Solar 2014 Q2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JA Solar Module

JA Solar Overview Protect the one Earth we all share, for this and future generations. Company Profile Headquarters Shanghai, China (with EU, US & Japan Offices) Founded / IPO May 2005 / February 2007 Business c-Si solar module & cell supplier Shipments 1.69GW in 2011 Attributes World class quality, efficiency, and cost structure Capacity (Annual) 3GW Cell, 2.0 GW Module, 1.0 GW Wafer Ticker Symbol JASO (NASDAQ) Employees ~12,000 2 JA Solar Holdings Co., Ltd. (Module) 2012 Optimized Vertical Integration Model SILICON SILICON WAFERS CELL MODULE SYSTEMS Solar Wafers Solar Cells PV Modules EPC • Low-cost, high-quality • One of the world’s largest • High-quality product with • Partnering with top-tier production manufacturers high-quality BOM developers in China • Recognized for top tech at • Additional channel for • Leading the industry in low cost product distribution • Cooperation with global high-efficiency wafer • High-performance mono- • Working with leading leading IPPs on utility research and multi-crystalline solar brands on OEM modules scale projects cells JA Solar Holdings Co., Ltd. (Module) 2012 JA SOLAR Nationwide Production Plant Lianyungang Wafer Facility 500MW Capacity Yanjiao Wafer Facility 500MW Capacity Ningjin Cell Facility 1200MW Capacity Shanghai Head Quarter Yangzhou Cell Facility Hefei Solar Products Facility 1800MW Capacity Fengxian Module Facility 3GW Capacity (Started from Y11) State-of-the-art PV R&D Center 1500MW Capacity Current Module Capacity 500MW Above data will be valid until Q4, 2012. JA Solar Holdings Co., Ltd. (Module) 2012 Featured Projects Partnership with world leading independent power producers for utility scale PV projects Macy’s, New Jersey, USA Lingwu, Ningxia, China Giuliano, Italy 1.1 MW Project 40 MW Project 20.4 MW Project JA Solar Holdings Co., Ltd. -

Turkey Lake Feasibility Study

A Comprehensive Solar Energy Power System for the Turkey Lake Service Plaza Contract #: BDK75-977-18 7 January 2010 Project Research Team Charles J. Kibert, Ph.D., P.E., Principal Investigator S.A. Sherif, Ph.D. Robert Ries, Ph.D. Edward Minchin, Ph.D., P.E. Russell Walters, Ph.D., P.E. Lauren Hertel Consultant Al Simpler, President, Simpler Solar, Inc. Research Assistants Kevin Priest Jason Sanders Sean Snowden Srikanth Madala Milind Gholap 01/07/2010 iii EXECUTIVE SUMMARY The Florida Turnpike Enterprise (FTE) has the bold vision of maximizing the use of renewable energy in their operations and potentially supplying all the energy needs of their facilities via solar technologies. To determine the technical and financial feasibility of executing this vision, the FTE selected the Turkey Lake Service Plaza on the Florida Turnpike for a case study to explore this potential shift to renewable energy sources. A University of Florida research team collaborated with FTE and Florida Department of Transportation staff to examine contemporary solar technologies, particularly solar photovoltaic (PV) systems, for their potential to meet the energy needs of the Turkey Lake Service Plaza. The scope of the research included: 1. Evaluation of Solar Electric (PV), Solar Thermal (hot water), and Solar Lighting systems. 2. Assessment of the renewable energy generation potential of the Service Plaza. 3. Designing and planning of photovoltaic systems to determine the energy output. 4. Identification of innovative financing options. 5. Development of a marketing and education concept for the project. The research team concluded that by implementing the Net Zero Energy scenario, the annual electrical energy needs of all the facilities at the Turkey Lake Service Plaza could be met. -

Countervailing Duty Administrative (NAICS 621) About Telemedicine Solar Cells from China

Federal Register / Vol. 85, No. 237 / Wednesday, December 9, 2020 / Notices 79163 service delivery for the healthcare DEPARTMENT OF COMMERCE days.2 On July 21, 2020, Commerce industry, and its importance has tolled the due date for these final results increased during the current pandemic. International Trade Administration an additional 60 days.3 On September 25, 2020, Commerce extended the Expanding the collection of data on [C–570–980] telemedicine use will support deadline for issuing the final results of measurement on changes in its adoption Crystalline Silicon Photovoltaic Cells, this review by 60 days, until November 4 during this unprecedented public health Whether or Not Assembled Into 27, 2020. emergency. SAS currently asks Modules, From the People’s Republic Scope of the Order of China: Final Results of ambulatory health care providers The products covered by the order are Countervailing Duty Administrative (NAICS 621) about telemedicine solar cells from China. A full Review; 2017 services in relation to patient visits. description of the scope of the order is This proposal will add a question about AGENCY: Enforcement and Compliance, contained in the Issues and Decision revenues from telemedicine services for International Trade Administration, Memorandum.5 hospitals (NAICS 622) and nursing Department of Commerce. homes (NAICS 623). Furthermore, to Analysis of Comments Received SUMMARY: The Department of Commerce standardize content across industries All issues raised in interested parties’ (Commerce) determines that and provide consistency for briefs are addressed in the Issues and countervailable subsidies are being respondents, the current telemedicine Decision Memorandum accompanying provided to producers/exporters of this notice. -

Project Bond Focus Issue 4 | Project Bonds: New Energies – Solar

Project Bond Focus Issue 4 | Project Bonds: New Energies – Solar Project Bonds: New Energies – Solar Crédit Agricole CIB, a leader in the global Project Bond market, is authoring a series of articles covering key topics for issuers to consider. New Energies Solar Project Bonds The volume of Project Bonds issued for renewable energy Solar Project Bonds projects has steadily increased in recent years. (Global volume in $MM equivalent) 2,400 The Capital Markets opened its doors to renewable energy 2,200 1,896 2,000 projects with a wind Project Bond in 2003, followed by 1,780 solar Project Bonds a few years later in 2010. 1,800 1,600 1,446 1,284 1,421 These trail-blazing transactions allowed investors to gain 1,400 1,200 1,034 familiarity with the technologies, risks, and contractual 1,000 arrangements related to renewable assets. They also 800 paved the way for future issuances, as rating agencies 600 400 started publishing specific methodologies dedicated to this 258 200 newly accessible asset class. 0 2010 2011 2012 2013 2014 2015 2016 Renewables have grown to represent nearly 25% of power Source: PFI, CA CIB Project Bonds and 10% of total Project Bonds issued in just over a decade. In 2015, renewable energy projects Historically, the first solar Project Bond issuance was the accounted for $3.5BN of Project Bond issuances globally. €196MM Andromeda Finance offering for a 51MW utility- scale PV Italian solar project in December 2010. In 2011, Power Project Bonds the $702MM Project Bond for NextEra Genesis Solar, a (Global volume in $MM equivalent) single-site Concentrating Solar Power (CSP) project with a 20,000 capacity of 250MW in California, marked the opening of 15,054 the US Debt Capital Markets for solar projects. -

Sentimental Journey the Long, Winding Road to a Renewable Energy Future

EYE ON THE MARKET • ENERGY OUTLOOK 2016 Sentimental Journey The long, winding road to a renewable energy future J.P. MORGAN PRIVATE BANK On a sentimental journey, some of the images you recall seeing were real, some were based in reality but weren’t exactly what you thought they were, and others existed only in the realm of your imagination. This year’s topics include a status report on renewable energy penetration compared to some prior forecasts, a look at New York’s ambitious conservation and renewable energy plan, the latest on electric cars, the potential for more hydropower in the US, the commodity super-cycle and oil prices in 2017, and how utilities in sunny US states are changing their customer billing as distributed solar power grows. EYE ON THE MARKET • MICHAEL CEMBALEST • J.P. MORGAN Sentimental Journey: the long, winding road to a renewable energy future June 2016 The journey to a renewable energy future is taking longer than many analysts and agencies expected. How so? The solid line in the first chart shows the percentage of US primary energy1 derived from renewable sources, alongside some over-optimistic prior forecasts2. Similarly, most forecasts for nd electric vehicles (EVs and plug-in hybrid vehicles) have been too high as well, as shown in the 2 chart. The share of US primary energy coming from renewable Another generation of electric car projections out of sources, and some notable forecasts sync with reality, EV+PHEV sales as % of total car sales 50% Physicist Bent Sorensen 12% Deutsche Bank Google 2030 Clean ● US 40% Energy Plan 10% PwC ● Global Frost & Sullivan Bloomberg NEF Amory Lovins (RMI) 8% 30% IEA Carter Admin Roland Berger (solar only) Nat'l 6% 20% Renew. -

Solar Is Driving a Global Shift in Electricity Markets

SOLAR IS DRIVING A GLOBAL SHIFT IN ELECTRICITY MARKETS Rapid Cost Deflation and Broad Gains in Scale May 2018 Tim Buckley, Director of Energy Finance Studies, Australasia ([email protected]) and Kashish Shah, Research Associate ([email protected]) Table of Contents Executive Summary ......................................................................................................... 2 1. World’s Largest Operational Utility-Scale Solar Projects ........................................... 4 1.1 World’s Largest Utility-Scale Solar Projects Under Construction ............................ 8 1.2 India’s Largest Utility-Scale Solar Projects Under Development .......................... 13 2. World’s Largest Concentrated Solar Power Projects ............................................... 18 3. Floating Solar Projects ................................................................................................ 23 4. Rooftop Solar Projects ................................................................................................ 27 5. Solar PV With Storage ................................................................................................. 31 6. Corporate PPAs .......................................................................................................... 39 7. Top Renewable Energy Utilities ................................................................................. 44 8. Top Solar Module Manufacturers .............................................................................. 49 Conclusion ..................................................................................................................... -

Solar Power for the Veneto

Photovoltaics Rovigo solaR PRoject Rovigo solar farm and central inverter/transformer station 70 MW of solar power for the Veneto On a foggy November day, SunEdison Italy, its financial partners track record in utility-scale solar plants, using 840 km of cables, 50 km of conduits and more than 6 tons of and local officials inaugurated Europe’s largest solar farm in steel for the metal substructures and the like. Rovigo, Veneto. Hundreds of guests demonstrated the “The polycrystalline panels have been supplied by Canadian Solar, Trina Solar, Yingli and Solarfun,” importance of the project as a reference for its initiators, as well says Liborio Nanni, Country Manager at SunEdison Italia. The last modules were shipped by air cargo di- as a means to support local development. rectly from China, in order to stay within the deadline. “The Rovigo project is important for several reasons, not only for its size,” Pancho Perez, General Manager t first glance, the solar power plant is an exten- of SunEdison EMEA, points out. According to him, ded blue surface equalling a big inland lake in the solar farm is a reference for a quick and precise Asize. Having realised that the object is just a ve- project realisation, as it took only nine months from ry huge solar park, the passer-by can’t help seeing the the beginning of construction to the interconnection central inverter station, which manages the electricity in November 2010. produced and makes it compatible with the national “This milestone has been made possible with the grid. help of perfect timing for installation work and excel- Today, the Rovigo project is the largest European lent cooperation of the partners,” adds Perez, re- PV power plant – bigger than the 60 MW solar farm ferring first of all to financial partners MEMC and in Olmedilla, Spain, and the 50 MW project in SunEdison. -

Bankrupt Companies

The List of Fallen Solar Companies: 2015 to 2009: S.No Year/Status Company Name and Details 118 2015 Enecsys (microinverters) bankrupt -- Enecsys raised more than $55 million in VC from investors including Wellington Partners, NES Partners, Good Energies and Climate Change Capital Private Equity for its microinverter technology. 117 2015 QBotix (trackers) closed -- QBotix had a two-axis solar tracker system where the motors, instead of being installed two per tracker, were moved around by a rail-mounted robot that adjusted each tracker every 40 minutes. But while QBotix was trying to gain traction, single-axis solar trackers were also evolving and driving down cost. QBotix raised more than $19.5 million from Firelake, NEA, DFJ JAIC, Siemens Ventures, E.ON and Iberdrola. 116 2015 Solar-Fabrik (c-Si) bankrupt -- German module builder 115 2015 Soitec (CPV) closed -- France's Soitec, one of the last companies with a hope of commercializing concentrating photovoltaic technology, abandoned its solar business. Soitec had approximately 75 megawatts' worth of CPV projects in the ground. 114 2015 TSMC (CIGS) closed -- TSMC Solar ceased manufacturing operations, as "TSMC believes that its solar business is no longer economically sustainable." Last year, TSMC Solar posted a champion module efficiency of 15.7 percent with its Stion- licensed technology. 113 2015 Abengoa -- Seeking bankruptcy protection 112 2014 Bankrupt, Areva's solar business (CSP) closed -- Suffering through a closed Fukushima-inspired slowdown in reactor sales, Ausra 111 2014 Bankrupt, -

Changing the Way Business Is Powered

Changing the way ANTI-REFLECTIVE GLASS business is powered. ULTRA-PURE, MONOCRYSTALLINE SILICON SOLID COPPER FOUNDATION ALL SOLAR PRODUCTS ARE NOT EQUAL. YOUR TURNKEY SOLUTION FOR SOLAR. SUNPOWER® MAXEON® CELL TECHNOLOGY PREMIUM PRODUCT WARRANTY COMMERCIAL FINANCING OPTIONS BEST-IN-CLASS INSTALLER NETWORK Maxeon solar cells are fundamentally better. • Offering the best 25-year Combined Power and There are a variety of financing options available in the market You can count on your local SunPower installation partner to Product Warranty and through our dealer partner network for businesses and provide the highest standards of quality and customer service. • More power and reliability from back-side contact design not-for-profit organizations. • No warranty restrictions for coastal applications • SunPower installation partners are pre-screened and • Efficiencies up to 22.8% • Purchase evaluated regularly • SunPower panels deliver 60% more energy from the same PREMIUM PERFORMANCE WARRANTY – Enjoy the benefits of ownership with no monthly • Installers receive industry leading design and installation space over 25 years2 payment training • Durable solid copper foundation • SunPower panels average only 0.25% power loss per year over the first 25 years2 – Keep the tax credits and any other state, local, or utility incentive5 MONITORING ENABLES PEAK PERFORMANCE 2 RIGOROUS TESTING & ANALYSIS • SunPower predicts its panels will have a useful life of 40 years • Lease SunPower monitoring is available to you and your installer in • Durability and -

Q4 2018 / Q1 2019 Solar Industry Update

Q4 2018/Q1 2019 Solar Industry Update David Feldman Robert Margolis May 2019 NREL/PR-6A20-73992 Executive Summary • At the end of 2018, global PV installations reached 509 GW-DC, • The United States installed 10.7 GW-DC of PV in 2018 (8.3 GW- an annual increase of 102 GW-DC from 2017. AC), with 4.2 GW-DC coming in Q4—cumulative capacity reached 62.5 GW-DC (49.7 GW-AC). – In 2018, the leading markets in terms of annual deployment were China (44 GW-DC), the United States (11 GW-DC), and – Analysts also expect U.S. PV capacity to double by 2022. India (8 GW-DC). • In 2018, global PV shipments were approximately 89 GW—a Analysts expect cumulative PV capacity to double by 2022. – decrease of 5% from 2017. More than 96% of those PV shipments used c-Si technology and were shipped from Asian • At the end of 2018, cumulative global CSP installations reached countries. 6.2 GW, up 710 MW from 2017. • In 2018, the United States produced approximately 1 GW of c-Si • Solar installations represented 22% of all new U.S. electric modules and 0.4 GW of thin film. generation capacity in 2018—second to natural gas (58%). – The United States expanded its PV manufacturing capacity • In 2018, solar represented 4.6% of net summer capacity and to 6 GW in Q1 2019 (up from 2.5 GW in 2017), and it is 2.3% of annual net generation. expected to add another 3 GW in the near future. -

Solar Technology Reference Guide

Solar Technology Reference Guide January 2012 Aaron Binkley Prepared for and Funded by the NAIOP Research Foundation Help ensure that the NAIOP Research Foundation continues to promote industry success. Thank you for your choosing to download this report. Foundation research and analysis gives industry professionals unique insights in to the current business environment and emerging trends that lead to successful development and communities. Traditional sources of revenue cover only a portion of the costs of producing these reports. Additional support, provided by end users of this research through the Foundation’s Sustainer Fund, helps to ensure that the Foundation will have the funds to continue to proactively address the many research project requests it receives each year. Donate to the Sustainers Fund today! Gift Levels Benefactor Gifts of $2,500 and above (Contributions to the NAIOP Research Foundation Amount: Leader Gifts of $1,000-$2,499 are tax deductible to the extent allowed by law.) Donor Gifts of $500-$999 Sustainer Gifts of $250-$499 Please see below for contribution information. Learn how to become involved in the work of the Foundation. Yes, I am interested in ways I can Please call me to discuss support the work of the Foundation. Please send me information about Becoming a Foundation Governor Underwriting a Foundation project, or major initiative Area of interest __________________________ Making an annual gift How to apply for a research grant Contact Information NAME COMPANY TITLE ADDRESS CITY STATE ZIP PHONE E-MAIL Contribution Information *Make checks payable to NAIOP Research Foundation CARD HOLDER NAME CREDIT CARD TYPE NUMBER EXPIRATION DATE Call Bennett Gray at (703) 674-1436 to make a contribution by telephone. -

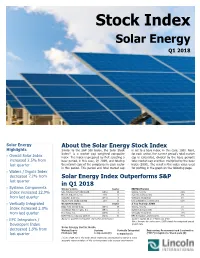

Solar Energy Stock Index Q1 2

Stock Index Solar Energy Q1 2018 Solar Energy About the Solar Energy Stock Index Highlights Similar to the S&P 500 Index, the Solar Stock is set to a base index, in this case, 1000. Next, (1) Index is a market cap weighted composite for each sector, the current period’s total market Overall Solar Index index. The index is prepared by first selecting a cap is calculated, divided by the base period’s increased 2.5% from base period, in this case, Q1 2009, and totaling total market cap and then multiplied by the base last quarter the market caps of the companies in each sector index (1000). The result is the index value used in this period. This period and total market cap for plotting in the graph on the following page. Wafers / Ingots Index decreased 7.2% from Solar Energy Index Outperforms S&P last quarter in Q1 2018 Systems Components Winner’s Circle Sector EBITDA Margins Index increased 22.9% GCL-Poly Energy Holdings Ltd. (26%) W Wafers / Ingots 28% Motech Industries, Inc. 21% S Systems Components 6% from last quarter Canadian Solar Inc. (27%) I Vertically Integrated 8% Azure Power Global Limited 31% D EPC Integrators / Developers 55% Vertically Integrated Worst Performers Sector 3 Year Revenue CAGR Daqo New Energy Corp. (68%) W Wafers / Ingots 5% Index increased 2.0% SolarEdge Technologies, Inc. (59%) S Systems Components 0% from last quarter First Solar, Inc. (60%) I Vertically Integrated 13% BCPG Public Company Limited (52%) D EPC Integrators / Developers 71% Based on quarter-over-quarter share price performance Source: Capital