Disclosure of Contracts Relevant to Northpower's Electricity Lines

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download PDF

Table of Contents Executive summary ............................................................................................... 2 What Auckland consumers have to say about electricity retail issues ........................... 3 The EAP has not fully met the requirements of the terms of reference ......................... 4 The big-5 incumbent retailers are to blame for residential price increases .................... 5 Sweet-heart deals with Tiwai Smelter are keeping prices artificially high ...................... 6 Stronger wholesale and retail competition needed to make electricity more affordable ... 8 Saves & Winbacks is making the two-tier retail market problem worse ...................... 11 Late payment penalties disadvantage vulnerable Kiwis unable to pay on time ............. 14 Prepayment arrangements exploit vulnerable consumers ......................................... 18 There are questions about compliance with the Vulnerable Consumer Guidelines and the objectives of the Guidelines .................................................................................. 19 Concluding remarks and recommendations ............................................................. 20 Appendix 1: Price increases over the last 18-years largely driven by retail (energy) .... 22 Appendix 2: Manipulation of pricing data can make it look like lines are to blame ........ 27 Appendix 3: The electricity retail and generation markets are highly “concentrated” .... 30 Appendix 4: Retail competition improvements driven by the last inquiry reforms -

Statement of Preliminary Issues – 17 August 2021

ISBN 978-1-869459-13-0 Statement of Preliminary Issues Mercury NZ Limited / Trustpower Limited’s retail business 17 August 2021 Introduction 1. On 3 August 2021, we registered an application from Mercury NZ Limited (Mercury) seeking clearance to acquire Trustpower Limited’s (Trustpower) retail business (the Proposed Acquisition). 1 2. The Commission will give clearance if it is satisfied that the Proposed Acquisition will not have, or would not be likely to have, the effect of substantially lessening competition in a market in New Zealand. 3. This statement of preliminary issues sets out the issues we currently consider to be important in deciding whether or not to grant clearance. 2 4. As set out in the Framework section below, our assessment of the Proposed Acquisition is limited to the impact of the transaction on competition in New Zealand markets. Except to the extent it is relevant to the Proposed Acquisition, our clearance process does not involve assessment of the competitive workability of the relevant markets in general. 5. We invite interested parties to provide comments on the likely competitive effects of the Proposed Acquisition. We request that parties who wish to make a submission do so by close of business on 31 August 2021 . The parties and the Proposed Acquisition 6. Mercury and Trustpower both generate electricity and sell electricity to a range of customers and are two of the five traditional ‘gentailers’ that operate in New Zealand.3 In addition to electricity, Mercury and Trustpower also supply, to varying degrees, other utility services such as gas and broadband. -

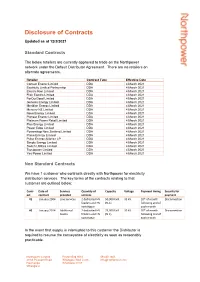

Disclosure of Contracts

Disclosure of Contracts Updated as at 12/3/2021 Standard Contracts The below retailers are currently approved to trade on the Northpower network under the Default Distributor Agreement. There are no retailers on alternate agreements. Retailer Contract Type Effective Date Contact Energy Limited DDA 4 March 2021 Ecotricity Limited Partnership DDA 4 March 2021 Electric Kiwi Limited DDA 4 March 2021 Flick Electric Limited DDA 4 March 2021 ForOurGood Limited DDA 4 March 2021 Genesis Energy Limited DDA 4 March 2021 Meridian Energy Limited DDA 4 March 2021 Mercury NZ Limited DDA 4 March 2021 Nova Energy Limited DDA 4 March 2021 Pioneer Energy Limited DDA 4 March 2021 Platinum Power Retail Limited DDA 4 March 2021 Plus Energy Limited DDA 4 March 2021 Power Edge Limited DDA 4 March 2021 Powershop New Zealand Limited DDA 4 March 2021 Prime Energy Limited DDA 4 March 2021 Pulse Energy Alliance LP DDA 4 March 2021 Simply Energy Limited DDA 4 March 2021 Switch Utilities Limited DDA 4 March 2021 Trustpower Limited DDA 4 March 2021 Yes Power Limited DDA 4 March 2021 Non Standard Contracts We have 1 customer who contracts directly with Northpower for electricity distribution services. The key terms of the contracts relating to that customer are outlined below: Contr Date of Services Quantity of Capacity Voltage Payment timing Security for act contract provided services payment #1 January 2004 Line Services 2 dedicated HV 50,000 kVA 33 kV 20th of month Disconnection feeders and HV (N-1) following end of switchgear each month #2 January 2014 Additional 2 dedicated HV 25,000 kVA 33 kV 20th of month Disconnection Assets feeders and HV (N-1) following end of switchgear each month In the event that supply is interrupted to this customer the Distributor is required to resume the conveyance of electricity as soon as reasonably practicable. -

Solar Pv and Batteries in New Zealand – Consumer Centric Electricity

SOLAR PV AND BATTERIES IN NEW ZEALAND – CONSUMER CENTRIC ELECTRICITY November 2016 ITP Renewables Australia Benefits of Distributed PV in NZ- Draft Report About IT Power The IT Power Group, formed in 1981, is a specialist renewable energy, energy efficiency and carbon markets consulting company. The group has offices and projects throughout the world. IT Power (Australia) Pty Ltd (ITP) was established in 2003 and has undertaken a wide range of projects, including designing grid-connected renewable power systems, providing advice for government policy, feasibility studies for large, off-grid power systems, developing micro-finance models for community-owned power systems in developing countries and modelling large-scale power systems for industrial use. The staff at ITP have backgrounds in renewable energy and energy efficiency, research, development and implementation, managing and reviewing government incentive programs, high level policy analysis and research, including carbon markets, engineering design and project management. ITP/A0215 – November 2016 Benefits of Distributed PV in NZ – Draft Report Document Control Record Document prepared by: IT Power (Australia) Pty Limited Level 1, 19-23 Moore St, Turner, ACT, 2612, Australia PO Box 6127, O’Connor, ACT, 2602, Australia Tel. +61 2 6257 3511 Fax. +61 2 6257 3611 E-mail: [email protected] http://www.itpau.com.au Document Control Proposal title Benefits of Distributed PV in NZ Client RFP No. NA ITP Project Number A0215 Client SEANZ Client Contact Brendan Winitana Rev Date Status Author/s Project Manager Approved Rob Passey, Annie Ngo, Muriel Watt, 1 4 Nov 2016 Draft Rob Passey Muriel Watt Graham Henricksen 2 11 Nov 2016 Final Rob Passey, Annie Ngo, Muriel Watt, Muriel Watt Rob Passey Graham Henricksen A person or organisation choosing to use documents prepared by IT Power (Australia) Pty Ltd accepts the following: a) Conclusions and figures presented in draft documents are subject to change. -

FY20 Full Year Results Presentation 20 August 2020

FY20 Full Year Results Presentation 20 August 2020 Marc England – CHIEF EXECUTIVE OFFICER Chris Jewell – CHIEF FINANCIAL OFFICER GENESIS ENERGY LIMITED AGENDA 1 Year in Review 2 Financial Performance and Guidance 3 Strategy Update and Outlook 4 Supplementary Information Genesis Energy Limited FY20 Full Year Result Presentation 2. 1. Year in Review GENESIS ENERGY LIMITED Results at a glance 1 EBITDAF m Retail $ ➢ Genesis’ residential gross customer churn down 3.5 ppt to 24.1% and net churn down 1.6 ppt to 14.8% ➢ Continued Retail momentum - netbacks up in all fuels, Electricity up 7%, Gas up 10% and LPG up 10% ➢ Customers choosing to purchase more than 1 fuel grew to over 121,000, up 3% NPAT m $ ➢ Over 77% of customers now choosing to interact digitally ➢ Launch of new customer Care Package for those most vulnerable post-COVID-19 Final dividend Wholesale cps ➢ 2nd lowest January to June North Island inflow sequence in 95 years, hydro generation down 20% to 491 GWh . Gross ➢ Thermal generation up 12%, fuel portfolio costs up 20% yield of ➢ Average FY20 thermal fuel cost up 7% but has commenced a decline and is down 3% on HY20 to $79/MWh % ➢ Our adaptive flexible generation and fuels portfolio defended low hydrology and high fuel cost impacts ➢ Tekapo upgrades successfully completed and its intake gate capital project reached the half-way point As at 18 August 2020 Operating expenses Kupe down $1m m $ ➢ Field production down 10% due to planned November 30-day outage and February perforation project Finance ➢ Well perforation project completed successfully. -

Energy Complaints Scheme – Accepted Deadlocked Complaints Report for the Period 1 April 2020 - 31 March 2021

Energy Complaints Scheme – accepted deadlocked complaints report for the period 1 April 2020 - 31 March 2021 Accepted deadlocked complaints The tables below show the number of deadlocked complaints that were accepted for consideration, and the relevant provider. Not all providers in the Energy Complaints Scheme had an accepted deadlocked complaint in this period. A full provider list is available on our website: www.utilitiesdisputes.co.nz The tables also show each providers’ market share, which is calculated by the number of installation control points (ICPs) or equivalent. Total ICPs (or equivalent) were calculated on 28 February 2021 from ICPs on the electricity and gas registries, and customer numbers obtained from providers. Distributors Distributor Accepted Share of Total ICPs Market share deadlocked accepted (or of ICPs (or complaints deadlocked equivalent) equivalent) complaints Alpine Energy 1 1.8% 33,113 1.3% Aurora Energy 7 12.7% 92,584 3.7% Counties Power 2 3.6% 44,978 1.8% Electra 1 1.8% 45,697 1.8% ElectroNet Services * 1 1.8% 0 0.0% Horizon Networks 1 1.8% 24,940 1.0% MainPower 1 1.8% 41,494 1.6% Northpower 3 5.5% 60,326 2.4% Orion 1 1.8% 208,259 8.2% Powerco 6 10.9% 447,295 17.7% The Lines Company (TLC) 3 5.5% 23,716 0.9% Top Energy 4 7.3% 33,049 1.3% Unison 4 7.3% 113,586 4.5% Vector 17 30.9% 699,786 27.7% WEL Networks 3 5.5% 95,851 3.8% Total 55 100% 1,964,674 77.8% Total ICPs (or equivalent) for all electricity and gas distributors: 2,524,362 Key: *Subsidiary of Westpower. -

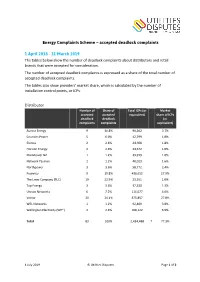

Energy Complaints Scheme – Accepted Deadlock Complaints 1

Energy Complaints Scheme – accepted deadlock complaints 1 April 2018 - 31 March 2019 The tables below show the number of deadlock complaints about distributors and retail brands that were accepted for consideration. The number of accepted deadlock complaints is expressed as a share of the total number of accepted deadlock complaints. The tables also show providers’ market share, which is calculated by the number of installation control points, or ICPs. Distributor Number of Share of Total ICPs (or Market accepted accepted equivalent) share of ICPs deadlock deadlock (or complaints complaints equivalent) Aurora Energy 9 10.8% 90,262 3.7% Counties Power 5 6.0% 42,799 1.8% Electra 2 2.4% 44,908 1.8% Horizon Energy 2 2.4% 24,672 1.0% MainPower NZ 1 1.2% 39,919 1.6% Network Tasman 1 1.2% 40,023 1.6% Northpower 3 3.6% 58,772 2.4% Powerco 9 10.8% 436,652 17.9% The Lines Company (TLC) 19 22.9% 23,551 1.0% Top Energy 3 3.6% 32,330 1.3% Unison Networks 6 7.2% 111,577 4.6% Vector 20 24.1% 675,857 27.8% WEL Networks 1 1.2% 92,400 3.8% Wellington Electricity (WE*) 2 2.4% 168,122 6.9% Total 83 100% 2,434,488 † 77.3% 4 July 2019 © Utilities Disputes Page 1 of 2 Retail brand Number of Share of Total ICPs (or Market accepted accepted equivalent) share of ICPs deadlock deadlock (or complaints complaints equivalent) Contact 11 8.3% 478,525 18.3% Ecotricity 5 3.8% 5,640 0.2% Electric Kiwi 4 3.0% 36,132 1.4% Elgas 7 5.3% 31,314 1.2% Energy Online 3 2.3% 106,576 4.1% Flick Electric Co 4 3.0% 20,702 0.8% Genesis Energy * 20 15.0% 566,276 21.6% GLOBUG 4 3.0% -

Certus Industry Focus: Energy and Utilities Product Sheet

CERTUS INDUSTRY FOCUS: ENERGY AND UTILITIES PRODUCT SHEET Our Industry Experience Certus Certus’s long track record means we Certus Solutions is the largest IBM systems understand the business drivers and integrator and reseller in the Australasian technology needs of companies in region, with a complete end-to-end IBM the energy and utilities sector. offering we call Certus PurePlay. We have been Our experience encompasses: helping energy and utilities companies achieve their business objectives for more than 20 • asset management, including networked, years. Utility industry certified by IBM, and an distributed, mobile and linear assets IBM Premier Business Partner, Certus brings • work management, including optimised its PurePlay advantage to downstream and scheduling upstream energy and resources operations, and • faults and outage management water supply operations. • health, safety and the environment • connectivity and real-time data, encompassing everything from smart metering to SCADA, and condition monitoring to network operations, and the Big Data implications of smart grids • spatial and geo-locational data • mobile work and workforce management • predictive analytics, ranging from predictive maintenance to demand forecasting • supply chain management • compliance, regulation, risk, and emerging industry standards e.g. PAS 55 • regulatory reporting, and other challenges inherent in a regulated CERTUS INDUSTRY FOCUS: ENERGY AND UTILITIES ENERGY FOCUS: INDUSTRY CERTUS asset industry. FRESH IDEAS. EXCEPTIONAL OUTCOMES. certussolutions.com -

THE GENESIS ENERGY SHARE OFFER PROSPECTUS DATED 13 MARCH 2014 Important Information

THE GENESIS ENERGY THE SHARE OFFER GENESIS ENERGY PROSPECTUS DATED 13 MARCH 2014 DATED PROSPECTUS SHARE OFFER INITIAL PUBLIC OFFERING OF ORDINARY SHARES IN GENESIS ENERGY LIMITED PROSPECTUS DATED 13 MARCH 2014 we’re in it for you IMPORTANT INFORMATION IMPORTANT NOTICE —the signed consent of the Auditor to the audit report Genesis Energy, their respective offi cers, the directors This document (“Prospectus”) relates to the Off er by appearing in this Prospectus; of Genesis Energy or any other person referred to in this the Crown of ordinary shares in Genesis Energy Limited. —the signed consent of Ernst & Young Transaction Prospectus with respect to the achievement of the results A description of the Off er and the Shares is set out in Advisory Services Limited to the investigating set out in any such statement, or that the underlying Section 7.1 Details of the Off er. accountant’s report appearing in this Prospectus; assumptions used will in fact be realised. —the signed consent of Beca Limited to the This document is a prospectus for the purposes of the independent engineer’s report appearing in SUPPLEMENTARY DISCLOSURE AND Securities Act and the Securities Regulations and is this Prospectus; WITHDRAWAL RIGHT prepared as at, and dated, 13 March 2014. —the signed consent of Gaff ney, Cline & Associates If any signifi cant adverse developments occur This Prospectus is an important document and should be (Consultants) Pte Limited to the independent expert’s prior to the Allotment Date, the Crown and Genesis read carefully before deciding whether or not to invest in report appearing in this Prospectus; Energy may advise investors of those developments Genesis Energy. -

Genesis Energy Limited (GNE) – Hedge Contract Agreed with Meridian Energy

MARKET RELEASE Date: 8 July 2014 Release: Immediate Genesis Energy Limited (GNE) – hedge contract agreed with Meridian Energy Genesis Energy has signed a “swaption” electricity hedge contract to provide dry year cover for Meridian Energy for four years from 1 January 2015. The 150MW swaption follows on from the existing 200MW swaption between Genesis Energy and Meridian Energy which expires in October 2014. The new four-year agreement has a provision to terminate after the first two years in the event Meridian’s contract with NZ Aluminium Smelters sees a reduction in volume. The structure of the new agreement allows for 100MW to be available year round, with an additional 50MW available from 1 April to 30 October in each year of the contract. Genesis Energy’s prospective financial information (PFI) was prepared on the assumption that the existing 200MW swaption would not be replaced with a similar instrument. The new agreement is therefore expected to have a positive impact on Genesis Energy’s FY2015 PFI. Genesis Energy’s Chief Executive, Albert Brantley, said the agreement provides a useful independent revenue stream and enables enhanced economic utilisation of its diverse portfolio of hydro and thermal power generation located in both the North and South Islands of New Zealand. ENDS For media enquiries, please contact: Richard Gordon Public Affairs Manager Genesis Energy P: 09 951 9280 M: 021 681 305 For investor relations enquiries, please contact: Rodney Deacon Investor Relations Manager Genesis Energy P: 09 571 4970 M: 021 631 074 About Genesis Energy Genesis Energy (NZX: GNE) is a diversified New Zealand energy company. -

Waikato and Upper North Island Voltage Management

WAIKATO AND UPPER NORTH ISLAND VOLTAGE MANAGEMENT ATTACHMENT D - STAKEHOLDER CONSULTATION SUMMARY Transpower New Zealand Limited December 2019 Waikato and Upper North Island Voltage Management © Transpower New Zealand Limited 2007. All rights reserved. i Table of Contents Table of Contents Glossary................................................................................................................................ 5 1 Introduction .................................................................................................................. 7 1.1 Purpose ..................................................................................................................... 7 1.2 Document structure ................................................................................................... 7 1.3 Stakeholder engagement to date ............................................................................... 8 2 Long-list stakeholder consultation (July 2016): Summary of submissions with Transpower responses................................................................................................. 8 2.1 Need and project scope ............................................................................................. 9 2.1.1 Need for wider scope .............................................................................................. 9 2.1.2 Definition of the N-1 contingency ........................................................................... 10 2.2 Reactive power devices, batteries and transmission ............................................... -

Contracts Disclosure 2019 9/07/2019 1 2

Disclosure of Contracts relevant to Northpower’s Electricity Lines Business Updated 9 July 2019 This disclosure is made in accordance with clauses 2.4.9 to 2.4.17 of the Electricity Distribution Information Disclosure Determination 2012 (EDIDD 2012) published by the Commerce Commission which requires Northpower to publicly disclose “Prescribed Terms & Conditions” of Northpower’s standard and non- standard contracts relating to the supply of Electricity Lines Services. Contracts with Electricity Retailers Northpower’s contractual arrangement for the provision of Lines Services to most end-use consumers connected to the Northpower network is on an interposed basis. The electricity retailers are “interposed” between Northpower and the end-use consumers, meaning that Northpower has contracts with the electricity retailers and the electricity retailers have individual contracts with the end-use consumers. Table 1 following lists the electricity retailers who have contracts with Northpower for line services to supply consumers on the Northpower network and, for completeness, some additional details. Table 1: Electricity Retailers who have contracts with Northpower for line services (Listed in alphabetical order) Retailer Services provided Basis of contract Contract date Body Corporate Power Lines services Model Use of System July 2018 Limited Agreement 2012 Contact Energy Limited Lines services Model Use of System January 2008 Agreement 2005 Ecotricity Limited Lines services Model Use of System September 2015 Agreement 2005 Electric Kiwi Limited