Annual Report 2013 -2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EEA Conf Programme 2021

Conference Programme - Provisional - 29 March 2021 WEDNESDAY, 30 JUNE 2021 8.30am REGISTRATION & TRADE EXHIBITION OPENS ROOM 3 ROOM 4 ROOMS 2 TO 4 9.30am CONFERENCE OPENING 9.35am Keynote Address 1 10.10am Keynote Address 2 10.45am ROOM 1 ROOM 2 ROOM 3 ROOM 4 CARBON ZERO SMART TECHNOLOGY FUTURE GRIDS PANEL SESSION 1 11.00am Architecture of the Future Low-Carbon, ConductorDown – A groundbreaking safety solution for New approaches to network planning. Details to be advised Resilient, Electrical Power System. overhead distribution networks. Richard Kingsford, WEL Networks Prof. Neville Watson, University of Rodger Griffiths, Electronet Technology Canterbury 11.30am Perverse incentives creating an impact on Practical experience of IEC61850 and future IoT for a smarter grid. network performance and New Zealand’s zero applications. Max Feickert, Energy Outcomes & Darren carbon future. Nathan Rich, Connetics Ltd Lucinsky, Electra Ltd Dougal McQueen & Junaid Qureshi, Aurora Energy 12.00pm The effects on the wider electricity network of Enhancing rating studies through soil digital twin. The use, development and improvement of heating decarbonisation projects. Nu’man Rashid, Unison Networks Ltd approaches for generation balancing to meet peak Campbell Rae, Connetics Ltd demand. Katherine Moore, Transpower NZ Ltd 12.30pm LUNCH ASSET MANAGEMENT INNOVATION FUTURE ENERGY SECURITY INNOVATIVE TECHNOLOGY SMART TECHNOLOGY 1.30pm Rethinking test data and reporting. An Electricity network infrastructure resilience through the Implementation of Whangamata’s -

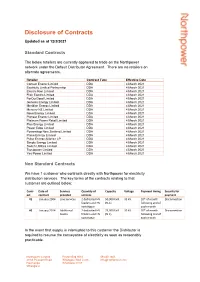

Disclosure of Contracts

Disclosure of Contracts Updated as at 12/3/2021 Standard Contracts The below retailers are currently approved to trade on the Northpower network under the Default Distributor Agreement. There are no retailers on alternate agreements. Retailer Contract Type Effective Date Contact Energy Limited DDA 4 March 2021 Ecotricity Limited Partnership DDA 4 March 2021 Electric Kiwi Limited DDA 4 March 2021 Flick Electric Limited DDA 4 March 2021 ForOurGood Limited DDA 4 March 2021 Genesis Energy Limited DDA 4 March 2021 Meridian Energy Limited DDA 4 March 2021 Mercury NZ Limited DDA 4 March 2021 Nova Energy Limited DDA 4 March 2021 Pioneer Energy Limited DDA 4 March 2021 Platinum Power Retail Limited DDA 4 March 2021 Plus Energy Limited DDA 4 March 2021 Power Edge Limited DDA 4 March 2021 Powershop New Zealand Limited DDA 4 March 2021 Prime Energy Limited DDA 4 March 2021 Pulse Energy Alliance LP DDA 4 March 2021 Simply Energy Limited DDA 4 March 2021 Switch Utilities Limited DDA 4 March 2021 Trustpower Limited DDA 4 March 2021 Yes Power Limited DDA 4 March 2021 Non Standard Contracts We have 1 customer who contracts directly with Northpower for electricity distribution services. The key terms of the contracts relating to that customer are outlined below: Contr Date of Services Quantity of Capacity Voltage Payment timing Security for act contract provided services payment #1 January 2004 Line Services 2 dedicated HV 50,000 kVA 33 kV 20th of month Disconnection feeders and HV (N-1) following end of switchgear each month #2 January 2014 Additional 2 dedicated HV 25,000 kVA 33 kV 20th of month Disconnection Assets feeders and HV (N-1) following end of switchgear each month In the event that supply is interrupted to this customer the Distributor is required to resume the conveyance of electricity as soon as reasonably practicable. -

ENA's Response to Climate Change Commission's Draft Advice

Date: 28 March 2021 Name of submitter: Electricity Networks Association Industry/area of interest: Utilities/infrastructure Contact details Richard Le Gros, Manager, Policy and Innovation Address: Level 5, Legal House 101 Lambton Quay WELLINGTON 6011 Telephone: 64 4 471 1335 Email: [email protected] 2021 Draft Advice for Consultation Submission to the Climate Change Commission From the Electricity Networks Association ELECTRICITY NETWORKS ASSOCIATION Draft Advice submission to Climate Change Commission Contents 1. Introduction ................................................................................................................ 3 2. Overview ..................................................................................................................... 3 3. Question 1 - Principles to guide our advice ................................................................... 3 4. Question 15 - Do you support the package of recommendations and actions for the heat, industry and power sectors? ................................................................................ 5 5. Question 19 - Multisector strategy - Do you support the package of recommendations and actions to create a multisector strategy? ................................................................ 9 6. Conclusion .................................................................................................................. 10 7. Appendix ................................................................................................................... -

Electricity Distributors' Performance from 2008 to 2011

ISBN no. 978-1-869453-02-2 Project no. 14.20/13107 Public version Electricity distributors’ performance from 2008 to 2011 Date: 29 January 2013 2 Chapter 1 Introduction 4 Helping customers understand how their electricity distributor is performing 4 We have focused on some key areas of performance 4 We use public information to give an overview of distributors’ performance 5 Structure of this report 5 We would like to hear how useful you found this report 5 Chapter 2 Overview of New Zealand’s electricity industry 6 The main parts of the electricity industry supply chain 6 Key features of the New Zealand electricity distribution sector 7 Chapter 3 Our role in the electricity industry 11 How we regulate electricity distributors in New Zealand 11 Chapter 4 Overview of industry performance 14 Prices, revenue and demand 16 How reliable is electricity distribution in New Zealand? 25 Expenditure 28 3 On 5 February 2013 we made some corrections to the paper. The table below summarises the changes. Distributor Change Buller corrected information in Table 7.1 Electricity Invercargill corrected information in Table 13.1; replaced $7.5m with $1m in commentary under Figure 13.3 MainPower corrected information in Table 16.1 Orion corrected information in Table 22.1; replaced ‘Electra’ with ‘Orion’ in notes to Figures 22.13 and 22.14 OtagoNet corrected information in Table 23.1 Powerco corrected information in Table 24.1 The Power Company corrected information in Table 25.1 Vector corrected information in Table 29.1; added note under Figure 29.1; corrected Figure 29.17 WEL Networks corrected information in Table 31.1 Wellington corrected wording above Figure 32.17 Westpower corrected information in Table 33.1 Introduction 4 Chapter 1 Introduction Helping customers understand how their electricity distributor is performing We have written this report primarily for customers of electricity distribution services, by which we mean people who have, and pay for, a connection to an electricity distribution network.1 This includes both households and businesses. -

Attendee Conference Pack

Wind Energy Conference 2021 Rising to the Challenge 12 May 2021, InterContinental Hotel, Wellington, New Zealand Programme Joseph, aged 9 We would like to thank our sponsors for their support 2021 Wind Energy Conference – 12th May 2021 Wind Energy Conference Programme 12 May 2021 InterContinental, Wellington Rising to the Challenge Welcome and Minister’s The energy sector and renewables Presentation ▪ Hon Dr Megan Woods, Minister of Energy and Resources 8.30 – 9.00 Session 1 Facilitator: Dr Christina Hood, Compass Climate Decarbonising the New Zealand’s journey to net zero carbon energy sector ▪ Hon James Shaw, Minister of Climate Change 9.00 to 10.45 Infrastructure implications of decarbonisation ▪ Ross Copland, New Zealand Infrastructure Commission The industrial heat opportunity ▪ Linda Mulvihill, Fonterra Panel and Audience Discussion – testing our key opportunities and level of ambition ▪ Ross Copland, New Zealand Infrastructure Commission ▪ Linda Mulvihill, Fonterra ▪ Briony Bennett (she/her), Ministry of Business, Innovation and Employment ▪ Matt Burgess, The New Zealand Initiative ▪ Liz Yeaman, Retyna Ltd Morning Tea Sponsored by Ara Ake 10.45 to 11.15 Session 2 Waipipi, Delivering a wind farm during a global pandemic Jim Pearson, Tilt Renewables Building new wind Australian renewables and wind development update 11.15 -1.00 ▪ Kane Thornton, Clean Energy Council DNV’s Energy Transition Outlook what it means for wind energy ▪ Graham Slack, DNV A changing regulatory landscape and implications for wind and other renewables ▪ Amelia -

Genesis Energy

NEW ZEALAND Genesis Energy 13 June 2008 Performance evaluation Genesis Energy equity valuation Macquarie Research’s discounted cashflow based equity valuation for Genesis Energy is $2,115m (nominal WACC 9.17%, asset beta 0.60, TGR 3.0%). Forecast financial model A detailed financial model with explicit forecasts out to 2030 has been completed and is summarised through this report. 12 month and 24 month target valuations Our 12 month ($2,257m) and 24 month ($2,433m) target valuations for the company have been derived by rolling forward the discounted cashflow model 12 and 24 months respectively and deducting from these values the forecast 12 and 24 month dividends to the Crown. Financial model assumptions and commentary We have assessed the sensitivity of our equity valuation to a wide range of inputs. Broadly, these sensitivities are divided into five categories: generation Inside assumptions, electricity supply, gas supply, financials and price path. Performance evaluation report 2 This report highlights and discusses a number of key model input assumptions: Valuation summary 5 ⇒ The extent to which Huntly coal is backed off; Financial model assumptions and ⇒ The company’s retail and SME pricing position; commentary 11 ⇒ Future fuel cost position; Financial statements summary 18 ⇒ Genesis Energy Retail Gas margins; and Genesis Energy historic and forecast performance 21 ⇒ Wholesale electricity price paths. Historic and forecast performance versus SCI Financial flexibility and generation development 22 We have analysed the spread between Genesis Energy’s return on funds and its WACC to gauge its historic and forecast financial performance; Alternative valuation methodologies 23 We have compared our forecasts for Genesis Energy against those outlined in its Statement of Corporate Intent (SCI). -

Confidential Version

Public Version ISSN No. 0114-2720 11711/900832 Decision No. 682 Determination pursuant to the Electricity Industry Reform Act 1998 (EIR Act) in the matter of an application for exemption, of a prohibited involvement in an electricity lines business and an electricity generation and sales business, from the application of the EIR Act. The application is made by: MARK TUME The Commission: M N Berry P J M Taylor Summary of Application: Application by Mark Tume for exemption from the application of the EIR Act in respect of certain prohibited involvements in Powerco Limited’s lines and in the generation and sale of electricity by TrustPower Limited. Determination: The Commission, pursuant to section 81 of the EIR Act, determines to grant an exemption from compliance with section 17(2)(a) of the EIR Act, but with the conditions specified in the Notice of Exemption. Date of Determination: 10 November 2009 CONFIDENTIAL MATERIAL IN THIS REPORT IS CONTAINED IN SQUARE BRACKETS 2 CONTENTS INTRODUCTION .........................................................................................................3 COMMISSION PROCEDURES...................................................................................3 General.......................................................................................................................3 Criteria Used by the Commission to Consider Exemption Applications ..................3 PARTIES .......................................................................................................................5 -

WEL Networks Annual Report 2018

2018 WEL Networks and subsidiaries Annual Report 0800 800 935 | wel.co.nz ISSN 2463-4646 (print) ISSN 2463-4646 (print) 02 2018 WEL Networks | Annual Report THIS IS THE ANNUAL REPORT OF WEL NETWORKS LIMITED Dated this 6th day of June 2018 Signed for and on behalf of the Board of Directors ROB CAMPBELL Chairman TONY STEELE Director wel.co.nz CONTENTS PROFILE 03 CHAIRMAN’S REPORT 05 WEL NETWORKS CHIEF EXECUTIVE REPORT 07 ULTRAFAST FIBRE CHIEF EXECUTIVE REPORT 09 QUICK FACTS AND KEY PERFORMANCE INDICATORS 11 DIRECTOR PROFILES AS AT 31 MARCH 2018 21 CORPORATE GOVERNANCE 25 SUSTAINABILITY 26 DIRECTOR DISCLOSURES OF INTEREST 27 WEL ENERGY TRUST 29 THE HEADLINES 31 FINANCIAL STATEMENTS 35 AUDITORS’ REPORT 87 DIRECTORS’ REPORT AND STATUTORY INFORMATION 90 DIRECTORY 95 02 2018 WEL Networks | Annual Report 2018 WEL Networks | Annual Report 03 PROFILE The WEL Group is focused on delivering innovative utility services to enable our communities to thrive. Our electricity network has been serving the Waikato for 100 years distributing power from the national grid, supplying over 160,000 people with electricity services through 90,000 connections. We play a vital part in the economic and social development of the region by recognising and investing in new technologies that will revolutionise our network and future proof our region. The safety of our staff and communities is our highest network that is available to deliver ultra-fast broadband priority and we are committed to ensuring everyone services to more than 200,000 households, schools, makes it home safely every day. businesses and healthcare facilities within the Waikato, Taranaki and Bay of Plenty regions. -

Commerce Commission CPP Open Letter July 2018

First Gas Limited 42 Connett Road West, Bell Block 31 July 2018 Private Bag 2020, New Plymouth, 4342 New Zealand P +64 6 755 0861 F +64 6 759 6509 Matthew Lewer Manager, Regulation Development Commerce Commission PO Box 2351 WELLINGTON Sent via email: [email protected] Dear Matthew Feedback on recent CPP processes This is First Gas’ submission on the Commerce Commission’s open letter requesting feedback on recent customised price-quality path (CPP) processes dated 3 July 2018. Summary of key points First Gas welcomes the Commission’s review of recent CPPs. The findings of this work are of interest to us as we consider a CPP application for our gas transmission business to address the risk of coastal erosion near our pipelines at White Cliffs in northern Taranaki. We disagree with the Commission’s view that the principle of proportionate scrutiny is sufficiently defined in the Input Methodologies. We consider that the Wellington Electricity (WELL) CPP process demonstrates the value of considering high-priority, specific resilience issues outside of a full CPP process. This ensures a timely response to identified major resilience risks, without the resource required for a full CPP. Most of the other topics canvassed in the open letter set out activities that we expect any prudent regulated business would undertake prior to submitting a CPP application. These activities require a degree of flexibility to reflect the drivers of the individual CPP applications, so we do not support these being codified into the CPP requirements. We expand on these points below. Importance of consultation on CPP processes and experience to date Industry consultation and feedback on the CPP process is of considerable interest to First Gas, as we are currently considering a CPP application for our White Cliffs realignment project. -

IT HAPPENS... Annual Report 2014

IT HAPPENS... Annual Report 2014 …AND OUR RELIABILITY RECORD GETS SHREDDED! It’s been an eventful twelve months. Headline-making storms and earthquakes ripped through the Marlborough region on more than one occasion and – in comparison with last year – parts of our network really got slammed. Reduced reliability statistics tell part of the story, but challenging events such as these also serve to demonstrate our overall resilience and ability to perform for our customers and region in the face of adversity. They show what we’re really made of. Marlborough Lines Limited Annual Report 2014 1 CONTENTS About Marlborough Lines 4 Our ownership and areas of operation Performance overview 6 Our key financial measures were steady Performance overview 8 Parent company performance overview against key targets Our mission 10 Working to exceed customer expectations – the achievements Chairman’s report 12 Taking the long-term view Managing Director’s report 14 Investing to future proof assets Customer Q&A The answers to some of our customers’ 16 most frequently asked questions 2 Marlborough Lines Limited Annual Report 2014 About this report The real value of a resilient network This 2014 Annual Report summarises Working to reduce lost supply minutes Marlborough Lines’ operations, activities 18 and financial position as at 31 March 2014. 19 Our network 30 Contracting Marlborough Lines Limited is the Parent 32 Our people company of the Marlborough Lines Group of 38 Safety companies. In this report, we have detailed as 41 Community appropriate, numbers and tables for the financial 44 Environment indicators of both the Parent and Group, and where necessary, descriptions of the activities of the individual entities comprising investments Senior management within the Group. -

2010 Default Price-Quality Path Compliance Assessment Decision

COMMERCE COMMISSION Regulation of Electricity Lines Businesses Price-Quality Regulation Reasons for Not Declaring Control of the following Non-exempt Electricity Distribution Businesses: Alpine Energy Limited, Centralines Limited, Eastland Network Limited, Horizon Energy Distribution Limited, Nelson Electricity Limited, Network Tasman Limited, Orion New Zealand Limited, OtagoNet Joint Venture, Powerco Limited, The Lines Company Limited, Top Energy Limited and Wellington Electricity Lines Limited 1 April 2011 CONTENTS PAGE INTRODUCTION .................................................................................................. 3 Purpose and Scope .............................................................................................. 3 Electricity Distribution Businesses Assessed ................................................... 3 Statutory Framework ......................................................................................... 4 Consumer-owned .................................................................................................................. 4 Process and Analytical Framework Applied ................................................... 5 Overview of the 2009/10 Assessment ................................................................ 6 Breaches of the Price Path ................................................................................................... 6 Breaches of the Quality Threshold ..................................................................................... 11 DECISIONS – -

Certus Industry Focus: Energy and Utilities Product Sheet

CERTUS INDUSTRY FOCUS: ENERGY AND UTILITIES PRODUCT SHEET Our Industry Experience Certus Certus’s long track record means we Certus Solutions is the largest IBM systems understand the business drivers and integrator and reseller in the Australasian technology needs of companies in region, with a complete end-to-end IBM the energy and utilities sector. offering we call Certus PurePlay. We have been Our experience encompasses: helping energy and utilities companies achieve their business objectives for more than 20 • asset management, including networked, years. Utility industry certified by IBM, and an distributed, mobile and linear assets IBM Premier Business Partner, Certus brings • work management, including optimised its PurePlay advantage to downstream and scheduling upstream energy and resources operations, and • faults and outage management water supply operations. • health, safety and the environment • connectivity and real-time data, encompassing everything from smart metering to SCADA, and condition monitoring to network operations, and the Big Data implications of smart grids • spatial and geo-locational data • mobile work and workforce management • predictive analytics, ranging from predictive maintenance to demand forecasting • supply chain management • compliance, regulation, risk, and emerging industry standards e.g. PAS 55 • regulatory reporting, and other challenges inherent in a regulated CERTUS INDUSTRY FOCUS: ENERGY AND UTILITIES ENERGY FOCUS: INDUSTRY CERTUS asset industry. FRESH IDEAS. EXCEPTIONAL OUTCOMES. certussolutions.com