Additional Speakers | More Content

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download PDF

Table of Contents Executive summary ............................................................................................... 2 What Auckland consumers have to say about electricity retail issues ........................... 3 The EAP has not fully met the requirements of the terms of reference ......................... 4 The big-5 incumbent retailers are to blame for residential price increases .................... 5 Sweet-heart deals with Tiwai Smelter are keeping prices artificially high ...................... 6 Stronger wholesale and retail competition needed to make electricity more affordable ... 8 Saves & Winbacks is making the two-tier retail market problem worse ...................... 11 Late payment penalties disadvantage vulnerable Kiwis unable to pay on time ............. 14 Prepayment arrangements exploit vulnerable consumers ......................................... 18 There are questions about compliance with the Vulnerable Consumer Guidelines and the objectives of the Guidelines .................................................................................. 19 Concluding remarks and recommendations ............................................................. 20 Appendix 1: Price increases over the last 18-years largely driven by retail (energy) .... 22 Appendix 2: Manipulation of pricing data can make it look like lines are to blame ........ 27 Appendix 3: The electricity retail and generation markets are highly “concentrated” .... 30 Appendix 4: Retail competition improvements driven by the last inquiry reforms -

Decision No 540

PUBLIC VERSION ISSN NO. 0114-2720 J6822 Commerce Commission Decision No 540 Determination pursuant to the Commerce Act 1986 in the matter of an application for clearance of a business acquisition involving: VECTOR LIMITED and NGC HOLDINGS LIMITED The Commission: P R Rebstock D R Bates QC D F Curtin Summary of Application: Vector Limited or an interconnected body corporate has sought clearance to acquire, whether directly or indirectly, up to and including 100% of the shares in NGC Holdings Limited Determination: Pursuant to section 66(3) (a)/(b) of the Commerce Act 1986, the Commission determines to give clearance to the proposed acquisition. Date of Determination: 10 December 2004 CONFIDENTIAL MATERIAL IN THIS REPORT IS CONTAINED IN SQUARE BRACKETS 2 TABLE OF CONTENTS THE PROPOSAL ....................................................................................................................4 STATUTORY FRAMEWORK..............................................................................................4 ANALYTICAL FRAMEWORK............................................................................................4 THE PARTIES.........................................................................................................................5 Vector....................................................................................................................................5 NGC.......................................................................................................................................5 PREVIOUS -

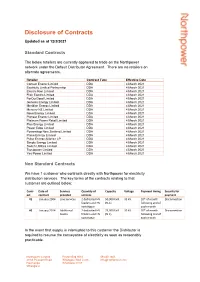

Disclosure of Contracts

Disclosure of Contracts Updated as at 12/3/2021 Standard Contracts The below retailers are currently approved to trade on the Northpower network under the Default Distributor Agreement. There are no retailers on alternate agreements. Retailer Contract Type Effective Date Contact Energy Limited DDA 4 March 2021 Ecotricity Limited Partnership DDA 4 March 2021 Electric Kiwi Limited DDA 4 March 2021 Flick Electric Limited DDA 4 March 2021 ForOurGood Limited DDA 4 March 2021 Genesis Energy Limited DDA 4 March 2021 Meridian Energy Limited DDA 4 March 2021 Mercury NZ Limited DDA 4 March 2021 Nova Energy Limited DDA 4 March 2021 Pioneer Energy Limited DDA 4 March 2021 Platinum Power Retail Limited DDA 4 March 2021 Plus Energy Limited DDA 4 March 2021 Power Edge Limited DDA 4 March 2021 Powershop New Zealand Limited DDA 4 March 2021 Prime Energy Limited DDA 4 March 2021 Pulse Energy Alliance LP DDA 4 March 2021 Simply Energy Limited DDA 4 March 2021 Switch Utilities Limited DDA 4 March 2021 Trustpower Limited DDA 4 March 2021 Yes Power Limited DDA 4 March 2021 Non Standard Contracts We have 1 customer who contracts directly with Northpower for electricity distribution services. The key terms of the contracts relating to that customer are outlined below: Contr Date of Services Quantity of Capacity Voltage Payment timing Security for act contract provided services payment #1 January 2004 Line Services 2 dedicated HV 50,000 kVA 33 kV 20th of month Disconnection feeders and HV (N-1) following end of switchgear each month #2 January 2014 Additional 2 dedicated HV 25,000 kVA 33 kV 20th of month Disconnection Assets feeders and HV (N-1) following end of switchgear each month In the event that supply is interrupted to this customer the Distributor is required to resume the conveyance of electricity as soon as reasonably practicable. -

Solar Pv and Batteries in New Zealand – Consumer Centric Electricity

SOLAR PV AND BATTERIES IN NEW ZEALAND – CONSUMER CENTRIC ELECTRICITY November 2016 ITP Renewables Australia Benefits of Distributed PV in NZ- Draft Report About IT Power The IT Power Group, formed in 1981, is a specialist renewable energy, energy efficiency and carbon markets consulting company. The group has offices and projects throughout the world. IT Power (Australia) Pty Ltd (ITP) was established in 2003 and has undertaken a wide range of projects, including designing grid-connected renewable power systems, providing advice for government policy, feasibility studies for large, off-grid power systems, developing micro-finance models for community-owned power systems in developing countries and modelling large-scale power systems for industrial use. The staff at ITP have backgrounds in renewable energy and energy efficiency, research, development and implementation, managing and reviewing government incentive programs, high level policy analysis and research, including carbon markets, engineering design and project management. ITP/A0215 – November 2016 Benefits of Distributed PV in NZ – Draft Report Document Control Record Document prepared by: IT Power (Australia) Pty Limited Level 1, 19-23 Moore St, Turner, ACT, 2612, Australia PO Box 6127, O’Connor, ACT, 2602, Australia Tel. +61 2 6257 3511 Fax. +61 2 6257 3611 E-mail: [email protected] http://www.itpau.com.au Document Control Proposal title Benefits of Distributed PV in NZ Client RFP No. NA ITP Project Number A0215 Client SEANZ Client Contact Brendan Winitana Rev Date Status Author/s Project Manager Approved Rob Passey, Annie Ngo, Muriel Watt, 1 4 Nov 2016 Draft Rob Passey Muriel Watt Graham Henricksen 2 11 Nov 2016 Final Rob Passey, Annie Ngo, Muriel Watt, Muriel Watt Rob Passey Graham Henricksen A person or organisation choosing to use documents prepared by IT Power (Australia) Pty Ltd accepts the following: a) Conclusions and figures presented in draft documents are subject to change. -

ENA's Response to Climate Change Commission's Draft Advice

Date: 28 March 2021 Name of submitter: Electricity Networks Association Industry/area of interest: Utilities/infrastructure Contact details Richard Le Gros, Manager, Policy and Innovation Address: Level 5, Legal House 101 Lambton Quay WELLINGTON 6011 Telephone: 64 4 471 1335 Email: [email protected] 2021 Draft Advice for Consultation Submission to the Climate Change Commission From the Electricity Networks Association ELECTRICITY NETWORKS ASSOCIATION Draft Advice submission to Climate Change Commission Contents 1. Introduction ................................................................................................................ 3 2. Overview ..................................................................................................................... 3 3. Question 1 - Principles to guide our advice ................................................................... 3 4. Question 15 - Do you support the package of recommendations and actions for the heat, industry and power sectors? ................................................................................ 5 5. Question 19 - Multisector strategy - Do you support the package of recommendations and actions to create a multisector strategy? ................................................................ 9 6. Conclusion .................................................................................................................. 10 7. Appendix ................................................................................................................... -

Electricity Distributors' Performance from 2008 to 2011

ISBN no. 978-1-869453-02-2 Project no. 14.20/13107 Public version Electricity distributors’ performance from 2008 to 2011 Date: 29 January 2013 2 Chapter 1 Introduction 4 Helping customers understand how their electricity distributor is performing 4 We have focused on some key areas of performance 4 We use public information to give an overview of distributors’ performance 5 Structure of this report 5 We would like to hear how useful you found this report 5 Chapter 2 Overview of New Zealand’s electricity industry 6 The main parts of the electricity industry supply chain 6 Key features of the New Zealand electricity distribution sector 7 Chapter 3 Our role in the electricity industry 11 How we regulate electricity distributors in New Zealand 11 Chapter 4 Overview of industry performance 14 Prices, revenue and demand 16 How reliable is electricity distribution in New Zealand? 25 Expenditure 28 3 On 5 February 2013 we made some corrections to the paper. The table below summarises the changes. Distributor Change Buller corrected information in Table 7.1 Electricity Invercargill corrected information in Table 13.1; replaced $7.5m with $1m in commentary under Figure 13.3 MainPower corrected information in Table 16.1 Orion corrected information in Table 22.1; replaced ‘Electra’ with ‘Orion’ in notes to Figures 22.13 and 22.14 OtagoNet corrected information in Table 23.1 Powerco corrected information in Table 24.1 The Power Company corrected information in Table 25.1 Vector corrected information in Table 29.1; added note under Figure 29.1; corrected Figure 29.17 WEL Networks corrected information in Table 31.1 Wellington corrected wording above Figure 32.17 Westpower corrected information in Table 33.1 Introduction 4 Chapter 1 Introduction Helping customers understand how their electricity distributor is performing We have written this report primarily for customers of electricity distribution services, by which we mean people who have, and pay for, a connection to an electricity distribution network.1 This includes both households and businesses. -

Energy Complaints Scheme – Accepted Deadlocked Complaints Report for the Period 1 April 2020 - 31 March 2021

Energy Complaints Scheme – accepted deadlocked complaints report for the period 1 April 2020 - 31 March 2021 Accepted deadlocked complaints The tables below show the number of deadlocked complaints that were accepted for consideration, and the relevant provider. Not all providers in the Energy Complaints Scheme had an accepted deadlocked complaint in this period. A full provider list is available on our website: www.utilitiesdisputes.co.nz The tables also show each providers’ market share, which is calculated by the number of installation control points (ICPs) or equivalent. Total ICPs (or equivalent) were calculated on 28 February 2021 from ICPs on the electricity and gas registries, and customer numbers obtained from providers. Distributors Distributor Accepted Share of Total ICPs Market share deadlocked accepted (or of ICPs (or complaints deadlocked equivalent) equivalent) complaints Alpine Energy 1 1.8% 33,113 1.3% Aurora Energy 7 12.7% 92,584 3.7% Counties Power 2 3.6% 44,978 1.8% Electra 1 1.8% 45,697 1.8% ElectroNet Services * 1 1.8% 0 0.0% Horizon Networks 1 1.8% 24,940 1.0% MainPower 1 1.8% 41,494 1.6% Northpower 3 5.5% 60,326 2.4% Orion 1 1.8% 208,259 8.2% Powerco 6 10.9% 447,295 17.7% The Lines Company (TLC) 3 5.5% 23,716 0.9% Top Energy 4 7.3% 33,049 1.3% Unison 4 7.3% 113,586 4.5% Vector 17 30.9% 699,786 27.7% WEL Networks 3 5.5% 95,851 3.8% Total 55 100% 1,964,674 77.8% Total ICPs (or equivalent) for all electricity and gas distributors: 2,524,362 Key: *Subsidiary of Westpower. -

Annual Report 2019/20 Alpine Energy Annual Report 2019/20 Alpine Energy Annual Report 2019/20

ANNUAL REPORT 2019/20 ALPINE ENERGY ANNUAL REPORT 2019/20 ALPINE ENERGY ANNUAL REPORT 2019/20 CONTENTS Highlights ................................................................................................. 2 Chairman and Chief Executive’s report ....................................4 Our vision, purpose and values .................................................... 6 Financial summary ............................................................................... 8 Empowering our people ................................................................. 10 Empowering our network ...............................................................12 Empowering our community ...................................................... 20 Empowering our future .................................................................. 24 Financial statements ........................................................................29 Harsh, unabating, persistent, uncompromising. Beautiful, inspiring, empowering, calming. The power of nature as she empowers our community. 100% of the power we distribute starts its journey in the Southern Alps of our beautiful country. > PAGE 1 > PAGE 2 ALPINE ENERGY ANNUAL REPORT 2019/20 ALPINE ENERGY ANNUAL REPORT 2019/20 FINANCIAL NETWORK $91.31m $11.66m $33.7m $8.16m 33,446 841 140MW Revenue Earnings before interest and tax Customer connections Gigawatt hours Network maximum of electricity demand delivered $21.63m $7.89m $9.92m same as 2019 594km 3,294km 46,000 of distribution & of distribution & LV wood & concrete poles, -

2010 Default Price-Quality Path Compliance Assessment Decision

COMMERCE COMMISSION Regulation of Electricity Lines Businesses Price-Quality Regulation Reasons for Not Declaring Control of the following Non-exempt Electricity Distribution Businesses: Alpine Energy Limited, Centralines Limited, Eastland Network Limited, Horizon Energy Distribution Limited, Nelson Electricity Limited, Network Tasman Limited, Orion New Zealand Limited, OtagoNet Joint Venture, Powerco Limited, The Lines Company Limited, Top Energy Limited and Wellington Electricity Lines Limited 1 April 2011 CONTENTS PAGE INTRODUCTION .................................................................................................. 3 Purpose and Scope .............................................................................................. 3 Electricity Distribution Businesses Assessed ................................................... 3 Statutory Framework ......................................................................................... 4 Consumer-owned .................................................................................................................. 4 Process and Analytical Framework Applied ................................................... 5 Overview of the 2009/10 Assessment ................................................................ 6 Breaches of the Price Path ................................................................................................... 6 Breaches of the Quality Threshold ..................................................................................... 11 DECISIONS – -

Asset Management Plan 2019

ASSET MANAGEMENT PLAN 2019 ALPINE ENERGY LIMITED ____________________________________ Planning Period: 1 April 2019 to 31 March 2029 ___________________________________________________________________ Disclosure date: 31 March 2019 _____________________________________________ 03 687 4300 alpineenergy.co.nz ____________________________________ LIABILITY DISCLAIMER Any information contained in this document is based on information available at the time of preparation. Numerous assumptions have been made to allow future resource requirements to be assessed. These assumptions may prove to be incorrect or inaccurate, consequently, many of the future actions identified in this document may not occur. Users of the information contained in this document do so at their own risk. Alpine Energy Limited will not be liable to compensate any persons for loss, injury, or damage resulting from the use of the contents of this document. If any person wishes to take any action on the basis of the content of this document, they should contact Alpine Energy Limited for advice and confirmation of all relevant details before acting. P a g e | 1 DIRECTORS’ STATEMENT case now. Sole beneficiaries identified for additional capacity will have back-to-back agreements to minimise the risk of stranded assets. The purpose of our 2019 to 2029 Asset Management Plan (AMP) is to provide insight We encourage consumers to comment on this document and the approach taken to and explanation of how we intend to provide electricity distribution services. We are maintain a safe, reliable, and cost-effective, electricity supply to South Canterbury. committed to managing our distribution assets in a safe, reliable, and cost-effective manner that addresses required service levels and maintains a robust energy delivery system for our stakeholders. -

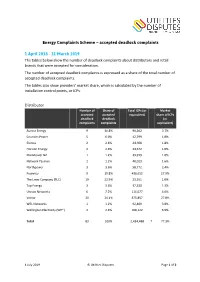

Energy Complaints Scheme – Accepted Deadlock Complaints 1

Energy Complaints Scheme – accepted deadlock complaints 1 April 2018 - 31 March 2019 The tables below show the number of deadlock complaints about distributors and retail brands that were accepted for consideration. The number of accepted deadlock complaints is expressed as a share of the total number of accepted deadlock complaints. The tables also show providers’ market share, which is calculated by the number of installation control points, or ICPs. Distributor Number of Share of Total ICPs (or Market accepted accepted equivalent) share of ICPs deadlock deadlock (or complaints complaints equivalent) Aurora Energy 9 10.8% 90,262 3.7% Counties Power 5 6.0% 42,799 1.8% Electra 2 2.4% 44,908 1.8% Horizon Energy 2 2.4% 24,672 1.0% MainPower NZ 1 1.2% 39,919 1.6% Network Tasman 1 1.2% 40,023 1.6% Northpower 3 3.6% 58,772 2.4% Powerco 9 10.8% 436,652 17.9% The Lines Company (TLC) 19 22.9% 23,551 1.0% Top Energy 3 3.6% 32,330 1.3% Unison Networks 6 7.2% 111,577 4.6% Vector 20 24.1% 675,857 27.8% WEL Networks 1 1.2% 92,400 3.8% Wellington Electricity (WE*) 2 2.4% 168,122 6.9% Total 83 100% 2,434,488 † 77.3% 4 July 2019 © Utilities Disputes Page 1 of 2 Retail brand Number of Share of Total ICPs (or Market accepted accepted equivalent) share of ICPs deadlock deadlock (or complaints complaints equivalent) Contact 11 8.3% 478,525 18.3% Ecotricity 5 3.8% 5,640 0.2% Electric Kiwi 4 3.0% 36,132 1.4% Elgas 7 5.3% 31,314 1.2% Energy Online 3 2.3% 106,576 4.1% Flick Electric Co 4 3.0% 20,702 0.8% Genesis Energy * 20 15.0% 566,276 21.6% GLOBUG 4 3.0% -

NZ Gas Story Presentation

From wellhead to burner - The New Zealand Gas Story August 2014 Who are we – and why are we here • We’re the industry body and co-regulator • We’re telling the Gas Story because: − the industry has changed, there are more players, and the story is getting fragmented and lost − the industry asked us to stitch the story together and to tell it. − it fits with our obligation to report to the Minister on the state and performance of the gas industry. • and, because gas has a long pedigree and makes a valuable contribution to New Zealand, it’s a great story worth telling... Gas Industry Co 2 What we’ll cover… • History and development • The contribution of gas to New Zealand’s energy supply • How gas used • Industry structure and the players • Gas policy evolution and the regulatory framework • A look at each key element: − exploration & production − processing − transmission we’ll take a short break here − distribution − wholesale and retail markets − metering − pricing − safety • Gas in a carbon-conscious world • What the future for gas may look like Gas Industry Co 3 What is natural gas? Some terms we’ll be using: • Petajoule (PJ) – Measure of gas volume. 1PJ = 40,000 households or approximate annual gas use of Wanganui. • Gigajoule (GJ) – Also a measure of gas volume. There are one million GJs in a PJ. The average household use is around is around 25GJ per year. • LPG – Liquefied Petroleum Gas. Comprising propane and butane components of the gas stream • LNG – Liquefied Natural Gas. Natural gas that is chilled to minus 162C for bulk transport storage in the international market • Condensate – a light oil Gas Industry Co 4 Gas has a long history Oil seeps have been observed in NZ since Maori settlement.