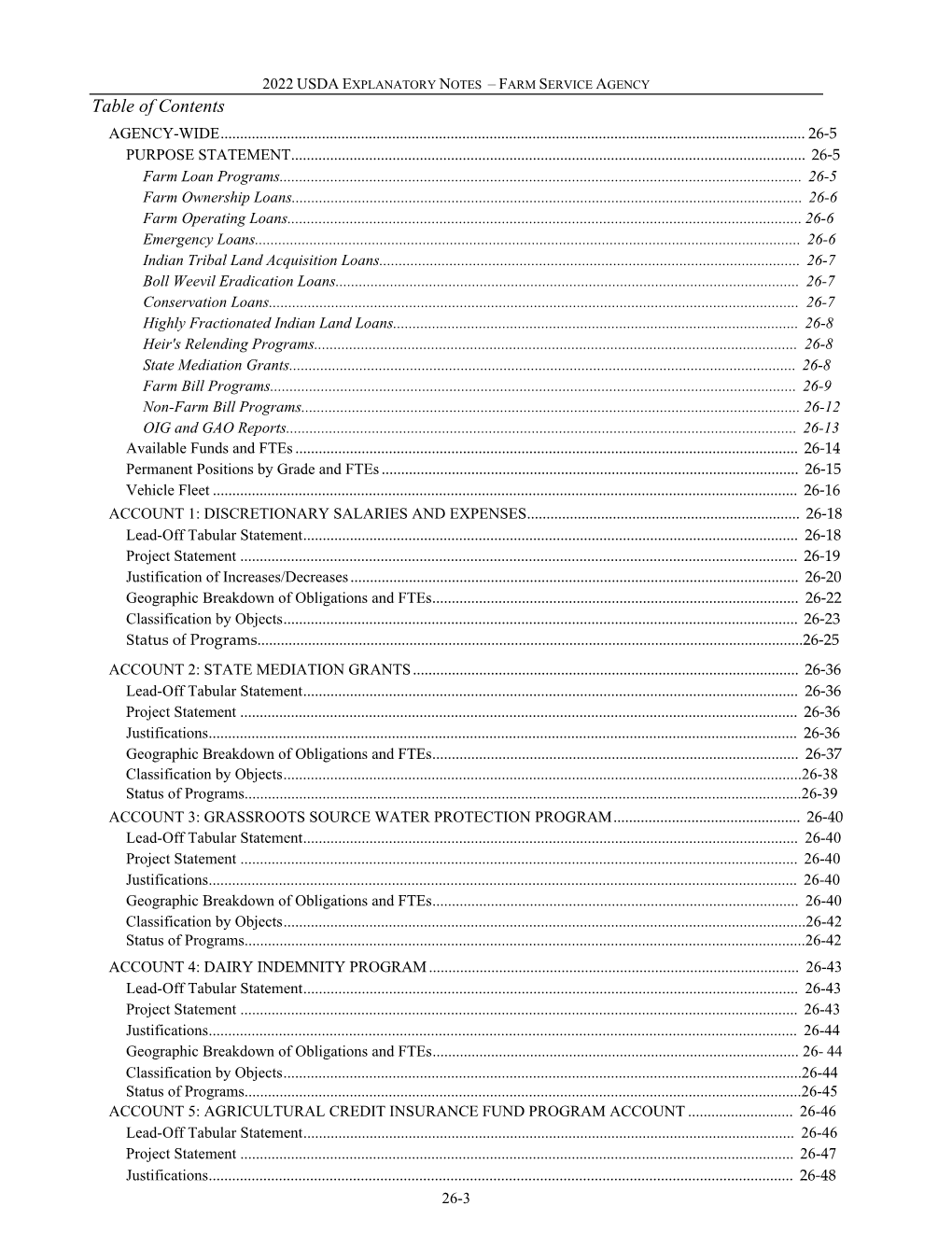

2022 Usda Explanatory Notes – Farm Service Agency 26-3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Midwest Drought Early Warning System Kickoff Meeting 1

MIDWEST DROUGHT EARLY WARNING SYSTEM KICKOFF MEETING 1 Include logos of all partners that contributed to meeting on bottom here? MIDWEST DROUGHT EARLY WARNING SYSTEM KICKOFF MEETING 1 Table of Contents Introduction to the Midwest DEWS ......................................................................................... 2 Background..........................................................................................................................................................................2 Midwest DEWS Kick-off Meeting and Planning Process ..................................................................................4 Keynote Speaker Highlights...................................................................................................... 6 Mayor Francis G. Slay, Mayor of the City of St. Louis.........................................................................................6 Colleen Callahan, USDA Rural Development Illinois Director .......................................................................6 Todd Sampsell, Deputy Director of the Missouri DNR......................................................................................7 Highlights of the Presentations and Panel Discussions ...................................................... 7 Day 1 Theme: Laying the Foundation for a Midwest DEWS ..........................................................................7 Day 2 Theme: Current Climate Outlook and Forecasting, Drought Impacts & Vulnerabilities, and Drought Preparedness Resource Needs ........................................................................................................8 -

Agricultural Marketing Service

AGRICULTURAL MARKETING SERVICE 2018 President’s Budget Agricultural Marketing Service Contents Page Purpose Statement ....................................................................................................................... 21-1 Statement of Available Funds and Staff Years ............................................................................ 21-9 Permanent Positions by Grade and Staff Year Summary ............................................................ 21-10 Motor Vehicle Fleet Data ............................................................................................................ 21-11 Marketing Services Appropriations Language ........................................................................................................ 21-12 Lead-off Tabular Statement ..................................................................................................... 21-12 Summary of Increases and Decreases ...................................................................................... 21-12 Project Statements .................................................................................................................... 21-13 Justifications ............................................................................................................................ 21-15 Summary of Proposed Legislation ........................................................................................... 21-24 Geographic Breakdown of Obligations and Staff Years ......................................................... -

FSA Guaranteed Farm Loan Programs

FSA Guaranteed Farm Loan Programs TIDBITS/HELPFUL HINTS November 2015 Lender Meetings State Office Staff Dan Gieseke Farm Loan Chief Email = [email protected] Sandra Waibel State Farm Loan Specialist Email = [email protected] Janet Bollinger State Farm Loan Specialist Email = Lorna Plowman State Farm Loan Program Technician Email = 601 Business Loop 70 W Parkade Center, Suite 225 Columbia, MO 65203 Telephone (573) 876-0980 Fax (855) 830-0682 INDEX Subject 0BPage # 1. Why Should USDA’s Farm Service Agency Be Your Lender of First Opportunity? …………………….. 1-2 2. MO State Fact Sheet – FSA Guaranteed Farm Loan Programs …………………………………………… 3-4 3. Direct Loan Information Sheet ………………………………………………………………………………………………………………. 5 4. Missouri Agricultural and Small Business Development Authority (MASBDA) Fact Sheet …………………… 6 5. MO FSA Guaranteed Lender Website ……………………………………………………………………………………………………. 7 6. Average County Farm Acreage – Missouri ……………………………………………………………………………………………. 8 7. Weekly Funds Report ……………………………………………………………………………………………………………………………. 9 8. Email or Faxed Applications ……………………………………………………………………………………………………………………. 10 Appeal Rights – Guaranteed Loans Lender Conflict of Interest Guaranteed Forms 9. FSA-2211: CLP & SEL Guaranteed Application …………………………………………….…………………………………. 11-15 10. FSA-2212: PLP Guaranteed Application ………………………………………………………………………………………….. 16-17 11. 2-FLP Exhibit 5 Electronic Access ………………………………………………………………………………………………………… 18-20 12. Guar Loan vs. Direct Loan Comparison ………………………………………………………………………………………………… -

USDA Rural Development Financing for Food Hubs

USDA Potential USDA Programs to Support Regional Food Hub Development This is not a comprehensive list, but an edited selection of USDA programs that have previously supported regional food hubs, with examples of funded projects. Many other USDA programs support various activities of regional food hubs. Page 4 has a longer list of funding resources, divided by agency. State and local USDA offices offer a wealth of resources in researching and preparing applications for support. Rural Development agency: The following programs are administered by WKHVWDWHVRIILFHVRI86'$¶V5XUDO'HYHORSPHQW)LQG\RXUVWDWH office here: http://www.rurdev.usda.gov/recd_map.html 1. The Rural Business Enterprise G rant (RB E G) supports the development of physical infrastructure and facilities, including food processing, marketing, and distribution business ventures for locally-grown agricultural products. It is administered by the Rural Business Cooperative Service, and can support everything from planning, plant upgrades, equipment purchases, and technical assistance. Grants range from $10,000 up to $500,000, although smaller projects are given higher priority. Rural public entities, Indian tribes, and rural non-SURILWRUJDQL]DWLRQVDUHHOLJLEOHWRDSSO\³5XUDO´LQWKLVFDVHLVGHILQHGDV any area other than a city or town that has a population of greater than 50,000 and the urbanized area contiguous and adjacent to such a city or town according to the latest decennial census. Information and grants are disbursed on the state level. For more information go to: http://www.rurdev.usda.gov/rbs/busp/rbeg.htm RBEG Example: Coast Grown in San Luis Obispo received an $88,000 RBEG grant in 2007 to form the Coast *URZQ&RRSHUDWLYHRILQGHSHQGHQWIDUPVDQGUDQFKHVDORQJ&DOLIRUQLD¶V&HQWUDO&RDVWDQGWREXLOGWKH first Mobile Harvest Unit in California. -

Agency Financial Report

2020 AGENCY FINANCIAL REPORT United States Department of Agriculture Page Intentionally Blank USDA’s Non-Discrimination Statement In accordance with Federal civil rights law and U.S. Department of Agriculture (USDA) civil rights regulations and policies, USDA, its Mission Areas, agencies, staff offices, employees, and institutions participating in or administering USDA programs are prohibited from discriminating based on race, color, national origin, religion, sex, gender identity (including gender expression), sexual orientation, disability, age, marital status, family/parental status, income derived from a public assistance program, political beliefs, or reprisal or retaliation for prior civil rights activity, in any program or activity conducted or funded by USDA (not all bases apply to all programs). Remedies and complaint filing deadlines vary by program or incident. Program information may be made available in languages other than English. Persons with disabilities who require alternative means of communication to obtain program information (e.g., Braille, large print, audiotape, or American Sign Language) should contact the responsible Mission Area, agency, or staff office; the USDA TARGET Center at (202) 720-2600 (voice and TTY); or the Federal Relay Service at (800) 877-8339. To file a program discrimination complaint, a complainant should complete a Form AD 3027, USDA Program Discrimination Complaint Form, which can be obtained online, from any USDA office, by calling (866) 632-9992, or by writing a letter addressed to USDA. The letter must contain the complainant’s name, address, telephone number, and a written description of the alleged discriminatory action in sufficient detail to inform the Assistant Secretary for Civil Rights (ASCR) about the nature and date of an alleged civil rights violation. -

USDA Strategic Plan FY 2018

United States Department of Agriculture USDA Strategic Plan FY 2018 – 2022 Contents STRATEGIC GOAL 1: Ensure USDA Programs Are Delivered Effciently, Effectively, With Integrity and a Focus on Customer Service...............................................................................5 STRATEGIC GOAL 2: Maximize the Ability of American Agricultural Producers To Prosper by Feeding and Clothing the World.....................................................................................15 STRATEGIC GOAL 3: Promote American Agricultural Products and Exports ....................................................................25 STRATEGIC GOAL 4: Facilitate Rural Prosperity and Economic Development..................................................................33 STRATEGIC GOAL 5: Strengthen the Stewardship of Private Lands Through Technology and Research..................................................................................................................39 STRATEGIC GOAL 6: Ensure Productive and Sustainable Use of Our National Forest System Lands...........................................................................................................45 STRATEGIC GOAL 7: Provide All Americans Access to a Safe, Nutritious, and Secure Food Supply ....................................................................................................................53 1 Message From the Secretary It’s my honor to serve with Here at USDA, we will facilitate rural prosperity each and every one of you through the expansion of rural -

Farm Activities Associated with Rural Development Initiatives, ERR-134, U.S

United States Department of Agriculture Farm Activities Associated Economic With Rural Development Research Service Initiatives Economic Research Faqir Singh Bagi Report Number 134 Richard Reeder May 2012 da.gov .us rs .e w Visit Our Website To Learn More! w w www.ers.usda.gov Recommended citation format for this publication: Bagi, Faqir Singh and Richard Reeder. Farm Activities Associated With Rural Development Initiatives, ERR-134, U.S. Department of Agriculture, Economic Research Service, May 2012. Photos: Thinkstock and USDA, Economic Research Service. The U.S. Department of Agriculture (USDA) prohibits discrimination in all its programs and activities on the basis of race, color, national origin, age, disability, and, where applicable, sex, marital status, familial status, parental status, religion, sexual orientation, genetic information, political beliefs, reprisal, or because all or a part of an individual's income is derived from any public assistance program. (Not all prohibited bases apply to all programs.) Persons with disabilities who require alternative means for communication of program information (Braille, large print, audiotape, etc.) should contact USDA's TARGET Center at (202) 720-2600 (voice and TDD). To file a complaint of discrimination write to USDA, Director, Office of Civil Rights, 1400 Independence Avenue, S.W., Washington, D.C. 20250-9410 or call (800) 795-3272 (voice) or (202) 720-6382 (TDD). USDA is an equal opportunity provider and employer. A Report from the Economic Research Service United States Department www.ers.usda.gov of Agriculture Economic Research Report Number 134 May 2012 Farm Activities Associated With Rural Development Initiatives Faqir Singh Bagi, [email protected] Richard Reeder, [email protected] Abstract Since 2002, USDA’s Rural Business and Industry (B&I) Loan Guarantee program has increased its emphasis on farm-related business activities associated with renew- able energy, local/regional food, and value-added agriculture. -

USDA Implements Immediate Measures to Help Rural Residents, Businesses and Communities Affected by COVID-19

(Updated June 24, 2021) The * denotes a new or updated item. USDA Implements Immediate Measures to Help Rural Residents, Businesses and Communities Affected by COVID-19 WASHINGTON, June 24, 2021 – USDA Rural Development has taken a number of immediate actions to help rural residents, businesses and communities affected by the COVID-19 outbreak. Rural Development will keep our customers, partners and stakeholders continuously updated as more actions are taken to better serve rural America. Visit www.rd.usda.gov/coronavirus for information on Rural Development loan payment assistance, application deadline extensions and more. COVID-19 RESOURCES On April 13, 2020, USDA unveiled a one-stop-shop of federal programs that can be used by rural communities, organizations and individuals impacted by the COVID-19 pandemic. The COVID-19 Federal Rural Resource Guide (PDF, 349 KB) is a first-of-its-kind resource for rural leaders looking for federal funding and partnership opportunities to help address this pandemic. On May, 4, 2020, USDA released a summary of key service changes to increase the use of telehealth in response to the COVID-19 pandemic. These changes will help ensure that more rural residents can access care when and where they need it during this pandemic. This summary is intended to help interested parties understand the telehealth changes that have been made and explore new ways to support health care providers as they increase or transition to virtual care services. OPPORTUNITIES FOR IMMEDIATE RELIEF Rural Housing Service Single-Family Housing Mutual Self-Help Housing Technical Assistance Grants: • USDA issued guidance on March 20, 2020, about steps the Department is taking to help you continue to successfully operate the Self-Help Program. -

Recreation Economy at USDA Economic Development Resources for Rural Communities

Recreation Economy at USDA Economic Development Resources for Rural Communities Together, America Prospers Table of Contents Background 3 Recreation Economy 4 Factors to Consider in Building the Recreation Economy 5 U.S. Forest Service 6 USDA Rural Development 7 National Institute for Food and Agriculture (NIFA) Land Grant Universities 8 How USDA Agencies Partner to Provide Recreation Economy Assistance 9 Highlighted Recreation Economy Resources at USDA 10 Additional Resources 13 Planning for a Recreation Economy 14 Business Development in The Recreation Economy Sector 18 Infrastructure Development to Support the Recreation Economy 21 Conservation/Easement Initiatives 22 Front cover: Ravens Rock at Coopers Rock State Park, W.Va. Photo courtesy of Nick Brolin © Feverpitched | Dreamstime.com Background USDA’s Forest Service (FS), Rural Development (RD), and the National Institute for Food and Agriculture (NIFA) have developed this resource guide for rural communities to identify resources that develop the recreation economy. Growing and maintaining a healthy recreation sector that System trail management. The importance of strategic benefits residents over the long term requires balancing partnerships, coordination and tracking their impact is also natural resource management, conservation efforts, highlighted in the revised 2012 Forest Service Planning infrastructure investment, business development and Rule, the 2016 Outdoor Recreation Jobs and Economic many other factors. It also requires active stakeholder Impact Act and the Native American Tourism and engagement, a robust understanding of potential Improving Visitor Experience (NATIVE) Act. challenges and opportunities, collaboration among various The U.S. Department of Agriculture Forest Service levels of government and landowners and a strong plan November 2016 report, “Federal Outdoor Recreation for the region’s future. -

USDA Resource Guide for Rural Workforce Development

USDA Resource Guide for Rural Workforce Development Together, America Prospers Contents How Your Rural Community can use USDA Programs to Build a Stronger Workforce . 2 Workforce Development Planning . .2 Infrastructure and Equipment Financing . .4 Industry and Employer Engagement, Entrepreneurship and Local Business Development . 6 Education, Training and Apprenticeship . .8 Rural Workforce Resource Guide Matrix . 10 Other Federal Agency Programs . 16 Additional Resources Available at USDA . 17 USDA Contact Information . 17 Created by the USDA Rural Development Innovation Center America’s rural workforce provides a vital foundation for the nation’s economy . Rural America supplies the nation’s food and energy resources, and the fiber necessary for goods and manufacturing . As USDA continues to respond to the COVID-19 pandemic and help restore the economy, we remain committed to supporting rural employers and job seekers to rebuild rural America’s workforce better, stronger and more equitably than ever before . For these reasons, USDA is prioritizing collaborations with its federal partners to help start and grow thousands of businesses and give individuals the educational and financial tools to succeed in rural America . This guide was created for community leaders and other local entities to help them access resources to create jobs, train talent, expand educational opportunities and provide technical assistance . The guide outlines programs and services available at USDA and other federal departments and agencies that support workforce development in rural communities . The guide highlights four key assistance types necessary to building a stronger rural workforce: 1. Workforce development planning 2. Infrastructure and equipment financing 3. Industry and employer engagement, entrepreneurship and local business development 4. -

July/August 2011

l a r u R CCUSDA /OORural DeOOvelopmePPnt EE RRAATTIIVVJulyEE/AugusSS t 2011 Forging links between growers and buyers Page 4 Features Volume 78, Number 4 July/August 2011 Rural Cooperatives (1088-8845) is published bimonthly by USDA Rural Development, 1400 Independence Ave. SW, Stop 0705, Washington, DC. 20250- 0705. The Secretary of Agriculture has determined that publication of this p.4 p. 8 p. 20 p. 30 periodical is necessary in the transaction of public business required by law of the Department. Periodicals postage paid at Washington, DC. and additional mailing offices. Copies may be obtained from the Superintendent of Documents, Government Printing Office, Washington, Taking the plunge DC, 20402, at $23 per year. Postmaster: 04 send address change to: Rural American Prawn Co-op helping aquaculture take root in tobacco country Cooperatives, USDA/RBS, Stop 3255, By Anne Todd Wash., DC 20250-3255. Mention in Rural Cooperatives of Pilot Mountain Pride forges links between growers and buyers company and brand names does not 08 signify endorsement over other By Anne Todd companies’ products and services. Unless otherwise stated, articles in this 11 Hogs on the range publication are not copyrighted and may Carolina growers form co-op to supply local pasture-based pork market be reprinted freely. Any opinions express- ed are those of the writers, and do not By Bill Brockhouse necessarily reflect those of USDA or its employees. 16 Market edge for the Wedge The U.S. Department of Agriculture Food co-op’s warehouse/distribution division a -

Community of Prosperity

USDA and its agencies have programs that can provide financial assistance to rural and underserved communities across the country. These programs support residents, businesses and communities through: • technical, training, and planning assistance; • financial assistance This resource matrix organizes funding opportunities identified at the USDA that support capacity building in rural America, and that foster hope and opportunity, wealth creation, and asset building. Opportunities are categorized by stakeholder group and type of technical assistance. 1 Table of Contents Letter from Director Beatty Pg. 3 Rural Prosperity Taskforce Priorities Pg. 4 USDA Agencies and Descriptions Pg. 5-7 Econnectivity Pg. 8-10 Economic Development Pg. 11-12 Innovation and Technology Pg. 13-14 Workforce Pg. 14-15 Quality of life Pg. 16-19 Resources and Tools Pg. 20 2 June 24, 2020 Greetings, It is my pleasure to share the USDA Community Prosperity Resource Matrix developed under the Centers of Community Prosperity initiative. The matrix provides easy to access information about USDA programs, tools, and data sources that foster hope and opportunity, asset building, and wealth creation in rural and underserved communities. Centers of Community Prosperity represent the partnerships between USDA agencies and its stakeholders including state, federal, and tribal partners, land-grant institutions, cooperative extension, other federal departments, and the private sector, such as, nongovernmental and philanthropic organizations, and community development financial institutions (CDFIs). The Centers of Community Prosperity host outreach and training summits and capacity-building workshops to encourage a sustainable development process focusing on locally-driven, bottom-up solutions addressing challenges in rural and underserved communities. This matrix is a tool to assist your community identify the appropriate USDA program, and highlights innovations in public and private financing.