Insideradio.Com

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EMERGENCY OPERATIONS PLAN BASIC PLAN (Rev

City of Apple Valley EMERGENCY OPERATIONS PLAN BASIC PLAN (rev. 0) CITY OF APPLE VALLEY EMERGENCY OPERATIONS PLAN Effective Date January 1, 2017 Apple Valley – Emergency Operations Plan Basic Plan–i City of Apple Valley EMERGENCY OPERATIONS PLAN BASIC PLAN (rev. 0) FOREWARD The purpose of this plan is to provide a guide for emergency operations. The plan is intended to assist city officials and emergency organizations to carry out their responsibilities for the protection of life and property under a wide range of emergency conditions. This plan is in accordance with existing federal, state, and local statues and understandings of the various departments/agencies involved. It has been adopted by the city council and reviewed by the Dakota County Emergency Management Director. It is subject to review and recommendation of approval by the Minnesota Department of Public Safety, Division of Homeland Security and Emergency Management and the Metro Regional Review Committee (RRC). This plan is to be reviewed and re-certified annually by the City’s Emergency Management Director. All recipients are requested to advise the City’s Emergency Management Director of any changes that might result in its improvement or increase its usefulness. This document will serve to provide documentation of the knowledge of key individuals and can be used to inform persons who become replacements. "This Emergency Operations Plan shall not be shared or disclosed to any person or agency outside of the City of Apple Valley that do not have direct responsibilities to implement the Plan.” The data in this Emergency Operations Plan is not public data and shall not be disclosed. -

Federal Communications Commission DA 20-1040 Before the Federal

Federal Communications Commission DA 20-1040 Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of Online Political Files of ) File Nos.: POL -072120-20603981 ) POL -072120-28010627 ) Chicago FCC License Sub, LLC ) FRN: 20603700 Cincinnati FCC License Sub, LLC ) FRN: 20604005 HBI Radio Alexandria, LLC ) FRN: 24063364 HBI Radio Bemidji, LLC ) FRN: 24063349 HBI Radio Brainerd/Wadena, LLC ) FRN: 24063323 KSTP-AM, LLC ) FRN: 2624385 KSTP-FM FCC License Sub, LLC ) FRN: 20604047 KTMY-FM, LLC ) FRN: 4084570 Phoenix FCC License Sub, LLC ) FRN: 22840441 Seattle FCC License Sub, LLC ) FRN: 22840409 St. Louis FCC License Sub, LLC ) FRN: 20604021 Washington DC FCC License Sub, LLC ) FRN: 20603981 WPB FCC License Sub, LLC ) FRN: 28010627 Licensees of Commercial Radio Station(s) ORDER Adopted: September 4, 2020 Released: September 4, 2020 By the Chief, Media Bureau: 1. The Commission first adopted rules requiring broadcast stations to maintain public files documenting requests for political advertising time more than 80 years ago,1 and political file obligations have been embodied in section 315(e) of the Act since 2002.2 Section 315(e)(1) requires radio station licensees, among other regulatees, to maintain and make available for public inspection information about each request for the purchase of broadcast time that is made: (a) by or on behalf of a legally qualified candidate for public office,3 or (b) by an issue advertiser whose advertisement communicates a message relating to a political matter of national importance.4 Section 315(e)(3) of the Act requires stations to upload information about such requests to their online political files “as soon as possible.”5 Section 73.1943(a) of the Commission’s Rules requires stations to maintain and make available for public inspection information about all requests for broadcast time made by or on behalf of candidates for public office,6 and section 73.1943(c) requires stations to upload such information to their online political files 1 See 3 Fed. -

Front Cover 01-2012.Ppp

The Official Publication of the Worldwide TV-FM DX Association JANUARY 2012 The Magazine for TV and FM DXers Anxious Dxers Camp out on a Snowy New Years Eve Anticipating huge Discounts on DX Equipment at Ozzy’s House of Antennas. Paul Mitschler Happy New DX Year 2012! Visit Us At www.wtfda.org THE WORLDWIDE TV-FM DX ASSOCIATION Serving the UHF-VHF Enthusiast THE VHF-UHF DIGEST IS THE OFFICIAL PUBLICATION OF THE WORLDWIDE TV-FM DX ASSOCIATION DEDICATED TO THE OBSERVATION AND STUDY OF THE PROPAGATION OF LONG DISTANCE TELEVISION AND FM BROADCASTING SIGNALS AT VHF AND UHF. WTFDA IS GOVERNED BY A BOARD OF DIRECTORS: DOUG SMITH, GREG CONIGLIO, KEITH McGINNIS AND MIKE BUGAJ. Editor and publisher: Mike Bugaj Treasurer: Keith McGinnis wtfda.org Webmaster: Tim McVey wtfda.info Site Administrator: Chris Cervantez Editorial Staff: Jeff Kruszka, Keith McGinnis, Fred Nordquist, Nick Langan, Doug Smith, Peter Baskind, Bill Hale and John Zondlo, Our website: www.wtfda.org; Our forums: www.wtfda.info _______________________________________________________________________________________ We’re back. I hope everyone had an enjoyable holiday season! So far I’ve heard of just one Es event just before Christmas that very briefly made it to FM and another Es event that was noticed by Chris Dunne down in Florida that went briefly to FM from Colombia. F2 skip faded away somewhat as the solar flux dropped down to the 130s. So, all in all, December has been mostly uneventful. But keep looking because anything can still happen. We’ve prepared a “State of the Club” message for this issue. -

MASS INTENTIONS H 14 SUNDAY in ORDINARY TIME 5TH SUNDAY AFTER PENTECOST Monday, July 6 Sunday 4 July 2020

St. John the Beloved Catholic Church in McLean, Virginia July 5, 2020 IN TESTIMONIUM… MASS INTENTIONS H 14 SUNDAY IN ORDINARY TIME 5TH SUNDAY AFTER PENTECOST Monday, July 6 Sunday 4 July 2020 St. Maria Goretti, Virgin & Martyr 6:30 Michel Struelens † 9:00 Ann & Jim Thunder 8:00 Carol Purcell † Tuesday, July 7 Weekday 6:30 Lucas Gallegos † 9:00 James Kazunas † Wednesday, July 8 Weekday 6:30 Patricia Stark † 9:00 Modesto Robles III Thursday, July 9 St. Augustine Zhao Rong, Priest & Companions, Martyrs 6:30 Brice Bayle † Two flags hang in our church, those of the United States of 9:00 Caron Family American and the Holy See. One of them was stolen a few Friday, July 10 weeks ago. I borrowed an American flag from the school Weekday and replaced the missing Star Spangled Banner. 6:30 Galand Family 9:00 Josephine Melody † Even though I had and still have doubts about the Saturday, July 11 American Revolution being a just war, I wore the uniform of an Ensign in the United States Navy. Active duty in the St. Benedict, Abbot Chaplain Corps was my goal through my years in seminary 8:15 Parker Wilson † and that request was made every year of my priesthood 5:00 Gloria Albrittain until the Bishop released me for service to the Holy See Sunday, July 12 Mission to the United Nations. You could say that I have Fifteenth Sunday in Ordinary Time done Temporary Active Duty under both flags that fly near 7:30 Leslie Cooper our sanctuary. 9:00 President Trump 10:30 People of the Parish One of those flags represents an earthly realm that will one 12:00 Robin Maas day cease to exist. -

Promoter and Event Planning Guide

YOUR SEAT IS WAITING. PROMOTER AND EVENT PLANNING GUIDE 500 Howard Baker Jr. Avenue, Knoxville, TN 37915 | Phone: (865) 215-8900 www.knoxvillecoliseum.com Thank you for considering Knoxville as the WELCOME destination for your event or show. The Knoxville Civic Auditorium and Coliseum (KCAC) is a multipurpose event venue owned by the City of Knoxville and managed by SMG, the recognized global industry leader in public assembly facility management. The venue features several options for entertainment. The Coliseum is the largest space and seats more than 6,500 for concerts and public events. The Auditorium’s 2,500 seats allow for a more intimate experience for performances. A 10,000-square-foot exhibit hall, 4,800-square- foot reception hall and outdoor performance lawn with capacity for 10,000 guests also are available at the KCAC. You will receive the highest level of customer service to ensure the event is a success in the space that best suits your needs. This Promoter and Event Planning Guide is designed as a handbook for holding an event at our facility by providing information about services, guidelines and event-related topics. You will be contacted by the event management team member assigned to your event. The event manager will be available throughout the planning process to answer questions and provide assistance. The event manager will provide a cost estimate associated with the event, assist with development of floor plans, provide lists of preferred vendors and personally supervise your event from the first day through its conclusion. Thank you again for considering the KCAC for your event. -

Conference Program

1 Theology Of The Body Institute Presents Conference Program © Copyrights by Theology of the Body Institute. All Rights Reserved. 2 Table of Contents Welcome Letter 3 How the Virtual Conference Works 4 Clergy Biographies 6 Talks 8 Checklist 14 Women Biographies 16 Talks 20 Checklist 34 Men Biographies 37 Talks 42 Checklist 60 Español Biografías 64 Presentaciones 65 Lista de Verificación 69 Artists Biographies 71 Checklist 75 Upgrade to the Premium Pass 76 TOB Virtual Conference Team 77 Thank You to Our Sponsors 78 Theology of the Body Institute Resources 79 © Copyrights by Theology of the Body Institute. All Rights Reserved. 3 WELCOME LETTER FROM CHRISTOPHER WEST As the President of the Theology of the Body Institute, and on behalf of the entire TOB Institute team, it’s my honor to welcome you to our inaugural Theology of the Body Virtual Conference. We’ve been overwhelmed by the global response! Indeed, you are part of something unprecedented (dare I say historic?). Never before have so many people from around the world (as of this writing, we have over 50,000 registrants and are expecting thousands more over the weekend) participated in an event aimed at furthering an understanding and application of John Paul II’s Theology of the Body in the life of the Church. Of course, through the gift of the inter- net, you are participating from the comfort of your own home, but as you do so, try to imagine entering a great hall where you feel the collective enthusiasm of tens of thousands of people gathered from around the world to receive the wisdom of St. -

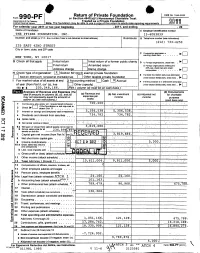

Return of Private Foundation CT' 10 201Z '

Return of Private Foundation OMB No 1545-0052 Form 990 -PF or Section 4947(a)(1) Nonexempt Charitable Trust Department of the Treasury Treated as a Private Foundation Internal Revenue Service Note. The foundation may be able to use a copy of this return to satisfy state reporting requirem M11 For calendar year 20 11 or tax year beainnina . 2011. and ending . 20 Name of foundation A Employer Identification number THE PFIZER FOUNDATION, INC. 13-6083839 Number and street (or P 0 box number If mail is not delivered to street address ) Room/suite B Telephone number (see instructions) (212) 733-4250 235 EAST 42ND STREET City or town, state, and ZIP code q C If exemption application is ► pending, check here • • • • • . NEW YORK, NY 10017 G Check all that apply Initial return Initial return of a former public charity D q 1 . Foreign organizations , check here . ► Final return Amended return 2. Foreign organizations meeting the 85% test, check here and attach Address chang e Name change computation . 10. H Check type of organization' X Section 501( exempt private foundation E If private foundation status was terminated Section 4947 ( a)( 1 ) nonexem pt charitable trust Other taxable p rivate foundation q 19 under section 507(b )( 1)(A) , check here . ► Fair market value of all assets at end J Accounting method Cash X Accrual F If the foundation is in a60-month termination of year (from Part Il, col (c), line Other ( specify ) ---- -- ------ ---------- under section 507(b)(1)(B),check here , q 205, 8, 166. 16) ► $ 04 (Part 1, column (d) must be on cash basis) Analysis of Revenue and Expenses (The (d) Disbursements total of amounts in columns (b), (c), and (d) (a) Revenue and (b) Net investment (c) Adjusted net for charitable may not necessanly equal the amounts in expenses per income income Y books purposes C^7 column (a) (see instructions) .) (cash basis only) I Contribution s odt s, grants etc. -

He KMBC-ÍM Radio TEAM

l\NUARY 3, 1955 35c PER COPY stu. esen 3o.loe -qv TTaMxg4i431 BItOADi S SSaeb: iiSZ£ (009'I0) 01 Ff : t?t /?I 9b£S IIJUY.a¡:, SUUl.; l: Ii-i od 301 :1 uoTloas steTaa Rae.zgtZ IS-SN AlTs.aantur: aTe AVSí1 T E IdEC. 211111 111111ip. he KMBC-ÍM Radio TEAM IN THIS ISSUE: St `7i ,ytLICOTNE OSE YN in the 'Mont Network Plans AICNISON ` MAISHAIS N CITY ive -Film Innovation .TOrEKA KANSAS Heart of Americ ENE. SEDALIA. Page 27 S CLINEON WARSAW EMROEIA RUTILE KMBC of Kansas City serves 83 coun- 'eer -Wine Air Time ties in western Missouri and eastern. Kansas. Four counties (Jackson and surveyed by NARTB Clay In Missouri, Johnson and Wyan- dotte in Kansas) comprise the greater Kansas City metropolitan trading Page 28 Half- millivolt area, ranked 15th nationally in retail sales. A bonus to KMBC, KFRM, serv- daytime ing the state of Kansas, puts your selling message into the high -income contours homes of Kansas, sixth richest agri- Jdio's Impact Cited cultural state. New Presentation Whether you judge radio effectiveness by coverage pattern, Page 30 audience rating or actual cash register results, you'll find that FREE & the Team leads the parade in every category. PETERS, ñtvC. Two Major Probes \Exclusive National It pays to go first -class when you go into the great Heart of Face New Senate Representatives America market. Get with the KMBC -KFRM Radio Team Page 44 and get real pulling power! See your Free & Peters Colonel for choice availabilities. st SATURE SECTION The KMBC - KFRM Radio TEAM -1 in the ;Begins on Page 35 of KANSAS fir the STATE CITY of KANSAS Heart of America Basic CBS Radio DON DAVIS Vice President JOHN SCHILLING Vice President and General Manager GEORGE HIGGINS Year Vice President and Sally Manager EWSWEEKLY Ir and for tels s )F RADIO AND TV KMBC -TV, the BIG TOP TV JIj,i, Station in the Heart of America sú,\.rw. -

PPL Susquehanna, LLC Nuclear Power Plant, in Accordance with the Pennsylvania Emergency Management Services Code, 35 Pa

BUTLER TOWNSHIP/CONYNGHAM BOROUGH LUZERNE COUNTY RADIOLOGICAL EMERGENCY RESPONSE PLAN (Nuclear Power Plant Incidents) March 1996 Updated 2008 ButlerTownship/Conyngham Borough -LuzerneCounty RadiologicalEmergency Response Plan RESOLUTION PROMULGATION THIS PLAN SUPERSEDES PREVIOUS BUTLER TOWNSHIP PLANS DEVELOPED FOR RESPONSE TO A ~1AJOR EMERGENCY OR DISASTER, THIS PLAN WAS ADOPTED BY THE BOARD OF SUPERVISORS UNDER RESOLUTION NO. 1-493DATED JANUARY 4, 1993. BOARD OF SUPERVISORS BUTLER TOWNSHIP. BUTLER TOWNSHIP This plan was preparedby the ButlerTownshipEmergencyManagement agency in cooperationwith the Luzerne CountyEmergencyManagement Agency and thePennsylvaniaEmergencyManagementAgency. 2008 - i - Butler Township/Conyngham Borough - Luzerne County Radiological Emergency Response Plan RECORD OF UPDATE/CHANGE (Update Annually - Telephone Numbers Quarterly) CHANGE DATE OF DATE NUMBER CHANGE ENTERED CHANGE MADE 2008 - ii - Butler Township/Conyngham Borough - Luzerne County Radiological Emergency Response Plan TABLE OF CONTENTS Page Resolution ................................................................................................ i Record of Changes ................................................................................................ ii Table of Contents ................................................................................................ iii Preface ................................................................................................ iv I. Purpose ............................................................................................... -

Who Pays Soundexchange: Q1 - Q3 2017

Payments received through 09/30/2017 Who Pays SoundExchange: Q1 - Q3 2017 Entity Name License Type ACTIVAIRE.COM BES AMBIANCERADIO.COM BES AURA MULTIMEDIA CORPORATION BES CLOUDCOVERMUSIC.COM BES COROHEALTH.COM BES CUSTOMCHANNELS.NET (BES) BES DMX MUSIC BES ELEVATEDMUSICSERVICES.COM BES GRAYV.COM BES INSTOREAUDIONETWORK.COM BES IT'S NEVER 2 LATE BES JUKEBOXY BES MANAGEDMEDIA.COM BES MEDIATRENDS.BIZ BES MIXHITS.COM BES MTI Digital Inc - MTIDIGITAL.BIZ BES MUSIC CHOICE BES MUSIC MAESTRO BES MUZAK.COM BES PRIVATE LABEL RADIO BES RFC MEDIA - BES BES RISE RADIO BES ROCKBOT, INC. BES SIRIUS XM RADIO, INC BES SOUND-MACHINE.COM BES STARTLE INTERNATIONAL INC. BES Stingray Business BES Stingray Music USA BES STORESTREAMS.COM BES STUDIOSTREAM.COM BES TARGET MEDIA CENTRAL INC BES Thales InFlyt Experience BES UMIXMEDIA.COM BES SIRIUS XM RADIO, INC CABSAT Stingray Music USA CABSAT MUSIC CHOICE PES MUZAK.COM PES SIRIUS XM RADIO, INC SDARS 181.FM Webcasting 3ABNRADIO (Christian Music) Webcasting 3ABNRADIO (Religious) Webcasting 8TRACKS.COM Webcasting 903 NETWORK RADIO Webcasting A-1 COMMUNICATIONS Webcasting ABERCROMBIE.COM Webcasting ABUNDANT RADIO Webcasting ACAVILLE.COM Webcasting *SoundExchange accepts and distributes payments without confirming eligibility or compliance under Sections 112 or 114 of the Copyright Act, and it does not waive the rights of artists or copyright owners that receive such payments. Payments received through 09/30/2017 ACCURADIO.COM Webcasting ACRN.COM Webcasting AD ASTRA RADIO Webcasting ADAMS RADIO GROUP Webcasting ADDICTEDTORADIO.COM Webcasting ADORATION Webcasting AGM BAKERSFIELD Webcasting AGM CALIFORNIA - SAN LUIS OBISPO Webcasting AGM NEVADA, LLC Webcasting AGM SANTA MARIA, L.P. -

Emergency Response Plan

EMERGENCY RESPONSE PLAN March 2009 (2018 Revision pending review and approval) ROANE STATE COMMUNITY COLLEGE EMERGENCY RESPONSE PLAN GUIDELINE INDEX Section Page I. Purpose ……………………………………………………………………….. 3 II. Emergency Defined A. Minor Emergency ………………………………………………………... 4 B. Major Emergency ………………………………………………………... C. 4 Building Evacuation……………………………………………………… 4 D. Disaster…………………………………………………………………... 4 III. Procedures of Emergency Response Plan 1. Initial Response Plan ……………………………………………………... 5 2. Declaration of Emergency and Activation of Emergency Response Plan... 5 3. Emergency Operations Center …………………………………………… 4. 6 Command Post …………………………………………………………… 6 5. Emergency Management Response Team (EMRT) ……………………... 7 6. Evacuations ………………………………………………………………. 7 7. Shelters …………………………………………………………………… 8 8. News Media ……………………………………………………………… 9. 8 Volunteer Management ………………………………………………….. 9 10. Purchasing Guidelines 9 …………………………………………………… 9 11. Transportation Services 9 ………………………………………………….. 12. Lines of Communication 10 ………………………………………………… 10 13. Documentation of Activities …………………………………………….. 14. Campus Maps and Building Prints ……………………………………… 10 15. Distressed, Disturbed, Disruptive & Dangerous Students: Student Assistance Coordinating Committee (Threat Assessment Team)……….. 10 16. Distressed, Disturbed, Disruptive & Dangerous Students: Faculty & Staff 11 Training …………………………………………………………………. 11 17. Maintenance of Emergency Response Plan …………………………….. 18. Emergency Response Plan Training ……………………………………. Page 1 APPENDICES Page A EMRT Administrators -

Minnesota Emergency Alert System Statewide Plan 2016

Minnesota Emergency Alert System Statewide Plan 2016 MINNESOTA EAS STATEWIDE PLAN Revision 9 Basic Plan 11/9/2016 I. REASON FOR PLAN The State of Minnesota is subject to major emergencies and disasters, natural, technological and criminal, which can pose a significant threat to the health and safety of the public. The ability to provide citizens with timely emergency information is a priority of emergency managers statewide. The Emergency Alert System (EAS) was developed by the Federal Communications Commission (FCC) to provide emergency information to the public via television, radio, cable systems and wire line providers. The Integrated Public Alert and Warning System, (IPAWS) was created by FEMA to aid in the distribution of emergency messaging to the public via the internet and mobile devices. It is intended that the EAS combined with IPAWS be capable of alerting the general public reliably and effectively. This plan was written to explain who can originate EAS alerts and how and under what circumstances these alerts are distributed via the EAS and IPAWS. II. PURPOSE AND OBJECTIVES OF PLAN A. Purpose When emergencies and disasters occur, rapid and effective dissemination of essential information can significantly help to reduce loss of life and property. The EAS and IPAWS were designed to provide this type of information. However; these systems will only work through a coordinated effort. The purpose of this plan is to establish a standardized, integrated EAS & IPAWS communications protocol capable of facilitating the rapid dissemination of emergency information to the public. B. Objectives 1. Describe the EAS administrative structure within Minnesota. (See Section V) 2.