Building Michigan's Vibrant Future

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2Nd FCF Life Science IPO Report

FCF Life Science Research 2nd Life Science IPO Report – Initial Public Offerings in Europe and the US Enterovirus Part of FCF Life Science Research Series FCF Overview European and US Life Science IPOs C r o s s - border IPOs of European Issuers in the US Life Science IPO Outlook Appendix: European Cross - border Issuances in the US 2 FCF Overview FCF seeks to provide Who We Are Capital Markets Capabilities and Services its clients with ▪ Specialized investment bank and financing specialist financing Private / Venture capital financing Private equity financing ▪ Advising public and private small / midcap companies Pre-IPO Growth capital financing (i) at the lowest cost, ▪ Advisor for structuring and placement of financing transactions: Initial Public Offering (IPO) pursued in tandem) – All instruments: Unbiased approach to all available corporate Equity / Capital increase Private Investment in (ii) with the highest Public Dual-track (IPO and Public Equity (PIPE) flexibility, financing instruments (no product selling approach), allowing alternative transaction Block trade for customized financing structures (iii) in the shortest Receivables financing / Working capital / Revolving – All investors: Close and trusted relationships with senior period of time, Short-term Factoring / ABS credit facility executives of virtually all relevant equity and debt investors Debt Borrowing base / Guarantees / (iv) with the highest – Fast process: Process management skills and direct / personal Inventory financing Letter of Credit closing proba- access to institutional debt and equity investors enable fast Bank loan facility / Promissory note bility, and with transactions Straight debt (Schuldscheindarlehen) Debt Long-term Sale-and-lease back High-yield / PIK bond (v) financing partners ▪ More than 100 transactions with a total placement volume in Debt Corporate bonds (public / (public / private) that integrate well excess of EUR 4.0 billion since foundation in 2005 private placement) Second lien financing into their strategy ▪ Approx. -

DENVER CAPITAL MATRIX Funding Sources for Entrepreneurs and Small Business

DENVER CAPITAL MATRIX Funding sources for entrepreneurs and small business. Introduction The Denver Office of Economic Development is pleased to release this fifth annual edition of the Denver Capital Matrix. This publication is designed as a tool to assist business owners and entrepreneurs with discovering the myriad of capital sources in and around the Mile High City. As a strategic initiative of the Denver Office of Economic Development’s JumpStart strategic plan, the Denver Capital Matrix provides a comprehensive directory of financing Definitions sources, from traditional bank lending, to venture capital firms, private Venture Capital – Venture capital is capital provided by investors to small businesses and start-up firms that demonstrate possible high- equity firms, angel investors, mezzanine sources and more. growth opportunities. Venture capital investments have a potential for considerable loss or profit and are generally designated for new and Small businesses provide the greatest opportunity for job creation speculative enterprises that seek to generate a return through a potential today. Yet, a lack of needed financing often prevents businesses from initial public offering or sale of the company. implementing expansion plans and adding payroll. Through this updated resource, we’re striving to help connect businesses to start-up Angel Investor – An angel investor is a high net worth individual active in and expansion capital so that they can thrive in Denver. venture financing, typically participating at an early stage of growth. Private Equity – Private equity is an individual or consortium of investors and funds that make investments directly into private companies or initiate buyouts of public companies. Private equity is ownership in private companies that is not listed or traded on public exchanges. -

The Global Investment Banking Advisor for Asia

The global investment banking advisor for Asia The global investment banking advisor for Asia September 2021 Experts in Asian M&A The global investment banking advisor for Asia 2021 marks 25 years of providing high-quality M&A advice Where we are Key facts We deliver global coverage for our clients from BDA’s own platform #1 Cross-border Asian sellside M&A advisor London 1996 Founded and led since then by the same team New York Seoul Shanghai Tokyo Bankers across three continents Hong Kong 100 Mumbai Ho Chi Minh City Singapore 9 Offices globally 2 Strategic partners Our services How we are organized We provide M&A advisory services for: Divestitures Acquisitions Capital raisings Chemicals Consumer Healthcare & Retail Debt advisory & restructuring transactions Valuations Industrials Services Technology 1 On the ground, with local relationships BDA Partners is #1 for Asian cross-border private sellside M&A No other firm has built the same scale, focus, connectivity and deal flow in Asia Private, cross-border Asian sellside transactions up to US$1bn EV of last five years (2016–2020) Highlights Rank Advisor # of Deals 80% of transactions involved either the sale/acquisition of an Asian asset, an Asian buyer or an Asian seller 1 34 80% of M&A transactions with BDA as sellside advisor 2 32 75% of M&A transactions were cross-border 3 31 60% of sale to a strategic buyer vs 40% of sale to financial sponsors 4 27 Long-established Asian presence 5 26 Coverage across Asia 60+ bankers in Asia 6 25 7 countries Seoul 2002 Tokyo 25 years of relationship- Shanghai 2002 1998 7 24 building Hong Kong 2000 8 22 Mumbai 2005 Ho Chi Minh City 2014 9 21 Singapore We reach Asian buyers 1996 10 19 120+ assets sold to Asian buyers 20,000+ calls made to Asian buyers 600+ transactions with Asian participation Note: (1) Target headquartered in China, India, Japan, Korea or Southeast Asia; Control transactions: i.e. -

2020 Philadelphia Venture Report

2020 PHILADELPHIA VENTURE REPORT Data provided by WE HELP BREAKTHROUGH IDEAS ACTUALLY BREAK THROUGH. We believe in the risk takers, the game-changers and the disruptors—those who committed to leveraging innovation to make the world a better place. Bridge Bank, founded in 2001 in Silicon Valley, serves small-market and middle-market businesses across many industries, as well as emerging technology and life sciences companies and the private equity community. Geared to serving both venture-backed and non-venture-backed companies across all stages of growth, Bridge Bank offers a broad scope of financial solutions including growth capital, equipment and working capital credit facilities, venture debt, treasury management, asset-based lending, SBA and commercial real estate loans, ESOP finance and full line of international products and services. To learn more about us, visit info.bridgebank.com/tech-innovation. Matt Klinger Brian McCabe Senior Director, Technology Banking Senior Director, Technology Banking [email protected] [email protected] (703) 547-8198 (703) 345-9307 Bridge Bank, a division of Western Alliance Bank. Member FDIC. *All offers of credit are subject to approval. Introduction 2020 was a watershed moment on so many fronts. The COVID-19 pandemic will forever change how we live, work, and interact. The killings of George Floyd, Breonna Taylor, Ahmaud Arbery, and countless others have brought focus and urgency to attacking racism, racial injustice, and the resulting inequities in our society. Philadelphia has always been a city fueled by passion and determination to challenge the status quo, think differently, invent, and push forward together. This report showcases the fruits of that passion in the form of capital raised to fuel innovation. -

Game-Tech-Whitepaper

Type & Color October, 2020 INSIGHTS Game Tech How Technology is Transforming Gaming, Esports and Online Gambling Elena Marcus, Partner Sean Tucker, Partner Jonathan Weibrecht,AGC Partners Partner TableType of& ContentsColor 1 Game Tech Defined & Market Overview 2 Game Development Tools Landscape & Segment Overview 3 Online Gambling & Esports Landscape & Segment Overview 4 Public Comps & Investment Trends 5 Appendix a) Game Tech M&A Activity 2015 to 2020 YTD b) Game Tech Private Placement Activity 2015 to 2020 YTD c) AGC Update AGCAGC Partners Partners 2 ExecutiveType & Color Summary During the COVID-19 pandemic, as people are self-isolating and socially distancing, online and mobile entertainment is booming: gaming, esports, and online gambling . According to Newzoo, the global games market is expected to reach $159B in revenue in 2020, up 9.3% versus 5.3% growth in 2019, a substantial acceleration for a market this large. Mobile gaming continues to grow at an even faster pace and is expected to reach $77B in 2020, up 13.3% YoY . According to Research and Markets, the global online gambling market is expected to grow to $66 billion in 2020, an increase of 13.2% vs. 2019 spurred by the COVID-19 crisis . Esports is projected to generate $974M of revenue globally in 2020 according to Newzoo. This represents an increase of 2.5% vs. 2019. Growth was muted by the cancellation of live events; however, the explosion in online engagement bodes well for the future Tectonic shifts in technology and continued innovation have enabled access to personalized digital content anywhere . Gaming and entertainment technologies has experienced amazing advances in the past few years with billions of dollars invested in virtual and augmented reality, 3D computer graphics, GPU and CPU processing power, and real time immersive experiences Numerous disruptors are shaking up the market . -

Oklahoma City Employee Retirement System

Oklahoma City Employee Retirement System Comprehensive Annual Financial Report | A Pension Trust Fund of Oklahoma City The City of Oklahoma City, Oklahoma | for the Fiscal Year ended June 30, 2019 and 2020 OKLAHOMA CITY EMPLOYEE RETIREMENT SYSTEM A Pension Trust Fund of Oklahoma City, Oklahoma Board of Trustees Paul Bronson, Chairman Ken Culver, Vice-Chairman Frances Kersey, Secretary (ex-officio) Matthew Boggs, Treasurer (ex-officio) Karla Nickels Aimee Maddera Brent Bryant Jacqueline Ames Jim Williamson JC Reiss Randy Thurman Vacant Eugene (Marty) Lawson Management Regina Story, Administrator Comprehensive Annual Financial Report for the Fiscal Years Ended June 30, 2020 and 2019 Prepared by The Oklahoma City Finance Department, Accounting Services Division Angela Pierce, CPA, Assistant Finance Director / Controller OKLAHOMA CITY EMPLOYEE RETIREMENT SYSTEM TABLE OF CONTENTS For the Fiscal Years Ended June 30, 2020 and 2019 PAGE I. INTRODUCTORY SECTION Transmittal Letter 1 Certificate of Achievement for Excellence in Financial Reporting 5 Public Pension Standards Award for Funding and Administration 6 Board of Trustees 7 Professional Services 8 Organization Chart 9 Report of the Chair 10 II. FINANCIAL SECTION Independent Auditor's Report on Financial Statements and Supplementary Information 11 Management's Discussion and Analysis 13 Basic Financial Statements: Statements of Fiduciary Net Position 17 Statements of Changes in Fiduciary Net Position 18 Notes to Financial Statements 19 Required Supplementary Information: Defined Benefit Pension -

Proxy Statement

September 8, 2021 To our shareholders: I am pleased to invite you to the 2021 Annual General Meeting of Shareholders (the "Annual General Meeting") of Quotient Limited (“Quotient”, the “Company” or "we", "us" and "our") to be held on October 29, 2021, at 9:00 a.m., local time, at Business Park Terre Bonne B1, Route de Crassier 13, 1262 Eysins, Switzerland. Information about the meeting is presented on the following pages. Details regarding admission to the meeting and the business that will be conducted are described in the accompanying Notice of Annual General Meeting (the "AGM Notice") and Proxy Statement. In accordance with the “notice and access” rules and regulations adopted by the Securities and Exchange Commission (the "SEC"), instead of mailing a printed, paper copy of our proxy materials to each shareholder who holds shares in street name (the “full set delivery” option), we are furnishing proxy materials to those shareholders over the Internet (the “notice only” option). A company may use either option, “notice only” or “full set delivery,” for all of its shareholders or may use one method for some shareholders and the other method for others. We believe the “notice only” process expedites shareholders’ receipt of proxy materials and reduces the costs and environmental impact of our Annual General Meeting. We will bear the entire cost of the solicitation. On or about September 8, 2021, we will begin mailing a notice (the "Notice of Availability") to our shareholders containing instructions on how to access online our Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended March 31, 2021, filed with the SEC on June 3, 2021 (our "Annual Report"), vote online, and receive paper copies of these documents for shareholders who so select, as well as a link containing instructions on how to vote by telephone. -

March 19, 2020 State of Michigan Retirement System Quarterly Investment Review

STATE OF MICHIGAN INVESTMENT BOARD MEETING March 19, 2020 State of Michigan Retirement System Quarterly Investment Review Rachael Eubanks, State Treasurer Prepared by Bureau of Investments Michigan Department of Treasury STATE OF MICHIGAN INVESTMENT BOARD MEETING MARCH 19, 2020 Agenda 9:30 a.m. Call to Order and Opening Remarks 9:40 a.m. Approval of the 12/19/19 SMIB Meeting Minutes 9:45 a.m. Executive Summary & Performance for Periods Ending 12/31/19 10:00 a.m. Current Asset Allocation Review Markets Review and Outlook 10:15 a.m. Action Item: Removal of Oakmark Equity and Income Fund from 401(k)/457 DC Plans Investment Manager Lineup 10:25 a.m. Review of Investment Reports Defined Contribution International Equity Domestic Equity Fixed Income Private Equity – Receive and File Real Estate & Infrastructure – Receive and File Real & Opportunistic Return – Receive and File Absolute Return – Receive and File Basket Clause – Receive and File 11:00 a.m. Public Comment Closing Remarks ~ Adjournment 2020 Meeting Schedule Thursday, June 11, 2020 Thursday, September 10, 2020 Thursday, December 10, 2020 All meetings start at 9:30 a.m. www.michigan.gov/treasury State of Michigan Retirement System MINUTES State of Michigan Investment Board Meeting March 19, 2020 Robert L. Brackenbury Deputy C hief Investment Officer Bureau of Investments STATE OF MICHIGAN INVESTMENT BOARD December 19, 2019 Meeting Minutes Board Members Present: Chairman – Treasurer Rachael Eubanks Ms. Dina Richard Mr. Chris Kolb Mr. Reginald Sanders Mr. James Nicholson Members -

Healthcare & Life Sciences

HEALTHCARE & LIFE SCIENCES Industry Update │ May 2021 Healthcare & Life Sciences INDUSTRY UPDATE │ May 2021 Healthcare & Life Sciences Industry Overview QUICK TAKE: HEALTHCARE AUTOMATION Operating on tight margins and with lives at stake, healthcare providers are embracing automation as a way to ensure process quality while optimizing efficiency. Here, senior members of the Harris Williams Healthcare & Life Sciences Group share insights on the top considerations for investors exploring opportunities in the healthcare automation solutions sector, with a special focus on pharmacy automation. Read the article. M&A ENVIRONMENT ( 1 ) There have been roughly 625 M&A transactions in the healthcare and life sciences industry since the beginning of 2021, worth roughly $100 billion, compared with approximately $222 billion for all of 2020. Notable recent transactions include the acquisition of PPD Inc. (NasdaqGS: PPD) by Thermo Fisher Scientific Inc. (NYSE: TMO), Kindred Healthcare LLC by Humana Inc. (NYSE: HUM), and Luminex Corporation (NasdaqGS: LMNX) by DiaSorin SpA (BIT: DIA). PUBLIC COMPANY PERFORMANCE ( 1 ) Stock prices increased for many healthcare and life sciences companies during the past three months. In fact, the Harris Williams HCLS Composite Index increased 10.1%, while the S&P increased 12.6%. Notable sector increases include assisted living (increased 48.3%), healthcare staffing (increased 31.0%), and dental products (increased 21.8%). Industrywide stock prices have experienced increases as a whole; the HCLS Composite Index showed an increase over the past 12 months of 67.3%. At the category level, provider-based services grew by 67.7% on average over the past 12 months, followed by payor, provider, and pharmacy support services increasing 37.6% and products and devices stock prices increasing 35.4%. -

CB-Insights Healthcare-Report-Q3

In The Shadow Of Covid-19: Consumer InvestmentState Of Healthcare & Sector Q3’20 Trends Report: SectorTo Watch And Investment Trends To Watch 1 WHAT IS CB INSIGHTS? CB Insights helps the world’s leading companies make smarter technology decisions with data, not opinion. Our Technology Insights Platform provides companies with comprehensive data, expert insights and work management tools to drive growth and improve operations with technology. SIGN UP FOR A FREE TRIAL 2 With CB Insights, Froedtert Health is able to move quickly when assessing the market or evaluating potential partners. We can then dive deeper into a certain topic and collaborate across our organization all within one platform. Mike Anderes Chief Innovation and Digital Officer, Froedtert Health 3 8,000+ companies. 150 winners. 1 list. Digital Health 150 is here! Join Healthcare Managing Analyst, Ja Lee, for a behind the scenes tour of the list's development and trends it highlights. October 20th at 2pm EDT SIGN UP HERE FOR THE WEBINAR 1 The CBI Community DISCOUNTED TICKETS TO OUR UPCOMING OUR VIRTUAL EVENTS VIRTUAL EVENTS 4 Our Most Popular Client-Exclusive Research Digital Therapeutics: The $9B Market Redefining Disease Prevention, Management, & Treatment 9 Startups That Are Tackling Healthcare Interoperability Healthcare Anywhere: 120+ Telehealth Startups Transforming Patient Care 12 Startups Using Telehealth To Fill Gaps In Pandemic Care 9 Direct-To-Consumer Telehealth Startups To Watch Inside Google’s Ambitions To Become The Go-To Vendor For Healthcare IT 10 Startups -

Private Equity Analyst

PRIVATE EQUITY ANALYST NOVEMBER 2020 Women to Private Equity’s Top Female Talent of Today and Tomorrow p. 7 10 VCs Grooming Game-Changing Startups p. 13 Watch LP Cycles Ad HFA+PEA-Ltr DR080420.pdf 1 8/4/20 5:43 PM Private equity investing has its cycles. Work with a secondary manager who’s C experienced them all. M Y CM MY As leaders of the secondary market, the Lexington Partners team CY draws on more than 400 years of private equity experience. CMY Through all types of business cycles, we have completed over K 500 secondary transactions, acquiring more than 3,000 interests managed by over 750 sponsors with a total value in excess of $53 billion. Our team has excelled at providing customized alternative investment solutions to banks, financial institutions, pension funds, sovereign wealth funds, endowments, family offices, and other fiduciaries seeking to reposition their private investment portfolios. If you have an interest in the secondary market, our experience is second to none. To make an inquiry, please send an email to [email protected] or call us at one of our offices. Innovative Directions in Alternative Investing New York • Boston • Menlo Park • London • Hong Kong • Santiago • Luxembourg www.lexingtonpartners.com Includes information regarding six funds managed by Lexington’s predecessor formed during the period 1990 to 1995. This information is provided for informational purposes only and is not an offer to sell or solicitation of offers to purchase any security. Private Equity Analyst November 2020 contents Volume XXX, Issue 11 Fund News u The Roundup Comment Clayton Dubilier Collects About $14B for Latest Buyout Fund 26 H.I.G. -

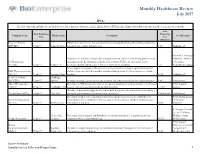

Monthly Healthcare Review July 2017

Monthly Healthcare Review July 2017 IPOs The following table includes the medical devices, biotechnology, pharmaceuticals, and healthcare IPO pricings, filings and withdrawals announced over the previous month. Last Last Financing Financing Company Name HQ Location Description Lead Manager Date Size (Millions) Promore Pharma Owner and operator of a bio-pharmaceutical company developing therapeutic peptides for (PROMO) 6-Jul-17 Solna, Sweden treating local wounds and infections. 8.74 Undisclosed Network 1 Financial Operator of a molecular diagnostics company offering a DNA-based testing platform that Securities, Network Co-Diagnostics specializes in the development of probes for real-time PCR to its customers. It also 1 Securities, (CODX) 12-Jul-17 Sandy, UT develops a design and analytics software for DNA test designing. 7.07 WallachBeth Capital The company is engaged in the extraction and purification of heparin glycosaminoglycan NKF Pharmaceuticals and develops a controlled, traceable, and detectable process for the production of crude (603707) 13-Jul-17 Nanjing, China heparin. 67.22 Undisclosed NextCell Pharma Huddinge, (NEXTCL) 13-Jul-17 Sweden Provider of medical products for autoimmune and inflammatory diseases and transplants. 2.88 Undisclosed Akcea Therapeutics Developer of RNA-targeted antisense therapeutic products created to transform the lives of BMO Capital (AKCA) 14-Jul-17 Cambridge, MA patients with serious cardiometabolic lipid disorders. 175.00 Markets Provider of nutritional supplements and medical devices for the restoration of the ability to PharmaNutra (PHN) 18-Jul-17 Pisa, Italy articulate and movement in osteoarticular affections. Undisclosed Undisclosed Developer of innovative nanoparticle-based treatments created to treat ocular diseases BofA Merrill Lynch, Kala Pharmaceuticals affecting both front and back of the eye, such as dry eye disease and post-surgical ocular J.P Morgan (KALA) 20-Jul-17 Waltham, MA inflammation and pain.