kita-ku 12 9 3 6 Mon. 18:30 – 22:00 Tue – Sun 12:00 – 15:00/17:30 – 22:00 Mondays 5 min. walk from JR Akabane Station East Exit Signature menu Cabbage with Salt-Based ★ Hiroshima Yaki Sauce Available Year-round Available Year-round Ingredients Ingredients cabbages from Nerima cabbages from Nerima used used AkabaneAkabane ☎ 03-3894-4226 Arakawa Izumiya Home Cooking URL http://www.yuenchidori.com 6-30-9 Nishiogu, Arakawa-ku 12 9 3 6 11:00 – 14:00/17:00 – 22:00 Tuesdays 2 min. -

Notice of the 34Th Ordinary General Meeting of Shareholders [PDF

TRANSLATION NOTICE OF THE 34TH ORDINARY GENERAL MEETING OF SHAREHOLDERS TO BE HELD IN TOKYO, JAPAN ON JUNE 22, 2021 (This is a translation, for information purposes only, of the original Japanese language Notice of the General Meeting of Shareholders which has been dispatched to shareholders in Japan. The financial statements included in this Business Report have been prepared in accordance with the Business Corporation Law and related laws and regulations of Japan.) EAST JAPAN RAILWAY COMPANY TOKYO, JAPAN 1 TRANSLATION May 28, 2021 TO OUR SHAREHOLDERS East Japan Railway Company 2-2, Yoyogi 2-chome Shibuya-ku, Tokyo Japan Yuji Fukasawa President and CEO Notice of Convocation of the 34th Ordinary General Meeting of Shareholders This is to inform you that the Company’s 34th Ordinary General Meeting of Shareholders will be held as described below. Currently various efforts to prevent the spread of COVID-19 are strongly required. In response to the situation, upon careful consideration we have decided to hold this meeting while taking appropriate measures to prevent the spread of COVID-19. In order to prevent the spread of COVID-19, you are strongly encouraged, to the extent possible, to exercise your voting rights in writing or by an electronic method (via the Internet, etc.) prior to the meeting and refrain from physically attending the meeting. WHEN YOU EXERCISE YOUR VOTING RIGHTS IN WRITING OR BY AN ELECTRONIC METHOD (VIA THE INTERNET, ETC.), AFTER EXAMINING THE ATTACHED REFERENCE MATERIALS FOR THE GENERAL MEETING OF SHAREHOLDERS, PLEASE EXERCISE YOUR VOTING RIGHTS BY NO LATER THAN 6:00 P.M. -

Map of Japanese Learning in Toshima City

英語版 Map of Japanese Learning in Toshima City (1)Japanese language classes 1 ~ 8 (2)Japanese learning support for school children in Toshima city ~ C (3)Children learning support classes a ~ Information is as of the end of January 2020. For the latest information please ask the POC for each classroom. The map is made by Gakushuin University, supported by “Nihongo Net Toshima.” *Japanese proficiency level A. Have almost no Japanese language skills B. Can use simple, daily Japanese expressions, such as greetings ⑤ Mejiro Japanese Circle ⑦-2. Gakushuin University Wakuwaku Toshima C. Can talk about familiar topics 1. Mejiro Daini City Assembly Hall (5-minute Japanese Class Adults D. Can talk about topics of interest. walk from JR Mejiro) 1. Gakushuin University(Same as ⑦-1.Gakushuin E. Can talk about any topics 2. Tuesday 14:00~16:00 University) 3. 100 yen per session 2. Saturday 10:00~12:30 (Please refer to the FB 4.One-to-one instruction 5.Anyone ② Ikebukuro Japanese Circle page for class schedule.) 6.03-3951-2410(Mr. Hayashi) (1) Japanese language 1. Teikyo Heisei University Ikebukuro campus 3. 1,000 yen per session/10 Classes 4.Mass 7.We can support your learning as needed. We classes teaching assembly room (12-minute walk from JR hold exchange events twice a year. Here is the information about Japanese Ikebukuro station) 5. Japanese proficiency levels A and B language classes for those who live in Toshima 2. Thursday 19:00~21:00 6.03-5992-1024 (Gakushuin University city and its neighboring areas and are willing to 3. -

![Non-Transportation [PDF/281KB]](https://docslib.b-cdn.net/cover/3246/non-transportation-pdf-281kb-6963246.webp)

Non-Transportation [PDF/281KB]

REVIEW OF OPERATIONS—NON-TRANSPORTATION STATION RENAISSANCE— CREATING NEW STATION ENVIRONMENTS FOR THE 21st CENTURY Since establishment, JR East has moved decisively to leverage the potential synergy of its business resources such as high-traffic stations and adjacent commercial spaces. Creation of convenient and attractive retail-store, restaurant, office, hotel and other facilities will deliver sustainable revenue growth and complementary business diversity. Shopping Centers & Office Buildings In April 2002, JR East and Tokyu Corporation jointly opened the JR Tokyu Meguro Building. A subsidiary of JR East is renting out office space and operating a shop- ping center there. Station Space Utilization JR East continued its efforts to improve the attractiveness and earning power of its stations. Tsudanuma and Asagaya stations were enhanced through Cosmos Plan initiatives implement- ed in November 2002 and May 2003, respectively. Sunflower Plan initiatives were imple- mented at 67 stations, including Mejiro, Osaki, Sakuragicho, Hashimoto and Hachinohe. 32 EAST JAPAN RAILWAY COMPANY ANNUAL REPORT 2003 Cosmos Plan Shops/ Convenience Introduced in December 2000, the Cosmos Plan involves com- Convenience Restaurants store prehensive reviews of existing operational facilities at stations where passenger numbers are in excess of 200 thousand per day and major terminal stations in prefectural capitals. In addi- tion, substantial new station spaces are being newly created through various methods, including the construction of artificial ground. Sunflower Plan Ticket gate Commercial Launched in fiscal 1998, the Sunflower Plan mainly targets sta- space tions with passenger numbers generally in excess of 30 thou- Station sand per day. Activities include partial reviews of operational Artificial office facilities at and around stations and short construction sched- ground ules with minimal investment to develop stores. -

APEBH 2009 Asia-Pacific Economic and Business History Conference

Return to home page APEBH 2009 Asia-Pacific Economic and Business History Conference 主催:オーストラリア&ニュージーランド経済史学会 開催地:学習院大学 開催日:2009年2月18-20日 テーマ:『国際経済&ビジネスにおけるアジア太平洋』 Home Call for Papers Registration Programme Prizes and Awards Keynote Lecture Accommodation Functions Venue Contacts Return to home page 2009 Conference The 2009 Conference will be hosted by Gakushuin University When: 18-20 February 2009 Where: Gakushuin University, Tokyo (Japan) “Asia-Pacific in International Economy and Business” Return to home page Call for Papers English Version PDF Copy - Japanese Translation Return to home page Registration APEBH 2009 Registration Form APEBH 2009 Credit Card Payment Form Please complete the above forms, photocopy for your records, and post, fax or e-mail to: Shinobu Majima Faculty of Economics, Gakushuin University 1-5-1 Mejiro, Toshima-ku, Tokyo 171-8588, JAPAN Fax: +81-3-5992-1007 E-mail: [email protected] 上記の用紙をご記入後、控えのコピーをお取りになった上、郵送、ファックス、または、電子メールにて、登録手続き をお願い致します。 支払いに関しましては、上記クレジットカード支払用紙をご利用いただくか、または下記の口座へ振込みをお願いいた します。 三菱東京UFJ銀行 目白駅前支店 普通口座 店番 174 口座番号 0481335 171-8588 東京都豊島区目白1-5-1 学習院大学 経済学部 准教授 眞嶋史叙 Fax: +813 5992 1007 E-mail: [email protected] Return to home page Programme Please Note: The permission of the author is required to use any material from the papers presented at this conference. All sessions will be held in West 1 Building Wednesday 18th February Registration, 10.00-11.00 Block One, 11-12.30 1. Historiographical Reflections Wednesday 11:00 - 12:30 Chair - Chris Lloyd Yuzawa, Takeshi Gakushuin University, Japan Recent trends of business history in Japan Ohnuki, Mari and Masanori Takashima, Bank of Japan Recent trends in researches in Japanese economic history: from the viewpoint of archival materials in the Bank of Japan Archive Lunch, 12.30-13.30 Block Two, 13.30-15.00 2.