MID-YEAR 2019 RIAA MUSIC REVENUES REPORT Joshua P

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Heos CLI Protocol Specification Version 1 16

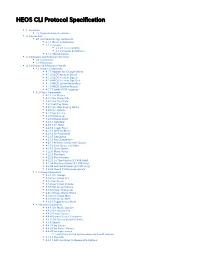

HEOS CLI Protocol Specification 1. Overview 1.1 Supported music services 2. Connection 2.1 Controller Design Guidelines 2.1.1 Driver Initialization 2.1.2 Caveats 2.1.2.1 Compatibility 2.1.2.2 Issues & Solutions 2.1.3 Miscellaneous 3. Command and Response Overview 3.1 Commands 3.2 Responses 4. Command and Response Details 4.1 System Commands 4.1.1 Register for Change Events 4.1.2 HEOS Account Check 4.1.3 HEOS Account Sign In 4.1.4 HEOS Account Sign Out 4.1.5 HEOS System Heart Beat 4.1.6 HEOS Speaker Reboot 4.1.7 Prettify JSON response 4.2 Player Commands 4.2.1 Get Players 4.2.2 Get Player Info 4.2.3 Get Play State 4.2.4 Set Play State 4.2.5 Get Now Playing Media 4.2.6 Get Volume 4.2.7 Set Volume 4.2.8 Volume Up 4.2.9 Volume Down 4.2.10 Get Mute 4.2.11 Set Mute 4.2.12 Toggle Mute 4.2.13 Get Play Mode 4.2.14 Set Play Mode 4.2.15 Get Queue 4.2.16 Play Queue Item 4.2.17 Remove Item(s) from Queue 4.2.18 Save Queue as Playlist 4.2.19 Clear Queue 4.2.20 Move Queue 4.2.21 Play Next 4.2.22 Play Previous 4.2.23 Set QuickSelect [LS AVR Only] 4.2.24 Play QuickSelect [LS AVR Only] 4.2.25 Get QuickSelects [LS AVR Only] 4.2.26 Check for Firmware Update 4.3 Group Commands 4.3.1 Get Groups 4.3.2 Get Group Info 4.3.3 Set Group 4.3.4 Get Group Volume 4.3.5 Set Group Volume 4.2.6 Group Volume Up 4.2.7 Group Volume Down 4.3.8 Get Group Mute 4.3.9 Set Group Mute 4.3.10 Toggle Group Mute 4.4 Browse Commands 4.4.1 Get Music Sources 4.4.2 Get Source Info 4.4.3 Browse Source 4.4.4 Browse Source Containers 4.4.5 Get Source Search Criteria 4.4.6 Search 4.4.7 Play Station 4.4.8 Play Preset Station 4.4.9 Play Input source Limitations for the system when used multi devices. -

Tidal Customer QA

Q & A Cisco Integrated Customer Experience Cisco Services Q&A for Cisco Tidal Software Products Contents Introduction .................................................................................................................................................................... 1 Cisco Services for Tidal Software Products ................................................................................................................... 1 Cisco Technical Assistance Center Support .................................................................................................................. 2 Cisco Software Application Support plus Upgrades ....................................................................................................... 4 Warranty ........................................................................................................................................................................ 5 Advanced and Other Services ....................................................................................................................................... 5 Introduction This document provides answers to some of the most common questions regarding service offerings and technical support for Cisco® Tidal software products now that Tidal Software is a part of Cisco. Cisco Services for Tidal Software Products Q. What are the Cisco Advanced Services, Technical Services, and Training Services that correspond to legacy Tidal services? A. Below are the services: Advanced Services Cisco Tidal S ervices Name Original -

Hifi Und Musik

44 44Anker HIFI UND MUSIK 44 August 2019 / Juli ■ 8. Jahrgang ■ Für anspruchsvolle Hörer. Für anspruchsvolle Leser. anspruchsvolle Für Hörer. anspruchsvolle Für 04/2019 S 151 SKR S 151 ■ CH 20,60CH SFR ■ 04/2019 A/IT/BENELUX 14,40 € A/IT/BENELUX 14,40 ■ HIFI UND MUSIK 12,50 € D EDITORIAL DEAR READERS DEAR READERS, Anker Carsten Barnbeck Photography: FIDLEITY It’s those rare experiences that raise up all sorts of questions and every system deserves to have the optimal performance teased out of suddenly force you to see the world anew. Only a few weeks ago, I was it. And when we’ve finally got everything running perfectly, the system enveloped again. I had the exclusive honor and pleasure of spending an is left alone – to properly warm up and burn-in, of course. Then, even intimate hour with German manufacturer Tidal Audio’s top-of-the-line when we sit down with it again, we become enslaved to the intensive system. Simply put, it blew me away. Completely enveloped, I forgot processes of a listening test. everything going on around me for that blissful hour – all the details of which start on page 142 of this issue. But that sublime moment really With all this in mind, I’ve decided to add to my New Year’s resolutions got me thinking: why do I so seldom find myself fully and effortlessly for 2019: spend considerably more time simply sitting in front of the immersed in music nowadays? A question that seems strange to me, system with goosebumps. -

Q1 2021 Dolby Laboratories Inc Earnings Call on January 28, 2021 / 10:00PM

REFINITIV STREETEVENTS EDITED TRANSCRIPT DLB.N - Q1 2021 Dolby Laboratories Inc Earnings Call EVENT DATE/TIME: JANUARY 28, 2021 / 10:00PM GMT OVERVIEW: Co. reported 1Q21 revenue of $390m, GAAP net income of $135.2m and non-GAAP net income of $153.3m. Also reported 1Q21 GAAP net diluted EPS of $1.30 and non-GAAP net diluted EPS of $1.48. Expects 2Q21 revenue to be $280-310m, GAAP diluted EPS to be $0.36-0.51 and non-GAAP diluted EPS to be $0.57-0.72. REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2021 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. 'Refinitiv' and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. JANUARY 28, 2021 / 10:00PM, DLB.N - Q1 2021 Dolby Laboratories Inc Earnings Call CORPORATE PARTICIPANTS Jason Dea Dolby Laboratories, Inc. - Director of Corporate Finance & IR Kevin J. Yeaman Dolby Laboratories, Inc. - President, CEO & Director Lewis Chew Dolby Laboratories, Inc - Executive Vice President & Chief Financial Officer CONFERENCE CALL PARTICIPANTS James Charles Goss Barrington Research Associates, Inc., Research Division - MD Paul Chung JPMorgan Chase & Co, Research Division - VP & IT Hardware Analyst Steven Bruce Frankel Colliers Securities LLC, Research Division - Senior VP & Director of Research PRESENTATION Operator Ladies and gentlemen, thank you for standing by, and welcome to the Dolby Laboratories Conference Call discussing Fiscal First Quarter Results. (Operator Instructions) As a reminder, this call is being recorded, Thursday, January 28, 2021. I would now like to turn the conference over to Jason Dea, Director of Investor Relations for Dolby Laboratories. -

TIDAL EVENTS and GALACTIC ACTIVITY J .B.Hutchings Dominion

TIDAL EVENTS AND GALACTIC ACTIVITY J .B.Hutchings Dominion Astrophysical Observatory, Victoria, B .C., Canada S .G .Neff NASA Goddard Space Flight Center, Greenbelt, MD, USA Summary. We report some results from recent and ongoing work which relate to the connection between nuclear activity and tidal interactions. We suggest that tidal events are in general a necessary but not sufEcient condition for nuclear activation. We also suggest that nuclear activity generally develops at a ‘late stage’ of a tidal encounter, following star- formation and dust evaporation, and when the most obvious morphological disturbances may have disappeared. Table 1 summarizes the quantitative results from four programs which relate to the present topic. The full details are found in the references given. Our summary comments follow: 1. QSO imaging. In an investigation of matched samples of radio-loud and radio- quiet QSOs and radio galaxies, the results (Table 1) indicate disturbances of the host galaxy (indicating tidal encounters) in essentially all radio-luminous objects. (In the QSOs it is harder to see the closest companions and disturbances because of the bright nuclear light source.) The fraction (or strength) of interaction is lower in the radio-quiet QSOs. There is a range of Mv and colour for the host galaxies that makes them significantly different by K-S significance tests. The sense of these differences is consistent with different amounts of star-formation in the three types of object, widespread throughout galaxies with initially similar luminosities. 2. Radio evolution. In the references given, we have argued for a general time sequence of radio source evolution from unresolved (C) to one-sided (CL) to triple (T) structures. -

Tidal Download Albums How to Download Tidal Music to Computer

tidal download albums How to Download Tidal Music to Computer. Tidal is a marvelous music streaming service, ideal for those with a special liking for hi-fidelity audios. It provides two subscription plans – Premium and Hi-Fi, with the former priced at $9.99 per month offering streams at a bitrate of 320kbps (the same audio quality as Spotify) and the latter priced at $19.99 per month offering streams at a bitrate of 1411kbps. Like Spotify, Tidal is available by the Chrome-based Web player or through the Tidal app. Tidal subscribers are authorized to download Tidal music for offline listening. However, like other music streaming services, the downloaded Tidal music are not saved as local files on your computer. They are restricted to be played with the Tidal app and can’t be moved to anywhere else for normal playback. It’s not a difficult job to download music from Tidal to your computer , all you need is a powerful music tool – Tidal Music Converter, which is able to rip music from Tidal as MP3, AAC, WAV, FLAC or AIFF files. Most importantly, it supports 10X faster conversion speed and keeps ID tags & Hi-Fi audio quality after conversion. Now let’s learn more about the program and check the guide about how to use the tool to download Tidal music to your local drive step by step. Tool Required - Tidal Music Converter. Tidal Music Converter is a 100% clean program. It requires no need to install any extra hardware. It’s the only tool you need to download music from Tidal to your local computer. -

Why Music Streaming Services Should Switch to a Per-Subscriber Model

DIMONT (MEDRANO_10) (DO NOT DELETE) 2/10/2018 10:11 AM Royalty Inequity: Why Music Streaming Services Should Switch to a Per-Subscriber Model JOSEPH DIMONT* Digital music streaming services, like Spotify, Apple Music, and Tidal, currently distribute royalties based on a per-stream model, known as service-centric licensing, while at the same time receive income through subscription fees and advertising revenue. This results in a cross-subsidization between low streaming users and high streaming users, streaming fraud, and a fundamental inequity between the number of subscribers an artist may attract to a service compared to how much they are compensated. Instead, streaming services should distribute royalties by taking each user’s subscription fee and dividing it pro rata based on what the specific user is listening toknown as a subscriber-share modelor user-centric licensing. Many scholars have focused on creating a minimum royalty rate; however, this does little to solve the inherent inequity. Either the music industry should self-regulate by switching to a subscriber-centric model, or the Copyright Royalty Board should make the switch for them. Under a subscriber-centric model, royalty distribution would more accurately reward artists for generating fans, not streams. Each month, the streaming service should take each subscription fee and apportion it out based on the percentages of artists that unique listeners choose to listen to during the subscription period. This change could come through the industry itself, litigation, or regulation, but will likely face resistance from the major record labels and the services themselves. * J.D. Candidate 2018, University of California, Hastings College of the Law. -

Competitor Analysis

Spotify Tidal Amazon Music Pandora Apple Music Youtube Music Connects to Apple's homepod; can Non-label tracks available; Personalized experience control search with Siri; features can stream videos of fan tailored to what you listen Audio quality and exclusive Beats 1 radio; can search for songs covers, concert clips; more to; can create own content; branding as for the Cheap ($3.99/month) if Highly advanced predictive by typing in lyrics; artists post more mature algorithm for selecting playlists; unlimited offline audience; selection of you have an echo & prime algorithm for music free updates; can listen to already songs you'd like; better sync;new music or show 75,000 music videos; ticket account; lyrics auto pop recommendations; hidely owned music with streamed music; search engine for finding Strengths alerts; pre-sales for some artists up while listening recognized brand for radio; already comes with apple products; songs based on lyrics No free option; music Cannot create or share No desktop app; limited Doesn't offer other discovery and hand playlists; cannot choose a tools/features for discovering services with product like curated playlists are specific song to listen to; lacks new songs; limited to no other competitiors (e.g. No free service tier and lacking; artist profiles don't social features; low audio No free option; fewer songs than podcast support; limited social Weaknesses Amazon and Youtube); expensive monthly cost; have biographies quality compared to competition other streaming services; features Offer different -

Digital Music Distribution and Royalty Investment

AudioSwim NASAB Dubai, UAE [email protected] Digital Music Distribution and Royalty Investment 2020 - 2021 Overview AudioSwim allows artists to upload, sell and stream their music globally, turning fans into investors. We focus on creating innovative ways for musicians to expand their catalog and careers through fan engagement and investments. Music Distribution and Audio Management ● Get your music streaming in 30+ stores including iTunes, Spotify, Anghami, TikTok, Google Play, Amazon, Tidal, & Deezer! ● We ensure a high degree of confidentiality and security allowing you to gain control and get paid from music streaming and sales. ● We offer daily and weekly analytical reports that help you learn about your fans. Find out who's paying attention to you. ● News, Blogs, Interviews, Podcasts and more about digital music distribution from artists and music industry insiders to help you get ahead. Royalty Reporting and Royalty Investment ● Each artist or band will be able to set the value of their royalty rights being offered at their own discretion, within a limit determined by AudioSwim. The limit is based on prior earnings of previous songs and future potential. ● AudioSwim will provide customized deals that will allow intellectual property holders to sell proportions of their royalty streams in return for lump sum payment. 2 ● Royalties will be sold as investments to your fans who will be able to sell or trade artists royalties in the future. ● The purchase of royalties will ensure that your fans give you the proper support and push needed. ● Remixes, cover versions, and anything with unlicensed samples can not be permitted. All releases undergo a strict quality control assessment prior to release. -

Music Recommendation Algorithms: Discovering Weekly Or Discovering

MUSIC RECOMMENDATION ALGORITHMS Music Recommendation Algorithms: Discovering Weekly or Discovering Weakly? Jennie Silber Muhlenberg College, Allentown, PA, USA Media & Communication Department Undergraduate High Honors Thesis April 1, 2019 1 MUSIC RECOMMENDATION ALGORITHMS 2 MUSIC RECOMMENDATION ALGORITHMS Abstract This thesis analyzes and assesses the cultural impact and economic viability that the top music streaming platforms have on the consumption and discovery of music, with a specific focus on recommendation algorithms. Through the support of scholarly and journalistic research as well as my own user experience, I evaluate the known constructs that fuel algorithmic recommendations, but also make educated inferences about the variables concealed from public knowledge. One of the most significant variables delineated throughout this thesis is the power held by human curators and the way they interact with algorithms to frame and legitimize content. Additionally, I execute my own experiment by creating new user profiles on the two streaming platforms popularly used for the purpose of discovery, Spotify and SoundCloud, and record each step of the music discovery process experienced by a new user. After listening to an equal representation of all genre categories within each platform, I then compare the genre, release year, artist status, and content promotion gathered from my listening history to the algorithmically-generated songs listed in my ‘Discover Weekly’ and ‘SoundCloud Weekly’ personalized playlists. The results from this experiment demonstrate that the recommendation algorithms that power these discovery playlists intrinsically facilitate the perpetuation of a star- driven, “winner-take-all” marketplace, where new, popular, trendy, music is favored, despite how diverse of a selection the music being listened to is. -

Discovery Music Server

Discover the world of computer audio without the computer. The Discovery Music Server is designed to be the heart of a serious music system, offering playback of local and streaming music, rich multi-dimensional metadata and multi-room audio, all with an interface that anyone can master in a few minutes. Keeping in line with quality music, the lossless, high-fidelity music streaming service Tidal® has been tightly integrated into the Discovery’s software*. Content from your local collection and content from Tidal are presented in the same beautiful, easy-to-use interface. Discovery Music Server DISCOVERY SERIES DS-S101-G MUSIC SERVER One component, infinite sound. Adding the Discovery Series DS-S101-G Music Server to an existing system is simple. Connect the Discovery to the internet and one of the outputs to the upcoming ELAC Integrated Amplifier or your existing system. Adding your personal music collection is a snap. Connect either a hard drive to the rear mounted USB port or point the Discovery to your NAS (Networked Attached Storage) device and the Discovery will take care of the rest, organizing and gathering feature rich meta-data for your entire music collection. Expanding your Discovery system to other rooms is easy. Whether you want the full functionality of an integrated amplifier or a simple wireless speaker in the kids’ room, the Discovery eco-system is ready to grow when you are. * iOS (64-bit Devices), Android, Windows (7, 8, and 10) and Apple OSX DS-S101-G Specs CONNECTIONS POWER SUPPLY & CONSUMPTION Analog outputs (independent zones): 2 Power Supply: 12 VDC 2A Coaxial output (independent zone): 1 (192 khz 24-bit max) Power Consumption Normal Operation: 4.8 Watts Optical output: 1 (192 khz 24-bit max) USB port (mass storage class): 1 USB 2.0 DIMENSIONS & WEIGHT Ethernet port: 1 gigabit ethernet Dimensions (WxHxD): 8-1/4” x 1-7/8” x 4-5/16” Weight: 2 lbs END POINT SUPPORT Discovery, AirPlay and Roon End Point NOTE: The Discovery can be controlled using the free Roon CONTROL & USER INTERFACE Essentials app for Windows, OS X, iOS, and Android. -

Tidal -- Pattern Language for Live Coding of Music

TIDAL – PATTERN LANGUAGE FOR LIVE CODING OF MUSIC Alex McLean and Geraint Wiggins Centre for Cognition, Computation and Culture Department of Computing Goldsmiths, University of London ABSTRACT into a canon [3]. Hierarchies and heterarchies of repeat- ing structure run throughout much of music theory, and Computer language for the description of pattern has been computational approaches to music analysis, indexing and employed for both analysis and composition of music. In composition all have focus on discrete musical events and this paper we investigate the latter, with particular inter- the rules to which they conform [4, x4.2]. From this we est in pattern language for use in live coding performance assert that the encoding of pattern is fundamental to mu- [1]. Towards this end we introduce Tidal, a pattern lan- sic making. In the following we review support given to guage designed for music improvisation, and embedded in musical pattern making by computer language, and then the Haskell programming language. introduce Tidal, a language for live improvisation of musi- Tidal represents polyphonic patterns as a time varying cal pattern. Before that we motivate the discussion through function, providing an extensible range of pattern genera- brief review of the practice of live coding, for which Tidal tors and combinators for composing patterns out of hier- has been created. archies of sub-patterns. Open Sound Control (OSC) mes- sages are used to trigger sound events, where each OSC parameter may be expressed as a pattern. Tidal is designed 2. LIVE CODING to allow patterns to be created and modified during a live Since 2003 an active group of practitioners and researchers coded performance, aided by terse, expressive syntax and [5] have been developing new (and rejuvinating old) ap- integration with an emerging time synchronisation stan- proaches to improvising computer music and video ani- dard.