CRDB BANK PLC the Bank That Listens

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Peter Mapigano

TPB Bank PLC is a Bank that provides competitive financial services to our customers and creates value for our stakeholders through innovative products. TPB Bank PLC is a Bank, whose vision is “to be the leading bank in Tanzania in the provision of affordable, accessible and convenient financial services”. As part of effective organizational development and management of its human capital in an effective way, TPB BANK PLC commits itself towards attaining, retaining and developing the highly capable and qualified workforce for TPB BANK PLC betterment and the Nation at large. BANKING OPERATION OFFICERS - UPCOUNTRY ( 58 POSITIONS) TPB Bank PLC seeks to recruit dedicated, self-motivated and highly organized Banking Operation Officers (58 positions) to join the Directorate of Technology and Operation team. The work stations are upcountry . DIRECT REPORTING LINE BRANCH MANAGER LOCATION UPCOUNTRY WORK SCHEDULE AS PER TPB BANK PLC STAFF REGULATIONS DIVISION BRANCHES SALARY COMMENSURATE TO THE JOB ADVERTISED POSITION OBJECTIVE Serve Customers effectively, Maintain Competitive turnaround time and process transactions accurately. His/her efficiency and courtesy often reflects the Bank’s standard of service. He/she has to ensure that both front and back office operations are performed fast, accurately and friendly. KEY RESPONSIBILITIES . Guide prospective customers who come over the counter for inquiries. Coordinate all counter activities while ensuring that quality service is provided to customers. Receive Cash and Cheque deposits . Posting Transactions . Verify teller proof of cash and teller proof of cheques against actual documents by ticking and signing the printouts. Scrutinize internal vouchers to ensure that they are properly drawn and authorized in line with the approval limits. -

"Rural Transformation in Postsocialist Tanzania: Toward an Institutional

Embedded Institutions and Rural Transformation in Tanzania: Privatizing Rural Property and Markets1 Paper Prepared for the Fourth Meeting of the Africa Task Force, Initiative for Policy Dialogue (Columbia University), Pretoria, South Africa 9,10 July, 2009 Howard Stein and Kelly Askew The University of Michigan [email protected] [email protected] Numerous studies have focused on the nature and transformation of former socialist regimes in Eastern Europe and their impact on existing institutional arrangements. Little attention, however, has been paid to formerly socialist states in Africa. Our paper seeks to address this gap by investigating how institutions have been affected by reform and in turn how they have affected the patterns of rural transformation. Institutionalist theory includes consideration of what happens when existing habits of thought are no longer capable of coordinating economic activity, due to a shift in the rules, organizations, or erosion in capacities—a situation termed ‘institutional hiatus’. The end of socialist patterns of production and distribution in Tanzania, as in the former Soviet bloc countries, can be understood in terms of institutional hiatus and carefully examined for the development of new attitudes, new incentives, and new behavioral practices. Unlike the typical neo-liberal view that dichotomizes socialism and reform, we posit an approach that recognizes that the reform outcome is greatly shaped by the character of previous institutions. While our research focused on a number of important elements -

Currency Bank Account SWIFT Code 1 EURO CRDB Bank 19J1043011100 CORUTZ 2 USD CRDB Bank 202J1043011100 CORUTZ 3 USD CITI Bank 0100235021 CITITZTZ

TANZANIA ELECTRIC SUPPLY COMPANY LIMITED TENDER No. PA/001/ 2019-20/HQ/N/42 For MAJOR REHABILITATION OF TRANSFORMERS T6 AND T7 INCLUDING SERVICE OF ABB TAP CHANGERS AT UBUNGO SUBSTATION INVITATION FOR TENDERS The Tanzania Electric Supply Company Limited (TANESCO) has set aside funds for its operations during Financial year 2019-2020 and it intends to apply part of the proceeds of its funds to cover eligible payments under the contract for which this invitation is issued. TANESCO now invites sealed Tenders from eligible Tenderer for carrying out the Major Rehabilitation of Transformers T6 and T7 Including Service of ABB T ap Changers at Ubungo Substation. Tendering will be conducted through International Competitive Tendering procedures as specified in the Procurement Regulations of 2013 Government Notice No.446 as amended in 2016 and is open to all Tenderers as defined in the Regulations. Interested eligible Tenderers may obtain further information from and inspect the Tendering Documents at the office of the Secretary of the Tender Board, Room No. G 04, TANESCO, Umeme Park Building, Ubungo, along Morogoro Road, PO. Box 9024 Dar es Salaam. Telephone No. +255 222 210 264; 210 267 from 092th to 16.00hrs on Mondays to Fridays inclusive except on public holidays. A complete set of bidding documents in English may be purchased by interested Applicants on the submission of a written application with contact details to the address given under paragraph 4 above and upon payment of a nonrefundable fee of TZS 100,000.00 or equivalent amount in freely convertible currency excluding bank charges. -

Introduction 3 Before Arrival in Arusha 3

Introduction 3 Before arrival in Arusha 3 Mail Address 3 Pre-Registration 3 Travel to and from Arusha 4 Insurance 5 Visa, Passports and Entry Formalities 5 Customs Formalities 8 th Welcome to the 47 Annual Health Services 8 Meeting of the Board Air Transport 9 of Governors of the African Development Bank and the Hotel Accommodation in Arusha 9 38th Annual Meeting of the Arrival in Arusha 11 Board of Governors of the Reception at Kilimanjaro International Airport 11 African Development Fund Annual Meetings Information 11 Press 11 28 May - 1 June 2012 Practical Information 12 Arusha Telecommunications 12 Tanzania The AICC Conference Facility 12 Practical Information 13 Car Rental Services in Arusha 15 Commercial Banks in Arusha 16 Places of Interest in Arusha 16 Shopping Centres 18 Places of Worship 19 Security 20 Badges 20 Annexes I 2012 Annual Meetings of the Boards of Governors of the African Development Bank Group 23 II Provisional Spouse Programme 26 III AfDB Board of Governors- Joint Reception and Gala Dinner Programme 27 IV Diplomatic Missions Accredited to Tanzania 28 V Tanzania Diplomatic Missions Abroad 37 VI Hotels in Arusha Description and Accommodation Booking 41 VII Airlines Serving Dar es Salaam (Julius Nyerere International Airport) 46 VIII Hospital and Special Assistance for emergencies in Arusha 47 IX Hospital and Special Assistance for emergencies in Arusha 48 X Emergency Call in Arusha 49 1 2 Introduction The 2012 Annual Meetings of the Boards of Governors of the African Development Bank Group (African Development Bank and the African Development Fund) will take place in Arusha, Tanzania, at the Arusha International Conference Centre (AICC), from 28May to 1 June 2012. -

Trust Funds Presentation

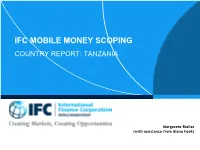

IFC MOBILE MONEY SCOPING COUNTRY REPORT: TANZANIA Margarete Biallas (with assistance from Alana Fook) TANZANIA SUMMARY - PAGE 1 CURRENT MOBILE MONEY SOLUTION Currently 5 mobile money solutions offered. POPULATION 51 million MOBILE PENETRATION 55% (high) BANKED POPULATION 19% through financial institutions, 40% overall [Source: World Bank FINDEX] PERCENT UNDER POVERTY LINE 28.2% (2012) [Source: World Bank] ECONOMICALLY ACTIVE POPULATION Workforce: 26.11 million (2015) [Source: CIA] ADULT LITERACY 70.6% of Tanzanians, age 15 and over, can read and write (2015) [Source: CIA] MOBILE NETWORK OPERATORS Vodacom (12.4 million subscribers) Tigo (11.4 million subscribers) Airtel (10.7 million subscribers) Zantel (1.2 million subscribers) There are smaller MNO’s eg Halotel (4%), Smart (3%) and TTCL (1%) but they are marginal and do not currently Market Readiness offer mobile money at this time. OVERALL READINESS RANKING The telcom sector has dramatically improved access Regulation 3 through mobile money. Over 40% of mobile money Financial Sector 3 subscribers are active on a 90-day basis. The financial Telecom Sector 4 sector has begun to incorporate agency banking into their channel strategies. Scope for improvements in Distribution 3 strategy formulation and execution exists. Distribution Market Demand 4 in rural areas is difficult as population density is low and infrastructure is poor. 4 (Moderate) Macro-economic Overview Regulations Financial Sector Telecom Sector Other Sectors Digital Financial Services Landscape MOBILE BANKING MARKET POTENTIAL -

Q4 2016 Tanzania

Q4 2016 www.bmiresearch.com TANZANIA COMMERCIAL BANKING REPORT INCLUDES 5-YEAR FORECASTS TO 2020 Published by:BMI Research Tanzania Commercial Banking Report Q4 2016 INCLUDES 5-YEAR FORECASTS TO 2020 Part of BMI’s Industry Report & Forecasts Series Published by: BMI Research Copy deadline: September 2016 ISSN: 2053-3020 BMI Research © 2016 Business Monitor International Ltd 2 Broadgate Circle All rights reserved. London EC2M 2QS All information contained in this publication is United Kingdom copyrighted in the name of Business Monitor Tel: +44 (0) 20 7248 0468 International Ltd, and as such no part of this Fax: +44 (0) 20 7248 0467 publication may be reproduced, repackaged, Email: [email protected] redistributed, resold in whole or in any part, or used Web: http://www.bmiresearch.com in any form or by any means graphic, electronic or mechanical, including photocopying, recording, taping, or by information storage or retrieval, or by any other means, without the express written consent of the publisher. DISCLAIMER All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the time of publishing. However, in view of the natural scope for human and/or mechanical error, either at source or during production, Business Monitor International Ltd accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting any part of the publication. All information is provided without warranty, and Business Monitor International Ltd makes no representation of warranty of any kind as to the accuracy or completeness of any information hereto contained. -

Comparison Study on the Financial Performance Between Islamic Bank and Convectional Banks in Tanzania: the Cases of Amana and CRDB Banks

The University of Dodoma University of Dodoma Institutional Repository http://repository.udom.ac.tz Business Master Dissertations 2017 Comparison study on the financial performance between Islamic bank and convectional banks in Tanzania: the cases of Amana and CRDB banks Magesa, Angela Peter The University of Dodoma Magesa, A. P. (2017). Comparison study on the financial performance between Islamic bank and convectional banks in Tanzania: the cases of Amana and CRDB banks. Dodoma: The University of Dodoma http://hdl.handle.net/20.500.12661/339 Downloaded from UDOM Institutional Repository at The University of Dodoma, an open access institutional repository. COMPARISON STUDY ON THE FINANCIAL PERFORMANCE BETWEEN ISLAMIC BANK AND CONVECTIONAL BANKS IN TANZANIA: THE CASES OF AMANA AND CRDB BANKS ANGELA PETER MAGESE MASTER OF BUSINESS ADMINISTRATION THE UNIVERSITY OF DODOMA OCTOBER, 2017 COMPARISON STUDY ON THE FINANCIAL PERFORMANCE BETWEEN ISLAMIC BANK AND CONVECTIONAL BANKS IN TANZANIA: THE CASES OF AMANA AND CRDB BANKS By Angela Peter Magese A Dissertation submitted in partial fulfilments of the requirements for the degree of Master of Business Administration at the University Of Dodoma The University of Dodoma October, 2017 CERTIFICATION The undersigned certifies that, he has read and hereby recommends for acceptance by the University of Dodoma a dissertation entitled “Comparison study on the financial performance between Islamic bank and Convectional banks in Tanzania: A cases of Amana and CRDB banks” In partial fulfilment of the requirements for a degree of Masters of Business Administration at the University of Dodoma. …………………………………………… Dr. Joel J Mmasa (SUPERVISOR) Date …………………………………… i DECLARATION AND COPYRIGHT I ANGELA P MAGESE declare that, this dissertation is my own original work and that it has not been presented and will not presented to any other university, for a similar or any other degree award. -

Tanzania Mortgage Market Update – 31 December 2020

TANZANIA MORTGAGE MARKET UPDATE – 31 DECEMBER 2020 1. Highlights The mortgage market in Tanzania registered a 6 percent annual growth in the value of mortgage loans from 31 December 2019 to 31 December 2020. On a quarter to quarter basis; the mortgage market in Tanzania registered a 4 percent growth in the value of mortgage loans as at 31 December 2020 compared to previous quarter which ended on 30 September 2020. There was no new entrant into the mortgage market during the quarter. The number of banks reporting to have mortgage portfolios increased from 31 banks to 32 banks recorded in Q4 2020 due to reporting to BOT by Mwanga Hakika Bank the newly formed bank after merger of Mwanga Community Bank, Hakika Microfinance Bank and EFC Microfinance Bank. EFC Microfinance bank did not report in Q3-2020 due to revocation of their licence after the merger and the newly formed bank reported for the first time in Q4-2020. Outstanding mortgage debt as at 31 December 2020 stood at TZS 464.14billion1 equivalent to US$ 200.93 million compared to TZS 445.21 billion equivalent to US$ 192.81 as at 30 September 2020. Average mortgage debt size was TZS 78.56 million equivalent to US$ 34,010 (TZS 76.67 million [US$ 33,203] as at 30 September 2020). The ratio of outstanding mortgage debt to Gross Domestic Product (GDP) increased to 0.30 percent compared to 0.28 percent recorded for the quarter ending 30 September 2020. Mortgage debt advanced by top 5 Primary Mortgage Lenders (PMLs) remained at 69 percent of the total outstanding mortgage debt as recorded in the previous quarter. -

Implications of the Covid-19 Pandemic on the Banking Industry and the Role That Mergers and Acquisitions May Play

IMPLICATIONS OF THE COVID-19 PANDEMIC ON THE BANKING INDUSTRY AND THE ROLE THAT MERGERS AND ACQUISITIONS MAY PLAY TANZANIA POSTAL BANK PLC & TIB CORPORATE BANK LIMITED 1 TPB BANK PLC‘S MERGER WITH TIB CORPORATE BANK LIMITED AND ITS IMPLICATIONS ON THE BANKING INDUSTRY AMID COVID-19 The recent announcement of TPB Bank Plc’s (“TPB”) merger with TIB Corporate Bank Limited (“TIB’) was met with much optimism especially within the Tanzanian banking and media industry. This is owed to the fact that TPB has now joined a unique group of commercial banks operating in Tanzania that hold assets amounting to TZS 1 trillion (approximately USD 431 million) or more. This follows the government owned lender’s acquisition of the assets and liabilities of TIB, which is also a government majority owned bank. This signals a continued shift towards consolidation within the banking industry but also further raises questions of the implications of the COVID-19 pandemic on the banking industry and the role that mergers and acquisitions may play in its consequences. The evidentiary shift to mergers within the banking industry is highlighted by the fact that TPB on its own has been party to three mergers within the past two years in which Twiga Bancorp Limited (“Twiga Bancorp”), the Tanzania Women’s Bank and now TIB have all been subsumed under its control. One of the main reasons cited for the merger between TPB and TIB has been the need to increase efficiency and reduce operational costs. However, the standout issue appears to be the fact that TIB had one of the highest levels of nonperforming loans in the market potentially leading to expensive and drawn out litigation in recovering said loans. -

United Republic of Tanzania Tanzania Electric Supply

UNITED REPUBLIC OF TANZANIA TANZANIA ELECTRIC SUPPLY COMPANY LIMITED SPECIFIC PROCUREMENT NOTICE IFB Number:PA/001/2020-2021/HQ/W/19 Employer:Tanzania Electric Supply Company Limited (TANESCO) Project:P-TZ-FA0-013 -North West Grid (400kV Nyakanazi-Kigoma Transmission Line) Contract title:Procurement of Design, Supply, Installation, Testing and Commissioning of 280km 400kV Double Circuit Overhead Transmission Line from Nyakanazi to Kigoma Country:TANZANIA Loan No. / Grant No.:2000200002754 Procurement Method:Open Competitive Bidding (International) (OCBI) OCBI/LCB No: PA/001/2020-2021/HQ/W/19 Issued on:16th November, 2020 1. The Government of the United Republic of Tanzania received financing from the African Development Bank (AfDB) hereinafter called the Bank toward the cost of the North West Grid 400kV Nyakanazi-Kigoma Transmission Line, and intends to apply part of the proceeds toward payments under the contract for Procurement of Design, Supply, Installation, Testing and Commissioning of 280km 400kV Double Circuit Overhead Transmission Line from Nyakanazi to Kigoma. 2. The Tanzania Electric Supply Company Limited (TANESCO) now invites sealed Bids from eligible Bidders for Procurement of Design, Supply, Installation, Testing and Commissioning of 280km 400kV Double Circuit Overhead Transmission Line from Nyakanazi to Kigoma. Construction period will be Twenty-Four(24) Months. Location of Construction is along Nyakanazi –Kigoma and Margin of preference is NOT applicable. 3. Bidding will be conducted through the Open Competitive Bidding (International), OCBI procedures as specified in the Bank’s Procurement Framework for Bank Group Funded Operations, October 2015 and is open to all eligible Bidders as defined in the Procurement Framework. 4. -

Schedule of Rates and Charges 2020 BANK CHARGES (VAT Exclusive) (VAT Inclusive)

Schedule of Rates and Charges 2020 BANK CHARGES (VAT Exclusive) (VAT Inclusive) USD / Transaction Descriptions TZS USD /EUR GBP TZS GBP EUR Maintenance Fee Current Account: Corporate Per month 15,000 12 8 17,700 14.16 9.44 Chana Customers SME Per month 13,000 12 8 15,340 14.16 9.44 Personal Per month 13,000 12 8 15,340 14.16 9.44 Lipa Customers Financial Institutions Per month 200,000 12 8 236,000 14.16 9.44 (Banks) Bidii Per month 3,000 3 3 3,540 3.54 3.54 na Account Savings Accounts: Fanya malipo Normal Savings Per month 1,600 2.5 2.5 1,888 2.95 2.95 Account Salary Visa Per month 1,500 2.5 2.5 1,770 2.95 2.95 Account Busara Per month Free n/a n/a Free n/a n/a Popote bila stress Account Scholar Per month Free Free Free Free Free Free Account Junior Per month Free Free Free Free Free Free Jumbo Malkia Per month Free Free Free Free Free Free Account Thamani Per month Free n/a n/a Free n/a n/a Account Dhahabu Per month Free n/a n/a Free n/a n/a Account Bal. >USD/ Tanzanite GBP/EUR, 1,500 Free Free 1,770 Free Free Account 5000 Bal. <USD/ GBP/EUR, 1,500 2.5 2.5 1,770 2.95 2.95 5000 Cash Deposit Over the Per transac- Free Free Free Free Free Free Counter tion CRDB Per transac- Free Free Free Free Free Free Wakala tion Cash withdrawal Over the Counter "Per trans- Current action 1.18% 1.18% 5,085 1% min.5 1% min. -

MKUTANO WA KUMI NA TISA Kikao Cha Arobaini Na Sita

NAKALA MTANDAO(ONLINE DOCUMENT) BUNGE LA TANZANIA ________ MAJADILIANO YA BUNGE _________ MKUTANO WA KUMI NA TISA Kikao cha Arobaini na Sita – Tarehe 15 Juni, 2020 (Bunge Lilianza Saa Tatu Asubuhi) D U A Spika (Mhe. Job Y. Ndugai) Alisoma Dua SPIKA: Waheshimiwa Wabunge tukae, tunaendelea na Mkutano wetu wa 19, Kikao cha 46, bado kimoja tu cha kesho. Katibu! NDG. STEPHEN KAGAIGAI – KATIBU WA BUNGE: HATI ZILIZOWASILISHWA MEZANI Hati zifuatazo ziliwasilishwa mezani na: NAIBU WAZIRI WA FEDHA NA MIPANGO: Maelezo ya Waziri wa Fedha na Mipango kuhusu Muswada wa Sheria ya Fedha wa Mwaka 2020 (The Finance Bill, 2020). Muhtasari wa Tamko la Sera ya Fedha kwa Mwaka wa Fedha 2020/2021 (Monetary Policy Statement for the Financial Year 2020/2021). MHE. ALBERT N. OBAMA - K.n.y. MWENYEKITI WA KAMATI YA KUDUMU YA BUNGE YA BAJETI:Maoni ya Kamati ya Kudumu ya Bunge ya Bajeti Kuhusu Muswada wa Sheria ya Fedha wa Mwaka 2020 (The Finance Bill, 2020). 1 NAKALA MTANDAO(ONLINE DOCUMENT) MHE. RHODA E. KUNCHELA - K.n.y. MSEMAJI MKUU WA KAMBI RASMI YA UPINZANI BUNGENI KWA WIZARA YA FEDHA NA MIPANGO: Maoni ya Kambi Rasmi ya Upinzani Bungeni kuhusu Muswada wa Sheria ya fedha wa mwaka 2020 (The Finance Bill, 2020). MHE. DKT. TULIA ACKSON - MAKAMU MWENYEKITI WA KAMATI YA KUDUMU YA BUNGE YA KANUNI ZA BUNGE: Azimio la Kamati ya Kudumu ya Bunge ya Kanuni za Bunge kuhusu Marekebisho ya Kanuni za Bunge SPIKA: Asante sana Mheshimiwa Naibu Spika, Katibu MASWALI NA MAJIBU (Maswali yafuatayo yameulizwa na kujibiwa kwa njia ya mtandao) Na. 426 Migogoro ya Mipaka MHE.