Presentasi Perusahaan 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

BAB 2 LANDASAN TEORI 2.1 Tinjauan Data 2.1.1 Pengertian Teh

BAB 2 LANDASAN TEORI 2.1 Tinjauan Data 2.1.1 Pengertian Teh Teh adalah minuman yang mengandung kafein, sebuah minuman yang dibuat dengan cara menyeduh daun, pucuk daun, atau tangkai daun yang di keringkan dari tanaman Camellia sinensis dengan air panas. Teh merupakan minuman yang sudah dikenal dengan luas di Indonesia maupun di dunia. Minuman teh ini umum menjadi minuman sehari-hari. Karena aromanya yang harum serta rasanya yang khas membuat minuman ini banyak dikonsumsi. Namun banyak masyarakat yang kurang mengetahui tentang kelebihan dari minuman tersebut. Manfaat teh antara lain adalah sebagai antioksidan bagi tubuh manusia, dapat memperbaiki sel- sel yang rusak, menghaluskan kulit, melarutkan lemak, mencegah kanker, mencegah penyakit jantung, mengurangi kolesterol dalam darah, dan menghilangkan kantuk. Teh melati merupakan jenis teh yang paling populer di Indonesia. Konsumsi teh di Indonesia sebesar 0,8 kilogram per kapita per tahun masih jauh di bawah negara-negara lain di dunia, walaupun Indonesia merupakan negara penghasil teh terbesar nomor lima di dunia. 2.1.2 Sejarah Teh di Indonesia Tanaman penghasil teh ( Camellia sinensis ) pertama kali masuk ke Indonesia tahun 1684, berupa biji teh dari Jepang yang di bawa oleh seorang berkebangsaan Jerman bernama Andreas Cleyer, dan ditanam sebagai hiasan di Batavia. F. Valentijn, seorang rahib, juga melaporkan tahun 1694, bahwa ia melihat tanaman teh sinensis di halaman rumah gubernur jendral VOC Camphuys, di Batavia. Pada abad ke-18 muali berdiri pabrik-pabrik pengolahan (pengemasan) teh dan di dukung VOC. Setelah berakhirnya pemerintahan Inggris di Nusantara, pemerintahan Hindia Belanda mendirikan Kebun Raya Bogor sebagai kebun botani (1817). Pada tahun 1826 tanaman teh melengkapi koleksi Kebun Raya, diikuti pada tahun 1827 di Kebun 3 4 Percobaan Cisurupan, Garut, Jawa Barat. -

Empire of Tea

Empire of Tea Empire of Tea The Asian Leaf that Conquered the Wor ld Markman Ellis, Richard Coulton, Matthew Mauger reaktion books For Ceri, Bey, Chelle Published by Reaktion Books Ltd 33 Great Sutton Street London ec1v 0dx, uk www.reaktionbooks.co.uk First published 2015 Copyright © Markman Ellis, Richard Coulton, Matthew Mauger 2015 All rights reserved No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publishers Printed and bound in China by 1010 Printing International Ltd A catalogue record for this book is available from the British Library isbn 978 1 78023 440 3 Contents Introduction 7 one: Early European Encounters with Tea 14 two: Establishing the Taste for Tea in Britain 31 three: The Tea Trade with China 53 four: The Elevation of Tea 73 five: The Natural Philosophy of Tea 93 six: The Market for Tea in Britain 115 seven: The British Way of Tea 139 eight: Smuggling and Taxation 161 nine: The Democratization of Tea Drinking 179 ten: Tea in the Politics of Empire 202 eleven: The National Drink of Victorian Britain 221 twelve: Twentieth-century Tea 247 Epilogue: Global Tea 267 References 277 Bibliography 307 Acknowledgements 315 Photo Acknowledgements 317 Index 319 ‘A Sort of Tea from China’, c. 1700, a material survival of Britain’s encounter with tea in the late seventeenth century. e specimen was acquired by James Cuninghame, a physician and ship’s surgeon who visited Amoy (Xiamen) in 1698–9 and Chusan (Zhoushan) in 1700–1703. -

PROSPECTS Jurnal Humaniora, Sains, Pendidikan Dan Pengajaran Volume 8, Nomor 1, Mei 2018

ISSN : 2302-6278 PROSPECTS Jurnal Humaniora, Sains, Pendidikan dan Pengajaran Volume 8, Nomor 1, Mei 2018 Penasihat Ketua STIBA SATYA WIDYA Penanggung Jawab: Nuria Mufidah, S.S. M.Pd Ketua Penyunting: Muchmmad Fahmi, M.Pd. Penyunting Bahasa Dra. Firda Djuita Penyunting Ahli Drs. H.Hardono, MPd Prof. Dr. D. Wagiman A., M.A. Dr. H. Sueb Hadi Saputro, M.Pd. Dr. H. Idris As, M.Pd. Sekretaris Seto Ariwibowo,S.Pd, M.Pd. Dicetak Oleh Perwira Media Nusantara (PMN) Jl. Griya Kebraon Tengah XVII Blok FI – 10 Surabaya Telp. 0317672603. Email : [email protected] Sekretariat STIBA “SATYA WIDYA” Jln. Bendul Merisi Utara VIII No.23 Tlp. 031 8494369 Fax. 0318416870 Surabaya Website : stiba-satyawidya.ac.id E-mail : info @ stiba-satyawidya.ac.id E-mail : [email protected] PROSPECTS, Jurnal Humaniora, Sains, Pendidikan dan Pengajaran diterbitkan oleh STIBA “SATYA WIDYA” Surabaya. Jurnal ini sebagai media informasi dan media penuangan ide-ide kritis dan hasil-hasil penelitian yang berkaitan dengan humaniora, sains, pendidikan dan pengajaran. Jurnal ini terbit 2 kali setahun, pada bulan Mei dan November. Jurnal ini pertama kali terbit pada bulan November 2012. Volume 8 , Nomor 1, Mei 2018 ISSN : 2302-6278 Untuk Berlangganan Hubungi Redaksi Jurnal PROSPECTS SekretariatSTIBA”SATYA WIDYA” Jln. BendulMerisiUtara VIII No.23 Tlp. 031 8494369 Fax. 0318416870 Surabaya Website : stiba-satyawidya.ac.id E-mail : info @ stiba-satyawidya.ac.id E-mail : [email protected] ISSN : 2302-6278 PROSPECTS Jurnal Humaniora, Sains, Pendidikan dan Pengajaran Volume 8, Nomor 1, Mei 2018 DAFTAR ISI Chyntia Heru Woro Prastiwi1 ; Yuniarta Ita Purnama2 BIPA TEXTBOOK: A CULTURAL CONTENT ANALYSIS OF BASIC INDONESIAN (AN INTRODUCTORY COURSE BOOK) 1 – 9 Indra Iis Wahyuni1; Chatarini, S. -

Research on Supply Chain in the Tea Sector in Indonesia

FINAL REPORT RESEARCH ON SUPPLY CHAIN IN THE TEA SECTOR IN INDONESIA By: Veronika Ratri Kustanti Theresia Widiyanti To: SOMO The Business Watch Indonesia 2007 1 INTRODUCTION Background Tea is an important commodity with many benefits to human life. Drinking tea has become a culture in countries like Japan, Britain, and China and the catechin it contains is a cure to a number of illnesses. As a commodity, tea sustains lives of growers, pickers, factory workers as well as brings in foreign exchange to tea producing countries. Global tea consumption and production keep growing. Production increased from 3,152,987 in 2003 to 3,233,216 tons in 2004, while consumption from 1,344,200 in 2003 to 1,414,400 tons in 2004 1. In terms of trade, global tea export increased from 1,397,389 tons in 2003 to 1,522,290 tons in 2004. Indonesia is tea fifth largest tea producer in tea world, after India, China, Sri Lanka and Kenya, with 65% of tea product for towards export. The large export volume, however, has little impact on welfare of tea plantation workers and smallholders. The majority of growers are oriented more to domestic market of green and jasmine tea, while export is dominated by large plantation, both state and private. Many researches come to the conclusion that growers are put under the pressure to sell fresh leaf to collectors and processing factories for low prices which can not cover the production cost before tea leaves wither and the quality drops. 2 Although the Indonesia tea sales orient to export, the price of tea leaves at smallholder level is same as its domestic sales (IDR 600 – 800 per Kg in October 2006 and has increased from IDR 1000 to 1100 between November 2006 and May 2007 3). -

The World Health Organization Is Taking Cash Handouts from Junk Food Giants by Vigilant Citizen October 23, 2012

The World Health Organization is Taking Cash Handouts from Junk Food Giants By Vigilant Citizen October 23, 2012 The World Health Organization (WHO) is the United Nationʼs “public health” arm and has 194 member states. While its official mission is “the attainment by all people of the highest possible level of health“, it is also clear that it works according to a specific agenda, one that laid out by the world elite and the organizations that are part of it. In the article entitled ‘Contagionʼ or How Disaster Movies “Educate” the Masses, weʼve seen how the WHO was involved in the promotion of mass vaccination campaigns following (bogus) disease scares, of civilian camps, of the bar-coding of individuals and so forth. More proof of the WHOʼs “elite bias” has been recently uncovered by a study: The organization has been taking hundreds of thousands of dollars from the worldʼs biggest pushers of unhealthy foods such as Coca-Cola, Nestlé and Unilever. It is relying on these companies for advice on how to fight obesity..é which is the equivalent of asking a drug dealer for advice on how stay off drugs and NOT buy his product. Coca-Cola, Nestlé and Unilever are not simply “food companies, they are gigantic conglomerates that produce and distribute an enormous proportion of processed foods across the world. In the article entitled Irrational Consumerism (or The Few Companies Who Feed the World), I described how only a few mega-conglomerates own most of the worldʼs brands of processed foods. To refresh your memory here are some of the brands -

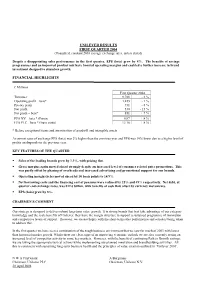

UNILEVER RESULTS FIRST QUARTER 2004 (Unaudited, Constant 2003 Average Exchange Rates, Unless Stated)

UNILEVER RESULTS FIRST QUARTER 2004 (Unaudited, constant 2003 average exchange rates, unless stated) Despite a disappointing sales performance in the first quarter, EPS (beia) grew by 8%. The benefits of savings programmes and an improved product mix have boosted operating margins and enabled a further increase in brand investment designed to stimulate growth. FINANCIAL HIGHLIGHTS € Millions First Quarter 2004 Turnover 9,788 - 2 % Operating profit – beia* 1,455 - 1 % Pre-tax profit 931 - 8 % Net profit 530 - 15 % Net profit – beia* 851 + 7 % EPS NV – beia * (Euros) 0.87 + 8 % EPS PLC – beia * (Euro cents) 13.10 + 8 % * Before exceptional items and amortisation of goodwill and intangible assets At current rates of exchange EPS (beia) was 2% higher than the previous year and EPS was 19% lower due to a higher level of profits on disposals in the previous year. KEY FEATURES OF THE QUARTER § Sales of the leading brands grew by 1.3%, with pricing flat. § Gross margins again moved ahead strongly despite an increased level of consumer related price promotions. This was partly offset by phasing of overheads and increased advertising and promotional support for our brands. § Operating margin (beia) moved ahead by 30 basis points to 14.9%. § Net borrowing costs and the financing cost of pensions were reduced by 22% and 49% respectively. Net debt, at quarter end exchange rates, was €12.6 billion, with benefits of cash flow offset by currency movements. § EPS (beia) grew by 8%. CHAIRMEN’S COMMENT Our strategy is designed to deliver robust long-term value growth. It is strong brands that best take advantage of our category knowledge and the scale benefits of Unilever; they have the margin structure to support a sustained programme of innovation and competitive levels of support. -

A Case Study of Unilever in Indonesia

Exploring the Links Between International Business and Poverty Reduction: A Case Study of Unilever in Indonesia Principal Author: Jason Clay Principal Author: Jason Cla An Oxfam GB, Novib, Unilever, and Unilever Indonesia joint research project First published by Oxfam GB, Novib Oxfam Netherlands, and Unilever in 2005 © Oxfam GB, Novib Oxfam Netherlands, and Unilever 2005 ISBN 0 85598 566 6 All rights reserved. This publication is copyright, but may be reproduced by any method without fee for advocacy or teaching purposes, but not for resale. The copyright holders request that all such use be registered with them for impact assessment purposes. For copying in any other circumstances, or for re-use in other publications, or for translation or adaptation, prior written permission must be obtained from the publishers, and a fee may be payable. Printed by Information Press, Eynsham, UK Original language: English A catalogue record for this publication is available from the British Library. Copies of this report and more information are available from: Oxfam GB, Oxfam House, John Smith Drive, Cowley, Oxford, OX4 2JY,UK Email: [email protected] Oxfam GB is registered as a charity (no. 202918) and is a member of Oxfam International. Novib, Mauritskade 9, Postbus 30919, 2500 GX Den Haag, The Netherlands, +31()703421991 Unilever PLC, PO Box 68, Unilever House, Blackfriars, London EC4P 4BQ, UK Tel +44 (0)20 7822 5252 Fax +44 (0)20 7822 5951 Acknowledgements This report is based on research commissioned by Oxfam GB and Unilever Indonesia and carried out in Indonesia by T.Hani Handoko, A. Prasetyantoko, B.M. -

Men's Toiletries – AXE Deodorant

Magnum Opus Men’s toiletries – AXE deodorant Submitted To: Prof. Sriram Rajan Submitted By: Souvik Hazra 08BS0003343 Section- ‘E’ Souvik Hazra 08BS0003343 Content 1. Prologue a. What is Magnum Opus b. Executive Summary c. Learning from Magnum Opus 2. Introduction & Background of Hindustan Unilever Limited a. Industry wise b. Sector wise 3. Background of Hindustan Unilever Limited 4. Environmental Factors influencing & affecting the sector and HUL 5. Demand & Supply equation and situation a. Present condition b. Future situation 6. Buyer’s Behaviour a. Psychology of buyer b. Factors influencing buying behaviour Souvik Hazra 08BS0003343 7. Segmenting, Targeting, Positioning a. Analysis of present STP b. Future changes 8. Product Portfolio of HUL a. Analysis of present product portfolio b. Future probable product line extension 9. Analysis of Advertising, Sales promotion & Communication Strategies 10. Distribution, Dealership channels of HUL 11. International Marketing Strategy 12. Future of the sector and HUL 13. Conclusion 14. Bibliography & Reference Souvik Hazra 08BS0003343 Acknowledgement I would like to take this opportunity to thank Prof. Sriram Rajan whose able guidance has enabled me to complete this case study successfully. There has definitely been some value addition to each of us in doing Magnum Opus. I would also like to acknowledge to everyone who have extended their valuable time, knowledge and helped me directly or indirectly to complete this project. This project has definitely opened all of us towards the new vistas of analyzing a product, a company and an industry. I once again thank Prof. Sriram Rajan for providing the magnificent opportunity for doing this Magnum Opus. Souvik Hazra 08BS0003343 Magnum Opus Magnum opus, from the Latin meaning great work, refers to the largest, and perhaps the best, greatest, most popular, or most renowned achievement of an author, artist, or composer. -

Presentasi Hemant Bakshi 2015

PUBLIC EXPOSE June 8th, 2015 TOGETHER FOR A BRIGTHER FUTURE Hemant Bakshi President Director & Sancoyo Antarikso VP Governance and Corporate Affairs AGENDA 1 Result of AGMS & EGMS 2015 2 Unilever Indonesia Performance 3 USLP 4th Year Update 4 Winning in Difficult Times RESULT OF ANNUAL GENERAL MEETING OF SHAREHOLDERS 1. First Agenda a. Ratification of Financial Statement and Annual Report of the Company for accounting year ended 31 December 2014. b. To give full acquittal and discharge for BoD and BoC for their action on accounting year ended 31 December 2014 c. Determination of the appropriation of the profit of the Company. - Interim dividend Rp336,- per share (paid in 12/12/2014) - Final Dividend Rp416,- per share (to be paid before 7/7/2015) 2. Second Agenda Approval on the designation of Public Accountants for the accounting year ending 31 December 2015; 3. Third Agenda a. Re-appointments and/or appointments of members of the Board of Commissioners of the Company. b. Determination of remuneration of the members of the Board of Directors and the Board of Commissioners of the Company for the accounting year ending on 31 December 2015. RESULT OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS 1. First Agenda Approval of the proposed amendments to the Articles of Associations of the Company for the purpose of compliance with the Financial Service Authority Regulation No. 32/POJK.04/2014 on the Plan and Implementation of General Meeting of Shareholders of Public Companies. 2. Second Agenda Approval on the plan for the transfer of the Company’s Defined Contribution Pension Fund Program to Financial Institution Pension Fund. -

Pengembangan Sistem Informasi Persediaan Barang Di Toko Dua Putra

1. Information Engineering PENGEMBANGAN SISTEM INFORMASI PERSEDIAAN BARANG DI TOKO DUA PUTRA TUGAS AKHIR Diajukan untuk memenuhi sebagian persyaratan Mencapai derajat Sarjana Teknik Industri FRANSISKUS RIVAN RINALDI 15 06 08300 PROGRAM STUDI TEKNIK INDUSTRI FAKULTAS TEKNOLOGI INDUSTRI UNIVERSITAS ATMA JAYA YOGYAKARTA YOGYAKARTA 2020 PERNYATAAN ORIGINALITAS Saya yang bertanda tangan di bawah ini: Nama : Fransiskus Rivan Rinaldi NPM : 150608300 Dengan ini menyatakan bahwa tugas akhir saya dengan judul “Pengembangan Sistem Informasi Persediaan Barang di Toko Dua Putra” merupakan hasil penelitian saya pada Tahun Akademik 2019/2020 yang bersifat original dan tidak mengandung plagiasi dari karya manapun. Bilamana di kemudian hari ditemukan ketidak sesuaian dengan pernyataan ini, maka saya bersedia dituntut dan diproses sesuai dengan ketentuan yang berlaku termasuk untuk dicabut gelar Sarjana yang telah diberikan Universitas Atma Jaya Yogyakarta kepada saya. Demikian pernyataan ini dibuat dengan sesungguhnya dan dengan sebenar-benarnya. Yogyakarta, 9 Desember 2019 Yang menyatakan, Fransiskus Rivan Rinaldi iii KATA PENGANTAR Puji syukur kepada Tuhan Yang Maha Esa karena kasih dan karunia-Nya, Laporan Tugas Akhir yang berjudul “Pengembangan Sistem Informasi Persediaan Barang di Toko Dua Putra” dapat diselesaikan dengan baik. Laporan Tugas Akhir ini disusun untuk memenuhi syarat dalam memperoleh derajat S1/Sarjana di Program Teknik Industri, Fakultas Teknologi Industri, Universitas Atma Jaya Yogyakarta. Laporan Tugas Akhir ini juga dapat diselesaikan berkat bimbingan, arahan, serta dukungan dari berbagai pihak. Penulis mengucapkan terima kasih sebesar-besarnya kepada: 1. Tuhan Yang Maha Esa yang telah memberikan karunia-Nya sebagai kekuatan bagi penulis. 2. Bapak Dr. A. Teguh Siswantoro, M.Sc. selaku Dekan Fakultas Teknologi Industri Universitas Atma Jaya. 3. Bapak Anugrah Kusumo P., S.T., M.T. -

New Ways of Accountancy

Munich Personal RePEc Archive New ways of accountancy PAUNIĆ, ALIDA University of Madison, Gulfport, Doctoral work 1 March 2006 Online at https://mpra.ub.uni-muenchen.de/1727/ MPRA Paper No. 1727, posted 16 Mar 2007 UTC ✁✄✂✆☎✆✝ ✞✠✟☛✡✌☞✎✍✑✏✓✒✔☎✠✕✔✖✘✗✙☞✔✡✛✚✌✞✢✜✢✍✣✞✠✟✆✝ ✤✥☞ ✦✙☞✘✧★✧✩✕✥✪✠✏✫✝ ☎✬✕✭✞✓✞✮✒✔✂✆☎✓✯✑✕✔☎✥✞✰✪ ✜✢✖ ✝ ✱✆✕✲✡✳✕✔✂✆☎✆✝ ✴ ✵✶☎✆✝ ✤✥☞✎✍✷✏✥✝ ✯✸✪✬✒✠✹✳✁✺✕✆✱✔✝ ✏✓✒✔☎✎✻✠✼✽✂✆✖ ✹✿✾✠✒✔✍✑✯ ✁✺✕✔✍✣✞✠✟✭✻✘❀✭❁✆❁✆❂ ❃ ☎✆✖ ✝ ☎✥☞✄✕❄✯❅✟✘✯✸✯❆✾✎❇ ❈❉❈❋❊●✾✆✍✷✕❅❍■✂✆❏✭❍■✂✆☎✆✝ ❑▲❊●✂✥☞✎☎✠✞✠✟✥☞✎☎✎❍ ✱✭☞ ❃ ✁●✡✛✗▼✜◆✡✳✕✔✾✥☞✎✍❖✦ ❍✸❍ ✾✠✒✆✏✯✷☞❄✱◗✁✺✕✔✍✣✞✘✟✬❀✭❁✆❁✆❂ ✁✄✂✆☎✆✝ ✞✠✟☛✡✌☞✎✍✑✏✓✒✔☎✠✕✔✖✘✗✙☞✔✡✛✚✌✞✢✜✢✍✣✞✠✟✆✝ ✤✥☞ ✦✙☞✘✧★✧✩✕✥✪✠✏✫✝ ☎✬✕✭✞✓✞✮✒✔✂✆☎✓✯✑✕✔☎✥✞✰✪ ✜✢✖ ✝ ✱✆✕✲✡✳✕✔✂✆☎✆✝ ✞ ✵✶☎✆✝ ✤✥☞✎✍✷✏✥✝ ✯✸✪✬✒✠✹✳✁✺✕✆✱✔✝ ✏✓✒✔☎✎✻✠✼✽✂✆✖ ✹✿✾✠✒✔✍✑✯ ✜✢❏✠✏✮✯❆✍✷✕✭✞❘✯ ❙❯❚✎❱✬❲✳❳❩❨❄❬✆❭ ❱✥❪●❫✲❴ ❚✆❵❅❴✎❵✆❳❛❱❜❫✘❱✆❱✥❝ ❞✓❡❢❬❘❣❤❲✳❵✮❲▼❱✥❳✐❝ ❫❋❴ ❨❖❱❥✆❵✆❪●❝ ❞✎❱❦❴ ❨♠❧✳❚✆❵❅❴❅❱❥❅❴■❱✥❞❅❴✎❵✎♥✓♥❨✔♦✘❞❅❴ ❝ ❞✓❡❢❳❛❱❘❲✌❨❄❳♣❴ ❫❤♥❵✆❞ ❲✳❳❩❨✛♣❝ ✆❱❖♦✘❫❧✳❝■❴ ❚❦❴ ❚✎❱❖❴ ❳♣♦✥❱✽❲✳❝ ♥✠❴❉♦✘❳❛❱❜❨✆✉♥✮❨✥❪✈❲✳❵✆❞❘❣☛❲▼❱✥❳❩✸❨✥❳✿❪●❵✆❞✎♥✓❱☛❵✆❞✎✲■❝ ❞✎✥❫✇❴ ❚✎❱①❧✉❵❘❣❦❚✭❨▼❧②❴ ❨❜❬❄❳❩❨❄❵✎✆❱✥❞ ❵✎♥✓♥✮❨✔♦✘❞❅❴ ❝ ❞✓❡③❳❛❱❘❲✌❨✥❳♣❴ ❫④❝ ❞⑤❨❄❳❛✆❱✥❳⑥❴ ❨⑦❝ ❞✎♥✮❨❄❳✸❲✌❨✥❳✿❵❅❴■❱⑦❨✎❴ ❚✎❱✥❳⑧❳❛❱✥❭ ❱⑨♣❵✆❞❅❴★❝ ❞✎✸❨✥❳❆❪●❵❅❴ ❝ ❨❄❞❶⑩✷❷✢❱✌❧✳❫❸❝ ❞❹❙✳❺❼❻ ❞✎❱✌❧✳❫❯❲✳❵✮❲▼❱✥❳✿❫❻❽❱✆✎♦✥♥❵✔❴ ❝ ❨❄❞✥❻✙❪☛❨❄❳✿❵✆❭✉❫❄❴ ❵✆❞✎✥❵✆❳❛✥❫❘❻▼❡✳❨❄❵✆❭✉❵✎♥❚✆❝ ❱⑨❾❱✥❪❤❱✥❞❅❴ ❫❘❻✌❲✌❨❄❫✓❝■❴ ❝ ❨❄❞①❨✥❞②❴ ❚✎❱❪●❵❄❳✿❿✠❱✎❴ ❻➀❵❢❭ ❝ ✸❱ ♥➁❣✉♥❭ ❱●❲▼❱✥❳✿❝ ❨✭✘❻➀♥✮❨❄❪✈❲✛♦❄❴■❱✥❳✶❭ ❝ ❴■❱✥❳✿❵✎♥➁❣✆❻➀✷♦❄❴❉♦✘❳❛❱❖❝ ❞✐❾❱✥❫✥❴ ❪❤❱✥❞✔❴✥❲✳❭ ❵✆❞✆❫❜❵✆❞✎●❲✌❨❄❫✓❫✓❝ ❬✆❭ ❱❖❪❤❱✥❳❉❡✌❱✥❳✿❫❻✐❵❢➂✎♦✥❱✥❫✥❴ ❝ ❨❄❞✆❫❻ ❧✌❨❄❪❤❱✥❞✲❲✌❨❄❫✓❝■❴ ❝ ❨❄❞➃❱✎❴■♥✓➄ ➅❘➄✛➆✷❴✳❝ ❫❋❵②❴ ❵✆❫✓❿❖❨✭➀❴ ❚✆❝ ❫②❧✌❨❄❳✿❿➇❴ ❨❢❱❥✆❵✆❪●❝ ❞✎❱❝ ❫❋❫❄♦✥♥❚❢❵✆❞❢❵✎♥✓♥✮❨✔♦✘❞❅❴ -

Unilever Overview of Controversial Business Practices in 2007

Unilever Overview of controversial business practices in 2007 Sanne van der Wal and Roos van Os Amsterdam, May 2008 Introduction This company report has been prepared by SOMO (Centre for Research on Multinational Corporations). It provides an overview of business practices that could be regarded as unsustainable or irresponsible which occurred (or might have been addressed) in 2007. In addition, it describes developments on some of the issues identified in a similar overview for 2006. The overview below describes only controversial practices and not the positive achievements of a company in the same year, except for positive developments related to some of the practices from last year’s overview. Information on positive achievements can usually be found in a company’s annual and/or sustainability report and on the company’s website. The purpose of this report is to provide additional information to shareholders and other stakeholders of a company on controversies that might or might not be detected and reported by the company itself. This report does not contain an analysis of a company’s corporate responsibility policies, operational aspects of corporate responsibility management, implementation systems, reporting and transparency, or total performance on any issue. For some controversies, it is indicated which standards or policies may have been violated and a brief analysis is presented. Apart from this, the report is mainly descriptive. The range of sustainability and corporate responsibility issues eligible for inclusion in this overview is relatively broad and mainly based on the OECD Guidelines for Multinational Enterprises. These Guidelines are used as a general frame of reference in addition to the company-specific standards.