THE GENESIS ENERGY SHARE OFFER PROSPECTUS DATED 13 MARCH 2014 Important Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Decision No 540

PUBLIC VERSION ISSN NO. 0114-2720 J6822 Commerce Commission Decision No 540 Determination pursuant to the Commerce Act 1986 in the matter of an application for clearance of a business acquisition involving: VECTOR LIMITED and NGC HOLDINGS LIMITED The Commission: P R Rebstock D R Bates QC D F Curtin Summary of Application: Vector Limited or an interconnected body corporate has sought clearance to acquire, whether directly or indirectly, up to and including 100% of the shares in NGC Holdings Limited Determination: Pursuant to section 66(3) (a)/(b) of the Commerce Act 1986, the Commission determines to give clearance to the proposed acquisition. Date of Determination: 10 December 2004 CONFIDENTIAL MATERIAL IN THIS REPORT IS CONTAINED IN SQUARE BRACKETS 2 TABLE OF CONTENTS THE PROPOSAL ....................................................................................................................4 STATUTORY FRAMEWORK..............................................................................................4 ANALYTICAL FRAMEWORK............................................................................................4 THE PARTIES.........................................................................................................................5 Vector....................................................................................................................................5 NGC.......................................................................................................................................5 PREVIOUS -

Statement of Preliminary Issues – 17 August 2021

ISBN 978-1-869459-13-0 Statement of Preliminary Issues Mercury NZ Limited / Trustpower Limited’s retail business 17 August 2021 Introduction 1. On 3 August 2021, we registered an application from Mercury NZ Limited (Mercury) seeking clearance to acquire Trustpower Limited’s (Trustpower) retail business (the Proposed Acquisition). 1 2. The Commission will give clearance if it is satisfied that the Proposed Acquisition will not have, or would not be likely to have, the effect of substantially lessening competition in a market in New Zealand. 3. This statement of preliminary issues sets out the issues we currently consider to be important in deciding whether or not to grant clearance. 2 4. As set out in the Framework section below, our assessment of the Proposed Acquisition is limited to the impact of the transaction on competition in New Zealand markets. Except to the extent it is relevant to the Proposed Acquisition, our clearance process does not involve assessment of the competitive workability of the relevant markets in general. 5. We invite interested parties to provide comments on the likely competitive effects of the Proposed Acquisition. We request that parties who wish to make a submission do so by close of business on 31 August 2021 . The parties and the Proposed Acquisition 6. Mercury and Trustpower both generate electricity and sell electricity to a range of customers and are two of the five traditional ‘gentailers’ that operate in New Zealand.3 In addition to electricity, Mercury and Trustpower also supply, to varying degrees, other utility services such as gas and broadband. -

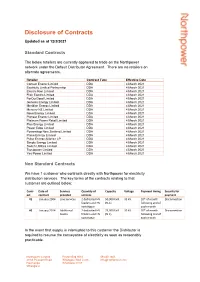

Disclosure of Contracts

Disclosure of Contracts Updated as at 12/3/2021 Standard Contracts The below retailers are currently approved to trade on the Northpower network under the Default Distributor Agreement. There are no retailers on alternate agreements. Retailer Contract Type Effective Date Contact Energy Limited DDA 4 March 2021 Ecotricity Limited Partnership DDA 4 March 2021 Electric Kiwi Limited DDA 4 March 2021 Flick Electric Limited DDA 4 March 2021 ForOurGood Limited DDA 4 March 2021 Genesis Energy Limited DDA 4 March 2021 Meridian Energy Limited DDA 4 March 2021 Mercury NZ Limited DDA 4 March 2021 Nova Energy Limited DDA 4 March 2021 Pioneer Energy Limited DDA 4 March 2021 Platinum Power Retail Limited DDA 4 March 2021 Plus Energy Limited DDA 4 March 2021 Power Edge Limited DDA 4 March 2021 Powershop New Zealand Limited DDA 4 March 2021 Prime Energy Limited DDA 4 March 2021 Pulse Energy Alliance LP DDA 4 March 2021 Simply Energy Limited DDA 4 March 2021 Switch Utilities Limited DDA 4 March 2021 Trustpower Limited DDA 4 March 2021 Yes Power Limited DDA 4 March 2021 Non Standard Contracts We have 1 customer who contracts directly with Northpower for electricity distribution services. The key terms of the contracts relating to that customer are outlined below: Contr Date of Services Quantity of Capacity Voltage Payment timing Security for act contract provided services payment #1 January 2004 Line Services 2 dedicated HV 50,000 kVA 33 kV 20th of month Disconnection feeders and HV (N-1) following end of switchgear each month #2 January 2014 Additional 2 dedicated HV 25,000 kVA 33 kV 20th of month Disconnection Assets feeders and HV (N-1) following end of switchgear each month In the event that supply is interrupted to this customer the Distributor is required to resume the conveyance of electricity as soon as reasonably practicable. -

FY20 Full Year Results Presentation 20 August 2020

FY20 Full Year Results Presentation 20 August 2020 Marc England – CHIEF EXECUTIVE OFFICER Chris Jewell – CHIEF FINANCIAL OFFICER GENESIS ENERGY LIMITED AGENDA 1 Year in Review 2 Financial Performance and Guidance 3 Strategy Update and Outlook 4 Supplementary Information Genesis Energy Limited FY20 Full Year Result Presentation 2. 1. Year in Review GENESIS ENERGY LIMITED Results at a glance 1 EBITDAF m Retail $ ➢ Genesis’ residential gross customer churn down 3.5 ppt to 24.1% and net churn down 1.6 ppt to 14.8% ➢ Continued Retail momentum - netbacks up in all fuels, Electricity up 7%, Gas up 10% and LPG up 10% ➢ Customers choosing to purchase more than 1 fuel grew to over 121,000, up 3% NPAT m $ ➢ Over 77% of customers now choosing to interact digitally ➢ Launch of new customer Care Package for those most vulnerable post-COVID-19 Final dividend Wholesale cps ➢ 2nd lowest January to June North Island inflow sequence in 95 years, hydro generation down 20% to 491 GWh . Gross ➢ Thermal generation up 12%, fuel portfolio costs up 20% yield of ➢ Average FY20 thermal fuel cost up 7% but has commenced a decline and is down 3% on HY20 to $79/MWh % ➢ Our adaptive flexible generation and fuels portfolio defended low hydrology and high fuel cost impacts ➢ Tekapo upgrades successfully completed and its intake gate capital project reached the half-way point As at 18 August 2020 Operating expenses Kupe down $1m m $ ➢ Field production down 10% due to planned November 30-day outage and February perforation project Finance ➢ Well perforation project completed successfully. -

Lines to Vines and Wines

Lines to Vines and Wines Annual Report 2016 The investment that broke the The Beauty industry mould — see page 67 of Blue Sky Thinking About this report Report objectives This 2016 report summarises Marlborough Lines’ operations, activities This report meets the New Zealand compliance and legislative and financial position for the 15 month period to 30 June 2016 following requirements of the Companies Act, The Financial Reporting Act a change in our balance date from 31 March. Marlborough Lines Limited and the Energy Companies Act, whilst also providing easy to read is the Parent company of the Marlborough Lines Group of companies. information on Marlborough Lines’ aspirations and performance In this report we provide as appropriate, numbers and tables for the for 2016 – the factors which affect our performance, and our goals financial indicators of both the Parent and Group, and where necessary, for the 2016 year. The industry and regulatory environment in which descriptions of the activities of the individual entities comprising we operate is complex and for that reason we have provided for our investments within the Group. References in this report for the year stakeholders an outline of our position, activities and attributes in means the 15 month calendar period 1 April 2015 to 30 June 2016 the supply chain for electricity (see page 26). On pages 62 and except for Parent operational data which, for compliance purposes 63 we also outline the regulatory environment applicable to our and in accord with Commerce Commission criteria, is provided for electricity network business. the 12 month period to 31 March 2016. -

NZ Gas Story Presentation

From wellhead to burner - The New Zealand Gas Story August 2014 Who are we – and why are we here • We’re the industry body and co-regulator • We’re telling the Gas Story because: − the industry has changed, there are more players, and the story is getting fragmented and lost − the industry asked us to stitch the story together and to tell it. − it fits with our obligation to report to the Minister on the state and performance of the gas industry. • and, because gas has a long pedigree and makes a valuable contribution to New Zealand, it’s a great story worth telling... Gas Industry Co 2 What we’ll cover… • History and development • The contribution of gas to New Zealand’s energy supply • How gas used • Industry structure and the players • Gas policy evolution and the regulatory framework • A look at each key element: − exploration & production − processing − transmission we’ll take a short break here − distribution − wholesale and retail markets − metering − pricing − safety • Gas in a carbon-conscious world • What the future for gas may look like Gas Industry Co 3 What is natural gas? Some terms we’ll be using: • Petajoule (PJ) – Measure of gas volume. 1PJ = 40,000 households or approximate annual gas use of Wanganui. • Gigajoule (GJ) – Also a measure of gas volume. There are one million GJs in a PJ. The average household use is around is around 25GJ per year. • LPG – Liquefied Petroleum Gas. Comprising propane and butane components of the gas stream • LNG – Liquefied Natural Gas. Natural gas that is chilled to minus 162C for bulk transport storage in the international market • Condensate – a light oil Gas Industry Co 4 Gas has a long history Oil seeps have been observed in NZ since Maori settlement. -

Annual R Eport

Annual Report Electricity and Gas Complaints Commission 10 Annual Report 1 05 Commissioner $ authorised to deal with claims up to $20,000, and up to $50,000 with the agreement of the company 01 02 03 04 Joint electricity industry Commissioner Review of Review of voluntary complaints appointed Electricity Scheme scheme established, the and Office Consumer established Code of Electricity Complaints Practice Commissioner Scheme 05 Gas joins to create the Electricity and Gas Complaints Commissioner Scheme Customer service Disconnections Debt Billing Meter Lines Supply Switch 06 Land complaints covered by the Scheme Electricity Gas Land April 2010 All energy companies must be members of 10 the Scheme Electricity and Gas Complaints Commissioner Scheme becomes the approved Scheme The Electricity and Gas Complaints Commissioner Scheme offers an independent service for resolving complaints about electricity and gas companies. The service is accountable, efficient, accessible, fair, effective and free. 09|10 Electricity and Gas Complaints Commission Message from the Chair At the time last year’s Annual Report went to print, the Electricity Commission and Gas Industry Co were considering whether to approve the Electricity and Gas Complaints Commissioner Scheme (the Scheme) as the approved consumer complaint resolution scheme for the electricity and gas industries. Approval was granted, and confirmed with the publication of a notice in the New Zealand Gazette on 10 December 2009. Richard Janes Independent Chair The approval is a major milestone in the history of the Scheme. But it does not mean an end to changes. The approval was granted after members agreed to make changes to the Constitution, effective from 1 April 2010, and the Commission agreed to consider a set of retailer principles proposing The work associated further changes to the Scheme. -

Genesis Energy Limited (GNE) – Hedge Contract Agreed with Meridian Energy

MARKET RELEASE Date: 8 July 2014 Release: Immediate Genesis Energy Limited (GNE) – hedge contract agreed with Meridian Energy Genesis Energy has signed a “swaption” electricity hedge contract to provide dry year cover for Meridian Energy for four years from 1 January 2015. The 150MW swaption follows on from the existing 200MW swaption between Genesis Energy and Meridian Energy which expires in October 2014. The new four-year agreement has a provision to terminate after the first two years in the event Meridian’s contract with NZ Aluminium Smelters sees a reduction in volume. The structure of the new agreement allows for 100MW to be available year round, with an additional 50MW available from 1 April to 30 October in each year of the contract. Genesis Energy’s prospective financial information (PFI) was prepared on the assumption that the existing 200MW swaption would not be replaced with a similar instrument. The new agreement is therefore expected to have a positive impact on Genesis Energy’s FY2015 PFI. Genesis Energy’s Chief Executive, Albert Brantley, said the agreement provides a useful independent revenue stream and enables enhanced economic utilisation of its diverse portfolio of hydro and thermal power generation located in both the North and South Islands of New Zealand. ENDS For media enquiries, please contact: Richard Gordon Public Affairs Manager Genesis Energy P: 09 951 9280 M: 021 681 305 For investor relations enquiries, please contact: Rodney Deacon Investor Relations Manager Genesis Energy P: 09 571 4970 M: 021 631 074 About Genesis Energy Genesis Energy (NZX: GNE) is a diversified New Zealand energy company. -

Breach Notice 2011-122 GENESIS POWER LIMITED Notifying Participant GENESIS POWER LIMITED Participant Allegedly in Breach CONTACT

Breach notice 2011-122 GENESIS POWER LIMITED Notifying participant GENESIS POWER LIMITED Participant allegedly in breach CONTACT ENERGY LIMITED MERCURY ENERGY LIMITED ON GAS LIMITED Parties to breach notice Breach notice 2011-138 TETENBURG & ASSOCIATES LIMITED Notifying participant GENESIS POWER LIMITED Participant allegedly in breach CONTACT ENERGY LIMITED ON GAS LIMITED Parties to breach notice Record of settlement of alleged breach of rule 26.2.1 of the Gas (Downstream Reconciliation) Rules 2008 186180.1 2 Record of settlement of alleged breach of rule 26.2.1 of the Gas (Downstream Reconciliation) Rules 2008 Breach Notice: 2011-122 Between: Notifying participant: Genesis Power Limited Participant allegedly in breach: Genesis Power Limited Parties to alleged breach: Contact Energy Limited, Mercury Energy Limited, On Gas Limited Breach notice: 2011-138 Between: Notifying participant: Tetenburg & Associates Limited Participant allegedly in breach: Genesis Power Limited Parties to alleged breach: Contact Energy Limited, On Gas Limited Background 1. Pursuant to regulations 18(3) and 23 of the Gas Governance (Compliance) Regulations 2008, the Market Administrator referred alleged breaches of rule 26.2.1 of the Gas (Downstream Reconciliation) Rules 2008 (“the Rules”) to an investigator, Jason McHerron, for investigation. 2. Rule 26 is in Part 2 of the Rules, which contains the rules relating to the allocation process. Rule 26 is headed “General obligations of allocation participants”. Rule 26.2.1 provides that every allocation participant must provide the information required under the Rules in a manner that is accurate and complete. 3. These alleged breaches both relate to the Palmerston North Gas Gate, PLN24201. -

Energy Freedom for a Changing World

ENERGY FREEDOM FOR A CHANGING WORLD. 2020 ANNUAL REPORT // MERCURY NZ LIMITED MENU. ABOUT THIS MENU 1. ENERGY FREEDOM TODAY. 2. OUR WORLD OF ENERGY FREEDOM. REPORT. 04 WHO WE ARE 14 THE WORLD AROUND US 05 OUR DIRECTION 18 ENGAGING WITH OUR STAKEHOLDERS Mercury is committed to providing transparent disclosures in 06 OUR BUSINESS MODEL 20 THE RISKS WE FACE easily understood, comparable and engaging ways so that we meet the expectations of our many stakeholders. 09 CHAIR & CHIEF EXECUTIVE 21 PULLING IT ALL TOGETHER UPDATE 22 CREATING VALUE IN FY20 This report follows the Integrated Reporting <IR> framework. We describe Our Business Model, including inputs, outputs and the outcomes of our strategic approach across five pillars, taking a long-term view of value creation. We also include a specific Global Reporting Initiative (GRI) Standards index and our climate change section follows the Task Force on Climate- ABOUT THIS REPORT 3. LIVING ENERGY FREEDOM. related Financial Disclosures (TCFD). OUR PILLAR STORIES We have grouped our reporting into five sections to help you find areas of particular interest, but note that they are all part of who we are, what we do and why. Across all this, we seek to report openly and honestly on our performance in a way that shows the integrated approach CUSTOMER PARTNERSHIPS KAITIAKITANGA PEOPLE COMMERCIAL we take. If you have any comments about this report, including things 24 27 30 36 39 we could do better, please email [email protected] STATEMENT FROM THE DIRECTORS PREPARING FOR CLIMATE CHANGE The directors are pleased to present Mercury NZ Limited’s 33 integrated Annual Report and Financial Statements for the year ended 30 June 2020. -

Trustpower Limited

133 APPENDIX 2 SCHEME BOOKLET Demerger of Trustpower Limited Trustpower Limited Independent Adviser’s Report Prepared in Relation to the Proposed Demerger of Trustpower Limited August 2016 Statement of Independence Northington Partners Limited confirms that it: . Has no conflict of interest that could affect its ability to provide an unbiased report; and . Has no direct or indirect pecuniary or other interest in the proposed transaction considered in this report, including any success or contingency fee or remuneration, other than to receive the cash fee for providing this report. Northington Partners Limited has satisfied the Takeovers Panel, on the basis of the material provided to the Panel, that it is independent under the Takeovers Code and the Panel’s requirements for schemes of arrangements involving Code companies for the purposes of preparing this report. 134 APPENDIX 2 SCHEME BOOKLET Demerger of Trustpower Limited AbbreviationsTable of Contents and Definitions A$ 1.0 AssessmentAustralian of the dollars Merits of the Proposed Demerger ......................................................... 4 1.1. Introduction ............................................................................................................................ 4 ASX ASX Limited, or the financial market operated by the ASX Limited as the context requires 1.2. Key Conditions....................................................................................................................... 5 BEL Bay Energy Limited 1.3. Proposed Demerger Timetable............................................................................................. -

Waikato and Upper North Island Voltage Management

WAIKATO AND UPPER NORTH ISLAND VOLTAGE MANAGEMENT ATTACHMENT D - STAKEHOLDER CONSULTATION SUMMARY Transpower New Zealand Limited December 2019 Waikato and Upper North Island Voltage Management © Transpower New Zealand Limited 2007. All rights reserved. i Table of Contents Table of Contents Glossary................................................................................................................................ 5 1 Introduction .................................................................................................................. 7 1.1 Purpose ..................................................................................................................... 7 1.2 Document structure ................................................................................................... 7 1.3 Stakeholder engagement to date ............................................................................... 8 2 Long-list stakeholder consultation (July 2016): Summary of submissions with Transpower responses................................................................................................. 8 2.1 Need and project scope ............................................................................................. 9 2.1.1 Need for wider scope .............................................................................................. 9 2.1.2 Definition of the N-1 contingency ........................................................................... 10 2.2 Reactive power devices, batteries and transmission ...............................................