Discloseable Transaction

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fenhe (Fen He)

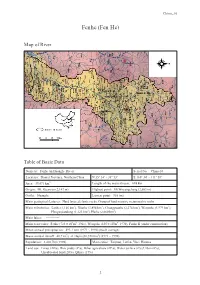

China ―10 Fenhe (Fen He) Map of River Table of Basic Data Name(s): Fenhe (in Huanghe River) Serial No. : China-10 Location: Shanxi Province, Northern China N 35° 34' ~ 38° 53' E 110° 34' ~ 111° 58' Area: 39,471 km2 Length of the main stream: 694 km Origin: Mt. Guancen (2,147 m) Highest point: Mt.Woyangchang (2,603 m) Outlet: Huanghe Lowest point: 365 (m) Main geological features: Hard layered clastic rocks, Group of hard massive metamorphic rocks Main tributaries: Lanhe (1,146 km2), Xiaohe (3,894 km2), Changyuanhe (2,274 km2), Wenyuhe (3,979 km2), Honganjiandong (1,123 km2), Huihe (2,060 km2) Main lakes: ------------ 6 3 6 3 Main reservoirs: Fenhe (723×10 m , 1961), Wenyuhe (105×10 m , 1970), Fenhe II (under construction) Mean annual precipitation: 493.2 mm (1971 ~ 1990) (basin average) Mean annual runoff: 48.7 m3/s at Hejin (38,728 km2) (1971 ~ 1990) Population: 3,410,700 (1998) Main cities: Taiyuan, Linfen, Yuci, Houma Land use: Forest (24%), Rice paddy (2%), Other agriculture (29%), Water surface (2%),Urban (6%), Uncultivated land (20%), Qthers (17%) 3 China ―10 1. General Description The Fenhe is a main tributary of The Yellow River. It is located in the middle of Shanxi province. The main river originates from northwest of Mt. Guanqing and flows from north to south before joining the Yellow River at Wanrong county. It flows through 18 counties and cities, including Ningwu, Jinle, Loufan, Gujiao, and Taiyuan. The catchment area is 39,472 km2 and the main channel length is 693 km. -

Maria Khayutina • [email protected] the Tombs

Maria Khayutina [email protected] The Tombs of Peng State and Related Questions Paper for the Chicago Bronze Workshop, November 3-7, 2010 (, 1.1.) () The discovery of the Western Zhou period’s Peng State in Heng River Valley in the south of Shanxi Province represents one of the most fascinating archaeological events of the last decade. Ruled by a lineage of Kui (Gui ) surname, Peng, supposedly, was founded by descendants of a group that, to a certain degree, retained autonomy from the Huaxia cultural and political community, dominated by lineages of Zi , Ji and Jiang surnames. Considering Peng’s location right to the south of one of the major Ji states, Jin , and quite close to the eastern residence of Zhou kings, Chengzhou , its case can be very instructive with regard to the construction of the geo-political and cultural space in Early China during the Western Zhou period. Although the publication of the full excavations’ report may take years, some preliminary observations can be made already now based on simplified archaeological reports about the tombs of Peng ruler Cheng and his spouse née Ji of Bi . In the present paper, I briefly introduce the tombs inventory and the inscriptions on the bronzes, and then proceed to discuss the following questions: - How the tombs M1 and M2 at Hengbei can be dated? - What does the equipment of the Hengbei tombs suggest about the cultural roots of Peng? - What can be observed about Peng’s relations to the Gui people and to other Kui/Gui- surnamed lineages? 1. General Information The cemetery of Peng state has been discovered near Hengbei village (Hengshui town, Jiang County, Shanxi ). -

Addition of Clopidogrel to Aspirin in 45 852 Patients with Acute Myocardial Infarction: Randomised Placebo-Controlled Trial

Articles Addition of clopidogrel to aspirin in 45 852 patients with acute myocardial infarction: randomised placebo-controlled trial COMMIT (ClOpidogrel and Metoprolol in Myocardial Infarction Trial) collaborative group* Summary Background Despite improvements in the emergency treatment of myocardial infarction (MI), early mortality and Lancet 2005; 366: 1607–21 morbidity remain high. The antiplatelet agent clopidogrel adds to the benefit of aspirin in acute coronary See Comment page 1587 syndromes without ST-segment elevation, but its effects in patients with ST-elevation MI were unclear. *Collaborators and participating hospitals listed at end of paper Methods 45 852 patients admitted to 1250 hospitals within 24 h of suspected acute MI onset were randomly Correspondence to: allocated clopidogrel 75 mg daily (n=22 961) or matching placebo (n=22 891) in addition to aspirin 162 mg daily. Dr Zhengming Chen, Clinical Trial 93% had ST-segment elevation or bundle branch block, and 7% had ST-segment depression. Treatment was to Service Unit and Epidemiological Studies Unit (CTSU), Richard Doll continue until discharge or up to 4 weeks in hospital (mean 15 days in survivors) and 93% of patients completed Building, Old Road Campus, it. The two prespecified co-primary outcomes were: (1) the composite of death, reinfarction, or stroke; and Oxford OX3 7LF, UK (2) death from any cause during the scheduled treatment period. Comparisons were by intention to treat, and [email protected] used the log-rank method. This trial is registered with ClinicalTrials.gov, number NCT00222573. or Dr Lixin Jiang, Fuwai Hospital, Findings Allocation to clopidogrel produced a highly significant 9% (95% CI 3–14) proportional reduction in death, Beijing 100037, P R China [email protected] reinfarction, or stroke (2121 [9·2%] clopidogrel vs 2310 [10·1%] placebo; p=0·002), corresponding to nine (SE 3) fewer events per 1000 patients treated for about 2 weeks. -

中国砂梨出口美国注册包装厂名单(20180825更新) Registered Packinghouses of Fresh Chinese Sand Pears to U.S

中国砂梨出口美国注册包装厂名单(20180825更新) Registered Packinghouses of Fresh Chinese Sand Pears to U.S. 序号 所在地 Location: County, 包装厂中文名 包装厂英文名 包装厂中文地址 包装厂英文地址 注册登记号 Number Location Province Chinese Name of Packing house English Name of Packing house Address in Chinese Address in English Registered Number 辛集市裕隆保鲜食品有限责任公 XINJI YULONG FRESH FOOD CO.,LTD. 1 河北辛集 XINJI,HEBEI 河北省辛集市南区朝阳路19号 NO.19 CHAOYANG ROAD,XINJI,HEBEI 1300GC001 司果品包装厂 PACKING HOUSE 2 河北辛集 XINJI,HEBEI 河北天华实业有限公司 HEBEI TIANHUA ENTERPRISE CO.,LTD. 河北省辛集市新垒头村 XINLEITOU VILLAGE,XINJI CITY, HEBEI 1300GC002 TONGDA ROAD, JINZHOU CITY,HEBEI 3 河北晋州 JINZHOU,HEBEI 晋州天洋贸易有限公司 JINZHOU TIANYANG TRADE CO.,LTD. 河北省晋州市通达路 1300GC005 PROVINCE HEBEI JINZHOU GREAT WALL ECONOMY 4 河北晋州 JINZHOU,HEBEI 河北省晋州市长城经贸有限公司 河北省晋州市马于开发区 MAYU,JINZHOU,HEBEI,CHINA 1300GC006 TRADE CO.,LTD. TIANJIAZHUANG INDUSTRIAL DEVELOPMENT 5 河北辛集 XINJI,HEBEI 辛集市天宇包装厂 XINJI TIANYU PACKING HOUSE 辛集市田家庄乡工业开发区 1300GC009 ZONE,XINJI,HEBEI HEBEI YUETAI AGRICULTURAL PRODUCTS TEXTILE INDUSTRIAL PARK,JINZHOU,HEBEI, 6 河北晋州 JINZHOU,HEBEI 河北悦泰农产品加工有限公司 河北省晋州市纺织园区 1300GC036 PROCESSING CO.,LTD. CHINA 7 河北泊头 BOTOU,HEBEI 泊头东方果品有限公司 BOTOU DONGFANG FRUIT CO.,LTD. 泊头河西金马小区 HEXI JINMA SMALL SECTION, BOTOU CITY 1306GC001 8 河北泊头 BOTOU,HEBEI 泊头亚丰果品有限公司 BOTOU YAFENG FRUIT CO., LTD. 泊头市齐桥镇 QIQIAO TOWN, BOTOU CITY 1306GC002 9 河北泊头 BOTOU,HEBEI 泊头食丰果品有限责任公司 BOTOU SHIFENG FRUIT CO., LTD. 泊头市齐桥镇大炉村 DALU VILLAGE,QIQIAO TOWN, BOTOU CITY 1306GC003 HEJIAN ZHONGHONG AGRICULTURE NANBALIPU VILLAGE, LONGHUADIAN TOWN, 10 河北河间 HEJIAN,HEBEI 河间市中鸿农产品有限公司 河间市龙华店乡南八里铺 1306GC005 PRODUCTS CO.,LTD. HEJIAN CITY 11 河北泊头 BOTOU,HEBEI 沧州金马果品有限公司 CANGZHOU JINMA FRUIT CO.,LTD. 泊头市龙华街 LONGHUA STREET,BOTOU CITY 1306GC018 SHEN VILLAGE, GUXIAN TOWN, QIXIAN, 12 山西晋中市 JINZHONG,SHANXI 祁县耀华果业有限公司 QIXIAN YAOHUA FRUIT CO., LTD 山西省晋中市祁县古县镇申村 1400GC020 JINZHONG, SHANXI 山西省晋中市祁县昭馀镇西关村西 SOUTHWESTERN ALLEY, XIGUAN VILLAGE, 13 山西晋中市 JINZHONG,SHANXI 祁县麒麟果业有限公司 QIXIAN QILIN FRUIT CO., LTD. -

RELACION DE LUGARES DE PRODUCCION AUTORIZADOS a EXPORTAR MANZANAS (Malus Domestica) AL PERU

RELACION DE LUGARES DE PRODUCCION AUTORIZADOS A EXPORTAR MANZANAS (Malus domestica) AL PERU 2019-2020年中国苹果输往秘鲁注册果园名单 LIST OF REGISTERED ORCHARDS FOR APPLES EXPORTING TO PURE IN THE YEAR OF 2019-2020 所在地中文名 果园中文名称 注册登记号 序号 所在地英文名 Location 果园英文名称 中文地址 英文地址 Location Orchard Name Registered No. (English) Orchard Name (English) Address (Chinese) Address (English) (Chinese) (Chinese) Code TIANHUYU VILLAGE, GREAT WALL APPLE 石家庄市井陉矿区贾庄镇 JIAZHUANG TOWN, 1 河北 JINGXING,HEBEI 长城苹果园 1300GY028 ORCHARD 天户屿村 JINGXING DISTRICT, SHIJIAZHUANG CITY SHUIYU VILLAGE, 山西省运城市芮城县学张 XUEZHANG TOWN, 2 山西运城 YUNCHENG,SHANXI 条山果园 TIAO MOUNTAIN ORCHARD RUICHENG COUNTY, 0507GY0027 乡水峪村 YUNCHENG CITY, SHANXI PROVINCE PEIZHUANG TOWN, 山西省运城市万荣县裴庄 WANRONG COUNTY, 3 山西运城 YUNCHENG,SHANXI 裴庄果园 PEIZHUANG ORCHARD 0507GY0104 乡 YUNCHENG CITY, SHANXI PROVINCE , 山西省运城市临猗县猗氏 YISHI TOWN LINYI 4 山西运城 YUNCHENG,SHANXI 孙家卓果园 SUNJIAZHUO ORCHARD COUNTY, YUNCHENG CITY, 0507GY0153 镇 SHANXI PROVINCE XIQI VILLAGE, BUGUAN 山西省运城市平陆县部官 TOWN, PINGLU COUNTY, 5 山西运城 YUNCHENG,SHANXI 西祁果园 XIQI ORCHARD 0507GY0017 镇西祁村 YUNCHENG CITY, SHANXI PROVINCE FENGWANG ROAD QIJI 山西省运城市临猗七级冯 TOWN LINYI COUNTY 6 山西运城 YUNCHENG,SHANXI 七级镇果园 QIJI TOWNSHIP ORCHARD 0507GY0159 王路 1 号 YUNCHENG CITY SAHNXI PROVINCE RELACION DE LUGARES DE PRODUCCION AUTORIZADOS A EXPORTAR MANZANAS (Malus domestica) AL PERU JIACUN VILLAGE, TONGAI HONGYAN APPLE 山西省运城市万荣县贾村 TOWN, WANRONG CONTRY, 7 山西运城 YUNCHENG,SHANXI 红艳苹果园 0507GY0235 ORCHARD 乡贾村 YUNCHENG CITY, SHANXI PROVINCE. SUNJIAZHUANG VILLAGE, 山西省运城市万荣县贾村 JIACUN TOWN, WANRONG 8 山西运城 YUNCHENG,SHANXI -

48358-001: Shanxi Inclusive Agricultural Value Chain Development

Environmenta l Monitoring Report Project Number: 48358-001 October 2019 PRC: Shanxi Inclusive Agricultural Value Chain Development Project (Jan.-June 2019) Prepared by: Shanxi Foreign Capital Poverty Alleviation Project Management Office. This environmental monitoring report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management or staff, and may be preliminary in nature. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area. CURRENCY EQUIVALENTS (as of 30 June 2019) Currency unit – Yuan (CNY) CNY1.00 = $ 0.1459 $1.00 = CNY 6.8531 ACRONYMS AND ABBREVIATIONS ADB Asian Development Bank GRM Grievance redress mechanism AVC Agricultural value chain Leq Equivalent continuous sound pressure level, in decibels BOD5 5-day biochemical oxygen demand LAeq Equivalent continuous A-weighted sound pressure level, in decibels CNY Chinese Yuan, Renminbi LIC Loan implementation consultant CODcr Chemical oxygen demand IA Implementing agency CSC Construction supervision company IEE Initial environmental examination dB Decibels MOE Ministry of Environment DO Dissolved oxygen NH3-N Ammonia nitrogen EIA Environmental impact assessment NO2 Nitrate EA Executing Agency O&M Operation and maintenance EIA Environmental impact assessment pH potential -

Shanxi Achieves Victory, Lifts Over 3M People out of Poverty

CHINA DAILY | HONG KONG EDITION Friday, March 5, 2021 DISCOVER SHANXI | 15 Modern methods help with bumper harvests By YUAN SHENGGAO ning similar hopes on agricultural modernization. As spring is the crucial time for Spring is the busiest time for agriculture, farmers in North Chi- local agronomists. They have to na’s Shanxi province are busy travel frequently and extensively working on their land and hoping to meet farmers’ demand for tech- for a good harvest this year. nological services. And the use of modern means of Li Fengchao, head of the agricul- operation is putting their expecta- tural technology station in tions on more solid ground. Ruicheng, is not to be found in his In Pinglu county in the south of office during this period. Instead, Shanxi, farmers are using water he can often be spotted in the from the Yellow River to irrigate fields. their 9,000-plus hectares of win- He was busy measuring the soil ter-sowed wheat. thickness and moisture of farm- Liang Wenbo, who was operat- land in various townships. He gave ing a spray-irrigation system in the his suggestions on irrigation and field, highly praised the modern fertilizing to township agricultural methods. technicians through WeChat. “Several years ago, we used to Li Yaping, a farmer in Qiaotou pump underground water from village in Ruicheng, said the servi- A total of 3,378 forestry cooperatives have been founded in 58 impoverished counties and cities in Shanxi over the past five years, wells to irrigate and the cost was ces from experts like Li Fengchao contributing to rural environmental improvements by planting some 535,300 hectares of trees. -

Meanings of Worship in Wooden Architecture in Brick

MEANINGS OF WORSHIP IN WOODEN ARCHITECTURE IN BRICK Yin Wu A thesis submitted to the faculty at the University of North Carolina at Chapel Hill in partial fulfillment of the requirements for the degree of Master of Arts in the Department of Art. Chapel Hill 2016 Approved by: Eduardo Douglas Wei-Cheng Lin Daniel Sherman @2016 Yin Wu ALL RIGHTS RESERVED ii ABSTRACT Yin Wu: Meanings of Worship in Wooden Architecture in Brick (Under the direction of Wei-Cheng Lin) The brick burial chamber built to imitate the wooden structure that became popular since the late Tang period was usually understood as a mimicry of the aboveground residence. Its more and more elaborate construction toward the Jin period was also often described as representing the maturity of the “wooden architecture in brick.” In this paper, however, I argue that the increasing elaboration of the form, in fact, indicates a changing meaning of the tombs. To this end, this paper investigates the “wooden architecture in brick” built in the 12th-century tombs of the Duan family in Jishan, Shanxi province from two interrelated viewpoints—that of the fabricated world of the tomb owner and that of the realistic world of the burial chamber. I suggest that the complicated style of “wooden architecture in brick” does not mean a more magnificent imitation of the aboveground residence. Rather, when considered with other decorations in the chamber, the burial space was constructed for the deceased with reference to a temple, or a shrine. This suggested reference thus turns the chamber into a space of the deity, where the tomb master was revered, indeed, as a deity. -

Minimum Wage Standards in China August 11, 2020

Minimum Wage Standards in China August 11, 2020 Contents Heilongjiang ................................................................................................................................................. 3 Jilin ............................................................................................................................................................... 3 Liaoning ........................................................................................................................................................ 4 Inner Mongolia Autonomous Region ........................................................................................................... 7 Beijing......................................................................................................................................................... 10 Hebei ........................................................................................................................................................... 11 Henan .......................................................................................................................................................... 13 Shandong .................................................................................................................................................... 14 Shanxi ......................................................................................................................................................... 16 Shaanxi ...................................................................................................................................................... -

Study on the Development Path of Apple Industry in Wanrong County from the Perspective of the Integration of Three Industries

2019 8th International Conference on Social Science, Education and Humanities Research (SSEHR 2019) Study on the Development Path of Apple Industry in Wanrong County from the Perspective of the Integration of Three industries Liyu Zhu1, Yichi Zhang2 1School of International Trade and Finance, Shanxi University of Finance and Economics, Taiyuan, China 2School of Economics and Foreign languages, Shanxi University of Finance and Economics, Taiyuan, China Keywords: Integration of three industries; Apple industries; SWOT methods; Path analysis Abstract: In 2015 the central government proposed the coordinated development of three industries in rural areas. Only by improving the mechanism of integrated development in rural areas and, can farmers can share more added value brought by the industries. Based on the current condition of the apple industries in Wanrong county, the essay analyzes advantages and disadvantages of the apple industry in Wanrong in the process of the integrated development of three industries and threats as well as opportunities it has by combining four models of integrated development of apple industry and adopting SWOT method. It also proposes three development paths of the apple industry in Wanrong county form the perspective of the integration of the three industries. 1. Introduction In 2015 the central government proposed the coordinated development of three industries in rural areas. At the end of 2015, the General Office of the State Council released the Guiding Principles to Promote the Integrated Development in Rural areas, in which the government makes it clear to follow the original development path of the integration of three industries in rural areas. Only by improving the mechanism of integrated development in rural areas and, can farmers can share more added value brought by the industries, and by doing so, the integration of three industries can help to achieve economic growth in rural areas, industrial prosperity and rural rejuvenation. -

Online Supplement

Clinical characteristics and outcomes of hospitalized patients with COVID-19 treated in Hubei (epicenter) and outside Hubei (non-epicenter): A Nationwide Analysis of China Online Supplement Figure S1. The flowchart of cohort establishment As of February 15th, 2020, a total of 68,500 laboratory-confirmed cases have been identified in China. The largest percentage (82.12%) of cases were diagnosed in Hubei province (56,249 patients). The percentage of cases with severe pneumonia in Hubei province (21.20%) was higher than that outside of Hubei province (10.45%). The mortality was also higher in Hubei province (2.84% vs. 0.56%). (Figure S3). Figure S2 shows the change of mortality rate in Hubei province, regions outside of Hubei province and the overall population who had laboratory-confirmed COVID-19. Figure S1. Trends of daily mortality stratified by the geographic location where patients with COVID-19 were diagnosed and managed. COVID-19: coronavirus disease 2019 1 Figure S2. Severe and deaths cases in China, in Hubei and outside Hubei province as of Feb 15th, 2020 2 Table S1. Hazard ratios for patients treated in Hubei estimated by multivariate proportional hazard Cox model Variables HR LL UL P value Age (continuous) 1.036 1.021 1.05 <0.001 Any comorbidity (yes vs. no) 2.095 1.419 3.093 <0.001 Hubei location (yes vs. no) 1.594 1.054 2.412 0.027 HR: hazards ratio; LL: lower limit of the 95% confidence interval; UL: upper limit of the 95% confidence interval Table S2. Hazard ratios for Wuhan-contacts estimated by multivariate proportional hazard Cox model Variables HR LL UL P value Age (continuous) 1.039 1.025 1.053 <0.001 Any comorbidity (yes vs. -

2021年度中国苹果输美登记注册包装厂名单list of Registered

2021年度中国苹果输美登记注册包装厂名单 LIST OF REGISTERED PACKINGHOUSES FOR FRESH APPLES EXPORTING TO U.S.A. IN THE YEAR OF 2021 序号 包装厂名称 包装厂地址 注册登记号 所在地 NUMBE PACKINGHOUSE NAME PACKINGHOUSE ADDRESS REGISTERED LOCATION 海阳津成泰农产品发展有限公司 海阳市徐家店镇驻地 1 HAIYANG CHIANG MAI THAI AGRI- 4200GC0025 XUJIADIAN TOWN,HAIYANG CITY PRODUCTS CO., LTD. 烟台俊杰食品有限公司 栖霞市蛇窝泊镇西荆夼村 2 4200GC0028 YANTAI JUNJIE FOODSTUFF CO., LTD XIJINGKUANG VILLAGE,SHEWOPO TOWN,QIXIA CITY 龙口盛兴果蔬有限公司 山东省龙口市芦头镇芦头村 3 LONGKOU SHENGXING LUTOU VILLAGE,LUTOU TOWN,LONGKOU 4200GC0012 山东 FRUIT&VEGETABLE CO., LTD CITY,SHANDONG PROVINCE SHANDON 烟台宏辉食品有限公司 山东省莱阳市经济开发区 G 4 YANTAI GREAT-SUN FOODSTUFFS CO., LAIYANG ECONOMY DEVELOPMENT 4200GC0026 LTD. AREA,SHANDONG PROVINCE P.R.CHINA 烟台圣誉食品有限公司 莱阳市沐浴店镇驻地 5 4200GC0027 YANTAI SHENGYU FOODSTUFFS CO.,LTD. MUYUDIAN TOWN,LAIYANG CITY 齐鲁泉源供应链有限公司 栖霞市经济开发区 6 4200GC0031 QILU QUANYUAN CO.,LTD. QIXIA ECONOMIC DEVELOPMENT ZONE,QIXIA CITY 三门峡市金秋果业有限公司 河南省三门峡市交口工业园区 7 SANMENXIA GOLDEN AUTUMN FRUIT LNDUSTRIAL ZONE OF JIAOKOU,SANMENXIA 4100GC001 PRODUCTS CO.,LTD. CITY,HENAN PROVINCE 河南 灵宝市鹤立果蔬产业有限公司 河南省灵宝市大王镇镇区310国道南 HENAN 8 LINGBAO HELI FRUIT AND SOUTH OF NATIONAL HIGHWAY 310,DAWANG 4100GC006 VEGETABLESCO.,LTD TOWN,LINGBAO CITY,HENAN PROVINCE 大连天立农业开发有限公司 瓦房店市赵屯乡光明村 9 DALIAN TIANLI AGRICULTURE GUANGMING VILLAGE ZHAOTUN TOWN 2100GC002 DEVELOPING CO.,LTD. WAFANGDIAN CITY 大连瑞华景年物流有限公司 瓦房店市土城乡冯沟村 10 2100GC019 DALIAN GLORY TIMES LOGISTICS FENGGOU VILLAGE TUCHENG TOWN WAFANGDIAN 辽宁 大连宏源果蔬有限公司 辽宁省瓦房店市李官镇李官村 LIAONING 11 DALIAN HONGYUAN FRUIT&VEGETABLE 2100GC001 LIGUAN VILLAGE LIGUAN TOWN WAFANGDIAN CITY CO.,LTD. 营口瑞达食品有限公司 盖州市小石棚乡 12 2110GC020 YINGKOU RUIDA FOODSTUFFS CO.,LTD. XIAOSHIPENG VILLAGE GAIZHOU CITY 陕西华圣现代农业集团有限公司 西安市未央湖旅游经济技术开发区 13 HUASHENG AGRICULTURE GROUP WEIYANG LAKE,WEIYANG DISTRICT,XI'AN 9001GC0012 CO.,LTD. CITY,SHAANXI PROVINCE 陕西宝联果品有限责任公司 白水县杜康工业园区 14 SHAANXI BAOLIAN FRUIT PRODUCT 9011GC0005 DUKANG INDUSTRIAL PARK,BAISHUI COUNTY LIMITED COMPANY 陕西 美域高生物科技有限责任公司 陕西省洛川县凤栖镇苹果产业园区 SHAANXI 15 APPLE INDUSTRIAL PARK,FENGXI TOWN,LUOCHUAN 9010GC0009 MERRYCALL BIOTECHNOLOGY CO.,LTD.