BDA Brochure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2Nd FCF Life Science IPO Report

FCF Life Science Research 2nd Life Science IPO Report – Initial Public Offerings in Europe and the US Enterovirus Part of FCF Life Science Research Series FCF Overview European and US Life Science IPOs C r o s s - border IPOs of European Issuers in the US Life Science IPO Outlook Appendix: European Cross - border Issuances in the US 2 FCF Overview FCF seeks to provide Who We Are Capital Markets Capabilities and Services its clients with ▪ Specialized investment bank and financing specialist financing Private / Venture capital financing Private equity financing ▪ Advising public and private small / midcap companies Pre-IPO Growth capital financing (i) at the lowest cost, ▪ Advisor for structuring and placement of financing transactions: Initial Public Offering (IPO) pursued in tandem) – All instruments: Unbiased approach to all available corporate Equity / Capital increase Private Investment in (ii) with the highest Public Dual-track (IPO and Public Equity (PIPE) flexibility, financing instruments (no product selling approach), allowing alternative transaction Block trade for customized financing structures (iii) in the shortest Receivables financing / Working capital / Revolving – All investors: Close and trusted relationships with senior period of time, Short-term Factoring / ABS credit facility executives of virtually all relevant equity and debt investors Debt Borrowing base / Guarantees / (iv) with the highest – Fast process: Process management skills and direct / personal Inventory financing Letter of Credit closing proba- access to institutional debt and equity investors enable fast Bank loan facility / Promissory note bility, and with transactions Straight debt (Schuldscheindarlehen) Debt Long-term Sale-and-lease back High-yield / PIK bond (v) financing partners ▪ More than 100 transactions with a total placement volume in Debt Corporate bonds (public / (public / private) that integrate well excess of EUR 4.0 billion since foundation in 2005 private placement) Second lien financing into their strategy ▪ Approx. -

DENVER CAPITAL MATRIX Funding Sources for Entrepreneurs and Small Business

DENVER CAPITAL MATRIX Funding sources for entrepreneurs and small business. Introduction The Denver Office of Economic Development is pleased to release this fifth annual edition of the Denver Capital Matrix. This publication is designed as a tool to assist business owners and entrepreneurs with discovering the myriad of capital sources in and around the Mile High City. As a strategic initiative of the Denver Office of Economic Development’s JumpStart strategic plan, the Denver Capital Matrix provides a comprehensive directory of financing Definitions sources, from traditional bank lending, to venture capital firms, private Venture Capital – Venture capital is capital provided by investors to small businesses and start-up firms that demonstrate possible high- equity firms, angel investors, mezzanine sources and more. growth opportunities. Venture capital investments have a potential for considerable loss or profit and are generally designated for new and Small businesses provide the greatest opportunity for job creation speculative enterprises that seek to generate a return through a potential today. Yet, a lack of needed financing often prevents businesses from initial public offering or sale of the company. implementing expansion plans and adding payroll. Through this updated resource, we’re striving to help connect businesses to start-up Angel Investor – An angel investor is a high net worth individual active in and expansion capital so that they can thrive in Denver. venture financing, typically participating at an early stage of growth. Private Equity – Private equity is an individual or consortium of investors and funds that make investments directly into private companies or initiate buyouts of public companies. Private equity is ownership in private companies that is not listed or traded on public exchanges. -

The Global Investment Banking Advisor for Asia

The global investment banking advisor for Asia The global investment banking advisor for Asia September 2021 Experts in Asian M&A The global investment banking advisor for Asia 2021 marks 25 years of providing high-quality M&A advice Where we are Key facts We deliver global coverage for our clients from BDA’s own platform #1 Cross-border Asian sellside M&A advisor London 1996 Founded and led since then by the same team New York Seoul Shanghai Tokyo Bankers across three continents Hong Kong 100 Mumbai Ho Chi Minh City Singapore 9 Offices globally 2 Strategic partners Our services How we are organized We provide M&A advisory services for: Divestitures Acquisitions Capital raisings Chemicals Consumer Healthcare & Retail Debt advisory & restructuring transactions Valuations Industrials Services Technology 1 On the ground, with local relationships BDA Partners is #1 for Asian cross-border private sellside M&A No other firm has built the same scale, focus, connectivity and deal flow in Asia Private, cross-border Asian sellside transactions up to US$1bn EV of last five years (2016–2020) Highlights Rank Advisor # of Deals 80% of transactions involved either the sale/acquisition of an Asian asset, an Asian buyer or an Asian seller 1 34 80% of M&A transactions with BDA as sellside advisor 2 32 75% of M&A transactions were cross-border 3 31 60% of sale to a strategic buyer vs 40% of sale to financial sponsors 4 27 Long-established Asian presence 5 26 Coverage across Asia 60+ bankers in Asia 6 25 7 countries Seoul 2002 Tokyo 25 years of relationship- Shanghai 2002 1998 7 24 building Hong Kong 2000 8 22 Mumbai 2005 Ho Chi Minh City 2014 9 21 Singapore We reach Asian buyers 1996 10 19 120+ assets sold to Asian buyers 20,000+ calls made to Asian buyers 600+ transactions with Asian participation Note: (1) Target headquartered in China, India, Japan, Korea or Southeast Asia; Control transactions: i.e. -

Proxy Statement

September 8, 2021 To our shareholders: I am pleased to invite you to the 2021 Annual General Meeting of Shareholders (the "Annual General Meeting") of Quotient Limited (“Quotient”, the “Company” or "we", "us" and "our") to be held on October 29, 2021, at 9:00 a.m., local time, at Business Park Terre Bonne B1, Route de Crassier 13, 1262 Eysins, Switzerland. Information about the meeting is presented on the following pages. Details regarding admission to the meeting and the business that will be conducted are described in the accompanying Notice of Annual General Meeting (the "AGM Notice") and Proxy Statement. In accordance with the “notice and access” rules and regulations adopted by the Securities and Exchange Commission (the "SEC"), instead of mailing a printed, paper copy of our proxy materials to each shareholder who holds shares in street name (the “full set delivery” option), we are furnishing proxy materials to those shareholders over the Internet (the “notice only” option). A company may use either option, “notice only” or “full set delivery,” for all of its shareholders or may use one method for some shareholders and the other method for others. We believe the “notice only” process expedites shareholders’ receipt of proxy materials and reduces the costs and environmental impact of our Annual General Meeting. We will bear the entire cost of the solicitation. On or about September 8, 2021, we will begin mailing a notice (the "Notice of Availability") to our shareholders containing instructions on how to access online our Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended March 31, 2021, filed with the SEC on June 3, 2021 (our "Annual Report"), vote online, and receive paper copies of these documents for shareholders who so select, as well as a link containing instructions on how to vote by telephone. -

Building Michigan's Vibrant Future

BUILDING2 MICHIGAN’S0 VIBRANT1 FUTURE1 “THESE GUYS CAN ADD A ZERO.” “WE’VE GROWN 43% OVER THE LAST TWO “WHEN I SAW THE RESULTS FROM THE AD CAMPAIGN, Josh Linkner, CEO and Managing Partner, YEARS. THEIR MADNESS WORKS.” I THOUGHT SOMEONE SCREWED UP PLACING A Detroit Venture Partners Tim Marshall, President, Bank of Ann Arbor DECIMAL POINT.” John Lichtenberg, CMO, Walsh College BRANDING THAT HITS. Perich Ad_VCA.indd 1 4/9/12 11:44 AM TABLE OF CONTENTS Executive Summary ...................................................................................3 Michigan Venture Capital Association................................................4 National and Midwest Venture Capital ..............................................6 Michigan Venture Capital Summary ................................................. 12 Michigan’s Successful Exits .................................................................. 30 Angel and Pre-Seed Summary ............................................................. 34 MVCA Activities .........................................................................................40 Michigan Venture Capital and Angel Network Directory ............................................................. 42 Photography by Leisa Thompson and Jeff Borisen. Helping entrepreneurs build great companies in the software, digital media, education technology and health information technology markets Michigan Office: 130 S. First Street, Suite 201 $250 MILLION IN CAPITAL Ann Arbor, MI 48104 UNDER MANAGEMENT PH: (734) 663-6500 www.mkcapital.com -

Healthcare & Life Sciences

HEALTHCARE & LIFE SCIENCES Industry Update │ May 2021 Healthcare & Life Sciences INDUSTRY UPDATE │ May 2021 Healthcare & Life Sciences Industry Overview QUICK TAKE: HEALTHCARE AUTOMATION Operating on tight margins and with lives at stake, healthcare providers are embracing automation as a way to ensure process quality while optimizing efficiency. Here, senior members of the Harris Williams Healthcare & Life Sciences Group share insights on the top considerations for investors exploring opportunities in the healthcare automation solutions sector, with a special focus on pharmacy automation. Read the article. M&A ENVIRONMENT ( 1 ) There have been roughly 625 M&A transactions in the healthcare and life sciences industry since the beginning of 2021, worth roughly $100 billion, compared with approximately $222 billion for all of 2020. Notable recent transactions include the acquisition of PPD Inc. (NasdaqGS: PPD) by Thermo Fisher Scientific Inc. (NYSE: TMO), Kindred Healthcare LLC by Humana Inc. (NYSE: HUM), and Luminex Corporation (NasdaqGS: LMNX) by DiaSorin SpA (BIT: DIA). PUBLIC COMPANY PERFORMANCE ( 1 ) Stock prices increased for many healthcare and life sciences companies during the past three months. In fact, the Harris Williams HCLS Composite Index increased 10.1%, while the S&P increased 12.6%. Notable sector increases include assisted living (increased 48.3%), healthcare staffing (increased 31.0%), and dental products (increased 21.8%). Industrywide stock prices have experienced increases as a whole; the HCLS Composite Index showed an increase over the past 12 months of 67.3%. At the category level, provider-based services grew by 67.7% on average over the past 12 months, followed by payor, provider, and pharmacy support services increasing 37.6% and products and devices stock prices increasing 35.4%. -

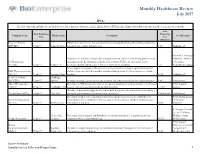

Monthly Healthcare Review July 2017

Monthly Healthcare Review July 2017 IPOs The following table includes the medical devices, biotechnology, pharmaceuticals, and healthcare IPO pricings, filings and withdrawals announced over the previous month. Last Last Financing Financing Company Name HQ Location Description Lead Manager Date Size (Millions) Promore Pharma Owner and operator of a bio-pharmaceutical company developing therapeutic peptides for (PROMO) 6-Jul-17 Solna, Sweden treating local wounds and infections. 8.74 Undisclosed Network 1 Financial Operator of a molecular diagnostics company offering a DNA-based testing platform that Securities, Network Co-Diagnostics specializes in the development of probes for real-time PCR to its customers. It also 1 Securities, (CODX) 12-Jul-17 Sandy, UT develops a design and analytics software for DNA test designing. 7.07 WallachBeth Capital The company is engaged in the extraction and purification of heparin glycosaminoglycan NKF Pharmaceuticals and develops a controlled, traceable, and detectable process for the production of crude (603707) 13-Jul-17 Nanjing, China heparin. 67.22 Undisclosed NextCell Pharma Huddinge, (NEXTCL) 13-Jul-17 Sweden Provider of medical products for autoimmune and inflammatory diseases and transplants. 2.88 Undisclosed Akcea Therapeutics Developer of RNA-targeted antisense therapeutic products created to transform the lives of BMO Capital (AKCA) 14-Jul-17 Cambridge, MA patients with serious cardiometabolic lipid disorders. 175.00 Markets Provider of nutritional supplements and medical devices for the restoration of the ability to PharmaNutra (PHN) 18-Jul-17 Pisa, Italy articulate and movement in osteoarticular affections. Undisclosed Undisclosed Developer of innovative nanoparticle-based treatments created to treat ocular diseases BofA Merrill Lynch, Kala Pharmaceuticals affecting both front and back of the eye, such as dry eye disease and post-surgical ocular J.P Morgan (KALA) 20-Jul-17 Waltham, MA inflammation and pain. -

Silicon Valley London Woodside Capital Partners (WCP)

Silicon Valley London Woodside Capital Partners (WCP) proudly releases the inaugural healthcare report “State of Digital Health”. In 2016, healthcare cost in the US was $3.3 Trillion – 17.9% of GDP, passing $10,000 per capita mark for the first time ever. According to CMS, by 2026, the figure is projected to grow to $5.7 Trillion – 19.8% of GDP. The answer to curbing and reversing the trend with respect to healthcare costs lies in large part to the movement towards Digital Health, or ‘Health Tech’. The proliferation of devices and applications across the healthcare spectrum has led to a data tsunami – the “what”. Machine Learning, Artificial Intelligence and overall Big Data analytics are leading to real-time actionable insights – the “so what”. We have entered the realm of the Internet of Medical Things (IoMT), with ubiquitous connectivity and measurement of everything from our vitals and nutrition to physical activity and medical compliance. We are just starting to leverage that data in a meaningful way and seeing early impact on health and well-being. In 2017, venture investments in Digital Health startups exceeded $6 Billion for the first time, and the trend seems to be accelerating with $1.6 Billion invested in Q1, 2018. The juxtaposition of rising healthcare costs and increased Digital Health investments is not all that surprising. Advances in underlying real-time analytics and potential of leading edge innovations around genomics are turning the perceived fiction of personalized medicine into a real possibility. Foundational disruptions such as Blockchain, while relatively nascent, are creating excitement (and some anxiety) around secure, immutable data sharing across silos – with healthcare as the ideal use case. -

Deal Drivers: Americas Q1 2021

Deal Drivers: Americas Q1 2021 A spotlight on mergers and acquisitions trends in 2021 Contents Foreword 03 Outlook 04 Summary 05 Canada 08 Western US 12 Midwestern US 16 Southern US 20 Northeastern US 24 Brazil 28 Latin America & the Caribbean (excl. Brazil) 32 About this report 36 2 Foreword: North-South divide underpinning uneven recovery After a challenging year that saw deal activity freeze through The US has led the way, with deal value more than H1 2020 as the outbreak of COVID-19 forced countries into doubling year-on-year in Q1 2021 to reach US$658.73bn. lockdowns, the M&A market in the Americas has reset and The conclusion of the US presidential election and the recovered, posting steady deal numbers through Q1 2021. inauguration of Joe Biden have given capital markets Aggregate deal value for the region reached US$658.73bn more certainty. The country has also benefited from a mass from 1,961 transactions announced in Q1 2021, up from roll-out of COVID-19 vaccines, with almost 100m people in US$236.77bn from 1,918 deals in the same period last year. the US fully vaccinated through the early months of this year. Outside of North America, deal markets in Brazil and But while the headline gains in M&A elsewhere in Latin America have also seen improvement activity offer reasons for optimism in in Q1 2021, but the rebound hasn’t been as pronounced. the deal community, the recovery has The outlook for the rest of the year is also less certain, with been noticeably uneven. -

Advertising.Pdf

YOUR AWARDWINNING SUPPLEMENT business-reporter.co.uk LEADERS OF DISTRIBUTED WITHIN THE SUNDAY TELEGRAPH, PRODUCED AND PUBLISHED BY LYONSDOWN WHICH TAKES SOLE RESPONSIBILITY FOR THE CONTENTS THEYOUR AWARDWINNING SUPPLEMENT PACK! Golden glow for the Dragons’ Den duo Global ambitions of British entrepreneurs who have set their sights on the tanning market | Page 5 June 2014 WOMEN IN BUSINESS Business Reporter prize at prestigious scoops industry top awards | Full story page 6 March 2014 What | business-reporter.co.uk Exclusive interview with shadow business emerging markets happened secretary Chuka Umunna The power behind decisions JULY Internet ofKeeping things next? "The sink doesn’t have a clue what it’s talking about.British I agree withbusiness the fridge" competitive Exclusive interview with Dr Leah Totton, e A p p r e n t i c e winner 2013 | Pages 8 and 9 in a global economy ents Pages 8-9 own which takes sole responsibility for the cont D yons l by publisheD D Dave Baxter reports from Brazil ahead of this year’s World Cup on a an uceD country that is finding its place on the international stage | Pages 4-5 D elegraph, pro t ay D un INSIDE s The schoolboy whose idea was sold to Yahoo! for $30m within the D DISTRIBUTED WITHIN THE SUNDAY TELEGRAPH, PRODUCED AND PUBLISHED BY LYONSDOWNExclusive WHICH TAKES SOLE RESPONSIBILITYinterview FOR THE CONTENTSwith Nick D’Aloisio | Pages 8-9 We have been setting the pace for months now withDistribute brilliant interviews, excellent analysis and engaging features in our award-winning supplements. Here’s a small reminder of what we’ve been up to.. -

Public Employee Retirement System of Idaho Report

Performance Summary by Investment PERSI PE Portfolio Performance Summary by Investment as of December 31, 2020 Total Vintage Capital Unfunded Capital Partnership Strategy Paid-In Capital Market Value Value Net IRR2 Year Committed Commitment Distributed1 Multiple Active Portfolio Advent International GPE IX, L.P. 2019 Corporate Finance Buyout - Mega $50,000,000 $31,625,151 $18,374,849 - $26,384,852 1.44x 56.98% Advent International GPE VII-B, L.P. 2012 Corporate Finance Buyout - Large 30,000,000 1,800,000 $28,200,000 $32,498,484 21,217,670 1.90x 15.32% Advent International GPE VIII-B, L.P. 2016 Corporate Finance Buyout - Mega 36,000,000 1,835,999 34,164,001 - 66,552,366 1.95x 27.14% Apollo Investment Fund IX, L.P. 2019 Corporate Finance Buyout - Mega 50,000,000 37,110,794 14,027,834 1,625,962 13,889,016 1.11x 10.02% Apollo Investment Fund VIII, L.P. 2013 Corporate Finance Buyout - Mega 40,000,000 5,516,202 38,018,950 22,040,145 31,555,120 1.41x 10.53% Ascribe Opportunities Fund III, L.P. 2014 Distressed Debt - Control 30,000,000 7,552,190 50,652,070 39,059,581 7,117,443 0.91x (11.71%) Ascribe Opportunities Fund IV, L.P. 2020 Distressed Debt - Control 40,000,000 39,902,826 378,451 373,559 (57,668) 0.83x (45.14%) Blackstone Capital Partners VI, L.P. 2011 Corporate Finance Buyout - Mega 40,000,000 4,470,091 43,183,763 46,173,308 25,510,388 1.66x 12.35% Blackstone Capital Partners VII, L.P. -

View Annual Report

ACURA PHARMACEUTICALS, INC FORM 10-K (Annual Report) Filed 03/15/07 for the Period Ending 12/31/06 Address 616 N. NORTH COURT, SUITE 120 PALATINE, IL 60067 Telephone 847-705-7709 CIK 0000786947 Symbol ACUR SIC Code 2834 - Pharmaceutical Preparations Industry Biotechnology & Drugs Sector Healthcare Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2012, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K FOR ANNUAL AND TRANSITION REPORTS PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2006 or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _____ to _____ Commission file number 1-10113 ACURA PHARMACEUTICALS, INC. (Exact name of registrant as specified in its charter) New York 11-0853640 (State or other jurisdiction of Incorporation or organization) (I.R.S. Employer Identification No.) 616 N. North Court, Suite 120, Palatine, Illinois 60067 (Address of principal executive office) (Zip code) Registrant's telephone number, including area code: 847 705 7709 Securities registered pursuant to section 12(b) of the Act: None Securities registered pursuant to section 12(g) of the Act: (Title of Class) Common Stock, par value $0.01 per share Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.