THQ Nordic Acquires Award-Winning Warhorse Studios, the Studio Behind Kingdom Come: Deliverance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Redeye-Gaming-Guide-2020.Pdf

REDEYE GAMING GUIDE 2020 GAMING GUIDE 2020 Senior REDEYE Redeye is the next generation equity research and investment banking company, specialized in life science and technology. We are the leading providers of corporate broking and corporate finance in these sectors. Our clients are innovative growth companies in the nordics and we use a unique rating model built on a value based investment philosophy. Redeye was founded 1999 in Stockholm and is regulated by the swedish financial authority (finansinspektionen). THE GAMING TEAM Johan Ekström Tomas Otterbeck Kristoffer Lindström Jonas Amnesten Head of Digital Senior Analyst Senior Analyst Analyst Entertainment Johan has a MSc in finance Tomas Otterbeck gained a Kristoffer Lindström has both Jonas Amnesten is an equity from Stockholm School of Master’s degree in Business a BSc and an MSc in Finance. analyst within Redeye’s tech- Economic and has studied and Economics at Stockholm He has previously worked as a nology team, with focus on e-commerce and marketing University. He also studied financial advisor, stockbroker the online gambling industry. at MBA Haas School of Busi- Computing and Systems and equity analyst at Swed- He holds a Master’s degree ness, University of California, Science at the KTH Royal bank. Kristoffer started to in Finance from Stockholm Berkeley. Johan has worked Institute of Technology. work for Redeye in early 2014, University, School of Business. as analyst and portfolio Tomas was previously respon- and today works as an equity He has more than 6 years’ manager at Swedbank Robur, sible for Redeye’s website for analyst covering companies experience from the online equity PM at Alfa Bank and six years, during which time in the tech sector with a focus gambling industry, working Gazprombank in Moscow he developed its blog and on the Gaming and Gambling in both Sweden and Malta as and as hedge fund PM at community and was editor industry. -

25 Jahre Koch Media – Ein Jubiläum (PDF Download)

25 JAHRE KOCH MEDIA - EIN JUBILÄUM Während Unternehmen in manch anderen Branchen mit 25 Und so ist die Entwicklung von Koch Media in den vergange- Jahren noch zu den Newcomern zählen würden, ist diese nen 25 Jahren auch ein Mutmacher: Sie zeigt, dass man mit Zeitspanne in der Entertainment-Branche kaum zu überbli- der Entwicklung und dem Vertrieb von Games auch in und cken. Zu schnell kommen und gehen Trends und mit ihnen aus Deutschland heraus enorm erfolgreich sein kann. häufig auch ganze Unternehmen. Das gilt ganz besonders für die Games-Branche, die zwar seit vielen Jahren stark Koch Media hat sich in den vergangenen 25 Jahren zu einem wächst, deren dynamische Entwicklung aber selbst Bran- integralen Bestandteil der deutschen Games-Branche ent- chen-Urgesteine von Zeit zu Zeit überfordert. Das 25-jähri- wickelt. Als Gründungsmitglied des BIU – Bundesverband ge Jubiläum von Koch Media ist daher ein Meilenstein, der Interaktive Unterhaltungssoftware und mit Dr. Klemens Kun- gar nicht hoch genug geschätzt werden kann. dratitz als aktivem Vorstand des Verbandes hat sich Koch Media immer für die Themen der Branche und die Weiter- Die Erfolgsgeschichte von Koch Media ist auch mit dem entwicklung der gamescom engagiert. Seit vielen Jahren ist Blick auf ihren Entstehungsort einmalig. Die Geschichte der Koch Media Partner von Spiele-Entwicklern in Deutschland deutschen Games-Branche ist sehr wechselhaft, nur wenige wie aktuell von King Art oder hat eigene Studios wie Deep Unternehmen schaffen es über viele Jahre, hier Games zu Silver Fishlabs. Doch darf man das Unternehmen nicht nur entwickeln und zu verlegen. Das Image von Games hat sich auf seine Rolle in Deutschland beschränken: Mit Niederlas- erst in den vergangenen Jahren verbessert und war zuvor sungen in allen europäischen Kernmärkten, in Nordamerika allzu lange von Klischees bestimmt. -

OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION

THQ NORDIC AB (PUBL) REG NO.: 556582-6558 EXTENDED FINANCIAL YEAR REPORT • 1 JAN 2018 – 31 MAR 2019 OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION JANUARY–MARCH 2019 JANUARY 2018–MARCH 2019, 15 MONTHS (Compared to January–March 2018) (Compared to full year 2017) > Net sales increased 158% to SEK 1,630.5 m > Net sales increased to SEK 5,754.1 m (507.5). (632.9). > EBITDA increased to SEK 1,592.6 m (272.6), > EBITDA increased 174% to SEK 618.6 m (225.9), corresponding to an EBITDA margin of 28%. corresponding to an EBITDA margin of 38%. > Operational EBIT increased to SEK 897.1 m > Operational EBIT increased 217% to SEK 395.9 m (202.3) corresponding to an Operational EBIT (124.9) corresponding to an Operational EBIT margin of 16%. margin of 24%. > Cash flow from operating activities amounted > Cash flow from operating activities amounted to SEK 1,356.4 m (179.1). to SEK 777.2 m (699.8). > Earnings per share was SEK 4.68 (1.88). > Earnings per share was SEK 1.10 (1.02). > As of 31 March 2019, cash and cash equivalents were SEK 2,929.1 m. Available cash including credit facilities was SEK 4,521.1 m. KEY PERFORMANCE INDICATORS, Jan-Mar Jan-Mar Jan 2018- Jan-Dec GROUP 2019 2018 Mar 2019 2017 Net sales, SEK m 1,630.5 632.9 5,754.1 507.5 EBITDA, SEK m 618.6 225.9 1,592.6 272.6 Operational EBIT, SEK m 395.9 124.9 897.1 202.3 EBIT, SEK m 172.0 107.3 574.6 188.2 Profit after tax , SEK m 103.0 81.1 396.8 139.2 Cash flow from operating activities, SEK m 777.2 699.8 1,356.4 179.1 Sales growth, % 158 673 1,034 68 EBITDA margin, % 38 36 28 54 Operational EBIT margin, % 24 20 16 40 Throughout this report, the extended financial year 1 January 2018 – 31 March 2019 is compared with the financial year 1 January – 31 December 2017. -

Interim Report • 1 January – 30 September 2018

THQ NORDIC AB (PUBL) REG NO.: 556582-6558 INTERIM REPORT • 1 JANUARY – 30 SEPTEMBER 2018 EBIT INCREASED 278% TO SEK 90.8 MILLION We had another stable quarter with continued momentum. The strategy of diversification is paying off. Net sales increased by 1,403% to a record SEK 1,272.7 million in the quarter. EBITDA increased by 521% to SEK 214.8 million and EBIT increased by 278% to SEK 90.8 million compared to the same period last year. The gross margin percentage decreased due to a large share of net sales with lower margin within Partner Publishing. Cash flow from operating activities in the quarter was SEK –740.1 million, mainly due to the decision to replace forfaiting of receivables with bank debt within Koch Media. Both THQ Nordic and Koch Media contributed to the group’s EBIT during the quarter. Net sales in the THQ Nordic business area were up 47% to SEK 124.2 million. This was driven by the release of Titan Quest, Red Faction Guerilla Re-Mars-tered and This is the Police 2, in addition to continued performance of Wreckfest. Net sales of Deep Silver were SEK 251.8 million, driven by the release of Dakar 18 and a good performance of Pathfinder Kingmaker at the end of the quarter. The digital net sales of the back-catalogue in both business areas continued to have solid performances. Our Partner Publishing business area had a strong quarter driven by significant releases from our business partners Codemasters, SquareEnix and Sega. During the quarter, we acquired several strong IPs such as Alone in the Dark, Kingdoms of Amalur and Time- splitters. -

THQ Nordic (THQNO.ST)

COMPANY ANALYSIS 1 March 2018 Summary THQ Nordic (THQNO.ST) List: Power-up! Market Cap: 11,190 MSEK The company had an immense release schedule with loads of Industry: Gaming new content during the quarter. The reported numbers beat CEO: Lars Wingefors Chairman: Kicki Wallje-Lund our estimates. Even though that THQ Nordic produced a record quarter, the thing stole the spotlight was the announcement of the acquisition of Koch Media; we get into OMXS 30 THQ Nordic detail about the acquired company in this research update. 160 The acquisition is a prime example of THQ Nordic’s 140 acquisition strategy. We believe that the market is yet to fully 120 100 grasp the underlying value and cash flow generating 80 capabilities of THQ Nordic’s growing IP portfolio, which was 60 enhanced significantly by the acquirement. 40 20 We raised our Base-case valuation to 140 SEK per share 0 28-Feb 29-May 27-Aug 25-Nov 23-Feb based on a Back-Of-The-Envelope assessment on the same day as the acquisition. Following a more in-depth analysis, we increase our fair value estimate further to 168 SEK per share. We argue that the new addition to the Group was acquired at a low price and that the long-term possibilities following the purchase are vast. Redeye Rating (0 – 10 points) Management Ownership Profit outlook Profitability Financial strength 8.0 points 9.0 points 7.0 points 6.0 points 8.0 points Key Financials 2016 2017 2018E 2019E 2020E Share information Revenue, MSEK 302 508 3,666 3,909 4,300 Share price (SEK) 141.0 Growth 42% 68% 622% 7% 10% Number of shares (m) 79.4 EBITDA 132 273 929 1,009 1,212 Market Cap (MSEK) 11,190 EBITDA margin 44% 54% 25% 26% 28% Net cash (MSEK) 255 EBIT 95 188 616 696 849 Free float (%) 50 % EBIT margin 31% 37% 17% 18% 20% Daily turnover (’000) 60 Pre-tax earnings 93 182 616 696 849 Net earnings 72 139 480 543 662 Net margin 24% 27% 13% 14% 15% Analysts: Kristoffer Lindstrom 2016 2017 2018E 2019E 2020E [email protected] Dividend/Share 0.00 0.00 0.00 0.00 2.50 2016 2017 2018E 2019E 2020E EPS adj. -

THQ Nordic Completes the Acquisition Warhorse Studios

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, WITHIN OR TO THE UNITED STATES, AUSTRALIA, CANADA, NEW ZEALAND, HONG KONG, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL OR WOULD REQUIRE REGISTRATION OR ANY OTHER MEASURES. Press release Karlstad (Sweden), 13 February 2019 THQ Nordic completes the acquisition Warhorse Studios THQ Nordic AB's indirectly wholly owned subsidiary Koch Media GmbH has today entered into an agreement to acquire Warhorse Studios s.r.o., which was announced earlier today through a press release, for a purchase price amounting to MEUR 33.2 on a cash and debt free basis. All conditions for the transaction have now been fulfilled and the transaction is thereby completed. The Purchase of MEUR 42.8, corresPonding to MEUR 33.2 on a cash and debt free basis has today been Paid through a cast Payment of MEUR 40.4 to the sellers and 142,870 B shares, corresPonding to a value of MEUR 2.4, have been issued, subscribed for and allotted to the sellers. Warhorse Studios will be consolidated into THQ Nordic’s financial as of 13 February 2019. For further information on the transaction, reference is made to the Press release announced earlier today. Advisers Ernst & Young AB is providing transaction suPPort and Baker McKenzie is acting as legal counsel to THQ Nordic in connection with the transaction. For additional information, please contact: Lars Wingefors, GrouP CEO Tel: +46 708 47 19 78 E-mail: [email protected] About THQ Nordic THQ Nordic acquires, develoPs and Publishes PC and console games for the global games market. -

Fiscal Year 2006 - 2007

ANNUAL REPORT CORPORATE PROFILE FISCAL YEAR 2006 - 2007 1, place Verrazzano 69252 Lyon Cedex 09 - France www.infogrames.com To our Shareholders, The industry leaders currently hold strong positions but there is still room at the top. Opportunities exist for Infogrames is now entering a new stage in its development. smaller, innovative companies. The current market offers The past year featured a major financial restructuring, vital good prospects of investment, as next-generation consoles for the business, that produced a substantial reduction in arrive with new features and interactive user modes. Thus, our debt and an increase in our shareholder’s equity. As a the growth of online gaming and changing consumption result, Infogrames’ financial structure today is noticeably patterns resulting from new game experiences and interfaces improved compared to a year ago. In addition, the past provide Infogrames with many growth opportunities, as does year saw our operating ratios improve, as operating losses the emergence of a market for advertising in video games and were reduced and gross margins increased. In the coming a growing emphasis on brands, where Infogrames enjoys an year, we will continue to work on improving Infogrames’ edge because of its portfolio of trademarks and exclusive operations with the aim of gradually restoring its operating intellectual properties. margin, thereby gaining the freedom needed to finance new projects and development. By following a strong publishing strategy and relying on the talent available at Infogrames, your Company is ready to With your help and the support of our financial and business start growing again. partners, the Group now has the resources it needs to implement a turnaround strategy. -

Stáhnout Číslo V

TÉMA XXXXYYY 2. číslo l ročník VII. l květen 2018 l cena 25 Kč DEMOKRATICKÝ STŘED 1 OBSAH Úvodník Takoví jsme byli (Tomáš Fošum) 3 Téma: Česká politická krize Čekání na stabilitu (Antonín Berdych) 4 Podceňovaná jízda na tygrovi (Tomáš Fošum) 6 Střední Evropa Další zápis do historie? V hlavní roli Sebastian Kurz (Miroslav Šepták) 7 Ficova vláda bez Fica a s Machiavellim (Marián Balázs) 9 O vyhlídkách slovenské pravice (Martin Gonda) 11 Proč Viktor Orbán nepotřebuje volební program (Peter Morvay) 13 Porošenko čeká na vyzyvatele (Michal Lebduška) 15 Polská opozice na čekané (Wojciech Hofmański) 17 Polští republikáni hledají nouzový východ (Jan Škvrňák) 19 Střední Evropa a čínské pokušení (Łukasz Kołtuniak) 21 Kultura Japonsko po roce nula (Anna Plasová) 23 Polidštěné myši a opice aneb k čemu zvířata v divadle (ne)potřebujeme (Olga Słowik) 24 Hollywood střední Evropy: česko-polské komiksové klání (Lucie Zakopalová) 26 Zpráva o stavu videoherního průmyslu ve střední Evropě (Jan Holovský) 27 Rozhovor Smutné je, když politická realita předhání fikci (Zuzana Lizcová) 29 Zraněná města Ralsko: cesty v prostoru a čase (Martin Veselka) 32 Demokratický střed 2/2018, vydáno v květnu 2018, ročník VII. adresa: Demokratický střed, Jirečkova 1012/9, 170 00 Praha 7, e-mail: [email protected], web: www.demokratickystred.cz šéfredaktor: Tomáš Fošum zástupce šéfredaktora: Petr Zenkner redakční rada: Tomáš Chlum, Marie Bydžovská, Marie Jüptner Medková, Ladislav Havelka Jan Jüptner, Kateřina Hamplová, Pavel Cechl, Tomáš Orlík, Jan Holovský, Anna Plasová grafická úprava: Jiří Kaufner, fotomontáž na úvodní straně: Alesh, logo: LUSEL vydavatel: Demokratický střed, z. s. č. účtu: 2400332468/2010 registrační číslo MK ČR E 20906, ISSN 1805-6202, vychází 4 x ročně 2 DEMOKRATICKÝ STŘED ÚVODNÍK V eseji Vzestup neliberální demokracie publikované vého rozdělení polské společnosti, kde si jednotlivé tá- v roce 1997 označil americký politolog Fareed Zakaria bory navzájem nedůvěřují. -

GID KOD Nazwa 63062 KSONKONPSP3004.6 Konsola

GID KOD Nazwa 63062 KSONKONPSP3004.6 Konsola SONY PSP 3004 + Tekken + Gran Turismo 71362 KMICKONXBOX250.1 MICROSOFT XBOX 360 + Kinect 76939 KSONKONPS3320.8 SONY PlayStation 3 320GB Move Fitness 77579 KSONKONPSP1004GT SONY PSP E-1004+2 gry ( GT + LBP ) 79917 KMICKONXBOX250.8 MICROSOFT XBOX Slim 250GB+Kinect+Fz4/W2 79921 KGRYPS3FIFA13 EA FIFA 13 PS3 Gra 79922 KGRYXBOXFIFA13 EA FIFA 13 XBOX Gra 82128 KGRYPS3SPORTCH2 SONY SPORT CHAMPIONS 2 PS3 Gra 83398 KGRYXBOXDANCE3 DANCE CENTRAL 3 XBOX 360 Gra 83403 KGRYXBOXSPORT.U Kinect Sports Ultimate Col. Gra 83404 KGRYXBOXNIKE NIKE FINTESS XBOX Gra 86501 KGRYPCSTARCRAFT2 BLIZZARD Starcraft 2: HotS PC Gra PC 87149 ACCEGRYAIDEM0003 Calineczka PC Gra PC 87169 ACCEGRYPLAY0014 PLAY Czarnobyl Terrorist Attack Gra PC 87172 ACCEGRYYDP0002 YOUNG DIGITAL PLANET Angielski dla nastolatków Gra PC 87176 ACCEGRYYDP000 5 EDUROM Matematyka na wesoło 7-8 lat Fabryka zabawek Gra PC 87310 ACCEPSP00001 Little Big Planet Gra 87313 ACCEPSP00004 God of War: Ghost of Sparta Gra 87390 ACCEGRYTECH002 TECHLAND Salon Piękności Gra PC 87396 ACCEGRYTECH005 Niesamowite Maszyny - Symulator Autobusu Gra PC 87397 ACCEGRYTECH006 Dobra Gra - Call of Juarez The Cartel Shotgun Edition Gra PC 87398 ACCEGRYTECH007 TECHLAND Dobra Gra - Flatout Pack 2 Gra PC 87404 ACCEGRYTECH010 Karaoke Dziecięce Przeboje 2 Gra PC 87603 ACCEGRYBLIZ00001 Starcraft II - Wings of Liberty Gra PC 87604 ACCEGRYBLIZ00002 BLIZZARD Diablo III PC Gra PC 87656 ACCEGRYDISNEY002 Auta 2 PC Gra PC 87657 ACCEGRYDISNEY003 Toy Story 3 PC Gra PC 87669 ACCEPS3SONY00002 EyePet -

Ursula K. Le Guin the DISPOSSESSED an Ambiguous Utopia Document4 3/18/02 9:30 AM Page 2

Document4 3/18/02 9:30 AM Page 1 Ursula K. Le Guin THE DISPOSSESSED An Ambiguous Utopia Document4 3/18/02 9:30 AM Page 2 For the partner Document4 3/18/02 9:30 AM Page 2 Document4 3/18/02 9:30 AM Page 2 TOC 3/18/02 2:09 PM Page 1 CONTENTS MAPS OF ANARRES MAPS OF URRAS 1 THERE was a wall. it did not look impor- tant. It was built of uncut rocks 2 IN a square window in a white wall is the clear bare sky. 3 WHEN Shevek woke, having slept straight through his first morning on Urras 4 THE westering sun shining in on his face woke Shevek 5 SHEVEK ended his career as a tourist with relief. 6 WHEN Shevek was sent home after a decade in hospital TOC 4/8/02 5:13 PM Page 2 7 SHEVEK found a letter in a pocket of the new fleece-lined coat 8 THEY were out on the athletic fields of Abbenay s North Park 9 SHEVEK was awakened by the bells in the chapel tower pealing the Prime Harmony 10RAIL lines in Southwest ran for the most part on embankments 11 RODARRED, the old capital of Avan Province, was a pointed city 12 I want to introduce a project, said Bedap, from the Syndicate of Initiative 13 BEFORE they broke orbit, the view ports were filled with the cloudy turquoise A Study Guide to The Dispossessed by Paul Brians About the Author Other Books by Ursula K. Le Guin Credits About the Publisher Front Cover Image Copyright text 3/18/02 1:36 PM Page 1 THERE was a wall. -

THQ Nordic Acquires Alone in the Dark

Press release Karlstad, Sweden, September 19, 2018 THQ Nordic acquires Alone in the Dark THQ Nordic has acquired the survival horror classic series “Alone in the Dark” and RTS-series “Act of War” from Atari Europe SAS, France, including all of its assets, intellectual property and publishing rights. About Alone in the Dark Alone in the Dark is originally developed by Infogrames and the first game was released 1992 and had average Gamerankings of 90%. The original story is based on the writings of H. P. Lovecraft. Six games of the series have been released, with various themes and locations. Two comic books and two films were created based upon the games. About Act of War Act of War is a real-time strategy game developed by Eugen Systems that featured a fine-grained story, fabricated by NYT bestselling author Dale Brown. For additional information, please contact: Lars Wingefors, Founder and CEO Tel: +46 708 471 978 E-mail: [email protected] About THQ Nordic THQ Nordic acquires, develops and publishes PC and console games for the global games market. The company has an extensive catalogue of over 100 owned franchises, such as Saints Row, Dead Island, Homefront, Darksiders, Metro (exclusive license), Titan Quest, MX vs ATV, Red Faction, Delta Force, Destroy All Humans, ELEX, Biomutant, Jagged Alliance, SpellForce, The Guild amongst others. THQ Nordic has a global publishing reach within marketing, sales and distribution, both online and offline. The company has a global presence, with its group head office located in Karlstad, Sweden and with operational offices in Vienna, Austria and Munich, Germany. -

20/21 Interim Report 3 Reg No

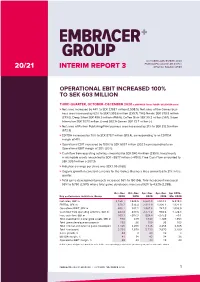

OCTOBER–DECEMBER 2020 EMBRACER GROUP AB (PUBL) 20/21 INTERIM REPORT 3 REG NO. 556582-6558 OPERATIONAL EBIT INCREASED 100% TO SEK 603 MILLION THIRD QUARTER, OCTOBER–DECEMBER 2020 (COMPARED TO OCTOBER–DECEMBER 2019) > Net sales increased by 44% to SEK 2,168.1 million (1,508.5). Net sales of the Games busi- ness area increased by 62% to SEK 1,355.6 million (835.7). THQ Nordic SEK 379.8 million (333.0), Deep Silver SEK 496.9 million (466.6), Coffee Stain SEK 99.2 million (36.1), Saber Interactive SEK 307.0 million (-) and DECA Games SEK 72.7 million (-). > Net sales of Partner Publishing/Film business area increased by 21% to SEK 812.5 million (672.9). > EBITDA increased by 70% to SEK 878.7 million (518.4), corresponding to an EBITDA margin of 41%. > Operational EBIT increased by 100% to SEK 603.1 million (302.1) corresponding to an Operational EBIT margin of 28% (20%). > Cash flow from operating activities amounted to SEK 840.4 million (239.5). Investments in intangible assets amounted to SEK –557.7 million (–419.0). Free Cash Flow amounted to SEK 309.1 million (–207.3). > Adjusted earnings per share was SEK 1.06 (0.68). > Organic growth in constant currency for the Games Business Area amounted to 21% in the quarter. > Total game development projects increased 56% to 150 (96). Total headcount increased 93% to 5,730 (2,970) where total game developers increased 92% to 4,325 (2,258). Oct–Dec Oct–Dec Apr–Dec Apr–Dec Apr 2019– Key performance indicators, Group 2020 2019 2020 2019 Mar 2020 Net sales, SEK m 2,168.1 1,508.5 6,620.0 3,910.3 5,249.4